UAE Wires and Cables Market Research Report: Forecast (2022-27)

By Type (Fiber Optic Cables, Telecom & Data Cables, Coaxial cable/Electronic wire, Signal & Control Cable, Power Cable - >1kV, MV, HV, EHV, Low Voltage Energy <1kV), By Installatio...n (Overhead, Underground), By Material (Copper, Glass, Aluminum), By End-User (Residential, Commercial, Industrial, Telecom, Others), By Country (Dubai, Abu Dhabi & Al Ain, Sharjah & Northern Emirates), By Company (Dubai Cable, National Cables Industry, Power Plus Cables Co LLC, MESC-RAK, Tekab Company Ltd., Brugg Cable Middle East DMCC, Prysmian Group, Nexans Middle East, Alfanar Company Ltd., Elsewedy Electric LLC) Read more

- Energy

- Mar 2022

- Pages 108

- Report Format: PDF, Excel, PPT

A wire is an isolated electrical conductor, and, on the other hand, a cable is a cluster of wires that carry the electricity flow. Both are used extensively in many applications (overhead, buildings, & underground wirings) across the industrial & commercial sectors for transmitting power & electrical signals. Swift advancements in telecommunications & core electronic technologies are expanding the application areas for the wires & cables industry in the UAE.

Market Insights

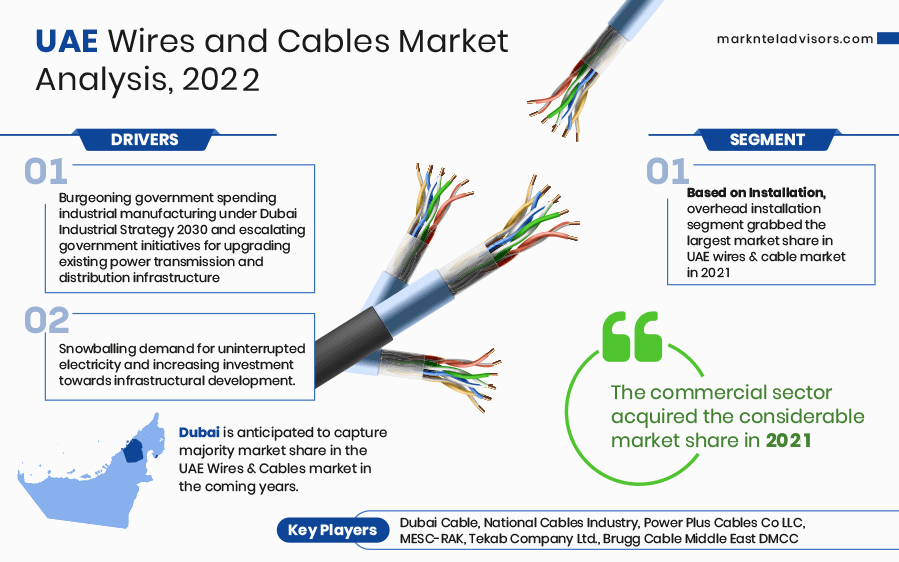

The UAE Wires & Cables Market is projected to grow at an exponential CAGR during the forecast period, i.e., 2022-27. The increasing construction of smart cities & commercial buildings, coupled with various smart-grid projects & development of power facilities, are the prime aspects driving the demand for wires & cables in the UAE. Moreover, the growing number of residential & commercial buildings in line with the UAE Expo 2021 and the mounting utilization of power cables for power distribution & transmission are also driving the demand for wires & cables in the UAE.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2017-20 |

| Base Year: 2021 | |

| Forecast Period: 2022-27 | |

| Country Covered | Dubai, Abu Dhabi & Al Ain, Sharjah & Northern Emirates |

| Key Companies Profiled | Dubai Cable, National Cables Industry, Power Plus Cables Co LLC, MESC-RAK, Tekab Company Ltd., Brugg Cable Middle East DMCC, Prysmian Group, Nexans Middle East, Alfanar Company Ltd., Elsewedy Electric LLC |

| Unit Denominations | USD Million/Billion |

Various initiatives for the economic diversification away from the oil sector and enormous investments in mega infrastructure projects like theme parks, skyscrapers, shopping malls, etc., would fuel the market for wires & cables in the UAE over the coming years. Furthermore, upcoming projects associated with the hospitality, real estate, tourism, & infrastructure sectors as the country witnessing a massive influx of visitors in line with the World Expo in Dubai are other prominent aspects projected to drive the market through 2027.

Impact of Covid-19 on the UAE Wires & Cables Market

The Covid-19 pandemic significantly impacted almost all industrial sectors of the UAE, where the power sector has been no exception, and consequently the wires & cables industry, mainly due to a pause in energy projects and reduced expenditure on active projects. As per estimates, the consumption of wires & cables across the Middle East considerably shrank in 2020 compared to the previous year.

