Global ATM Market Research Report: Forecast (2025-2030)

ATM Market Size, Share & Global Industry Analysis By Solution (Deployment, [Onsite ATM, Offsite ATM, Worksite ATM, Mobile ATM], Managed Services), By Type (Brown ATMs, White ATMs, ...Cash dispenser ATMs, Smart ATMs, Conventional/banks ATMs), By Application (Cash Withdrawal, Cash Deposit, Money Transfer, Others (PIN Change, Balance Inquiry, Bill Payments, etc.)) and others Read more

- FinTech

- Jul 2025

- Pages 200

- Report Format: PDF, Excel, PPT

Market Insights & Analysis: Global ATM Market (2025-30):

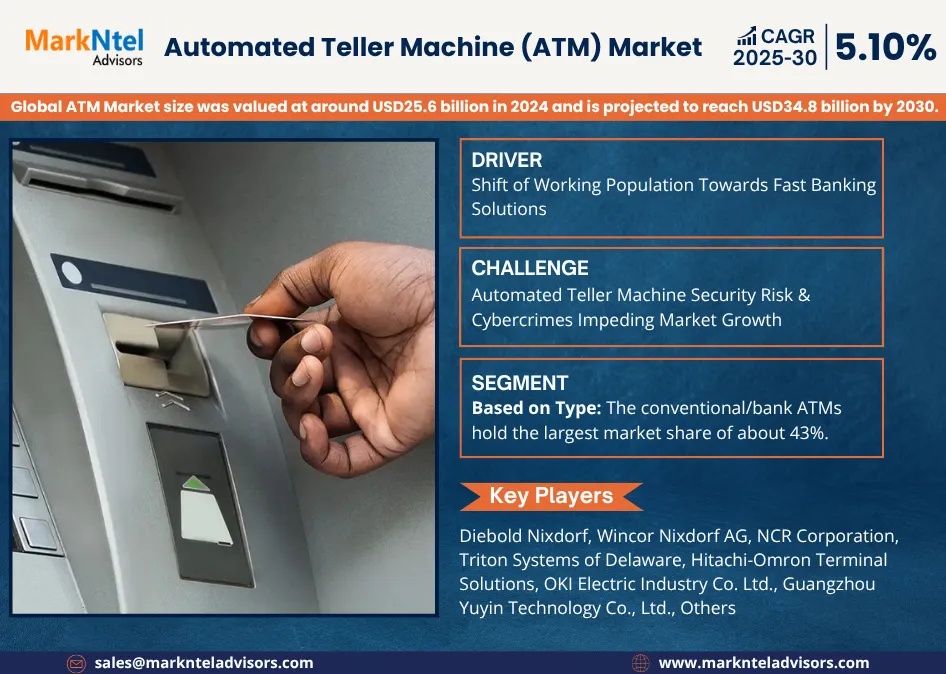

The Global ATM Market size was valued at around USD25.6 billion in 2024 and is projected to reach USD34.8 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 5.10% during the forecast period, i.e., 2025-30. The Global ATM Market growth is due to the rising need for fast banking solutions, expansion in rural & remote areas, the support of government, digitalization of the banking sector, rise in disposable income, growing white collar population, technological advances, upgraded security systems, regulatory norms, and others, across multiple regions.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020–23 |

| Forecast Years | 2025–30 |

| Market Value in 2024 | USD 25.6 Billion |

| Market Value by 2030 | USD 34.8 Billion |

| CAGR (2025–30) | 5.10% |

| Top Key Players | Diebold Nixdorf, Wincor Nixdorf AG, NCR Corporation, Triton Systems of Delaware, Hitachi-Omron Terminal Solutions, GRG Banking Equipment Co. Ltd., OKI Electric Industry Co. Ltd., Nautilus Hyosung Corporation, HESS Cash Systems GmbH & Co KG, Fujitsu Ltd., Euronet Worldwide, Brink's Company, Guangzhou Yuyin Technology Co., Ltd., Others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

The brown ATMs are gaining popularity, especially in urban and semi-urban regions, due to their cost-effectiveness for both the governing bank and the managing service providers, due to the reduced capital expenditure and low operational cost. Additionally, the reduced workload on them improves their functionality, leading to lower technical issues and malfunctioning faced by the ATM users worldwide.

