Saudi Arabia Electric Delivery Vans Market Research Report: Forecast (2026-2032)

Saudi Arabia Electric Delivery Vans Market - By Type (Light‑Duty Electric Vans, Medium‑Duty Electric Vans, Heavy‑Duty Electric Vans), By Battery Capacity (Below 30 kWh, 30 k...Wh to 70 kWh, Above 70 kWh), By Charging Type (AC Charging, DC Fast Charging, Wireless Charging), By Distribution Channel (Direct Sales, Dealerships & Automotive Retailers, Online Sales), By Propulsion Type (Battery Electric Vehicles (BEVs), Plug‑in Hybrid Electric Vehicles (PHEVs), Fuel Cell Electric Vehicles (FCEVs), By End Use (E-commerce, Food Delivery, Postal and Parcel Services, Healthcare), and others Read more

- Automotive

- Jan 2026

- Pages 135

- Report Format: PDF, Excel, PPT

Saudi Arabia Electric Delivery Vans Market

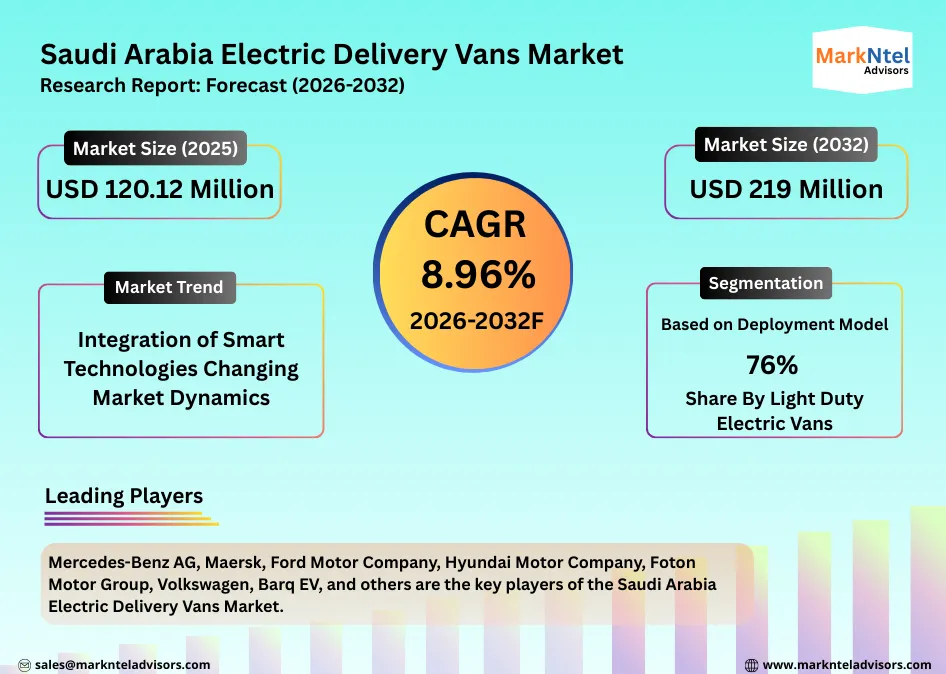

Projected 8.96% CAGR from 2026 to 2032

Study Period

2026-2032

Market Size (2025)

USD 120.12 Million

Market Size (2032)

USD 219 Million

Base Year

2025

Projected CAGR

8.96%

Leading Segments

By Propulsion Type: Battery Electric Vehicles

Saudi Arabia Electric Delivery Vans Market Report Key Takeaways:

- The Saudi Arabia Electric Delivery Vans Market size was valued at around USD 120.12 million in 2025 and is projected to reach USD 219 million by 2032. The estimated CAGR from 2026 to 2032 is around 8.96%, indicating strong growth.

- By type, the light‑duty electric vans represented 76% of the Saudi Arabia Electric Delivery Vans Market size in 2025.

