Middle East Smart Home Market Research Report: Forecast (2023-2028)

By Technology (Cellular Network Technologies, Protocols and Standards, Wireless Communication Technologies), By Software & Service (Behavioral, Proactive), By Product Type (Enterta...inment Controls [Audio, Volume and Multimedia Room Controls, Home Theater System Control, Touchscreen and Keypads], Security & Access Control [Video Surveillance {Hardware, Software, Services}, Access Control {Non-Biometric Access Control, Biometric Access Control}], HVAC Control [Smart Thermostats, Sensors, Actuators, Dampers, Control Valves, Heating and Cooling Coils, Pumps & Fans, Smart Vents], Smart Home Appliances [Smart Washer, Smart Dryers, Smart Water Heaters, Smart Vacuum Cleaners], Smart Kitchen [Smart Dishwashers, Smart Refrigerators, Smart Cookers, Smart Ovens, Smart Coffee Makers, Smart Kettles], Smart Lighting Control [Dimmers, Switches, Relays, Daylight Sensors, Timers, Others], Smart Furniture [Smart Tables, Smart Stools and Benches, Smart Sofas, Smart Chairs, Smart Desks, Others (Smart Plugs, Smoke Detectors, Smart Meters)]), By Country (UAE, Saudi Arabia, Qatar, Kuwait, Oman, Bahrain, Israel, Egypt, Turkey), By Company (ABB Ltd., Johnson Controls, United Technologies Corporation, Emerson Electronics Co., Honeywell International, Inc., Legrand S.A., Lutron Electronics, Inc., Schneider Electric S.A., Siemen AG, Robert Bosch GmbH, Samsung Electronics Co., Ltd., Haier Group, Crestron Electronics, Inc., LG Electronics, Inc. etc.) Read more

- ICT & Electronics

- Aug 2023

- Pages 176

- Report Format: PDF, Excel, PPT

Market Definition

Smart homes refer to advanced home automation technologies & solutions. It encompasses the adoption & integration of smart devices, systems, and software platforms within residential properties. These technologies enable homeowners to remotely control & monitor various aspects of their homes, such as lighting, security, heating, cooling, and entertainment systems.

Market Insights & Analysis: Middle East Smart Home Market (2023-28):

