US PFAS Water Treatment Market Research Report: Forecast (2023-2028)

By Technology (Reverse Osmosis, Granular Activated Carbon Filter, ion Exchange Resins), By End User (Industrial[Oil & Gas, Pharmaceutical, Chemical Manufacturing, Mining & Mineral ...Processing, Food & Beverage, Pulp & Paper, Others (Agriculture, Power Generation, etc.)], Commercial [Airports & Military Bases, Hospitality, Healthcare, Others (education Institutions, Offices, etc)], Municipal [Drinking Water Treatment, Waste Water Treatment]), By Company (Cyclopure, Inc., Pentair , A.O. Smith, Aquasana Inc., TIGG LLC, Express Water Inc., Eloqua Water Technologies LLC, Ion Exchange, Pre Aqua Inc., Hydroviv, Others), Read more

- Chemicals

- Feb 2023

- Pages 121

- Report Format: PDF, Excel, PPT

Market Definition

The perfluoroalkyl and poly-fluoroalkyl substances (PFAS) are a set of chemicals that are used in numerous industries such as food, textiles, and personal care. They act as surfactants with carbon-fluorine bonds that make highly stable ingredients. PFAs are bio-accumulative, toxic in nature, and significantly peripatetic in water which leads to the requirement for the treatment of water for PFAS.

Market Insights & Analysis: The US PFAS Water Treatment Market (2023-28)

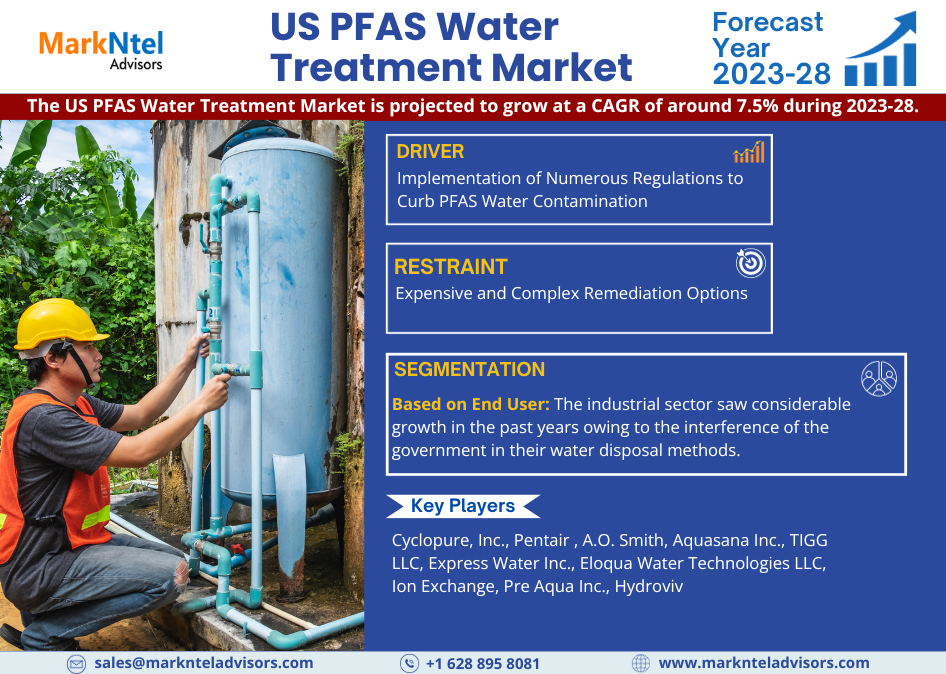

The US PFAS Water Treatment Market is projected to grow at a CAGR of around 7.5% during the forecast period, i.e., 2023-28. The US PFAS water treatment gained momentum owing to the mounting concerns about the PFAs present in the water. Customers are getting aware of the adverse effects of drinking water contaminated with PFAS as several studies have shown that such water could result in kidney cancer, ulcerative colitis, fertility problems, a higher risk of cardiovascular disease, respiratory disease, and diabetes, liver diseases, thyroid disease, and high cholesterol. The concerns have risen significantly as the PFAs are used in numerous industries such as food, textiles, and personal care products owing to which they are pervasive. The widespread usage of PFAs ultimately lets them contaminate the water. Owing to the rising water contamination several regulations have been issued by the US authorities to necessitate the treatment of water for PFAs.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 7.5% |

