Global Tax Software Market Research Report: Forecast (2024-2030)

Tax Software Market - By Offerings (Tax Software, Services), By Deployment (Cloud, On-premise), By Tax Type (Sales Tax, Income Tax, Others), By Enterprise Type (Large Enterprises, ...Small & Medium Enterprises), By End User (IT & Telecom, BFSI, Government, Retail & Consumer Goods, Healthcare, Others) and others Read more

- ICT & Electronics

- Feb 2024

- Pages 209

- Report Format: PDF, Excel, PPT

Market Definition

Tax software is designed for both personal and professional use cases and allows organizations to easily prepare and file tax returns with their respective government authorities. In addition, this software also guides organizations regarding the process of tax filing, including data entry and tax calculations. It allows organizations to reduce the time and effort required for tax filing processes.

Market Insights & Analysis: Global Tax Software Market (2024-30)

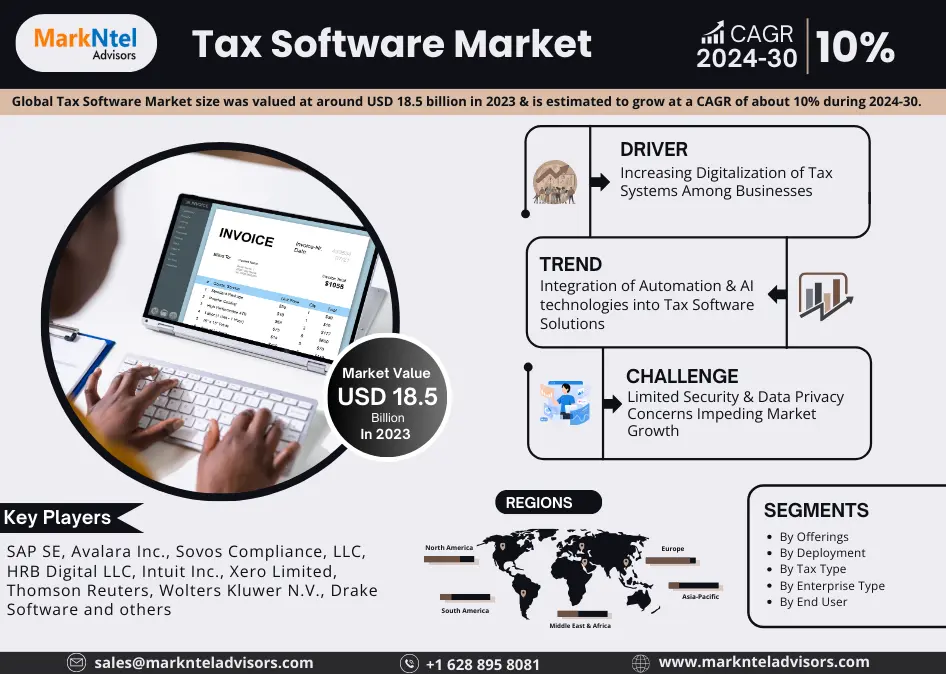

The Global Tax Software Market size was valued at around USD 18.5 billion in 2023 and is estimated to grow at a CAGR of about 10% during the forecast period, i.e., 2024-30. In recent years, the major factors that have been driving the demand for tax software technology include the growth of corporate offices across sectors including IT, BFSI, etc., in countries like India, Japan, Saudi Arabia, the UAE, etc. In recent years, the GCC and APAC regions have emerged as the preferred destinations for establishing businesses, owing to the availability of adequate resources, including a skilled workforce.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 10% |

| Regions Covered | North America: US, Canada, Mexico |

| Europe: Germany, The UK, France, Spain, Italy, Rest of Europe | |

| Asia-Pacific: China, India, Japan, South Korea, Australia, Rest of Asia-Pacific | |

| South America: Brazil, Rest of South America | |

| Middle East & Africa: UAE, Saudi Arabia, South Africa, Rest of MEA | |

| Key Companies Profiled | SAP SE, Avalara Inc., Sovos Compliance, LLC, HRB Digital LLC, Intuit Inc., Xero Limited, Thomson Reuters, Wolters Kluwer N.V., Drake Software, TaxSlayer LLC, Sage Group plc, ClearTax, TaxJar, TaxACT, Rethink Solutions Inc., Others |

| Market Value (2023) | USD 18.5 Billion |

This was also driven by the constant push by the governments of countries like the UAE, Qatar, Saudi Arabia, India, South Korea, etc., to establish their country as the digital hub and boost the economic growth of their respective countries. This has also led companies like NTT, Sentinel, etc. to announce their expansion programs across different countries. Hence, as these businesses ramped up their presence across the globe, the demand for tax software has accelerated, allowing them to reduce the manual workforce required for the paper-based tax filing process.

