India Biocides Market Research Report: Forecast (2026-2030)

India Biocides Market - By Product Type (Halogen Compounds, Organosulfurs,, Organic Acids Quaternary Ammonium Compounds, Phenolics, Nitrogen Compounds, Glutaraldehyde), By Applicat...ion (Water Treatment, Paint & Coatings, Personal Care, Food & Beverage, Wood Preservation, Oil & Gas, Marine (Antifoulant, Coatings), Others (Pulp & Paper, Disinfection, Metalworking Fluids), By End-User (Household, Commercial, Industrial), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Retail Pharmacies, Online Retail/E-Commerce Institutional/B2B), and others Read more

- Chemicals

- Oct 2025

- Pages 135

- Report Format: PDF, Excel, PPT

India Biocides Market

Projected 5.80% CAGR from 2025 to 2030

Study Period

2025-2030

Market Size (2025)

USD 414.07 Million

Market Size (2030)

USD 580.75 Million

Base Year

2025

Projected CAGR

5.80%

Leading Segments

By Application: Water Treatment

Market Insights & Analysis: India Biocides Market (2026-30):

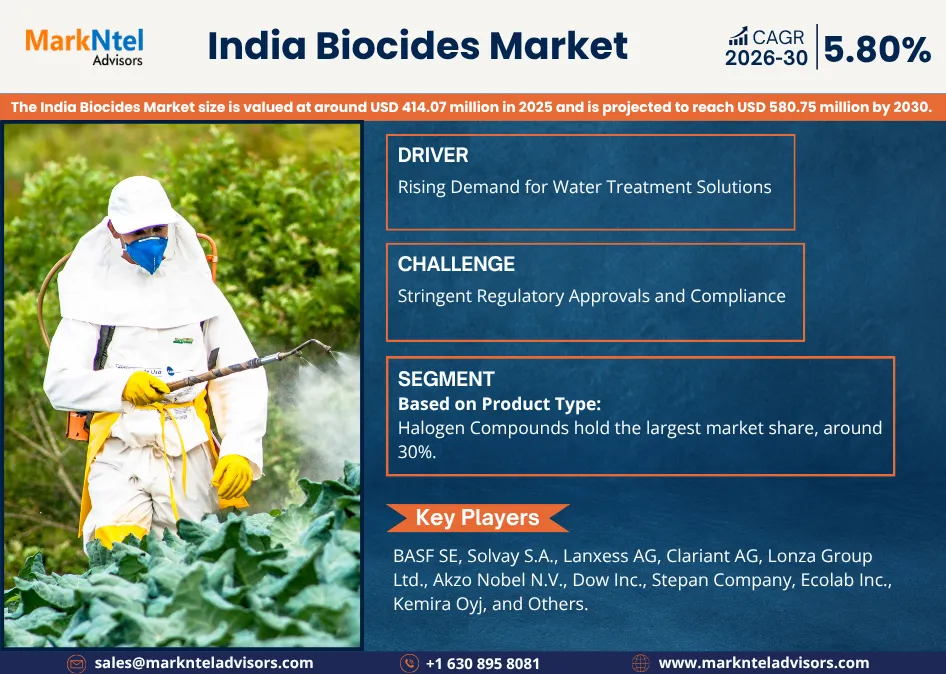

The India Biocides Market size is valued at around USD 414.07 million in 2025 and is projected to reach USD 580.75 million by 2030. Along with this, the market is estimated to grow at a CAGR of around 5.80% during the forecast period, i.e., 2026-30. The India Biocides Market is primarily driven by the industrial sectors expanding their operations, and people becoming more aware of hygiene practices and microbial control methods. Urbanization at a fast pace, together with growing population numbers, has led to rising requirements for clean water and safe food processing and disinfected public areas, which maintain steady demand for biocidal solutions throughout different industries. Waterborne diseases, along with communicable diseases, have become more common, which has forced governments to establish new sanitation requirements for public water systems and industrial water treatment operations. The regulatory focus on disinfection has led to the use of advanced formulations, which include halogen and quaternary ammonium compounds.

