Global Bio-based Paints and Coatings Market Research Report: Forecast (2024-2030)

By Resin Type (Alkyd Resin, Polyurethane Resin, Acrylic Resin, Others), By Application (Architectural, Automotive, Woodworking, Packaging, Others), By Region (North America, South ...America, Europe, The Middle East & Africa, Asia-Pacific), By Company (Akzo Nobel N.V., Industria Chimica Adriatica SpA, PPG Industries, Inc, Sherwin Williams Company, NIPSEA Group , Tremco CPG Inc., Cortec Coporation, Baril Coatings B.V., Covestro AG, Industrias Químicas Masquelack, S.A., Others) Read more

- Chemicals

- Nov 2023

- Pages 181

- Report Format: PDF, Excel, PPT

Market Definition

Bio-based paints and coatings refer to environment-friendly paints and coatings derived from renewable resources, primarily plant-based or biological materials. They are formulated using vegetable oils, resins, natural pigments, and binders obtained from sustainable sources. The production process of bio-based paints and coatings involves low environmental effects when compared to traditional petroleum-based paints. They possess desirable properties such as low or zero volatile organic compound (VOC) content, which reduces indoor air pollution & potential health risks.

Market Insights & Analysis: Global Bio-based Paints and Coatings Market (2024-30):

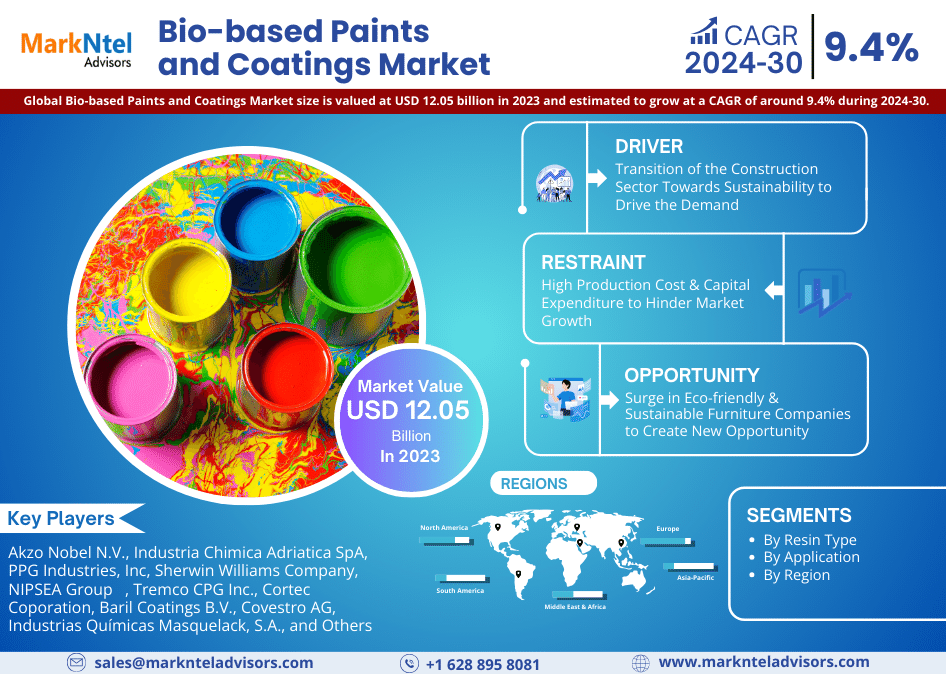

The Global Bio-based Paints and Coatings Market size is valued at USD 12.05 billion in 2023 and estimated to grow at a CAGR of around 9.4% during the forecast period, i.e., 2024-30. Stringent environmental regulations and sustainability initiatives imposed by governments and organizations worldwide have been driving the demand for eco-friendly and low-VOC (volatile organic compounds) coatings. These paints and coatings are derived from renewable sources owing to which they have reduced environmental footprint. As a result, they are in alignment with sustainability norms, leading to increased adoption in applications such as architectural & construction, automotive, furniture and woodwork, packaging, etc.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 9.4% |