- By propulsion type, the battery electric vehicles (BEVs) represented 70% of the Saudi Arabia Electric Delivery Vans Market size in 2025.

- By end use, the e-commerce sector captured around 40% of the Saudi Arabia Electric Delivery Vans Market size in 2025.

- The leading electric delivery vans companies are Mercedes-Benz AG, Maersk, Ford Motor Company, Hyundai Motor Company, Foton Motor Group, Volkswagen, Barq EV, and others.

Market Insights & Analysis: Saudi Arabia Electric Delivery Vans Market (2026-2032):

The Saudi Arabia Electric Delivery Vans Market size was valued at around USD 120.12 million in 2025 and is projected to reach USD 219 million by 2032. Along with this, the market is estimated to grow at a CAGR of around 8.96% during the forecast period, i.e., 2026-32. The Saudi Arabia Electric Delivery Vans Market is gaining strong momentum as the Kingdom advances its clean mobility and urban sustainability agenda under Saudi Vision 2030. The government's focus on reducing transport emissions and modernizing last-mile logistics is accelerating the shift toward electric commercial vehicles, particularly delivery vans operating in dense urban corridors.

A major catalyst is the rapid expansion of EV charging infrastructure led by the Electric Vehicle Infrastructure Company (EVIQ). In line with national sustainability goals, EVIQ signed an MoU with Riyadh Development Company to enhance EV charging infrastructure across Riyadh and support strategic nationwide deployments by 2030, strengthening the operational feasibility of electric delivery fleets.

Momentum further intensified in January 2025, when EVIQ and Al-Futtaim Electric Mobility (BYD partner) announced plans to install fast EV chargers across Saudi Arabia. This initiative supports the Kingdom’s broader EV ecosystem development and directly benefits logistics operators seeking reliable charging access for last-mile delivery vans.

Beyond infrastructure, the market is seeing growing integration of smart fleet and charging technologies. At the EV Auto Show Riyadh 2025, Smart Mobility announced a pilot with Al-Bassami Transport Group, deploying software-enabled EV chargers at logistics facilities to monitor usage, optimize charging schedules, and improve route efficiency for commercial fleets.

Overall, continued government-backed infrastructure rollout, smart mobility adoption, and logistics electrification are expected to steadily expand electric delivery van deployment, positioning the segment as a critical component of Saudi Arabia’s sustainable transport and logistics ecosystem.

Saudi Arabia Electric Delivery Vans Market Recent Developments:

- November 2025: Maersk and Unilever introduced Saudi Arabia’s first electric delivery van for logistics operations in Jeddah, serving BinDawood Group within a 50 km radius and covering 3,500 km/month. This supports logistics decarbonization and Saudi Vision 2030 sustainability targets.

- April 2025: Tembo e-LV signed an agreement with Saudi Green Watt worth up to USD 85 million to distribute 1,600 Tembo electric utility vehicles in Saudi Arabia by 2030, expanding EV fleet capacity and supporting sustainability goals.

Saudi Arabia Electric Delivery Vans Market Scope:

| Category | Segments |

|---|---|

| By Type | Light‑Duty Electric Vans, Medium‑Duty Electric Vans, Heavy‑Duty Electric Vans |

| By Battery Capacity | Below 30 kWh, 30 kWh to 70 kWh, Above 70 kWh |

| By Charging Type | AC Charging, DC Fast Charging, Wireless Charging |

| By Distribution Channel | Direct Sales, Dealerships & Automotive Retailers, Online Sales |

| By Propulsion Type | Battery Electric Vehicles (BEVs), Plug‑in Hybrid Electric Vehicles (PHEVs), Fuel Cell Electric Vehicles (FCEVs) |

| By End Use | E-commerce, Food Delivery, Postal and Parcel Services, Healthcare), and others |

Saudi Arabia Electric Delivery Vans Market Drivers:

Government Policies & Sustainability Goals Driving Market Demand

The Saudi Arabian government’s policy framework, anchored in Vision 2030 and aligned with sustainability initiatives, is a primary driver of the electric delivery vans industry. As part of Vision 2030, authorities aim to electrify 30% of Riyadh’s vehicles by 2030, significantly reshaping transport electrification and fleet composition across passenger and commercial segments.

