Global Acrylic Fiber Market Research Report: Forecast (2024-2030)

Acrylic Fiber Market Report - By Form (Continuous/Filament(Tow) Fiber, Non-continuous/Staple Fiber), By Blend (Acrylic-Wool, Acrylic-Viscose, Acrylic-Nylon, Acrylic-Cotton, Others ...(Cellulose, Rayon, etc.)), By End-Use Industry (Textiles & Apparel, Furniture & Upholstery, Industrial, Building & Construction, Automotive, Others), and Others Read more

- Chemicals

- May 2024

- Pages 196

- Report Format: PDF, Excel, PPT

Market Definition

Acrylic fibers, crafted from synthetic polymers primarily consisting of polyacrylonitrile, boast an average molecular weight of approximately 1,000,000 units, equivalent to nearly 1,900 monomer units. These fibers demonstrate remarkable resilience against UV degradation, microbial growth, bleaching agents, and mild alkalis. Renowned for their exceptional stability, elasticity, and low density, acrylic fibers find extensive applications in the apparel manufacturing industry.

Market Insights & Analysis: Global Acrylic Fiber Market (2024-30):

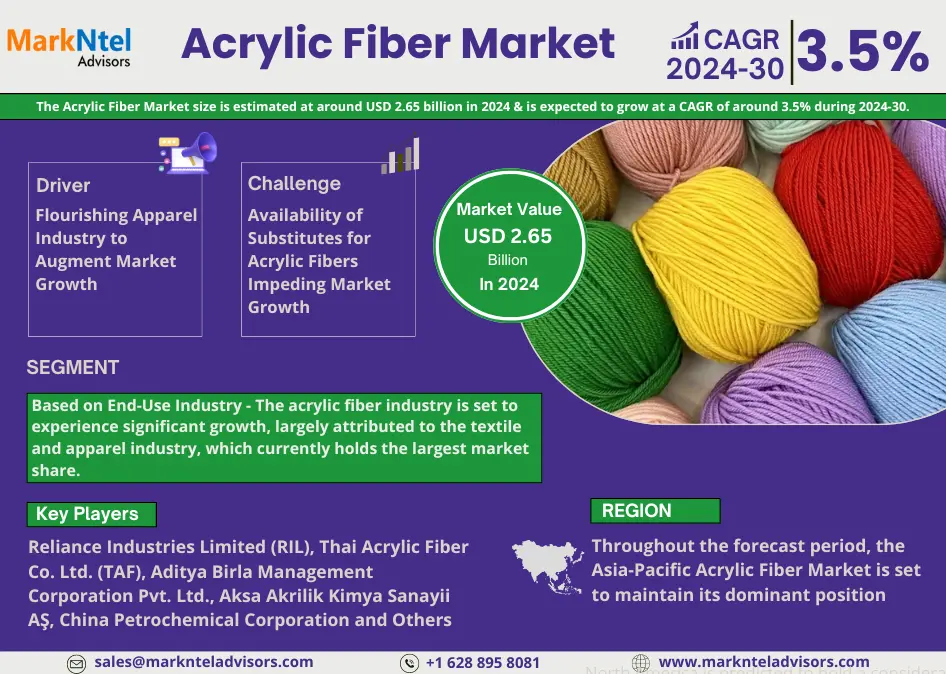

The Global Acrylic Fiber Market size is estimated at around USD 2.65 billion in 2024 & is expected to grow at a CAGR of around 3.5% during the forecast period, i.e., 2024-30. The acrylic fiber industry is experiencing substantial growth & expansion driven by increasing demands within the textiles and apparel industries and the rising adoption of sustainable production methods utilizing innovative technology. The acrylic fiber offers better washability, UV resistance, and microbial attack resistance. Additionally, these fibers are available in various colors and provide resistance to shrinkage, unlike cotton and other natural fibers. According to the research conducted by academic institutes, the acrylic fibers shirk only 1.5% when treated with boiling water for 30 minutes. Owing to these unique attributes of the fibers, the top apparel companies are using acrylic fibers to make different clothing, fueling the Global Acrylic Fiber Market growth.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 3.5% |

| Regions Covered | North America: The US, Canada, Mexico |

| South America: Brazil, Argentina, Rest of South America | |

| Europe: Germany, The UK, France, Italy, Spain, Rest of Europe | |

| Asia-Pacific: China, Japan, India, South Korea, Australia, Rest of Asia-Pacific | |