| Regions Covered | North America: US, Canada, Mexico |

| Europe: Germany, The UK, France, Spain, Italy, Rest of Europe | |

| Asia-Pacific: China, India, Japan, South Korea, Rest of Asia-Pacific | |

| South America: Brazil, Rest of South America | |

| Middle East & Africa: GCC, South Africa, Rest of MEA | |

| Key Companies Profiled | Akzo Nobel N.V., Industria Chimica Adriatica SpA, PPG Industries, Inc, Sherwin Williams Company, NIPSEA Group , Tremco CPG Inc., Cortec Coporation, Baril Coatings B.V., Covestro AG, Industrias Químicas Masquelack, S.A., Others |

| Market Value (2023) | USD 12.05 Billion |

The packaging industry has played a major role in enhancing the demand for bio-based coatings. Many brands and consumers were actively seeking eco-friendly & sustainable packaging options, owing to this many companies have released new and advanced sustainable plant-based bio-coatings, especially for food and beverage packaging. For Instance,

- In 2022, Israeli company Melodea launched sustainable plant-based plastic alternatives for packaging, which is made from MelOx, a high-performance, plant-sourced barrier coating.

Hence, growing consumer preference for sustainable and eco-friendly products has prompted many brands to incorporate bio-based coatings in their packaging, which enhanced the market growth. Along with this, the shift towards bio-based coatings in the packaging industry is expected to continue in coming years as well, as more brands and consumers prioritize sustainability and seek innovative solutions for their packaging needs.

In addition to this, the application of bio-based coatings in sectors such as aerospace, marine, industrial, and healthcare has witnessed a surge driven by sustainability goals, regulatory requirements, and the need for environment-friendly solutions. The marine sector faced stringent environmental regulations aimed at reducing pollution and minimizing the impact of coatings on marine ecosystems.

Conventional marine coatings often contain toxic substances, such as heavy metals & volatile organic compounds (VOCs), which have been observed to leach into the water and harm marine life. Owing to this, bio-based coatings containing sustainable epoxy resin from companies such as Sicomin, Resoltech, etc., have been gaining traction in the marine sector. Furthermore, the governments of several European and North American countries have been recently coming up with regulations to support clean shipping. For instance,

- In 2023, the European Commission presented five legislative proposals to modernize EU rules on maritime safety and prevent water pollution from ships.

Thus, as the government initiatives for tackling ship-source pollution are growing across the globe the adoption of bio-based paints and coatings in the marine sector is anticipated to surge during the forecast period.

Global Bio-based Paints and Coatings Market Driver:

Transition of the Construction Sector Towards Sustainability to Drive the Demand – The construction sector globally has undergone a transition towards sustainability, which has been driven by various factors, including environmental concerns and government measures to meet climate change goals. The construction sector in countries such as the UAE, Germany, Norway, Singapore, etc., has enhanced its focus on innovation, sustainability, and the circular economy. Moreover, real estate investments across the residential and commercial sectors have been growing across the regions like Middle East and Asia-Pacific among others. For instance,

- In 2022, South Africa’s Ministry of Human Settlements, Water and Sanitation, announced the construction of six mega social housing projects in the coming two years, starting in the financial year 2022/23.

These activities combined with the transition of the construction sector toward construction techniques that were less damaging to the environment have enhanced the demand for bio-based paints and coatings in the sector. Furthermore, many real estate investors and developers in Singapore, the UAE, Saudi Arabia, etc., have prioritized green building certifications, such as LEED and BREEAM, which promote sustainable construction practices. These certifications often require the use of eco-friendly materials, including bio-based paints and coatings, to meet their environmental criteria, which would also play a major role in market expansion during the forecast period.

Global Bio-based Paints and Coatings Market Opportunity:

Surge in Eco-friendly & Sustainable Furniture Companies to Create New Opportunity – Consumer preferences across the globe have evolved, with a greater emphasis on sustainable and ethical consumption, owing to which consumers have prioritized furniture that is manufactured using environment-friendly ways. Owing to this, many furniture manufacturers are introducing eco-friendly furniture to their portfolio. For instance,

- In 2023, Urban Ladder, a popular Indian furniture brand, introduced a sustainable furniture line called Karya. This range stands out by creatively utilizing biodegradable, safe materials to craft an eco-friendly board.

