Saudi Arabia Online Gaming Market Research Report: Forecast (2023-2028)

By Platform Type (Gaming Console, Smart Phone/ Tablet, Virtual Reality, PC, Streaming, Others (Television, Web Browser, Arcade, etc.)), By Game Type (Sports Games, Racing Games, Ad...venture & Action Games, Strategy Games, Others (Role-Playing Games, Card Games, etc.)), By Revenue Model (Free Online Gaming, Paid Online Gaming), By Company (Sony Corporation, Microsoft Corporation, Apple Inc., Google LLC (Alphabet Inc.), Electronic Arts Inc., NetEase Inc. Ltd., Tencent Holdings Ltd., Nintendo, Ubisoft Entertainment, Square Enix Co., Ltd., Blizzard Entertainment, Inc.) Read more

- ICT & Electronics

- May 2023

- Pages 121

- Report Format: PDF, Excel, PPT

Market Definition

Online Games are virtually-integrated video games on PCs, mobile phones, gaming consoles, etc., played over the internet. Rising internet penetration in the country and imposition of nationwide lockdown during 2020 are the key factors contributing to the increased demand for online games. Furthermore, burgeoning government support for gamers in line with Saudi Vision 2030 to help boost the online gaming industry as a key contributor to the nation’s economy is another crucial aspect driving the demand for online games.

Market Insights & Analysis: Saudi Arabia Online Gaming Market (2023-28)