To support this, the government is expanding charging infrastructure in a coordinated strategy. The Electric Vehicle Infrastructure Company (EVIQ), a joint venture between the Public Investment Fund (PIF) and the Saudi Electricity Company (SEC), plans to deploy 5,000 fast chargers across over 1,000 locations by 2030. Such infrastructure build-out is crucial to enabling electric delivery vans for logistics firms and reducing range anxiety. Additionally, initiatives like the Saudi Electric Vehicle Charging Infrastructure Development Initiative (SEVCIDI) target 50,000 charging stations by 2025, providing foundational support for commercial EV adoption.

Fiscal and regulatory incentives, including custom duty exemptions, zero VAT for EV chargers, and fleet electrification incentives, further lower barriers to electric vehicle uptake, encouraging private fleets to adopt electric delivery vans.

Moreover, the government’s long-term strategy includes integrating EV manufacturing and infrastructure, aiming for over 60% EV share of new vehicle sales by 2035, which will broaden the market for electric delivery vans.

Overall, Saudi Arabia’s explicit EV policy targets, coupled with robust infrastructure expansion and fiscal incentives, create a supportive environment that directly accelerates the adoption of electric delivery vans, bolstering market growth now and in the years ahead.

Saudi Arabia Electric Delivery Vans Market Trends:

Integration of Smart Technologies Changing Market Dynamics

A key trend shaping the Saudi Arabia Electric Delivery Vans Industry is the integration of smart technologies into electric vehicle ecosystems, particularly fleet management systems, charging software, and connected platforms that enhance efficiency, reliability, and commercial viability. Saudi initiatives are increasingly embedding intelligent technology into EV operations to support wider electrification goals.

A cornerstone of this trend is the Charging Point Management System (CPMS) being developed under the Smart Mobility joint venture between Foxconn Interconnect Technology and Saleh Suleiman Alrajhi & Sons at King Salman Energy Park (SPARK). CPMS platforms, which have completed more than six months of field testing in Saudi Arabia, are designed to provide data-driven control and analytics for EV charging networks, enabling real-time monitoring, load management, and optimization across charging sites. The facility is scheduled to begin producing CPMS-integrated hardware in 2026.

Beyond charging systems, smart tech plays a role in fleet electrification pilots, such as partnerships with logistics operators where charging solutions are tailored and monitored digitally to optimize fleet deployment and reduce downtime.

Integration of smart technologies enhances operational transparency, reduces energy costs, and supports predictive maintenance crucial factors for commercial fleets running electric delivery vans. As Saudi Arabia pursues localized production and digital infrastructure standards, such technologies will become foundational to next-generation logistics electrification.

Overall, Smart technologies are transforming how electric delivery fleets are deployed in Saudi Arabia by enabling data-driven fleet operations and intelligent charging, thereby reducing costs and boosting adoption in the commercial transportation market.

Saudi Arabia Electric Delivery Vans Market Challenges:

High Initial Purchase Costs

A key challenge for the Saudi Arabia Electric Delivery Vans Market is the high upfront cost of electric vehicles relative to conventional alternatives. In Saudi Arabia, a significant proportion of electric vehicles available in the country are priced above USD 65,000, while traditional internal combustion models remain comparatively affordable. This pricing gap persists even as the government expands charging infrastructure and supports EV adoption, making it harder for logistics companies and delivery fleet operators to justify the initial expenditure.

The high purchase price is compounded by very low domestic fuel costs around USD 0.62 per liter, which diminishes the short-term operational savings advantage of electric vehicles, reducing fleet managers’ incentive to absorb a larger upfront investment for future savings.

