Europe Medium & Heavy Duty Electric Trucks Market Research Report: Forecast (2023-2028)

By Battery Capacity (50-250 KWH, Above 250 KWH), By Battery Type (Lithium-Nickle-Manganese-Cobalt Oxide, Lithium-Iron-Phosphate, Others), By Propulsion Type (Battery Electric Truck... [BET], Plug-in Hybrid Electric Truck [PHET], Fuel Cell Electric Truck [FCET]), By Level of Automation (Level 1, Level 2, Level 3, Level 4 & 5), By Range (Up to 200 miles, Above 200 miles), By Application (Long Haul Transportation, Field Services, Distribution Services, Others), By Country (Germany, The UK, France, Italy, Spain, Rest of the Europe), By Company (Volvo Group, Renault Trucks, Scania AB, Daimler, MAN trucks, Tevva Motors Limited, Tesla Motors Inc. trucks, IVECO SpA, E-Force One AG, DAF Trucks NV, Others) Read more

- Automotive

- May 2023

- Pages 157

- Report Format: PDF, Excel, PPT

Market Definition

Several European countries have rigorously implemented zero-emission norms, and are increasingly adopting green mobility solutions, owing to which EV (Electric Vehicle) sales are skyrocketing with ever-increased EV charging infrastructure developments alongside incentives for EV buyers. As governments continue to focus on lowering these emissions and the e-commerce & logistics sectors are flourishing at a phenomenal pace, Europe is witnessing a significantly surging demand for medium & heavy-duty electric trucks.

Market Insights

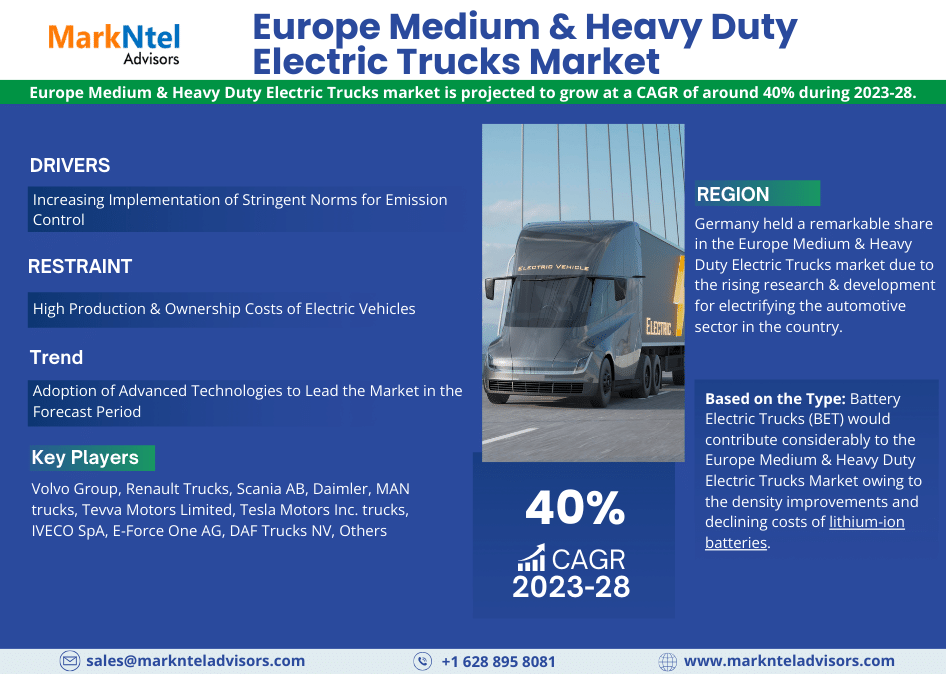

The Europe Medium & Heavy Duty Electric Trucks market is projected to grow at a CAGR of around 40% during the forecast period, i.e., 2023-28. It owes to the growing proliferation of EVs, several targets toward reducing carbon emissions, and the energy production shifts to renewable sources in order to meet the Paris Agreement target of reducing GHG emissions by 2050. As a result, the demand for electric trucks in countries like Austria, France, & Germany, among others, is dramatically increasing, thereby driving the market.

According to the International Energy Agency (IEA), the gross energy consumption through renewable resources in France increased from 17.2% in 2019 to 19.1% in 2020. Thus, both consumers & OEMs in countries like France, the UK, & Germany are shifting toward electric trucks to attain sustainable goals in the automotive sector.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 40% |

| Country Covered | Germany, The UK, France, Italy, Spain, Rest of the Europe |

| Key Companies Profiled | Volvo Group, Renault Trucks, Scania AB, Daimler, MAN trucks, Tevva Motors Limited, Tesla Motors Inc. trucks, IVECO SpA, E-Force One AG, DAF Trucks NV, Others |

| Unit Denominations | USD Million/Billion |

Various government efforts, like the Efficient and Sustainable Mobility Incentives (MOVES) II program in Spain, the electro-mobility directive from Germany, and electric charging funding in France, have driven electrification in the transportation sector, alongside the expansion of EV charging infrastructure. Additionally, in 2022 the Heavy-duty vehicle (HDV) manufacturers made ambitious pledges to sell more & more battery-electric and fuel-cell electric trucks, to about 40% of new vehicle sales in 2030 and close to 100% of those in 2040, as per European Clean Trucking Alliance.

