United States Financial Services Market Research Report: Forecast (2025-2030)

United States Financial Services Market Size and Analysis By Product Type (Banking Services [Retail Banking, Commercial Banking, Investment Banking, Private Banking, Digital/Neo Ba...nking], Insurance Services [Life Insurance, Health Insurance, Property & Casualty Insurance, Auto Insurance, Specialty Insurance], Asset & Wealth Management [Mutual Funds, Pension/Retirement Funds, Private Equity, Hedge Funds, Robo-Advisory], Payments & Fintech [Credit Cards, Debit Cards, Mobile Payments, Digital Wallets, P2P Transfers, Buy Now, Pay Later], Lending Services [Mortgage Lending, Consumer Lending, SME Lending, Student Loans, Auto Loans], Capital Markets [Equity Markets, Fixed Income, Derivatives, Structured Products], Real Estate Finance, Crowdfunding, Crypto & Digital Assets), By Distribution Channel (Direct, Online/Digital Platforms, Mobile Applications, Agents/Brokers, Third-Party Aggregators, Others), By End-User (Individuals/Households, Small & Medium Enterprises, Large Enterprises, Government/Public Sector, Non-Profit Organizations) and Others Read more

- FinTech

- Jul 2025

- Pages 129

- Report Format: PDF, Excel, PPT

Market Insights & Analysis: United States Financial Services Market (2025-30):

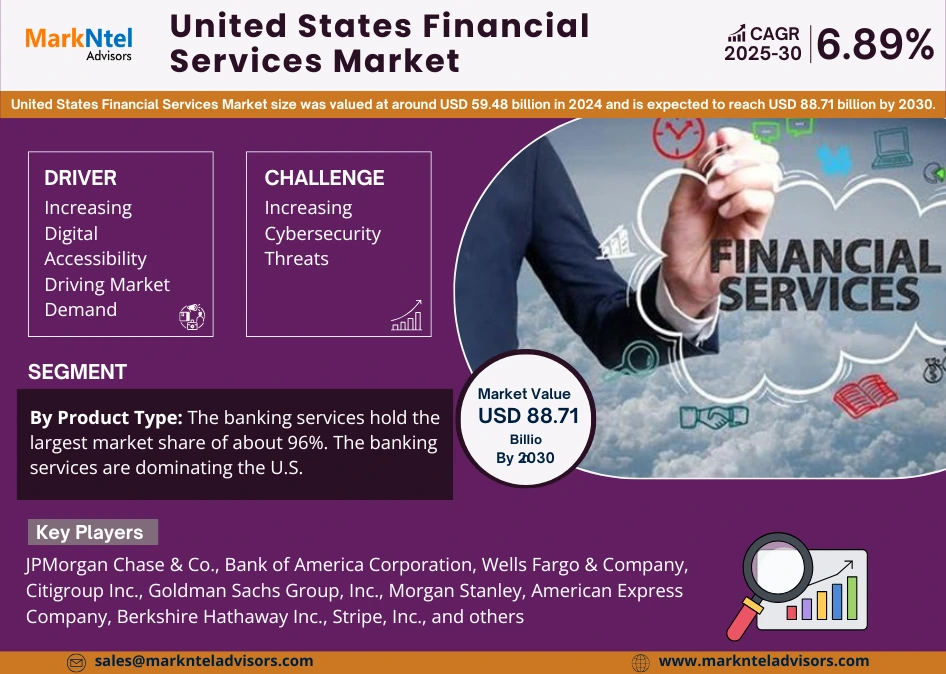

The United States Financial Services Market size was valued at around USD 59.48 billion in 2024 and is expected to reach USD 88.71 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 6.89% during the forecast period, i.e., 2025-30. The United States Financial Services Market is significantly growing due to several growth factors, including the rapid shift towards digitalization in the country, the high internet penetration, the rising adoption of fintech services, the infrastructural development of financial institutions, and the technological advancements, including artificial intelligence in the financial services, etc. One of the most prominent growth factors is the robust shift towards online and smartphone banking in the country, as in 2025, there are more than 215 million people shifted towards digital banking regularly. This shift is due to the high adoption of smartphones and rising internet penetration, which is more convenient for financial services.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020–23 |

