Global Vehicle Diagnostics Market Research Report: Forecast (2025-2030)

Vehicle Diagnostics Market Size - By Offering (Hardware, (Diagnostic Scanners, Handheld Devices, Adapters and Connectors, Others (Battery Testers, Analysers, etc.)), Software)), By... Vehicle Type (Passenger Vehicles, Commercial Vehicles, (Light Commercial Vehicles, Medium & Heavy Commercial Vehicles)), By Propulsion (ICE (Internal Combustion Engine), Electric), By Application (Automatic Crash Notification, Vehicle Tracking, Vehicle Health Alert, Roadside Assistance, Others (Vehicle Telematics, Emission Testing, etc.)), By End User (Automotive OEMs, Service Stations & Workshops, Fleet Operators, Government & Regulatory Bodies), and Others Read more

- Automotive

- Jul 2025

- Pages 187

- Report Format: PDF, Excel, PPT

Market Definition

Vehicle diagnostics is the detection, analysis, and diagnosis of problems that may have occurred in a vehicle using special tools and software. The vehicle diagnostic systems gain access to a vehicle's computer via an onboard diagnostic port, reading data from the system, and using that data to trace faults and malfunctions of a vehicle. Such data may include operations of its engine, transmission, brakes, etc.

Market Insights & Analysis: Global Vehicle Diagnostics Market (2025-30):

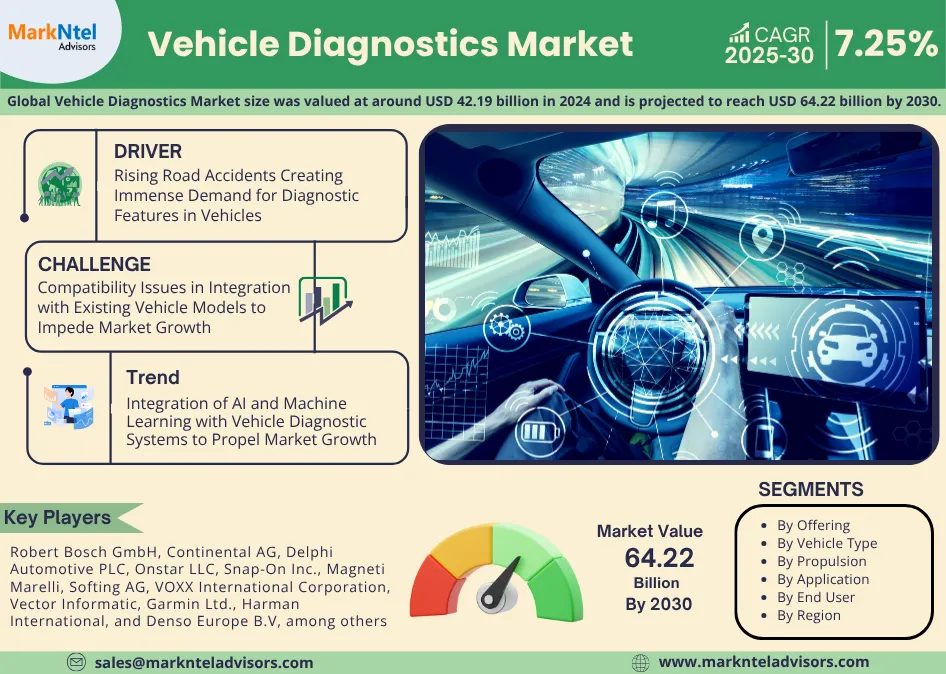

The Global Vehicle Diagnostics Market size was valued at around USD 42.19 billion in 2024 and is projected to reach USD 64.22 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 7.25% during the forecast period 2025-30. This market growth is attributed to the new vehicles that are getting increasingly complicated with their electronics, sensors, and software. Modern cars, buses, trucks, etc., have sophisticated electronic systems like advanced driver-assistance systems, autonomous driving technologies, infotainment systems, and electric powertrains. Such systems demand more sophisticated and accurate diagnostic tools to make sure that all systems work at the highest possible level of performance. Features such as lane-keeping assist, adaptive cruise control, and collision avoidance systems of ADAS require continuous monitoring and diagnostics for safety and reliability. With this increasing sophistication of vehicles, the demand for diagnostic tools and software to effectively monitor and maintain these systems is growing significantly, thereby boosting market size & volume.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020–23 |

