UAE Bottled Water Market Research Report: Forecast (2025-2030)

UAE Bottled Water Market - By Type of Water (Purified Water, Mineral Water, Sparkling Water, Spring Water, Plain, Flavore), By Packaging (Plastic Bottles, Glass Bottles, Metal Cans..., Others (Tetra Pack Cartons, Bioplastics, etc.)), By Distribution (Hypermarkets & Supermarkets, Convenience Stores, Home Delivery, On Trade, Others), and others Read more

- Environment

- Jul 2025

- Pages 89

- Report Format: PDF, Excel, PPT

Market Definition

Bottled water is drinking water that is normally packaged in portable bottles that can be of varying sizes and types. Bottled water is a convenient way for consumers to buy water and has quickly grown in popularity in plain, flavored, and functional varieties that serve a range of consumer segments across the UAE.

Market Insights and Analysis: UAE Bottled Water Market (2025-30):

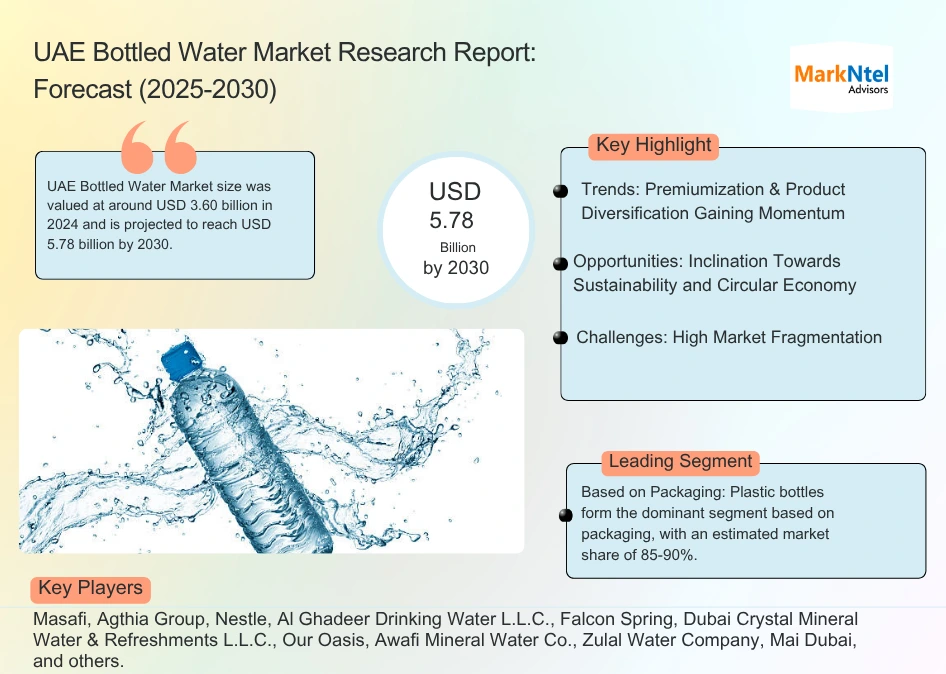

The UAE Bottled Water Market size was valued at around USD 3.60 billion in 2024 and is projected to reach USD 5.78 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 8.21% during the forecast period, i.e., 2025-30. This consistent growth is likely to be driven by climate conditions, health concerns, tourism growth, and demographics.

The climate in the UAE is classified as a hot desert, which results in extreme summer temperatures and an elevation of humidity levels in coastal areas. Consequently, consumers turn to bottled water as the easiest method to ease their thirst due to these conditions. Additionally, bottled water is also in demand by consumers because they have health concerns about the quality of freely available water.

Moreover, the increasing population and urbanization of the UAE are creating a very high demand for bottled water. This is illustrated by the fact that a bottled-water plant at the medium-sized city of Ras Al Khaimah produces 90,000 bottles per hour. There will be even greater demand for bottled water in the UAE as its tourism industry is growing quickly.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020–23 |

| Base Years | 2024 |

| Forecast Years | 2025–30 |

| Market Value in 2024 | USD 3.60 Billion |

| Market Value by 2030 | USD 5.78 Billion |

| CAGR (2025–30) | 8.21% |

| Top Key Players | Masafi, Agthia Group, Nestle, Al Ghadeer Drinking Water L.L.C., Falcon Spring, Dubai Crystal Mineral Water & Refreshments L.L.C., Our Oasis, Awafi Mineral Water Co., Zulal Water Company, Mai Dubai, and others. |

| Segmentation | By Type of Water (Purified Water, Mineral Water, Sparkling Water, Spring Water, Plain, Flavore), By Packaging (Plastic Bottles, Glass Bottles, Metal Cans, Others (Tetra Pack Cartons, Bioplastics, etc.)), By Distribution (Hypermarkets & Supermarkets, Convenience Stores, Home Delivery, On Trade, Others), and others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

With both legacy players and newer entrants catering to the rising demand from various consumer segments across the country, the market is likely to see strong growth supported by premiumization and product diversification. This provides an attractive opportunity for companies and investors looking to compete in the UAE Bottled Water Market through 2030 and beyond.

