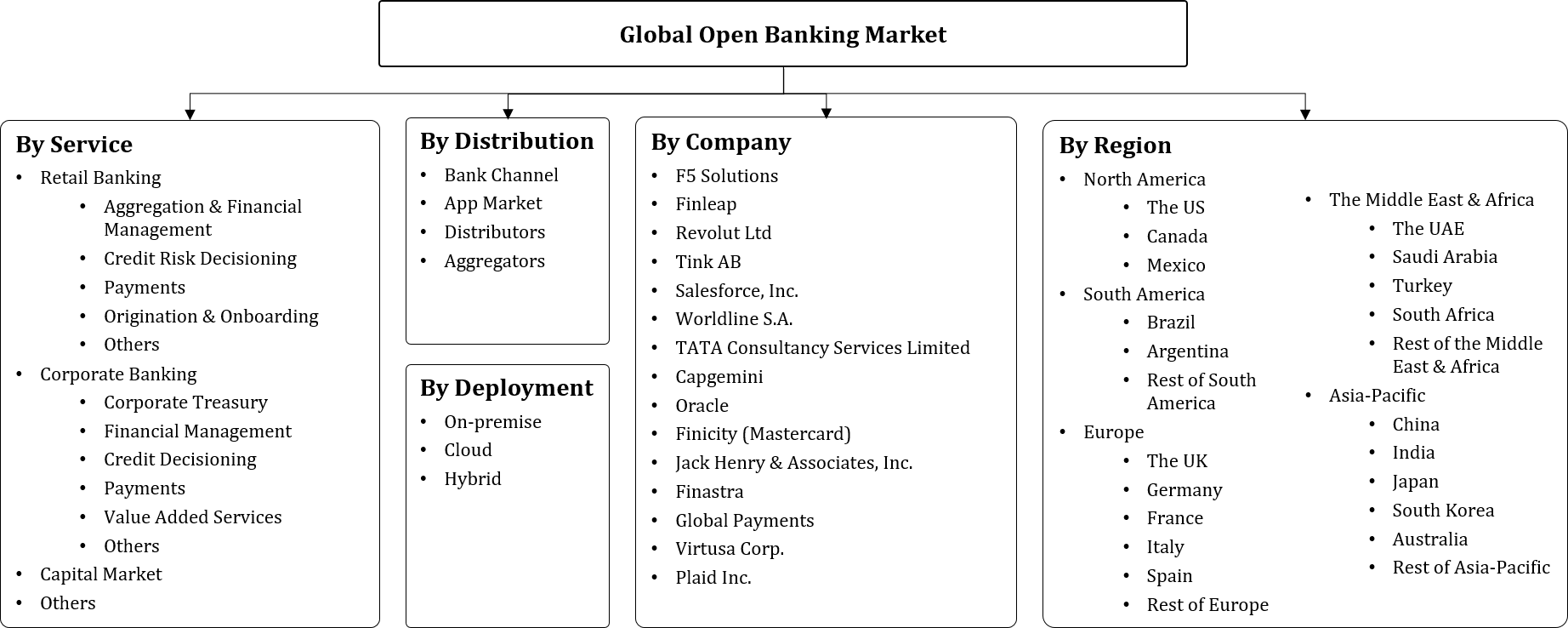

Open Banking Market Size - By Service (Retail Banking [Aggregation & Financial Management, Credit Risk Decisioning, Payments, Origination & Onboarding, Others], Corporate Banking [Corporate Treasury,... ... Corporate Treasury, Financial Management, Credit Decisioning, Payments, Value Added Services, Others], Capital Markets, Others), By Distribution Channel (Bank Channel, App Market, Distributors, Aggregators), By Deployment (On-premise, Cloud, Hybrid) and Others Read more

- FinTech

- Mar 2025

- 202

- PDF, Excel, PPT

Market Definition

Open Banking is a system that enables external financial services to securely retrieve and utilize information from a user's bank account. This sharing of data is facilitated through standardized interfaces, or APIs, which ensure a secure and controlled exchange of information between banks and authorized third-party providers. This practice is designed to promote innovation, competition, and the development of new financial services by allowing external entities to build upon the existing infrastructure and offer more tailored and innovative solutions to consumers.

