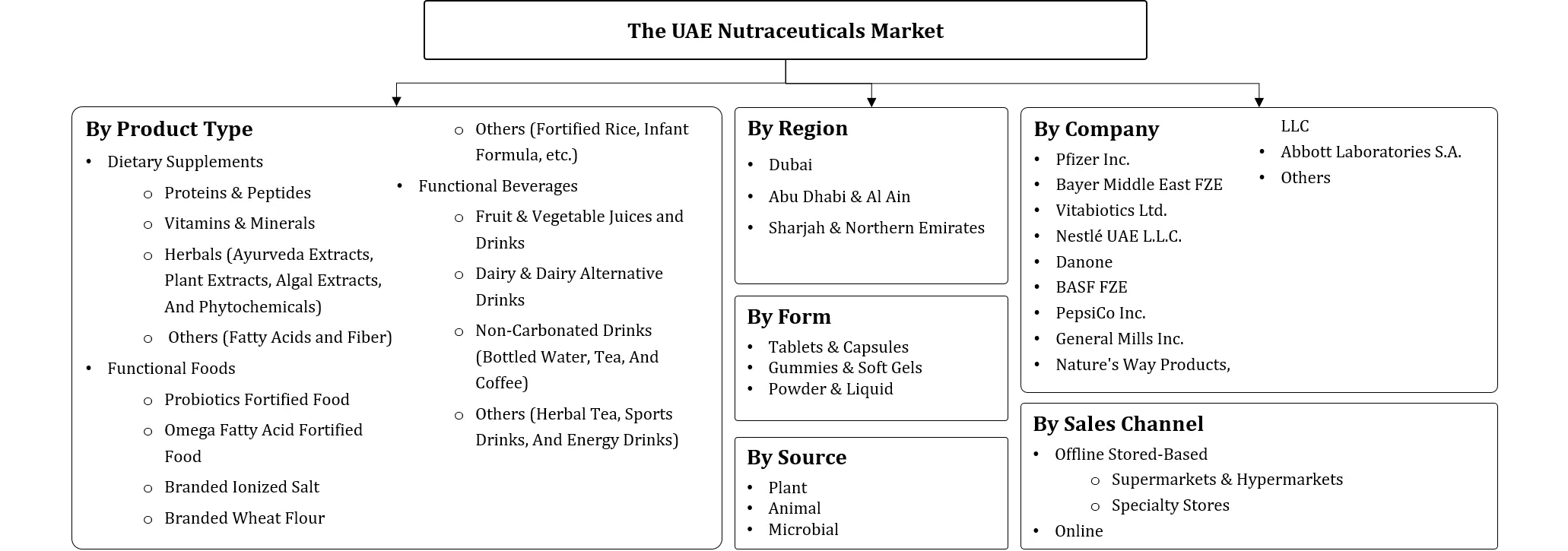

UAE Nutraceuticals Market - By Product Type (Dietary Supplements (Proteins & Peptides, Vitamins & Minerals, Herbals), Functional Foods (Probiotics Fortified Food, Omega Fatty Acid......Fortified Food, Branded Ionized Salt, Branded Wheat Flour), Functional Beverages (Fruit & Vegetable Juices and Drinks, Dairy & Dairy Alternative Drinks, and Non-Carbonated Drinks)), By Source (Plant, Animal, Microbial), By Form (Tablets & Capsules, Gummies & Softgels, Powder & Liquid), By Sales Channel (Offline Store-based (Supermarkets & Hypermarkets, Speciality Stores), Online) and others Read more

- Food & Beverages

- Jan 2024

- 88

- PDF, Excel, PPT

Market Definition

Nutraceutical products are non-specific biological therapies that are used to promote general well-being, control symptoms, and prevent malignant processes. It provides medical or health benefits, including the prevention & treatment of disease. The UAE has a high prevalence of lifestyle-based diseases due to excessive consumption of packaged food and a sedentary lifestyle due to which the demand for nutraceuticals in the form of fortified functional food & beverages among the consumers has increased during the historical period.

Market Insights & Analysis: UAE Nutraceuticals Market (2025-30)

The UAE Nutraceuticals Market is projected to grow at a CAGR of around 6.96% during the forecast period, i.e., 2025-30. The UAE Nutraceuticals market grew significantly during the historical years, on account of the rising adoption of a sedentary lifestyle and improper & unhealthy diet, along with widespread obesity & diabetes among the consumers in the region. According to International Diabetes Federation, the country had the world’s highest prevalence rates of diabetes as of 2019. Moreover, the increasing health consciousness & rising number of nutritionists & wellness coaches in the country positively impacted the nutraceuticals market growth from 2020 to 2023. In addition, the growing number of large-scale gyms & wellness centers have supported the stipulation of nutraceuticals in the UAE.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020-23 |

|

Base Years

|

2024

|

|

Forecast Years

|

2025-30

|

| CAGR (2025-30) | 6.96% |

| Top Key Players | Pfizer Inc., Bayer Middle East FZE, Vitabiotics Ltd., Nestlé UAE L.L.C., Danone, BASF FZE, PepsiCo Inc., General Mills Inc., Nature's Way Products, LLC., Abbott Laboratories S.A., Others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

Additionally, the UAE government has been promoting health & wellness since historical times in order to educate consumers about the growing prevalence of chronic health issues related to lifestyles. As of 2018, the UAE Ministry of Cabinet Affairs announced three national initiatives, such as the UAE Wellbeing Model for Residential Communities, Community Wellbeing Nutrition Program, and Community Program for Active Lifestyle, which encourage community members to exercise & adopt healthy eating habits.

