Global Blockchain Market Research Report: Forecast (2023-2028)

By Component (Services (Consultation, Development & Integration, Support & Maintenance), Platform), By Provider (Application Provider, Infrastructure Provider, Middleware Provider)..., By Type (Private, Public, Hybrid), By Organization (Small, Medium, Large), By Application (Payment, Documentation, Exchanges, Supply Chain Management, Digital Identity, Others (Advertising insights, etc.)), By End-User (Manufacturing, Government & Transportation, Logistics, Healthcare & Life science, Energy & Utilities, Media & Entertainment, BFSI, IT & Telecom, Retail & Ecommerce, Others (Agriculture, etc.)), By Region (North America, South America, Europe, Asia-Pacific, Middle East & Africa), By Company (IBM, AWS, Microsoft, SAP, Intel, Oracle, NTT Data, Earthport, Amazon Web Services, Consensus Systems, Huawei, Monax, Ripple, BTL Group, R3) Read more

- ICT & Electronics

- Jun 2023

- Pages 189

- Report Format: PDF, Excel, PPT

Market Definition

Blockchain, also known as DLT (Distributed Ledger Technology), allows for different types of digital information to be stored & distributed but not deleted or edited. Initially, it was related only to cryptocurrencies but has acquired extensive popularity in several other applications over the past few years. Globally, numerous businesses & government authorities are increasingly adopting blockchain technology to make their daily operations more efficient, accurate, secure, & economical, which projects a pool of lucrative prospects for the blockchain industry in the coming years.

Market Insights

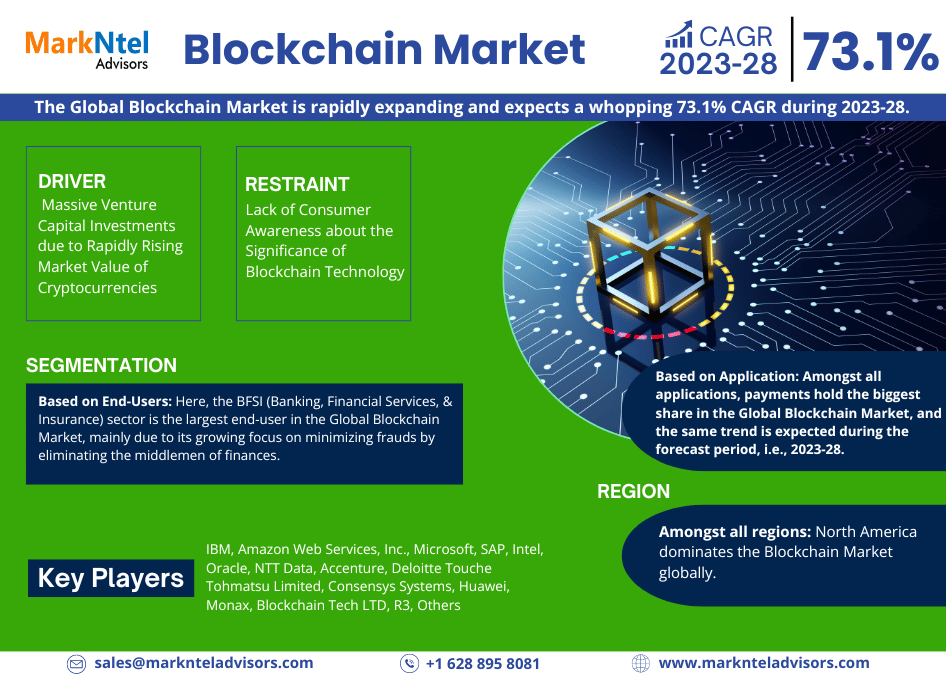

The Global Blockchain Market is rapidly expanding and expects a whopping 73.1% CAGR during the forecast period, i.e., 2023-28. The most prominent factors contributing to the market growth are the ever-increasing need for operational efficiency, especially in banks & other financial institutes, coupled with substantial investments in blockchain technology with the rising legalization of cryptocurrency. The consistently increasing venture-capital funding for blockchain start-up companies is notably contributing to the expansion of the global blockchain market.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 73.1% |

