Global Liquid Biopsy Market Research Report: Forecast (2023-2028)

By Work Process (Sample Preparation, Library Preparation, Sequencing, Data Analysis), By Technology (PCR [RT-PCR, dPCR, Multiplex PCR, Others], NGS, FISH, Other Technologies), By U...sage (RUO, Clinical), By Sample Type (Blood, Urine, Saliva, CerebroSpinal Fluid), By Product (Test /Services, Kits and Consumables, Instruments), By Circulating Biomarkers (Circulating Tumor Cells, Cell-free DNA, Circulating Cell-Free RNA, Exosomes and Extracellular Vesicles, Others), By Disease Type (Lung Cancer, Breast Cancer, Prostate Cancer, Colorectal Cancer, Melanoma, Other Cancers, Non-Oncology Disorders), By Clinical Application (Treatment Monitoring, Prognosis and Recurrence Monitoring, Treatment Selection, Diagnosis and Screening), By Region (North America, South America, Europe, Asia-Pacific, Middle East & Africa), By Country (US, Canada, Mexico, Brazil, UK, Germany, France, Italy, Spain, UAE, Saudi Arabia, South Africa, China, Japan, South Korea, India, South East Asia), By Company (Bio-Rad Laboratories, Biocept Inc, Abcodia Ltd, Chronix Biomedical, Epic Sciences Inc, Hoffmann-La Roche AG, Cynvenio Biosystems, Inc., GUARDANT HEALTH, INC, Illumina, Inc., NeoGenomics Laboratories, Inc., Menarini Silicon Biosystems, Inc., Qiagen N.V., Thermo Fisher Scientific, Personal Genome Diagnostics, Inc., Qiagen N.V. etc.) Read more

- Healthcare

- Jun 2023

- Pages 182

- Report Format: PDF, Excel, PPT

Market Definition

Liquid Biopsy is a laboratory test done on a sample of blood, urine, or other body fluids to look for remnants of cancer cells, from tumor to slightest strain, like DNA, RNA, or other molecules released by tumorous cancer cells into the body’s fluids. It can be applied to screen early cancer, track cancer/tumor progression, assess clinical prognosis, detect recurrent tumor cells, and more. It has gained attention and is appreciated as a non-invasive technique as it is less bodily taxing than tissue biopsy due to technological advances.

Market Insights & Analysis: Global Liquid Biopsy Market (2023-28)