The market expansion receives backing from the thriving food & beverage sector and the healthcare industry. Biocides serve as essential agents in food processing because they help disinfect surfaces and sterilize equipment, which preserves product quality and extends storage periods. The Ministry of Health and Family Welfare has set infection control standards that hospitals and diagnostic centers follow by using biocidal cleaning solutions. For example, the post-pandemic sanitation campaign from COVID-19 led to increased adoption of surface disinfectants and antimicrobial coatings within public spaces and commercial buildings.

Furthermore, the water treatment industry in India functions as a vital development opportunity for economic growth. The ongoing funding of wastewater recycling systems and municipal water networks has created a demand for chlorine-based and metallic biocides to stop biofilm development in water distribution pipes and cooling systems. The growing construction sector and the paint and coatings industry drive market expansion because biocides protect materials from microbial damage, which extends their lifespan.

India Biocides Market Scope:

| Category | Segments |

|---|---|

| By Product Type | Halogen Compounds, Organosulfurs,, Organic Acids Quaternary Ammonium Compounds, Phenolics, Nitrogen Compounds, Glutaraldehyde |

| By Application | Water Treatment, Paint & Coatings, Personal Care, Food & Beverage, Wood Preservation, Oil & Gas, Marine (Antifoulant, Coatings), Others (Pulp & Paper, Disinfection, Metalworking Fluids), |

|

By End-User |

Household,Commercial,Industrial |

| By Distribution Channel | Supermarkets/Hypermarkets, Specialty Stores, Retail Pharmacies, Online Retail/E-Commerce Institutional/B2B), and others |

India Biocides Market Driver:

Rising Demand for Water Treatment Solutions – The India Biocides Industry will experience growth due to the industrial, residential, and municipal sectors' need for better water treatment systems. The Indian government, along with private organizations, allocates large funds to establish water purification systems because of the country's severe water contamination and shortage problems. The situation has forced industries to increase their application of biocides, which include chlorine, bromine, and metallic compounds, to stop microbial growth, biofouling, and algae development in pipelines, cooling towers, and storage systems.

Moreover, the growing demand for water stems from India's fast industrial growth and city development processes demand more water while producing increased amounts of wastewater. For example, the government has established two programs, which include Namami Gange Mission and Jal Jeevan Mission, to create new requirements for water disinfection through enhanced water quality benchmarks. Market participants now direct their attention toward creating high-performance biocides that comply with environmental protection standards and regulatory requirements. Continued efforts to ensure water safety and conserve resources will keep driving the growth & expansion of the Indian Biocides Market.

India Biocides Market Opportunity:

Growth Potential in Eco-Friendly & Bio-Based Biocides – The Biocides Market is witnessing further growth due to the development, commercialization of eco-friendly and bio-based biocides. The market for sustainable antimicrobial solutions experiences faster growth, regulatory agencies want to lower chemical dangers, and consumers show rising interest in environmental protection. Traditional biocides deliver their intended purpose, create environmental danger and human health threats, which makes industries choose natural or biodegradable solutions instead.

The market transition creates a strategic opening for businesses to direct their resources toward research and development of plant-based, enzyme-based, and silver-ion biocides. Companies that use green chemistry methods and work with biotechnology businesses will create unique products, which allows them to enter markets with higher prices. The market for sustainable biocides will expand because more businesses want to export their products to countries that need environmentally friendly solutions. The first companies to enter this new market will establish long-lasting competitive superiority and build strong brand trust.

India Biocides Market Challenge:

Stringent Regulatory Approvals and Compliance – The India Biocides Market is facing challenges due to the strict regulatory system, which requires long waiting periods for biocidal product registration. The regulatory bodies of India have adopted international benchmarks to strengthen their chemical safety rules, toxicity limits, and environmental protection standards. The implemented safety regulations protect human beings and the environment, but they create major setbacks for product launches and higher manufacturing costs for regulatory compliance.