| Base Years | 2024 |

| Forecast Years | 2025–30 |

| Market Value in 2024 | USD 59.48 Billion |

| Market Value by 2030 | USD 88.71 Billion |

| CAGR (2025–30) | 6.89% |

| Top Key Players | JPMorgan Chase & Co., Bank of America Corporation, Wells Fargo & Company, Citigroup Inc., Goldman Sachs Group, Inc., Morgan Stanley, American Express Company, Berkshire Hathaway Inc., Prudential Financial, Inc., MetLife, Inc., The Charles Schwab Corporation, Visa Inc., Mastercard Incorporated, PayPal Holdings, Inc., Stripe, Inc., and others |

| Segmentation | By Product Type (Banking Services [Retail Banking, Commercial Banking, Investment Banking, Private Banking, Digital/Neo Banking], Insurance Services [Life Insurance, Health Insurance, Property & Casualty Insurance, Auto Insurance, Specialty Insurance], Asset & Wealth Management [Mutual Funds, Pension/Retirement Funds, Private Equity, Hedge Funds, Robo-Advisory], Payments & Fintech [Credit Cards, Debit Cards, Mobile Payments, Digital Wallets, P2P Transfers, Buy Now, Pay Later], Lending Services [Mortgage Lending, Consumer Lending, SME Lending, Student Loans, Auto Loans], Capital Markets [Equity Markets, Fixed Income, Derivatives, Structured Products], Real Estate Finance, Crowdfunding, Crypto & Digital Assets), By Distribution Channel (Direct, Online/Digital Platforms, Mobile Applications, Agents/Brokers, Third-Party Aggregators, Others), By End-User (Individuals/Households, Small & Medium Enterprises, Large Enterprises, Government/Public Sector, Non-Profit Organizations) and Others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

Additionally, the US government is actively supporting the market growth by drafting various policies and heavily investing in the development of both physical and digital financial services infrastructure in the United States. Also, the financial institutions are upgrading their systems and significantly shifting towards cloud-based services by establishing partnerships and collaborations with different cloud-based companies, like Google Cloud, Microsoft Azure, and many more. These efforts are contributing to the potential growth of this market.

Moreover, the adoption of advanced technologies like artificial intelligence in the financial services is significantly increasing the market growth, as the integration is increasing the convenience, precision, accuracy, protection, and automation of the financial services. However, the increasing risks of cyber threats to financial institutions are creating hindrances to the market growth & expansion, as these institutions have a huge amount of personal details of their customers, including their account details, transaction records, and other bank details. These details are at a high risk of cyberattacks, thus restraining the market growth.

United States Financial Services Market Driver:

Increasing Digital Accessibility Driving Market Demand – The market growth is driven by the rising digital accessibility in the United States. For instance, 88% of Americans have access to the internet, and over 90% own a smartphone, contributing to the market growth, as people can easily use online and mobile banking services anytime, anywhere. This wide availability allows customers to open accounts, transfer money, apply for loans, invest, and buy insurance without visiting a physical branch. For example, apps like Chase Mobile, Venmo, and Robinhood have millions of users in the country who prefer managing their money digitally because it is fast and convenient. This is because features such as instant payments, mobile check deposits, and AI-powered chatbots make banking simpler and more personalized, enabling people in rural or underserved areas to benefit from digital services, helping increase financial inclusion. It has increased the availability of fully online financial services in the country. For instance, around 30 banks, such as Varo Bank and Chime, in the United States are fully online banks called neobanks, which are increasing market growth.

This high level of internet penetration and smartphone adoption fuels the demand for digital financial services, encouraging traditional banks and fintech startups to invest heavily in technology. As a result, digital accessibility is a key driver of growth and transformation in the U.S. financial services industry.

