GCC Concrete Admixture Market Research Report: Forecast (2022-27)

By Admixture Type(Water Reducer (plasticizers, mid-range plasticizers and superplasticizers), Accelerator (triethanolamine, calcium formate, silica fume, etc.), Retarder (calcium s...ulphate or gypsum, starch, cellulose products, etc.), Air Entraining (vinsol resin, darex, Teepol, Cheecol, etc.), Alkali Aggregate Expansion Inhibitors (aluminum powder and lithium salts), Corrosion Admixture (sodium benzoate, sodium nitrate, sodium nitrite etc.), Others (pozzolanic, damp-proofing, gas forming, Air detainer, etc.), By End User(Residential, Corporate Buildings, Healthcare, Oil and Gas, Hospitality, Public Utility (Dams, Bridges, Airports, Roads, etc.),Manufacturing, Others(Power Plants, Education Institutes, etc), By Country (UAE, Saudi Arabia, Oman, Qatar, Kuwait, Bahrain), By Company(BASF SE, Sika GCC, MBCC Group, Arkema Middle East DMCC (Bostik), Chryso Group, Mapei S.p.A., Dow Chemical Company, Arkaz Alsharq Building Materials, Don Construction Products Ltd., Fosroc Inc) Read more

- Chemicals

- Mar 2022

- Pages 194

- Report Format: PDF, Excel, PPT

Market Definition

Concrete admixtures are additives/materials that act as enhancers to the concrete before or during cement mixing. Adding these chemicals to freshly formed concrete or hardened concrete alters the properties, enriching the cement mixture. Moreover, in construction plants, they are delivered in liquid form & directly added to concrete. Its primary functions include corrosion inhibition, shrinkage reduction, alkali-silica reactivity reduction, workability enhancement, water reduction, damp proofing, coloring, among others. With the rise in the construction sector, the demand for the concrete admixtures industry is expected to grow in the coming years.

