Global Venous Stents Market Research Report: Forecast (2024-2030)

Venous Stents Market Report - By Technology (Iliac Vein Stent Technology, Wall Stent Technology), By Material (Nitinol, Elgiloy), By Indication (Chronic Deep Vein Thrombosis, Post-...Thrombotic Syndrome (PTS), May- Thurner’s Syndrome, Pelvic Congestion Syndrome (PCS), Others (Hemodialysis/Arteriovenous Fistulae, Chronic Venous Insufficiency (CVI), etc.)), By Stent Design (Braided, Open Cell, Closed Cell, Hybrid), By Introducer (Size-6, Size-7, Size-8, Size-9, Size-10), By Application (Leg, Chest, Abdomen, Arm), By End User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Cardiac Catheterization Labs), Others Read more

- Healthcare

- Nov 2023

- Pages 188

- Report Format: PDF, Excel, PPT

Market Definition

Venous stents are medical devices designed to treat venous diseases and conditions by providing structural support to the veins, primarily in the lower extremities, pelvis, and abdomen. They are typically used in cases of venous insufficiency, deep vein thrombosis (DVT), and venous obstruction, among other conditions.

Market Insights & Analysis: Global Venous Stents Market (2024-30):

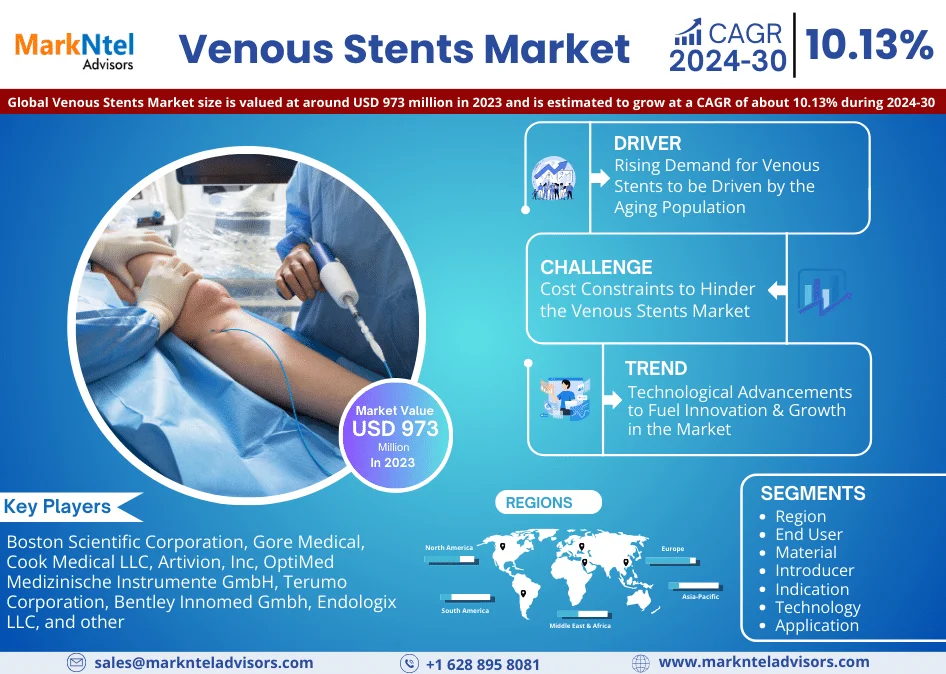

The Global Venous Stents Market size is valued at around USD 973 million in 2023 and is estimated to grow at a CAGR of about 10.13% during the forecast period, i.e., 2024-30. The market has witnessed impressive growth in recent years, and several key factors contribute to this demand. Firstly, there has been a notable increase in the prevalence of venous disease cases. For instance, according to the Centers for Disease Control and Prevention (CDC), around 900,000 individuals are affected each year in the United States, from which around 60,000-100,000 die due to venous thromboembolism.

