Global Alkoxylates Market Research Report: Forecast (2024-2030)

By Grade (Natural, Synthetic), By Type (Fatty Alcohol Alkoxylates, Methyl Ether Alkoxylates, Fatty Acid Alkoxylates, Fatty Amine Alkoxylates, Glycerine Alkoxylates, Others (Tristyr...ylphenol Alkoxylates, PropyleneOxide Copolymers, etc.)), By Application Type (Wetting Agents, Cleansing Agents, Emulsifiers, Dispersing Agents, Demulsifiers, Detergents, Others (Solubilizers, etc.), By End Users (Agrochemicals, Paint & Coatings, Personal Care, Pharmaceuticals, Oil & Gas, Others (Papers, Textile, Ceramic, etc.), By Region (North America, South America, Europe, The Middle East & Africa, Asia Pacific), By Company (Croda International PLC, BASF SE, Lamberti S.p.A., The Dow Chemical Company, ChemPoint.com Inc., Evonik Industries, Eastman Chemical Company, Clariant AG, LyondellBasell Industries Holdings B.V., Sasol Limited., Solvay S.A., Akzo Nobel N.V., Stepan Company, KLK OLEO., HUNTSMAN INTERNATIONAL LLC, Others,) Read more

- Chemicals

- Jul 2023

- Pages 192

- Report Format: PDF, Excel, PPT

Market Definition

Alkoxylates are the chemicals produced by adding alkoxides such as ethylene oxide, propylene oxide, and butylene oxide to fatty hydrophobes, including alcohols, phenols, and amines, via the alkoxylation process. Its numerous kinds, like fatty alcohol alkoxylates, fatty acid alkoxylates, and fatty amine alkoxylates, are used widely as emulsifying agents, detergents, stabilizers, wetting agents, and cleaning agents.

Market Insights & Projections: Global Alkoxylate Market (2024-30)

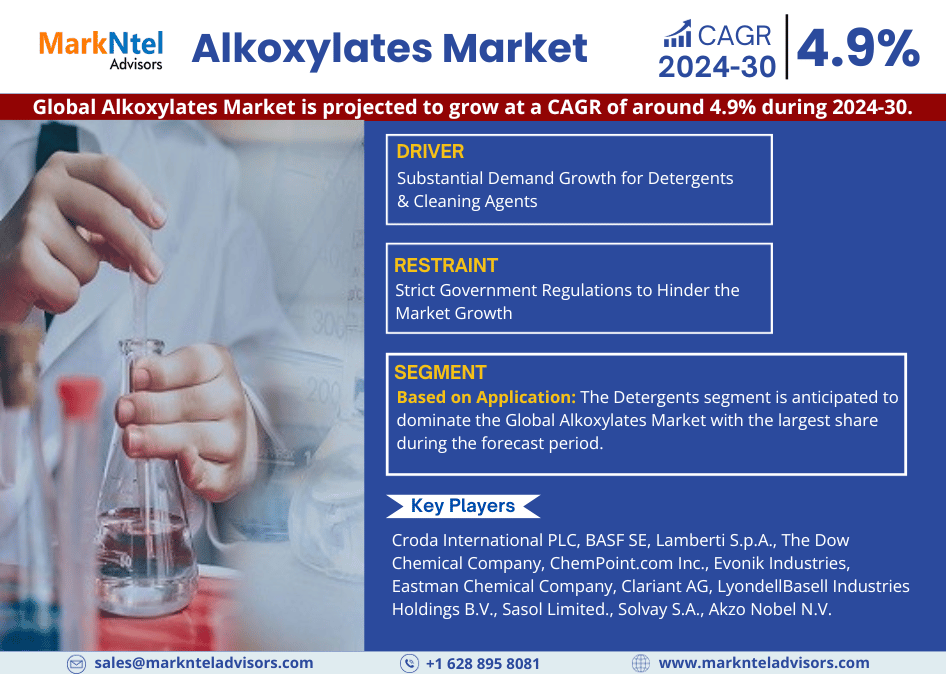

The Global Alkoxylates Market is projected to grow at a CAGR of around 4.9% during the forecast period, i.e., 2024-30. The market is swiftly driven by the growing consumer awareness of sanitation & hygiene, especially after the pandemic, propelling the demand for alkoxylates for their cleaning properties. The broad industrial adoption of alkoxylates in hair care products like shampoos & conditioners due to their incredible benefits in aiding in foaming, removing oil & dirt, and stimulating a clean skin feeling further adds to the peaking demand.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 4.9% |

| Regions Covered | North America: The US, Canada, Mexico |

| South America: Brazil, Argentina, Rest of South America | |

| Europe: Germany, The UK, France, Russia, Spain, Rest of Europe | |

| Asia-Pacific: China, Japan, India, South Korea, Australia, Rest of Asia Pacific | |

| Middle East & Africa: Saudi Arabia, The UAE, Egypt, Turkey, Israel, Rest of The Middle East & Africa | |

