Global Electric Vehicle Fast Charging System Market Research Report: Forecast (2022-2027)

By Application (Public, Private), By Vehicle Type (Passenger Car, Light Commercial Vehicle, Medium & Heavy Commercial Vehicle), By Product (CHADeMO, SAE Combo Charging System, Supe...rcharger, GB/T), By Charging Power (Less than 100 KW, 100-200 KW, Greater than 200 KW), By Region (North America, South America, Europe, the Middle East & Africa, Asia-Pacific), By Competitors (ABB, Blink Charging Co., BP Chargemaster Ltd, Broadband TelCom Power, Inc., ChargePoint Inc., Delta Electronics, Inc., Efacec Electric Mobility, EVBox, FLO, GARO Group, Proterra Inc., Signet EV Inc., Tesla, Inc., Tritium Pty Ltd, ShenZhen SETEC Power Co., Ltd., Xi?an TGOOD Intelligent, Charging Technology Co., Ltd., Others) Read more

- Automotive

- Jun 2022

- Pages 205

- Report Format: PDF, Excel, PPT

Market Definition

Electrical vehicle (EV) fast chargers are used to provide power to electric vehicles via the installed battery set & help to charge the battery. Electric vehicle (EV) fast-charging systems come under Level-3 chargers & range from 22KW to nearly 200KW. These charging stations are commonly found in the public areas & charge the vehicle faster than normal chargers, thereby reducing the time taken to charge an EV. In addition, it has the capability to charge more than one electric vehicle at a time to reduce delay in charging time.

Moreover, the growing environmental concerns from the internal combustion engine (ICE) vehicles have stimulated the global automotive industry's strategic shift toward renewable energy sources, which would augment the market growth in the coming years.

Market Insights

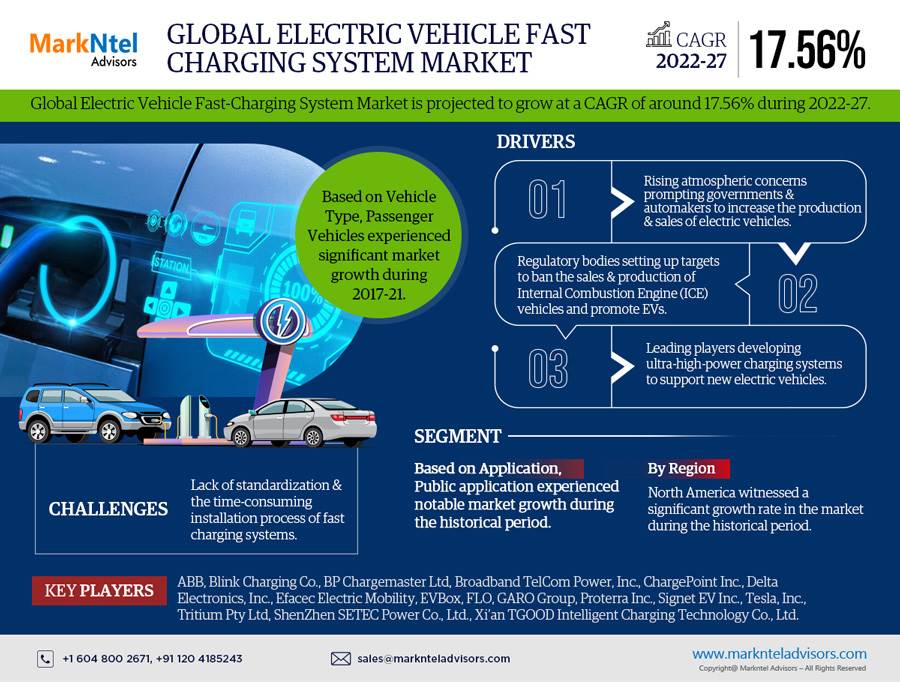

The Global Electric Vehicle Fast-charging System market is projected to grow at a CAGR of around 17.56% during the forecast period, i.e., 2022-27. The Global Electric Vehicle Fast-Charging System market witnessed a significant growth rate during the historical period. The factors responsible for market growth have been the rising concerns about global warming due to extensive pollution caused by the ICE vehicles. As a result, the government bodies of various countries across the globe have initiated numerous plans to stimulate EV demand & infrastructure in their respective countries. Moreover, with these steps, the regulatory bodies are also setting up some targets for banning the sales & production of internal combustion engine vehicles in the countries. Hence, this resulted in an increasing demand for electrical vehicles across the globe, which escalated the demand for the fast charging system.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2017-20 |