The European Union’s (EU) CO2 standards for trucks and buses also got revised in November 2022, which provided an opportunity to enshrine the ambitions of manufacturers for zero-emission vehicles into regulations. However, the declining crude oil reserves globally and, consequently, its increasing prices in European countries, coupled with the low maintenance of electric trucks, are other prominent aspects stimulating the market growth. Moreover, appealing truck & battery leasing alternatives and easier access to charging stations would further promulgate the expansion of the medium and heavy-duty electric trucks market in Europe over the coming years.

Market Dynamics:

Key Driver: Increasing Implementation of Stringent Norms for Emission Control

The sales of medium and heavy duty trucks vehicles have been growing steadily in Europe as more & more emission-related norms & regulations are being implemented by governments & the European Union in order to reduce the impact of global warming & greenhouse effect. In 2022, the European Union presented the new Euro 7 standards for ensuring cleaner vehicles on roads and improved air quality. These norms extremely focus on lowering harmful gasses like carbon monoxide, hydrocarbons, nitrogen oxides, etc.

In addition, various countries like Portugal, Finland, & Denmark, among others, have set their targets to phase-out conventional fuel-based trucks by 2040, which would result in a strong demand for electric trucks in the coming years. Hence, OEMs like Volvo, Renault, MAN, & Scania are increasing their production capacities in order to cater to the evolving consumer demands, thereby driving the Europe Medium & Heavy Duty Electric Trucks Market.

Growth Restraint: High Production & Ownership Costs of Electric Vehicles

Financing the transition to zero-emission trucking is one of the major challenges faced by fleet owners. The truck companies lack the resources to overcome the large capital investments needed to purchase zero-emission trucks due to the higher Total Cost of Ownership (TCO) of electric trucks as compared to diesel trucks. Hence, the high investment in the procurement of electric trucks is restraining the fleet owners from transiting to the electric trucks and this may further create a challenge for the Europe Medium and Heavy-Duty Electric Trucks market during the forecast period as well.

Key Trend: Adoption of Advanced Technologies to Lead the Market in the Forecast Period

The development of self-driving electric trucks is the key trend gaining popularity in the electric trucks market in Europe. The vehicle manufacturing companies are collaborating with related technology-based companies to accelerate their research and development efforts for the development of advanced self-driving truck models in Europe. For instance,

in 2022, Pininfarina, an Italy-based design company and subsidiary of Mahindra, developed an electric semi-truck in partnership with Deppway, a subsidiary of Baidu, which has provided self-driving technology known as the Highway Intelligence System (HIS) to the truck. The self-drive system uses 11 cameras on board, an infrared detector, 5mm wave radars, and LIDAR sensors. Thus, the growing development of self-driving trucks in Europe is anticipated to propel the market demand in the forthcoming years as well.

Market Segmentation

By Propulsion Type:

- Battery Electric Truck (BET)

- Plug-in Hybrid Electric Truck (PHET)

- Fuel Cell Electric Truck (FCET)

Of these three, Battery Electric Trucks (BET) would contribute considerably to the Europe Medium & Heavy Duty Electric Trucks Market owing to the density improvements and declining costs of lithium-ion batteries. As BETs consume no conventional resources, it results in zero-carbon emissions. Moreover, the increasing number of targets set by several countries in Europe to phase-out conventional fueled trucks across the EU-27 is another crucial aspect augmenting the demand for BETs.

As a result, to support the sustainable goals of these countries, EV companies like MAN, Northvolt AB, etc., alongside battery manufacturers have ramped up their production & distribution capacities in order to cater to the ever-growing end-user requirements for BETs, thereby propelling the overall market expansion.

By Level of Automation:

- Level 1

- Level 2

- Level 3

- Level 4 & 5

Here, the demand for Level 3 trucks is projected to rise substantially during 2023-28, owing mainly to the active government efforts toward increasing the fleet size of automated & electric driven trucks, coupled with initiatives like the Connected and Automated Mobility (CAM) taken by the UK government in 2015 that aimed at bringing together CAM technology developers, vehicle manufacturers & suppliers, academia, insurers, local & regional governments, and transport bodies, for R&D on automated vehicles.

Moreover, Level 3 automated trucks have gained immense popularity across Europe in recent years as they are equipped with ADAS (Advanced Driver Assistance System) that assists in environmental detection, leading to conditional driving without the requirement of a driver. Additionally, as the level 4 & level 5 automated vehicles are still in R&D phase, consumers are increasingly opting for level 3 electric trucks, and the same trend is likely to be followed in the forecast years.