| Base Years | 2024 |

| Forecast Years | 2025–30 |

| Market Value in 2024 | USD 42.19 Billion |

| Market Value by 2030 | USD 64.22 Billion |

| CAGR (2025–30) | 7.25% |

| Leading Region | Europe |

| Top Key Players | Robert Bosch GmbH, Continental AG, Delphi Automotive PLC, Onstar LLC, Snap-On Inc., Magneti Marelli, Softing AG, VOXX International Corporation, Vector Informatic, Vidiwave Ltd., Pioneer Incorporation, Alpine Electronics Inc., Garmin Ltd., Harman International, and Denso Europe B.V, among others |

| Segmentation | By Offering (Hardware, (Diagnostic Scanners, Handheld Devices, Adapters and Connectors, Others (Battery Testers, Analysers, etc.)), Software)), By Vehicle Type (Passenger Vehicles, Commercial Vehicles, (Light Commercial Vehicles, Medium & Heavy Commercial Vehicles)), By Propulsion (ICE (Internal Combustion Engine), Electric), By Application (Automatic Crash Notification, Vehicle Tracking, Vehicle Health Alert, Roadside Assistance, Others (Vehicle Telematics, Emission Testing, etc.)), By End User (Automotive OEMs, Service Stations & Workshops, Fleet Operators, Government & Regulatory Bodies), and Others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

Moreover, with rising environmental concerns and stringent emission norms, the world automobile industry is moving towards electric and hybrid vehicles. The governments across the world have framed policies and fiscal incentives for cutting carbon emissions, leading automobile manufacturers to accelerate their production of EV/hybrid vehicles. Also, the growing consumer awareness and demand for cleaner transportation, coupled with improvements in battery technology, have further improved the range, performance, and affordability of EVs, further accelerating this shift. For instance,

- In 2023, according to the International Energy Agency, China witnessed around 8.1 million new electric car registrations, an increase of 35% relative to 2022.

As more and more electric and hybrid vehicles have been launched in the market, they have been incorporated with a wide array of complexities. These vehicles use state-of-the-art systems that include high-voltage batteries, electric motors, power electronics, and regenerative braking, each requiring individually developed and rather sophisticated diagnostic approaches. In addition, complex software and control systems used in EVs and hybrids require diagnostic tools that can download and analyze data and update software. All this, in turn, has been generating a huge demand for vehicle diagnostics systems and solutions across the globe. With increasing complexities in vehicles and growing demand for electric and hybrid vehicles, the vehicle diagnostic segment is also growing at a tremendous pace, thereby fueling the growth of the Global Vehicle Diagnostics Market.

Global Vehicle Diagnostics Market Driver:

Rising Road Accidents Creating Immense Demand for Diagnostic Features in Vehicles – Fast urbanization and expansion of road networks have been increasing vehicle ownership and traffic density worldwide. With more vehicles on the road, the risk of accidents is also surging in developing countries where infrastructure development is usually not parallel to this growth in traffic. The poorly maintained vehicles and improper services of vehicles further lead to incidents such as brake failures, system crashes, airbags remaining closed, etc. This has resulted in severe road accidents and casualties across the globe. For instance,

- In 2023, according to the World Health Organization (WHO), the number of annual road traffic deaths was about 1.19 million globally.

To mitigate such situations, regular diagnosis is carried out to detect impending failures of the critical components like brakes, tires, and steering systems, creating the demand for vehicle diagnosis systems. This proactive approach in the maintenance of vehicles greatly reduces the risk of an accident occurring due to mechanical failure. Furthermore, the integration of telematics and connected vehicle technologies in Vehicle Diagnostics solutions makes provision for real-time monitoring and diagnostics, which enables fleet operators and individual drivers to receive real-time alerts on impending safety issues. This not only helps in avoiding accidents but also in post-accident analysis by providing data of value in improving vehicle standards of safety standards and design. Hence, surging road accidents dictate the need for Vehicle Diagnostics, thereby proliferating the growth of the Global Vehicle Diagnostics Market.