UAE Bottled Water Market Driver:

Hot Climate & Water Scarcity Driving Market Demand – Most of the UAE has a dry and hot climate where temperatures regularly cross 45°C in the summers, and the humidity in coastal regions like Dubai and Abu Dhabi rises to 90%. This results in high hydration requirements for its population who live in such conditions for almost half of the year. This is evident in the fact that the country has one of the highest per capita consumption of bottled water in the world, 250-300 liters per year, as compared to the US’s 100 liters and the global average of just 24 liters. Extreme weather conditions see public advisories being issued to increase hydration and ensure heat safety, which shows the critical demand for bottled water in the country.

The demand for bottled water is further boosted because of the scarcity of fresh water in the UAE. The drinking water available in the country is supplied after processing seawater because there are no rivers or perennial lakes in the country. This causes consumers to prefer bottled water not just for drinking but also for cooking food and making beverages because of taste and perceived safety concerns. These factors are creating a strong demand for bottled water that is likely to continue in the foreseeable future.

UAE Bottled Water Market Opportunity:

Inclination Towards Sustainability and Circular Economy – The UAE is rapidly moving towards environmental sustainability and is aiming to reduce plastic waste dramatically. The country has pledged to cut its landfill volume by 75% by 2031 and is thus promoting reusable materials and recycling. Manufacturers and retailers are being encouraged to design environmentally friendly packaging for bottled water by several cities that have limited single-use plastic consumption. Sustainable packaging solutions such as plant-based bottles (Agthia), aluminum cans (Mai Dubai), and Tetra Pak (Our Oasis) have thus emerged in the marketplace.

Sustainable packaging is also gaining traction as consumers are choosing bottled water brands that use alternative materials due to shifting preferences for eco-friendly materials. This is also driven by environmental, social, and governance (ESG) goals of large-scale retailers and clients in the hospitality sector, who are showing increasing preference for sustainable packaging. Bottled water companies can thus unlock market growth by tapping into this growing demand for sustainability across the UAE.

UAE Bottled Water Market Challenge:

High Market Fragmentation – The UAE Bottled Water Industry contains a large number of players who operate on the national (Agthia, Mai Dubai, etc.) or regional (Falcon Spring, Zulal, etc.) levels. This can lead to tough competition amongst existing players for market share, while also making the entry of new players a bit challenging. Consumers are price-sensitive and show limited brand loyalty, which makes them switch to products that are cheaper or readily accessible.

This lack of maturity in the UAE Bottled Water Market is causing two problems for players operating in the market. Firstly, the inconsistency in sales can lead to diminished revenues and profits, which can make operations difficult for newer entrants. Secondly, it can also affect the scalability of operations and technological innovation, which can restrict the growth potential. Thus, companies in the UAE bottled water market face a big challenge unless they undertake strategic initiatives like consolidation or product differentiation.

UAE Bottled Water Market Trend:

Premiumization & Product Diversification Gaining Momentum – The bottled water market in the UAE is seeing a rising trend of companies offering a more premium and diversified portfolio of products, which is slowly transforming bottled water from a basic commodity to a value-added product. Companies are responding to an evolving consumer base, where the market is getting segmented into value, mid-level, and premium consumers. While plain purified water serves the large value segment, companies are offering other products to cater to the needs of the mid (mineral and flavored water) and premium (alkaline and sparkling water) segments.

This is increasing profit margins for these companies as they are shifting the focus of the bottled water market from volume to value. This is allowing these companies to scale operations and grow their market share as the market continues to evolve. This trend is thus likely to shape the UAE Bottled Water Market in the coming years as industry players continue to offer more differentiated products.

UAE Bottled Water Market (2025-2030): Segmentation Analysis

The UAE Bottled Water Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025-2030 at the national level. Based on the analysis, the market has been further classified as:

Based on Packaging:

- Plastic Bottles

- Glass Bottles

- Metal Cans

- Others (Tetra Pack Cartons, Bioplastics, etc.)