| Middle East & Africa: The UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| Key Companies Profiled | Reliance Industries Limited (RIL), Thai Acrylic Fiber Co. Ltd. (TAF), Aditya Birla Management Corporation Pvt. Ltd., Aksa Akrilik Kimya Sanayii AŞ, China Petrochemical Corporation, Dralon, Formosa Plastics Corporation, Goonvean Fibres, Japan Exlan Co. Ltd., Jiangsu Zhongxin Resources Group, Jilin Chemical Fiber Group Co. Ltd., Kaltex, Mitsubishi Chemical Corporation, Pasupati Acrylon Ltd., Polyacryl Iran Corp., and others |

| Market Value (2024) | USD 2.65 Billion |

Moreover, the cost of natural fibers is relatively greater than that of acrylic fibers. According to East Asia Textile Technology Ltd., the price of acrylic fiber lies within the range of USD2-3/kg, whereas the cost of wool is more than USD8/kg. The low price of acrylic fibers is compelling the local apparel manufacturers to use these fibers to produce & sell garments company at significantly lower costs. Additionally, several top companies are seeking ways to reduce overall garment costs to attract more consumers. However, the costly raw materials previously used by the manufacturers accounted for the higher cost of garment manufacturing. According to the Online Clothing Study, around 60%-70% of the total garment costs are due to the expensive raw materials & fabric. Therefore, the top market players are increasingly using acrylic fibers to minimize their overall production costs & garment costs.

Additionally, the top companies are actively investing in Research and Development (R&D) to enhance the features and develop high-quality acrylic fiber. These strategic initiatives would result in the development of acrylic fibers with unique & advanced properties. As a result, several apparel manufacturers would continue to use these acrylic fibers to introduce their new apparel range, enlarging the Global Acrylic Fiber Market size.

Global Acrylic Fiber Market Driver:

Flourishing Apparel Industry to Augment Market Growth – The apparel industry across the world is being fueled by various factors, such as fast fashion and fluctuating financial situations. The consumption of clothing in emerging economies has increased rapidly due to a surge in GDP growth, especially observed in developing countries like China and India, which are investing heavily in their markets. Government schemes for textile manufacturing, like production-linked incentives, have been implemented by nations including India, which help boost manufacturing capabilities.

In 2022, Chinese textile companies had an incredible increase in profits of 25.5%, while also breaking records with garment exports valued at USD 315 billion. Thus enhancing its potential market value even further. The global apparel sector shows continued positive incremental growth projections where levels will hit peak values exceeding the USD 2.9 trillion mark, expanding up to rates of around 3-8% annually in the coming years. Therefore, the growing apparel industry leads to a higher demand for acrylic fiber.

Global Acrylic Fiber Market Challenge:

Availability of Substitutes for Acrylic Fibers Impeding Market Growth – A significant market challenge for acrylic fiber lies in the plethora of substitutes readily available in the synthetic fiber market. With alternatives like polyester, polyamide, and polypropylene dominating the industry, acrylic fiber faces stiff competition. Polyester, in particular, boasts widespread usage globally due to its robustness, lightweight nature, and excellent dye retention. Textile Exchange data highlights polyester's dominance, commanding a staggering 52% market share in 2020, while acrylic fiber lagged significantly behind at just 1.6%. Hence, the primary hurdle for the acrylic fiber market in the forecast period is navigating through the abundance of substitute options vying for market attention.

Global Acrylic Fiber Market Trend:

Rise in E-Commerce for the Furniture & Upholstery Industry Changing Market Dynamics – The furniture and upholstery sector is driving significant growth in the Global Acrylic Fiber Market, largely due to the rise of e-commerce. This offers consumers unparalleled convenience and accessibility when browsing or purchasing related products. Additionally, with stay-at-home practices and social distancing becoming prevalent amidst current circumstances, online sales have soared. As per the India Brand Equity Foundation (IBEF), by 2030, roughly 37% of retail demand in India will be delivered via online channels, accounting for around 4%. Furniture & upholstery have occupied a substantial market share in recent years.

Moreover, investments are increasing within this industry due to escalating preferences for eco-friendly goods that can adapt as workspaces evolve, making it look optimistic for the acrylic fiber market's future.

Global Acrylic Fiber Market (2024-30): Segmentation Analysis

The Global Acrylic Fiber Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2024-2030 at the global level. According to the analysis, the market has been further classified as:

Based on Blend:

- Acrylic-Wool

- Acrylic-Viscose

- Acrylic-Nylon

- Acrylic-Cotton

- Others (Cellulose, Rayon, etc.)