By Range:

- Up to 200 miles

- Above 200 miles

Among both, above 200-mile electric trucks are witnessing higher in Europe, mainly for inter-state & inter-city cargo deliveries that incur long distances. Increased R&D in battery technologies that have resulted in longer EV ranges and massive investments in developing EV charging stations are the prime aspects augmenting the demand for electric trucks that can run beyond 200 miles. Additionally, the significantly expanding food & beverage, agriculture, & healthcare sectors are also propelling the demand for EVs that can travel long distances to transport consumption products in both domestic & international markets.

Regional Projection

Geographically, the market expands across:

- Germany

- The UK

- France

- Italy

- Spain

- Rest of the Europe

Germany held a remarkable share in the Europe Medium & Heavy Duty Electric Trucks market due to the rising research & development for electrifying the automotive sector in the country. According to the European Automobile Manufacturers Association, Germany registered a sale of 987 electric trucks out of 1,243 total electric trucks in the European Union. Commercial trucks are a significant source of carbon emissions owing to their massive use in the transportation of goods to different destinations. Thus, the government started various initiatives to boost the sale of electric trucks in the country.

In 2021, the government announced an investment of around USD7.9 billion for the commercial fleets’ uptake of electrified powertrains, including retrofitting to replace diesel power units. The government would pay up to 80% of the additional investment costs of going electric compared to replacing vehicles with diesel equivalents. Hence, the rapidly rising carbon emissions and strong government support & investments are proliferating the demand for medium & heavy-duty electrical trucks in Germany.

Recent Developments by Leading Companies

- 2022: MAN Truck & Bus SE announced the production of high voltage batteries for electric trucks & buses, in Nuremberg, Germany from 2025, with an investment of around USD106 million.

Gain a Competitive Edge with Our Europe Medium & Heavy Duty Electric Trucks Market Report

- Europe Medium & Heavy Duty Electric Trucks Market Report by Markntel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Europe Medium & Heavy Duty Electric Trucks Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Europe Medium and Heavy Duty Electric Trucks Market Trends & Insights

- Europe Medium and Heavy Duty Electric Trucks Market Dynamics

- Growth Drivers

- Challenges

- Europe Medium and Heavy Duty Electric Trucks Market Policies, Regulations, & Product Standards

- Europe Medium and Heavy Duty Electric Trucks Market- Supply Chain Analysis

- Key Stakeholders

- Margins Across the Stakeholders

- Europe Medium and Heavy Duty Electric Trucks Market Start-up Ecosystem

- Company Started

- Country Incorporated

- Year on Year Funding Received

- Key Investors Active in the Market

- Series Wise Funding Received

- Europe Medium and Heavy Duty Electric Trucks Market Hotspot & Opportunities

- Europe Medium and Heavy Duty Electric Trucks Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Battery Capacity

- 50-250 KWH

- Above 250 KWH

- By Battery Type

- Lithium-Nickle-Manganese-Cobalt Oxide

- Lithium-Iron-Phosphate

- Others (Lead-Acid Batteries, Ultracapacitors, etc.)

- By Propulsion Type

- Battery Electric Truck (BET)

- Plug-in Hybrid Electric Truck (PHET)

- Fuel Cell Electric Truck (FCET)

- By Level of Automation

- Level 1

- Level 2

- Level 3

- Level 4 & 5

- By Range

- Up to 200 miles

- Above 200 miles

- By Application

- Long Haul Transportation

- Field Services

- Distribution Services

- Others (Last Mile Delivery, Refuse Services, etc.)

- By Country

- Germany

- The UK

- France

- Italy

- Spain

- Rest of the Europe

- By Companies

- Units Sold and Revenue Generated

- Competition Characteristics

- By Battery Capacity

- Market Size & Analysis

- Germany Medium and Heavy Duty Electric Trucks Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Battery Capacity

- By Battery Type

- By Propulsion Type

- By Level of Automation

- By Range

- By Application

- Market Size & Analysis

- The UK Medium and Heavy Duty Electric Trucks Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Battery Capacity

- By Battery Type

- By Propulsion Type

- By Level of Automation

- By Range

- By Application

- Market Size & Analysis

- France Medium and Heavy Duty Electric Trucks Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Battery Capacity

- By Battery Type

- By Propulsion Type

- By Level of Automation

- By Range

- By Application

- Market Size & Analysis

- Italy Medium and Heavy Duty Electric Trucks Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Battery Capacity

- By Battery Type

- By Propulsion Type

- By Level of Automation

- By Range

- By Application

- Market Size & Analysis

- Spain Medium and Heavy Duty Electric Trucks Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Battery Capacity

- By Battery Type

- By Propulsion Type

- By Level of Automation

- By Range

- By Application

- Market Size & Analysis

- Europe Medium and Heavy Duty Electric Trucks Market Key Strategic Imperatives for Growth & Success

- Competition Outlook

- Competition Matrix

- Brand Specialization

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles (Business Description, Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Volvo Group

- Renault Trucks

- Scania AB

- Daimler

- MAN trucks

- Tevva Motors Limited

- Tesla Motors Inc. trucks

- IVECO SpA

- E-Force One AG

- DAF Trucks NV

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making