| Key Companies Profiled | Cyclopure, Inc., Pentair , A.O. Smith, Aquasana Inc., TIGG LLC, Express Water Inc., Eloqua Water Technologies LLC, Ion Exchange, Pre Aqua Inc., Hydroviv, Others |

| Unit Denominations | USD Million/Billion |

However, the government faced hurdles as the private and public water treatment plants were not designed to treat water for the chemicals like PFAS. Not only the updating for the same was an expense but also it hampered their prevailing revenue-generating models. For instance,

- The public utility managing Merrimack, New Hampshire’s wastewater made nearly USD0.4 million yearly by turning sludge into compost and selling the same as fertilizer. Due to PFAS contamination measures, the revenue model will vanish and the plant would instead have to pay around USD2.4 million yearly as landfill charges.

Nevertheless, with the rising concerns related to health & demand for sustainability, the government has been able to enforce restrictions on the disposal of PFAS into the water by these industries. Furthermore, the development in the industries like paper & textile supports the air of sustainability and thus encourages the installation of PFAS water treatment in their industries, further enhancing the market size. According to American Forest & Paper Association, customers are opting for sustainable options like containerboard which are resulting in the industries ready themselves accordingly.

Additionally, the growth of the industrial sector has also been adding to the new sources for the addition of PFAS in water. The combination of the regulatory framework for the release of the rejected water from these industries increases the market size of PFAS water treatment.

Market Segmentation

Based on Technology:

- Reverse Osmosis

- Granular Activated Carbon Filter

- Ion Exchange Resins

From the above, reverse osmosis technology has been a widely used water treatment method as it had been a convenient way for end users to eliminate PFAs in their drinking water supplies. To provide potable water devoid of PFAs several drinking water treatment plants had been established to provide drinking water in packaged bottles. Moreover, the granular activated carbon filter has also been a popular choice for water treatment owing to its easy incorporation into the water treatment facility.

Based on End User:

- Industrial

- Oil & Gas

- Pharmaceutical

- Chemical Manufacturing

- Mining & Mineral Processing

- Food & Beverage

- Pulp & Paper

- Others (Agriculture, Power Generation, etc.)

- Commercial

- Airports & Military Bases

- Hospitality

- Healthcare

- Others (education Institutions, Offices, etc)

- Municipal

- Drinking Water Treatment

- Waste Water Treatment

Above them all, the industrial sector saw considerable growth in the past years owing to the interference of the government in their water disposal methods. As the treatment of water for PFAs on a large scale is not economically and environmentally feasible, the United States Environmental Protection Agency has formed regulatory requirements to control the PFAs in the water at the source level. This increases the demand for PFAs water treatment in the industries such as metal, paper, and textile. These regulations are expected to get stringent in the forecast years owing to the rising health and environmental concerns, which would raise the demand for PFAS water treatment.

Recent Developments by Leading Companies

- Pentair Acquired Manitowoc Ice from Welbilt, Inc. in 2022 to expand its network of customers and partners and to provide water management solutions to them. The acquisition was done for USD1.6 billion.

- In 2022, AO Smith Corporation acquired Atlantic Filter Corporation a Florida-based water treatment company to expand its reach in the US. The acquisition would also help the company to advance its capabilities.

Market Dynamics:

Key Driver

- Implementation of Numerous Regulations to Curb PFAS Water Contamination

The US government is highly concerned about the PFAS in water owing to its bio-accumulate and toxic nature. Subsequently, the government imposed several restrictions on the industries enforcing them to install water treatment plants to prevent the release of PFAS-dissolved water into the water sources while disposing of the rejected water. The formation of regulations has sped up in the recent year due to the PFAS Strategic Roadmap announced by the United States Environmental Protection Agency in 2021. In the upcoming years, with the high attention of the government to reduce the quantity of PFAS in the water combined with the ongoing research & development the number of regulations is predicted to increase. The constant research & development in the area of PFAS equip the government with novel solutions that led to the formulation of new rules and guidelines for the industries and municipalities.