United States Financial Services Market Opportunity:

Surging Infrastructural Developments in Financial Sector – The US is currently witnessing a significant infrastructural development in the financial service institutions, providing lucrative growth opportunities to the key players of the US Financial Services Market. These new institutions are helping the customers with faster, more accessible, and secure financial services in the country. For instance, in 2023, the Federal Reserve launched a Fed Now Service that enables credit unions and banks to transfer money for real-time 4/7 across the country. Similarly, traditional platforms are moving to upgrade their systems and moving towards cloud-based systems by partnering with different companies like Microsoft Azure, Google Cloud, etc.

Additionally, the US government is investing in infrastructure development related to financial services in the US. For instance, in 2024, the government has allocated about USD75 million under the initiative called the State Small Business Credit Initiative to increase the financial services accessibility, especially to small and medium enterprises. Such types of developments are creating ample growth opportunities for this market and increasing its potential market growth.

United States Financial Services Market Challenge:

Increasing Cybersecurity Threats – The market is facing increased cybersecurity threats, as these financial institutions contain a huge amount of customers’ data with personal information, including social security numbers, transaction records, and other bank details, which are hindering the market’s growth. For instance, in 2024, the company called LoanDepot faced a major ransomware attack, which revealed the data of more than 16 million customers. As a result, to recover the data, the company experienced major financial loss and had to pay about USD26.5 million. Similarly, the Evolve Bank & Trust was hit by cyberattacks twice in 2024 and 2025, in which the data of nearly 8 million people was breached, and the bank is still dealing with these losses and trying to recover from the situation.

Additionally, a major theft has taken place in another financial service provider called SRP Federal Credit Union in 2024, in which hackers have stolen almost 650 GB of data of 2,40,000 customers. Likewise, the Bank of America (2023) faced a data breach, in which hackers accessed the personal information of about 60,500 US customers. Such kinds of cyberattacks are creating growth hindrances and financial losses, and hampering market growth & expansion.

United States Financial Services Market Trend:

Integration of Artificial Intelligence in the Financial Services – The market dynamics are changing due to the rapid adoption of artificial intelligence by the financial service providers to increase their efficiency, protection for consumers’ data, precision, and operational automation. Many financial service-providing companies, like JP Morgan, Bank of America, and BlackRock in the country, are actively using AI in their services, such as Large Language Models (LLM), Small Language Models (SLM), etc. For instance, JP Morgan Chase has recently started using a proprietary AI tool called Contract Intelligence (COiN), which can analyze documents in seconds and save thousands of labor hours.

Additionally, many software development companies in the country, such as Ayasdi, Gradient AI, etc., are providing fraud detection and insurance risk prediction tools to the financial services industry. These advancements are positively transforming the United States Financial Services Market and paving the path for future growth & development.

United States Financial Services Market (2025-30): Segmentation Analysis

The United States Financial Services Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the country level. Based on the analysis, the market has been further classified as:

Based on Product Type:

- Banking Services

- Insurance Services

- Asset & Wealth Management

- Payments & Fintech

- Lending Services

- Capital Markets

- Real Estate Finance

- Crowdfunding

- Crypto & Digital Assets

Out of these, the banking services hold the largest market share of about 96%. The banking services are dominating the U.S. Financial Services Market due to the high customer base under this type of service, because these banks provide extra advantages and offer financial Safety by insuring the deposits of the customers. For instance, the retail banks offer up to USD2,50,000 per account via the Federal Deposit Insurance Corporation (FDIC). Also, the banks provide loans for home, automobile, education, etc., which improves people's lives & the economy, and builds customers’ trust and loyalty. For instance, approximately 96% of Americans use banking services, while only 4% are left with these services. Whereas, the insurance services adoption rate is only 60% in the country, along with a 27% acceptance rate of asset and wealth management services in the United States, showing the dominance of banking services in the market segment.

