Saudi Arabia Super Sucker Machine Rental Market Research Report: Forecast (2026-2032)

Saudi Arabia Super Sucker Machine Rental Market - By Equipment Type (Wet Super Sucker, Dry Super Sucker, Combination Super Sucker), By Fuel (ICE, Electric), By Load Capacity (Small... capacity (Up to 5 m³), Medium capacity (5–10 m³), Large capacity (Above 10 m³)), By Rental Duration (Short-Term Rentals (Up to 12 Months), Long-Term Rentals (More than 12 Months)), By End User (Municipalities & Public Utilities, Oil & Gas Companies, Environmental Service Providers, Chemical & Mining Operations, Industrial Cleaning, Waste Management & Environmental Services, Construction & Excavation, Others), and others Read more

- Energy

- Jan 2026

- Pages 135

- Report Format: PDF, Excel, PPT

Saudi Arabia Super Sucker Machine Rental Market

Projected 10.25% CAGR from 2026 to 2032

Study Period

2026-2032

Market Size (2025)

USD 24.39 Million

Market Size (2032)

USD 48.29 Million

Base Year

2025

Projected CAGR

10.25%

Leading Segments

Based on Fuel: ICE

Saudi Arabia Super Sucker Machine Rental Market Report Key Takeaways:

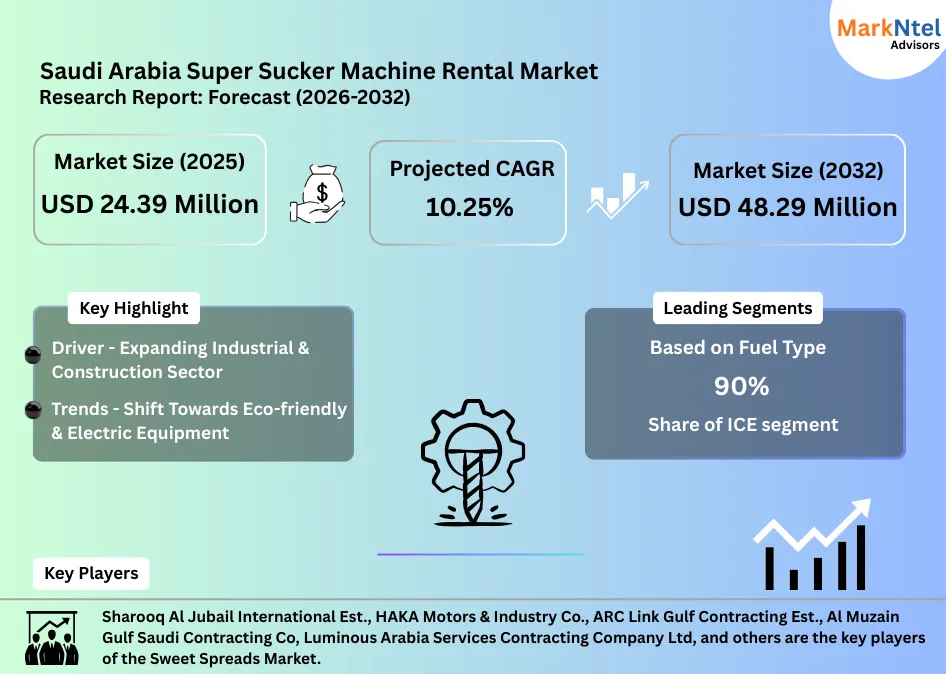

- The Saudi Arabia Super Sucker Machine Rental Market size was valued at around USD 24.39 million in 2025 and is projected to reach USD 48.29 million by 2032. The estimated CAGR from 2026 to 2032 is around 10.25%, indicating strong growth.

- By fuel, the ICE-based segment represented 90% of the Saudi Arabia Super Sucker Machine Rental Market size in 2025.

- By load capacity, the small capacity (Up to 5 m³) represented 60% of the Saudi Arabia Super Sucker Machine Rental Market size in 2025.

- By region, the central region leads the Saudi Arabia Super Sucker Machine Rental Market with a substantial 33% market share.

- The leading super sucker machine rental companies in Saudi Arabia are Sharooq Al Jubail International Est., HAKA Motors & Industry Co., ARC Link Gulf Contracting Est., Al Muzain Gulf Saudi Contracting Co, Luminous Arabia Services Contracting Company Ltd, Kanooz Industrial Services, Plant-Tech Arabia Co. Ltd., Zero Waste International Company Ltd., Arabian Consolidated Industrial Cleaning Services Co. (ACIC), Al-Fahhad Zegwaard-Co., and others.

