Global Railway Cyber Security Market Research Report: Forecast (2022-27)

By Type (Infrastructural, On-board), By Security (Application Security, Network Security, Data Protection, End Point Security and System Administration), By Solutions and Services ...(Services, Designs, Implementation, Risk and Threat Assessment, Support and Maintenance, Solutions, Risk and Compliance Management, Encryption, Firewall, Antivirus/Anti-malware, Intrusion Detection System/Intrusion Prevention System, Others), By Region (North America, South America, Europe, Middle East, Africa, Asia-Pacific), By Company (Alstom, Hitachi, Bombardier, Siemens, Cisco, Huawei, Thales, General Electric, Toshiba Digital Solutions Corporations, and IBM) Read more

- Automotive

- Sep 2022

- Pages 191

- Report Format: PDF, Excel, PPT

Market Definition & Overview

Cyber security involves technology and techniques that act as defense mechanisms against various electronic devices like mobiles, computers, servers, networks, & critical systems against malicious attacks. Since the utilization of electronic devices and technologies like the Internet of Things (IoT) & Artificial Intelligence (AI), among others, are widening, the prevalence of cyber-attacks & threats is escalating too.

These acts are often materialized using malicious software like Viruses, Trojans, Ransomware, Adware, Botnets, & Spyware, depending upon the motives behind such threats. Hence, the need to strengthen the defense systems of an organization using cyber security systems has become indispensable for almost every sector, including the railways.

As vast as the railway network is around the globe, the requirement for a robust & effective cybersecurity solution in this network to attain real-time alerts & constant monitoring is becoming essential. These solutions enable the rail operators to procure full visibility into their systems & address potential threats beforehand.

Market Insights

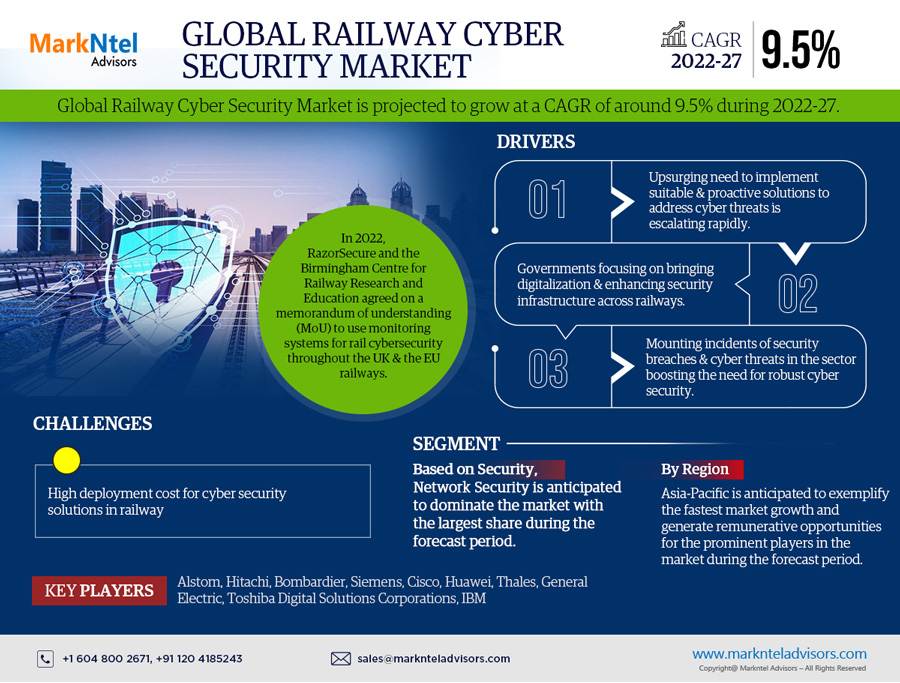

The Global Railway Cyber Security Market is projected to grow at a CAGR of around 9.5% during the forecast period, i.e., 2022-27. Backed by the growing sophistication of cyber-attacks on the railways, the need to implement suitable & proactive solutions to address these threats is escalating rapidly. It, in turn, is augmenting the demand for preventive measures & solutions like cybersecurity technologies that are capable of detecting & eliminating potential threats by closely monitoring the systems and boosting the market growth.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2017-20 |