Additionally, the regulations and guidelines issued by the PCI Security Standards Council (PCI SSC), like Payment Card Industry Data Security Standards 4.0 (PCI DSS 4.0) enacted in 2022. Under these standards, over 50 new guidelines and updates are released to ensure the security and upgradation of cards, offering the smooth and seamless ATM cash withdrawals & deposits, and other operations, increasing the trust and reliability of the consumers. Thus, the rising technological advancements, frequent cash withdrawals, growing white collar population, government support, enhanced security, development of the ATM infrastructure & technological connectivity, and others, boost the growth of ATM worldwide.

Global ATM Market Driver:

Shift of Working Population Towards Fast Banking Solutions – The increasing need for fast cash withdrawals is a key factor driving the growth of the market across multiple regions globally. The adoption of ATM has surged due to digitalization, remote working culture, internet connectivity, and other factors.

The rising number of the working population, primarily in tier-1 and tier-2 cities, accounts for more than 60% of the population worldwide, who have a busy schedule and need a fast and efficient cash withdrawal solution. The time constraint and the off weekends of most of the banking institutions have complicated the cash withdrawal procedure, thus pushing the banking sector to incorporate ATM, a 24/7 cash withdrawal service, with approximately 3 million ATMs globally. Additionally, the adoption of multi-interface ATM for the withdrawal and deposit of cash, with additional features like touch screen, NFC readers, advanced authentication system, and others, increases the acceptability of the ATM. With the rising urbanization and expanding workforce, the demand for convenient, time-conserving, and effective banking services has increased, thus accelerating the demand for ATMs globally.

Global ATM Market Challenge:

Automated Teller Machine Security Risk & Cybercrimes Impeding Market Growth – The digital transformation of the banking institutions and the integration of banks has increased the cyber footprints on the servers, creating an opening for hackers to easily access sensitive data for espionage, ransom, etc.

The regular tapping of the ATM cards and cash withdrawals results in the vulnerability of the banking details to hackers, leading to a surge in terminal frauds like card tapping, TRFs, Relay, and others, increasing the cyberattacks across the globe. As per the European Association for Secure Transactions (EAST), the terminal-related frauds have increased by nearly 96% from 3,021 in the first half of 2023 to 5,913 in 2024, with a rise of 164% in the ATM card trapping, accounting for a loss of approximately USD80.24 million, in European countries. Similarly, other nations are facing physical and cyberattacks with the intention of monetary gains and ransomware, affecting millions of individuals, primarily ATM users. Such attacks are further fuelled by the acceptance of digital payment applications like UPI, Mobikwik, Amazon Pay, CRED, etc., which require the ATM card details during the registration procedure, leading to a further increase in the terminal-end crime rate, thus hampering the market growth worldwide.

Global ATM Market Trend:

Contactless and Biometric-Authenticated ATMs Gaining Traction – The rising cases of ATM threats due to weak security walls, outdated hardware & software, integrational complexity, malfunctioning, and others have pushed the banks to opt for advanced verification and authentication security systems.

The end-to-end PIN encryption, biometric verification, and other measures are integrated at the point of withdrawal. The face recognition, iris, and fingerprint scanning are being integrated into the Automated Teller Machine for security, enabling only the authorized user and owner to access the banking account. For instance, the CaixaBank has deployed over 100 ATMs with face recognition in Spain, becoming the world’s largest commercial network to deploy this innovation, eliminating the need for PIN for cards for the withdrawal and access to ATM services. Similarly, more than 500 biometric ATMs are deployed in Argentina, offering a smooth and secure channel to access some banking services. Thus, the increasing advances in technology, additional security verification, and the smooth withdrawal and deposit of cash increase the demand for contactless and biometric authenticated automated teller machine services globally.