Market Insights & Analysis: Saudi Arabia Super Sucker Machine Rental Market (2026- 2032):

The Saudi Arabia Super Sucker Machine Rental Market size was valued at around USD 24.39 million in 2025 and is projected to reach USD 48.29 million by 2032. Along with this, the market is estimated to grow at a CAGR of around 10.25% during the forecast period, i.e., 2026-32.

The Saudi Arabia Super Sucker Machine Rental Market is experiencing rapid growth, driven by the Kingdom’s expanding industrial and construction base and a parallel transition toward eco-efficient and electric equipment solutions across infrastructure, utilities, and industrial service operations.

Government indicators affirm this trajectory. As the data from the General Authority for Statistics (GaStat) shows, the construction sector’s real output expanded by 2.8% year-on-year in Q3 2025, while operating revenues reached SAR USD 125.5 billion in 2024, reflecting a 9.6% annual increase. This momentum mirrors the scale of nationwide building, infrastructure, and utility projects, each requiring excavation, waste extraction, and site remediation, where suction equipment is mission-critical.

Public expenditure continues to reinforce market fundamentals. For instance, Saudi Arabia’s 2025 national budget allocates USD 350 billion, with substantial funding directed toward infrastructure, housing, and transport networks. These segments demand precision excavation around buried utilities, pipelines, and dense urban corridors, applications increasingly served by Super Sucker machines due to their operational safety, speed, and minimal surface disruption.

Industrial investment is advancing in parallel. For example, in early 2024, private-sector industrial investment more than doubled, surpassing USD 1.8 billion, as the Kingdom accelerates downstream manufacturing and supply-chain localization.

Major industrial ecosystems such as Jubail and Yanbu, alongside expansions including the Yasref petrochemical complex, are generating continuous demand for pipeline works, tank cleaning, sludge removal, and industrial waste handling, core use cases for high-capacity suction equipment.

Beyond volume growth, the market is evolving technologically. Vision 2030’s sustainability agenda and the national emphasis on energy efficiency are reshaping equipment preferences. For instance, Advanced Super Sucker models, such as MH1S’s 15,000-liter unit, exemplify this shift: higher-capacity systems reduce operating cycles and disposal trips, lowering aggregate fuel consumption and on-site emissions while enhancing productivity. Rental customers increasingly prioritize such energy-efficient configurations to align with environmental compliance and operational efficiency standards.

Looking beyond 2025, Saudi Arabia’s industrial and construction trajectory will remain a primary demand driver for Super Sucker machine rentals. Official strategies outline plans to increase industrial exports six-fold and triple industrial investment to over USD 346 billion, supported by incentives, new industrial zones, and advanced manufacturing infrastructure. These commitments will drive continuous factory construction, logistics expansion, and utility development, where every phase of site preparation, trenching, and maintenance requires precision excavation and industrial cleanup, sustaining demand for high-capacity suction equipment.

Meanwhile, the Public Investment Fund’s forthcoming 2026–2030 strategy emphasizes advanced manufacturing and industrial ecosystems, ensuring a sustained pipeline of factories, logistics hubs, and utility corridors.

Saudi Arabia’s sustained construction expenditure, industrial expansion, and green transition are establishing a durable growth foundation for Super Sucker machine rentals. As project scale and technical complexity increase, demand for flexible, high-capacity, and environmentally efficient suction solutions will intensify across construction and industrial operations.

Saudi Arabia Super Sucker Machine Rental Market Recent Developments:

- November 2025: Blue Links Trading Co. has introduced the German-engineered MTS DINO suction excavator series to Saudi Arabia’s infrastructure market, offering high-performance non-destructive excavation equipment ideal for Vision 2030 mega-projects such as NEOM and Riyadh Metro. With models like the heavy-duty DINO12 and versatile DINO8, rental providers can now support safer, more efficient vacuum excavation operations nationwide.