Possible Restraint

- Expensive and Complex Remediation Options

The techniques surrounding the treatment and detection of PFAS are still evolving. They have the such staying power that clean-up and remediation alternatives are restricted and expensive, worsened by the fact that not all PFAS are the same. Because of varying degrees of toxicity, precise testing and detection are challenging. In addition, the expenses of investigation, repair, or treatment will significantly rise as laws tighten. For example, Orange County, California, estimated that around USD1 billion would be required to set up a structure to meet the state-recommended levels of PFAS in drinking water. As more scientific data on the substances are gathered, many governments worldwide have already banned or phased out specific PFAS. However, concerns about the safety of alternative PFAS, which may also prove toxic in the future, as well as contamination from legacy PFAS, continue to exist. Therefore, the economic impracticality of the treatment restricts the market growth in the capitalist economy of the US in the upcoming years as the government has to maintain the balance of growth of the industrial sector and the campaign for the adoption of PFAS water treatment.

Growth Opportunity

- Mounting Concern for PFAS’ Expanding Presence

The publications of reports and research papers have fueled the thoughtfulness of the PFAS dissolved in water. This opens up and prospect for the companies to advertise and promote their service of PFAS water treatment. The bio-accumulative nature of PFAS pushes the swift requirement for water treatment in the US as if more time is taken in action the more it would get integrated into the environment and the tougher it would be to get rid of it. The rising awareness has made the citizens realize this effect and made them raise the demand for PFAS water treatment.

Gain a Competitive Edge with Our US PFAS Water Treatment Market Report

- The US PFAS Water Treatment Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- The US PFAS Water Treatment Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- The US PFAS Water Treatment Market Trends & Insights

- The US PFAS Water Treatment Market Dynamics

- Growth Drivers

- Challenges

- The US PFAS Water Treatment Market Value Chain Analysis

- The US PFAS Water Treatment Market Policies & Regulations

- The US PFAS Water Treatment Market Hotspot & Opportunities

- The US PFAS Water Treatment Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology

- Reverse Osmosis

- Granular Activated Carbon Filter

- ion Exchange Resins

- By End User

- Industrial

- Oil & Gas

- Pharmaceutical

- Chemical Manufacturing

- Mining & Mineral Processing

- Food & Beverage

- Pulp & Paper

- Others (Agriculture, Power Generation, etc.)

- Commercial

- Airports & Military Bases

- Hospitality

- Healthcare

- Others (education Institutions, Offices, etc)

- Municipal

- Drinking Water Treatment

- Waste Water Treatment

- Industrial

- By Competitors

- Competition Characteristics

- Market Share & Analysis

- By Technology

- Market Size & Analysis

- The US Reverse Osmosis Based-PFAS Water Treatment Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- Point-of-use reverse osmosis systems

- Whole house reverse osmosis systems

- By Type

- By End User

- Market Size & Analysis

- The US Granular Activated Carbon Filter Based-PFAS Water Treatment Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End User

- Market Size & Analysis

- The US ion Exchange Resins Based-PFAS Water Treatment Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Resin Matrix

- Gel Type Ion Exchange Resins

- Macroporous Type Ion Exchange Resins

- By Type

- Cationic

- Anionic

- By End User

- By Resin Matrix

- Market Size & Analysis

- The US PFAS Water Treatment Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Competition Matrix

- Target Markets

- Research & Development

- Collaborations & Strategic Alliances

- Key Business Expansion Initiatives

- Business Restructuring- Mergers, Acquisitions, JVs

- Strategic Initiatives

- Company Profiles (Business Description, Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Cyclopure, Inc.

- Pentair

- A.O. Smith

- Aquasana Inc.

- TIGG LLC

- Express Water Inc.

- Eloqua Water Technologies LLC

- Ion Exchange

- Pre Aqua Inc.

- Hydroviv

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making