Global Automated Teller Machine Market (2025-30): Segmentation Analysis

The Global ATM Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the global level. Based on the analysis, the market has been further classified as:

Based on Type:

- Brown ATMs

- White ATMs

- Cash dispenser ATMs

- Smart ATMs

- Conventional/bank ATMs

The conventional/bank ATMs hold the largest market share of about 43%. This is due to the widespread deployment, cost-effectiveness, consumer-friendly features, loyalty of the consumers, expansion of e-commerce platforms, etc. The pre-existing conventional ATMs have an ancient history in the markets, with a strong connectivity network across the banks in multiple regions. It reduces the cost of integrating new and advanced ATMs, which need specific requirements, adding to the high price of advanced ATMs like Brown ATMs, White ATMs, and Smart ATMs. The consumers are familiar with the features and the operations of the conventional and bank ATMs because of their lineage since the introduction of the ATMs and related services.

Further, the surging cases of security risks and cyberattacks on ATMs have prevented consumers from shifting towards the advanced and third-party ATMs because of their trust and reliability in the bank ATMs. The compatibility of the ATM cards with their banking ATMs and their widespread availability result in bank ATMs being the preferred choice among consumers worldwide, thus increasing the utility of the conventional and bank ATMs.

Global ATM Market (2025-30): Regional Projections

- North America

- South America

- Europe

- The Middle East and Africa

- Asia-Pacific

Asia-Pacific dominates the market with a market share of around 37%. The key reasons contributing to the market growth are the large population, easier accessibility of the ATM services, lack of digital payment opting population, strategic collaborations & partnerships, government support, advances in the ATM technology, etc.

A significant rise in the usage of the ATM services in Asia-Pacific is observed due to the rising population, increase in disposable income, spreading awareness & benefits of bank accounts, and growing white collar population. The most populous countries of Asia-Pacific, like India, China, and Indonesia, are among the top 5 rank holders in the list, with an increased population, and the government initiatives such as National Strategy for Financial Inclusion (SNKI) of Indonesia, Financial Inclusion Development Plan of China, Reserve Bank of India (RBI) initiatives, along with the other rural expansion plan, of these countries promoting the basic financing and banking across the nations. For instance, India’s Pradhan Mantri Jan Dhan Yojana (PMJDY), initiated in 2014, has encouraged more than 545 million individuals to access banking services by 2025. Similarly, in the Philippines, the installation of ATM services has increased by 40% in rural areas, increasing the utility of the ATM services.

Moreover, the deployment of smart ATMs and the advanced security prototypes like QR code-based, biometric authentication, and others have increased, ensuring a secure and efficient ATM service experience. The individuals in smaller cities and rural areas in Asia-Pacific still rely on cash for transactions, thus boosting the demand for ATMs in the region.

Global ATM Industry Recent Development:

- 2024-25: Euronet Worldwide significantly expanded its independent ATM network. Key moves included a joint venture in Latin America (LATM), a partnership in Indonesia for 4,500+ ATMs, and acquisitions of Swedbank's ATMs in the Baltics, plus expansion into Belgium and Mexico.

- 2024: Diebold Nixdorf partnered with America First Credit Union to modernize their self-service banking, which included the deployment of Microsoft Windows 11 IoT Enterprise LTSC 2024 operating system on their ATMs.

Gain a Competitive Edge with Our Global ATM Market Report

- Global ATM Market by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global ATM Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Solution Definition