Global Vehicle Diagnostics Market Challenge:

Compatibility Issues in Integration with Existing Vehicle Models to Impede Market Growth – Compatibility issues of the diagnostic system with the earlier models of vehicles pose a major barrier to the growth of the vehicle diagnostic market at a global level. The automotive industry continues to advance at a very fast pace, with vehicles designed through highly diversified electronic systems, sensors, and software across different manufacturers, models, and years of production. This creates an extremely complex environment wherein a single diagnostic tool cannot be designed to work with every vehicle. Most of the older vehicles are not fitted with the standard OBD-II ports, which create a barrier in the integration of advanced vehicle diagnostic systems. Furthermore, most of them lack the electronic architecture that supports modern diagnostics without the use of specialized or legacy tools, making it very difficult for a service provider to diagnose the problems accurately.

Moreover, vehicle manufacturers often design their vehicles with proprietary software and communication protocols, which add to the complications in diagnosis. Such systems often require special tools that do not work with third-party diagnostic tools to prevent independent repair shops or any aftermarket service provider from running full diagnostics. The aftermarket gets affected due to these compatibility issues, preventing the vehicle diagnosis market from developing on a global scale. It results in forcing service providers to invest in multiple devices and software updates to cover a broad range of vehicles. This not only increases costs but also adds complexity to the diagnostic process, hampering the growth of the overall Global Vehicle Diagnostics Market.

Global Vehicle Diagnostics Market Trend:

Integration of AI and Machine Learning with Vehicle Diagnostic Systems to Propel Market Growth – The increasing complexity of today's vehicles, which includes such modern systems as ADAS, electric powertrains, and connected technologies, has been putting AI increasingly into integration with Vehicle Diagnostics. AI allows real-time analysis of high-volume data from sensors and ECUs (Electric Control Units), improving the detection of faults and consequently predicting issues before failures. Thus, more efficient maintenance, reduced downtime, and increased safety of vehicles can be achieved. Moreover, AI personalizes diagnostics according to driving patterns to ensure optimum performance. Now, as these vehicles are more efficient, AI-driven diagnostics become an important part of their management and maintenance in keeping such systems running effectively and reliably. This has seen companies like V2M, Launch AI, SERP AI, etc., integrating AI in their vehicle diagnostic systems and solutions to provide more reliable and efficient data.

Moreover, AI makes it easy to develop friendly user interfaces for diagnostic tools, such as mobile apps providing real-time vehicle health updates and alerts to the driver, thus opening up advanced diagnostics even more to ordinary drivers. Hence, increasing the demand for AI and ML-powered diagnosis systems in vehicles globally.

Global Vehicle Diagnostics Market (2025-30): Segmentation Analysis

The Global Vehicle Diagnostics Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the global level. Based on the analysis, the market has been further classified as:

Based on Offering:

- Hardware

- Diagnostic Scanners

- Handheld Devices

- Adapters & Connectors

- Others (Battery Testers, Analyzers, etc.)

- Software

Out of both, the hardware segment holds a considerable market share of around 56% in the Vehicle Diagnostics Industry globally. Diagnostic hardware or tools, such as scan tools, code readers, and handhelds, are required to communicate directly with the vehicle's onboard diagnostics system, surging their demand and adoption. These tools are critical in providing immediate, accurate data on vehicle performance, making them indispensable for both professionals and repair shops. Specialized diagnostic tools are required to address complications in modern vehicles, particularly in advanced driver-assistance systems or electric powertrains. This creates the demand for highly specialized tools, such as oscilloscopes and engine analyzers, to diagnose problems in sophisticated systems that require extensive analysis, which further surges hardware adoption. Moreover, adapters and connectors are equally important in ensuring compatibility between diagnostic tools and various vehicle interfaces, which further increases the demand for hardware components.

Thus, hardware components form one of the integral parts of the vehicle diagnostic systems. Although software and services are equally important, with increasing cloud-based diagnostics and remote vehicle monitoring, they need strong hardware to support their operation, which supplements the growth of the hardware segment in the Global Vehicle Diagnostics Market.