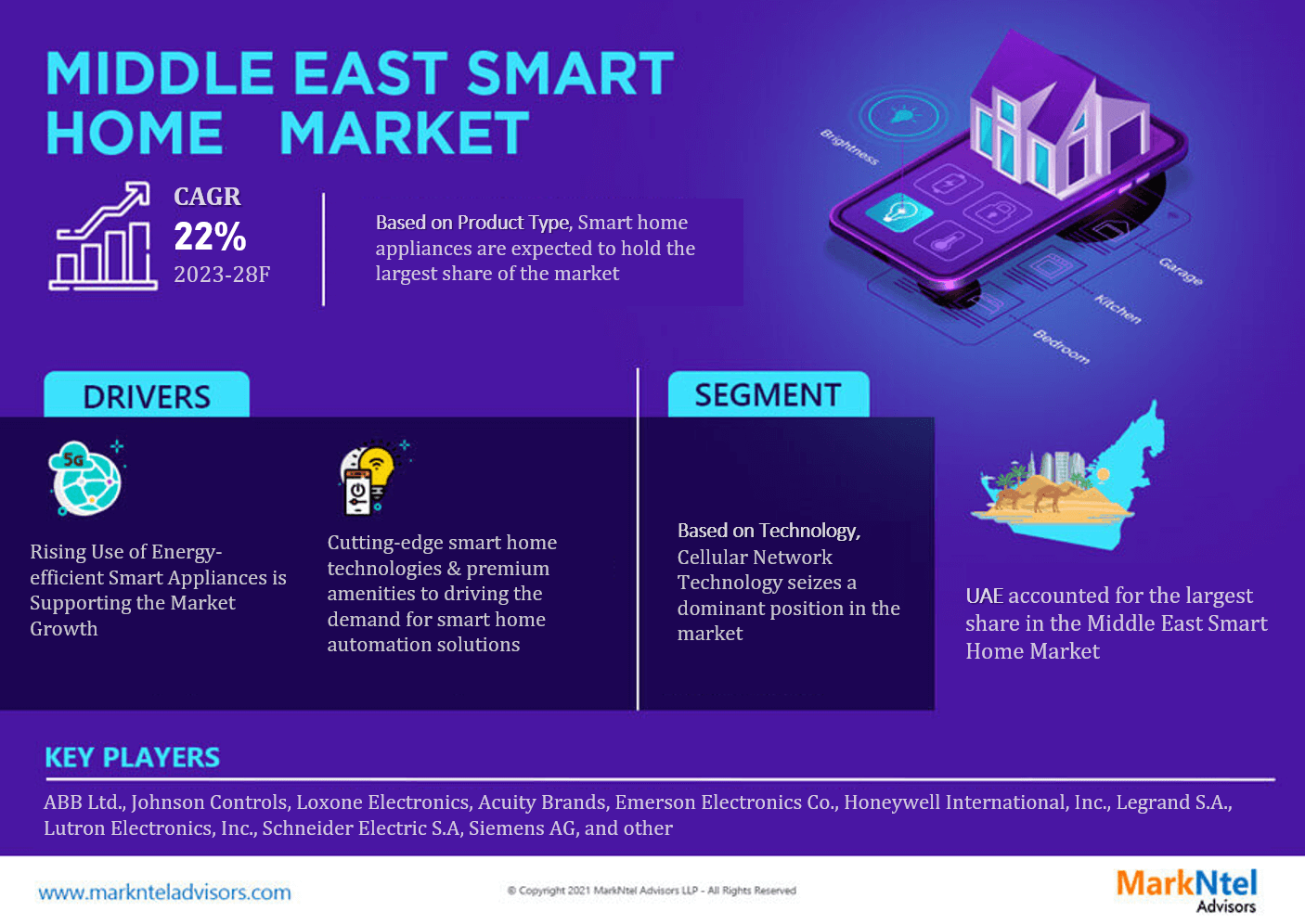

The Middle East Smart Home Market is projected to grow at a CAGR of around 22% during the forecast period, i.e., 2023-28, which can be attributed to several factors such as rapid urbanization, rising disposable income, government initiatives, and increasing awareness of the benefits of smart living. Homeowners in the region are adopting advanced home automation technologies to enhance convenience, comfort, energy efficiency, and security. For instance:

- In the UAE, in 2023, Nakheel launched Como Residences, an exclusive residential development on Palm Jumeirah, offering luxurious living experiences with privacy, premium amenities, and stunning waterfront views.

Como Residences' incorporation of cutting-edge smart home technologies & premium amenities is expected to set a new standard in the Middle East Smart Home Market, driving demand for smart home automation solutions in the region. These homes feature advanced automation systems that allow residents to control lighting, temperature, security, and entertainment through smart devices & voice commands, thus fueling the market growth.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 22% |

| Country Covered | The UAE, Saudi Arabia, Oman, Bahrain, Kuwait, Qatar, Israel, Turkey and Others |

| Key Companies Profiled | ABB Ltd., Johnson Controls, Loxone Electronics, Acuity Brands, Emerson Electronics Co., Honeywell International, Inc., Legrand S.A., Lutron Electronics, Inc., Schneider Electric S.A, Siemens AG, Robert Bosch GmbH, Samsung Electronics Co., Ltd., Haier Group, Crestron Electronics, Inc., LG Electronics, Inc., Others |

| Unit Denominations | USD Million/Billion |

The market is rapidly expanding & innovating as governments, real estate developers, and consumers embrace the benefits of smart living. The rapid growth & innovation in smart home technologies are reshaping residential spaces, offering elevated living experiences through advanced automation, connectivity, convenience, sustainability, and efficiency, with promising potential to transform the way people live in the future, thus creating a positive outlook for the Middle East Smart Home Market.

