Southeast Asia Passenger Car Tire Market Research Report: Forecast (2024-2030)

Southeast Asia Passenger Car Tire Market Report - By Vehicle Type (Sedan, SUV, Hatchback), By Type of Tire (Radial, Bias), By Demand Type (OEMs, Aftermarket), By Price Category (Bu...dget, Premium, Economy), By Tire Size (Tire Size 1, Tire Size 2, Tire Size 3, Tire Size 4, Tire Size 5), By Sales Channel (Direct Sales, Online, Multi Brand, Exclusive Outlets) and Others Read more

- Tire

- May 2024

- Pages 155

- Report Format: PDF, Excel, PPT

Market Insights & Analysis: Southeast Asia Passenger Car Tire Market (2024-30):

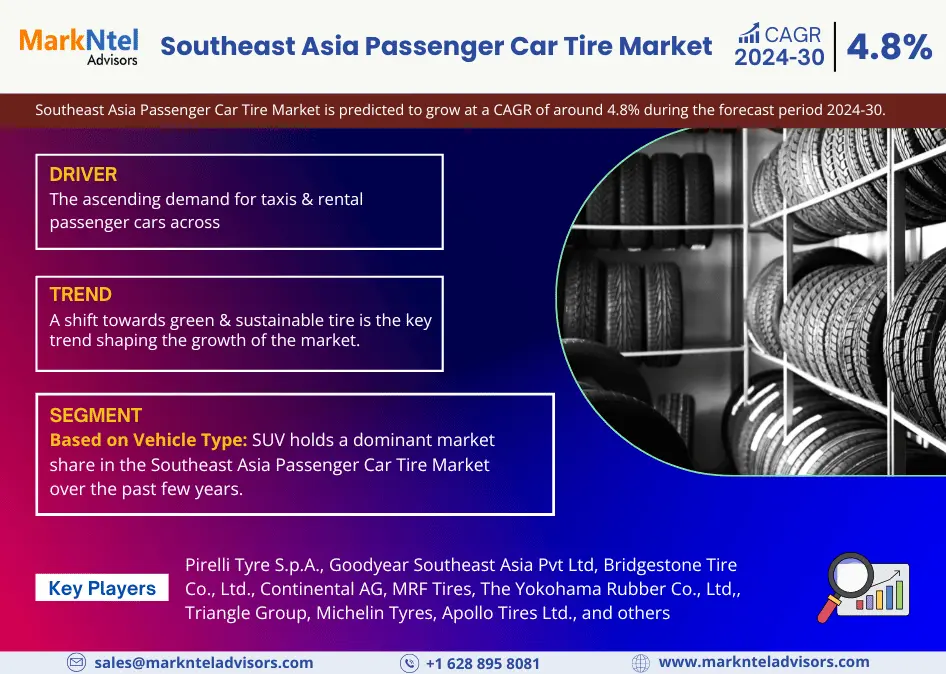

The Southeast Asia Passenger Car Tire Market is predicted to grow at a CAGR of around 4.8% during the forecast period, i.e., 2024-30. Southeast Asian countries have been experiencing an increase in the rising middle-class population & rapid urbanization due to the country's overall economic growth. As a result, passenger cars in these countries are becoming more accessible & common. Moreover, post-COVID-19, individuals in these countries are now preferring commuting via personal vehicles to ensure personal safety & well-being. This increasing demand for personal transportation is leading to the purchase of new passenger cars in these countries, which is directly contributing to the surge in the requirement for passenger car tires in Southeast Asia.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 4.8% |

| Country Covered | Malaysia, Indonesia, Singapore, Cambodia, Vietnam, Thailand, Philippines, Others |

| Key Companies Profiled | Pirelli Tyre S.p.A., Goodyear Southeast Asia Pvt Ltd, Bridgestone Tire Co., Ltd., Continental AG, MRF Tires, The Yokohama Rubber Co., Ltd,, Triangle Group, Michelin Tyres, Apollo Tires Ltd., Stamford Tyres Thailand, Others |

| Unit Denominations | USD Million/Billion |

Also, as nowadays majority of the individuals prefer to equip their passenger cars with quality tires, this in turn is elevating the demand for passenger cars tires. Moreover, the booming automotive manufacturing in Southeast Asian nations, such as Indonesia, Thailand, Vietnam, and Malaysia is attracting substantial funds from local & international manufacturers. These nations boast a deep-rooted automotive ecosystem, with several assembly plants and a trained workforce. Ford, Honda, Toyota, BMW, and various others, are some of the highlighted competitors across the regional market, who are focusing on advancing & innovating the present automotive industry, eventually aiding in enhancing the tire market as well.

Furthermore, as countries like Thailand, Indonesia, Malaysia, and Vietnam experience a boom in automotive manufacturing, there's a tremendous surge in the sales of passenger cars, thus eventually enhancing the Southeast Asia Passenger Car Market size. Additionally, the region is also seeing a high boost in tourism, which is creating demand for taxis & other commuting transportation options, eventually affecting the passenger cars tires demand. Besides, with the passing of time, more & more vehicles are hitting roads, therefore there is a high probability of growth in the market during 2024-30.