| Base Year: 2021 | |

| Forecast Period: 2022-27 | |

| CAGR (2022-2027) | 17.56% |

| Regions Covered | North America: The US, Canada, Others |

| South America: Brazil, Rest of South America | |

| Europe: Germany, The UK, France, Germany, Spain, Italy, Rest of Europe | |

| Asia-Pacific: China, Japan, India, South Korea, Rest of Asia Pacific | |

| Middle East & Africa: GCC, South Africa, Rest of Middle East and Africa | |

| Key Companies Profiled | ABB, Blink Charging Co., BP Chargemaster Ltd, Broadband TelCom Power, Inc., ChargePoint Inc., Delta Electronics, Inc., Efacec Electric Mobility, EVBox, FLO, GARO Group, Proterra Inc., Signet EV Inc., Tesla, Inc., Tritium Pty Ltd, ShenZhen SETEC Power Co., Ltd., Xi?an TGOOD Intelligent, Charging Technology Co., Ltd., Others |

| Unit Denominations | USD Million/Billion |

Furthermore, the automobile industry experts are also backing up these schemes by providing rebates & plans for pushing people toward the e-mobility trend. Therefore, the car manufacturers are also planning & gearing up to make relevant changes in EVs to meet the future demand for EVs. For instance, Volvo is targeting to obtain 50% of vehicle sales from their electric vehicles segment by 2025. These proactive efforts & policies are destined to result in the growth of EV charging infrastructure & the installation of public & private charging stations in countries across the globe.

Additionally, the growing demand for electric vehicles has spurred the expansion of direct current (DC) fast-charging infrastructure. DC fast-charging infrastructure is rapidly increasing with the demand for high power & less time-consuming charging systems. Therefore, several companies, including Tritium Pty Ltd & ABB, are developing ultra-high-power charging systems to support new electric vehicles such as electric passenger cars, electric buses, and electric trucks, which can be charged much faster than conventional DC fast chargers. Further, the rising demand for electric vehicles in countries, including China, the US, and India, as well as the growing investment in the development of charging infrastructure, has led to the worldwide demand for electric vehicles.

Impact of COVID-19 on the Global Electric Vehicle Fast-Charging System Market

The COVID-19 pandemic had an adverse impact on the global automotive industry due to a steep decline in the vehicle demand from the end-user as well as from the manufacturer’s end. In addition, the supply chain disruption caused by the low export of Chinese automotive parts & huge manufacturing disruptions across Europe & the shutting down of assembly plants in the US were other major reasons for the low demand for EV fast chargers. This placed extreme pressure on the global automotive industry as many automotive manufacturers to cut down their investment plans & the government also delayed spending on infrastructure development, including vehicle charging infrastructure. This resulted in slowdown in the installation of EV fast-charging systems around the globe.

Furthermore, in 2021, the automotive sector witnessed an incline in the demand due to the post-pandemic recovery, along with relaxations in the mobility restrictions. Moreover, the government's growing attention to the automotive sector & the rising companies’ investment in the manufacturing of electric vehicles is expected to dominate the market growth in the years 2022-2027.

Market Segmentation

Based on the Application:

- Public

- Private

Among the two, the Public application experienced notable market growth during the historical period. Public EV fast-charging systems are open to the public & are operated for numerous commercial purposes. Most of the public charging stations are operated by the network operators, such as EVgo, Blink, TGOOD Global Ltd., EVBox, and ChargePoint Inc. In addition, several charger manufacturers, as well as the governments of various countries such as the US, Germany, and China, are actively investing in the installation of public EV fast-charging systems cohesively, resulting in an increased demand for the fast-charging system.

Moreover, the dense Chinese cities, such as Beijing & Hefei, have a vast network of public fast-charging stations compared to the major EV markets of Europe & the US. For instance, China planned to deploy 12,000 stations to swap battery stations & 500,000 publicly accessible chargers by 2020, which would create numerous opportunities for the charger manufacturers to increase their overall market share.