The acrylic-wood blend segment dominates the acrylic fiber industry, holding the largest market share. Acrylic fibers are frequently combined with various other fibers, such as wool, nylon, and cotton, to amplify their characteristics and yield more resilient fibers. Acrylic wool blends offer exceptional durability, washability, and resistance to shrinkage, among other qualities, making them highly sought after, particularly in the production of sportswear and circular knitted textiles. With wool being the favored animal fiber, boasting a total production of 1 million tons in recent years, according to Textile Exchange, advancements in wool production, including initiatives like the Responsible Wool Standard (RWS), have further bolstered this segment.

Notably, RWS-certified wool accounted for 25.5% of the global wool market share in 2022. Among these, wool stands out, generating approximately 47% (USD 1.9 billion) of income in 2022. The innate ability of wool to bounce back from distortion over time underscores its allure, rendering garments crafted from these fibers highly appealing. Moreover, with Textile Exchange reporting a production of 1.03 million tons of woolen fiber in 2021, a steady increase is anticipated in the coming years as well.

Based on End-Use Industry:

- Textiles & Apparel

- Furniture & Upholstery

- Industrial

- Building & Construction

- Automotive

- Others

The acrylic fiber industry is set to experience significant growth, largely attributed to the textile and apparel industry, which currently holds the largest market share. Forecasts predict a substantial increase in this sector's expansion in the upcoming years. Acrylic fibers are essential components for furnishing fabrics due to their durability against moths, oils, and chemicals, as well as their softness and lightweight nature. They can also be formed into staple lengths after being initially produced as filaments by spinning them into yarns during manufacturing processes where versatility reigns supreme. Additionally, these fibers possess excellent moisture-wicking properties that make them highly sought-after materials suitable for activewear or outdoor clothing purposes. Moreover, Business Finland forecasts anticipate global revenues from high-end fashion production reaching USD 2.85 trillion by 2025, bringing forth another wave of demand surge within the forecast period. This results in wider market extension opportunities for acrylic fiber suppliers worldwide.

Global Acrylic Fiber Market (2024-30): Regional Projections

Geographically, the Global Acrylic Fiber Market expands across:

- North America

- South America

- Europe

- The Middle East and Africa

- Asia-Pacific

Throughout the forecast period, the Asia-Pacific Acrylic Fiber Market is set to maintain its dominant position, fueled by key factors such as increased urbanization, novel applications for acrylic fibers, and online fashion retailing. China continues to lead in terms of market share, but substantial growth within India's acrylic fiber sector can be expected. The region holds a commendable 38% share of global trade due greatly to expansion within textile industries across nations like Australia, Korea, Malaysia, and most notably China and India, where GDP and export earnings have reaped significantly from this industry. In FY2021 alone, it was estimated that India produced close to 2.5 million metric tons of synthetic resin, with both countries continuing on an upward trajectory toward further expanding their respective markets, particularly through successful investments in textiles.

Global Acrylic Fiber Industry Recent Development:

- 2024: Reliance Industries Limited (RIL) announced the launch of Ecotherm, an acrylic fiber product that has completely transformed the textile industry, and offered a sneak peek at the Circular Design Challenge's (CDC) global growth. The distinguished "Reliance Sourcing Solutions Pavilion" at BharatTex 2024 is the site of this launch of innovative acrylic fiber.

- 2022: Thai Acrylic Fiber Co. Ltd. (TAF) unveiled its latest initiative with the launch of a groundbreaking film advocating for the recycling of pre-consumed acrylic fibers as a pivotal waste management strategy within the textile and garment industry. Introducing their newest fiber brand, Regel Fiber, TAF champions the use of recycled acrylic fibers as a sustainable solution, emphasizing its role in tackling waste generated by the clothing sector and promoting a greener approach to manufacturing.

Gain a Competitive Edge with Our Global Acrylic Fiber Market Report

- Global Acrylic Fiber Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Acrylic Fiber Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Market Definition

- Research Process

- Assumption

- Executive Summary

- Global Acrylic Fiber Market Trends & Insights

- Global Acrylic Fiber Market Dynamics

- Growth Drivers

- Challenges

- Global Acrylic Fiber Market Hotspot & Opportunities

- Global Acrylic Fiber Market Supply Chain Analysis

- Global Acrylic Fiber Market Regulation & Policy

- Global Acrylic Fiber Market Outlook, 2019- 2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Share & Analysis

- By Form

- Continuous/Filament(Tow) Fiber- Market Size & Forecast 2019-2030, (Thousand Tons)