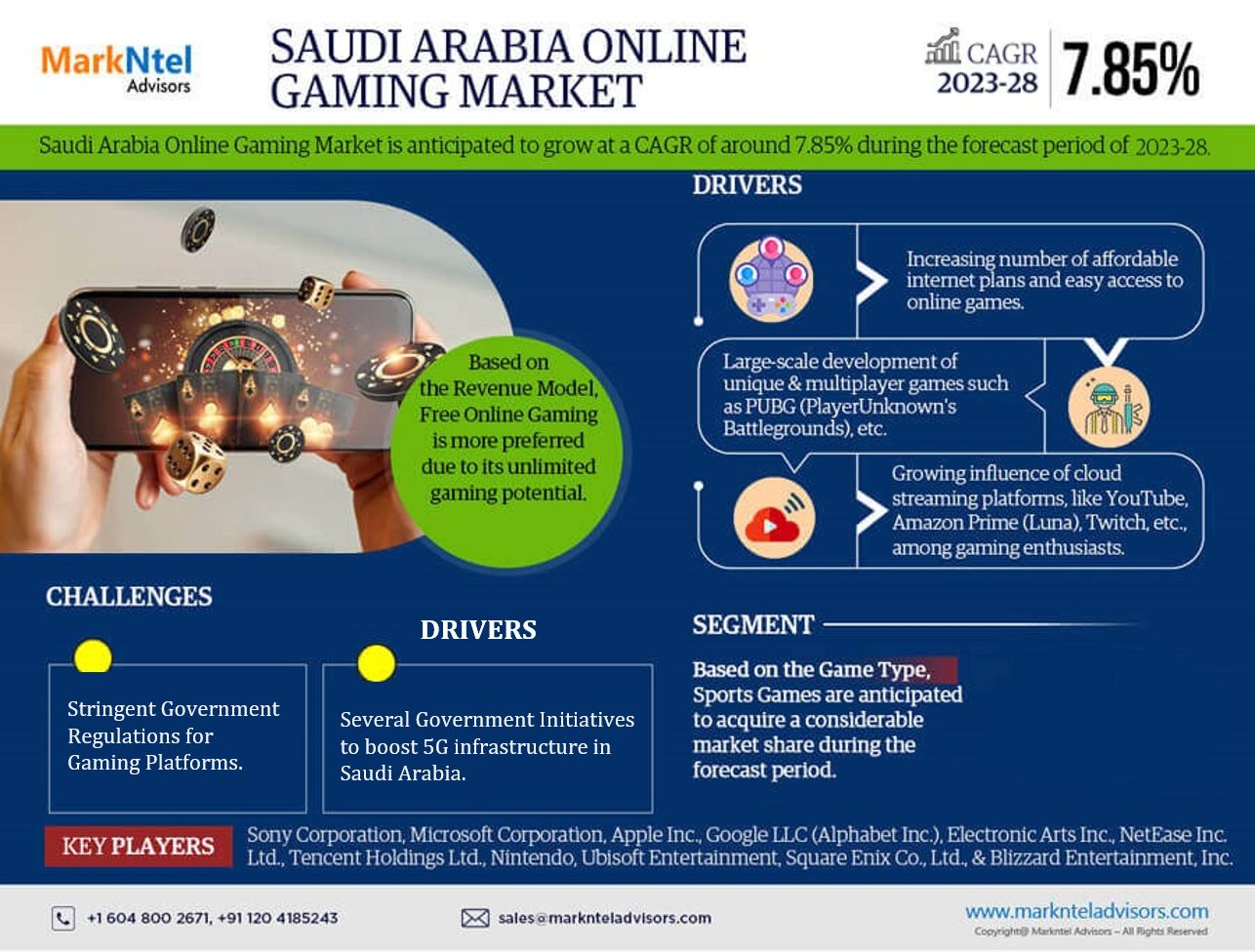

The Saudi Arabia Online Gaming Market is projected to grow at around 7.85% CAGR during the forecast period, i.e., 2023-28. The growth of the market would be propelled mainly by the increasing number of affordable internet plans, easy access to online games, and large-scale development of unique & multiplayer games, such as PUBG (PlayerUnknown's Battlegrounds), etc.

Since its inception, the federation has organized multiple world-class national & international gaming tournaments & events to attract investments from both local & private-sector corporations while actively working with international gaming developers for opportunities in Saudi Arabia.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 7.85% |

| Key Companies Profiled | Sony Corporation, Microsoft Corporation, Apple Inc., Google LLC (Alphabet Inc.), Electronic Arts Inc., NetEase Inc. Ltd., Tencent Holdings Ltd., Nintendo, Ubisoft Entertainment, Square Enix Co., Ltd., Blizzard Entertainment, Inc. |

| Unit Denominations |

USD Million/Billion |

The educational institutions of Saudi Arabia are increasingly adopting different forms of computer games for children to deliver learning content in the form of puzzle games, GK quiz games, etc. This development aims to offer alternative educational games to develop their learning & social skills, inspired by their culture, history, and language. Hence, these aspects are expected to enhance the Saudi Arabia Online Gaming Market size through 2028.

Market Dynamics

Key Driver: Several Government Initiatives to boost 5G infrastructure in Saudi Arabia

The Kingdom of Saudi Arabia has the highest penetration of Internet users & gamers, making it the 19th largest online gaming market worldwide. With the increasing number of online gamers in the country, there exists a need to have a stable internet connection to minimize breakouts in gaming since the online gaming industry is slowly becoming one of Saudi Arabia’s prominent revenue generators. Moreover, technology, media, & telecommunications are the key pillars strengthening the objectives of Saudi Vision 2030.

To strengthen the internet infrastructure of Saudi Arabia, the Ministry of Communications and Information Technology is working toward expanding high-speed internet connectivity of more than 10 Megabytes per second (Mbps) across all rural areas by 2022 in order to stipulate online gamers to play games without any speed breakout for a better gaming experience.

Furthermore, new government agencies, such as the Saudi Data, Artificial Intelligence Authority (SAAIA), & its sub-entities, the National Center for AI, etc., are dedicated to advancing technology-enabled society & promoting the penetration of online gamers in Saudi Arabia. For instance, London-based satellite firm OneWeb is forming a joint venture with a NEOM Tech & Digital Holding Company to provide high-speed internet across Saudi Arabia.

Growth Restraint: Stringent Government Regulations for Gaming Platforms

One of the most prominent challenges to the Saudi Arabia Online Gaming Market is dynamic regulations imposed by the government for citizens' welfare. In November 2021, the Saudi Communications and Information Technology Commission (CITC) published a consultation on its draft Digital Content Platform regulations for digital gaming platforms in the country. Article 5.2 of the CITC draft specifies that Satellite Pay TV platforms, IPTV platforms (Amazon), Video OTT platforms (Netflix), etc., face the heaviest burden since they need to obtain a license before offering services.

Furthermore, games like Call of Duty 4: Modern Warfare, Grand Theft Auto series, Manhunt series, along with 44 other games, have been completely banned in Saudi Arabia since these were not in compliance with the Saudi Arabian digital regulation and were depicting violence, terrorism role plays, & other offensive content.

Market Segmentation

Based on Game Type:

- Sports Games

- Racing Games

- Adventure & Action Games

- Strategy Games

- Others (Role-Playing Games, Card Games, etc.)

Of them all, Sports Games are anticipated to acquire a considerable market share during the forecast period, owing to the increasing gaming subscribers and government partnerships to boost the country's Electronic Sports (E-sports) industry. According to Saudi Arabia CITC (Communications & Information Technology Commission), FIFA topped the list of most-played video games.

