UAE and Saudi Arabia Furniture Market Research Report: Forecast (2021-2026)

By Material (Plastic, Wood, Metal), By Furniture and Furnishing (Organized Sector, Unorganized Sector), By Product Categories (Living Room, Bed Room, Dining Room, Home Office Furni...ture, Kitchen Furniture, Storage Furniture, Other), By End-User (Residential Furniture, Commercial Furniture, Retail Furniture), By Distribution Channel (Home Centers, Flagship Stores, Specialty Stores, Online Stores, Other), By Company (IKEA, Home Centre, PAN Emirates, Royal Furniture, Danube, Marina Home, Homes R Us, IDdesign, Pottery Barn, Home Box, Natuzzi. Major, Al-Abdulkader Furniture Co. Ltd, Riyadh Furniture Industries Co., Al Jedaie, AL Rugaib Furniture, Saudi Modern Factory Company, AL Aamer Furniture, Almutlaq Furniture, Wardeh Salehiya, HABITAT FURNITURE CO. LTD., Midas Furniture, Gautier Jeddah, BoConcept, Ebarza, The People of Sand, MarMarLand, The Bowery Company, WysadaIKEA, Home Centre, PAN Emirates, Royal Furniture, Danube, Marina Home, Homes R Us, IDdesign, Pottery Barn, Home Box, Natuzzi. Major, Al-Abdulkader Furniture Co. Ltd, Riyadh Furniture Industries Co., Al Jedaie, AL Rugaib Furniture, Saudi Modern Factory Company, AL Aamer Furniture, Almutlaq Furniture, Wardeh Salehiya, HABITAT FURNITURE CO. LTD., Midas Furniture, Gautier Jeddah, BoConcept, Ebarza, The People of Sand, MarMarLand, The Bowery Company, Wysada) Read more

- FMCG

- Feb 2022

- Pages 154

- Report Format: PDF, Excel, PPT

Market Definition

Furniture is considered an essential requirement at home or offices & a crucial aspect that brings solace & comfort to people while making their life simpler & efficient. Additionally, the aesthetic looks that furniture brings to a space are becoming a trendy aspect and propelling the demand for different & modern furnitures. These can include objects like tables, chairs, desks, beds, & cupboards, among others. The furniture industry uses different materials like plastic, wood, metal, etc.

Market Insights

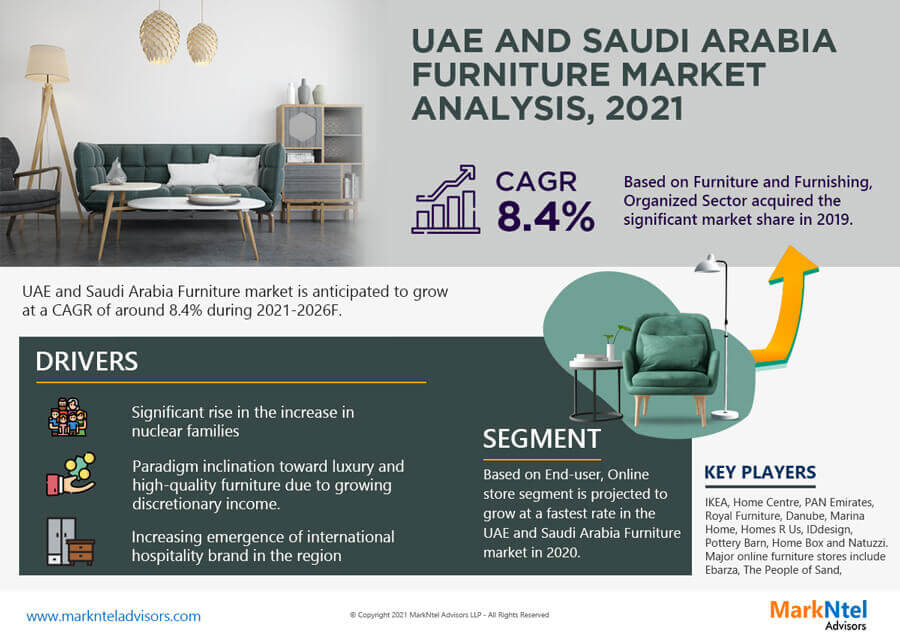

The UAE and Saudi Arabia Furniture Market is projecting around 8.40% CAGR during the forecast period, i.e., 2021-26. It owes to the swiftly growing establishment of several businesses, i.e., propelling the demand for office spaces & furniture, coupled with the rising demand for value-added features, shapes & sizes of furniture.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2016-19 |