Based on Vehicle Type

- Passenger Vehicles

- Light Commercial Vehicle (LCV)

- Medium & Heavy Commercial Vehicles (M&HCV)

Of them all, Passenger Vehicles experienced significant market growth during 2017-21. The factors responsible for the growth are an expanding fleet of passenger EVs compared to electric light-commercial vehicles & heavy commercial vehicles. Additionally, the increasing sales of battery electric passenger vehicles across the globe are anticipated to boost the Electronic Vehicle Fast Charging market growth. Moreover, the import duty for a gasoline-fueled vehicle is around 128% to 827%, while the Total Tax Incidence (TTI) of EVs is about 59%, which is nearly half of the lowest tax slab as compared to other gasoline-fueled vehicles.

Therefore, the burgeoning trend toward the emissions-free motoring, increasing Research & Development (R&D) towards EV designing, charging & battery technology, etc., are expected to surge the overall sales of passenger cars, which would emerge as an opportunity for fast-charging stations. Therefore, the passenger car segment is expected to dominate the Electric Vehicle Fast-Charging market growth in the coming years.

Regional Landscape

Geographically, the Global Electric Vehicle Fast Charging System Market expands across:

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

Of all regions globally, North America witnessed a significant growth rate in the EV Fast-Charging System market during the historical period. The growing developmental activities by the regional EV charging companies, such as Electrify Canada & Quebec’s electric circuit, among others, have created a competitive EV charging market in the region. In addition, the major players in the US are expanding their fast-charging station networks, such as ChargePoint Inc., Electrify America, and EVGo to deepen their customer reach. This further resulted in escalating the demand for electric vehicle fast-charging systems in the region. Furthermore, the presence of these networks has strongly driven the fast-charger market for OEMs to develop new updates & provide better specifications for EV DC fast-charging stations in the region.

Moreover, the government has adopted various initiatives to attract major OEMs to manufacture electric vehicle charging infrastructure in the domestic market. Therefore, the region has immense revenue opportunities for the installation of EV fast-charging systems in the countries, such as the US, Canada, and Mexico. Additionally, the country has a wide adoption of Tesla, Inc. electric vehicles & its DC Superchargers installed across the country. Tesla, Inc. has planned to install more Superchargers across the nation to increase the adoption of its cars in the country & attain the largest market share. For instance:

- In 2020, Electrify Canada, a subsidiary of Volkswagen Group, planned to install a network of 32 fast-charging stations across Canada by the end of 2020.

Recent Developments by the Leading Companies

- In 2021, EVBox announced its collaboration with Bridgestone EMIA & TSG to enhance EV charging infrastructure in Europe.

- In 2021, WEX, a leading financial service provider & ChargePoint, announced the expansion of their existing relationship to provide seamless integration of EV charging for mixed fleets.

- In 2020, Tritium Pty Ltd collaborated with Pod Point to supply a 50KW DC fast-charging system for the deployment of EV charging stations in the UK.

Market Dynamics:

Key Drivers: Demonstration of Environmental Commitment & Supporting Brand Values

The rising adoption of a large number of electric vehicles to reduce greenhouse gas emissions and air pollution led to an increase in the demand for electric vehicles across the globe. Furthermore, the rising atmospheric concerns have prompted the governments, environmental agencies, and automobile manufacturers to increase the production & sale of electric vehicles to curb the alarming rise in temperature & pollution levels. Moreover, the increasing amount of carbon emissions in the atmosphere is deteriorating the earth’s atmospheric conditions, resulting in an increased sale of EVs across the globe. Therefore, the increased demand is expected to promote the growth of the market for EV fast-charging stations. In addition, the OEMs started focusing & investing a significant amount in their research & development activities to cater to the demands for green vehicles & provide an alternate solution for gasoline-powered vehicles. Hence, the rising environmental concerns around the globe led to a rise in sales of EVs. Due to this, the demand for electric vehicle fast-charging systems has increased globally.