- Non-continuous/Staple Fiber- Market Size & Forecast 2019-2030, (Thousand Tons)

- By Blend

- Acrylic-Wool- Market Size & Forecast 2019-2030, (Thousand Tons)

- Acrylic-Viscose- Market Size & Forecast 2019-2030, (Thousand Tons)

- Acrylic-Nylon- Market Size & Forecast 2019-2030, (Thousand Tons)

- Acrylic-Cotton- Market Size & Forecast 2019-2030, (Thousand Tons)

- Others (Cellulose, Rayon, etc.)- Market Size & Forecast 2019-2030, (Thousand Tons)

- By End-Use Industry

- Textiles & Apparel- Market Size & Forecast 2019-2030, (Thousand Tons)

- Furniture & Upholstery- Market Size & Forecast 2019-2030, (Thousand Tons)

- Industrial- Market Size & Forecast 2019-2030, (Thousand Tons)

- Building & Construction- Market Size & Forecast 2019-2030, (Thousand Tons)

- Automotive- Market Size & Forecast 2019-2030, (Thousand Tons)

- Others- Market Size & Forecast 2019-2030, (Thousand Tons)

- By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- By Company

- Competition Characteristics

- Revenue Shares

- By Form

- Market Size & Analysis

- North America Acrylic Fiber Market Outlook, 2019- 2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Share & Analysis

- By Form- Market Size & Forecast 2019-2030, (Thousand Tons)

- By Blend- Market Size & Forecast 2019-2030, (Thousand Tons)

- By End-Use Industry- Market Size & Forecast 2019-2030, (Thousand Tons)

- By Country- Market Size & Forecast 2019-2030, (Thousand Tons)

- The US

- Canada

- Mexico

- The US Acrylic Fiber Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Size & Analysis

- By Blend- Market Size & Forecast 2019-2030, (Thousand Tons)

- By End-Use Industry- Market Size & Forecast 2019-2030, (Thousand Tons)

- Market Size & Analysis

- Canada Acrylic Fiber Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Size & Analysis

- By Blend- Market Size & Forecast 2019-2030, (Thousand Tons)

- By End-Use Industry- Market Size & Forecast 2019-2030, (Thousand Tons)

- Market Size & Analysis

- Mexico Acrylic Fiber Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Size & Analysis

- By Blend- Market Size & Forecast 2019-2030, (Thousand Tons)

- By End-Use Industry- Market Size & Forecast 2019-2030, (Thousand Tons)

- Market Size & Analysis

- Market Size & Analysis

- South America Acrylic Fiber Market Outlook, 2019- 2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Share & Analysis

- By Form- Market Size & Forecast 2019-2030, (Thousand Tons)

- By Blend- Market Size & Forecast 2019-2030, (Thousand Tons)

- By End-Use Industry- Market Size & Forecast 2019-2030, (Thousand Tons)

- By Country- Market Size & Forecast 2019-2030, (Thousand Tons)

- Brazil

- Argentina

- Rest of South America

- Brazil Acrylic Fiber Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Size & Analysis

- By Blend- Market Size & Forecast 2019-2030, (Thousand Tons)

- By End-Use Industry- Market Size & Forecast 2019-2030, (Thousand Tons)

- Market Size & Analysis

- Argentina Acrylic Fiber Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Size & Analysis

- By Blend- Market Size & Forecast 2019-2030, (Thousand Tons)

- By End-Use Industry- Market Size & Forecast 2019-2030, (Thousand Tons)

- Market Size & Analysis

- Market Size & Analysis

- Europe Acrylic Fiber Market Outlook, 2019- 2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Share & Analysis

- By Form- Market Size & Forecast 2019-2030, (Thousand Tons)

- By Blend- Market Size & Forecast 2019-2030, (Thousand Tons)

- By End-Use Industry- Market Size & Forecast 2019-2030, (Thousand Tons)

- By Country- Market Size & Forecast 2019-2030, (Thousand Tons)

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- The UK Acrylic Fiber Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Size & Analysis

- By Blend- Market Size & Forecast 2019-2030, (Thousand Tons)

- By End-Use Industry- Market Size & Forecast 2019-2030, (Thousand Tons)

- Market Size & Analysis

- Germany Acrylic Fiber Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Size & Analysis

- By Blend- Market Size & Forecast 2019-2030, (Thousand Tons)

- By End-Use Industry- Market Size & Forecast 2019-2030, (Thousand Tons)

- Market Size & Analysis

- France Acrylic Fiber Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Size & Analysis