| Base Year: 2021 | |

| Forecast Period: 2022-27 | |

| CAGR (2022-2027) | 9.5% |

| Regions Covered | North America: The US, Canada, Mexico |

| Europe: France, Germany, Italy, Spain, United Kingdom, Belgium, Russia, Others | |

| Asia-Pacific: China, India, Japan, South Korea, Others | |

| South America: Brazil, Rest of South America | |

| Middle East & Africa: GCC, South Africa, Rest of Middle East & Africa | |

| Key Companies Profiled |

Alstom, Hitachi, Bombardier, Siemens, Cisco, Huawei, Thales, General Electric, Toshiba Digital Solutions Corporations, IBM, Others |

| Unit Denominations | USD Million/Billion |

In addition, the market growth attributes to the growing focus of the governments of different countries on bringing digitalization and their inclination toward enhancing the security infrastructure across sectors, including railways. This incorporation of digital systems procuring critical data & real-time information of railways propels the need to deploy a robust cybersecurity solution for the identification & elimination of possible risks & threats and enable better operating & managing experiences for the authorities.

Across the industry, the key areas projecting a recurring implementation of these technological solutions include the signaling systems, train control systems, & traction & passenger information systems. Since these systems are at enormous risk owing to their vulnerabilities in containing substantial details of the rail network, the demand for cybersecurity systems is massive. The same aspect is also generating growth opportunities for the leading players to increase their service offering capabilities and cater to the burgeoning needs globally.

Moreover, with a mounting number of incidents associated with security breaches & cyber threats in the sector, the need for robust cyber security is arising and hinting toward substantial growth for the cybersecurity industry. Furthermore, owing to the modernization of several cities, coupled with improved mass transits, the anticipated presence of relatively better cyber security solutions & services for railways is extensive, demonstrating a widespread adoption of the IoT in Metro & Rail projects.

Nonetheless, owing to the operational efficiency offered by these technological solutions in the railway network & system, the advent of Cloud-based technologies & cutting-edge techniques are also complementing the market expansion globally through 2027.

Market Segmentation

Based on Security:

- Application Security

- Network Security

- Data Protection

- End Point Security and System Administration

Network Security is anticipated to dominate the Global Railway Cyber Security Market with the largest share during the forecast period. It owes principally to the massive bunch of centralized data generated in the expansive rail network offering real-time information, monitoring, & supervision, up-surging the need for cybersecurity systems to eliminate the possibilities of threats & crimes.

Network security is essential to attain a real-time view of the entire network with detailed information covering from the topology to the granular level of each asset like interlocking, trackside devices, & management workstations, among others. Hence, the need for a cybersecurity solution to strengthen this in-depth visibility into the network while eliminating blind spots & crimes mounts substantially.

Besides, network security also determines the real-time cybersecurity status by closely monitoring & analyzing attained data, and therefore, hints toward the need & perks of cybersecurity in this area of the railway sector. Moreover, network security in railways is highly important as this segment is responsible for regulating & automating traffic over the networks. Hence, considering trends & features, the network security is set to demonstrate high demand for cybersecurity in railways and drive the market through 2027.

Regional Projection

On the geographical front, the Global Railway Cyber Security Market expands across:

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

Here, Asia-Pacific is anticipated to exemplify the fastest market growth and generate remunerative opportunities for the prominent players in the market during the forecast period. It owes principally to the vast railway networks in the region, across countries like China & India, and their higher vulnerabilities to cybercrimes. Since these networks witness mass transportation regularly and generate substantial data, the network is much more at risk against cyber threats & attacks.

Hence, the governments are actively seeking robust & reliable solutions like cyber security systems to strengthen the network. Besides, several countries in the region are massively working on their infrastructure development & service offered, including bringing advancements in the railways. It, in turn, is propelling the demand for cybersecurity mechanisms and contributing to market growth.

Moreover, the introduction of several new projects in the railways across the region is also generating remunerative opportunities for the prominent players in the industry to enhance their service offerings and cater to the burgeoning demands. According to the International Union of Railways, China and India contribute almost half of the world's passenger travels via Rail. It, in turn, hints toward a presence of opportunities for the players to offer cybersecurity systems and shall contribute to the overall market expansion through 2027.

Regulatory Landscape in the Global Railway Cyber Security Market

India has an extensive railway network, which is the second largest in the Asia-Pacific region. Backed by the mass transition using this mode of transportation on a regular basis, the need for a robust cybersecurity system is essential. Hence, the government is actively participating in the industry and procuring security solutions, including cybersecurity.