Possible Restraint: Lack of Standardization & Stringent Rules for Installation of EV Fast-Charging Stations

Lack of standardization & the time-consuming installation process of fast charging systems has slowed the market growth. Installation of an EV fast-charging system is more complex than installing a conventional EV charging system. This resulted in a low number of installations of fast charging systems around the globe. In addition, the governments of different countries, including the US, Germany, and Italy, have implemented numerous regulations concerning EV fast-charging systems. Consequently, service providers in different countries are required to follow specific instructions during the installation in the commercial area, which becomes time-consuming. Besides, different standardized charging infrastructures & protocols have resulted in the declining installation of charging stations. Therefore, the different standards of the EV fast-charging system & the high cost of installation of fast charging systems have resulted in declining market growth.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares) of the Global Electric Vehicle Fast-Charging System Market?

- What are the region-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in Global Electric Vehicle Fast-Charging System Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the Global Electric Vehicle Fast-Charging System Market based on the competitive landscape?

- What are the key results derived from surveys conducted during the Global Electric Vehicle Fast-Charging System Market study?

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Assumptions

- Market Segmentation

- Preface

- Executive Summary

- Global Market Start-up Ecosystem, 2016-2021

- Entrepreneurial Activity

- Year On Year Funding Received

- Funding Received by Top Companies

- Key Investors Active in the Market

- Series Wise Funding Received

- Seed Funding

- Angel Investing

- Venture Capital

- Others

- Global Electric Vehicle Fast-Charging System Market Government Regulations

- Global Electric Vehicle Fast-Charging System Market Trends & Insights

- Global Electric Vehicle Fast-Charging System Market Dynamics

- Growth Drivers

- Challenges

- Impact Analysis

- Global Electric Vehicle Fast-Charging System Market Hotspot & Opportunities

- Global Electric Vehicle Fast-Charging System Market Outlook, 2019-2027F

- Market Size & Analysis

- By Revenues

- By Units

- Market Share & Analysis

- By Application

- Public

- Private

- By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Medium & Heavy Commercial Vehicle

- By Product

- CHADeMO

- SAE Combo Charging System

- Supercharger

- GB/T

- By Charging Power

- Less than 100 KW

- 100-200 KW

- Greater than 200 KW

- By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia Pacific

- By Competitor

- Competition Matrix

- Market Shares of Leading Companies

- By Application

- Market Size & Analysis

- North America Electric Vehicle Fast-Charging System Market Outlook, 2019-2027F

- Market Size & Analysis

- By Revenues

- By Units

- Market Share & Analysis

- By Application

- By Vehicle Type

- By Product

- By Charging Power

- Top Competitors in the Region

- Electric Vehicle Fast-Charging System Market Pricing Analysis

- By Region

- The US

- Canada

- Others

- The United States Electric Vehicle Fast-Charging System Market Outlook, 2019-2027F