Based on Distribution Channel:

- Direct (Branch/Office)

- Online/Digital Platforms

- Mobile Applications

- Agents/Brokers

- Third-Party Aggregators

- Others

Among these, the mobile applications are dominating the Financial Services Industry of the United States, accounting for more than 54% share of the total market volume. The dominance is due to the high adoption of smartphones in the country, which is contributing to the growth of this segment. As of 2025, over 90% of Americans are using smartphones, which is about 240 million individuals in the country. This is leading to a high preference for utilizing financial services via mobile applications rather than physical services, as these applications enable users to check their transactions, pay bills, transfer money, apply for loans, etc., through their phones without the need to visit banks or other financial service institutions physically.

Additionally, this approach is also cost-effective as compared to the physical services and branches, thus widely accepted by financial service providers. Big companies like PayPal, Bank of America, and Venmo etc. are offering various apps to provide these services and have attracted millions of users.

United States Financial Services Industry Recent Development:

- 2024: Citigroup Inc. partnered with Apollo to create a USD25 billion direct lending program in North America, primarily in the United States. The goal is to give loans to companies that don’t have high credit ratings or are backed by private equity firms. Mubadala and Athene (part of Apollo) are also helping by providing money for these loans.

- 2024: MetLife partnered with General Atlantic to create a new company called Chariot Reinsurance. It officially started in early 2025. This new firm helps manage financial risk by handling USD10 billion worth of MetLife’s insurance policies, giving MetLife more flexibility and support in the U.S. insurance market.

Gain a Competitive Edge with Our United States Financial Services Market Report

- United States Financial Services Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- United States Financial Services Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- United States Financial Services Market Policies, Regulations, and Product Standards

- United States Financial Services Market Supply Chain Analysis

- United States Financial Services Market Trends & Developments

- United States Financial Services Market Dynamics

- Growth Drivers

- Challenges

- United States Financial Services Market Hotspot & Opportunities

- United States Financial Services Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Million Transactions/Accounts)

