UAE Anti-Glare & Anti-Reflective Eyeglasses Market Research Report: Forecast (2023-2028)

By Lens Material (Normal Glass, Polycarbonate, Trivex, Others), By Application (Powered Eyeglasses, Sunglasses, Reading Eyeglasses, Computer Eyeglasses, Other), By Frame Material (...Metal, Plastic, Others), By Type (Rimmed, Rimless, Semi-Rimmed), By Sales Channel (E-commerce, Retail Chains, Clincs & Hospitals), By Region (Dubai, Abu Dhabi, Sharjah, Rest of the UAE), By Company (Cutler & Gross, Essilor International S.A., iCoat Company LLC, Carl Zeiss AG, Hoya Corporation, Rodenstock GmbH, Al Falah Optics, EGMA Lens Factory, Oakley, Carrera, Others) Read more

- FMCG

- Jun 2023

- Pages 124

- Report Format: PDF, Excel, PPT

Market Definition

Anti-glare glasses have an anti-reflective coating on one side, whereas anti-reflective has a coating on both sides of the glasses. These coatings are provided to reduce the glare & reflections from the surfaces of the lenses, thereby enhancing the quality of the vision as more light can pass through them.

Market Insights & Analysis: UAE Anti-Glare & Anti-Reflective Eyeglasses Market (2023-28)

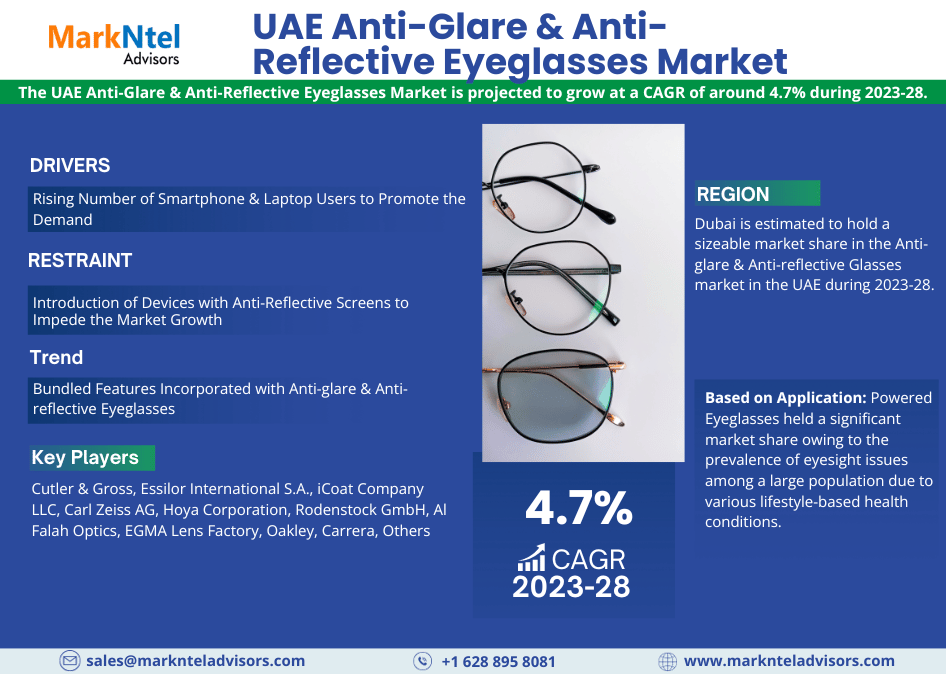

The UAE Anti-Glare & Anti-Reflective Eyeglasses Market is projected to grow at a CAGR of around 4.7% during the forecast period, i.e., 2023-28. The market has grown since the historical years owing to advancing technological upgradation in eyeglass technology as well as consumer focus towards adopting anti-glare & anti-reflective properties due to extensive work on computers & mobile screens. The high exposure to electronics like laptops, smartphones, and tablets has resulted in an increased screen, owing to which the customers are buying anti-glare glasses with technologies that protect them from harmful blue light emitting from these electronic devices. Also, prolonged exposure to these devices causes headaches & eyestrains, so to protect their eyes from the same individuals are inclined towards anti-glare eyeglasses.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 4.7% |

| Region Covered | Dubai, Abu Dhabi, Sharjah, Rest of the UAE |

| Key Companies Profiled | Cutler & Gross, Essilor International S.A., iCoat Company LLC, Carl Zeiss AG, Hoya Corporation, Rodenstock GmbH, Al Falah Optics, EGMA Lens Factory, Oakley, Carrera, Others |

| Unit Denominations | USD Million/Billion |

The high usage of digital signage for advertisement has led customers to be surrounded by glowing screens, as well as the lights for decorative purposes also add to the brightness. Consequently, customers use these glasses to reduce the glare emitting out of these screens. In addition to this, the climate of the UAE, which is usually hot & sunny, lets customers face reflections from many surfaces. Consequently, customers use anti-glare sunglasses to avoid the glares from these surfaces.