However, with the gradually declining number of Covid-19 cases, which enabled the UAE government to recommence business operations, the market observed recovery signs in 2021. China & the United States, the principal export markets, are witnessing a better than expected recovery, which would generate lucrative opportunities for the local manufacturers and boost the market in the coming years.

Market Segmentation

Based on Installation:

- Overhead

- Underground

Amongst both, the Overhead installation acquired the largest market share in the UAE Wires & Cables Market. The overhead installation is generally the most utilized approach across the country since it is the least expensive & simplest type of installation as it doesn't require crossbars & insulators. Moreover, this type of installation has a high current & voltage carrying capacity, and faults can be addressed & repaired easily.

On the other hand, the demand for Underground installation is projected to witness the highest growth rate during 2022-27 since it involves fewer transmission losses and largely reduced maintenance expenses. Moreover, it discharges no electric fields, owing to which its demand is high across various sectors like residential, commercial, telecom, automotive, energy, & power industries.

Based on End-Users:

- Residential

- Commercial

- Industrial

- Telecom

- Others

Here, the commercial sector acquired a considerable share in the UAE Wires & Cables Market in 2021 owing to various ongoing & upcoming construction projects in the UAE. Being the host of Expo 2021, it has surged the government spending toward hospitality & telecom sectors, which, in turn, has proliferated the demand for wires & cables in hotels, restaurants, telecommunication, etc.

On the other hand, the market would grow at the fastest rate across the residential & industrial sectors due to a boost in ongoing construction activities, massive investments in mega infrastructure projects, and the burgeoning number of power sector projects. Hence, the aspects cited above are set to positively impact the overall growth of the UAE Wires & Cables Market in the years to come.

Regional Landscape:

- Dubai

- Abu Dhabi & AI Ain

- Sharjah & Northern Emirates

Of all regions in the UAE, Dubai is more likely to capture the majority share in the Wires & Cables Market through 2027. It attributes primarily to the increasing investments in renewable & grid strengthening projects, robust & growing expanding tourism & transportation sectors, and mounting electricity consumption in the residential & commercial sectors. Besides, the considerable inflow of investment in the hospitality sector in line with the Expo 2020 is also strongly contributing to the overall growth of the Wires & Cables Market across Dubai.

Key Questions Answered in the Market Research Report:

- What are the key overall statistics or estimates (Overview, Size- by Value, Forecast Numbers, Segmentation, Shares) of the UAE Wires & Cables Market?

- What is the region wise industry size, growth drivers, challenges, & key market trends?

- What are the key innovations, technology upgrades, opportunities, regulations in the UAE Wires & Cables Market?

- Who are the key competitors or players and how do they perform in UAE Wires & Cables Market based on competitive benchmarking matrix?

- What are the key results derived from surveys conducted during the UAE Wires & Cables Market study?

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Market Segmentation

- Assumptions

- Executive Summary

- Impact of COVID-19 on UAE Wires and Cables Market

- UAE Wires and Cables Production Scenario

- Manufacturing Ecosystem

- Manufacturing By Leading Companies

- UAE Wires and Cables Market Analysis, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (in Tons)

- Market Share & Analysis

- By Type

- Fibre Optic Cables

- Telecom & Data Cables

- Coaxial cable/Electronic wire

- Signal & Control Cable

- Power Cable - >1kV, MV, HV, EHV

- Low Voltage Energy <1kV

- By Installation

- Overhead

- Underground

- By Material

- Copper

- Glass

- Aluminium

- By End Users

- Residential

- Commercial

- Industrial

- Telecom

- Others

- By Region

- Dubai

- Abu Dhabi & Al Ain

- Sharjah

- Northern Emirates

- By Competitors

- Market Competition Characteristics

- Market Share & Analysis

- Competitive Metrix

- By Type

- Market Size & Analysis

- UAE Wires & Cables Market Supply Chain Analysis

- UAE Wires & Cables Market Regulations, Policies, Product Benchmarks

- UAE Wires & Cables Market Import & Export Statistics

- Imports

- Exports

- Net Trade

- UAE Wires & Cables Market Trends & Insights

- UAE Wires & Cables Market Dynamics

- Drivers

- Challenges

- UAE Wires & Cables Market Hotspot & Opportunities

- UAE Wires & Cables Market Competition Landscape

- Competition Metrix

- Manufacturing Capabilities

- Target Markets

- Target Applications

- Research & Development

- Collaborations & Strategic Alliances

- Key Business Expansion Initiatives

- Business Restructuring- Mergers, Acquisitions, JVs

- Strategic Initiatives

- Company Profiles

- Dubai Cable

- National Cables Industry

- Power Plus Cables Co LLC

- MESC-RAK

- Tekab Company Ltd.

- Brugg Cable Middle East DMCC

- Prysmian Group

- Nexans Middle East

- Alfanar Company Ltd.

- Elsewedy Electric L.L.C

- Competition Metrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making