The Middle East Smart Home Market Driver:

Rising Use of Energy-efficient Smart Appliances is Supporting the Market Growth – The adoption of smart appliances in the Middle East, such as smart bulbs, lighting, dryers, and water heaters, is experiencing a significant surge due to the residents' desire to minimize energy costs. These smart appliances are designed to be energy-efficient & offer substantial energy savings compared to conventional electronic devices. According to Abu Dhabi Distribution Company, smart appliances can consume nearly 40% less energy, resulting in lower energy bills over the long run. This cost-saving advantage is driving the adoption of smart appliances among residents & contributing to the Middle East Smart Home Market's revenue growth.

Governments in the region are actively promoting the usage of energy-efficient home appliances as part of their efforts to reduce overall energy consumption. An example of this has been seen in Abu Dhabi, where the government has partnered with organizations to encourage individuals to purchase smart & energy-efficient home appliances. For instance:

- In 2020, the Abu Dhabi Distribution Company signed a Memorandum of Understanding with Lulu Group to reduce 20% of Abu Dhabi's water & energy consumption by 2030.

This initiative is aimed at creating awareness & incentivizing the adoption of smart appliances, which aligns with the government's energy conservation objectives. As a result, the market for smart appliances is anticipated to grow positively as more individuals embrace these energy-efficient solutions.

The Middle East Smart Home Market Challenge:

Risk Relating to Cyber Security & Loss of Data is Restricting its Adoption – The cyber security & potential loss of data associated with smart home technologies present significant challenges to their widespread adoption in the Middle East. Cyber-attacks & data breaches highlight the vulnerabilities existing within interconnected smart home systems, raising concerns among potential adopters & hindering their willingness to embrace these technologies.

One event that demonstrates the challenge of cyber security in smart homes is the 2019 incident in Qatar, where a vulnerability in smart home systems allowed unauthorized access to control various functions. This incident showcased the potential risks of inadequate security measures, as it exposed the possibility of privacy infringements & unauthorized control over residents' homes. Such cases highlight the need for robust security protocols, encryption, and authentication measures to protect smart homes from cyber-attacks & unauthorized access. With the vast amount of data generated & collected by smart home devices, the risk of data breaches & misuse of personal information becomes a concern for individuals & organizations. For instance:

- In 2023, the UAE Cyber Security Council, along with its partners, are deterring over 50,000 cyberattacks per day, with banking, financial, health, and oil & gas sectors being the most targeted.

In the context of smart homes, the loss or compromise of personal data leads to privacy breaches & potentially compromises the security & well-being of residents, thus limiting the enhancement of the Middle East Smart Home Market size.

The Middle East Smart Home Market Trend:

Surging Adoption of AI-enabled Smart Home Appliances to Assist Remote Monitoring of Appliances – The surging adoption of AI-enabled smart home appliances for remote monitoring of appliances is emerging as a notable market trend in the smart home industry due to the desire for increased convenience, energy efficiency, and enhanced control over household devices. With AI integration, homeowners can remotely monitor & control their appliances using smartphone applications or voice commands, providing them with real-time updates & the ability to manage their homes even when they are away.

The "Ecovacs Deebot N8 Pro+" was introduced as an AI-enabled smart home appliance for remote monitoring. This intelligent robot vacuum cleaner can be controlled & monitored remotely through a smartphone app, allowing users to schedule cleaning sessions & receive real-time updates on cleaning progress. Similarly, there is an increasing popularity of AI-enabled smart thermostats. Companies like Nest and Ecobee offer thermostats that utilize AI algorithms to learn the homeowners' behavior & adjust temperature settings accordingly.

By integrating AI algorithms, appliances can adapt to users' preferences, learn from their behaviors, and optimize operations accordingly. This trend aligns with the increasing demand for smart living solutions that offer enhanced automation & convenience. As the adoption of AI-enabled smart home appliances continues to grow, it is expected that the Middle East Smart Home Market share would upscale in the ensuing years.