| Base Year: 2020 | |

| Forecast Period: 2021-26 | |

| CAGR(2021-26) | 8.40% |

| Key Companies Profiled | (Offline (IIKEA, Home Centre, PAN Emirates, Royal Furniture, Danube, Marina Home, Homes R Us, IDdesign, Pottery Barn, Home Box, Natuzzi. Major, Al-Abdulkader Furniture Co. Ltd, Riyadh Furniture, industries Co., Al Jedaie, AL Rugaib Furniture, Saudi Modern Factory Company, AL Aamer Furniture, Almutlaq Furniture, Wardeh Salehiya, HABITAT FURNITURE CO. LTD., Midas Furniture, Gautier Jeddah, BoConcept ), Online (Ebarza, The People of Sand, MarMarLand, The Bowery Company, Wysada, etc. |

| Unit Denominations | USD Million/Billion |

As a result, several corporate companies & prominent market players are investing substantially in office furniture like tables, chairs, desks, and others to provide a comfortable working environment for employees & staff & augment the market growth.

Additionally, rapid infrastructural developments are also stimulating the overall market growth by displaying a massive inclination toward the construction of houses, community centers, hospitals, & educational institutions, etc., i.e., propelling the demand for suitable furniture, designed specifically to fulfill the requirements.

Besides, numerous furniture manufacturers are actively working on introducing new designs & creating furniture with different materials to add extra features that occupy minimal space. It, in turn, is instigating the demand for such modern furniture, especially among people who see luxury as a status symbol, which, in turn, is driving the market.

Key Trend in the Market

- Combining Smart Technologies into Furniture

With rapid advancements in technologies like Artificial intelligence (AI), the Internet of Things (IoT), and Deep Learning, among others, several leading players in the UAE & Saudi Arabia Furniture Market are integrating them into their furniture and bringing intelligent furniture like charging phone lamps, smart home devices, smart beds, & tablet coffee tables, among various others. Additionally, since in the UAE & Saudi Arabia, procuring advanced & luxury-based items are status symbols, the demand for furniture is swiftly gaining traction in these countries is positively influencing the UAE and Saudi Arabia Furniture Market growth through 2026.

The Covid-19 pandemic in 2020 had a decelerating effect on most industries, where the UAE and Saudi Arabia Furniture Market was no exception. While governments in these countries imposed stringent movement restrictions & lockdowns to curb the spread of this dreadful disease, the market witnessed several unprecedented challenges like unavailability of raw materials & labor due to severe disruptions in the supply chain. Additionally, this temporary halt also affected the deliveries of pre-produced furniture and brought massive financial challenges to the leading market players.

Impact of Covid-19 on the UAE and Saudi Arabia Furniture Market

However, a gradual betterment in the pandemic situation with a reducing number of Covid-19 cases across the UAE & Saudi Arabia prompted governments to uplift the restrictions & allow the recommencement of business operations. Moreover, this long duration of stay-at-home among people encouraged them toward home renovation ideas, which propelled the demand for new furniture. Hence, the UAE and Saudi Arabia Furniture Market, with the revival since 2021, is witnessing an increasing demand for furniture, and the same trend is likely to be followed in the coming years.

Market Segmentation

Based on End-Users, the UAE and Saudi Arabia Furniture Market segments into:

- Residential

- Commercial

- Retail

Of them all, the Residential sector is anticipated to demonstrate the fastest market growth during the forecast period. It attributes principally to the mounting support from governments of the UAE & Saudi Arabia through massive investments & escalating number of construction projects across the real estate & residential sector to serve the mounting population and the swiftly improving living standards of people, i.e., propelling the demand for luxurious furniture at homes in Saudi Arabia & the UAE.