Market Insights

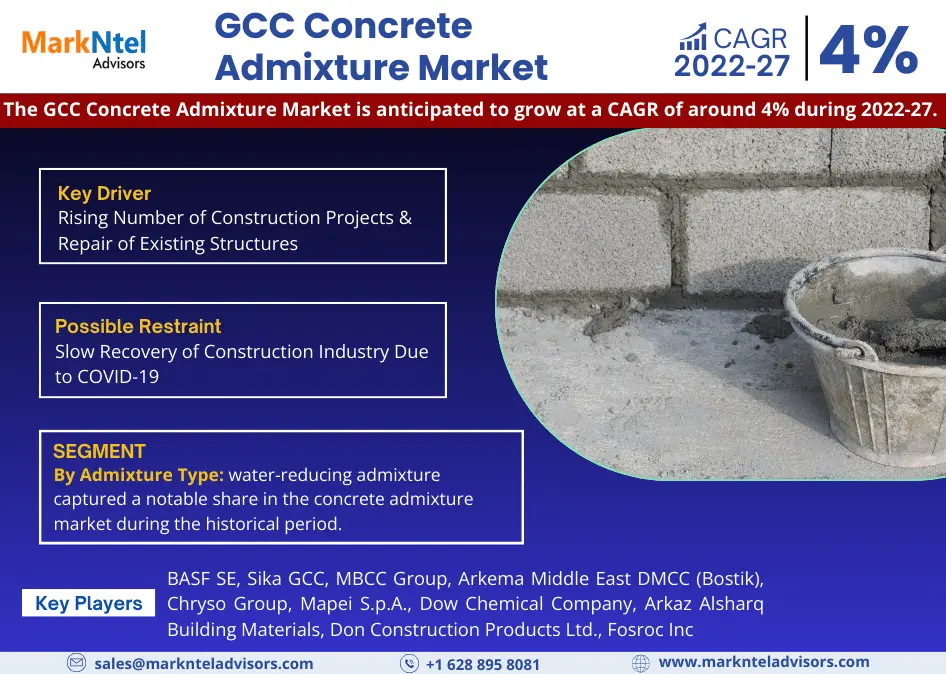

The GCC Concrete Admixture Market is anticipated to grow at a CAGR of around 4% during the forecast period, i.e., 2022-27. The rise in government investments by countries such as Saudi Arabia, the UAE, Qatar, etc., for the development of smart cities has contributed significantly to the growing demand for concrete additives. In addition, the growing infrastructure, such as the Silicon Park Project, the Red Sea Project, and various power projects, has expanded the need for concrete admixtures in the countries. Furthermore, noteworthy events have been hosted in the region, such as Expo 2020 in the UAE, FIFA World Cup 2022 in Qatar, etc., resulting in the rapid development of new structures such as residential buildings, office buildings, hospitals, etc.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2017-20 |

| Base Year: 2021 | |

| Forecast Period: 2022-27 | |

| CAGR (2022-2027) | 4% |

| Country Covered | UAE, Saudi Arabia, Oman, Qatar, Kuwait, Bahrain |

| Key Companies Profiled | BASF SE, Sika GCC, MBCC Group, Arkema Middle East DMCC (Bostik), Chryso Group, Mapei S.p.A., Dow Chemical Company, Arkaz Alsharq Building Materials, Don Construction Products Ltd., Fosroc Inc |

| Unit Denominations | USD Million/Billion |

Hence, the progressive growth in the number of construction activities across the GCC has heightened the requirement of concrete admixture for the durability of the building & stability improvement. In addition, the GCC region has a chronic water shortage, and several countries, including Oman, Bahrain, and Kuwait, are actively implementing technologies and other water-saving methods to reduce water usage. In this regard, concrete admixture, such as water reducers, has placed itself as a promising product to reduce the water usage at the time of cement mixing. The ability of water-reducing concrete admixture to harden the cement mixture with minimum utilization of water has broadened the scope of concrete admixture in the region. As a result, the market for concrete admixture is expected to grow rapidly in the forecast years.

Impact of Covid-19 on the GCC Concrete Admixture Market

The outbreak of the COVID-19 resulted in the sudden standstill of construction activities due to mobility restrictions imposed by the government of countries, including Saudi Arabia, the UAE, Bahrain, Qatar, etc., in 2020. On the other hand, the disruption in the global supply chain resulted in low oil revenues of these countries, which contracted the government construction budget during 2020. Subsequently, the impact of the slowdown in the construction industry was also felt in the mid of 2021. Therefore, the contraction of the overall spending on building & infrastructure across GCC led to low demand for concrete admixture during 2020-21.

Market Segmentation

By Admixture Type:

- Water Reducer (plasticizers, mid-range plasticizers & superplasticizers)

- Accelerator (triethanolamine, calcium formate, silica fume, etc.)

- Retarder (calcium sulfate or gypsum. Starch, cellulose products, etc.)

- Air Entraining (vinsol resin, darex, Teepol, Cheecol, etc.)

- Alkali Aggregate Expansion Inhibitors (aluminum powder & lithium salts)

- Corrosion Admixture (sodium benzoate, sodium nitrate, sodium nitrite, etc.)

- Others (Pozzolanic, Damp-proofing, Gas Forming, Air Detainer, etc.)

Based on admixture type, water-reducing admixture captured a notable share in the concrete admixture market during the historical period. Water-reducing concrete admixtures are used to enhance the durability & improve the stability of the building structures as they can reduce water up to 15% in the concrete mixture. In addition, it reduces the water-cement ratio by 7-8%, resulting in reduced CO2 emissions during construction. Thus, the water-reducers appeared to be one of the most protruding admixtures used in the construction, as it is readily available, sustainable, and has a low cost. Further, the demand for plasticizers has been increased in the residential & commercial construction industry, owing to its water-reducing property. Hence, it would significantly elevate the demand for concrete admixture in the coming years. Moreover, various players in the region have started implementing different ways to position their product offerings in the market. As a result, this would establish firm grounds for concrete admixture demand across GCC.