The Middle East Smart Home Market (2023-28): Segmentation Analysis

The Middle East Smart Home Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2023-28 at the global, regional, and national levels. In accordance to the analysis, the market has been further classified as:

Based on Product Type:

- Entertainment Controls

- Security & Access Control

- HVAC Control

- Smart Home Appliances

- Smart Kitchen

- Smart Lighting Control

- Smart Furniture

- Others (Smart Plugs, Smoke Detectors, Smart Meters, etc.)

Smart home appliances are expected to hold the largest share of the Middle East Smart Home Market. The growing demand for automation & convenience in household tasks has led to increased adoption of smart appliances, thus influencing the market growth. Some popular smart appliances include smart refrigerators, washing machines, and dishwashers that offer features, like remote monitoring, scheduling, and energy optimization, thereby improving the overall user experience.

The advancements in wireless connectivity technologies have played a significant role in the growth of smart appliances. The ability to connect wirelessly with smartphones & tablets allows users to control & monitor their appliances from anywhere, providing flexibility & convenience. This wireless connectivity also enables seamless integration with other smart home devices, creating a cohesive & interconnected ecosystem within houses. This trend reflects the increasing demand for convenience, automation, and connectivity in households, hence driving the Smart Home Market growth in the region.

Based on Technology:

- Cellular Network Technology

- Protocols & Standards

- Wireless Communication Technology

Cellular Network Technology seizes a dominant position in the Middle East Smart Home Market due to its seamless smartphone integration & wide coverage. By leveraging cellular networks, smart home devices can be easily connected to smartphones, enabling remote monitoring & control from anywhere. This widespread coverage contributes to the popularity of cellular network technology in the Middle East Smart Home Market & is predicted to continue driving its growth in the coming years.

In addition to seamless smartphone integration & wide coverage, cellular network technology offers real-time notifications & alerts, further enhancing its appeal in the market. Unlike Wi-Fi-connected devices that may face bandwidth limitations, cellular networks can provide instant & reliable communication between smart home devices & users. This capability enables users to receive immediate notifications & alerts about events or emergencies, such as security breaches, fire alarms, or system malfunctions.

The ability to stay informed in real-time enhances the overall safety, security, and peace of mind of smart homeowners in the Middle East, contributing to the continued growth & adoption of cellular network technology in the market.

The Middle East Smart Home Market Regional Projections:

Geographically, the Middle East Smart Home Market expands across:

- The UAE

- Saudi Arabia

- Oman

- Kuwait

- Bahrain

- Qatar

- Israel

- Turkey

- Others

The UAE accounted for the largest share in the Middle East Smart Home Market, primarily driven by the rising number of internet users & the increasing demand for smart devices. The UAE has experienced significant growth in internet penetration, leading to a surge in the adoption of connected devices & smart home technologies.

The UAE government has been actively promoting smart city initiatives & investing in digital infrastructure, creating an environment conducive to the growth of the Smart Homes Market. Thus, the country's efforts to build sustainable & energy-efficient cities have further accelerated the adoption of smart home technologies.

The Middle East Smart Home Industry Recent Development:

- 2023: LG MEA launched a range of innovative home appliance products such as refrigerators, ovens, etc. during the LG Showcase MEA 2023 event, offering cutting-edge technologies & features to enhance the living experience in the Middle East region. This product line-up aims to meet the diverse needs of households & demonstrates LG's dedication to providing innovative solutions for consumers.

- 2023: Samsung Gulf Electronics and Etisalat announced an expanded partnership to collaborate on digital experiences, including the supply of wearables & smart gadgets, and the introduction of Samsung's fitness platform GoWell to meet the growing demand for smart devices in the UAE.

Gain a Competitive Edge with Our Middle East Smart Home Market Report

- Middle East Smart Home Market research report provides a detailed and thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics and make informed decisions.

- This report also highlights current market trends and future projections, allowing businesses to identify emerging opportunities and potential challenges. By understanding market forecasts, companies can align their strategies and stay ahead of the competition.