Additionally, the growth of government expenditure across the education sector, especially across countries like the UAE, the UK, India, etc., has been consistently supporting the expansion of educational institutes. Also, as the number of international students arriving in countries like the UK, the US, Germany, etc. has been increasing, the educational sector across these countries is witnessing continuous growth. Therefore, as these sectors are required to maintain and file their taxes on time, the demand for tax software technology is projected to amplify in the coming years

Global Tax Software Market Driver:

Increasing Digitalization of Tax Systems Among Businesses – The market growth has been attributed to the increasing digital transformation of business operations, leading to the heightened adoption of tax software solutions globally. Additionally, businesses were transitioning away from manual, paper-based tax processes toward digital solutions to enhance workflow efficiency, data management, and collaboration among stakeholders, positively impacting market growth during the historical years.

Digital tax software streamlines tax-related processes by automating tasks such as data entry, calculation, and reporting. This automation reduces manual effort and minimizes errors, resulting in substantial efficiency gains in tax preparation for businesses. Moreover, the adoption of digital tax software contributes to cost savings by diminishing the need for manual labor, paper-based processes, and administrative overheads associated with traditional tax preparation methods. Consequently, the automation and efficiency achieved through digitalization translate into cost savings over time, making tax software a cost-effective investment for SMEs worldwide.

Global Tax Software Market Opportunity:

Expansion of Small and Medium-Sized Enterprises (SMEs) to Offer New Opportunities – SMEs play an important role in increasing the demand for tax software solutions globally. SMEs in emerging markets often operate with limited resources and manpower, making manual tax compliance processes time-consuming, error-prone, and costly. Tax software offers cost-effective solutions tailored to the needs and budget constraints of SMEs, enabling them to automate routine tasks, reduce manual errors, and enhance efficiency in tax preparation and reporting.

In addition, SMEs in emerging markets engage in cross-border trade, and they operate in multiple tax jurisdictions, requiring tax software solutions that support international tax compliance. Tax software dealers offer multi-jurisdictional support, localization features, and expertise in international taxation, which positively address the challenges faced by SMEs in navigating diverse regulatory environments. Hence, with the rising expansion of SMEs, the demand for tax software solutions is anticipated to increase in the forthcoming years.

Global Tax Software Market Challenge:

Limited Security & Data Privacy Concerns Impeding Market Growth – The technology has evolved over the past couple of years, due to which tax software companies have also started offering digital solutions to different businesses across the globe. However, the end-user industries are suspicious of adopting these digital solutions due to the prevalence of cyberattacks & data breaches related to their management. Tax software handles sensitive financial and personal data, raising concerns about security and data privacy. Thus, with the growing concern about data breaches, end-user industries are limiting the usage of digital solutions offered by tax software-providing companies since it puts confidential data such as information regarding their customers, data about investors, and other company information at risk.

Therefore, ensuring robust cybersecurity measures, such as encryption, access controls, and compliance with data protection regulations like GDPR, is essential to safeguarding client information and maintaining trust in tax software solutions to improve their adoption in the future.

Global Tax Software Market Trend:

Integration of Automation & Artificial Intelligence (AI) technologies into Tax Software Solutions – The introduction of advanced technology in recent years has significantly improved productivity, streamlined processes, reduced manual errors, and enhanced efficiency. As a result, tax software solutions providers such as Thomson Reuters, Avalara, etc. are equipping themselves with the latest technologies, such as artificial intelligence (AI), machine learning, and data analysis, to make robust & critical decisions. For instance, in 2023, Thomson Reuters announced its plan to invest more than USD100 million per year in generative AI.

These include integrating generative AI skills through product development and acquisitions, leveraging strategic partnerships, and ensuring that its global workforce is upskilled in AI. Also, AI-powered features such as natural language processing (NLP), machine learning (ML), and robotic process automation (RPA) automate routine tasks like data entry, classification, and analysis, enabling tax professionals to focus on higher-value activities. Hence, the surging adoption of digital technologies & the integration of the technologies with traditional tax software management services would further gain support from end-users in the upcoming years.