Furthermore, the launch of various sports events by SAFEIS (Saudi Arabian Federation for Electronic and Intellectual Sports) in Saudi Arabia to attract gaming nerds in the country is another crucial aspect expected to boost the online gaming market in the forthcoming years. For instance:

- In June 2021, NEOM signed a Memorandum of Understanding with SAFEIS to host an electronic sports event in the city.

- The same year in April, STC signed a Memorandum of Understanding (MOU) with the Saudi Arabia Federation for Electronic and Intellectual Sports (SAFEIS) as a strategic partner & digital enabler in the field of games, electronic & mental sports, etc.

Based on Revenue Model:

- Free Online Gaming

- Paid Online Gaming

Here, the free-to-play pricing model is more preferred by gamers due to its unlimited gaming potential & free-of-cost download availability in app stores. It helps players sample the game & decide whether to invest time & money to gain higher revenues. Poppy Horror: Chapter One, Poppy Rope Game, Brain Story: Tricky Puzzle, FNF Music Battle: Original Mod, etc., are some of the top free-to-play games that reported more than 10 million downloads in the country in 2021. Furthermore, the periodic launch of free-to-play games is another crucial aspect expected to drive users' interest in online gaming. For instance:

- In January 2022, Garena International announced launching “New Age Day” in Free Fire with features like Vantage Zone, Railroad Zone, Dock Zone, etc.

- In October 2021, Electronic Arts Inc. released FIFA 22 globally with features, such as real-life themes, Career Mode, FUT Heroes, etc.

Recent Developments in the Saudi Arabia Online Gaming Market

- In January 2022, Sony revealed a Virtual Reality (VR) headset, PSVR2, for its PS5 gaming console, i.e., furnished with upgraded hardware for enhanced headset features & VR2 sense controllers for exceptional immersion capabilities.

- In December 2021, in celebration of the 20th anniversary of Xbox & the Halo series, Microsoft released a multiplayer version of Halo Infinite for Windows, Xbox One, & Xbox Series X/S.

Gain a Competitive Edge with Our Saudi Arabia Online Gaming Market Report

- Saudi Arabia Online Gaming Market Report by Markntel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Saudi Arabia Online Gaming Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Market Segmentation

- Assumptions

- Preface

- Executive Summary

- Impact of COVID-19 on Saudi Arabia Online Gaming Market

- Saudi Arabia Online Gaming Market Trends & Insights

- Saudi Arabia Online Gaming Market Dynamics

- Drivers

- Challenges

- Saudi Arabia Online Gaming Market Regulations & Policies

- Saudi Arabia Online Gaming Market Supply Chain Analysis

- Saudi Arabia Online Gaming Market Hotspots & Opportunities

- Saudi Arabia Online Gaming Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Platform Type

- Gaming Console

- Smart Phone/ Tablet

- Virtual Reality

- PC

- Streaming

- Others (Television, Web Browser, Arcade, etc.)

- By Game Type

- Sports Games

- Racing Games

- Adventure & Action Games

- Strategy Games

- Others (Role-Playing Games, Card Games, etc.)

- By Revenue Model

- Free Online Gaming

- Paid Online Gaming

- By Company

- Competition Characteristics

- Market Share of Leading Companies, By Revenues

- Competitor Placement in MarkNtel Quadrant

- By Platform Type

- Market Size & Analysis

- Saudi Arabia Free Online Gaming Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Platform Type

- Gaming Console

- Smart Phone/ Tablet

- Virtual Reality

- PC

- Streaming

- Others (Television, Web Browser, Arcade, etc.)

- By Game Type

- Sports Games

- Racing Games

- Adventure & Action Games

- Strategy Games

- Others (Role-Playing Games, Card Games, etc.)

- By Platform Type

- Market Size & Analysis

- Saudi Arabia Paid Online Gaming Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Platform Type

- Gaming Console

- Smart Phone/ Tablet

- Virtual Reality

- PC

- Streaming

- Others (Television, Web Browser, Arcade, etc.)

- By Game Type

- Sports Games

- Racing Games

- Adventure & Action Games

- Strategy Games

- Others (Role-Playing Games, Card Games, etc.)

- By Platform Type

- Market Size & Analysis

- Saudi Arabia Online Gaming Market Key Strategic Imperatives for Growth & Success

- Competition Outlook

- Competition Matrix

- Brand Specialization

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles

- Sony Corporation

- Microsoft Corporation

- Apple Inc.

- Google LLC (Alphabet Inc.)

- Electronic Arts Inc.

- NetEase Inc. Ltd.

- Tencent Holdings Ltd.

- Nintendo

- Ubisoft Entertainment

- Square Enix Co., Ltd.

- Blizzard Entertainment, Inc.

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making