UAE Zero Liquid Discharge System Market Research Report: Forecast (2026-2032)

UAE Zero Liquid Discharge System Market - By Process (Pretreatment, Membrane Separation, Evaporation/Crystallization), By Capacity (Small-Scale (<1,000 m3 per day), Medium-Scale (1...,001 to 5,000 m3 per day), Large-Scale (>5,000 m3 per day)), By Application (Brine Disposal, Chemical Waste, Food & Beverage Waste, Produced Water and Refinery Effluent, Cooling Tower and Boiler Blowdown), By System Configuration (Membrane-Based ZLD, Thermal-Based ZLD, Hybrid ZLD systems, Others), By Project Type (Greenfield Industrial Projects, Brownfield Retrofits and Compliance Upgrades, Capacity Expansion and Debottlenecking), By End-Use (Oil & Gas, Energy & Power, Chemical & Petrochemicals, Food & Beverages, Pharmaceuticals, Others), and others Read more

- Environment

- Jan 2026

- Pages 135

- Report Format: PDF, Excel, PPT

UAE Zero Liquid Discharge System Market

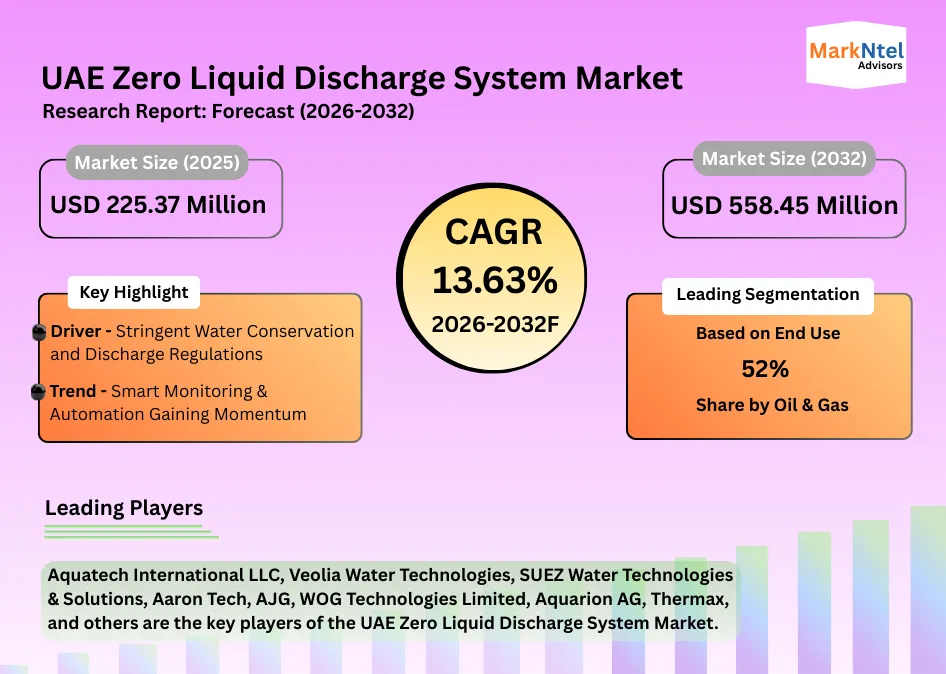

Projected 13.63% CAGR from 2026 to 2032

Study Period

2026-2032

Market Size (2025)

USD 225.37 Million

Market Size (2032)

USD 558.45 Million

Base Year

2025

Projected CAGR

13.63%

Leading Segments

By End Use: Oil & Gas

UAE Zero Liquid Discharge System Market Report Key Takeaways:

- The UAE Zero Liquid Discharge System Market size was valued at around USD 225.37 million in 2025 and is projected to reach USD 558.45 million by 2032. The estimated CAGR from 2026 to 2032 is around 13.63%, indicating strong growth.

- By system configuration, the hybrid ZLD systems represented 45% of the UAE Zero Liquid Discharge System Market size in 2025.

- By end use, the Oil & Gas represented 52% of the UAE Zero Liquid Discharge System Market size in 2025.

- By application, the Brine Disposal segment is anticipated to grow at 12.18% CAGR during 2026-32.

- By project type, brownfield retrofits and compliance upgrades are projected to grow at a CAGR of 14.18% during 2026-32.

