Germany Driver Monitoring System Market Research Report: Forecast (2026-2032)

Germany Driver Monitoring System Market - By Component (Hardware, Software, Services), By System Integration (Eye tracking system, Driver Identification, Steering behavior monitori...ng system, Heart rate monitoring system), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), By Sensor Suite (Monocular IR Camera, Stereo / Depth Sensing, RGB + NIR Hybrid, Camera + Sensor Fusion add-ons), By ADAS Level (Level 2 / Level 2+, Level 3), By Sales Channel (OEM (Factory-Fitted Systems), Aftermarket), and others Read more

- Automotive

- Jan 2026

- Pages 135

- Report Format: PDF, Excel, PPT

Germany Driver Monitoring System Market

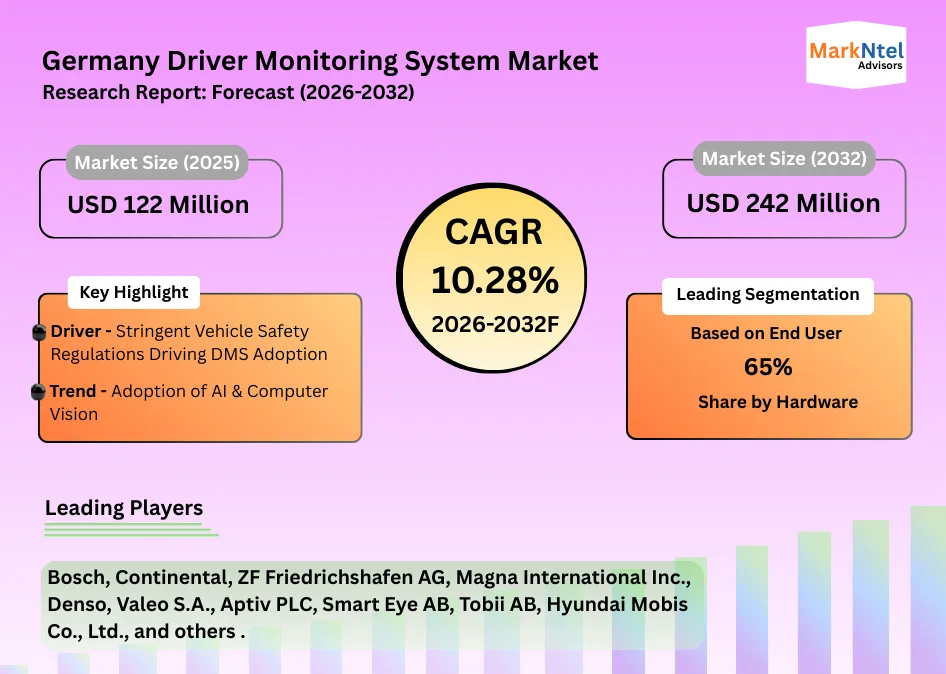

Projected 10.28% CAGR from 2026 to 2032

Study Period

2026-2032

Market Size (2025)

USD 122 Million

Market Size (2032)

USD 242 Million

Base Year

2025

Projected CAGR

10.28%

Leading Segments

By Component: Hardware

Germany Driver Monitoring System Market Report Key Takeaways:

- The Germany Driver Monitoring System Market size was valued at around USD 122 million in 2025 and is projected to reach USD 242 million by 2032. The estimated CAGR from 2026 to 2032 is around 10.28%, indicating strong growth.

- By component, the hardware represented 65% of the Germany Driver Monitoring System Market size in 2025.

- By vehicle type, the passenger cars represented 48% of the Germany Driver Monitoring System Market size in 2025.

- By system integration, the eye tracking system seized around 35% share of the Germany Driver Monitoring System Market in 2025.

- The leading Germany driver monitoring system companies are Bosch, Continental, ZF Friedrichshafen AG, Magna International Inc., Denso, Valeo S.A., Aptiv PLC, Smart Eye AB, Tobii AB, Hyundai Mobis Co., Ltd., and others.

Market Insights & Analysis: Germany Driver Monitoring System Market (2026-2032):

The Germany Driver Monitoring System Market size was valued at around USD 122 million in 2025 and is projected to reach USD 242 million by 2032. Along with this, the market is estimated to grow at a CAGR of around 10.28% during the forecast period, i.e., 2026-32. The Germany Driver Monitoring System Market is witnessing strong momentum, supported by stricter vehicle safety mandates and rapid progress in AI-enabled in-cabin technologies. The enforcement of the EU General Safety Regulation (EU 2019/2144), which requires driver attention, drowsiness, and distraction monitoring in new vehicles, is compelling German automakers to integrate camera-based DMS as a standard safety feature rather than an optional add-on.