This can be attributed to various lifestyle factors, such as sedentary habits and obesity, which are associated with conditions like chronic venous insufficiency. Additionally, as the global population continues to age, the risk of venous disorders naturally rises, as these conditions are often more common among older individuals.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 10.13% |

| Regions Covered | North America: US, Canada, Mexico |

| Europe: Germany, The UK, France, Italy, Spain, Rest of Europe | |

| Asia-Pacific: China, India, Japan, South Korea, Australia, Southeast Asia Rest of Asia-Pacific | |

| South America: Brazil, Argentina, Rest of South America | |

| Middle East & Africa: UAE, South Africa, Rest of MEA | |

| Key Companies Profiled | Boston Scientific Corporation, Gore Medical, Cook Medical LLC, Artivion, Inc, OptiMed Medizinische Instrumente GmbH, Terumo Corporation, Bentley Innomed Gmbh, Endologix LLC, Medtronic Plc, Cordis Inc., MicroPort Scientific Corporation, Abbott, plus medica GmbH & Co. KG, Koninklijke Phillips N.V., and others |

| Market Value (2023) | USD 973 Million |

Furthermore, there have been significant improvements in the diagnosis and treatment of venous diseases. Owing to this demand many companies investing in developing advanced imaging technologies and diagnostic tools to enhance the accuracy of disease identification, allowing for more targeted interventions. This, in turn, Evident Vascular launched with USD35 million funding to develop the IVUS platform which helps to capture images from inside blood vessels and has led to better patient outcomes and increased the demand for venous stenting procedures.

Moreover, the increasing adoption of minimally invasive treatment options for venous disorders has driven the demand in the market. Patients and healthcare providers are recognizing the benefits of these procedures, such as shorter recovery times and reduced hospital stays. As more countries and healthcare systems adopt minimally invasive techniques, the market for venous stents is expected to continue its upward trajectory. In essence, the Venous Stents Market would witness an upward trend driven by both the changing demographics of the population and advancements in medical practices, with a promising outlook for the foreseeable future.

Global Venous Stents Market Driver:

Rising Demand for Venous Stents to be Driven by the Aging Population – The aging population is a pivotal driver in the Global Venous Stents Market. This is primarily due to the demographic shift towards an older population, in which individuals are becoming more susceptible to venous diseases, including conditions like chronic venous insufficiency and deep vein thrombosis. This demographic shift significantly expands the market's patient pool, as elderly individuals increasingly require medical interventions, such as venous stenting procedures, to address these conditions. The market, therefore, experiences a direct uptick in demand as the aging population's healthcare needs grow.

Furthermore, older patients often have complex healthcare requirements and prioritize their quality of life, making venous stenting an attractive solution to alleviate symptoms and enhance well-being. As a result, healthcare providers and medical device manufacturers are seizing opportunities to cater to this growing segment with specialized solutions.

Global Venous Stents Market Challenge:

Cost Constraints to Hinder the Venous Stents Market – The high cost of the venous stent implantation procedure is one of the prominent challenges in the Venous Stents Market. Venous stent interventions encompass a comprehensive range of expenses, which include the procurement of the stent itself, fees for the medical team involved, the utilization of hospital facilities, and the subsequent post-operative care.

Hence, the cumulative costs incurred throughout the entire treatment process could impact the adoption of the procedures as patients seek alternative treatment options for venous diseases, such as medication or lifestyle modifications, further impacting the demand for venous stents and eventually restraining the market expansion.

Global Venous Stents Market Trend:

Technological Advancements to Fuel Innovation & Growth in the Market – The continuous innovation and development in venous stents is a new trend across the market. To improve the implantation procedures many companies are developing new products for the healthcare providers. As the number of venous disease cases increases globally, patients seek treatment with smaller delivery times, flexibility, and comfort. Thus, to cater to this demand, venous stent manufacturing companies are innovating new products. For instance:

- In 2022, Cordis received US Food and Drug Administration (FDA) approval for its S.M.A.R.T. RADIANZ Vascular Stent System, a self-expanding stent purposefully engineered for radial peripheral procedures.

These innovations in the Venous Stents Market offer alignment with technology-advanced procedures for the treatment, which would increase the demand for venous stents and accelerate the market growth in the forecast years.

Global Venous Stents Market (2024-30): Segmentation Analysis

The Global Venous Stents Market study by MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment & includes predictions for the period 2024–2030 at the global level. In accordance to the analysis, the market has been further classified as:

Based on Indication:

- Chronic Deep Vein Thrombosis

- Post-Thrombotic Syndrome (PTS)

- May-Thurner’s Syndrome

- Pelvic Congestion Syndrome (PCS)

The major share in the Venous Stents Market is held by the Chronic Deep Vein Thrombosis segment. This condition, known as Deep Vein Thrombosis (DVT), occurs when blood clots form in deep veins, typically in the legs, leading to symptoms like swelling and leg pain. DVT can be a part of a more complex condition known as venous thromboembolism (VTE), often accompanied by pulmonary embolism.