Furthermore, the changing lifestyle of individuals has resulted in an extended nightlife culture, supporting the sales of these glasses. The customers find them highly useful as they protect them from the reflections of the sun & glares of the lights at night, as well as from the glares of the taillights, indicators, and headlights of other vehicles, thus providing safety to the customers. Therefore, the rising number of automobiles in the region has augmented the chances of congestion & accidents. This, in turn, supplements the demand for these glasses in the following years.

UAE Anti-Glare & Anti-Reflective Eyeglasses Market Key Driver:

Rising Number of Smartphone & Laptop Users to Promote the Demand - In the historical period, the market witnessed rapid growth in digitalizing the lifestyle of the customers, which, in turn, has raised the amount of time customers are in front of the screens. Moreover, the pandemic gave a significant boost to digitalization as it advanced online education, online gaming, and OTT platforms. This growth further enriched the number of screens & time customers spent while sitting in front of the same. For instance,

- In 2022, Dubai Multi Commodities Centre (DMCC) and the Government of Dubai publicized the DMCC Gaming Centres to strengthen the industry in the Middle East & North America (MENA) region.

These advancements have led customers to sit for long hours facing the glare from the screens. Hence, with the higher exposure to blue light from the devices, customers across wide age groups have shifted towards anti-reflective & anti-protective eyeglasses. Moreover, in the coming years, technological advancements would further amplify the usage and installation of screens. For instance:

- In 2022, Majid Al Futtaim Leisure, Entertainment & Cinemas signed a deal with Immersive Gamebox (IGB) to develop & design digital smart rooms.

Therefore, with the higher adoption & integration of screens around the customers, the usage of these glasses is foreseen to be enhanced in the forecast period.

UAE Anti-Glare & Anti-Reflective Eyeglasses Market Possible Restraint:

Introduction of Devices with Anti-Reflective Screens to Impede the Market Growth - Electronic companies like LG, Samsung, and Dell have been working on screens that provide customer protection from the glare & blue light emitting from the screens. In recent years they have launched several products, such as television & laptops, offering respective capabilities. For instance:

- Samsung, in 2022, launched Odyssey Ark, a curved gaming screen with a matte display that provides both anti-glare & anti-reflection protection.

This shield feature decreases the importance of these eye protection glasses & pushes the customers towards using regular eyeglasses. Regular eyeglasses are also priced lower than anti-glare eyeglasses, therefore customers refrain from using anti-glare glasses with the advancement in glare protection technologies in the electronic devices segment. Accounting for the inclusion of these glasses in electronic devices, the demand for these glasses is envisioned to experience notable growth constraints in the coming years.

UAE Anti-Glare & Anti-Reflective Eyeglasses Market Growth Opportunity:

Emergence of Night Driving Glasses to Upscale the Market - The UAE has one of the highest ratios of population to the ownership of cars, due to which the consumers experience high exposure to light pollution at night on the roads. The rising number of automobiles in the region has raised the chances of congestion & accidents. This, in turn, augments the demand for night driving glasses, offering anti-reflective & anti-glare features for easy management of light on highways.

For instance, according to the Road and Transport Authority (RTA), Dubai had one of the highest car-to-people ratios in 2020, which was around 1000 people to nearly 540 cars, which led to congestion. This increased the time customers were exposed to the lights of the vehicles leading them towards anti-glare glasses to protect their eyes. With the growing number of cars in the UAE & traffic congestion in the country, the night driving eyeglasses category equipped with the eye-protecting coating is anticipated to find an upscaling demand, thereby offering great growth potential to the market.

UAE Anti-Glare & Anti-Reflective Eyeglasses Market Key Trend:

Bundled Features Incorporated with Anti-glare & Anti-reflective Eyeglasses - The anti-glare lenses offer bundled features like UV protection, crack resistance, scratch resistance, water resistance, dust resistance, and UV protection. These bundled features attract users towards them as they get the benefits of many features together while buying eyeglasses with these lenses instead of normal lenses. With the technological advancements in the upcoming years, the lenses would be able to provide more combinations of features together & provide customers with more bundled options.

UAE Anti-Glare & Anti-Reflective Eyeglasses Market (2023-28): Segmentation Analysis

The UAE Anti-Glare & Anti-Reflective Eyeglasses Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2023–2028 at the regional, and national levels. Based on the Application, and Frame Material the market has been further classified as:

Based on Application:

- Powered Eyeglasses

- Sunglasses

- Reading Eyeglasses

- Computer Eyeglasses

- Other (Fashion Accessory, Eye-protection, etc.)

Among them, Powered Eyeglasses held a significant market share owing to the prevalence of eyesight issues among a large population due to various lifestyle-based health conditions. With a higher requirement to opt for powered eyeglasses for correcting vision by the old age & adult population, this category has attained a sizeable position in the country's market. Additionally, the young-age individuals & children in the UAE suffer from various ailments on a notable scale, due to which the powered eyeglass category is expected to retain its prominent share in the UAE. For instance:

- In 2022, Abu Dhabi’s Phoenix Hospital reported a deficiency of Vitamin D among nearly 75% of the students in the UAE, leading to a major cause for upcoming eye-related issues.

