Global Nylon 66 Market Research Report: Forecast (2022-27)

By Grade (Resin, Fiber), By End-User (Automotive, Electrical & Electronics, Packaging, Textile, Others (Consumer Goods, etc.)), By Region (North America, South America, Europe, Mid...dle East & Africa, Asia-Pacific), By Countries (The US, Canada, Mexico, Brazil, The UK, France, Germany, Spain, Italy, Russia, South Africa, GCC, India, China, Japan, South Korea) Read more

- Chemicals

- Jul 2022

- Pages 178

- Report Format: PDF, Excel, PPT

Market Definition

Nylon 66, scientifically known as polyhexamethylene diamine adipamide, is a polyamide with numerous applications across different industries, including automotive, textile, & packaging industries, among others. It is considered superior to other Nylon compounds due to its unique mechanical properties, dimensional stability, and higher melting point. With properties like high tensile strength, excellent luster, wrinkle-proof, high elasticity, and superior resistance to abrasion & extreme temperatures, the application of Nylon 66 has significantly increased in recent years globally.

Market Insights

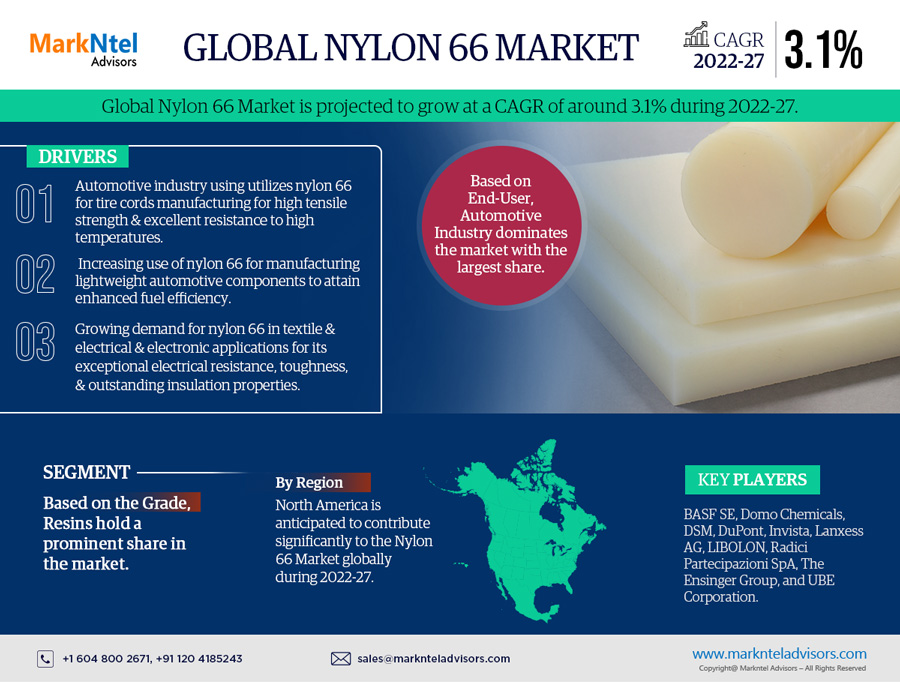

The Global Nylon 66 Market is projected to grow at a CAGR of around 3.1% during the forecast period, i.e., 2022-27. Most of the market expansion is likely to be driven primarily by the flourishing automotive industry, which utilizes nylon 66 for manufacturing tire cords due to its high tensile strength & excellent resistance to high temperatures. As a result, the burgeoning tire production globally is positively impacting the demand for nylon 66.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2017-20 |

| Base Year: 2021 | |

| Forecast Period: 2022-27 | |

| CAGR (2022-2027) | 3.1% |

| Regions Covered | North America: The US, Canada, Mexico |

| South America: Brazil, Rest of South America | |

| Europe: Germany, The UK, France, Spain, Italy, Russia, Rest of Europe | |

| Asia-Pacific: China, Japan, India, South Korea, Rest of Asia Pacific | |

| Middle East & Africa: GCC, South Africa, Rest of Middle East and Africa | |

| Key Companies Profiled | BASF SE, Domo Chemicals, DSM, DuPont, Invista, Lanxess AG, LIBOLON, Radici Partecipazioni SpA, The Ensinger Group, and UBE Corporation. |