| Key Companies Profiled | Croda International PLC, BASF SE, Lamberti S.p.A., The Dow Chemical Company, ChemPoint.com Inc., Evonik Industries, Eastman Chemical Company, Clariant AG, LyondellBasell Industries Holdings B.V., Sasol Limited., Solvay S.A., Akzo Nobel N.V., Stepan Company, KLK OLEO., HUNTSMAN INTERNATIONAL LLC, Others, |

| Unit Denominations | USD Million/Billion |

Ethoxylates have already witnessed a steady adoption in the textile sector for dyeing, scouring, and lubricating in the last few years. Further, the mounting demand for ethoxylate-based ointments in the pharmaceutical industry observes a positive influence on the market during the projected time frame. Moreover, the rising proliferation of surfactants incites the steady adoption of alcohol ethoxylates, as these are the primary agents used in producing industrial non-ionic surfactants. Since surfactants are broadly used as an emulsifier, detergents, cleaning agents, and wetting agents in industrial processes, the need for more alkoxylates are exploding in the market.

In addition, the growing inclination of manufacturers in formulations of laundry detergents, owing to their fast biodegradation, enhanced synthetic textiles cleaning, and better water hardness tolerance, enthralls the market through the forecast years. Furthermore, numerous applications of these chemicals in the form of leveling agents, dyeing assists, solubilizes, and coupling agents & fiber lubricants are also augmenting the demand for alkoxylates in diverse industrial needs and, in turn, accelerating the overall market growth through 2028.

Global Alkoxylate Market Driver:

Substantial Demand Growth for Detergents & Cleaning Agents – In recent years, especially after the COVID-19 pandemic detergents & cleaning agents have witnessed a tremendous demand across the globe. To maintain hygiene in households & industries, many of the sectors are opting for them for cleaning purposes. This eventually boosted the demand for alkoxylates over the historical period. Moreover, the need for soaps & detergents has been driven due to the growing application in hospitals, hotels, and public toilets.

Also, surging tourists, public & private investments, and government initiatives are some of the factors resulting in the growth of the construction of hotels, hospitals, and public toilets. Thus, to cater to the global demand for soaps & detergents, manufacturing companies are focusing on increasing the production capabilities of their products. Hence, the growth in the production of detergents, and cleaning agents ultimately fuels the Global Alkoxylates Market during the forecast period.

Global Alkoxylate Market Possible Restraint:

Strict Government Regulations to Hinder the Market Growth – Stringent government regulations pertaining to the usage and sale of chemicals might hamper the market in the historical period. Moreover, the hazardous nature of some alkoxylates makes the manufacturers extremely cautious while carrying out the manufacturing procedure, ultimately creating room for more alternatives and, in turn, restricting the Alkoxylate Market growth.

Global Alkoxylate Market Growth Opportunity:

Construction of New Cities Augments the Global Alkoxylate Market – The construction of residential & commercial infrastructure requires an extensive range of ceramics, paint & coatings, cleaners, and other product that needs alkoxylates for their production. The governments of countries such as Egypt, India, China, Indonesia, and others are working on new projects focused on creating new cities in their countries. This would propel the demand for ceramics & paints, further generating the demand for alkoxylates in the coming years.

Global Alkoxylate Market (2024-30): Segmentation Analysis

The Alkoxylate Market study by MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment and includes predictions for the period 2024–2030 at the global level. In accordance to the analysis, the market has been further classified as:

Based on Type:

- Fatty Alcohol Alkoxylates

- Methyl Ether Alkoxylates

- Fatty Acid Alkoxylates

- Fatty Amine Alkoxylates

- Glycerine Alkoxylates

- Others (Tristyrylphenol Alkoxylates, PropyleneOxide Copolymers, etc.)

Fatty Alcohol alkoxylates acquired the largest share in the Global Alkoxylates Market in recent years and shall emerge as an area of opportunity for the players in the coming years. This dominance is primarily attributed to the wide adoption of fatty alcohol ethoxylates in dishwashing detergents, personal care products like shampoos, & soaps, the paints industry, etc. Besides, fatty alcohol ethoxylate, being a C12-13 synthetic alcohol, is manufactured by its reaction with ethylene oxide, and due to its hydrophilic nature, they are widely opted in the formulation of foaming control agents. Hence, its demand is upscaling rapidly.

Moreover, Ethoxylates witnessed a broad adoption in liquid chromatography as mobile phase additives as they exhibit relatively more stability than regular alcohols. Additionally, with remarkable antibacterial and antifungal properties, fatty alcohol ethoxylates act as a household cleaning agent, stimulating market growth through 2030.

Based on Application:

- Wetting Agents

- Cleansing Agents

- Emulsifiers

- Demulsifies

- Detergents

- Others (Solubilizes, etc.)

The Detergents segment is anticipated to dominate the Global Alkoxylates Market with the largest share during the forecast period. This dominance is attributed to the accelerating adoption of ethoxylates, sourced from natural sources in various cleaning products like detergents owing to their mild & non-irritant human skin interaction, promulgating its extensive use.

Besides, backed by the biodegradable nature of these chemicals, making them environment-friendly, detergent manufacturers are procuring a substantial amount of these chemicals to produce detergents & cater to consumer needs without impacting nature. The same aspect is also instigating the players to widen their product portfolio, brand visibility, and consumer base while expanding their production & distribution capacities, contributing to the overall market growth during 2024-30.