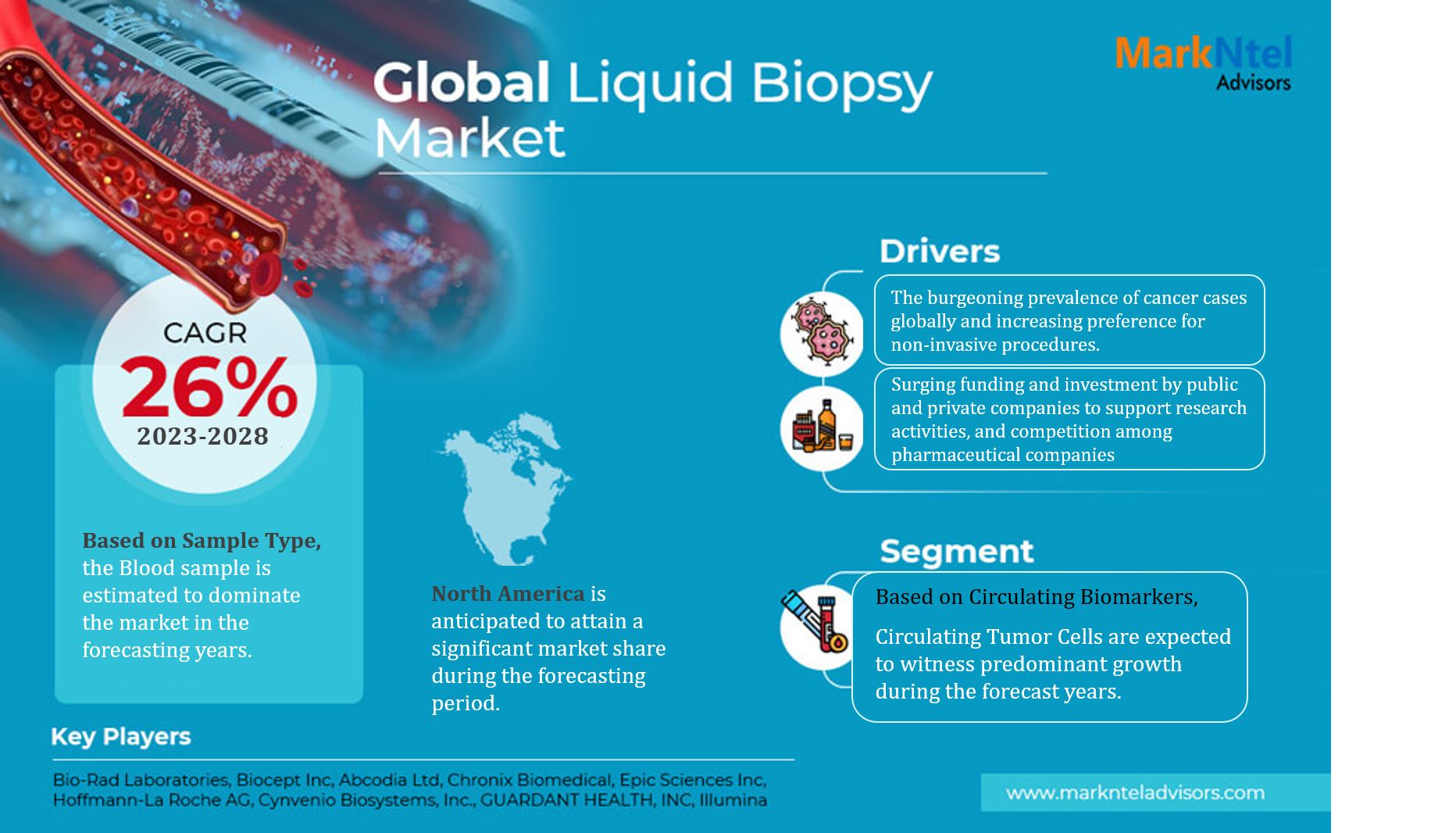

The Global Liquid Biopsy Market is projected to grow at a CAGR of around 26% during the forecast period, i.e., 2023-28. The market is significantly driven by the rising cases and prevalence of cancer, along with the increasing awareness and preference for non-invasive treatment procedures. Furthermore, the understanding and appreciation are guided by the several benefits associated with the new liquid biopsy technique, including rapid results, low cost, early prognosis, overcoming tumor heterogeneity, low risk, and non-invasiveness.

In addition, Liquid biopsy is less mentally taxing for the patient than other methods, such as tissue biopsy, resulting in further demand in the market and is expected to significantly drive the need for the market during the forecasting years.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 26% |

| Regions Covered | North America: The US, Canada, Mexico |

| Europe: United Kingdom, Germany, France, Spain, Italy, and Others | |

| Asia-Pacific: China, India, Japan, South Korea, South East Asia | |

| South America: Brazil, and Others | |

| Middle East & Africa: Saudi Arabia, UAE, South Africa | |

| Key Companies Profiled | Bio-Rad Laboratories, Biocept Inc, Abcodia Ltd, Chronix Biomedical, Epic Sciences Inc, Hoffmann-La Roche AG, Cynvenio Biosystems, Inc., GUARDANT HEALTH, INC, Illumina, Inc., NeoGenomics Laboratories, Inc., Menarini Silicon Biosystems, Inc., Qiagen N.V., Thermo Fisher Scientific, Personal Genome Diagnostics, Inc., Qiagen N.V. etc. |

| Unit Denominations | USD Million/Billion |

Consecutively, the rising preference for market growth is boosted by cancer awareness initiatives as it can monitor tumor progression early, along with eliminating the discomfort associated with the operation. In addition, with the emergence of advanced technologies, the demand for non-invasive diagnosis and treatment is rising. As it offers a non-risk effective alternative to patients, it is expected to spur the need for liquid biopsy in the forecasting period.