Market Insights & Analysis: Global Open Banking Market (2025-30):

The Global Open Banking Market size was valued at around USD 31.54 billion in 2024 and is projected to reach USD 136.13 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 27.60 % during the forecast period, i.e., 2025-30. The banking industry is undergoing a digital revolution, with emerging digital banking innovators earning consumers' trust. At the same time, established institutions are intensifying their digital transformation efforts, positioning themselves to preserve & expand their customer base. As per the Global Digital Banking Index 2021, across the 28 countries surveyed, the number of consumers with a digital bank account represented 23% of the population and an estimated 450 million customers.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020–23 |

| Forecast Years | 2025–30 |

| Market Value in 2024 | USD 31.54 Billion |

| Market Value by 2030 | USD 136.13 Billion |

| CAGR (2025–30) | 27.60% |

| Leading Region | Europe |

| Top Key Players | Finleap, Revolut Ltd., Tink AB, Salesforce Inc., Worldline S.A., Tata Consultancy Services Limited, Capgemini, Oracle, Finicity (Mastercard), Jack Henry & Associates, Inc., Finastra, Payments, Virtusa Corp, Plaid Inc, etc, and others |

| Segmentation | By Service (Retail Banking [Aggregation & Financial Management, Credit Risk Decisioning, Payments, Origination & Onboarding, Others], Corporate Banking [Corporate Treasury, Financial Management, Credit Decisioning, Payments, Value Added Services, Others], Capital Markets, Others), By Distribution Channel (Bank Channel, App Market, Distributors, Aggregators), By Deployment (On-premise, Cloud, Hybrid) and Others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

Additionally, as financial institutions expedited their digital transformation efforts to stay competitive, they modernized their systems and infrastructure. Owing to this, they are securely opening up their data and services to third-party providers, supporting the market expansion.

Furthermore, countries in regions like the Asia-Pacific and the Middle East are actively promoting digitalization, fostering an environment conducive to the digital transformation of the financial sector. This encouragement is driving financial institutions to make investments in open banking, further contributing to the expansion of the Open Banking Market in the future years.

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Evolution of Open Banking

- Global Open Banking Startup Ecosystem

- Year of Establishment

- Amount Raised (USD Billion)

- Series of Fund Raise

- Purpose of Fund Raise

- Investors Involved

- Global Open Banking Current Status of Integration & Implementation – A Survey of Financial Institutions

- Region-wise Current Status of Integrating Open Banking

- Region-wise Purpose of Adopting Open Banking

- Top Applications for Which Open Banking has been Implemented by Financial Institutions

- Results of Integrating Open Banking

- Others

- Global Open Banking Case Studies

- Global Open Banking Market Porter’s Five Forces Analysis

- Global Open Banking Market Trends & Insights

- Global Open Banking Market Dynamics

- Growth Drivers

- Challenges

- Global Open Banking Market Value Chain Analysis

- Global Open Banking Market Policies, Regulations, and Service Standards

- The US

- European Union

- The UK

- Australia

- Mexico

- India

- Japan

- Singapore

- Canada

- New Zealand

- South Africa

- Global Open Banking Market Hotspot & Opportunities

- Global Open Banking Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Service

- Retail Banking

- Aggregation & Financial Management - Market Size & Forecast 2020-2030F, USD Billion

- Credit Risk Decisioning- Market Size & Forecast 2020-2030F, USD Billion

- Payments- Market Size & Forecast 2020-2030F, USD Billion

- Origination & Onboarding- Market Size & Forecast 2020-2030F, USD Billion

- Others

- Corporate Banking

- Corporate Treasury- Market Size & Forecast 2020-2030F, USD Billion

- Financial Management- Market Size & Forecast 2020-2030F, USD Billion

- Credit Decisioning- Market Size & Forecast 2020-2030F, USD Billion

- Payments- Market Size & Forecast 2020-2030F, USD Billion

- Value Added Services- Market Size & Forecast 2020-2030F, USD Billion

- Others

- Capital Markets

- Others

- Retail Banking

- By Distribution Channel

- Bank Channel- Market Size & Forecast 2020-2030F, USD Billion

- App Market- Market Size & Forecast 2020-2030F, USD Billion

- Distributors- Market Size & Forecast 2020-2030F, USD Billion

- Aggregators- Market Size & Forecast 2020-2030F, USD Billion

- By Deployment

- On-premise- Market Size & Forecast 2020-2030F, USD Billion

- Cloud- Market Size & Forecast 2020-2030F, USD Billion

- Hybrid- Market Size & Forecast 2020-2030F, USD Billion

- By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- By Company

- Competition Characteristics

- Market Share & Analysis

- By Service

- Market Size & Analysis

- North America Open Banking Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Service- Market Size & Forecast 2020-2030F, USD Billion

- By Distribution Channel- Market Size & Forecast 2020-2030F, USD Billion

- By Deployment- Market Size & Forecast 2020-2030F, USD Billion

- By Country

- The US

- Canada

- Mexico

- The US Open Banking Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Service- Market Size & Forecast 2020-2030F, USD Billion

- By Distribution Channel- Market Size & Forecast 2020-2030F, USD Billion

- Market Size & Analysis

- Canada Open Banking Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Service- Market Size & Forecast 2020-2030F, USD Billion

- By Distribution Channel- Market Size & Forecast 2020-2030F, USD Billion

- Market Size & Analysis

- Mexico Open Banking Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Service Type- Market Size & Forecast 2020-2030F, USD Billion

- By Service- Market Size & Forecast 2020-2030F, USD Billion

- Market Size & Analysis

- Market Size & Analysis

- South America Open Banking Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Service- Market Size & Forecast 2020-2030F, USD Billion