Saudi Arabia Super Sucker Machine Rental Market Scope:

| Category | Segments |

|---|---|

| Equipment Type | (Wet Super Sucker, Dry Super Sucker, Combination Super Sucker |

| Fuel | (ICE, Electric |

| Load Capacity | (Small capacity (Up to 5 m³), Medium capacity (5–10 m³), Large capacity (Above 10 m³) |

| Rental Duration | (Short-Term Rentals (Up to 12 Months), Long-Term Rentals (More than 12 Months) |

| End User | (Municipalities & Public Utilities, Oil & Gas Companies, Environmental Service Providers, Chemical & Mining Operations, Industrial Cleaning, Waste Management & Environmental Services, Construction & Excavation, Others |

Saudi Arabia Super Sucker Machine Rental Market Drivers:

Expanding Industrial & Construction Sector

Saudi Arabia’s accelerating industrial transformation is emerging as a core growth engine for the Super Sucker Machine Rental Market, driven by large-scale factory construction, utility expansion, and rising demand for efficient excavation and industrial cleanup solutions.

As of the end of 2024, Saudi Arabia hosts 40 industrial cities and over 12,000 factories, with plans to reach 36,000 factories by 2035 under the National Industrial Strategy. These facilities across the petrochemicals, mining, food, and automotive sectors require continuous earthworks, utility installation, vacuum excavation, and industrial cleanup.

To anchor this industrial expansion, Saudi Arabia is developing specialized clusters. For instance, the Aerospace cluster (“Aero Park One”) near Jeddah, spanning 1.2 million m², will support aircraft, space, and defense manufacturing. The automotive cluster in KAEC targets 300,000 vehicles annually, including EVs. Meanwhile, a food industry mega-cluster of 11 million m² is planned to host up to 800 factories by 2035. Each hub demands intensive site preparation, utility trenching, and lifecycle industrial maintenance core applications for high-capacity suction and vacuum equipment.

Industrial momentum is already evident, as in June 2025, the Ministry of Industry and Mineral Resources issued 83 new industrial licenses valued at USD 253.3 million, while 58 factories commenced operations with investments totaling USD 760 million, directly expanding construction activity and machinery demand.

Saudi Arabia’s large-scale industrialization and cluster-led development create sustained requirements for excavation and industrial cleanup. This structural expansion will continuously elevate demand for Super Sucker machine rentals as enterprises prioritize flexible, high-performance solutions across construction and operational phases.

Saudi Arabia Super Sucker Machine Rental Market Trends:

Shift Towards Eco-friendly & Electric Equipment

Saudi Arabia’s sustainability agenda under Vision 2030 and its Green Framework is reshaping equipment deployment across construction and industrial services. The Kingdom has committed to sourcing 50% of domestic electricity from renewable energy by 2030, underpinned by approximately USD 101 billion in public and private investments into solar and wind infrastructure. This policy direction is accelerating demand for machinery that delivers lower emissions, improved fuel efficiency, and enhanced environmental compliance, including equipment used for excavation, vacuuming, and industrial maintenance.

Large-scale renewable developments illustrate this transition. For instance, the Sudair Solar PV Project, with a capacity of 1.5 GW and investment nearing USD 924 million, reflects the scale at which clean-energy infrastructure is being deployed. Such projects increasingly require contractors and service providers to operate within eco-sensitive environments, favoring equipment that aligns with sustainability benchmarks and regulatory expectations.

Industrial service providers are adapting accordingly. For example, Sharooq Al Jubail integrates Super Sucker services with hydro-jetting, de-watering, and waste recovery, minimizing environmental discharge, contamination, and on-site pollution. This integrated approach enables clients to replace traditional, higher-emission cleanup methods with environmentally aligned solutions.

Saudi Arabia’s renewable energy transition and tightening environmental standards are structurally shifting equipment preferences. Within the Super Sucker machine rental market, this is translating into sustained demand for low-emission, compliance-ready vacuum solutions, reinforcing sustainability as a core competitive parameter.

Saudi Arabia Super Sucker Machine Rental Market Challenges:

High Operational & Maintenance Costs

Rising operational and maintenance expenditures represent a structural constraint for the Saudi Arabia Super Sucker Machine Rental Market, directly influencing project economics and equipment affordability.

Official data from the General Authority for Statistics (GaStat) shows that the Construction Cost Index in June 2025 recorded a 2.5% year-on-year increase in equipment and machinery rental costs. This escalation reflects mounting cost pressures across the construction ecosystem, particularly in segments dependent on heavy-duty machinery.