Based on End User:

- Automotive OEMs

- Service Stations & Workshops

- Fleet Operators

- Government & Regulatory Bodies

Based on end users, the service stations & workshops segment holds a substantial share of the market of about 47% owing to the diversity of vehicles. As they provide services to a sheer volume of vehicles, as compared to OEMs and fleet operators. The service stations and workshops have a huge diversity of vehicles from various brands. As a result, they have different diagnostic tools suiting different kinds of vehicles and models, thereby surging their demand and adoption in the service centers. Moreover, as service centers and workshops offer services to a diverse consumer base, they have to invest heavily in new and technologically advanced diagnostic tools, which further increase their adoption.

Moreover, most of the fleet in Europe and North America is composed of older vehicles that remain in service for a longer period, hence increasing the demand for diagnostics in service stations and workshops. Accurate diagnostics in older cars are highly required by consumers. Older vehicles need servicing and repairs more frequently, so identification of impending problems at an early stage can help avoid expensive failures. Independent workshops and service stations are the major providers of such services and are, anyway, more common in older cars outside of warranty or service campaigns from OEM stations, which increases the adoption of diagnostic tools in service centers, propelling market growth & expansion.

Global Vehicle Diagnostics Market (2025-30): Regional Projection

Geographically, the Global Vehicle Diagnostics Market expands across:

- North America

- South America

- Europe

- The Middle East and Africa

- Asia-Pacific

Of them all, Europe is anticipated to dominate the market with the largest share of around 33% during the forecast period. The strict regulations by European authorities on vehicle emissions and safety have made it imperative to equip any vehicle with the latest OBDs. For instance, EU Euro 6 standards require complete monitoring of emissions; therefore, sophisticated diagnostic tools are key to meet such demand for compliance. This creates immense demand for diagnostic solutions that monitor and report on emissions and vehicle performance accurately.

Besides, the majority of leading vehicle companies and tier-one suppliers such as Volkswagen, BMW, Daimler, etc., are located in Europe. Companies of this nature naturally favor innovating vehicle technologies and, hence, diagnostic systems. These leading automotive players drive demand for advanced diagnostics that can support new models and technologies of vehicles, particularly e-mobility and hybrid drive trains that require specialized diagnostic tools.

The European market is also characterized by a high level of technological adoption and a strong focus on vehicle safety and maintenance. With this, European consumers and fleet operators are increasingly calling for advanced diagnostic solutions that would bring in real-time data, predictive maintenance, and improve vehicle performance monitoring. This demand is further enhanced by well-built infrastructural support across the region for vehicle repair and maintenance, comprising a line of authorized service centers and independent workshops kitted with state-of-the-art diagnostic tools, which in turn are driving the growth of Europe in the Global Vehicle Diagnostics Market.

Global Vehicle Diagnostics Industry Recent Development:

- 2024: Robert Bosch GmbH released the ADS X 6.0 software update, introducing advanced topology views, 57% faster scan speeds, battery voltage indicators, and expanded diagnostic support for 2018–2024 vehicle models, enhancing workshop efficiency and multi-brand service capabilities.

- 2024: Bosch’s subsidiary ETAS demonstrated connected, cloud-enabled diagnostic tools for commercial trucks at IAA Transportation, featuring live remote monitoring, guided diagnostics, and fuel-cell vehicle health tracking via handheld workshop devices.

Gain a Competitive Edge with Our Global Vehicle Diagnostics Market Report

- Global Vehicle Diagnostics Market by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Vehicle Diagnostics Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Vehicle Diagnostics Market Supply Chain Analysis

- Global Vehicle Diagnostics Market Trends & Insights

- Global Vehicle Diagnostics Market Dynamics

- Growth Drivers

- Challenges

- Global Vehicle Diagnostics Market Hotspot & Opportunities

- Global Vehicle Diagnostics Market Government Regulations and Policies

- Global Vehicle Diagnostics Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Offering