In March 2025, Volkswagen Group announced a strategic collaboration with Valeo and Mobileye to enhance advanced driver assistance systems, including driver monitoring, in future MQB-platform vehicles, targeting high-volume passenger cars and improved safety performance. This development reflects how German OEMs are embedding DMS into mass-market architectures to meet regulatory and consumer safety expectations.

Technology validation aligned with regulation is also shaping adoption. Roadzen confirmed that its AI-based DrivebuddyAI driver monitoring system achieved formal compliance with EU GSR 2144, including DDAW and ADDW requirements, positioning it for wider use among European vehicle manufacturers and fleet operators.

Germany’s role in future mobility is further underscored by Uber and Momenta’s announcement to begin Level-4 autonomous vehicle testing in Munich from 2026, increasing the importance of advanced monitoring systems that assess driver and vehicle states during automated operations.

At the technology level, Cipia showcased its AI-driven Driver Sense DMS running on Arm CPUs at Embedded World 2025 in Nuremberg, highlighting the shift toward energy-efficient, computer-vision-based monitoring architectures.

Together, regulatory enforcement, OEM partnerships, AI innovation, and autonomous vehicle initiatives are expected to sustain robust demand for driver monitoring systems in Germany, firmly establishing DMS as a cornerstone of automotive safety.

Germany Driver Monitoring System Market Recent Developments:

- December 2025: Smart Eye secured new design wins to supply its driver monitoring system software to two additional truck models, valued at an estimated USD 1.4 million. Production is slated for Q1 2028, supporting Europe’s commercial vehicle safety tech trend.

- October 2025: Magna International announced its mirror-integrated Driver Monitoring System entered its first full year of scaled production with a Germany-based OEM, expected to reach several million units annually.

Germany Driver Monitoring System Market Scope:

| Category | Segments |

|---|---|

| Component | Hardware, Software, Services |

| System Integration | Eye tracking system, Driver Identification, Steering behavior monitoring system, Heart rate monitoring system |

| Vehicle Type | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Sensor Suite | Monocular IR Camera, Stereo / Depth Sensing, RGB + NIR Hybrid, Camera + Sensor Fusion add-ons |

| ADAS Level | Level 2 / Level 2+, Level 3 |

| Sales Channel | OEM (Factory-Fitted Systems), Aftermarket |

Germany Driver Monitoring System Market Drivers:

Stringent Vehicle Safety Regulations Driving DMS Adoption

A major driver of the Germany Driver Monitoring System (DMS) market is the EU’s General Safety Regulation (Regulation (EU) 2019/2144), which mandates advanced safety systems, including driver availability and attention monitoring in new motor vehicles, to enhance road safety and reduce traffic fatalities. The regulation was adopted in 2019 and has been implemented in phases across EU member states, including Germany. As of 7 July 2024, a range of advanced driver assistance technologies became compulsory for all new vehicles sold in the EU, driving OEMs to integrate camera-based monitoring systems to comply with these standards.

Specifically, requirements for Driver Drowsiness and Attention Warning (DDAW) systems took effect for all new vehicles from July 2024, and Advanced Driver Distraction Warning (ADDW) systems (which rely on camera-based detection of eye and head movements) will be mandatory for all new vehicles from July 2026. These timelines have compelled German automakers, including Volkswagen, Mercedes-Benz, and BMW, to accelerate R&D, testing, and supply chain readiness for DMS integration to meet regulatory deadlines ahead of full enforcement.

In terms of quantifiable impact, the European Commission projects that the broader set of mandatory driver assistance systems introduced by the General Safety Regulation could help save over 25,000 lives and avoid at least 140,000 serious injuries by 2038, underscoring the safety rationale behind DMS adoption.

Further regulatory enhancements and type-approval revisions are expected to expand technical requirements for monitoring systems, driving continued investments by OEMs and Tier-1 suppliers into next-generation DMS technologies, including AI-driven gaze estimation, infrared sensors, and integrated occupant safety platforms to remain compliant and competitive.

In conclusion, stringent EU safety regulations are a foundational and measurable driver of Germany’s DMS market growth, compelling industry players to adopt sophisticated monitoring systems and invest in future-ready technologies to meet tightening compliance standards and improve road safety outcomes.