A key driver is the 27.3% rise in diesel prices, which sharply increases fuel expenses for predominantly diesel-powered suction fleets. Simultaneously, energy costs rose by 9.9%, adding to the financial burden associated with machine operation, servicing, and on-site deployment. These factors collectively raise the baseline cost of operating Super Sucker units, especially on long-duration infrastructure and industrial projects.

Higher running and upkeep expenses compress margins for rental providers and inflate service costs for contractors. Smaller operators and cost-sensitive projects are particularly exposed, often delaying or downsizing equipment deployment to manage budgets.

Escalating fuel, energy, and rental cost components increase the total cost of ownership and use. This financial pressure can restrict adoption, slow fleet expansion, and moderate the pace of market growth across construction and industrial applications.

Saudi Arabia Super Sucker Machine Rental Market (2026-32) Segmentation Analysis:

The Saudi Arabia Super Sucker Machine Rental Market Report and Forecast 2026-2032 offers a detailed analysis of the market based on the following segments:

Based on Fuel:

- ICE

- Electric

Based on fuel type, the ICE segment holds the top spot in the Saudi Arabia Super Sucker Machine Rental Market, with a market share of around 90%. This segment is maintaining its leadership due to the country’s operational realities and infrastructure needs.

Super sucker machines are primarily deployed for heavy-duty applications such as industrial waste removal, refinery maintenance, pipeline cleaning, and large-scale municipal drainage. These tasks demand high suction power, long operating hours, and continuous reliability capabilities best delivered by internal combustion engine (ICE) platforms.

Many project sites, including oilfields, construction zones, and remote industrial areas, lack consistent access to grid power or high-capacity charging infrastructure. ICE-driven units offer complete operational independence, rapid deployment, and refueling convenience, making them indispensable for time-sensitive contracts. Rental operators also favor ICE machines due to their proven durability in extreme temperatures, ease of maintenance, and compatibility with existing fleets and service networks.

Furthermore, most legacy fleets across the Kingdom are ICE-based, allowing rental companies to maximize asset utilization and minimize capital replacement cycles. Until electric alternatives achieve comparable range, power, and uptime in harsh environments, ICE-based super sucker machines will continue to dominate rental demand.

Based on Load Capacity:

- Small capacity (Up to 5 m³)

- Medium capacity (5–10 m³)

- Large capacity (Above 10 m³)

The small capacity (Up to 5 m³) category leads the Saudi Arabia Super Sucker Machine Rental Industry, with about 60% market share, and continues to lead due to its operational flexibility and cost efficiency across routine maintenance applications.

These compact units are ideally suited for urban environments, where access constraints, narrow service corridors, and dense infrastructure limit the deployment of larger equipment. Municipalities, facility management firms, and industrial operators rely heavily on small-capacity machines for sewer cleaning, storm drain maintenance, grease trap servicing, and confined-space vacuuming in commercial complexes and residential districts.

Their lower rental cost and reduced fuel consumption make them economically attractive for frequent, short-duration jobs, which account for the majority of vacuum service demand. In addition, small-capacity units require minimal crew sizes and are easier to maneuver, enabling faster deployment and higher job turnover for rental providers.

Saudi Arabia’s expanding urban footprint, driven by housing developments, retail centers, and mixed-use projects, generates continuous demand for routine cleaning and preventive maintenance. This workload profile favors compact, agile machines over large-capacity units designed for heavy industrial or long-haul operations, reinforcing the segment’s market leadership.

Saudi Arabia Super Sucker Machine Rental Market (2026-32): Regional Projection

The Saudi Arabia Super Sucker Machine Rental Market is dominated by the Central region, which holds a substantial 33% share. Market dominance is supported by the region’s concentration of large-scale infrastructure, municipal, and industrial activity.

Anchored by Riyadh, the Kingdom’s political and administrative hub, the Central region hosts the highest density of government projects, commercial developments, and utility networks, all of which generate sustained demand for vacuum excavation, sludge removal, and sewer maintenance services.

Mega urban programs such as Riyadh’s metro expansion, road redevelopment, drainage upgrades, and mixed-use construction zones require frequent non-destructive digging and waste extraction, where super sucker machines are preferred for their precision and safety. The region also houses major government facilities, hospitals, and commercial complexes that mandate routine tank cleaning and wastewater management under strict regulatory standards.