Besides, the growing focus of governments on diversifying the economy away from the oil & gas industry is promoting infrastructural developments and investments & construction activities in the residential sector. Moreover, since local manufacturers in the UAE & Saudi Arabia are facing difficulties while producing raw materials, there's increasing penetration of imported furniture across these countries.

Furthermore, several foreign players are viewing these countries as a hub of lucrative growth opportunities, thereby establishing manufacturing units to expand their scalability for residential furniture and, as a result, augmenting the overall market growth.

Based on the Material:

- Plastic

- Wood

- Metal

Of them all, Wood dominated the market with the largest share in recent years & is projected to prevail the same trend during the forecast period. It owes principally to its easy & abundant availability to produce different types of furniture.

Additionally, the properties & capabilities of wood to deliver high strength & durability to the furniture with resilient & minimal maintenance entwined with its appealing looks shall further fuel the overall market growth in the coming years. Besides, increasing customer preference toward wooden aesthetics is displaying a growing inclination on the adoption of wooden furniture and positively influencing the market.

Country Landscape

The furniture industry across the UAE & Saudi Arabia is witnessing dynamic changes. Amongst both countries, UAE is expecting the fastest market growth during 2021-26. It owes to the rapidly increasing establishment of Multinational Companies (MNCs) & surging employment opportunities, i.e., propelling the demand for office spaces & furniture.

Besides, the rapidly increasing number of construction activities & events in AutoExpos are also likely to instigate the demand for luxury furniture & generate lucrative growth opportunities for the leading market players. Moreover, favorable government policies on Foreign Direct Investments (FDIs) shall augment the number of businesses in the country & positively influence the overall furniture market.

On the other hand, Saudi Arabia is projected to display remunerative growth opportunities for the leading players in its furniture market during 2021-26. It attributes primarily to the extensive presence of numerous domestic & international furniture providers in the country, i.e., creating a competitive landscape among the prominent players.

Recent Developments by Leading Companies

- In November 2020, prominent player PAN Emirates Home Furnishings inaugurated a new store in the Capital Mall of Abu Dhabi. The leader invested substantially, making the store the biggest in the region, covering around 4200 sqm.

- The same year, in September, leading player IKEA incorporated with the Republic of Gamers (RoG) to manufacture a new line of affordable gaming furniture & accessories in order to enhance the overall gaming experience at homes.

Market Dynamics:

Key Driver & Opportunity: Expanding Industrial & Commercial Sectors across the UAE & Saudi Arabia

The leading players in the UAE and Saudi Arabia Furniture Market are anticipated to witness an upswing in the coming years owing to the rapidly expanding industrial & commercial sectors across these countries. It owes principally to the increasing establishment of MNCs, i.e., propelling the demand for office furniture, coupled with the rising government focus on developing the commercial sector, thereby laying out construction projects to build hotels, resorts, etc., and instigating the overall market growth.

Growth Restraint: Shortage or Delayed Procurement of Raw Materials

The UAE and Saudi Arabia Furniture Market observe shortage of timber wood, which in turn, is spiking up its costs and introducing severe challenges like project delays, cash flow issues, demand-supply gap, etc. Hence, this might restrain the market growth during the forecast period. Besides, factors such as stringent government regulations on wood production, natural disasters, poor logistics, etc., shall also act as prominent growth challenges to the market in the coming years.

Competitive Landscape

According to MarkNtel Advisors’, the key players with a considerable market share in the UAE and Saudi Arabia Furniture market include IKEA, Home Centre, PAN Emirates, Royal Furniture, Danube, Marina Home, Homes R Us, IDdesign, Pottery Barn, Home Box and Natuzzi. Major online furniture stores include Ebarza, The People of Sand, MarMarLand, The Bowery Company, Wysada, Al Jedaie, AL Rugaib Furniture, Saudi Modern Factory Company, AL Aamer Furniture, Almutlaq Furniture, Wardeh Salehiya, HABITAT FURNITURE CO. LTD., Midas Furniture, Gautier Jeddah, BoConcept and Souq.com, etc.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares) of the UAE and Saudi Arabia Furniture Market?