Furthermore, the rising geriatric population, government initiatives to promote health & wellness, and increasing focus on pediatric nutrition are some of the other reasons that fueled the nutraceuticals market growth in the UAE. Hence, it is expected that the higher disposable income & rising awareness of nutraceuticals among consumers would further accelerate the UAE Nutraceuticals market in the forecast years.

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Impact of COVID-19 on The UAE Nutraceuticals Market

- The UAE Nutraceuticals Market Trends & Insights

- The UAE Nutraceuticals Market Dynamics

- Growth Drivers

- Challenges

- The UAE Nutraceuticals Market Hotspot & Opportunities

- The UAE Nutraceuticals Market Policies, Regulations, Product Standards

- The UAE Nutraceuticals Market Outlook, 2020-2030

- Market Size & Outlook

- By Revenues (USD Million)

- Market Share & Outlook

- By Product Type

- Dietary Supplements- Market Size & Forecast 2020-2030, USD Million

- Proteins & Peptides- Market Size & Forecast 2020-2030, USD Million

- Vitamins & Minerals- Market Size & Forecast 2020-2030, USD Million

- Herbals (Ayurveda Extracts, Plant Extracts, Algal Extracts, And Phytochemicals)- Market Size & Forecast 2020-2030, USD Million

- Others (Fatty Acids and Fiber)- Market Size & Forecast 2020-2030, USD Million

- Functional Foods- Market Size & Forecast 2020-2030, USD Million

- Probiotics Fortified Food- Market Size & Forecast 2020-2030, USD Million

- Omega Fatty Acid Fortified Food- Market Size & Forecast 2020-2030, USD Million

- Branded Ionized Salt- Market Size & Forecast 2020-2030, USD Million

- Branded Wheat Flour- Market Size & Forecast 2020-2030, USD Million

- Others (Fortified Rice, Infant Formula, etc.)- Market Size & Forecast 2020-2030, USD Million

- Functional Beverages- Market Size & Forecast 2020-2030, USD Million

- Fruit & Vegetable Juices and Drinks- Market Size & Forecast 2020-2030, USD Million

- Dairy & Dairy Alternative Drinks- Market Size & Forecast 2020-2030, USD Million

- Non-Carbonated Drinks (Bottled Water, Tea, And Coffee)- Market Size & Forecast 2020-2030, USD Million

- Other (Herbal Tea, Sports Drinks, And Energy Drinks)- Market Size & Forecast 2020-2030, USD Million

- Dietary Supplements- Market Size & Forecast 2020-2030, USD Million

- By Source

- Plant- Market Size & Forecast 2020-2030, USD Million

- Animal- Market Size & Forecast 2020-2030, USD Million

- Microbial- Market Size & Forecast 2020-2030, USD Million

- By Form

- Tablets & Capsules- Market Size & Forecast 2020-2030, USD Million

- Gummies & Soft Gels- Market Size & Forecast 2020-2030, USD Million

- Powder & Liquid- Market Size & Forecast 2020-2030, USD Million

- By Sales Channel

- Offline Store-Based- Market Size & Forecast 2020-2030, USD Million

- Supermarkets & Hypermarkets- Market Size & Forecast 2020-2030, USD Million

- Specialty Stores- Market Size & Forecast 2020-2030, USD Million

- Online- Market Size & Forecast 2020-2030, USD Million

- Offline Store-Based- Market Size & Forecast 2020-2030, USD Million

- By Region

- Dubai

- Al Ain & Abu Dhabi

- Sharjah & Northern Emirates

- By Company

- Revenue Shares

- Competition Characteristics

- By Product Type

- Market Size & Outlook

- The UAE Tablets & Capsule Nutraceuticals Market Outlook, 2020-2030

- Market Size & Outlook

- By Revenues (USD Million)

- Market Share & Outlook

- By Source- Market Size & Forecast 2020-2030, USD Million

- Market Size & Outlook

- The UAE Gummies & Soft Gels Nutraceuticals Market Outlook, 2020-2030

- Market Size & Outlook

- By Revenues (USD Million)

- Market Share & Outlook

- By Source- Market Size & Forecast 2020-2030, USD Million

- Market Size & Outlook

- The UAE Powder & Liquid Nutraceuticals Market Outlook, 2020-2030

- Market Size & Outlook

- By Revenues (USD Million)

- Market Share & Outlook

- By Source- Market Size & Forecast 2020-2030, USD Million

- Market Size & Outlook

- The UAE Nutraceuticals Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profile

- Pfizer Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Bayer Middle East FZE

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Vitabiotics Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Nestlé UAE L.L.C.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Danone

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- BASF FZE

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- PepsiCo Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- General Mills Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Nature's Way Products, LLC.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Abbott Laboratories S.A.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Pfizer Inc.

- Company Profile

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making