Recently, the government planned to launch six cyber cells throughout the nation, where the foremost would inaugurate at Pune, Maharashtra. The core duty of the cell is to conduct various cyber-related investigations & keep an eye on illicit internet ticketing, social media, & various cyber frauds.

On the other hand, the government of Singapore is implementing digital technology in transportation to realize its vision of a "Smart Nation." As the most prominent pillar of a nation's economic & transportation development, these initiatives are anticipated to directly influence the demand for cybersecurity and contribute to the overall market expansion.

Recent Developments in the Global Railway Cyber Security Market

- In 2022, RazorSecure and the Birmingham Centre for Railway Research and Education agreed on a memorandum of understanding (MoU) to use monitoring systems for rail cybersecurity throughout the UK & the EU railways.

- In November 2021, prominent players Siemens Mobility and RazorSecure agreed to provide rolling stock operators worldwide with enhanced rail cyber security monitoring solutions. Although increased digitization has numerous benefits, it also necessitates robust cyber security. The two businesses are set to combine their skills to safeguard intricate transportation systems, where an expert in rail cyber security, RazorSecure continuously monitors the activity of individual systems & network traffic in real-time. Siemens Mobility is dedicated to ensuring the availability of the rail system with cutting-edge digital asset management solutions like Railigent.

- The same year in September, Alstom, a pioneer in sustainable mobility and company Airbus Cyber Security, signed a global collaboration agreement concentrating on rail transport cyber security to provide solutions & services to the rail operator.

Possible Restraint

- High Deployment Cost for Cyber Security Solutions in Railway

Since cyber security systems are essential in strengthening the security infrastructure in railways, their deployment cost is often high, due to which its fledged adoption is affected. Additionally, the improper development of the security infrastructure further brings limitations on the use of contemporary technology & hampers the implementation of railway cyber security.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares) of the Global Railway Cyber Security Market?

- What are the region-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the Global Railway Cyber Security Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the Global Railway Cyber Security Market based on the competitive benchmarking matrix?

- What are the key results derived from surveys conducted during the Global Railway Cyber Security Market study?

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Assumptions

- Market Segmentation

- Executive Summary

- Expert Verbatim- What our Experts Say?