Southeast Asia Passenger Car Tire Market Driver:

Increasing Demand for Taxis & Rental Passenger Cars – As numerous countries of the region such as Indonesia, Thailand, etc., are witnessing high influx of tourism & business travel, the need for reliable transportation like taxis & other commuting transportation option is also increasing, thus infusing the demand for more passenger cars & eventually their tires as well. Along with this the increasing urbanization is also affecting the demand graph of the Southeast Asia Passenger Car Tire Market.

Also, it is witnessed that in many of the cities, including Ho Chi Minh, Bangkok, Jakarta, and others individuals are facing traffic congestion & limited parking spaces, which is making most of the people to opt for rental services, taxis, etc. Hence, the growing demand for rental cars & passenger cars is infusing the sales & need for more & more passenger cars, therefore driving the Southeast Asia Passenger Car Tire Market.

Southeast Asia Passenger Car Tire Market Opportunity:

Rising Inclination Towards Electric & Hybrid Passenger Cars – Southeast Asian nations are seeing a boom in carbon emissions owing to rapid industrialization & rapid increase in transportation activities. These damaging carbon emissions result in environmental degradation & health concerns, due to which the governments of the regional countries are encouraging the adoption of sustainable transportation solutions, including electric passenger cars. The governments of the Southeast Asian countries are laying initiatives such as the Thailand 4.0 policy, the Eco-Car program, and Malaysia's National Electric Mobility Blueprint. Along with this, the governments are also providing subsidies & incentives to purchase electric vehicles. For Instance,

- In 2024, the government of Indonesia launched new incentives & subsidies for its residents to encourage sales of domestic & imported electric vehicles (EVs) in the country.

This would pose an opportunity for pivotal tire manufacturers, like Bridgestone, Michelin, Apollo, etc., to supply their specialized tires for electric vehicles, uplifting market growth in the forecast years.

Southeast Asia Passenger Car Tire Market Challenge:

Leaning Towards Counterfeit Tire – In recent years, there has been a relaxation in the trade policies and ease in the import & export tariff. Southeast Asian countries have also increasingly signed trade agreements with other foreign nations to elevate the trading activities & boost their country’s economy. This gave a prospect to several counterfeit tire-producing companies to export their tires to these countries. As a result, southeast Asian nations recorded a surge in the arrival of these counterfeit products in the countries. These products are manufactured without using the standard raw materials & consideration of the safety standards.

The price of these products is relatively lower than the average passenger car tire costs. Also, the lower costs of passenger car tires attract the attention of several consumers in Southeast Asian nations as individuals in these countries are price sensitive. Therefore, the inclination towards counterfeit tires due to financial constraints hinders the sales of the original & brand new tires, impeding the Southeast Asia Passenger Car Tire Market.

Southeast Asia Passenger Car Tire Market Trend:

Green & Sustainable Tire to Gain Traction – The emerging health problems & environmental issues are resulting in consumers becoming more environment conscious. As a result, individuals in these countries are shifting towards eco-friendly products to encourage sustainability. In addition, the official authorities in Southeast Asian countries are increasingly facilitating environmental programs to make the consumers in the region more conscious & aware. Consequently, this growing environmental consciousness & increasing concerns about climate change are leading consumers to look for eco-friendly alternatives, including tires made from sustainable materials, and designed for reduced environmental impact. Moreover, to cater to the growing demand for sustainable tires, the major tire players are increasingly manufacturing green tires. For instance,

- In 2023, Michelin, one of the leading tire manufacturers announced to develop tires by using sustainable tires to cater to the growing demand for environmentally friendly tires.

Along with fulfilling the sustainability goals, these tires also provide superior performance than traditional tires. As a result, more consumers would continue to shift towards these tires, amplifying the Southeast Asia Passenger Car Tire Market in the forthcoming years as well.

Southeast Asia Passenger Car Tire Market (2024-30): Segmentation Analysis

The Southeast Asia Passenger Car Tire Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2024–2030 at the regional level. In accordance to the analysis, the market has been further classified as:

Based on Vehicle Type:

- Sedan

- SUV

- Hatchback

SUV holds a dominant market share in the Southeast Asia Passenger Car Tire Market over the past few years. The road infrastructure in Southeast Asian countries includes rough terrain. As a result, individuals in these countries are inclined towards passenger cars that provide high ground clearance, such as SUVs. In addition, SUV cars offer ample space, higher speed, and better comfort to individuals, making SUVs preferable for consumers & families residing in Southeast Asian countries.

Based on Sales Channel:

- Direct Sales

- Online

- Multi Brands

- Exclusive Stores

Sales through multi-brand stores and exclusive outlets have been steadily increasing, as people prefer to buy tires from these stores since they offer a diverse selection of options from brands such as Goodyear, Bridgestone, and others at a single point of sale. Therefore, multi-brand stores' ability to provide a greater selection and price comparison between different tire manufacturers and variants would continue to enhance tire sales. Furthermore, users frequently value the option to compare costs and features across various passenger car tire companies. Multi-brand stores make this comparison easier, allowing customers to make informed judgments based on aspects, including pricing, quality, and tire features.

