Press Release Description

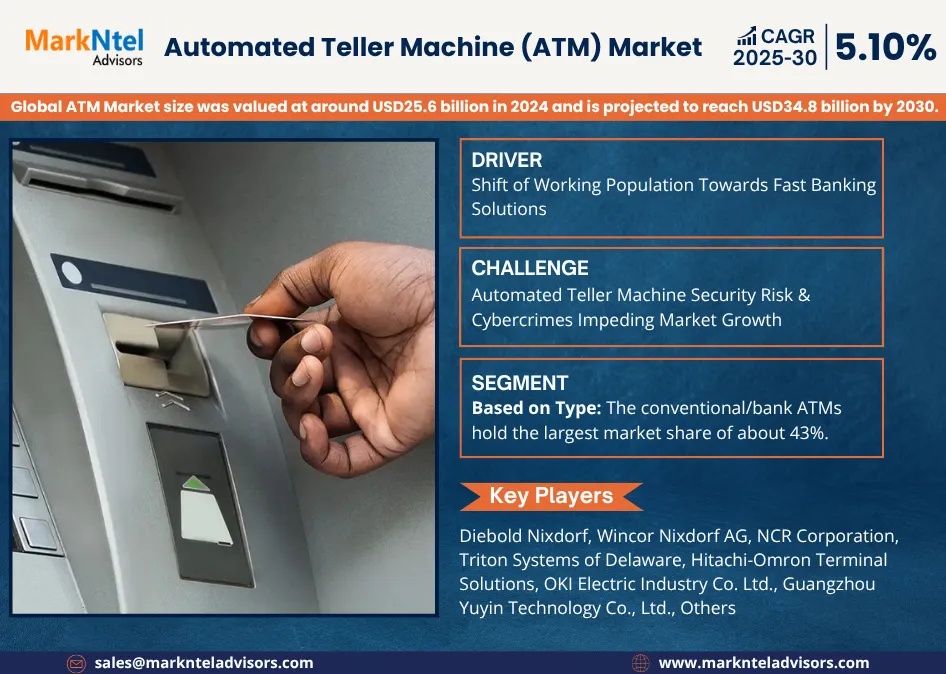

ATM Market to Reach USD 34.8 Billion by 2030 Due to a Steady CAGR of Around 5.10%

The Global ATM Market size was valued at around USD25.6 billion in 2024 and is projected to reach USD34.8 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 5.10% during the forecast period, i.e., 2025-30, cites MarkNtel Advisors in the recent research report. The rise in the market is due to an increase in the need for fast banking solutions among the working population, government support, growing investments in developing advances ATM infrastructure, digitalization of banks, frequent issuance of standards & guidelines, increasing internet connectivity, upgradations in security systems, integration of advancements, and others.

The growing working population is unable to access banking services due to the busy working schedule and the weekends off of most banks, resulting in the shift of consumers towards the fast and efficient 24/7 ATM services globally. The outsourcing of the third-party-operated brown and white ATMs is gaining acceptance among the service providers because of the reduced workload and the effective management of the ATMs in the urban and semi-urban regions worldwide.

Moreover, the regular standardization, partnerships, and issuance of guidelines by the PCI Security Standards Council (PCI SSC) ensure the security and close monitoring of threats and attacks, offering a smooth cash withdrawal and deposit. For instance, the DN Series signed an agreement with the 3 leading banks for three years, in the US, to upcycle the ATMs, further states in the research report, “Global ATM Market Analysis, 2025.”

Global ATM Market Segmentation Analysis

Conventional/Bank ATMs Serving a Wide Range of Customers

Based on the type, the market is further bifurcated into Brown ATMs, White ATMs, Cash dispenser ATMs, Smart ATMs, and Conventional/bank ATMs. Conventional/bank ATMs hold the majority of the market share, nearly 43%. This is due to its consumer-friendly features, consumer loyalty & friendliness, cost-effectiveness, easier availability, etc.

Additionally, the existing strong connecting network of the conventional ATMs and their connectivity across the banks uplifts their market share. The network of banks and the management service providers lowers the deployment cost and is budget-friendly. On the other hand, the price of deployment of brown ATMs, white ATMs, and smart ATMs is relatively high because of the need for an updated IT infrastructure and network, motivating the users towards the installation of conventional ATMs. Moreover, the increasing familiarity of consumers with the long lineage of conventional & bank ATMs, and the trust and loyalty of consumers incline them towards the conventional and bank ATMs, thus, facilitating their large market share.

Asia-Pacific Leads the Global ATM Industry

Asia-Pacific leads the ATM market globally with a substantial market share of around 37%. This is due to the large banking services consumer base, the growing ATM deployment in the rural & remote areas, the presence of market players, government support, collaborations & partnerships, etc.

The growing population, rise in disposable income, increasing white collar population, spreading awareness & financial inclusiveness, etc., have increased the utility of ATM services in the region. The large consumer base of countries like India, China, the Philippines, and Indonesia, with government initiatives like the Strategy for Financial Inclusion (SNKI), the Financial Inclusion Development Plan, the Pradhan Mantri Jan Dhan Yojna, and others, has encouraged the unbanked population to open their bank accounts. Further, the increasing investment and focus of the government towards the untapped cities and regions have increased the usage of ATMs and services in Asia-Pacific.

Competitive Landscape

With strategic initiatives, such as mergers, collaborations, and acquisitions, the leading market companies, including Diebold Nixdorf, Wincor Nixdorf AG, NCR Corporation, Triton Systems of Delaware, Hitachi-Omron Terminal Solutions, GRG Banking Equipment Co. Ltd., OKI Electric Industry Co., Ltd., Nautilus Hyosung Corporation, HESS Cash Systems GmbH & Co KG, Fujitsu Ltd., Euronet Worldwide, Brink's Company, Guangzhou Yuyin Technology Co., Ltd, and others are looking forward to strengthening their market positions.

Key Questions Answered in the Research Report

- What are the industry’s overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares)?

- What are the trends influencing the current scenario of the market?

- What key factors would propel and impede the industry across the globe?

- How has the industry been evolving in terms of geography & solution adoption?

- How has the competition been shaping up across various regions?

- How have buying behavior, customer inclination, and expectations from product manufacturers been evolving during 2020-30?

- Who are the key competitors, and what strategic partnerships or ventures are they coming up with to stay afloat during the projected time frame?

We offer flexible licensing options to cater to varying organizational needs. Choose the pricing pack that best suits your requirements:

Buy NowNeed Assistance?

WRITE AN EMAIL

sales@marknteladvisors.comCustomization Offered

100% Safe & Secure

Strongest encryption on the website to make your purchase safe and secure