- Middle East Smart Home industry analysis aids in assessing and mitigating risks associated with entering or operating in the market.

- The report would help in understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks and optimize their operations.

Frequently Asked Questions

Middle East Smart Home Market Research Report (2023-2028) - Table of Contents

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- The Middle East Smart Home Market Trends & Development

- The Middle East Smart Home Market Policies, Regulations, Product Standards

- The Middle East Smart Home Market Hotspot & Opportunities

- The Middle East Smart Home Market Supply Chain Analysis

- The Middle East Smart City Projects, 2018-2022

- By Country

- By Companies

- By Description

- The Middle East Smart Home Market Dynamics

- Growth Drivers

- Challenges

- The Middle East Smart Home Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology

- Cellular Network Technology- Market Size & Forecast, 2018-2028, USD Million

- Protocols and Standards- Market Size & Forecast, 2018-2028, USD Million

- Wireless Communication Technologies- Market Size & Forecast, 2018-2028, USD Million

- By Software & Service

- Behavioral- Market Size & Forecast, 2018-2028, USD Million

- Proactive- Market Size & Forecast, 2018-2028, USD Million

- By Product Type

- Entertainment Controls

- Audio, Volume and Multimedia Room Controls-Market Size & Forecast, 2018-2028, USD Million

- Home Theater System Control-Market Size & Forecast, 2018-2028, USD Million

- Touchscreen and Keypads- Market Size & Forecast, 2018-2028, USD Million

- Security & Access Control

- Video Surveillance

- Hardware- Market Size & Forecast, 2018-2028, USD Million

- Software- Market Size & Forecast, 2018-2028, USD Million

- Services- Market Size & Forecast, 2018-2028, USD Million

- Access Control

- Non-Biometric Access Control- Market Size & Forecast, 2018-2028, USD Million

- Biometric Access Control- Market Size & Forecast, 2018-2028, USD Million

- Video Surveillance

- HVAC Control

- Smart Thermostats- Market Size & Forecast, 2018-2028, USD Million

- Sensors- Market Size & Forecast, 2018-2028, USD Million

- Actuators- Market Size & Forecast, 2018-2028, USD Million

- Dampers- Market Size & Forecast, 2018-2028, USD Million

- Control Valves- Market Size & Forecast, 2018-2028, USD Million

- Heating and Cooling Coils- Market Size & Forecast, 2018-2028, USD Million

- Pumps & Fans- Market Size & Forecast, 2018-2028, USD Million

- Smart Vents- Market Size & Forecast, 2018-2028, USD Million

- Smart Home Appliances

- Smart Washer- Market Size & Forecast, 2018-2028, USD Million

- Smart Dryers- Market Size & Forecast, 2018-2028, USD Million

- Smart Water Heaters- Market Size & Forecast, 2018-2028, USD Million

- Smart Vacuum Cleaners- Market Size & Forecast, 2018-2028, USD Million

- Smart Kitchen

- Smart Dishwashers- Market Size & Forecast, 2018-2028, USD Million

- Smart Refrigerators- Market Size & Forecast, 2018-2028, USD Million

- Smart Cookers- Market Size & Forecast, 2018-2028, USD Million

- Smart Ovens- Market Size & Forecast, 2018-2028, USD Million

- Smart Coffee Makers- Market Size & Forecast, 2018-2028, USD Million

- Smart Kettles- Market Size & Forecast, 2018-2028, USD Million

- Smart Lighting Control

- Dimmers- Market Size & Forecast, 2018-2028, USD Million

- Switches- Market Size & Forecast, 2018-2028, USD Million

- Relays- Market Size & Forecast, 2018-2028, USD Million

- Daylight Sensors- Market Size & Forecast, 2018-2028, USD Million

- Timers- Market Size & Forecast, 2018-2028, USD Million

- Others- Market Size & Forecast, 2018-2028, USD Million

- Smart Furniture

- Smart Tables- Market Size & Forecast, 2018-2028, USD Million

- Smart Stools and Benches- Market Size & Forecast, 2018-2028, USD Million

- Smart Sofas- Market Size & Forecast, 2018-2028, USD Million

- Smart Chairs- Market Size & Forecast, 2018-2028, USD Million

- Smart Desks- Market Size & Forecast, 2018-2028, USD Million

- Others (Smart Plugs, Smoke Detectors, Smart Meters, etc.)) - Market Size & Forecast, 2018-2028, USD Million