Furthermore, due to the inaccessibility of direct laboratories with infrastructures to undertake the liquid biopsy tests of patients in need, the fluid biopsy industry depends on the distance collection of samples by transporting the diagnostic kits to the patient. Therefore, this rising demand for the equipment would also accelerate the demand graph, further enhancing the Global Liquid Biopsy Market size in the future.

Moreover, developing interest, research, and competition among significant laboratories, clinical industries, and research companies with dedicated investments from private and public organizations to fund the research for better cancer treatments. With the integration of advanced technology into the treatment process, further Market expansion could be expected.

- In November 2020, NeoGenomics, Inc. launched a mobile phlebotomy service for biopsy tests. It ensures that the test is performed with geographical efficiency.

Market Dynamics

Key Driver: Surge in Cancer Cases Across the Globe

The number of cancer cases has surged significantly on a global scale. Environmental factors are the leading causes of cancer. The rise in cancer diagnosis has led various countries and international health organizations to undertake various initiatives to spread awareness about cancer. With this increase, Liquid biopsy is preferred for its multiple advantages, counting low-cost, early prognosis, tumor heterogeneity identification, drug resistance, therapeutic drug monitoring, and the most ascendant, patient comfort by eliminating the need for surgery. Consecutively, this increase in preference for Liquid Biopsies is expected to increase the Market during the forecasting period.

Possible Restraint: Compatibility of Liquid Biopsies with Specific Kinds and Stages of Cancer

Detecting ctDNA through Liquid Biopsy becomes technically tricky as the quantities of ctDNA may be lower in the plasma of a cancer patient for particular cancer mutations, especially after the treatment and surgery. It is also not applicable to all cancers, as certain tumors do not shed a recognizable amount of ctDNA. Also, there may be fewer than one detectable copy of the cancer mutation containing ctDNA in a patient’s sample, resulting in ctDNA not being identified, even though ctDNA is deficient. As a result, the credibility is lessened, as it might give a false negative where ctDNA is not identifiable. This discrepancy could negatively hinder the market.

Growth Opportunities: Developing Countries' Apprehension of Cancer

Developing economies such as India, South Korea, Russia, etc., are working towards a better system and treatment of cancer to cater to the high number of diagnoses with growth in urbanization, technological advancements, and awareness. Furthermore, potential growth opportunities for the industry exist due to higher cancer prevalence, booming population, steps towards building and improving the health care infrastructure, rising disposable income, and growing medical tourism within such countries. On top of that, due to proportionately less stringent regulations and data requirements, the Asia Pacific region is emerging as an adaptive and business-friendly hub, which could further help the market.

Key Trends: Global Health Organizations' Initiatives Toward Cancer Awareness

The government in various countries and global health organizations have undertaken several initiatives and started several schemes to spread awareness about cancer and its treatment. For Instance,

- On 4 February 2022, the World Health Organization's (WHO) International Agency for Research of Cancer (IARC) launched the World Code Against Cancer Framework. This online platform will promote prevention globally & develop Regional Codes to help fight the disease.

Likewise, the National Breast and Cervical Cancer Early Detection Program (NBCCEDP) provides breast cancer screening diagnosis for uninsured and low-income patients in the US every year, initiated by the US Centers for Diseases and Prevention (CDC) in 1991.

Market Segmentation

Based on Sample Type:

- Blood

- Urine

- Saliva

- CerebroSpinal Fluid

Here, the Blood sample is estimated to dominate the market in the forecasting years. A blood test is relatively simple, especially for the patient, as it is non-invasive, has no risks, and is painless. Also, because it reduces the cost and time taken for the diagnosis, patients and doctors prefer blood samples. In addition, CTCs, ctDNAs, exosomes, and microvesicles can be detected along with other biomarkers by blood-based liquid biopsy. These biomarkers can help determine tumor dynamics and assist in treatment. Additionally, more ongoing research on blood sample tests for cancer is expected to accelerate the market forward.