Germany Driver Monitoring System Market Trends:

Adoption of AI & Computer Vision

The adoption of artificial intelligence (AI) and computer vision is a pivotal trend shaping the Germany Driver Monitoring System market in 2025. Leading automotive technology firms are actively embedding deep learning and computer vision algorithms into in-cab monitoring systems to enhance driver safety by accurately detecting distraction, fatigue, and inattention in real time. For example, German engineering firm FEV unveiled its AI-supported DMS “CogniSafe,” which uses deep learning and multi-spectral cameras to monitor driver behavior and alertness, reflecting a shift toward intelligent, adaptive safety systems rather than simple threshold-based alerts.

Globally, solutions like Roadzen’s DrivebuddyAI have demonstrated the effectiveness of AI and computer vision at scale, analyzing over 3.5 billion kilometers of driving data and showing 70%+ accident reductions while achieving official compliance with the EU General Safety Regulation (EU GSR 2144), which will mandate in-cab monitoring in new vehicles from July 2026. These developments underscore a broad industry movement toward computer vision-driven DMS, enabling more accurate, context-aware driver state assessment compared with legacy sensor systems.

The application of AI and vision systems in Germany’s DMS market aligns with regional regulatory requirements while improving safety outcomes. Computer vision’s ability to process visual driver cues under varied lighting and operational conditions is critical for fulfilling stringent European safety mandates and OEM expectations, making AI-based systems a dominant design choice in 2025 and beyond

Germany Driver Monitoring System Market Challenges:

Data Privacy & Regulatory Concerns

One major challenge in the Germany Driver Monitoring System (DMS) market stems from data privacy and regulatory compliance, particularly under the EU’s General Data Protection Regulation (GDPR). Connected vehicles and DMS technologies inherently collect and process personal and biometric data, including camera images, driver behavior, and sensor-derived information. According to the European Data Protection Supervisor (EDPS), modern connected cars can generate up to 25 GB of personal data per hour, much of which can be directly linked to an individual, requiring careful Data Protection Impact Assessments (DPIAs) and strict compliance with GDPR principles such as transparency, purpose limitation, and data minimization.

GDPR mandates that data subjects must be informed clearly about what data is processed, who processes it, for what purposes, and how long it is retained. For AI-powered DMS that use in‑cab video and biometric measurements, this necessitates explicit consent mechanisms and robust privacy disclosure steps that are technically and operationally demanding for automakers and suppliers. The European Data Protection Board (EDPB) has provided specific guidelines on processing personal data through video devices, emphasizing that such use cases “are subject to different specific requirements” and need careful alignment with national laws, adding layers of regulatory complexity.

Non‑compliance carries significant penalties. GDPR allows fines of up to USD 21.5 million or 4 % of global annual turnover, whichever is higher. This risk makes OEMs and Tier‑1 suppliers cautious about how DMS data is collected, stored, and shared. As sensor sophistication increases and AI models evolve, ensuring privacy‑by‑design and secure data handling remains a persistent challenge for the German automotive industry.

Germany Driver Monitoring System Market (2026-32) Segmentation Analysis:

The Germany Driver Monitoring System Market Report and Forecast 2026-2032 offers a detailed analysis of the market based on the following segments:

Based on Component:

- Hardware

- Software

- Services

The hardware segment dominates the Germany Driver Monitoring System Market, accounting for around 65% share, primarily due to the compulsory integration of physical sensing components required to meet EU safety regulations. Camera-based driver monitoring relies heavily on infrared cameras, image sensors, processors, and illumination units, all of which fall under hardware. Under the EU General Safety Regulation, driver drowsiness and distraction detection systems must be installed in new vehicles, making hardware deployment unavoidable for OEMs.

Germany’s automotive industry, led by high-volume manufacturers such as Volkswagen, BMW, and Mercedes-Benz, integrates DMS hardware directly at the vehicle design stage, driving large-scale procurement of camera modules and embedded processors. Additionally, advanced hardware configurations such as infrared cameras for low-light detection and sensor-fusion modules are increasingly adopted to improve accuracy and regulatory compliance. Unlike software or services, hardware represents a one-time, high-value installation per vehicle, significantly increasing its revenue contribution. As vehicle production volumes remain high and safety mandates expand across vehicle categories, hardware continues to capture the largest share of total DMS market value.