- Abu Dhabi and Al Ain lead the UAE Zero Liquid Discharge System Market with a market share of around 44% in 2025.

- The leading zero liquid discharge system companies are Aquatech International LLC, Veolia Water Technologies, SUEZ Water Technologies & Solutions, Aaron Tech, AJG, WOG Technologies Limited, Aquarion AG, Thermax, and others.

Market Insights & Analysis: UAE Zero Liquid Discharge System Market (2026-2032):

The UAE Zero Liquid Discharge System Market size was valued at around USD 225.37 million in 2025 and is projected to reach USD 558.45 million by 2032. Along with this, the market is estimated to grow at a CAGR of around 13.63% during the forecast period, i.e., 2026-32. The UAE Zero Liquid Discharge System Market is transforming its water management landscape to address acute water scarcity and environmental sustainability, positioning advanced wastewater treatment, including Zero Liquid Discharge (ZLD) systems, at the heart of its infrastructure plans. With over 53% of the country’s water supply now coming from non‑conventional sources such as reused wastewater and desalinated seawater, the emphasis on maximizing water reuse has never been stronger. This shift is part of the UAE Water Security Strategy 2036, which targets a 95 % treated water reuse rate and a 21 % reduction in overall water demand by 2036, underscoring the long‑term need for ZLD and similar technologies that eliminate effluent discharge while conserving water.

At the regulatory level, emirate frameworks such as the Dubai Free Zone Water Environment Regulations (EN 5.0) now prohibit industrial soakaways and mandate onsite wastewater pre‑treatment with full recycling or safe disposal, compelling industries to adopt advanced treatment options that align with zero off‑site discharge outcomes. Similarly, Abu Dhabi’s Trade Effluent Control Regulations 2022 set legally enforceable standards for effluent quality and discharge, strengthening enforcement and inspection regimes that indirectly encourage investment in ZLD systems to meet tightening effluent caps.

Digital transformation is further accelerating this transition. The Abu Dhabi Department of Energy’s pilot of AI‑enabled smart water meters across 80 sites, feeding real‑time data into the AD.WE platform illustrates how IoT sensors and analytics are being deployed to improve monitoring, reduce losses, and enhance decision‑making across water infrastructure, a capability that directly benefits ZLD system performance and compliance.

Overall, these layered drivers, regulatory enforcement, national water reuse targets, and smart infrastructure buildup point to a steadily expanding ZLD market as industries and utilities alike invest in technologies that ensure compliance, reduce freshwater dependency, and optimize operational efficiency. As the UAE pursues its water security ambitions, ZLD systems will increasingly serve not just as compliance tools but as strategic assets for sustainable water resource management and industrial resilience.

UAE Zero Liquid Discharge System Market Recent Developments:

- January 2026: A UAE‑French consortium was selected in late 2025 to design, build, operate, and transfer a new wastewater treatment plant in Ras Al‑Khaimah, the emirate’s first PPP project in this sector, valued at around USD 120 million. This plant will help drive advanced effluent management and enable future ZLD/ reuse integrations.

- October 2025: UAE’s WETEX 2025 exhibition, global firms presented advanced water and wastewater treatment solutions with up to 99% water recycling and zero‑liquid discharge capabilities, spotlighting innovations that tackle water scarcity and enhance industrial wastewater reuse in the region.

UAE Zero Liquid Discharge System Market Scope:

| Category | Segments |

|---|---|

| Process | Pretreatment, Membrane Separation, Evaporation/Crystallization |

| Capacity | Small-Scale (<1,000 m3 per day), Medium-Scale (1,001 to 5,000 m3 per day), Large-Scale (>5,000 m3 per day) |

| Application | Brine Disposal, Chemical Waste, Food & Beverage Waste, Produced Water and Refinery Effluent, Cooling Tower and Boiler Blowdown |

| System Configuration | Membrane-Based ZLD, Thermal-Based ZLD, Hybrid ZLD systems, Others |

| Project Type | Greenfield Industrial Projects, Brownfield Retrofits and Compliance Upgrades, Capacity Expansion and Debottlenecking |

| End-Use | Oil & Gas, Energy & Power, Chemical & Petrochemicals, Food & Beverages, Pharmaceuticals, Others |

UAE Zero Liquid Discharge System Market Drivers:

Stringent Water Conservation and Discharge Regulations

In the United Arab Emirates (UAE), strict government regulations are a fundamental driver of the Zero Liquid Discharge (ZLD) systems market. The federal and emirate-level authorities have established rigorous wastewater and effluent quality standards that compel industries to adopt advanced treatment and reuse technologies. For example, Cabinet Resolution No. (39) of 2006 and related standards mandate limits on biological oxygen demand (BOD), total suspended solids (TSS), and pathogen levels in treated effluent, while emirate guidelines, such as those enforced by Abu Dhabi and Dubai municipal bodies, require high-quality treated sewage effluent for reuse in irrigation and industrial applications. These regulatory requirements align with national goals to conserve limited freshwater resources and protect environmental and public health.

The UAE Water Security Strategy 2036 further strengthens this regulatory framework by targeting a 95 % reuse rate of treated water by 2036, alongside a 21 % reduction in total water demand, thereby creating long-term incentives for industrial water recycling and ZLD adoption. Similarly, Dubai Municipality has also committed to recycling 100 % of wastewater by 2030, reducing desalinated water use by 30 % and saving an estimated USD 544 million annually.

To support sustainable water management beyond 2025, regulatory policies such as Abu Dhabi’s Recycled Water Policy promote efficient use of reclaimed water across economic sectors, expanding opportunities for ZLD integration.

Overall, as environmental standards tighten and national strategies mandate higher wastewater reuse, regulatory pressure will continue to drive ZLD system deployment, firmly anchoring market growth in compliance and sustainability.

UAE Zero Liquid Discharge System Market Trends:

Smart Monitoring & Automation Gaining Momentum

A major trend in the UAE Zero Liquid Discharge (ZLD) Systems Market is the integration of smart monitoring and automation technologies into water and wastewater infrastructure, improving operational performance and compliance. For example, Dubai Electricity and Water Authority (DEWA) has deployed an advanced Water Smart Distribution Management System that uses remote sensors, real-time monitoring, and automated control units linked with SCADA (Supervisory Control and Data Acquisition) to oversee water transmission and distribution around the clock. This digital platform has helped Dubai achieve one of the world’s lowest water network loss rates at 4.5%, substantially reducing wastage and supporting efficient resource management.

In Abu Dhabi, TAQA Water Solutions initiated a USD 25.9 million project to develop a centralized SCADA system spanning its wastewater treatment infrastructure. With over 2,000 sensors and AI-enabled analytics, the system enables real-time monitoring and predictive maintenance, cutting energy use, reducing maintenance costs, and supporting regulatory compliance across 43 treatment plants.

These smart systems align with the UAE Water Security Strategy 2036, which prioritizes digital transformation and resilient water infrastructure. By automating data collection, fault detection, and decision-making, utilities can ensure consistent treatment quality and efficient operations.

As automation expands, predictive analytics and AI will further enhance ZLD performance, making treatment plants more adaptive, cost-efficient, and compliant with evolving environmental standards.

UAE Zero Liquid Discharge System Market Challenges:

High Capital & Operational Costs

A major challenge for the UAE Zero Liquid Discharge (ZLD) Systems Market is the substantial capital and ongoing operational expenses linked with advanced wastewater treatment and reuse infrastructure. Wastewater systems, especially those involving tertiary treatment and high‑recovery processes akin to ZLD, require complex infrastructure, high‑grade materials, and energy‑intensive equipment. For example, in Dubai, treatment plants must meet tertiary treatment standards under Dubai Municipality Law No. (18) of 2024, obligating facilities to invest in high‑performance systems to comply with effluent quality limits. This regulatory requirement raises both initial investment and long‑term operating costs for industrial and municipal operators.

Operational costs are often far higher than construction costs: typical wastewater treatment facilities can spend 88 % of their total life‑cycle costs on operation and maintenance, with energy consumption and staff costs dominating expenditures due to aeration, pumping, and continuous process control. Energy intensity is especially significant in the UAE’s arid context, where power‑dependent treatment is common.

Moreover, large water infrastructure projects such as Dubai Municipality’s Strategic Sewerage Tunnel Programme, valued at USD 22 billion, highlight the scale of investment required to expand and upgrade wastewater handling capacity, indirectly pressuring budgets for complementary ZLD installations.