Global Alkoxylate Market: Regional Analysis

Geographically, the Alkoxylate Market expands across:

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

Europe is predicted to hold the largest revenue share of the Global Alkoxylates Market during the forecast period. This dominance is attributed to the swift expansion of the pharmaceutical industry, propelling the demand for these chemicals, entwined with the widening adoption of alkoxylates in various home & industrial cleaning and personal care applications, stimulating across Europe. Nevertheless, as the governments of different countries in the region are encouraging the adoption of environment-friendly and bio-degradable products, the utilization of these chemicals is escalating substantially and finding application across diverse industries in Europe, catering to the overall market expansion.

Moreover, the changing lifestyles and increasing environmental consciousness for personal hygiene are also prompting the adoption of personal care products. Furthermore, concerted efforts of countries & private companies to revitalize agrochemicals & medicines are also playing a significant role in boosting the production of alkoxylates like ethoxylates across the region & stimulating the Europe Alkoxylate Market.

Global Alkoxylate Market: Recent Developments

- 2023: BASF SE instigates its production capacity in Europe (Antwerp, Belgium, and Ludwigshafen, Germany) to produce Alkoxylate.

- 2023: Clariant AG announced to launch 100% bio-degradable surfactant range, increasing the transition towards renewable carbon.

Gain a Competitive Edge with Our Global Alkoxylate Market Report

- Global Alkoxylate Report by MarkNtel Advisors provides a detailed & thorough analysis of market size, share,growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Alkoxylate Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Alkoxylates Market Trends & Insights

- Global Alkoxylates Market Dynamics

- Drivers

- Challenges

- Global Alkoxylates Market Regulations & Policies

- Global Alkoxylates Market Hotspots & Opportunities

- Global Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade

- Natural

- Synthetic

- By Type

- Fatty Alcohol Alkoxylates

- Methyl Ether Alkoxylates

- Fatty Acid Alkoxylates

- Fatty Amine Alkoxylates

- Glycerine Alkoxylates

- Others (Tristyrylphenol Alkoxylates, PropyleneOxide Copolymers, etc.)

- By Application Type

- Wetting Agents

- Cleansing Agents

- Emulsifiers

- Dispersing Agents

- Demulsifiers

- Detergents

- Others (Solubilizers, etc.)

- By End Users

- Agrochemicals

- Paint & Coatings

- Personal Care

- Pharmaceuticals

- Oil & Gas

- Others (Papers, Textile, Ceramic, etc.)

- By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia Pacific

- By Company

- Competition Characteristics

- Market Share of Leading Companies

- By Grade

- Market Size & Analysis

- North America Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade

- By Type

- By Application Type

- By End Users

- By Country

- The US

- Canada

- Mexico

- Market Size & Analysis

- The US Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End Users

- Market Size & Analysis

- Canada Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End Users

- Market Size & Analysis

- Mexico Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End Users

- Market Size & Analysis

- South America Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade

- By Type

- By Application Type

- By End Users

- By Country

- Brazil

- Argentina

- Rest of South America

- Brazil Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End Users

- Market Size & Analysis

- Argentina Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End Users

- Market Size & Analysis

- Market Size & Analysis

- Europe Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade

- By Type

- By Application Type

- By End Users

- By Country

- Germany

- The UK

- France

- Russia

- Spain

- Rest of Europe

- Germany Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End Users

- Market Size & Analysis

- The UK Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End Users

- Market Size & Analysis

- France Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End Users

- Market Size & Analysis

- Russia Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End Users

- Market Size & Analysis

- Spain Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End Users

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade

- By Type

- By Application Type

- By End Users

- By Country

- Saudi Arabia

- The UAE

- Egypt

- Turkey

- Israel

- Rest of The Middle East & Africa

- Saudi Arabia Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End Users

- Market Size & Analysis

- The UAE Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End Users

- Market Size & Analysis

- Egypt Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End Users

- Market Size & Analysis

- Turkey Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End Users

- Market Size & Analysis

- Israel Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End Users

- Market Size & Analysis

- Market Size & Analysis

- Asia Pacific Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade

- By Type

- By Application Type

- By End Users

- By Country

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- China Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End Users

- Market Size & Analysis

- Japan Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End Users

- Market Size & Analysis

- India Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End Users

- Market Size & Analysis

- South Korea Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End Users

- Market Size & Analysis

- Australia Alkoxylates Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End Users

- Market Size & Analysis

- Market Size & Analysis

- Global Alkoxylates Market Key Strategic Imperatives for Growth & Success

- Competition Outlook

- Competition Matrix

- Brand Specialization

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles

- Croda International PLC

- BASF SE

- Lamberti S.p.A.

- The Dow Chemical Company

- ChemPoint.com Inc.

- Evonik Industries

- Eastman Chemical Company

- Clariant AG

- LyondellBasell Industries Holdings B.V.

- Sasol Limited.

- Solvay S.A.

- Akzo Nobel N.V.

- Stepan Company

- KLK OLEO.

- HUNTSMAN INTERNATIONAL LLC

- Others

- Competition Matrix

- Disclaimers

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making