Based on Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Passenger cars lead the Germany Driver Monitoring System Market with an estimated 48% share, driven by their dominant share in total vehicle production and early adoption of advanced safety technologies. Germany’s passenger car segment accounts for the majority of new vehicle registrations, making it the primary target for regulatory compliance with driver monitoring requirements. EU safety mandates apply uniformly to passenger vehicles, accelerating large-scale DMS installation across mass-market and premium models.

German OEMs increasingly use driver monitoring systems as a standard safety and comfort feature in passenger cars, particularly in vehicles equipped with Level 2 and Level 2+ ADAS. These systems require continuous driver attention monitoring, making DMS essential. Moreover, consumer demand for enhanced safety ratings and intelligent in-cabin features further supports adoption in this segment. Compared to commercial vehicles, passenger cars experience faster technology penetration cycles and higher production volumes, enabling quicker scaling of DMS deployments. As a result, passenger cars remain the largest and most influential vehicle category driving overall DMS market growth in Germany.

Gain a Competitive Edge with Our Germany Driver Monitoring System Market Report

- Germany Driver Monitoring System Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Germany Driver Monitoring System Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Germany Driver Monitoring System Market Policies, Regulations, and Product Standards

- Germany Driver Monitoring System Market Trends & Developments

- Germany Driver Monitoring System Market Dynamics

- Growth Drivers

- Challenges

- Germany Driver Monitoring System Market Hotspot & Opportunities

- Germany Driver Monitoring System Market Outlook, 2022-2032

- Market Size & Outlook

- By Revenues (USD Million)

- Market Share & Outlook

- By Component- Market Size & Forecast 2022-2032F, USD Million

- Hardware

- Software

- Services

- By System Integration- Market Size & Forecast 2022-2032F, USD Million

- Eye tracking system

- Driver Identification

- Steering behavior monitoring system

- Heart rate monitoring system

- By Vehicle Type- Market Size & Forecast 2022-2032F, USD Million

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- By Sensor Suite- Market Size & Forecast 2022-2032F, USD Million

- Monocular IR Camera

- Stereo / Depth Sensing

- RGB + NIR Hybrid

- Camera + Sensor Fusion add-ons

- By ADAS Level- Market Size & Forecast 2022-2032F, USD Million

- Level 2 / Level 2+

- Level 3

- By Sales Channel- Market Size & Forecast 2022-2032F, USD Million

- OEM (Factory-Fitted Systems)

- Aftermarket

- By Region

- East

- West

- North

- South

- By Company

- Company Revenue Shares

- Competitor Characteristics

- By Component- Market Size & Forecast 2022-2032F, USD Million

- Market Size & Outlook

- Germany Hardware Driver Monitoring System Market Outlook, 2022-2032

- Market Size & Analysis

- Market Share & Analysis

- By System Integration- Market Size & Forecast 2022-2032, USD Million

- By Vehicle Type- Market Size & Forecast 2022-2032, USD Million

- By Sensor Suite- Market Size & Forecast 2022-2032, USD Million

- By ADAS Level- Market Size & Forecast 2022-2032, USD Million

- By Sales Channel- Market Size & Forecast 2022-2032, USD Million

- Germany Software Driver Monitoring System Market Outlook, 2022-2032

- Market Size & Analysis

- Market Revenues (USD Million)

- Market Share & Analysis

- By System Integration- Market Size & Forecast 2022-2032, USD Million

- By Vehicle Type- Market Size & Forecast 2022-2032, USD Million

- By Sensor Suite- Market Size & Forecast 2022-2032, USD Million

- By ADAS Level- Market Size & Forecast 2022-2032, USD Million

- By Sales Channel- Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Germany Services Driver Monitoring System Market Outlook, 2022-2032

- Market Size & Analysis

- Market Revenues (USD Million)

- Market Share & Analysis

- By System Integration- Market Size & Forecast 2022-2032, USD Million

- By Vehicle Type- Market Size & Forecast 2022-2032, USD Million

- By Sensor Suite- Market Size & Forecast 2022-2032, USD Million

- By ADAS Level- Market Size & Forecast 2022-2032, USD Million

- By Sales Channel- Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Germany Driver Monitoring System Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Bosch

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Continental

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- ZF Friedrichshafen AG

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Magna International Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Denso

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Valeo S.A.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Aptiv PLC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Smart Eye AB

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Tobii AB

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Hyundai Mobis Co., Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Bosch

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making