These high costs can deter smaller industrial players and slow ZLD adoption unless balanced with government incentives, energy‑efficient technology integration, and long‑term financing mechanisms, making cost management a central hurdle in market expansion.

UAE Zero Liquid Discharge System Market (2026-32) Segmentation Analysis:

The UAE Zero Liquid Discharge System Market Report and Forecast 2026-2032 offers a detailed analysis of the market based on the following segments:

Based on System Configuration:

- Membrane-Based ZLD

- Thermal-Based ZLD

- Hybrid ZLD systems

- Others

Hybrid ZLD systems, combining membrane separation and thermal evaporation/crystallization technologies, dominate the UAE market with a 45% share due to their ability to maximize water recovery while minimizing energy consumption. Unlike standalone membrane or thermal systems, hybrid configurations provide flexible operation for varying wastewater compositions, handle high-salinity streams efficiently, and comply with stringent discharge and reuse regulations. Industries in the UAE, particularly in free zones and high-demand industrial clusters, prefer hybrid ZLD because it balances operational cost, energy efficiency, and reliability, making it suitable for medium-to-large-scale facilities.

Additionally, the UAE’s focus on sustainable water management and reuse under the Water Security Strategy 2036 encourages the adoption of systems that achieve near-zero effluent discharge with optimized performance.

Based on End Use:

- Oil & Gas

- Energy & Power

- Chemical & Petrochemicals

- Food & Beverages

- Pharmaceuticals

- Others

The oil and gas sector dominates the UAE ZLD Industry, with 52% market share, due to the large volumes of high-salinity produced water and refinery effluents that require advanced treatment before reuse or safe disposal. ZLD systems are essential in this sector to comply with strict regulatory standards set by the Abu Dhabi Department of Energy and Dubai Municipality, which restrict effluent discharge and promote water recycling. Facilities in oilfields and refineries generate wastewater streams containing hydrocarbons, heavy metals, and dissolved salts, making conventional treatment inadequate. By implementing ZLD solutions, operators can recover water for reinjection, cooling, or industrial processes, reducing freshwater dependency in a water-scarce region.

Additionally, UAE oil and gas companies are investing heavily in sustainable and energy-efficient ZLD technologies to meet both environmental obligations and operational efficiency goals, aligning with the national Water Security Strategy 2036. This regulatory and operational imperative ensures ZLD adoption remains high in the sector.

UAE Zero Liquid Discharge System Market (2026-32): Regional Projection

The UAE ZLD system market is dominated by Abu Dhabi and Al Ain, with a market share of around 44%. These regions host the largest concentration of oil, gas, and heavy industrial facilities, which generate high-salinity and complex wastewater streams requiring advanced ZLD treatment. Abu Dhabi, in particular, has implemented strict effluent discharge regulations through the Department of Energy and mandates for sustainable water reuse under the Water Security Strategy 2036, making ZLD systems essential for regulatory compliance. Industrial clusters in Al Ain, including chemical, petrochemical, and food processing units, also require large-scale treatment solutions to reduce environmental impact and conserve freshwater resources.

Furthermore, ongoing infrastructure and smart water network investments, including digital monitoring, predictive analytics, and AI-enabled water meters, facilitate the adoption of ZLD technologies. The combination of regulatory enforcement, high industrial activity, and water reuse initiatives positions Abu Dhabi and Al Ain as the primary growth hubs for ZLD deployment in the UAE.

Gain a Competitive Edge with Our UAE Zero Liquid Discharge System Market Report:

- UAE Zero Liquid Discharge System Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- UAE Zero Liquid Discharge System Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- UAE Macro Environment for Industrial Water and Wastewater

- Water Stress and Industrial Water Economics in the UAE

- Industrial Policy and Sustainability Programs

- Industrial Clusters and Growth Nodes

- Desalination and Brine Management Context

- UAE Zero Liquid Discharge System Market Policies, Regulations, and Product Standards