- In April 2021, Sika GCC announced that it has been working on the development of a low CO2 emission water-reducing admixture that enabled sustainable construction by implementing the LC3 technology. This technology can lower the CO2 emission during the construction of buildings, bridges, etc.

By End User:

- Residential

- Corporate Buildings

- Healthcare

- Oil & Gas

- Hospitality

- Public Utility (Dams, Bridges, Airports, Roads, etc.)

- Manufacturing

- Others (Power Plants, Education Institutes, etc.)

Based on end-user, the residential sector held a considerable share in the GCC Concrete Admixture Market during the historical period, and the trend will continue to lead in the forthcoming years as well. There has been a growing use of concrete admixture in residential construction, as it improves the sturdiness & firmness of the building structure. Therefore, the growing investments to build new residential infrastructure settings, such as affordable social housing, construction of new skyscrapers, increasing count of luxury villas, etc., would magnify the demand for concrete admixture. In addition, the growing trend of constructing high-rise buildings across GCC countries to accommodate the rising population of expatriates has deepened the government’s emphasis on the construction sector.

- In February 2022, Saudi Arabia launched a new Public-Private Partnership (PPP) to build new 618 flats, aimed to expand citizens’ house ownership in the country.

Regional Landscape

- UAE

- Saudi Arabia

- Oman

- Qatar

- Kuwait

- Bahrain

Geographically, Saudi Arabia is one of the major countries in the GCC region, contributing to the growth of the concrete admixture market. The factors responsible for the market growth are the rising cost competitiveness, advancements in building infrastructure, power projects, and surging government investments in the construction sector. Moreover, under the Saudi Vision 2030 & National Transformation Plan, the government aimed to increase the real estate sector contributing GDP by 5% to 10% by establishing a partnership with private sector developers to use government land for housing projects in Saudi Arabia. Further, under Saudi Vision 2030, the government has invested a considerable amount in housing projects for the development of new residential buildings, which would further fuel the market growth of concrete admixture. Additionally, the increasing inclination & massive investment towards the development of new construction projects in Saudi Arabia has led to the generation of new demand for the concrete admixture, which, is further projected to escalate during the forecast period.

Recent Developments by Leading Companies

- In 2021, Arkaz Alsharq Building Materials entered into an agreement with Silkroad C&T to become an exclusive distributor for various concrete products, including admixtures, chemicals, polymers, etc., in Saudi Arabia, Oman, and Bahrain.

- In early 2019, Arkema Middle East DMCC inaugurated its new offices in Dubai, UAE. This signifies its deepening interest to approach the GCC concrete admixture market via increasing its presence in the UAE.

- In 2019, Sika GCC acquired Parex, which was one of the biggest acquisitions of the company in the region. Under this acquisition, Sika GCC expanded its portfolio for the building finishing market.

- In 2019, BASF launched a new smartphone App, ‘MyConcrete’, to aid concrete producers to produce quality concrete by answering common questions about factors that impact slump, air, finishing, and set-time.

Market Dynamics:

Key Driver

- Rising Number of Construction Projects & Repair of Existing Structures

The growing number of construction activities focused on the development of new commercial & residential buildings in Saudi Arabia, the UAE, Qatar, Oman, etc., have led to an increased demand for concrete admixtures. Concrete admixtures provide high durability & ensure the high quality of concrete during mixing, curing, and transporting. Furthermore, the countries in the region have an increasing number of construction projects under their strategic initiatives, and long-term infrastructure strengthening goals, that are closely associated with the development of modern residential complexes & commercial structures. In addition, the rising implementation of the Public-Private Partnership (PPP) model in the GCC’s construction sector, along with the numerous government projects such as the Red Sea project, Silicon Park project, Furjan Wadi Lusail, etc., has escalated the demand for the concrete admixture market.

- In 2019, Abu Dhabi introduced Public-Private Partnership regulations to support & increase private sector investment for the development of infrastructure across the UAE.

- In 2018, the government of Saudi Arabia signed five agreements for the construction of around 19,000 housing units in Riyadh.