- By Product Type

- Banking Services- Market Size & Forecast 2020-2030, USD Million

- Retail Banking- Market Size & Forecast 2020-2030, USD Million

- Commercial Banking- Market Size & Forecast 2020-2030, USD Million

- Investment Banking- Market Size & Forecast 2020-2030, USD Million

- Private Banking- Market Size & Forecast 2020-2030, USD Million

- Digital/Neo Banking- Market Size & Forecast 2020-2030, USD Million

- Insurance Services- Market Size & Forecast 2020-2030, USD Million

- Life Insurance- Market Size & Forecast 2020-2030, USD Million

- Health Insurance- Market Size & Forecast 2020-2030, USD Million

- Property & Casualty Insurance- Market Size & Forecast 2020-2030, USD Million

- Auto Insurance- Market Size & Forecast 2020-2030, USD Million

- Specialty Insurance- Market Size & Forecast 2020-2030, USD Million

- Asset & Wealth Management- Market Size & Forecast 2020-2030, USD Million

- Mutual Funds- Market Size & Forecast 2020-2030, USD Million

- Pension/Retirement Funds- Market Size & Forecast 2020-2030, USD Million

- Private Equity- Market Size & Forecast 2020-2030, USD Million

- Hedge Funds- Market Size & Forecast 2020-2030, USD Million

- Robo-Advisory- Market Size & Forecast 2020-2030, USD Million

- Payments & Fintech - Market Size & Forecast 2020-2030, USD Million

- Credit Cards- Market Size & Forecast 2020-2030, USD Million

- Debit Cards- Market Size & Forecast 2020-2030, USD Million

- Mobile Payments- Market Size & Forecast 2020-2030, USD Million

- Digital Wallets- Market Size & Forecast 2020-2030, USD Million

- P2P Transfers- Market Size & Forecast 2020-2030, USD Million

- Buy Now, Pay Later (BNPL)- Market Size & Forecast 2020-2030, USD Million

- Lending Services- Market Size & Forecast 2020-2030, USD Million

- Mortgage Lending- Market Size & Forecast 2020-2030, USD Million

- Consumer Lending- Market Size & Forecast 2020-2030, USD Million

- SME Lending- Market Size & Forecast 2020-2030, USD Million

- Student Loans- Market Size & Forecast 2020-2030, USD Million

- Auto Loans- Market Size & Forecast 2020-2030, USD Million

- Capital Markets- Market Size & Forecast 2020-2030, USD Million

- Equity Markets- Market Size & Forecast 2020-2030, USD Million

- Fixed Income- Market Size & Forecast 2020-2030, USD Million

- Derivatives- Market Size & Forecast 2020-2030, USD Million

- Structured Products- Market Size & Forecast 2020-2030, USD Million

- Real Estate Finance- Market Size & Forecast 2020-2030, USD Million

- Crowdfunding- Market Size & Forecast 2020-2030, USD Million

- Crypto & Digital Assets- Market Size & Forecast 2020-2030, USD Million

- Banking Services- Market Size & Forecast 2020-2030, USD Million

- By Distribution Channel

- Direct (Branch/Office)- Market Size & Forecast 2020-2030, USD Million

- Online/Digital Platforms- Market Size & Forecast 2020-2030, USD Million

- Mobile Applications- Market Size & Forecast 2020-2030, USD Million

- Agents/Brokers- Market Size & Forecast 2020-2030, USD Million

- Third-Party Aggregators- Market Size & Forecast 2020-2030, USD Million

- Others

- By End-User

- Individuals/Households- Market Size & Forecast 2020-2030, USD Million

- Small & Medium Enterprises (SMEs)- Market Size & Forecast 2020-2030, USD Million

- Large Enterprises - Market Size & Forecast 2020-2030, USD Million

- Government/Public Sector- Market Size & Forecast 2020-2030, USD Million

- Non-Profit Organizations- Market Size & Forecast 2020-2030, USD Million

- By Region

- Northeast

- Midwest

- South

- West

- By Company

- Company Revenue Shares

- Competitor Characteristics

- By Product Type

- Market Size & Outlook

- United States Banking Services Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Million Accounts)

- By Distribution Channel - Market Size & Forecast 2020-2030, USD Million

- By End-User - Market Size & Forecast 2020-2030, USD Million

- Market Size & Outlook

- United States Insurance Services Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Million Policies)

- By Distribution Channel - Market Size & Forecast 2020-2030, USD Million

- By End-User - Market Size & Forecast 2020-2030, USD Million

- Market Size & Outlook

- United States Asset & Wealth Management Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Million Accounts)

- By Distribution Channel - Market Size & Forecast 2020-2030, USD Million

- By End-User - Market Size & Forecast 2020-2030, USD Million

- Market Size & Outlook

- United States Payments & Fintech Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Million Transactions)

- By Distribution Channel - Market Size & Forecast 2020-2030, USD Million

- By End-User - Market Size & Forecast 2020-2030, USD Million

- Market Size & Outlook

- United States Lending Services Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Million Loans)

- By Distribution Channel - Market Size & Forecast 2020-2030, USD Million

- By End-User - Market Size & Forecast 2020-2030, USD Million

- Market Size & Outlook

- United States Capital Markets Services Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Million Transactions)

- By Distribution Channel - Market Size & Forecast 2020-2030, USD Million

- By End-User - Market Size & Forecast 2020-2030, USD Million

- Market Size & Outlook

- United States Financial Services Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- JPMorgan Chase & Co.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Bank of America Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Wells Fargo & Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Citigroup Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Goldman Sachs Group, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Morgan Stanley

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- American Express Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Berkshire Hathaway Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Prudential Financial, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- MetLife, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- The Charles Schwab Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Visa Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Mastercard Incorporated

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- PayPal Holdings, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Stripe, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- JPMorgan Chase & Co.

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making