| Regions Covered | North America: US, Canada, Mexico |

| Europe: Germany, The UK, France, Spain, Switzerland, Rest of Europe | |

| Asia-Pacific: China, India, Japan, South Korea, Australia, Singapore, Rest of Asia-Pacific | |

| South America: Brazil, Rest of South America | |

| Middle East & Africa: UAE, Saudi Arabia, South Africa, Rest of MEA | |

| Key Companies Profiled | IBM, Amazon Web Services, Inc., Microsoft, SAP, Intel, Oracle, NTT Data, Accenture, Deloitte Touche Tohmatsu Limited, Consensys Systems, Huawei, Monax, Blockchain Tech LTD, R3, Others |

| Unit Denominations | USD Million/Billion |

Moreover, benefits like data accuracy, consistency, & transparency are further propelling the demand for blockchain technology and fueling the overall market growth. With these benefits, several government authorities and small & medium enterprises, among others, are displaying immense interest in utilizing this technology to enhance their workflows.

An emerging blockchain-based Fintech, DeFi (Decentralized Finance), is a blanket term for numerous financial applications in cryptocurrency and aims to reduce the power banks hold on public finances. The increasing strategic initiatives in the DeFi ecosystem are promoting the growth, hence becoming a trend in the Blockchain Market.

Furthermore, with the advent of Covid-19 in 2020, various cafes, bars, & restaurants, among others, have started offering their customers cryptocurrency-based payment options in order to enhance their overall experience. Hence, the growing acceptance of cryptocurrency-based payments among several companies would generate profitable opportunities for the Global Blockchain Market through 2028.

Market Segmentation

Based on End-Users:

- BFSI

- Manufacturing

- Government

- Transportation & Logistics

- Healthcare & Lifesciences

- Energy & Utilities

- Media & Entertainment

- IT & Telecom

- Retail & Ecommerce

- Others (Agriculture, etc.)

Here, the BFSI (Banking, Financial Services, & Insurance) sector is the largest end-user in the Global Blockchain Market, mainly due to its growing focus on minimizing frauds by eliminating the middlemen of finances. Blockchain technology is highly effective in removing vulnerability to cyber-attacks, breaches, & theft, which makes it a preferred choice for several banks & financial institutes to facilitate secure transactions. Besides, quicker transactions, improved traceability, & low operational costs are other noteworthy benefits associated with blockchain technology that led to the largest share of the BFSI sector in the global market.

On the other hand, the healthcare sector is another significant contributor to the overall growth of the Global Blockchain Market. It owes to the rapidly surging deployment of blockchain technology in hospitals & clinics due to stringent norms imposed by governments of different countries for protecting patient data, on account of rising instances of insurance fraud worldwide.

Based on Application:

- Payment

- Documentation

- Exchanges

- Supply Chain Management

- Digital Identity

- Others (Advertising insights, etc.)

Amongst all applications, payments hold the biggest share in the Global Blockchain Market, and the same trend is expected during the forecast period, i.e., 2023-28. It attributes primarily to the increasing market value of cryptocurrencies, declining transaction costs, and the mounting utilization of cloud services in payments & transactions. Blockchain technology helps automate payments and enable low-cost cross-border transactions & settlements.

Consumers & businesses worldwide transmit substantial amounts of money, which, in the past, has remained relatively expensive using bank transfers & currency conversions. However, with the BFSI sector as the largest end-user of blockchain technologies, it allows for low-cost international money transfers, better remittances, and reduced vulnerability to cryptocurrencies.

As a result, most financial companies are increasingly deploying blockchain technology to enhance their payment systems' transparency, cost-effectiveness, & operational efficiency, avoid data loss & frauds, and eliminate the need for intermediaries in payment processing. Hence, these aspects indicate payments as the largest application of blockchain technologies, thereby driving the global market.

Regional Landscape

Geographically, the Global Blockchain Market expands across:

- Americas

- Europe, Middle East & Africa (EMEA)

- Asia-Pacific

Amongst all regions, North America dominates the Blockchain Market globally. The well-established & massive IT sector across countries like the US & Canada, coupled with substantial R&D investments in open-source distributed ledger technology to attain quick transactions & data transparency, are the prime aspects driving the regional market.