Smaller market participants face obstacles when they need to fulfill broad testing requirements and documentation standards, which restrict their ability to compete against well-funded larger market participants. The ongoing changes to chemical regulations create an unstable environment, which forces businesses to keep updating their product formulations and labeling requirements. The Chemicals (Management and Safety) Rules now require businesses to follow more complex market entry requirements because they introduced new rules for labeling and safety data. The regulatory limits create obstacles that hinder market growth and slow innovation.

India Biocides Market Trend:

Adoption of Advanced and Controlled-Release Biocides – The growing adoption of advanced and controlled-release biocides ensures prolonged antimicrobial activity with reduced chemical usage. The paints & coatings industry, water treatment facilities, and oil and gas operations now use these formulations to control microbes while reducing environmental damage and toxicity levels.

Moreover, People understand more about sustainable production methods and affordable maintenance systems. Controlled-release biocides release their active ingredients slowly and steadily, which results in longer product life and decreased need for frequent reapplication. The industrial water systems benefit from these applications because they stop biofilm development, which leads to better operational efficiency for longer durations. Manufacturers today allocate funds to microencapsulation and nanotechnology-based delivery systems, which help enhance their product performance. The adoption of these biocidal solutions shows a path toward intelligent, environmentally friendly performance-based solutions, which will transform this industry.

India Biocides Market (2026-30): Segmentation Analysis

The India Biocides Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–30 at the country level. Based on the analysis, the market has been further classified as:

Based on Application:

- Water treatment

- Paints & Coatings

- Personal Care

- Food & beverage

- Wood Preservation

- Oil & Gas

- Marine (Antifoulant, Coatings)

- Others (Pulp & Paper, Disinfection, Metalworking Fluids)

Based on the application, water treatment holds the largest share of the Indian biocides market, around 45% driven by the country’s increasing need for safe and reliable water management solutions. The market maintains its leading position through the broad application of liquid biocides, which include chlorine-based and metallic compounds that effectively prevent microbial growth, biofilm development, algae buildup in pipelines and cooling towers, and storage tanks. The demand for wastewater treatment systems emerges from India's fast urban growth, industrial development, and expanding population, which leads to increased water usage and increased wastewater production. For example, Reliance Consumer Products introduced their bottled water brand 'Campa Sure' to deliver affordable premium drinking water throughout India. this initiative demonstrates how water safety and treatment systems have become more critical, which creates a higher demand for biocides that function in industrial and municipal water treatment systems. Market players focus on creating high-performance eco-compliant formulations to achieve operational efficiency as a result of these developments.

Based on Product Type:

- Halogen Compounds

- Oganosulfurs

- Organic Acid

- Quaternary Ammonium Compounds

- Phenolics

- Nitrogen Compounds

- Glutaraldehyde

Based on product type, Halogen Compounds hold the largest market share, around 30% due to their broad-spectrum antimicrobial properties and versatility across multiple applications. The chlorine and bromine-based compounds serve as essential water treatment agents, industrial cooling system components, and paint coatings because they provide strong microbial protection and prevent biofilm development while maintaining extended disinfection capabilities. The halogen compounds maintain their liquid and soluble forms, allowing for simple dosing and uniform distribution, which produces excellent results in various operational settings.

The expanding industrial sector and urban growth in India, together with increasing demand for drinking water, have made halogen-based biocides essential because these solutions deliver both high performance and budget-friendly prices. The water treatment facilities of municipalities and industrial cooling systems use chlorine-based chemicals to maintain their hygiene requirements. The market requires manufacturers to develop high-quality halogen formulations that meet regulatory standards, help them establish long-term contracts, increase production capacity, and market presence in the fast-growing Indian biocides industry.

Top India Biocides Market Companies: Players, Analysis & Future Outlook

The leading biocides players in the Indian industry include BASF SE, Solvay S.A., Lanxess AG, Clariant AG, Lonza Group Ltd., Akzo Nobel N.V., Dow Inc., Stepan Company, Ecolab Inc., Kemira Oyj, and Others.