As furniture manufacturers seek to align with sustainability and environmental standards, they actively seek coating solutions that are low in volatile organic compounds (VOCs) and made from renewable resources. This would present a favorable landscape for bio-based paints and coating manufacturers to capitalize on the growing demand for sustainable and environment conscious solutions.

Global Bio-based Paints and Coatings Market Challenge:

High Production Cost & Capital Expenditure to Hinder Market Growth – Bio-based paints and coatings are considerably more expensive than their petroleum-based counterparts, which has been limiting its market competitiveness and creating a challenge for market players to penetrate price-sensitive markets across the globe. The higher price of bio-based paints and coatings is attributed to high production costs, arising from the limited availability of bio-based feedstock and high capital expenditure. Bio-based raw materials, such as plant oils and natural resins, have a restricted supply chain compared to the abundant availability of fossil-based alternatives. The restriction in the supply chain has been mainly due to limited production arising from agricultural limitations.

Furthermore, the limited availability of bio-based raw materials and the need to develop and scale up production processes using these feedstocks require substantial investments. This includes specialized equipment, research and development efforts, and infrastructure enhancements, all of which contribute to higher capital expenditures. Thus, the higher prices of bio-based options have affected their sales in certain price-sensitive markets such as Egypt, South Africa, the Philippines, Cambodia, etc.

Global Bio-based Paints and Coatings Market (2024-30): Segmentation Analysis

The Global Bio-based Paints and Coatings Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2024–2030 at the global, level. According to the analysis, the market has been further classified as:

Based on Resin Type:

- Alkyd Resin

- Polyurethane Resin

- Acrylic Resin

- Others (Polylactic Acid (PLA) Resins, Cellulosic Resins, etc.)

Acrylic Resin has registered significant growth in the Global Bio-based Paints and Coatings Market, as they offer excellent performance characteristics, including good adhesion, durability, weather resistance, and color retention. Owing to this, the paints and coatings made from these resins have been widely used in various applications, including architectural, automotive, and industrial sectors. The construction sector has played a major role in substantiating the higher sales of acrylic resin-based coatings. Owing to this, many paints and coating manufacturers have launched bio-based acrylic paints to cater to this incoming demand. For instance,

- In 2023, Mowilex launched, Naturalle, a bio-based paint in Indonesia, this paint incorporates Primal RN Biobased Acrylic Emulsion from Dow Inc.

Consequently, the launch of new acrylic resin-based coatings and their rising demand among consumers has been improving their sales during the historical years. Moreover, due to global efforts to meet sustainability standards, many countries are currently looking to replace concrete with wood in buildings. Hence, as wood becomes a more prevalent construction material, the demand for paints containing acrylic resins would surge as they are well suited for application on wood surfaces.

Based on Application:

- Architectural

- Automotive

- Woodworking

- Packaging

- Others (Agricultural & Farm Equipment, Electronics, etc.)

The architectural sector has registered the highest demand for bio-based coatings and paints, as this sector has been at the forefront of sustainability initiatives and green building practices. During recent years, there has been a consumer transition to options that reduce environmental impact and improve indoor air quality. Bio-based coatings and paints synchronize with these sustainability objectives which has led to increased demand for this application. Additionally, many countries are planning to decarbonize the construction process as well, and have been introducing regulations for the same. For instance,

- In 2023, governments and the construction sector in the Czech Republic, Ireland, and Spain launched an EU building data project to drive full decarbonization of the heavily emitting sector, responsible for almost 40% of global carbon emissions.

This focus on decarbonizing the construction process would enhance the incorporation of bio-based paints and coatings in architectural applications, as it is derived from renewable resources, and has a lower carbon footprint compared to conventional petroleum-based alternatives.

Global Bio-based Paints and Coatings Market (2024-30): Regional Projections

Geographically, the Global Bio-based Paints and Coatings Market expands across:

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

Europe had registered the highest demand for bio-based paints and coatings, as the region has been at the forefront of sustainable practices and has implemented stringent regulations and policies to promote environment-friendly products, including coatings. The region has a strong focus on reducing carbon footprint, increasing resource efficiency, and promoting circular economy principles. This has resulted in higher adoption of bio-based paints and coatings in, automotive, and packaging.