- Market Size & Analysis

- By Revenues

- By Units

- Market Share & Analysis

- By Application

- By Vehicle Type

- By Product

- By Charging Power

- Market Size & Analysis

- Canada Electric Vehicle Fast-Charging System Market Outlook, 2019-2027F

- Market Size & Analysis

- By Revenues

- By Units

- Market Share & Analysis

- By Application

- By Vehicle Type

- By Product

- By Charging Power

- Market Size & Analysis

- Market Size & Analysis

- South America Electric Vehicle Fast-Charging System Market Outlook, 2019-2027F

- Market Size & Analysis

- By Revenues

- By Units

- Market Share & Analysis

- By Application

- By Vehicle Type

- By Product

- By Charging Power

- Top Competitors in the Region

- Electric Vehicle Fast-Charging System Market Pricing Analysis

- By Region

- Brazil

- Rest of South America

- Brazil Electric Vehicle Fast-Charging System Market Outlook, 2019-2027F

- Market Size & Analysis

- By Revenues

- By Units

- Market Share & Analysis

- By Application

- By Vehicle Type

- By Product

- By Charging Power

- Market Size & Analysis

- Market Size & Analysis

- Europe Electric Vehicle Fast-Charging System Market Outlook, 2019-2027F

- Market Size & Analysis

- By Revenues

- By Units

- Market Share & Analysis

- By Application

- By Vehicle Type

- By Product

- By Charging Power

- Top Competitors in the Region

- Electric Vehicle Fast-Charging System Market Pricing Analysis

- By Region

- Germany

- The UK

- France

- Italy

- Spain

- Rest of Europe

- Germany Electric Vehicle Fast-Charging System Market Outlook, 2019-2027F

- Market Size & Analysis

- By Revenues

- By Units

- Market Share & Analysis

- By Application

- By Vehicle Type

- By Product

- By Charging Power

- Market Size & Analysis

- The UK Electric Vehicle Fast-Charging System Market Outlook, 2019-2027F

- Market Size & Analysis

- By Revenues

- By Units

- Market Share & Analysis

- By Application

- By Vehicle Type

- By Product

- By Charging Power

- Market Size & Analysis

- France Electric Vehicle Fast-Charging System Market Outlook, 2019-2027F

- Market Size & Analysis

- By Revenues

- By Units

- Market Share & Analysis

- By Application

- By Vehicle Type

- By Product

- By Charging Power

- Market Size & Analysis

- Italy Electric Vehicle Fast-Charging System Market Outlook, 2019-2027F

- Market Size & Analysis

- By Revenues

- By Units

- Market Share & Analysis

- By Application

- By Vehicle Type

- By Product

- By Charging Power

- Market Size & Analysis

- Spain Electric Vehicle Fast-Charging System Market Outlook, 2019-2027F

- Market Size & Analysis

- By Revenues

- By Units

- Market Share & Analysis

- By Application

- By Vehicle Type

- By Product

- By Charging Power

- Market Size & Analysis

- Market Size & Analysis

- Middle East & Africa Electric Vehicle Fast-Charging System Market Outlook, 2019-2027F

- Market Size & Analysis

- By Revenues

- By Units

- Market Share & Analysis

- By Application

- By Vehicle Type

- By Product

- By Charging Power

- Top Competitors in the Region

- Market Size & Analysis

- Asia Pacific Electric Vehicle Fast-Charging System Market Outlook, 2019-2027F

- Market Size & Analysis

- By Revenues

- By Units

- Market Share & Analysis

- By Application

- By Vehicle Type

- By Product

- By Charging Power

- Top Competitors in the Region

- Electric Vehicle Fast-Charging System Market Pricing Analysis

- By Region

- China

- Japan

- South Korea

- India

- Rest of Asia Pacific

- China Electric Vehicle Fast-Charging System Market Outlook, 2019-2027F

- Market Size & Analysis

- By Revenues

- By Units

- Market Share & Analysis

- By Application

- By Vehicle Type

- By Product

- By Charging Power

- Market Size & Analysis

- Japan Electric Vehicle Fast-Charging System Market Outlook, 2019-2027F

- Market Size & Analysis

- By Revenues

- By Units

- Market Share & Analysis

- By Application

- By Vehicle Type

- By Product

- By Charging Power

- Market Size & Analysis

- South Korea Electric Vehicle Fast-Charging System Market Outlook, 2019-2027F

- Market Size & Analysis

- By Revenues

- By Units

- Market Share & Analysis

- By Application

- By Vehicle Type

- By Product

- By Charging Power

- Market Size & Analysis

- India Electric Vehicle Fast-Charging System Market Outlook, 2019-2027F

- Market Size & Analysis

- By Revenues

- By Units

- Market Share & Analysis

- By Application

- By Vehicle Type

- By Product

- By Charging Power

- Market Size & Analysis

- Market Size & Analysis

- Global Electric Vehicle Fast-Charging System Market Key Strategic Imperatives for Success & Growth

- Company Profiles

- ABB

- Blink Charging Co.,

- BP Chargemaster Ltd,

- Broadband TelCom Power, Inc.,

- ChargePoint Inc.,

- Delta Electronics, Inc.,

- Efacec Electric Mobility,

- EVBox, FLO,

- GARO Group,

- Proterra Inc.,

- Signet EV Inc.,

- Tesla, Inc.,

- Tritium Pty Ltd,

- ShenZhen SETEC Power Co., Ltd.,

- Xi′an TGOOD Intelligent Charging Technology Co., Ltd.

- Others

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making