- By Blend- Market Size & Forecast 2019-2030, (Thousand Tons)

- By End-Use Industry- Market Size & Forecast 2019-2030, (Thousand Tons)

- Market Size & Analysis

- Italy Acrylic Fiber Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Size & Analysis

- By Blend- Market Size & Forecast 2019-2030, (Thousand Tons)

- By End-Use Industry- Market Size & Forecast 2019-2030, (Thousand Tons)

- Market Size & Analysis

- Spain Acrylic Fiber Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Size & Analysis

- By Blend- Market Size & Forecast 2019-2030, (Thousand Tons)

- By End-Use Industry- Market Size & Forecast 2019-2030, (Thousand Tons)

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Acrylic Fiber Market Outlook, 2019- 2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Share & Analysis

- By Form- Market Size & Forecast 2019-2030, (Thousand Tons)

- By Blend- Market Size & Forecast 2019-2030, (Thousand Tons)

- By End-Use Industry- Market Size & Forecast 2019-2030, (Thousand Tons)

- By Country- Market Size & Forecast 2019-2030, (Thousand Tons)

- Saudi Arabia

- The UAE

- South Africa

- Rest of The Middle East & Africa

- Saudi Arabia Acrylic Fiber Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Size & Analysis

- By Blend- Market Size & Forecast 2019-2030, (Thousand Tons)

- By End-Use Industry- Market Size & Forecast 2019-2030, (Thousand Tons)

- Market Size & Analysis

- The UAE Acrylic Fiber Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Size & Analysis

- By Blend- Market Size & Forecast 2019-2030, (Thousand Tons)

- By End-Use Industry- Market Size & Forecast 2019-2030, (Thousand Tons)

- Market Size & Analysis

- South Africa Acrylic Fiber Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Size & Analysis

- By Blend- Market Size & Forecast 2019-2030, (Thousand Tons)

- By End-Use Industry- Market Size & Forecast 2019-2030, (Thousand Tons)

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Acrylic Fiber Market Outlook, 2019- 2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Share & Analysis

- By Form- Market Size & Forecast 2019-2030, (Thousand Tons)

- By Blend- Market Size & Forecast 2019-2030, (Thousand Tons)

- By End-Use Industry- Market Size & Forecast 2019-2030, (Thousand Tons)

- By Country- Market Size & Forecast 2019-2030, (Thousand Tons)

- China

- Japan

- South Korea

- India

- Australia

- Rest of Asia-Pacific

- China Acrylic Fiber Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Size & Analysis

- By Blend- Market Size & Forecast 2019-2030, (Thousand Tons)

- By End-Use Industry- Market Size & Forecast 2019-2030, (Thousand Tons)

- Market Size & Analysis

- Japan Acrylic Fiber Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Size & Analysis

- By Blend- Market Size & Forecast 2019-2030, (Thousand Tons)

- By End-Use Industry- Market Size & Forecast 2019-2030, (Thousand Tons)

- Market Size & Analysis

- South Korea Acrylic Fiber Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Size & Analysis

- By Blend- Market Size & Forecast 2019-2030, (Thousand Tons)

- By End-Use Industry- Market Size & Forecast 2019-2030, (Thousand Tons)

- Market Size & Analysis

- India Acrylic Fiber Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Size & Analysis

- By Blend- Market Size & Forecast 2019-2030, (Thousand Tons)

- By End-Use Industry- Market Size & Forecast 2019-2030, (Thousand Tons)

- Market Size & Analysis

- Australia Acrylic Fiber Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Size & Analysis

- By Blend- Market Size & Forecast 2019-2030, (Thousand Tons)

- By End-Use Industry- Market Size & Forecast 2019-2030, (Thousand Tons)

- Market Size & Analysis

- Market Size & Analysis

- Global Acrylic Fiber Market Key Strategic Imperatives for Success & Growth

- Competitive Outlook

- Company Profiles

- Reliance Industries Limited (RIL)

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Thai Acrylic Fiber Co. Ltd. (TAF)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Aditya Birla Management Corporation Pvt. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Aksa Akrilik Kimya Sanayii AŞ

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- China Petrochemical Corporation

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Dralon

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Formosa Plastics Corporation

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Goonvean Fibres

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Japan Exlan Co. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Jiangsu Zhongxin Resources Group

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Jilin Chemical Fiber Group Co. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Kaltex

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Mitsubishi Chemical Corporation

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Pasupati Acrylon Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Polyacryl Iran Corp.

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Reliance Industries Limited (RIL)

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making