Global Tax Software Market (2024-30): Segmentation Analysis

The Global Tax Software Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2024–2030 at the global level. According to the analysis, the market has been further classified as:

Based on Enterprise Type:

- Large Enterprises

- Small & Medium Enterprises (SMEs)

Out of these, the Small & Medium Enterprises (SMEs) have been dominating the Global Tax Software Market during the past few years. The number of SMEs across regions like South America, APAC, etc. has also showcased tremendous proliferation due to the healthy entrepreneurial ecosystem and supportive government measures. Countries such as Brazil, India, Saudi Arabia, etc., assisted in the form of business counseling, financial support & advice, technical support & guidance, etc., which led to the development of new SMEs across the globe. For instance,

- In 2022, according to Monsha’at, the General Authority for Small and Medium Enterprises, the number of SMEs in Saudi Arabia jumped by 9.3% in the third quarter of 2022 and reached approximately 1 million, up from 892,063 in the second quarter.

These SMEs needed scalable and compliant solutions to manage their tax filing and preparation processes, which has enhanced the demand for tax software across the segment.

Furthermore, countries like India, the UAE, Saudi Arabia, etc. are seeking to diversify their economies, for which they are planning to expand the SME ecosystem in the country to boost entrepreneurial activities. Hence, as these SMEs increase & expand and undergo digital transformation, the demand for efficient tax management solutions would surge in the coming years as well.

Based on End User:

- IT & Telecom

- BFSI

- Government

- Retail & Consumer Goods

- Healthcare

- Others (Hospitality, Education, etc.)

Among them, the government & public sector, which includes various government agencies, public institutions, and government-owned entities, held a noteworthy share of the market. The government and public sector encompass a wide range of services and activities, including infrastructure development, defense, public utilities, and more. Hence, as government sectors need to maintain a high level of compliance with tax regulation, they have been observed to largely adopt tax software and services over the past few years.

Furthermore, the governments of countries such as the UAE, India, Australia, etc., are actively promoting the digital transformation of the government sector. For instance,

- In 2023, Australia's government unveiled a fresh digital and data strategy that prioritizes the delivery of user-friendly services accessible to all individuals and businesses, the establishment of robust digital and data infrastructure built on trust and security, and the optimization of government operations to meet future challenges head-on.

Henceforth, the growing government initiatives to modernize the public sector through digitalization would further enhance the adoption of tax software in this sector in the coming years.

Global Tax Software Market (2024-30): Regional Projections

Geographically, the Global Tax Software Market expands across:

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

Regionally, Asia-Pacific has been showing significant market growth in the Global Tax Software Market over the past few years. This has been primarily attributed to a significant development in countries across the region like India, Australia, etc., in sectors like IT, BFSI, manufacturing, etc. Further, governments across countries like India, Thailand, etc. are focusing on paperless documentation across their offices. Hence, these efforts toward a paperless economy would boost the adoption of document management software technology across the region in the coming years as well.

Moreover, the Middle East and African countries are also anticipated to experience notable growth in the market in the coming years, specifically driven by their economic diversification efforts aimed at reducing reliance on oil revenues and promoting non-oil sectors. For this reason, countries like Saudi Arabia, the UAE, etc. are introducing strategic initiatives to stimulate growth across various industries, including pharmaceuticals, hospitality, and manufacturing. Consequently, with the expansion of businesses in these sectors, there would be a notable increase in demand for advanced tax software to efficiently manage their financial operations.

Global Tax Software Industry Recent Development:

- 2024: Sovos Compliance, LLC, acquired Aatrix Software, known for its e-filing solutions catering to small and medium-sized businesses (SMBs). This move aims to bolster Sovos' capabilities in compliance technology, particularly in local, state, and federal e-filing. The acquisition enhances Sovos' offerings for SMBs amidst evolving regulatory requirements and lower electronic filing thresholds.

- 2023: Avalara, Inc. introduced Avalara Property Tax, which is an innovative digital business solution that caters to real property and personal property tax management, aiming to enhance tax compliance through streamlined automation processes.

Gain a Competitive Edge with Our Global Tax Software Market Report

- Global Tax Software Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Tax Software Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Tax Software Market Start-up Ecosystem

- Entrepreneurial Activity

- Funding Received by Top Companies

- Key Investors Active in the Market

- Series Wise Funding Received

- Seed Funding

- Angel Investing

- Venture Capitalists (VC) Funding

- Others

- Global Tax Software Market Case Studies

- Global Tax Software Market Trends & Developments

- Global Tax Software Market Dynamics

- Drivers

- Challenges

- Global Tax Software Hotspot & Opportunities

- Global Tax Software Market Regulations, Policies & Standards

- Global Tax Software Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Offerings

- Tax Software- Market Size & Forecast 2019-2030, (USD Million)