Additionally, in Europe, the government has been providing extensive support for the bio-based paints and coating industry. For instance,

- In 2022, the Finland government funded the SUSBINCO project to develop 80-100% bio-based products to replace fossil-based raw materials and reduce greenhouse gas emissions.

This financial backing provided by governments of European countries would facilitate innovation and the discovery of new bio-based materials that would replace traditional fossil-based raw materials used in paints and coatings. Owing to this, the adoption of bio-based paints and coatings would surge and would also contribute to reduce the reliance on fossil-based materials.

Furthermore, bio-based paints and coatings are gaining traction in Europe's construction industry due to their sustainability and low emissions. As the region places a strong emphasis on green building practices, these eco-friendly options are becoming preferred choices for both residential and commercial buildings. This surging adoption by the construction sector would play a major role in expanding market share in Europe.

Global Bio-based Paints & Coatings Industry Recent Development:

- 2023: PPG launched SIGMAGLIDE® 2390 marine coating, which is a biocide-free fouling release coating based on the PPG HYDRORESET™ technology, which modifies the coating when it is immersed in water to create a smooth surface.

- 2022: Cortec Corporation introduced EcoAir bio-based outdoor coating powered by Nano VpCI. This shift toward a biobased ingredient enhances sustainability and reduces reliance on fossil fuels, contributing to a more environmentally responsible product.

Gain a Competitive Edge with Our Global Bio-based Paints and Coatings Market Report

- Global Bio-based Paints and Coatings Market Report by Markntel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps business organizations to gain a holistic understanding of the market dynamics & make vital decisions.

- This report also highlights current market trends & future projections, allowing business organizations to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies and stay ahead of the competition.

- Global Bio-based Paints and Coatings Industry Report aids in assessing & mitigating risks associated with entry or operation level in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, organizations can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

Global Bio-based Paints and Coatings Market Research Report (2024-2030) - Table of Contents

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Bio-based Paints and Coatings Case Study Analysis

- Global Bio-based Paints and Coatings- Key Conferences & Events

- Global Bio-based Paints and Coatings Market Trends & Insights

- Global Bio-based Paints and Coatings Market Dynamics

- Growth Drivers

- Challenges

- Global Bio-based Paints and Coatings Market Supply Chain Analysis

- Global Bio-based Paints and Coatings Market Policies, Regulations & Product Standards

- Global Bio-based Paints and Coatings Market Porter’s Five Force Analysis

- Global Bio-based Paints and Coatings Market Hotspot & Opportunities

- Global Bio-based Paints and Coatings Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Resin Type

- Alkyd Resin - Market Size & Forecast 2019-2030, Thousand Tons

- Polyurethane Resin - Market Size & Forecast 2019-2030, Thousand Tons

- Acrylic Resin - Market Size & Forecast 2019-2030, Thousand Tons

- Others (Polylactic Acid (PLA) Resins, Cellulosic Resins, etc.) - Market Size & Forecast 2019-2030, Thousand Tons

- By Application

- Architectural - Market Size & Forecast 2019-2030, Thousand Tons

- Automotive - Market Size & Forecast 2019-2030, Thousand Tons

- Woodworking - Market Size & Forecast 2019-2030, Thousand Tons

- Packaging - Market Size & Forecast 2019-2030, Thousand Tons

- Others (Agricultural & Farm Equipment, Electronics, etc.) - Market Size & Forecast 2019-2030, Thousand Tons

- By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- By Company

- Competition Characteristics

- Market Share & Analysis

- By Resin Type

- Market Size & Analysis

- North America Bio-based Paints and Coatings Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Resin Type- Market Size & Forecast 2019-2030, Thousand Tons

- By Application- Market Size & Forecast 2019-2030, Thousand Tons

- By Country

- The US

- Canada

- Mexico

- The US Bio-based Paints and Coatings Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Resin Type - Market Size & Forecast 2019-2030, Thousand Tons

- By Application- Market Size & Forecast 2019-2030, Thousand Tons

- Market Size & Analysis

- Canada Bio-based Paints and Coatings Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Resin Type - Market Size & Forecast 2019-2030, Thousand Tons