- Entertainment Controls

- By Distribution Channel

- Offline Sales

- Official Outlet

- Authorized Dealers

- Online Sales

- Offline Sales

- By Country

- The UAE

- Saudi Arabia

- Oman

- Bahrain

- Kuwait

- Qatar

- Israel

- Turkey

- Others

- By Company

- Market Share

- Competition Characteristics

- By Technology

- Market Size & Analysis

- The UAE Smart Home Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast, 2018-2028, USD Million

- By Software & Service- Market Size & Forecast, 2018-2028, USD Million

- By Product Type- Market Size & Forecast, 2018-2028, USD Million

- By Distribution Channel- Market Size & Forecast, 2018-2028, USD Million

- Market Size & Analysis

- Saudi Arabia Smart Home Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast, 2018-2028, USD Million

- By Software & Service- Market Size & Forecast, 2018-2028, USD Million

- By Product Type- Market Size & Forecast, 2018-2028, USD Million

- By Distribution Channel- Market Size & Forecast, 2018-2028, USD Million

- Market Size & Analysis

- Oman Smart Home Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast, 2018-2028, USD Million

- By Software & Service- Market Size & Forecast, 2018-2028, USD Million

- By Product Type- Market Size & Forecast, 2018-2028, USD Million

- By Distribution Channel- Market Size & Forecast, 2018-2028, USD Million

- Market Size & Analysis

- Bahrain Smart Home Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast, 2018-2028, USD Million

- By Software & Service- Market Size & Forecast, 2018-2028, USD Million

- By Product Type- Market Size & Forecast, 2018-2028, USD Million

- By Distribution Channel- Market Size & Forecast, 2018-2028, USD Million

- Market Size & Analysis

- Kuwait Smart Home Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast, 2018-2028, USD Million

- By Software & Service- Market Size & Forecast, 2018-2028, USD Million

- By Product Type- Market Size & Forecast, 2018-2028, USD Million

- By Distribution Channel- Market Size & Forecast, 2018-2028, USD Million

- Market Size & Analysis

- Qatar Smart Home Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast, 2018-2028, USD Million

- By Software & Service- Market Size & Forecast, 2018-2028, USD Million

- By Product Type- Market Size & Forecast, 2018-2028, USD Million

- By Distribution Channel- Market Size & Forecast, 2018-2028, USD Million

- Market Size & Analysis

- Israel Smart Home Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast, 2018-2028, USD Million

- By Software & Service- Market Size & Forecast, 2018-2028, USD Million

- By Product Type- Market Size & Forecast, 2018-2028, USD Million

- By Distribution Channel- Market Size & Forecast, 2018-2028, USD Million

- Market Size & Analysis

- Turkey Smart Home Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast, 2018-2028, USD Million

- By Software & Service- Market Size & Forecast, 2018-2028, USD Million

- By Product Type- Market Size & Forecast, 2018-2028, USD Million

- By Distribution Channel- Market Size & Forecast, 2018-2028, USD Million

- Market Size & Analysis

- Competition Outlook

- Company Profiles

- ABB Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Johnson Controls

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Loxone Electronics

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Acuity Brands

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Emerson Electronics Co.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Honeywell International, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Legrand S.A.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Lutron Electronics, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Schneider Electric S.A.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Siemen AG

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Robert Bosch GmbH

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Samsung Electronics Co., Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Haier Group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Crestron Electronics, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- LG Electronics, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- ABB Ltd.

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making