Moreover, although EV charging infrastructure is expanding under initiatives like EVIQ’s plan for 5,000 fast chargers by 2030, current infrastructure and cost support mechanisms are primarily general in scope and do not yet include specialized financial incentives for commercial EV fleets such as electric delivery vans. Without targeted purchase subsidies, low-interest financing, or leasing support, many fleet operators remain hesitant to transition due to higher capital expenses.

Until the government or industry introduces fleet-focused financial support that significantly lowers the upfront cost barrier, high initial purchase costs will continue to constrain the adoption of electric delivery vans in Saudi Arabia’s logistics sector.

Saudi Arabia Electric Delivery Vans Market (2026-32) Segmentation Analysis:

The Saudi Arabia Electric Delivery Vans Market Report and Forecast 2026-2032 offers a detailed analysis of the market based on the following segments:

Based on Type:

- Light Duty Electric Vans

- Medium Duty Electric Vans

- Heavy Duty Electric Vans

The light-duty electric vans hold around 76% of the Saudi Arabia electric delivery vans industry. Market dominance is due to its strong suitability for urban and last-mile delivery operations. Saudi Arabia’s expanding e-commerce, food delivery, postal, and courier services rely heavily on vehicles designed for frequent short trips, high maneuverability, and predictable daily routes. Light-duty vans effectively meet these requirements, particularly in metropolitan areas such as Riyadh, Jeddah, and Dammam, where delivery density is high.

From a cost perspective, light-duty electric vans have lower upfront prices, reduced battery size requirements, and lower charging infrastructure dependency compared to medium- and heavy-duty alternatives. These factors make them more attractive for fleet electrification pilots and phased deployment strategies. Additionally, their operating range aligns well with current charging availability, enabling depot-based charging models. As logistics companies prioritize operational efficiency and faster return on investment, light-duty electric vans remain the preferred vehicle type, reinforcing their dominant market position.

Based on Propulsion Type:

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Battery Electric Vehicles (BEVs) with a market share of around 70%, dominate the Saudi Arabia electric delivery vans landscape due to their zero-emission profile and technological maturity. BEVs are increasingly favored over hybrid and fuel-cell alternatives for urban logistics because they deliver fully electric operation, directly supporting national decarbonization objectives and sustainability commitments.

BEVs offer lower long-term operating costs, driven by reduced energy consumption and minimal mechanical maintenance compared to internal combustion or plug-in hybrid systems. The growing availability of DC fast-charging infrastructure further enhances BEV suitability for commercial delivery fleets operating on fixed or semi-fixed routes. Additionally, global manufacturers supplying the Saudi market are prioritizing BEV-only electric van platforms, expanding model availability, and improving battery performance.

With improving charging access and falling battery costs over time, BEVs continue to be the most practical and scalable propulsion option for electric delivery vans, sustaining their market leadership.

Saudi Arabia Electric Delivery Vans Market (2026-32): Regional Projection

The Saudi Arabia electric delivery vans industry is dominated by the Central Region, particularly Riyadh. This region leads adoption due to its role as the country’s primary economic, logistics, and administrative hub. Riyadh hosts major e-commerce fulfillment centers, courier headquarters, and government-backed smart mobility projects, driving early electrification of last-mile fleets. High delivery density, predictable urban routes, and large fleet operators make electric vans commercially viable in the city. The Central Region also benefits from the highest concentration of public and private EV charging infrastructure, supported by national programs under Vision 2030. Pilot deployments by logistics firms, postal operators, and retail distributors are largely concentrated in Riyadh, enabling faster learning curves and scale-up.

Additionally, municipal sustainability initiatives and corporate ESG commitments are more actively enforced in the capital compared to other regions. As a result, the Central Region captures the largest deployment share.