Pulmonary embolism is a potentially life-threatening complication associated with DVT, necessitating immediate medical attention when symptoms such as sudden shortness of breath, chest pain while breathing or coughing, rapid pulse, rapid breathing, feeling faint, and coughing up blood occur. Consequently, this urgency in managing DVT complications is expected to drive the demand for venous stenting procedures in the market over the forthcoming years.

Based on Application:

- Leg

- Chest

- Abdomen

- Arm

Leg segment holds the maximum demand for venous stent in the market. This is mainly attributed to the prevalence of venous diseases in the lower extremities, such as deep vein thrombosis (DVT) and chronic venous insufficiency. These conditions affect the veins in the legs, necessitating venous stent procedures to improve blood flow and alleviate associated symptoms. Consequently, this impacts the demand for venous stents in the market.

Global Venous Stents Market (2024-30): Regional Projection

Geographically, the Global Venous Stents Market expands across:

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

North America accounts for the largest share of the Venous Stents Market. The growing aging population in the region, as individuals grow older, their susceptibility to venous diseases, such as deep vein thrombosis and chronic venous insufficiency, increases, and the demand for venous stents also upscale. This demographic shift has led to a higher patient pool in need of medical intervention, including venous stent procedures.

Furthermore, the region has well-established and modern healthcare systems that enable access to cutting-edge medical technology and experience. This guarantees that patients have access to the most up-to-date treatment choices, such as venous stenting, which is frequently regarded as a preferable way for controlling venous problems due to its minimally invasive nature and effectiveness.

Also, there is a growing awareness of venous diseases and their available treatment options among both healthcare professionals and the general population. This impacts the early diagnosis and proactive treatment, which drives the demand for venous stent procedures across the region.

Global Venous Stents Industry Recent Development:

- 2023: Terumo received FDA approval in the USA to expand the indications for its RelayPro stent graft system, allowing it to be used for dissection and transection cases.

- 2023: Bentley Innomed Gmbh acquired Qmedics to expand the portfolio of self-expanding stents for peripheral endovascular procedures into the field of interventional radiology.

Gain a Competitive Edge with Our Global Venous Stents Market Report

-

Global Venous Stents Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

-

This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Venous Stents Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Venous Stents Market Trends & Insights

- Global Venous Stents Market Dynamics

- Drivers

- Challenges

- Global Venous Stents Market Hotspot & Opportunities

- Global Venous Stents Market Policies, Regulations, Product Standards

- Global Venous Stents Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology

- Iliac Vein Stent Technology- Market Size & Forecast 2019-2030F, USD Million

- Wall Stent Technology- Market Size & Forecast 2019-2030F, USD Million

- By Material

- Nitinol- Market Size & Forecast 2019-2030F, USD Million

- Elgiloy- Market Size & Forecast 2019-2030F, USD Million

- By Indication

- Chronic Deep Vein Thrombosis- Market Size & Forecast 2019-2030F, USD Million

- Post-Thrombotic Syndrome (PTS)- Market Size & Forecast 2019-2030F, USD Million

- May- Thurner’s Syndrome- Market Size & Forecast 2019-2030F, USD Million

- Pelvic Congestion Syndrome (PCS)- Market Size & Forecast 2019-2030F, USD Million

- Others (Hemodialysis/Arteriovenous Fistulae, Chronic Venous Insufficiency (CVI), etc.)- Market Size & Forecast 2019-2030F, USD Million

- By Stent Design

- Braided- Market Size & Forecast 2019-2030F, USD Million

- Open Cell- Market Size & Forecast 2019-2030F, USD Million

- Closed Cell- Market Size & Forecast 2019-2030F, USD Million

- Hybrid- Market Size & Forecast 2019-2030F, USD Million

- By Introducer

- Size-6- Market Size & Forecast 2019-2030F, USD Million

- Size-7- Market Size & Forecast 2019-2030F, USD Million

- Size-8- Market Size & Forecast 2019-2030F, USD Million

- Size-9- Market Size & Forecast 2019-2030F, USD Million

- Size-10- Market Size & Forecast 2019-2030F, USD Million

- By Application

- Leg- Market Size & Forecast 2019-2030F, USD Million

- Chest- Market Size & Forecast 2019-2030F, USD Million

- Abdomen- Market Size & Forecast 2019-2030F, USD Million

- Arm- Market Size & Forecast 2019-2030F, USD Million

- By End User

- Hospitals- Market Size & Forecast 2019-2030F, USD Million

- Ambulatory Surgical Centers- Market Size & Forecast 2019-2030F, USD Million

- Specialty Clinics- Market Size & Forecast 2019-2030F, USD Million

- Cardiac Catheterization Labs- Market Size & Forecast 2019-2030F, USD Million

- By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- By Competition

- Market Share of Top Companies

- Competition Characteristics

- By Technology

- Market Size & Analysis

- North America Venous Stents Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast 2019-2030F, USD Million