- Global Railway Cyber Security Market Analysis, 2017-2027

- Market Size & Analysis

- Market Revenue

- Market Share & Analysis

- By Type

- Infrastructural

- On-board

- By Security

- Application Security

- Network Security

- Data Protection

- End Point Security and System Administration

- By Solutions and Services

- Services

- Designs

- Implementation

- Risk and Threat Assessment

- Support and Maintenance

- Solutions

- Risk and Compliance Management

- Encryption

- Firewall

- Antivirus/Anti-malware

- Intrusion Detection System/Intrusion Prevention System

- Others

- By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

- By Company

- Revenue Shares

- Strategic Factorial Indexing

- Competitor Placement in MarkNtel Quadrant

- By Type

- Market Size & Analysis

- North America Railway Cyber Security Market Analysis, 2017-2027

- Market Size & Analysis

- Market Revenue

- Market Share & Analysis

- By Type

- By Security

- By Solutions and Services

- By Country

- United States

- Canada

- Mexico

- United States Railway Cyber Security Market Analysis, 2017-2027

- Market Size & Analysis

- Market Revenue

- Market Share & Analysis

- By Type

- By Security

- By Solutions and Services

- Market Size & Analysis

- Canada Railway Cyber Security Market Analysis, 2017-2027

- Market Size & Analysis

- Market Revenue

- Market Share & Analysis

- By Type

- By Security

- By Solutions and Services

- Market Size & Analysis

- Mexico Railway Cyber Security Market Analysis, 2017-2027

- Market Size & Analysis

- Market Revenue

- Market Share & Analysis

- By Type

- By Security

- By Solutions and Services

- Market Size & Analysis

- Market Size & Analysis

- South America Railway Cyber Security Market Analysis, 2017-2027

- Market Size & Analysis

- Market Revenue

- Market Share & Analysis

- By Type

- By Security

- By Solutions and Services

- By Country

- Brazil

- Others

- Brazil Railway Cyber Security Market Analysis, 2017-2027

- Market Size & Analysis

- Market Revenue

- Market Share & Analysis

- By Type

- By Security

- By Solutions and Services

- Market Size & Analysis

- Market Size & Analysis

- Europe Railway Cyber Security Market Analysis, 2017-2027

- Market Size & Analysis

- Market Revenue

- Market Share & Analysis

- By Type

- By Security

- By Solutions and Services

- By Country

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Russia

- Others

- France Railway Cyber Security Market Analysis, 2017-2027

- Market Size & Analysis

- Market Revenue

- Market Share & Analysis

- By Type

- By Security

- By Solutions and Services

- Market Size & Analysis

- Germany Railway Cyber Security Market Analysis, 2017-2027

- Market Size & Analysis

- Market Revenue

- Market Share & Analysis

- By Type

- By Security

- By Solutions and Services

- Market Size & Analysis

- Italy Railway Cyber Security Market Analysis, 2017-2027

- Market Size & Analysis

- Market Revenue

- Market Share & Analysis

- By Type

- By Security

- By Solutions and Services

- Market Size & Analysis

- Spain Railway Cyber Security Market Analysis, 2017-2027

- Market Size & Analysis

- Market Revenue

- Market Share & Analysis

- By Type

- By Security

- By Solutions and Services

- Market Size & Analysis

- United Kingdom Railway Cyber Security Market Analysis, 2017-2027

- Market Size & Analysis

- Market Revenue

- Market Share & Analysis

- By Type

- By Security

- By Solutions and Services

- Market Size & Analysis

- Russia Railway Cyber Security Market Analysis, 2017-2027

- Market Size & Analysis

- Market Revenue

- Market Share & Analysis

- By Type

- By Security

- By Solutions and Services

- Market Size & Analysis

- Market Size & Analysis

- Middle East & Africa Railway Cyber Security Market Analysis, 2017-2027

- Market Size & Analysis

- Market Revenue

- Market Share & Analysis

- By Type

- By Security

- By Solutions and Services

- By Country

- GCC

- South Africa

- Others

- GCC Railway Cyber Security Market Analysis, 2017-2027

- Market Size & Analysis

- Market Revenue

- Market Share & Analysis

- By Type

- By Security

- By Solutions and Services

- Market Size & Analysis

- South Africa Railway Cyber Security Market Analysis, 2017-2027

- Market Size & Analysis

- Market Revenue

- Market Share & Analysis

- By Type

- By Security

- By Solutions and Services

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Railway Cyber Security Market Analysis, 2017-

- Market Size & Analysis

- Market Revenue2027

- Market Share & Analysis

- By Type

- By Security

- By Solutions and Services

- By Country

- China

- India

- Japan

- South Korea

- Others

- China Railway Cyber Security Market Analysis, 2017-2027

- Market Size & Analysis

- Market Revenue

- Market Share & Analysis

- By Type

- By Security

- By Solutions and Services

- Market Size & Analysis

- India Railway Cyber Security Market Analysis, 2017-2027

- Market Size & Analysis

- Market Revenue

- Market Share & Analysis

- By Type

- By Security

- By Solutions and Services

- Market Size & Analysis

- Japan Railway Cyber Security Market Analysis, 2017-2027

- Market Size & Analysis

- Market Revenue

- Market Share & Analysis

- By Type

- By Security

- By Solutions and Services

- Market Size & Analysis

- South Korea Railway Cyber Security Market Analysis, 2017-2027

- Market Size & Analysis

- Market Revenue

- Market Share & Analysis

- By Type

- By Security

- By Solutions and Services

- Market Size & Analysis

- Market Size & Analysis

- Global Railway Cyber Security Market Policies, Regulations, Product Standards

- Global Railway Cyber Security Market Trends & Insights

- Global Railway Cyber Security Market Dynamics

- Growth Drivers

- Challenges

- Impact Analysis

- Global Railway Cyber Security Market Hotspot & Opportunities

- Global Railway Cyber Security Market Key Strategic Imperatives for Success & Growth

- Global Competition Outlook

- Competition Matrix

- Product Portfolio

- Brand Specialization

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles (Business Description, Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Alstom

- Hitachi

- Bombardier

- Siemens

- Cisco

- Huawei

- Thales

- General Electric

- Toshiba Digital Solutions Corporations

- IBM

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making