- Research Process

- Assumptions

- Executive Summary

- Global ATM Market Trends & Developments

- Global ATM Market Dynamics

- Growth Drivers

- Challenges

- Global ATM Market Hotspot and Opportunities

- Global ATM Market Regulations, Policies & Solution Standards

- Global ATM Market Supply Chain Analysis

- Global ATM Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Solution

- Deployment- Market Size & Forecast 2020-2030, USD Million

- Onsite ATM- Market Size & Forecast 2020-2030, USD Million

- Offsite ATM- Market Size & Forecast 2020-2030, USD Million

- Worksite ATM- Market Size & Forecast 2020-2030, USD Million

- Mobile ATM- Market Size & Forecast 2020-2030, USD Million

- Managed Services- Market Size & Forecast 2020-2030, USD Million

- Deployment- Market Size & Forecast 2020-2030, USD Million

- By Type

- Brown ATMs- Market Size & Forecast 2020-2030, USD Million

- White ATMs- Market Size & Forecast 2020-2030, USD Million

- Cash dispenser ATMs- Market Size & Forecast 2020-2030, USD Million

- Smart ATMs- Market Size & Forecast 2020-2030, USD Million

- Conventional/banks ATMs- Market Size & Forecast 2020-2030, USD Million

- By Application

- Cash Withdrawal- Market Size & Forecast 2020-2030, USD Million

- Cash Deposit- Market Size & Forecast 2020-2030, USD Million

- Money Transfer- Market Size & Forecast 2020-2030, USD Million

- Others (PIN Change, Balance Inquiry, Bill Payments, etc.)- Market Size & Forecast 2020-2030, USD Million

- By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- By Competition

- Competition Characteristics

- Market Share & Analysis

- By Solution

- Market Size & Analysis

- North America ATM Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2020-2030, USD Million

- By Type- Market Size & Forecast 2020-2030, USD Million

- By Application- Market Size & Forecast 2020-2030, USD Million

- By Country

- The US

- Canada

- Mexico

- The US ATM Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2020-2030, USD Million

- By Type- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Canada ATM Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2020-2030, USD Million

- By Type - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Mexico ATM Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2020-2030, USD Million

- By Type - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- South America ATM Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2020-2030, USD Million

- By Type- Market Size & Forecast 2020-2030, USD Million

- By Application- Market Size & Forecast 2020-2030, USD Million

- By Country

- Brazil

- Argentina

- Rest of South America

- Brazil ATM Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2020-2030, USD Million

- By Type - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Argentina ATM Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2020-2030, USD Million

- By Type - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Europe ATM Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2020-2030, USD Million

- By Type- Market Size & Forecast 2020-2030, USD Million

- By Application- Market Size & Forecast 2020-2030, USD Million

- By Country

- Germany

- The UK

- France

- Spain

- Italy

- Rest of Europe

- Germany ATM Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2020-2030, USD Million

- By Type - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- The UK ATM Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2020-2030, USD Million

- By Type - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- France ATM Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2020-2030, USD Million

- By Type - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Spain ATM Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2020-2030, USD Million

- By Type - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Italy ATM Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2020-2030, USD Million

- By Type - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa ATM Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2020-2030, USD Million

- By Type- Market Size & Forecast 2020-2030, USD Million

- By Application- Market Size & Forecast 2020-2030, USD Million

- By Country

- The UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

- The UAE ATM Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2020-2030, USD Million

- By Type - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Saudi Arabia ATM Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2020-2030, USD Million

- By Type - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- South Africa ATM Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2020-2030, USD Million

- By Type - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific ATM Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2020-2030, USD Million

- By Type- Market Size & Forecast 2020-2030, USD Million

- By Application- Market Size & Forecast 2020-2030, USD Million

- By Country

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia-Pacific

- China ATM Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2020-2030, USD Million

- By Type - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Japan ATM Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2020-2030, USD Million

- By Type - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- India ATM Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2020-2030, USD Million

- By Type - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- South Korea ATM Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2020-2030, USD Million

- By Type - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Australia ATM Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2020-2030, USD Million

- By Type - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Global ATM Market Key Strategic Imperatives for Success & Growth

- Competitive Outlook

- Company Profiles

- Diebold Nixdorf

- Business Description

- Solution Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Wincor Nixdorf AG

- Business Description

- Solution Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- NCR Corporation

- Business Description

- Solution Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Triton Systems of Delaware

- Business Description

- Solution Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Hitachi-Omron Terminal Solutions

- Business Description

- Solution Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- GRG Banking Equipment Co. Ltd.

- Business Description

- Solution Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- OKI Electric Industry Co. Ltd.

- Business Description

- Solution Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Nautilus Hyosung Corporation

- Business Description

- Solution Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- HESS Cash Systems GmbH & Co KG

- Business Description

- Solution Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Fujitsu Ltd.

- Business Description

- Solution Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Euronet Worldwide

- Business Description

- Solution Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Brink's Company

- Business Description

- Solution Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Guangzhou Yuyin Technology Co., Ltd.

- Business Description

- Solution Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Diebold Nixdorf

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making