| Unit Denominations | USD Million/Billion |

Besides, the increasing consumer preferences toward eco-friendly & sustainable mobility options, i.e., driving EV sales worldwide, is another prominent aspect driving the demand for nylon 66 for manufacturing lightweight automotive components in order to attain enhanced fuel efficiency. In addition, it is used extensively in manufacturing automotive airbags and as engineering thermoplastic materials that possess properties like high abrasion resistance & elasticity, as well as superior tensile strength.

These aspects have infused the demand for nylon across the automotive sector as it is environment-friendly compared to plastics and facilitates higher design flexibility that helps produce advanced shapes of vehicles without compromising their safety & stability. Moreover, it is also being utilized largely as a substitute for metal parts deployed in automobiles to help prevent damage caused by corrosion of various components. As a result, the surging demand for nylon 66 in the rapidly expanding automotive industry is set to contribute notably to the overall market expansion over the forecast years.

Apart from the automotive sector, the growing demand for nylon 66 for textile and electrical & electronic applications due to its exceptional electrical resistance, toughness, and outstanding insulation properties is also augmenting the growth of the global market. Additionally, the industrial applications of nylon 66, viz., the manufacturing of sportswear, recreational equipment, consumer goods, alloys, home furnishings, food packaging, & electrical wire casings, are also projected to bode well for the growth of the Global Nylon 66 Market.

Market Segmentation

Based on Grade:

- Resin

- Fiber

Of both grades, resins hold a prominent share in the Global Nylon 66 Market. It owes to their increasing demand across the automotive industry for manufacturing molded parts, coupled with the rapidly growing electronics & electrical industries. Besides, since Nylon 66 resins have excellent strengthening properties and help increase a product's toughness, they are also witnessing increasing demand in the packaging sector and, in turn, driving the global market.

Moreover, their high chemical resistance & physical resistance to external compounds & fungal attacks, respectively, entwined with their rigid characteristics, make them ideal for power tools & fibers in textile & carpet applications. Hence, these aspects project rapidly growing sales of nylon 66 resins across different end-user industries and a lucrative future for the global market through 2027.

Based on End-User:

- Textile

- Automotive

- Electrical & Electronics

- Packaging

- Others (Consumer Goods, etc.)

Of all end-users, the automotive sector dominates the Global Nylon 66 Market, and the same trend is expected during 2022-27. It attributes primarily to the massive demand for Nylon 66 in manufacturing lightweight vehicles to attain improved fuel efficiency & wear resistance, coupled with the mounting EV (Electric Vehicle) sales and the growing establishment of proper EV infrastructure.

Nylon 66 has excellent mechanical characteristics and is used extensively in manufacturing various automotive components like airbag containers, air intake manifolds, cooling systems, headlamps, exterior mirrors, handles, front-end grilles, hydraulic clutch lines, tailgates, fuel caps, wheel covers, etc. In addition, due to its greater design flexibility than traditional metals & lower weight, Nylon 66 is also used largely in the engine compartment of vehicles to replace steel parts.

Over the years, the automotive sector has been witnessing a trend of engine downsizing, i.e., driving automakers worldwide to use plastic polymers as an alternative, thereby infusing the sales of Nylon 66 and augmenting the overall market expansion. Moreover, the rapidly expanding e-commerce industry, i.e., propelling the sales of commercial vehicles, is another prominent aspect contributing to the growth of the Global Nylon 66 Market across the automotive sector.

Regional Landscape

Geographically, the Global Nylon 66 Market expands across:

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

Here, North America is anticipated to contribute significantly to the Nylon 66 Market globally during 2022-27. It owes to the mounting demand for high-temperature resistant engineering & lightweight plastics across industries like aerospace & defense, automotive, and electrical & electronics in the US & Canada. Several end-user organizations across these countries are portraying an increasing inclination toward incorporating sustainable products in their product offerings and joining forces with nylon 66 producers, i.e., another prominent aspect citing a lucrative future ahead for the regional market.