Major countries across the region are early adopters of advanced technologies and host the leading blockchain solution providers. In order to ensure business continuity, most organizations across the region are increasingly deploying security & vulnerability management solutions for enhanced data security & preventing cyberattacks.

Besides, the increasing consumer inclination toward using cryptocurrencies, coupled with the growing implementation of payment solutions, smart contracts, and digital identity solutions by BFSI, retail, & government sectors, among others, are generating immense demand for blockchain technologies across North America, and thus fueling the overall market growth.

Market Dynamics

Key Driver: Massive Venture Capital Investments due to Rapidly Rising Market Value of Cryptocurrencies

Cryptocurrencies incur lower transaction fees than other payment methods, as they are based on blockchain technology. As a result, many individuals & businesses are increasingly adopting the technology for cross-border payments & remittances since the latter involves high transaction costs. Moreover, since cryptocurrencies are immutable, regulatory authorities cannot impose any restrictions on cross-border transactions. All these aspects have resulted in a significant surge in the market value of cryptocurrencies, i.e., attracting massive venture capital funding in blockchain startups, which projects lucrative prospects for the Global Blockchain Market during 2023-28.

Growth Restraint: Lack of Consumer Awareness about the Significance of Blockchain Technology

The primary growth restraint to the Global Blockchain Market during 2023-28 is less awareness of the significance & benefits of blockchain technology, especially across sectors other than BFSI, coupled with the lack of knowledge among people about its implementation. It, in turn, is restricting its scalability and R&D investments associated with it. Besides, uncertain regulations, security & privacy concerns with blockchain transactions, and high energy consumption during crypto mining are a few other aspects restricting the adoption of blockchain technology among organizations, which could hinder the growth of the global market in the years to come.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Market Analysis, Size- By Value, Forecast Numbers, Segmentation, Shares) of the Global Blockchain Market?

- What are the region-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the Global Blockchain Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the Global Blockchain Market based on the competitive benchmarking matrix?

- What are the key results derived from surveys conducted during the Global Blockchain Market study?

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Blockchain Market Start-up Ecosystem

- Entrepreneurial Activity

- Year-on-Year Funding Received

- Funding Received by Top Companies

- Key Investors Active in the Market

- Series Wise Funding Received

- Seed Funding

- Angel Investing

- Venture Capitalist (VC) Funding

- Others

- Global Blockchain Market Trends & Developments

- Global Blockchain Market Dynamics

- Growth Drivers

- Challenges

- Global Blockchain Market Hotspot & Opportunities

- Global Blockchain Market Policies, Regulations, Product Standards

- Global Blockchain Market Outlook (2018-2028)

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component

- Services- Market Size & Forecast 2018-2028F, USD Million

- Consultation- Market Size & Forecast 2018-2028F, USD Million

- Development & Integration- Market Size & Forecast 2018-2028F, USD Million

- Support & Maintenance- Market Size & Forecast 2018-2028F, USD Million

- Platform- Market Size & Forecast 2018-2028F, USD Million

- Services- Market Size & Forecast 2018-2028F, USD Million

- By Provider

- Application Provider- Market Size & Forecast 2018-2028F, USD Million

- Infrastructure Provider- Market Size & Forecast 2018-2028F, USD Million

- Middleware Provider- Market Size & Forecast 2018-2028F, USD Million

- By Type

- Private- Market Size & Forecast 2018-2028F, USD Million

- Public- Market Size & Forecast 2018-2028F, USD Million

- Hybrid- Market Size & Forecast 2018-2028F, USD Million

- By Organization

- Small- Market Size & Forecast 2018-2028F, USD Million

- Medium- Market Size & Forecast 2018-2028F, USD Million

- Large- Market Size & Forecast 2018-2028F, USD Million

- By Application

- Payment- Market Size & Forecast 2018-2028F, USD Million

- Documentation- Market Size & Forecast 2018-2028F, USD Million

- Exchanges- Market Size & Forecast 2018-2028F, USD Million

- Supply Chain Management- Market Size & Forecast 2018-2028F, USD Million

- Digital Identity- Market Size & Forecast 2018-2028F, USD Million

- Others (Advertising insights, Smart Contracts, etc.) - Market Size & Forecast 2018-2028F, USD Million