Gain a Competitive Edge with Our Saudi Arabia Electric Delivery Vans Market Report:

- Saudi Arabia Electric Delivery Vans Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Saudi Arabia Electric Delivery Vans Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Saudi Arabia Electric Delivery Vans Market Policies, Regulations, and Product Standards

- Saudi Arabia Electric Delivery Vans Market Supply Chain Analysis

- Saudi Arabia Electric Delivery Vans Market Trends & Developments

- Saudi Arabia Electric Delivery Vans Market Dynamics

- Growth Drivers

- Challenges

- Saudi Arabia Electric Delivery Vans Market Hotspot & Opportunities

- Saudi Arabia Electric Delivery Vans Market Outlook, 2022-2032

- Market Size & Outlook

- By Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Outlook

- By Type- Market Size & Forecast 2022-2032F, USD Million & Thousand Units

- Light‑Duty Electric Vans

- Medium‑Duty Electric Vans

- Heavy‑Duty Electric Vans

- By Battery Capacity- Market Size & Forecast 2022-2032F, USD Million & Thousand Units

- Below 30 kWh

- 30 kWh to 70 kWh

- Above 70 kWh

- By Charging Type- Market Size & Forecast 2022-2032F, USD Million & Thousand Units

- AC Charging

- DC Fast Charging

- Wireless Charging

- By Distribution Channel- Market Size & Forecast 2022-2032F, USD Million & Thousand Units

- Direct Sales

- Dealerships & Automotive Retailers

- Online Sales

- By Propulsion Type- Market Size & Forecast 2022-2032F, USD Million & Thousand Units

- Battery Electric Vehicles (BEVs)

- Plug‑in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

- By End Use- Market Size & Forecast 2022-2032F, USD Million & Thousand Units

- E-commerce

- Food Delivery

- Postal and Parcel Services

- Healthcare

- By Region

- Central

- East

- West

- South

- By Company

- Company Revenue Shares

- Competitor Characteristics

- By Type- Market Size & Forecast 2022-2032F, USD Million & Thousand Units

- Market Size & Outlook

- Saudi Arabia Light‑Duty Electric Delivery Vans Market Outlook, 2022-2032

- Market Size & Analysis

- Market Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Analysis

- By Battery Capacity- Market Size & Forecast 2022-2032, USD Million & Thousand Units

- By Charging Type- Market Size & Forecast 2022-2032, USD Million & Thousand Units

- By Distribution Channel- Market Size & Forecast 2022-2032, USD Million & Thousand Units

- By Propulsion Type- Market Size & Forecast 2022-2032, USD Million & Thousand Units

- By End Use- Market Size & Forecast 2022-2032, USD Million & Thousand Units

- Market Size & Analysis

- Saudi Arabia Medium‑Duty Electric Delivery Vans Market Outlook, 2022-2032

- Market Size & Analysis

- Market Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Analysis

- By Battery Capacity- Market Size & Forecast 2022-2032, USD Million & Thousand Units

- By Charging Type- Market Size & Forecast 2022-2032, USD Million & Thousand Units

- By Distribution Channel- Market Size & Forecast 2022-2032, USD Million & Thousand Units

- By Propulsion Type- Market Size & Forecast 2022-2032, USD Million & Thousand Units

- By End Use- Market Size & Forecast 2022-2032, USD Million & Thousand Units

- Market Size & Analysis

- Saudi Arabia Heavy‑Duty Electric Delivery Vans Market Outlook, 2022-2032

- Market Size & Analysis

- Market Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Analysis

- By Battery Capacity- Market Size & Forecast 2022-2032, USD Million & Thousand Units

- By Charging Type- Market Size & Forecast 2022-2032, USD Million & Thousand Units

- By Distribution Channel- Market Size & Forecast 2022-2032, USD Million & Thousand Units

- By Propulsion Type- Market Size & Forecast 2022-2032, USD Million & Thousand Units

- By End Use- Market Size & Forecast 2022-2032, USD Million & Thousand Units

- Market Size & Analysis

- Saudi Arabia Electric Delivery Vans Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Mercedes‑Benz AG

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Maersk

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Ford Motor Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Hyundai Motor Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Foton Motor Group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Volkswagen

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Barq EV

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Mercedes‑Benz AG

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making