- By Material- Market Size & Forecast 2019-2030F, USD Million

- By Indication- Market Size & Forecast 2019-2030F, USD Million

- By Stent Design- Market Size & Forecast 2019-2030F, USD Million

- By Introducer- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By End User- Market Size & Forecast 2019-2030F, USD Million

- By Country

- The US

- Canada

- Mexico

- The US Venous Stents Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast 2019-2030F, USD Million

- By Material- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- Canada Venous Stents Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast 2019-2030F, USD Million

- By Material- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- Mexico Venous Stents Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast 2019-2030F, USD Million

- By Material- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- Market Size & Analysis

- South America Venous Stents Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast 2019-2030F, USD Million

- By Material- Market Size & Forecast 2019-2030F, USD Million

- By Indication- Market Size & Forecast 2019-2030F, USD Million

- By Stent Design- Market Size & Forecast 2019-2030F, USD Million

- By Introducer- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By End User- Market Size & Forecast 2019-2030F, USD Million

- By Country

- Brazil

- Argentina

- Rest of South America

- Brazil Venous Stents Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast 2019-2030F, USD Million

- By Material- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- Argentina Venous Stents Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast 2019-2030F, USD Million

- By Material- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Europe Venous Stents Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast 2019-2030F, USD Million

- By Material- Market Size & Forecast 2019-2030F, USD Million

- By Indication- Market Size & Forecast 2019-2030F, USD Million

- By Stent Design- Market Size & Forecast 2019-2030F, USD Million

- By Introducer- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By End User- Market Size & Forecast 2019-2030F, USD Million

- By Country

- Germany

- The UK

- France

- Italy

- Spain

- Rest of Europe

- Germany Venous Stents Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast 2019-2030F, USD Million

- By Material- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- The UK Venous Stents Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast 2019-2030F, USD Million

- By Material- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- France Venous Stents Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast 2019-2030F, USD Million

- By Material- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- Italy Venous Stents Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast 2019-2030F, USD Million

- By Material- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- Spain Venous Stents Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast 2019-2030F, USD Million

- By Material- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Venous Stents Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast 2019-2030F, USD Million

- By Material- Market Size & Forecast 2019-2030F, USD Million

- By Indication- Market Size & Forecast 2019-2030F, USD Million

- By Stent Design- Market Size & Forecast 2019-2030F, USD Million

- By Introducer- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By End User- Market Size & Forecast 2019-2030F, USD Million

- By Country

- The UAE

- South Africa

- Rest of the Middle East & Africa

- GCC Venous Stents Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast 2019-2030F, USD Million

- By Material- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- The UAE Venous Stents Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast 2019-2030F, USD Million

- By Material- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- South Africa Venous Stents Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast 2019-2030F, USD Million

- By Material- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Venous Stents Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast 2019-2030F, USD Million

- By Material- Market Size & Forecast 2019-2030F, USD Million

- By Indication- Market Size & Forecast 2019-2030F, USD Million

- By Stent Design- Market Size & Forecast 2019-2030F, USD Million

- By Introducer- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By End User- Market Size & Forecast 2019-2030F, USD Million

- By Country

- China

- India

- Japan

- South Korea

- Australia

- Southeast Asia

- Rest of Asia-Pacific

- China Venous Stents Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast 2019-2030F, USD Million

- By Material- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- India Venous Stents Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast 2019-2030F, USD Million

- By Material- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- Japan Venous Stents Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast 2019-2030F, USD Million

- By Material- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- South Korea Venous Stents Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast 2019-2030F, USD Million

- By Material- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- Australia Venous Stents Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast 2019-2030F, USD Million

- By Material- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- Southeast Asia Venous Stents Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast 2019-2030F, USD Million

- By Material- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Global Venous Stents Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Boston Scientific Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Becton, Dickinson Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Gore Medical

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Cook Medical LLC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Artivion, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- OptiMed Medizinische Instrumente GmbH

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Terumo Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Bentley Innomed Gmbh

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Endologix LLC.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Medtronic Plc

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Cordis Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- MicroPort Scientific Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Abbott

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- plus medica GmbH & Co. KG

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Koninklijke Phillips N.V.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Boston Scientific Corporation

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making