- By Application- Market Size & Forecast 2019-2030, Thousand Tons

- Market Size & Analysis

- Mexico Bio-based Paints and Coatings Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Resin Type - Market Size & Forecast 2019-2030, Thousand Tons

- By Application- Market Size & Forecast 2019-2030, Thousand Tons

- Market Size & Analysis

- Market Size & Analysis

- South America Bio-based Paints and Coatings Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Resin Type- Market Size & Forecast 2019-2030, Thousand Tons

- By Application- Market Size & Forecast 2019-2030, Thousand Tons

- By Country

- Brazil

- Rest of South America

- Brazil Bio-based Paints and Coatings Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Size & Analysis

- Market Size & Analysis

- Europe Bio-based Paints and Coatings Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Resin Type- Market Size & Forecast 2019-2030, Thousand Tons

- By Application- Market Size & Forecast 2019-2030, Thousand Tons

- By Country

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- The UK Bio-based Paints and Coatings Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Resin Type - Market Size & Forecast 2019-2030, Thousand Tons

- By Application- Market Size & Forecast 2019-2030, Thousand Tons

- Market Size & Analysis

- Germany-Based 3D Printing Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Resin Type - Market Size & Forecast 2019-2030, Thousand Tons

- By Application- Market Size & Forecast 2019-2030, Thousand Tons

- Market Size & Analysis

- France Bio-based Paints and Coatings Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Resin Type - Market Size & Forecast 2019-2030, Thousand Tons

- By Application- Market Size & Forecast 2019-2030, Thousand Tons

- Market Size & Analysis

- Italy Bio-based Paints and Coatings Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Resin Type - Market Size & Forecast 2019-2030, Thousand Tons

- By Application- Market Size & Forecast 2019-2030, Thousand Tons

- Market Size & Analysis

- Spain Bio-based Paints and Coatings Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Resin Type - Market Size & Forecast 2019-2030, Thousand Tons

- By Application- Market Size & Forecast 2019-2030, Thousand Tons

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Bio-based Paints and Coatings Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Resin Type- Market Size & Forecast 2019-2030, Thousand Tons

- By Application- Market Size & Forecast 2019-2030, Thousand Tons

- By Country

- GCC

- South Africa

- Rest of the Middle East & Africa

- GCC Bio-based Paints and Coatings Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Resin Type - Market Size & Forecast 2019-2030, Thousand Tons

- By Application- Market Size & Forecast 2019-2030, Thousand Tons

- Market Size & Analysis

- South Africa Bio-based Paints and Coatings Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Resin Type - Market Size & Forecast 2019-2030, Thousand Tons

- By Application- Market Size & Forecast 2019-2030, Thousand Tons

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Bio-based Paints and Coatings Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Resin Type- Market Size & Forecast 2019-2030, Thousand Tons

- By Application- Market Size & Forecast 2019-2030, Thousand Tons

- By Country

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- China Bio-based Paints and Coatings Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Resin Type - Market Size & Forecast 2019-2030, Thousand Tons

- By Application- Market Size & Forecast 2019-2030, Thousand Tons

- Market Size & Analysis

- Japan Bio-based Paints and Coatings Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Resin Type - Market Size & Forecast 2019-2030, Thousand Tons

- By Application- Market Size & Forecast 2019-2030, Thousand Tons

- Market Size & Analysis

- India Bio-based Paints and Coatings Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Resin Type - Market Size & Forecast 2019-2030, Thousand Tons

- By Application- Market Size & Forecast 2019-2030, Thousand Tons

- Market Size & Analysis

- South Korea Bio-based Paints and Coatings Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Resin Type - Market Size & Forecast 2019-2030, Thousand Tons

- By Application- Market Size & Forecast 2019-2030, Thousand Tons

- Market Size & Analysis

- Market Size & Analysis

- Global Bio-based Paints and Coatings Market Strategic Imperatives for Success & Growth

- Competitive Outlook

- Company Profiles

- Akzo Nobel N.V.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Industria Chimica Adriatica SpA

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- PPG Industries, Inc

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Sherwin Williams Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- NIPSEA Group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Tremco CPG Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Cortec Coporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Baril Coatings B.V.

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Covestro AG

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Industrias Químicas Masquelack, S.A.

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Akzo Nobel N.V.

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making