Additionally, Central Saudi Arabia benefits from superior contractor presence, fleet availability, and logistics connectivity, enabling faster deployment of rental equipment compared to peripheral regions.

As Vision 2030 accelerates urban transformation in Riyadh and surrounding provinces, project density and regulatory compliance requirements continue to rise. This structural concentration of construction and municipal activity firmly sustains the Central region’s leadership in super sucker machine rentals.

Gain a Competitive Edge with Our Saudi Arabia Super Sucker Machine Rental Market Report

- Saudi Arabia Super Sucker Machine Rental Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Saudi Arabia Super Sucker Machine Rental Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Saudi Arabia Super Sucker Machine Rental Market Policies, Regulations, and Product Standards

- Saudi Arabia Super Sucker Machine Rental Market Trends & Developments

- Saudi Arabia Super Sucker Machine Rental Market Dynamics

- Growth Drivers

- Challenges

- Saudi Arabia Super Sucker Machine Rental Market Hotspot & Opportunities

- Saudi Arabia Super Sucker Machine Rental Market Outlook, 2022-2032

- Market Size & Outlook

- By Revenues (USD Million)

- Market Share & Outlook

- By Equipment Type – Market Size & Forecast 2022-2032, USD Million

- Wet Super Sucker

- Dry Super Sucker

- Combination Super Sucker

- By Fuel – Market Size & Forecast 2022-2032, USD Million

- ICE

- Electric

- By Load Capacity – Market Size & Forecast 2022-2032, USD Million

- Small capacity (Up to 5 m³)

- Medium capacity (5–10 m³)

- Large capacity (Above 10 m³)

- By Rental Duration – Market Size & Forecast 2022-2032, USD Million

- Short-Term Rentals (Up to 12 Months)

- Long-Term Rentals (More than 12 Months)

- By End User – Market Size & Forecast 2022-2032, USD Million

- Municipalities & Public Utilities

- Oil & Gas Companies

- Environmental Service Providers

- Chemical & Mining Operations

- Industrial Cleaning

- Waste Management & Environmental Services

- Construction & Excavation

- Others

- By Region

- Eastern

- Central

- Western

- Northern

- Southern

- By Company

- Company Revenue Shares

- Competitor Characteristics

- By Equipment Type – Market Size & Forecast 2022-2032, USD Million

- Market Size & Outlook

- Saudi Arabia Wet Super Sucker Machine Rental Market Outlook, 2022-2032

- Market Size & Outlook

- By Revenues (USD Million)

- Market Share & Outlook

- By Fuel – Market Size & Forecast 2022-2032, USD Million

- By Load Capacity – Market Size & Forecast 2022-2032, USD Million

- By Rental Duration – Market Size & Forecast 2022-2032, USD Million

- By End User – Market Size & Forecast 2022-2032, USD Million

- By Region

- Market Size & Outlook

- Saudi Arabia Dry Super Sucker Machine Rental Market Outlook, 2022-2032

- Market Size & Outlook

- By Revenues (USD Million)

- Market Share & Outlook

- By Fuel – Market Size & Forecast 2022-2032, USD Million

- By Load Capacity – Market Size & Forecast 2022-2032, USD Million

- By Rental Duration – Market Size & Forecast 2022-2032, USD Million

- By End User – Market Size & Forecast 2022-2032, USD Million

- By Region

- Market Size & Outlook

- Saudi Arabia Combination Super Sucker Machine Rental Market Outlook, 2022-2032

- Market Size & Outlook

- By Revenues (USD Million)

- Market Share & Outlook

- By Fuel – Market Size & Forecast 2022-2032, USD Million

- By Load Capacity – Market Size & Forecast 2022-2032, USD Million

- By Rental Duration – Market Size & Forecast 2022-2032, USD Million

- By End User – Market Size & Forecast 2022-2032, USD Million

- By Region

- Market Size & Outlook

- Saudi Arabia Super Sucker Machine Rental Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Sharooq Al Jubail International Est.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- HAKA Motors & Industry Co.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- ARC Link Gulf Contracting Est.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Al Muzain Gulf Saudi Contracting Co

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Luminous Arabia Services Contracting Company Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kanooz Industrial Services

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Plant-Tech Arabia Co. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Zero Waste International Company Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Arabian Consolidated Industrial Cleaning Services Co. (ACIC)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Al-Fahhad Zegwaard-Co.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Sharooq Al Jubail International Est.

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making