- By End User

- BFSI- Market Size & Forecast 2018-2028F, USD Million

- Government- Market Size & Forecast 2018-2028F, USD Million

- Logistics- Market Size & Forecast 2018-2028F, USD Million

- Healthcare- Market Size & Forecast 2018-2028F, USD Million

- Energy & Utilities- Market Size & Forecast 2018-2028F, USD Million

- Media & Entertainment- Market Size & Forecast 2018-2028F, USD Million

- IT & Telecom- Market Size & Forecast 2018-2028F, USD Million

- Retail & E-commerce- Market Size & Forecast 2018-2028F, USD Million

- Others (Agriculture, Manufacturing, etc.)- Market Size & Forecast 2018-2028F, USD Million

- By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

- By Company

- Competition Characteristics

- Market Share of Leading Companies

- By Component

- Market Size & Analysis

- North America Blockchain Market Outlook (2018-2028F)

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2018-2028F, USD Million

- By Provider- Market Size & Forecast 2018-2028F, USD Million

- By Type- Market Size & Forecast 2018-2028F, USD Million

- By Organization- Market Size & Forecast 2018-2028F, USD Million

- By Application- Market Size & Forecast 2018-2028F, USD Million

- By End User- Market Size & Forecast 2018-2028F, USD Million

- By Country

- The US

- Canada

- Mexico

- The US Blockchain Market Outlook (2018-2028F)

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2018-2028F, USD Million

- By Provider- Market Size & Forecast 2018-2028F, USD Million

- By End User- Market Size & Forecast 2018-2028F, USD Million

- Market Size & Analysis

- Canada Blockchain Market Outlook (2018-2028)

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2018-2028F, USD Million

- By Provider- Market Size & Forecast 2018-2028F, USD Million

- By End User- Market Size & Forecast 2018-2028F, USD Million

- Market Size & Analysis

- Mexico Blockchain Market Outlook (2018-2028)

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2018-2028F, USD Million

- By Provider- Market Size & Forecast 2018-2028F, USD Million

- By End User- Market Size & Forecast 2018-2028F, USD Million

- Market Size & Analysis

- Market Size & Analysis

- South America Blockchain Market Outlook (2018-2028F)

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2018-2028F, USD Million

- By Provider- Market Size & Forecast 2018-2028F, USD Million

- By Type- Market Size & Forecast 2018-2028F, USD Million

- By Organization- Market Size & Forecast 2018-2028F, USD Million

- By Application- Market Size & Forecast 2018-2028F, USD Million

- By End User- Market Size & Forecast 2018-2028F, USD Million

- By Country

- Brazil

- Rest of South America

- Brazil Blockchain Market Outlook (2018-2028F)

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2018-2028F, USD Million

- By Provider- Market Size & Forecast 2018-2028F, USD Million

- By End User- Market Size & Forecast 2018-2028F, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Europe Blockchain Market Outlook (2018-2028F)

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2018-2028F, USD Million

- By Provider- Market Size & Forecast 2018-2028F, USD Million

- By Type- Market Size & Forecast 2018-2028F, USD Million

- By Organization- Market Size & Forecast 2018-2028F, USD Million

- By Application- Market Size & Forecast 2018-2028F, USD Million

- By End User- Market Size & Forecast 2018-2028F, USD Million

- By Country

- Germany

- The UK

- France

- Spain

- Switzerland

- Rest of Europe

- Germany Blockchain Market Outlook (2018-2028)

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2018-2028F, USD Million

- By Provider- Market Size & Forecast 2018-2028F, USD Million

- By End User- Market Size & Forecast 2018-2028F, USD Million

- Market Size & Analysis

- The UK Blockchain Market Outlook (2018-2028)

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2018-2028F, USD Million

- By Provider- Market Size & Forecast 2018-2028F, USD Million

- By End User- Market Size & Forecast 2018-2028F, USD Million

- Market Size & Analysis

- France Blockchain Market Outlook (2018-2028)