Plastic bottles form the dominant segment based on packaging, with an estimated market share of 85-90%. This segment constitutes the bulk of the market demand and is widely used in retail (0.5-1.5 liters) as well as gallon (18.9 liters) deliveries. This is possible because of the added convenience and portability due to the lightness, cost-effectiveness, and durability of plastic bottles. Plastic bottles also improve the competitiveness of manufacturers in a price-sensitive market due to enhanced cost-effectiveness in the production and distribution of bottled water.

Plastic bottles also allow manufacturers to conveniently offer bottled water in a wide variety of sizes because they can be easily modified according to requirements. They can also be designed to be reused with minimal chances of breaking or bending as compared to metal or glass containers. Their superior versatility is creating market demand and leading to the continued dominance of this segment in the UAE Bottled Water Market.

Based on Distribution:

- Hypermarkets & Supermarkets

- Convenience Stores

- Home & Office Delivery (HOD)

- On Trade

- Others

HOD forms the dominant segment based on distribution, accounting for an estimated 35-40% revenue in the UAE Bottled Water Market. This segment includes bottled water supplied directly to consumers at their location, which can be residential apartments, labor accommodations, offices, and small institutions. These buildings have large concentrations of consumers who are looking for convenience, cost-effectiveness, and customizability, driving the dominance of this segment.

HOD eliminates retailer dependency, which enhances the consumer experience as a result of direct relationships and feedback loops. Most companies operating in this segment have their dedicated mobile apps, which offer services like scheduled delivery and subscription models that add convenience. This also allows companies to analyze customer data and provide added features like order reminders and product recommendations. Companies also use promotional offers and cross-selling, which further boost their sales and contribute to the continued dominance of this segment in the bottled water market of the UAE.

UAE Bottled Water Industry Recent Development:

- March 2025: Agthia Group acquired leading HOD service provider Riviere, which boosted its market competitiveness by tripling its consumer base, enhancing its manufacturing capabilities, and expanding its presence across four Emirates.

- February 2025: At Gulfood 2025, Agthia Group received the ‘Supplier of the Year – Most Sustainable’ award for developing 100% recyclable PET bottles, positioning the company as a leader in sustainability.

Gain a Competitive Edge with Our UAE Bottled Water Market Report

- UAE Bottled Water Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- UAE Bottled Water Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Assumptions

- Market Segmentation

- Executive Summary

- UAE Bottled Water Market Outlook, 2020-2030F

- Market Size & Analysis

- By Quantity Sold in Liters

- By Revenues

- Market Share & Analysis

- By Type of Water

- Purified Water

- Mineral Water

- Sparkling Water

- Spring Water

- Plain

- Flavore

- By Packaging

- Plastic Bottles

- Glass Bottles

- Metal Cans

- Others (Tetra Pack Cartons, Bioplastics, etc.)

- By Distribution

- Hypermarkets & Supermarkets

- Convenience Stores

- Home Delivery

- On Trade

- Others

- By Region

- Dubai

- Abu Dhabi

- Sharjah

- Northern Emirates

- By Type of Water

- Market Size & Analysis

- UAE Purified Bottled Water Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues

- By Quantity Sold in Liters

- Market Size & Analysis

- By Distribution

- By Region

- Market Size & Analysis

- UAE Mineral Bottled Water Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues

- By Quantity Sold in Liters

- Market Size & Analysis

- By Distribution

- By Region

- Market Size & Analysis

- UAE Sparkling Bottled Water Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues

- By Quantity Sold in Liters

- Market Size & Analysis

- By Distribution

- By Region

- Market Size & Analysis

- UAE Spring Bottled Water Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues

- By Quantity Sold in Liters

- Market Size & Analysis

- By Distribution

- By Region

- Market Size & Analysis

- UAE Bottled Water Market Value Chain Analysis, 2023

- UAE Bottled Water Market Dynamics

- Growth Drivers

- Challenges

- Impact Analysis

- UAE Bottled Water Market Trends & Insights

- UAE Bottled Water Market Hotspots & Opportunities

- UAE Bottled Water Market Regulations

- Competitive Benchmarking

- Competition Matrix

- Product Portfolio

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles (Business Description, Product Offering, Target Markets, Assets, Strategic Alliances or Partnerships, etc.)

- Masafi

- Agathia Group

- Nestle

- AL Ghadeer Drinking Water L.L.C

- Falcon Spring

- Dubai Crystal Mineral Water & Refreshments L.L.C

- Our Oasis

- AWAFI MINERAL WATER CO.

- Zulal Water Company

- Mai Dubai

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making