- Federal and Emirate Level Environmental Requirements

- Discharge Standards and Permitting Pathways

- Industrial Wastewater Handling and Hazardous Waste Interfaces

- Compliance Cost Drivers and Penalty Risks

- ESG Reporting and Sustainability Disclosure Influence

- UAE Zero Liquid Discharge System Market Supply Chain Analysis

- EPC and System Integrators

- Technology Providers and OEMs

- Membrane and Thermal Equipment Suppliers

- Chemical Suppliers and Consumables

- Operation and Maintenance Providers

- Brine and Solid Waste Offtake and Disposal Ecosystem

- UAE Zero Liquid Discharge System Market Trends & Developments

- UAE Zero Liquid Discharge System Market Dynamics

- Growth Drivers

- Challenges

- UAE Zero Liquid Discharge System Market Hotspot & Opportunities

- UAE Zero Liquid Discharge System Market Risk & Risk Management Analysis, 2025-32

- Technical Risks: Scaling, Fouling, Corrosion

- Energy Price Volatility Risk

- Feed Variability and Operational Stability Risk

- Waste Crystals Handling and Disposal Risk

- Regulatory and Contractual Risks

- HSE Risks and Mitigation

- UAE Zero Liquid Discharge System Market Outlook, 2022-2032

- Market Size & Outlook

- By Revenues (USD Million)

- Market Share & Outlook

- By Process- Market Size & Forecast 2022-2032F, USD Million

- Pretreatment

- Membrane Separation

- Evaporation/Crystallization

- By Capacity- Market Size & Forecast 2022-2032F, USD Million

- Small-Scale (<1,000 m3 per day)

- Medium-Scale (1,001 to 5,000 m3 per day)

- Large-Scale (>5,000 m3 per day)

- By Application- Market Size & Forecast 2022-2032F, USD Million

- Brine Disposal

- Chemical Waste

- Food & Beverage Waste

- Produced Water and Refinery Effluent

- Cooling Tower and Boiler Blowdown

- By System Configuration- Market Size & Forecast 2022-2032F, USD Million

- Membrane-Based ZLD

- Thermal-Based ZLD

- Hybrid ZLD systems

- Others

- By Project Type- Market Size & Forecast 2022-2032F, USD Million

- Greenfield Industrial Projects

- Brownfield Retrofits and Compliance Upgrades

- Capacity Expansion and Debottlenecking

- By End-Use- Market Size & Forecast 2022-2032F, USD Million

- Oil & Gas

- Energy & Power

- Chemical & Petrochemicals

- Food & Beverages

- Pharmaceuticals

- Others

- By Region

- Abu Dhabi & Al Ain

- Dubai

- Sharjah & Northern Emirates

- By Company

- Company Revenue Shares

- Competitor Characteristics

- By Process- Market Size & Forecast 2022-2032F, USD Million

- Market Size & Outlook

- UAE Pretreatment Zero Liquid Discharge System Market Outlook, 2022-2032

- Market Size & Analysis

- Market Share & Analysis

- By Capacity- Market Size & Forecast 2022-2032, USD Million

- By Application - Market Size & Forecast 2022-2032, USD Million

- By System Configuration- Market Size & Forecast 2022-2032, USD Million

- By Project Type - Market Size & Forecast 2022-2032F, USD Million

- By End-Use- Market Size & Forecast 2022-2032, USD Million

- UAE Filtration Zero Liquid Discharge System Market Outlook, 2022-2032

- Market Size & Analysis

- Market Revenues (USD Million)

- Market Share & Analysis

- By Capacity- Market Size & Forecast 2022-2032, USD Million

- By Application - Market Size & Forecast 2022-2032, USD Million

- By System Configuration- Market Size & Forecast 2022-2032, USD Million

- By Project Type - Market Size & Forecast 2022-2032F, USD Million

- By End-Use- Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- UAE Evaporation/Crystallization Zero Liquid Discharge System Market Outlook, 2022-2032

- Market Size & Analysis

- Market Revenues (USD Million)

- Market Share & Analysis

- By Capacity- Market Size & Forecast 2022-2032, USD Million

- By Application - Market Size & Forecast 2022-2032, USD Million

- By System Configuration- Market Size & Forecast 2022-2032, USD Million

- By Project Type - Market Size & Forecast 2022-2032F, USD Million

- By End-Use- Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- UAE Zero Liquid Discharge System Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Aquatech International LLC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Veolia Water Technologies

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- SUEZ Water Technologies & Solutions

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Aaron Tech

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- AJG

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- WOG Technologies Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Aquarion AG

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Thermax

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Aquatech International LLC

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making