- By Distribution Channel- Market Size & Forecast 2020-2030F, USD Billion

- By Deployment- Market Size & Forecast 2020-2030F, USD Billion

- By Country

- Brazil

- Argentina

- Rest of Latin America

- Brazil Open Banking Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Distribution Channel- Market Size & Forecast 2020-2030F, USD Billion

- By Service- Market Size & Forecast 2020-2030F, USD Billion

- Market Size & Analysis

- Argentina Open Banking Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Distribution Channel- Market Size & Forecast 2020-2030F, USD Billion

- By Service- Market Size & Forecast 2020-2030F, USD Billion

- Market Size & Analysis

- Market Size & Analysis

- Europe Open Banking Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Service- Market Size & Forecast 2020-2030F, USD Billion

- By Distribution Channel- Market Size & Forecast 2020-2030F, USD Billion

- By Deployment- Market Size & Forecast 2020-2030F, USD Billion

- By Country

- Germany

- The UK

- France

- Italy

- Spain

- Rest of Europe

- Germany Open Banking Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Distribution Channel- Market Size & Forecast 2020-2030F, USD Billion

- By Service- Market Size & Forecast 2020-2030F, USD Billion

- Market Size & Analysis

- The UK Open Banking Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Distribution Channel- Market Size & Forecast 2020-2030F, USD Billion

- By Service- Market Size & Forecast 2020-2030F, USD Billion

- Market Size & Analysis

- France Open Banking Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Distribution Channel- Market Size & Forecast 2020-2030F, USD Billion

- By Service- Market Size & Forecast 2020-2030F, USD Billion

- Market Size & Analysis

- Italy Open Banking Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Distribution Channel- Market Size & Forecast 2020-2030F, USD Billion

- By Service- Market Size & Forecast 2020-2030F, USD Billion

- Market Size & Analysis

- Spain Open Banking Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Distribution Channel- Market Size & Forecast 2020-2030F, USD Billion

- By Service- Market Size & Forecast 2020-2030F, USD Billion

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Open Banking Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Service- Market Size & Forecast 2020-2030F, USD Billion

- By Distribution Channel- Market Size & Forecast 2020-2030F, USD Billion

- By Deployment- Market Size & Forecast 2020-2030F, USD Billion

- By Country

- The UAE

- Saudi Arabia

- Turkey

- South Africa

- Rest of the Middle East & Africa

- The UAE Open Banking Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Distribution Channel- Market Size & Forecast 2020-2030F, USD Billion

- By Service- Market Size & Forecast 2020-2030F, USD Billion

- Market Size & Analysis

- Saudi Arabia Open Banking Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Distribution Channel- Market Size & Forecast 2020-2030F, USD Billion

- By Service- Market Size & Forecast 2020-2030F, USD Billion

- Market Size & Analysis

- Turkey Open Banking Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Distribution Channel- Market Size & Forecast 2020-2030F, USD Billion

- By Service- Market Size & Forecast 2020-2030F, USD Billion

- Market Size & Analysis

- South Africa Open Banking Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Distribution Channel- Market Size & Forecast 2020-2030F, USD Billion

- By Service- Market Size & Forecast 2020-2030F, USD Billion

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Open Banking Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Service- Market Size & Forecast 2020-2030F, USD Billion

- By Distribution Channel- Market Size & Forecast 2020-2030F, USD Billion

- By Deployment- Market Size & Forecast 2020-2030F, USD Billion

- By Country

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia-Pacific

- China Open Banking Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Distribution Channel- Market Size & Forecast 2020-2030F, USD Billion

- By Service- Market Size & Forecast 2020-2030F, USD Billion

- Market Size & Analysis

- India Open Banking Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Distribution Channel- Market Size & Forecast 2020-2030F, USD Billion

- By Service- Market Size & Forecast 2020-2030F, USD Billion

- Market Size & Analysis

- Japan Open Banking Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Distribution Channel- Market Size & Forecast 2020-2030F, USD Billion

- By Service- Market Size & Forecast 2020-2030F, USD Billion

- Market Size & Analysis

- South Korea Open Banking Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Distribution Channel- Market Size & Forecast 2020-2030F, USD Billion

- By Service- Market Size & Forecast 2020-2030F, USD Billion

- Market Size & Analysis

- Australia Open Banking Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Distribution Channel- Market Size & Forecast 2020-2030F, USD Billion

- By Service- Market Size & Forecast 2020-2030F, USD Billion

- Market Size & Analysis

- Market Size & Analysis

- Global Open Banking Market Strategic Imperatives for Success & Growth

- Competitive Outlook

- Company Profiles

- F5 Solutions

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financia Details

- Others

- Finleap

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Revolut Ltd

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Tink AB

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Salesforce, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Worldline S.A.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- TATA Consultancy Services Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Capgemini

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Oracle

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Finicity (Mastercard)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Jack Henry & Associates, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Finastra

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Global Payments

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Virtusa Corp.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Plaid Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- F5 Solutions

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making