Based on Circulating Biomarkers:

- Circulating Tumor Cells

- Cell-free DNA

- Circulating Cell-Free RNA

- Exosomes and Extracellular Vesicle

- Others

Amongst the above, Circulating Tumor Cells are expected to witness predominant growth during the forecast years. Circulating Tumor Cells (CTCs) are the cells shed by the cancer tumor, which then spread through the bloodstream. As liquid biopsy is considered the most reliable method to recognize circulating tumor cells, it has resulted in them gaining rapid traction in the industry. In addition, circulating Tumor cells facilitate cancer prognosis, guide cancer therapeutics, and monitor therapeutic regimens.

Furthermore, the advancements in technology and science, which aim to better detect CTCs from different bodily fluids, have facilitated the early detection of various kinds of cancer through minimally invasive techniques, including Liquid Biopsy, thus pushing the market forward.

Regional Projection

Geographically, the Global Liquid Biopsy Market expands across:

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

Of them all, North America is anticipated to attain a significant market share during the forecasting period. It owes principally to the high adoption of advanced technologies like NGS's presence of well-established pharmaceutical companies, research centers, and biotechnology companies developing tests, funding, and investments from public and private organizations. Many organizations, such as the American Society of Clinical Oncology (ASCO), aid in the implementation of liquid biopsy. Additionally, the ongoing competition between biotechnological companies is expected to boost the market.

Along with it, a growing number of cancer diagnoses and the government's activeness towards the cause would further accelerate the growth of the market along with the presence of numerous national clinical laboratories and easy access to the technologically advanced instrument.

- In August 2020, Hoffmann-La Roche AG announced that it had received approval for its Foundation One Liquid CDx to diagnose solid tumors in the US FDA.

On the other hand, Asia Pacific is estimated to experience fast-growing market growth during the forecasting period with the increasing healthcare infrastructure and development of the region as a destination for healthcare tourism, given less stringent restrictions. Characterized by the booming economy, rising awareness, rising adoption of advanced techniques, and awareness programs, along with the rise in disposable income, the Asia-Pacific region is set to receive attention in the industry. In addition, the continuous adaptation of hospitals and diagnostic centers across states would further drive the industry.

Recent Developments in the Global Liquid Biopsy Market

- In August 2022, Thermo Fisher Scientific launched the first NGS-based test to support DNA and RNA input.

- In May 2022, Qiagen N.V. launched the therascreen EGFRplus RGQ PCR kit, a new in vitro diagnostic test for sensitive EGFR mutation analysis.

Gain a Competitive Edge with Our Global Liquid Biopsy Market Report

- Global Liquid Biopsy Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Liquid Biopsy Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Market Segmentation

- Assumptions

- Preface

- Executive Summary

- Global Liquid Biopsy Market Venture Capital Ecosystem

- Financing By Key Investors

- Financing Recipient Wise Details

- Global Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Work Process

- Sample Preparation

- Library Preparation

- Sequencing

- Data Analysis

- By Technology

- PCR

- RT-PCR

- dPCR

- Multiplex PCR

- Others

- NGS

- FISH

- Other Technologies

- PCR

- By Usage

- RUO

- Clinical

- By Sample Type

- Blood

- Urine

- Saliva

- Cerebrospinal Fluid

- By Products

- Test /Services

- Kits and Consumables

- Instruments

- By Circulating Biomarkers

- Circulating Tumor Cells

- Cell-free DNA

- Circulating Cell-Free RNA

- Exosomes and Extracellular Vesicles

- Others

- By Disease Type

- Lung Cancer

- Breast Cancer

- Prostate Cancer

- Colorectal Cancer

- Melanoma

- Other Cancers

- Non-Oncology Disorders

- By Clinical Application

- Treatment Monitoring

- Prognosis and Recurrence Monitoring

- Treatment Selection

- Diagnosis and Screening

- By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

- By Company

- Competition Characteristics

- Market Share & Analysis

- 2018

- 2019

- 2020

- Competitive Matrix

- By Work Process

- Market Size & Analysis

- North America Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Technology

- By Usage

- By Sample Type

- By Products

- By Circulating Biomarkers

- By Disease Type

- By Clinical Applications

- By Country

- The US Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Circulating Biomarkers