In addition, the rising electrical, electronics, & automotive industries, the rapid shift toward using cleaner fuels, growing consumer awareness regarding sustainable transportation, and massive investments in the automotive sector are further boosting the North America Nylon Market. Moreover, the extensive presence of the leading Nylon 66 manufacturers across the region and innovations in product designing further project remunerative opportunities for the Nylon 66 Market across North America during 2022-27.

On the other hand, Asia-Pacific Nylon 66 Market is expecting significant growth opportunities through 2027, mainly on the back of the exceptionally growing automotive & packaging industries, especially in China & India. Nylon 66 is used extensively for films & coating applications in the packaging sector. The leading manufacturers across Asia-Pacific are massively investing in bringing innovations to sustainable films & coatings for flexible packaging requirements. Moreover, the textile industry, another prominent end-user of Nylon 66, is also augmenting the regional market growth.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares) of the Global Nylon 66 Market?

- What are the region-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the Global Nylon 66 Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the Global Nylon 66 Market based on the competitive benchmarking matrix?

- What are the key results derived from surveys conducted during the Global Nylon 66 Market study?

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Nylon 66 Market Trends & Insights

- Global Nylon 66 Market Dynamics

- Drivers

- Challenges

- Global Nylon 66 Market Supply Chain Analysis

- Global Nylon 66 Market Hotspots & Opportunities

- Global Nylon 66 Market Regulations, Policies & Standards

- Global Nylon 66 Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade

- Resin- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- Fiber- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By End-User

- Automotive- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- Electrical & Electronics- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- Packaging- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- Textile- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- Others (Consumer Goods, etc.) - Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- By Company

- Competition Characteristics

- Market Share Analysis

- By Grade

- Market Size & Analysis

- North America Nylon 66 Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By End-User- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By Country

- The US

- Canada

- Mexico

- The US Nylon 66 Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By End-User- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- Market Size & Analysis

- Canada Nylon 66 Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By End-User- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- Market Size & Analysis

- Mexico Nylon 66 Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By End-User- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- Market Size & Analysis

- Market Size & Analysis

- South America Nylon 66 Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By End-User- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By Country

- Brazil

- Rest of South America

- Brazil Nylon 66 Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By End-User- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- Market Size & Analysis

- Market Size & Analysis

- Europe Nylon 66 Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By End-User- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By Country

- Germany

- The UK

- France

- Italy

- Spain

- Rest of Europe

- Germany Nylon 66 Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By End-User- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- Market Size & Analysis

- The UK Nylon 66 Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By End-User- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- Market Size & Analysis

- France Nylon 66 Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By End-User- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- Market Size & Analysis

- Itlay Nylon 66 Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By End-User- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- Market Size & Analysis

- Spain Nylon 66 Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By End-User- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Nylon 66 Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By End-User- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By Country

- GCC

- South Africa

- Rest of Middle East & Africa

- GCC Nylon 66 Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By End-User- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- Market Size & Analysis

- South Africa Nylon 66 Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By End-User- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Nylon 66 Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By End-User- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By Country

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- China Nylon 66 Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By End-User- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- Market Size & Analysis

- Japan Nylon 66 Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By End-User- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- Market Size & Analysis

- India Nylon 66 Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By End-User- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- Market Size & Analysis

- South Korea Nylon 66 Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Grade- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- By End-User- Market Size & Forecast 2019-2029, Quantity Sold (Thousand Tons)

- Market Size & Analysis

- Market Size & Analysis

- Global Nylon 66 Market Key Strategic Imperatives for Growth & Success

- Competition Outlook

- Company Profiles

- AdvanSix

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Ascend Performance Materials

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- BASF SE

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Domo Chemicals

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- DSM

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- DuPont

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Invista

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Lanxess AG

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- LIBOLON

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Radici Partecipazioni SpA

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- The Ensinger Group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- UBE Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Celanese Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Asahi Kasei Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Toray Industries

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others (Toyobo MC Corporation, SSB Polymers, etc.)

- AdvanSix

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making