- What are the region-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the UAE and Saudi Arabia Furniture Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the UAE and Saudi Arabia Furniture Market based on the competitive benchmarking matrix?

- What are the key results derived from surveys conducted during the UAE and Saudi Arabia Furniture Market study?

Market Outlook, Segmentation, and Statistics

- Impact of COVID-19 on UAE and Saudi Arabia Furniture Market

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Material

- Plastic

- Wood

- Metal

- By Furniture and Furnishing

- Organized Sector

- Unorganized Sector

- By Product Categories

- Living Room

- Bed Room

- Dining Room

- Home Office Furniture

- Kitchen Furniture

- Storage Furniture

- Other

- By End-Users

- Residential Furniture

- Commercial Furniture

- Retail Furniture

- By Distribution Channel

- Home Centers

- Flagship Stores

- Specialty Stores

- Online Stores

- Other

- By Company

- Revenue Shares

- Strategic Factorial Indexing

- Competitor Placement in MarkNtel Quadrant

- By Material

- UAE and Saudi Arabia Furniture Market Supply Chain Analysis

- UAE and Saudi Arabia Furniture Market Policies, Regulations, Product Standard

- UAE and Saudi Arabia Furniture Market Hotspots & Opportunities

- Competition Outlook

- Competitor Wise Growth Strategies

- Company Profiles

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Assumptions

- Market Segmentation

- Preface

- Executive Summary

- Impact of COVID-19 on UAE and Saudi Arabia Furniture Market

- UAE and Saudi Arabia Furniture Market Outlook, 2016-2026F

- Market Size & Analysis

- Market Revenues

- Market Share & Analysis

- By Material

- Plastic

- Wood

- Metal

- By Furniture and Furnishing

- Organized Sector

- Unorganized Sector

- By Product Categories

- Living Room

- Bed Room

- Dining Room

- Home Office Furniture

- Kitchen Furniture

- Storage Furniture

- Other

- By End-Users

- Residential Furniture

- Commercial Furniture

- Retail Furniture

- By Distribution Channel

- Home Centers

- Flagship Stores

- Specialty Stores

- Online Stores

- Other

- By Competitors

- Competition Characteristics

- Market Share & Analysis

- Competitive Metrix

- By Material

- Market Size & Analysis

- UAE and Saudi Arabia Furniture Market Government Regulations and Policies

- UAE and Saudi Arabia Furniture Market Supply Chain Analysis

- UAE and Saudi Arabia Furniture Market Trends & Insights

- UAE and Saudi Arabia Furniture Market Dynamics

- Growth Drivers

- Challenges

- Impact Analysis

- UAE and Saudi Arabia Furniture Market Hotspot & Opportunities

- UAE and Saudi Arabia Furniture Market Key Target Audience

- Key Target Audience

- Furniture Retailers

- Furnishings Retailers

- Private Equity Companies

- Contract Furniture Manufacturers

- Furniture Association

- UAE and Saudi Arabia Furniture Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Competition Matrix

- Target Markets

- Research & Development

- Collaborations & Strategic Alliances

- Key Business Expansion Initiatives

- Business Restructuring- Mergers, Acquisitions, JVs

- Strategic Initiatives

- Company Profiles (Business Description, Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Offline Furniture

- IKEA

- Home Centre

- PAN Emirates

- Royal Furniture

- Danube

- Marina Home

- Homes R Us

- IDdesign

- Pottery Barn

- Home Box

- Natuzzi. Major

- Al-Abdulkader Furniture Co. Ltd

- Riyadh Furniture Industries Co.

- Al Jedaie

- AL Rugaib Furniture

- Saudi Modern Factory Company

- AL Aamer Furniture

- Almutlaq Furniture

- Wardeh Salehiya

- HABITAT FURNITURE CO. LTD.

- Midas Furniture

- Gautier Jeddah

- BoConcept

- Online Furniture

- Ebarza

- The People of Sand

- MarMarLand

- The Bowery Company

- Wysada

- Offline Furniture

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making