Another fast-growing category in the market was Computer Eyeglasses & Reading Eyeglasses. Their growth was influenced by the growing usage of electronic screens among consumers in the UAE.

Based on Frame Material:

- Metal

- Plastic

- Others (Composites, wood, etc.)

The Metal Frame held a significant market share in the past years as it was able to provide all the desired frame properties & variabilities in color, durability, lightness, price, and uniqueness. The metals like Titanium, Stainless steel, and Monel are being used to make the frames, which provide a variety of options for the brands to make the raw materials & thus help in the production due to the easy availability of the above.

Plastic showed decent growth in the past years as it provided customers with economical anti-glare glasses with properties of lightweight & flexible. In recent years, in line with sustainability trends, wooden frame has also shown considerable growth as they are eco-friendly & have good aesthetic value. Therefore, in the upcoming years, wooden frame is also expected to grow at a modest rate, following metal frames, further contributing to the revenue growth of the UAE Anti-Glare & Anti-Reflective Eyeglasses Market in the following years.

UAE Anti-Glare & Anti-Reflective Eyeglasses Market Regional Projection

Geographically, the market expands across:

- Dubai

- Abu Dhabi

- Sharjah

- Rest of the UAE

Dubai is estimated to hold a sizeable market share in the Anti-glare & Anti-reflective Glasses market in the UAE during 2023-28. With the high population & heightened inclination of urban consumers to purchase premium eyewear products, the region is presumed to hold its prominence during the forecast years. Other places, such as Sharjah & Abu Dhabi, would be conducive to the adoption of anti-glare & anti-reflective glasses in the next years due to expanding urbanization & the establishment of a large number of retail stores aimed at stimulating consumer expenditure towards premium products.

Gain a Competitive Edge with Our UAE Anti-Glare & Anti-Reflective Eyeglasses Market Report

- UAE Anti-Glare & Anti-Reflective Eyeglasses Market report provides a detailed and thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics and make informed decisions.

- This report also highlights current market trends and future projections, allowing businesses to identify emerging opportunities and potential challenges. By understanding market forecasts, companies can align their strategies and stay ahead of the competition.

- UAE Anti-Glare & Anti-Reflective Eyeglasses Market report aids in assessing and mitigating risks associated with entering or operating in the market.

- The report would help in understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks and optimize their operations.

Frequently Asked Questions

UAE Anti-Glare & Anti-Reflective Eyeglasses Market Research Report (2023-2028) - Table of Contents

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- The UAE Anti-Glare & Anti-Reflective Eyeglasses Market Trends & Insights

- The UAE Anti-Glare & Anti-Reflective Eyeglasses Market Dynamics

- Growth Drivers

- Challenges

- The UAE Anti-Glare & Anti-Reflective Eyeglasses Market Hotspot & Opportunities

- The UAE Anti-Glare & Anti-Reflective Eyeglasses Market Outlook, 2018- 2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Lens Material

- Normal Glass

- Polycarbonate

- Trivex

- Others (Crown glass, Tribrid, etc.)

- By Application

- Powered Eyeglasses

- Sunglasses

- Reading Eyeglasses

- Computer Eyeglasses

- Other (Fashion Accessory, Eye-Protection, etc.)

- By Frame Material

- Metal

- Plastic

- Others (Composites, wood, etc.)

- By Type

- Rimmed

- Rimless

- Semi-Rimmed

- By Sales Channel

- E-commerce

- Retail Chains

- Clinics & Hospitals

- By Region

- Dubai

- Abu Dhabi

- Sharjah

- Rest of the UAE

- By Company

- Competition Characteristics

- Revenue Shares

- By Lens Material

- Market Size & Analysis

- Dubai Anti-Glare & Anti-Reflective Eyeglasses Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Lens Material

- By Application

- By Frame Material

- By Type

- By Sales Channel

- Market Size & Analysis

- Abu Dhabi Anti-Glare & Anti-Reflective Eyeglasses Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Lens Material

- By Application

- By Frame Material

- By Type

- By Sales Channel

- Market Size & Analysis

- Sharjah Anti-Glare & Anti-Reflective Eyeglasses Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Lens Material

- By Application

- By Frame Material

- By Type

- By Sales Channel

- Market Size & Analysis

- Competition Outlook

- Competition Matrix

- Product Portfolio

- Target Markets

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles (Business Description, Solutions Offered, Business Segments, Financials, Future Plans)

- Cutler & Gross

- Essilor International S.A.

- iCoat Company LLC

- Carl Zeiss AG

- Hoya Corporation

- Rodenstock GmbH

- Al Falah Optics

- EGMA Lens Factory

- Oakley

- Carrera

- Lenskart

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making