Press Release Description

United States Financial Services Market to Reach USD88.71 Billion by 2030 Due to Increasing Digital Accessibility

United States Financial Services Market Overview, Trends, Size and Forecast: 2025-2030

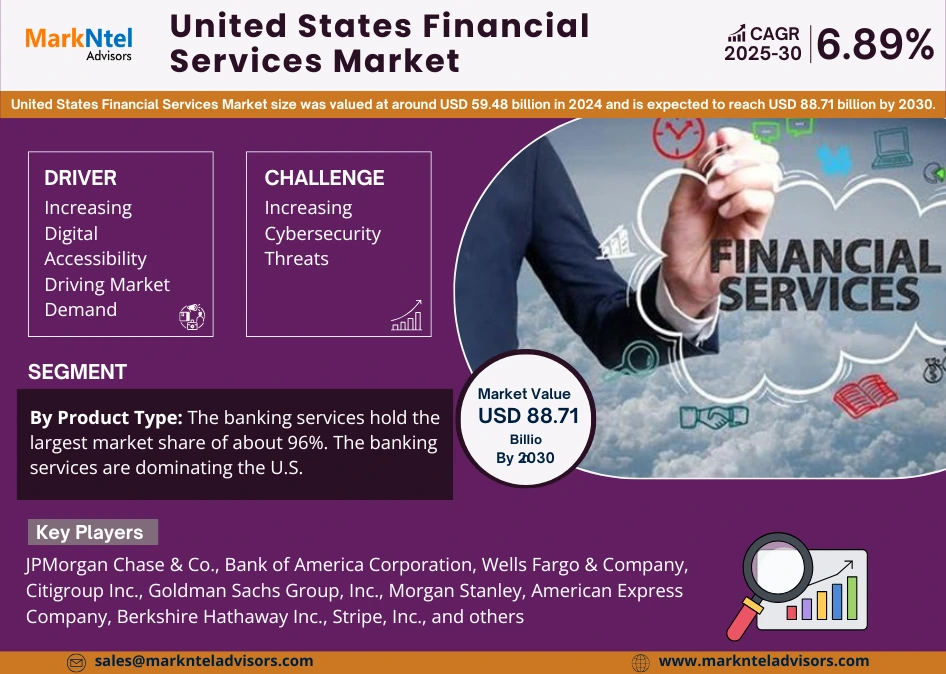

The United States Financial Services Market size was valued at around USD59.48 billion in 2024 and is expected to reach USD88.71 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 6.89% during the forecast period, i.e., 2025-30, cites MarkNtel Advisors in the recent research report. The market growth is driven by several growth factors, including the rapid inclination towards digitalization, the increasing adoption of smartphones, the rising internet penetration in the country, etc. Moreover, the widespread acceptance of fintech services, the robust government support in the infrastructure development of financial services, and the adoption of technological innovation, such as the incorporation of Artificial Intelligence in the financial service platforms, etc., are also augmenting the size & volume of the US Financial Services Industry.

One of the major growth factors is the increasing fintech companies, which are more accessible and convenient due to the high internet penetration and smartphone adoption in the country. Several fintech companies are there in the United States, such as PayPal, Venmo, CashApp, etc., which are expanding their business operations, ultimately augmenting the revenue growth of the financial services industry in the United States.

Additionally, the active support of the US government by significant investments in the infrastructural development for various financial service institutions, including both physical and digital services. Also, the continuous system upgradation and rising shift towards cloud-based services are providing ample growth opportunities for this market. The financial service providers are actively collaborating with cloud-based companies like Google Cloud, Microsoft Azure, etc., thus increasing the market growth. Moreover, the widespread adoption of technological advancements is also driving the size & volume of the market due to the incorporation of artificial intelligence in the financial services. These advances are gaining traction in the US Financial Services Market due to high accuracy, protection, automation, and convenience as compared to the traditional type of financial services in the country.

However, the high risk of cyber threats to these financial service platforms is hindering the market growth, because the financial institutions contain a huge amount of customers’ data, including transaction records, account details, and other bank-related details, etc. These details are highly vulnerable to cyberattacks, thus hampering the market growth, further states the research report, “United States Financial Services Market Analysis, 2025.”

United States Financial Services Market Segmentation Insights:

Banking Services Seized Huge Market Share

Based on the product type, the market is further segmented into Banking Services, Insurance Services, Asset & Wealth Management, Payments & Fintech, Lending Services, Capital Markets, Real Estate Finance, Crowdfunding, and Crypto & Digital Assets. Among these, the banking services hold the largest market share of about 96%. This segment is leading due to the high customer loyalty and base as compared to other types of financial services. It is because the banking services ensure the financial safety by insuring deposits up to the value of hundreds of thousands per account by the Federal Deposit Insurance Corporation (FDIC). Also, the banks help customers with their requirements by providing decent loans for real estate, such as homes, education, etc., and build customer trust and loyalty. Thus, these factors are contributing to the higher growth of banking services in the financial services industry of the United States.

Mobile Applications Are Used Widely for Delivering Financial Services

The mobile applications are dominating the market with more than 54% of the market share. The dominance is due to the massive penetration of smartphones in the United States, which is significantly contributing to the market growth, as more than 90% of Americans are active smartphone users, serving to increase the mobile apps for financial services. This is enabling the US customers to avoid physical bank visits, as these applications enable users to check their transactions, pay bills, transfer money, apply for loans, etc. As a result, the customers are highly preferring the mobile-based financial services over other types. Additionally, mobile–based financial services are cost-effective as compared to the physical services, thus accepted widely by the providers as well as the users. Several big companies are utilizing this approach, engaging millions of users and ultimately augmenting the revenue growth of mobile applications in this growing industry.

Top Companies in the United States Financial Services Market

With strategic initiatives, such as mergers, collaborations, and acquisitions, the leading Financial Services companies in us market, including JPMorgan Chase & Co., Bank of America Corporation, Wells Fargo & Company, Citigroup Inc., Goldman Sachs Group, Inc., Morgan Stanley, American Express Company, Berkshire Hathaway Inc., Prudential Financial, Inc., MetLife, Inc., The Charles Schwab Corporation, Visa Inc., Mastercard Incorporated, PayPal Holdings, Inc., Stripe, Inc., and others are looking forward to increase their market size & share.

Key Questions Answered in the Research Report

- What is the scope, size, value, and forecast of the United States Financial Services Market?

- What is the volume and share of each segment in the United States Financial Services Market?

- What are the key trends shaping the United States Financial Services Market from 2025 to 2030?

- What growth factors and risks impact the United States Financial Services Market?

- What are the main challenges faced by players in the United States Financial Services Market?

- What are the top opportunities in the United States Financial Services Market?

- What does competitive analysis reveal about the United States Financial Services Market landscape?

- Who are the key players and companies leading the United States Financial Services Market?

- What innovations are transforming the future dynamics of the United States Financial Services Market?

- How are partnerships and collaborations driving the United States Financial Services Market growth?

- How does the United States Financial Services Market differ based on geography and segments?

We offer flexible licensing options to cater to varying organizational needs. Choose the pricing pack that best suits your requirements:

Buy NowNeed Assistance?

WRITE AN EMAIL

sales@marknteladvisors.comCustomization Offered

100% Safe & Secure

Strongest encryption on the website to make your purchase safe and secure