- Standalone- Market Size & Forecast 2019-2030, (USD Million)

- Integrated- Market Size & Forecast 2019-2030, (USD Million)

- Services- Market Size & Forecast 2019-2030, (USD Million)

- Managed- Market Size & Forecast 2019-2030, (USD Million)

- Professional- Market Size & Forecast 2019-2030, (USD Million)

- Tax Software- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment

- Cloud- Market Size & Forecast 2019-2030, (USD Million)

- On-premise- Market Size & Forecast 2019-2030, (USD Million)

- By Tax Type

- Sales Tax- Market Size & Forecast 2019-2030, (USD Million)

- Income Tax- Market Size & Forecast 2019-2030, (USD Million)

- Others (VAT, Service Tax, Estate Tax, etc.)- Market Size & Forecast 2019-2030, (USD Million)

- By Enterprise Type

- Large Enterprises- Market Size & Forecast 2019-2030, (USD Million)

- Small & Medium Enterprises (SMEs)- Market Size & Forecast 2019-2030, (USD Million)

- By End User

- IT & Telecom- Market Size & Forecast 2019-2030, (USD Million)

- BFSI- Market Size & Forecast 2019-2030, (USD Million)

- Government- Market Size & Forecast 2019-2030, (USD Million)

- Retail & Consumer Goods- Market Size & Forecast 2019-2030, (USD Million)

- Healthcare- Market Size & Forecast 2019-2030, (USD Million)

- Others (Hospitality, Education, etc.)- Market Size & Forecast 2019-2030, (USD Million)

- By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- By Competition

- Competition Characteristics

- Market Share Analysis

- By Offerings

- Market Size & Analysis

- North America Tax Software Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offerings- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment- Market Size & Forecast 2019-2030, (USD Million)

- By Tax Type- Market Size & Forecast 2019-2030, (USD Million)

- By Enterprise Type- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- By Country

- The US

- Canada

- Mexico

- The US Tax Software Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offerings- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Canada Tax Software Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offerings- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Mexico Tax Software Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offerings- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- South America Tax Software Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offerings- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment- Market Size & Forecast 2019-2030, (USD Million)

- By Tax Type- Market Size & Forecast 2019-2030, (USD Million)

- By Enterprise Type- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- By Country

- Brazil

- Rest of South America

- Brazil Tax Software Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offerings- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- Europe Tax Software Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offerings- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment- Market Size & Forecast 2019-2030, (USD Million)

- By Tax Type- Market Size & Forecast 2019-2030, (USD Million)

- By Enterprise Type- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- By Country

- Germany

- The UK

- France

- Spain

- Italy

- Rest of Europe

- Germany Tax Software Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offerings- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- The UK Tax Software Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offerings- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- France Tax Software Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offerings- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Spain Tax Software Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offerings- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Italy Tax Software Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offerings- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Tax Software Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offerings- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment- Market Size & Forecast 2019-2030, (USD Million)

- By Tax Type- Market Size & Forecast 2019-2030, (USD Million)

- By Enterprise Type- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- By Country

- Saudi Arabia

- The UAE

- South Africa

- Rest of Middle East & Africa

- Saudi Arabia Tax Software Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offerings- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- The UAE Tax Software Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offerings- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- South Africa Tax Software Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offerings- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Tax Software Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offerings- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment- Market Size & Forecast 2019-2030, (USD Million)

- By Tax Type- Market Size & Forecast 2019-2030, (USD Million)

- By Enterprise Type- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- By Country

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia-Pacific

- China Tax Software Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offerings- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Japan Tax Software Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offerings- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- India Tax Software Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offerings- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- South Korea Tax Software Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offerings- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Australia Tax Software Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offerings- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- Global Tax Software Market Key Strategic Imperatives for Success & Growth

- Competitive Outlook

- Company Profiles

- SAP SE

- Business Description

- Range Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Avalara Inc.

- Business Description

- Range Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Sovos Compliance, LLC

- Business Description

- Range Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- HRB Digital LLC

- Business Description

- Range Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Intuit Inc.

- Business Description

- Range Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Xero Limited

- Business Description

- Range Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Thomson Reuters

- Business Description

- Range Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Wolters Kluwer N.V.

- Business Description

- Range Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Drake Software

- Business Description

- Range Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- TaxSlayer LLC

- Business Description

- Range Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Sage Group plc

- Business Description

- Range Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- ClearTax

- Business Description

- Range Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- TaxJar

- Business Description

- Range Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- TaxACT

- Business Description

- Range Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Rethink Solutions Inc.

- Business Description

- Range Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- SAP SE

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making