- Hardware- Market Size & Forecast 2020-2030, USD Million

- Diagnostic Scanners- Market Size & Forecast 2020-2030, USD Million

- Handheld Devices- Market Size & Forecast 2020-2030, USD Million

- Adapters and Connectors- Market Size & Forecast 2020-2030, USD Million

- Others (Battery Testers, Analysers, etc.) - Market Size & Forecast 2020-2030, USD Million

- Software- Market Size & Forecast 2020-2030, USD Million

- Hardware- Market Size & Forecast 2020-2030, USD Million

- By Vehicle Type

- Passenger Vehicles- Market Size & Forecast 2020-2030, USD Million

- Commercial Vehicles- Market Size & Forecast 2020-2030, USD Million

- Light Commercial Vehicles- Market Size & Forecast 2020-2030, USD Million

- Medium & Heavy Commercial Vehicles - Market Size & Forecast 2020-2030, USD Million

- By Propulsion

- ICE (Internal Combustion Engine) - Market Size & Forecast 2020-2030, USD Million

- Electric - Market Size & Forecast 2020-2030, USD Million

- By Application

- Automatic Crash Notification- Market Size & Forecast 2020-2030, USD Million

- Vehicle Tracking - Market Size & Forecast 2020-2030, USD Million

- Vehicle Health Alert- Market Size & Forecast 2020-2030, USD Million

- Roadside Assistance- Market Size & Forecast 2020-2030, USD Million

- Others (Vehicle Telematics, Emission Testing, etc.) - Market Size & Forecast 2020-2030, USD Million

- By End User

- Automotive OEMs- Market Size & Forecast 2020-2030, USD Million

- Service Stations & Workshops- Market Size & Forecast 2020-2030, USD Million

- Fleet Operators- Market Size & Forecast 2020-2030, USD Million

- Government & Regulatory Bodies- Market Size & Forecast 2020-2030, USD Million

- By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- By Company

- Competition Characteristics

- Market Shares & Analysis

- By Offering

- Market Size & Analysis

- North America Vehicle Diagnostics Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2020-2030, USD Million

- By Propulsion- Market Size & Forecast 2020-2030, USD Million

- By Application- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- By Country

- The US

- Canada

- Mexico

- The US Vehicle Diagnostics Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Canada Vehicle Diagnostics Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Mexico Vehicle Diagnostics Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- South America Vehicle Diagnostics Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2020-2030, USD Million

- By Propulsion- Market Size & Forecast 2020-2030, USD Million

- By Application- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- By Country

- Brazil

- Argentina

- Rest of South America

- Brazil Vehicle Diagnostics Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Argentina Vehicle Diagnostics Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Europe Vehicle Diagnostics Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2020-2030, USD Million

- By Propulsion- Market Size & Forecast 2020-2030, USD Million

- By Application- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- By Country

- Germany

- The UK

- France

- Italy

- Spain

- Others

- Germany Vehicle Diagnostics Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- The UK Vehicle Diagnostics Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- France Vehicle Diagnostics Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Italy Vehicle Diagnostics Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Spain Vehicle Diagnostics Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Vehicle Diagnostics Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2020-2030, USD Million

- By Propulsion- Market Size & Forecast 2020-2030, USD Million

- By Application- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- By Country

- The UAE

- Saudi Arabia

- South Africa

- Rest of the Middle East and Africa

- The UAE Vehicle Diagnostics Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Saudi Arabia Vehicle Diagnostics Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- South Africa Vehicle Diagnostics Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Vehicle Diagnostics Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Size & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2020-2030, USD Million

- By Propulsion- Market Size & Forecast 2020-2030, USD Million

- By Application- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- By Country

- China

- Japan

- India

- South Korea

- Australia

- Others

- China Vehicle Diagnostics Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Japan Vehicle Diagnostics Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- India Vehicle Diagnostics Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- South Korea Vehicle Diagnostics Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Australia Vehicle Diagnostics Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Global Vehicle Diagnostics Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profile

- Robert Bosch GmbH

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Continental AG

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Delphi Automotive PLC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Onstar LLC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Snap-On Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Magneti Marelli

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Softing AG

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- VOXX International Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Vector Informatic

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Vidiwave Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Pioneer Incorporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Alpine Electronics Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Garmin Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Harman International

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Denso Europe B.V

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Robert Bosch GmbH

- Company Profile

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making