Possible Restraint

- Slow Recovery of Construction Industry Due to COVID-19

The downfall experienced by GCC’s construction sector as a result of the COVID-19 pandemic has impacted the growth of concrete admixtures. The rippling effects of COVID-19 have been critical on the construction sector of countries, such as Oman, Bahrain, and Kuwait due to which the scope of concrete admixtures has been contracted notably. Moreover, the decline in the foreign direct investments (FDI) in these countries has impeded the establishment of new greenfield projects which could have been an opportunity area for concrete admixtures.

- According to the Royal Institution of Chartered Surveyors (RICS), in 2020, about 34% of Oman's construction projects were on hold and approximately 4% of them were permanently canceled.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- By Value & Volume, Forecast Numbers, Segmentation, Shares) of the GCC Concrete Admixture Market?

- What are the country-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the GCC Concrete Admixture Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the GCC Concrete Admixture Market based on the competitive benchmarking matrix?

- What are the key results derived from surveys conducted during the GCC Concrete Admixture Market study?

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Assumption

- Market Segmentation

- Executive Summary

- Impact of Covid-19 on GCC Concrete Admixture Market

- GCC Concrete Admixture Market Trends & Insights

- GCC Concrete Admixture Market Dynamics

- Drivers

- Challenges

- GCC Concrete Admixture Market Regulations & Policy

- GCC Concrete Admixture Market Supply Chain Analysis

- GCC Concrete Admixture Market Hotspots & Opportunities

- GCC Concrete Admixture Market Outlook, (2017-2027)

- Market Size & Analysis

- By Revenues

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Admixture Type

- Water Reducer (plasticizers, mid-range plasticizers and superplasticizers)

- Accelerator (triethanolamine, calcium formate, silica fume, etc.)

- Retarder (calcium sulphate or gypsum. Starch, cellulose products, etc.)

- Air Entraining (vinsol resin, darex, Teepol, Cheecol, etc.)

- Alkali Aggregate Expansion Inhibitors (aluminum powder and lithium salts)

- Corrosion Admixture (sodium benzoate, sodium nitrate, sodium nitrite etc.)

- Others (Pozzolanic, Damp-proofing, Gas Forming, Air detainer, etc.)

- By End User

- Residential

- Corporate Buildings

- Healthcare

- Oil and Gas

- Hospitality

- Public Utility (Dams, Bridges, Airports, Roads, etc.)

- Manufacturing

- Others (Power Plants, Education Institutes, etc.)

- By Country

- UAE

- Saudi Arabia

- Oman

- Qatar

- Kuwait

- Bahrain

- By Company

- Competition Characteristics

- Revenue Shares

- By Admixture Type

- Market Size & Analysis

- UAE Concrete Admixture Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis

- By Admixture Type

- By End User

- Market Size & Analysis

- Saudi Arabia Concrete Admixture Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis

- By Admixture Type

- By End User

- Market Size & Analysis

- Oman Concrete Admixture Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis

- By Admixture Type

- By End User

- Market Size & Analysis

- Qatar Concrete Admixture Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis

- By Admixture Type

- By End User

- Market Size & Analysis

- Kuwait Concrete Admixture Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis

- By Admixture Type

- By End User

- Market Size & Analysis

- Bahrain Concrete Admixture Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis

- By Admixture Type

- By End User

- Market Size & Analysis

- GCC Concrete Admixture Market Key Strategic Imperatives for Growth & Success

- Competitive Benchmarking

- Competition Matrix

- Product Portfolio

- Target Markets

- Target Security Type

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Companies Profile (Business Description, Products Diversification, Solutions, Assets, Target Market, Partnership, Merger & Acquisition, etc.)

- BASF SE

- Sika GCC

- MBCC Group

- Arkema Middle East DMCC (Bostik)

- Chryso Group

- Mapei S.p.A.

- Dow Chemical Company

- Arkaz Alsharq Building Materials

- Don Construction Products Ltd.

- Fosroc Inc

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making