- By Disease Type

- By Clinical Applications

- Market Size & Analysis

- Canada Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Circulating Biomarkers

- By Disease Type

- By Clinical Applications

- Market Size & Analysis

- Mexico Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Circulating Biomarkers

- By Disease Type

- By Clinical Applications

- Market Size & Analysis

- The US Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- South America Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Technology

- By Usage

- By Sample Type

- By Products

- By Circulating Biomarkers

- By Disease Type

- By Clinical Applications

- By Country

- Brazil Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Product & Service

- By Circulating Biomarker

- By Technology

- By Sample Type

- By Application

- By Clinical Application

- Market Size & Analysis

- Market Size & Analysis

- Europe Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Technology

- By Usage

- By Sample Type

- By Products

- By Circulating Biomarkers

- By Disease Type

- By Clinical Applications

- By Country

- Germany Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Circulating Biomarkers

- By Disease Type

- By Clinical Applications

- Market Size & Analysis

- France Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Circulating Biomarkers

- By Disease Type

- By Clinical Applications

- Market Size & Analysis

- The United Kingdom Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Circulating Biomarkers

- By Disease Type

- By Clinical Applications

- Market Size & Analysis

- Italy Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Circulating Biomarkers

- By Disease Type

- By Clinical Applications

- Market Size & Analysis

- Spain Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Circulating Biomarkers

- By Disease Type

- By Clinical Applications

- Market Size & Analysis

- Germany Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- Middle East & Africa Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Technology

- By Usage

- By Sample Type

- By Products

- By Circulating Biomarkers

- By Disease Type

- By Clinical Applications

- By Country

- Saudi Arabia Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Circulating Biomarkers

- By Disease Type

- By Clinical Applications

- Market Size & Analysis

- UAE Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Circulating Biomarkers

- By Disease Type

- By Clinical Applications

- Market Size & Analysis

- Market Size & Analysis

- South Africa Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Circulating Biomarkers

- By Disease Type

- By Clinical Applications

- Market Size & Analysis

- Asia-Pacific Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Technology

- By Usage

- By Sample Type

- By Products

- By Circulating Biomarkers

- By Disease Type

- By Clinical Applications

- By Country

- China Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Circulating Biomarkers

- By Disease Type

- By Clinical Applications

- Market Size & Analysis

- India Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Circulating Biomarkers

- By Disease Type

- By Clinical Applications

- Market Size & Analysis

- Japan Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Circulating Biomarkers

- By Disease Type

- By Clinical Applications

- Market Size & Analysis

- South Korea Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Circulating Biomarkers

- By Disease Type

- By Clinical Applications

- Market Size & Analysis

- South East Asia Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Circulating Biomarkers

- By Disease Type

- By Clinical Applications

- Market Size & Analysis

- China Liquid Biopsy Market Outlook, 2018-2028F

- Market Size & Analysis

- Global Liquid Biopsy Market List of Biopsies Approved by The Governments

- Global Liquid Biopsy Market Policies, Regulations, Product Standards

- The United States

- European Union

- Global Liquid Biopsy Market Intellectual Property Rights Insights

- Patent Portfolio of Leading Players

- Patent Filings, Registrations and Expiration

- Global Liquid Biopsy Market Trends & Insights

- Global Liquid Biopsy Market Dynamics

- Growth Drivers

- Challenges

- Impact Analysis

- Global Liquid Biopsy Market Hotspot & Opportunities

- Competition Outlook

- Competition Matrix

- Product/ Solution Portfolio

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Competitor Capability Matrix

- By Technology

- By Sample Type

- By Biomarker

- By Application

- Company Profiles of Top Companies (Business Description, Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Bio-Rad Laboratories

- Biocept Inc

- Abcodia Ltd

- Chronix Biomedical

- Epic Sciences Inc

- Hoffmann-La Roche AG

- Cynvenio Biosystems, Inc.

- GUARDANT HEALTH, INC

- Illumina, Inc.

- NeoGenomics Laboratories, Inc.

- Menarini Silicon Biosystems, Inc.

- Qiagen N.V.

- Thermo Fisher Scientific

- Personal Genome Diagnostics, Inc.

- Qiagen N.V.

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making