India Biocides Industry Recent Development:

- 2025: LANXESS AG opened its India Application Development Center (IADC) in Thane, Mumbai, to focus on antimicrobial, disinfection and preservation solutions among other specialties.

- 2024: Dow Inc. announced expanded water stewardship and nature conservation targets for Indian operations, positioning its chemical and treatment business toward more sustainable practices relevant to biocide applications.

Gain a Competitive Edge with Our India Biocides Market Report

- India Biocides Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & market share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- India Biocides Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- India Biocides Market Policies, Regulations, and Product Standards

- India Biocides Market Supply Chain Analysis

- India Biocides Market Trends & Developments

- India Biocides Market Dynamics

- Growth Drivers

- Challenges

- India Biocides Market Hotspot & Opportunities

- India Biocides Market Outlook, 2020-2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Million Units)

- Market Share & Outlook

- By Product Type

- Halogen Compounds- Market Size & Forecast 2020-2030, USD Million & Million Units

- Organosulfurs- Market Size & Forecast 2020-2030, USD Million

- Organic Acids- Market Size & Forecast 2020-2030, USD Million

- Quaternary Ammonium Compounds- Market Size & Forecast 2020-2030, USD Million

- Phenolics- Market Size & Forecast 2020-2030, USD Million

- Nitrogen Compounds- Market Size & Forecast 2020-2030, USD Million

- Glutaraldehyde- Market Size & Forecast 2020-2030, USD Million

- By Application

- Water Treatment- Market Size & Forecast 2020-2030, USD Million

- Paint & Coatings- Market Size & Forecast 2020-2030, USD Million

- Personal Care- Market Size & Forecast 2020-2030, USD Million

- Food & Beverage- Market Size & Forecast 2020-2030, USD Million

- Wood Preservation- Market Size & Forecast 2020-2030, USD Million

- Oil & Gas- Market Size & Forecast 2020-2030, USD Million

- Marine (Antifoulant, Coatings)- Market Size & Forecast 2020-2030, USD Million

- Others (Pulp & Paper, Disinfection, Metalworking Fluids)- Market Size & Forecast 2020-2030, USD Million

- By End-User

- Household- Market Size & Forecast 2020-2030, USD Million

- Commercial- Market Size & Forecast 2020-2030, USD Million

- Industrial- Market Size & Forecast 2020-2030, USD Million

- By Distribution Channel

- Supermarkets/Hypermarkets- Market Size & Forecast 2020-2030, USD Million

- Specialty Stores- Market Size & Forecast 2020-2030, USD Million

- Retail Pharmacies- Market Size & Forecast 2020-2030, USD Million

- Online Retail/E-Commerce- Market Size & Forecast 2020-2030, USD Million

- Institutional/B2B- Market Size & Forecast 2020-2030, USD Million

- By Region

- North India

- South India

- West India

- East India

- By Company

- Company Revenue Shares

- Competitor Characteristics

- By Product Type

- Market Size & Outlook

- India Household Market Outlook, 2020-2030F

- Market Size & Analysis

- Market Share & Analysis

- By Distribution Channel- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2050-2030, USD Million

- By Application- Market Size & Forecast 2020-2030, USD Million

- India Commercial Market Outlook, 2020-2030F

- Market Size & Analysis

- Market Revenues (USD Million)

- Market Share & Analysis

- By Distribution Channel- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- By Application- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- India Industrial Market Outlook, 2020-2030F

- Market Size & Analysis

- Market Revenues (USD Million)

- Market Share & Analysis

- By Distribution Channel- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- By Application- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- India Biocides Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- BASF SE

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Solvay S.A.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Lanxess AG

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Clariant AG

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Lonza Group Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Akzo Nobel N.V.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Dow Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Stepan Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Ecolab Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kemira Oyj

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- BASF SE

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making