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2018-2028F, USD Million

- By Provider- Market Size & Forecast 2018-2028F, USD Million

- By End User- Market Size & Forecast 2018-2028F, USD Million

- Market Size & Analysis

- Spain Blockchain Market Outlook (2018-2028)

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2018-2028F, USD Million

- By Provider- Market Size & Forecast 2018-2028F, USD Million

- By End User- Market Size & Forecast 2018-2028F, USD Million

- Market Size & Analysis

- Switzerland Blockchain Market Outlook (2018-2028)

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2018-2028F, USD Million

- By Provider- Market Size & Forecast 2018-2028F, USD Million

- By End User- Market Size & Forecast 2018-2028F, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Middle East & Africa Blockchain Market Outlook (2018-2028F)

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2018-2028F, USD Million

- By Provider- Market Size & Forecast 2018-2028F, USD Million

- By Type- Market Size & Forecast 2018-2028F, USD Million

- By Organization- Market Size & Forecast 2018-2028F, USD Million

- By Application- Market Size & Forecast 2018-2028F, USD Million

- By End User- Market Size & Forecast 2018-2028F, USD Million

- By Country

- The UAE

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- The UAE Blockchain Market Outlook (2018-2028)

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2018-2028F, USD Million

- By Provider- Market Size & Forecast 2018-2028F, USD Million

- By End User- Market Size & Forecast 2018-2028F, USD Million

- Market Size & Analysis

- Saudi Arabia Blockchain Market Outlook (2018-2028)

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2018-2028F, USD Million

- By Provider- Market Size & Forecast 2018-2028F, USD Million

- By End User- Market Size & Forecast 2018-2028F, USD Million

- Market Size & Analysis

- South Africa Blockchain Market Outlook (2018-2028)

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2018-2028F, USD Million

- By Provider- Market Size & Forecast 2018-2028F, USD Million

- By End User- Market Size & Forecast 2018-2028F, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Blockchain Market Outlook (2018-2028)

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2018-2028F, USD Million

- By Provider- Market Size & Forecast 2018-2028F, USD Million

- By Type- Market Size & Forecast 2018-2028F, USD Million

- By Organization- Market Size & Forecast 2018-2028F, USD Million

- By Application- Market Size & Forecast 2018-2028F, USD Million

- By End User- Market Size & Forecast 2018-2028F, USD Million

- By Country

- China

- India

- Australia

- Japan

- South Korea

- Singapore

- Rest of Asia-Pacific

- China Blockchain Market Outlook (2018-2028)

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2018-2028F, USD Million

- By Provider- Market Size & Forecast 2018-2028F, USD Million

- By End User- Market Size & Forecast 2018-2028F, USD Million

- Market Size & Analysis

- India Blockchain Market Outlook (2018-2028)

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2018-2028F, USD Million

- By Provider- Market Size & Forecast 2018-2028F, USD Million

- By End User- Market Size & Forecast 2018-2028F, USD Million

- Market Size & Analysis

- Australia Blockchain Market Outlook (2018-2028)

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2018-2028F, USD Million

- By Provider- Market Size & Forecast 2018-2028F, USD Million

- By End User- Market Size & Forecast 2018-2028F, USD Million

- Market Size & Analysis

- Japan Blockchain Market Outlook (2018-2028)

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2018-2028F, USD Million

- By Provider- Market Size & Forecast 2018-2028F, USD Million

- By End User- Market Size & Forecast 2018-2028F, USD Million

- Market Size & Analysis

- South Korea Blockchain Market Outlook (2018-2028)

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2018-2028F, USD Million

- By Provider- Market Size & Forecast 2018-2028F, USD Million

- By End User- Market Size & Forecast 2018-2028F, USD Million

- Market Size & Analysis

- Singapore Blockchain Market Outlook (2018-2028F)

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2018-2028F, USD Million

- By Provider- Market Size & Forecast 2018-2028F, USD Million

- By End User- Market Size & Forecast 2018-2028F, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Global Blockchain Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- IBM

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Amazon Web Services, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Microsoft

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- SAP

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Intel

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Oracle

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- NTT Data

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Accenture

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Deloitte Touche Tohmatsu Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Consensys Systems

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Huawei

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Monax

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Blockchain Tech LTD

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- R3

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- IBM

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making