Southeast Asia Passenger Car Tire (2024-30): Regional Projection

Geographically, Southeast Asia Passenger Car Tire Market expands across:

- Malaysia

- Indonesia

- Singapore

- Cambodia

- Vietnam

- Thailand

- Philippines

- Others

Thailand holds a prominent market share in the Southeast Asia Passenger Car Tire Market. The nation has several tourist attractions like beaches & museums, due to which tourism in the country is expanding. As per the statistics of the government of Thailand, the country registered the arrival of more than 28 million inbound foreign tourists. These foreign travelers rely on ride-hailing services to explore the vibrant cities of the nations. This amplifies the usage of the cars via these services resulting in tire wear & tear. Hence, the major ride-hailing service providers ensure frequent tire replacements to maintain the operational efficiency of the passenger cars, enhancing the demand for passenger car tires in Thailand.

Further, the country has several automotive manufacturing units that directly generate the demand for passenger car tires, enhancing market growth. The automotive sector in Thailand is a key contributor to the nation's GDP, consequently, the governing authorities of the country are facilitating the establishment of automotive units in Thailand. Thus, this rising setup of passenger car units in the country is uplifting the requirement for passenger car tires in Thailand.

Southeast Asia Passenger Car Tire Industry Recent Development:

- 2023: The Yokohama Rubber Co., Ltd. announced to start of a new company Yokohama Tyre Sales Vietnam Co., Ltd. by 2024 to provide radial tires for passenger cars & trucks.

Gain a Competitive Edge with Our Southeast Asia Passenger Car Tire Market Report

- Southeast Asia Passenger Car Tire Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Southeast Asia Passenger Car Tire Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Southeast Asia Passenger Car Tire Market Regulations & Policies

- Southeast Asia Passenger Car Tire Market Import Export Statistics

- Southeast Asia Passenger Car Tire Market Trends & Insights

- Southeast Asia Passenger Car Tire Market Dynamics

- Drivers

- Challenges

- Southeast Asia Passenger Car Tire Market Hotspots & Opportunities

- Southeast Asia Passenger Car Tire Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Share & Analysis

- By Vehicle Type

- Sedan – Market Size & Forecast, 2019-2030 (Thousands)

- SUV– Market Size & Forecast, 2019-2030 (Thousands)

- Hatchback– Market Size & Forecast, 2019-2030 (Thousands)

- By Type of Tire

- Radial– Market Size & Forecast, 2019-2030 (Thousands)

- Bias– Market Size & Forecast, 2019-2030 (Thousands)

- By Demand Type

- OEMs– Market Size & Forecast, 2019-2030 (Thousands)

- Aftermarket– Market Size & Forecast, 2019-2030 (Thousands)

- By Price Category

- Budget– Market Size & Forecast, 2019-2030 (Thousands)

- Premium– Market Size & Forecast, 2019-2030 (Thousands)

- Economy– Market Size & Forecast, 2019-2030 (Thousands)

- By Tire Size

- Tire Size 1– Market Size & Forecast, 2019-2030 (Thousands)

- Tire Size 2– Market Size & Forecast, 2019-2030 (Thousands)

- Tire Size 3– Market Size & Forecast, 2019-2030 (Thousands)

- Tire Size 4– Market Size & Forecast, 2019-2030 (Thousands)

- Tire Size 5– Market Size & Forecast, 2019-2030 (Thousands)

- By Sales Channel

- Direct Sales– Market Size & Forecast, 2019-2030 (Thousands)

- Online– Market Size & Forecast, 2019-2030 (Thousands)

- Multi Brand– Market Size & Forecast, 2019-2030 (Thousands)

- Exclusive Outlets– Market Size & Forecast, 2019-2030 (Thousands)

- By Country

- Malaysia

- Indonesia

- Singapore

- Cambodia

- Vietnam

- Thailand

- Philippines

- Others

- By Company

- Competition Characteristics

- Market Share & Analysis

- By Vehicle Type

- Market Size & Analysis

- Malaysia Passenger Car Tire Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Share & Analysis

- By Vehicle Type– Market Size & Forecast, 2019-2030 (Thousands)

- By Type of Tire– Market Size & Forecast, 2019-2030 (Thousands)

- By Demand Type– Market Size & Forecast, 2019-2030 (Thousands)

- By Price Category– Market Size & Forecast, 2019-2030 (Thousands)

- By Tire Size– Market Size & Forecast, 2019-2030 (Thousands)

- By Sales Channel– Market Size & Forecast, 2019-2030 (Thousands)

- Market Size & Analysis

- Indonesia Passenger Car Tire Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Share & Analysis

- By Vehicle Type– Market Size & Forecast, 2019-2030 (Thousands)

- By Type of Tire– Market Size & Forecast, 2019-2030 (Thousands)

- By Demand Type– Market Size & Forecast, 2019-2030 (Thousands)

- By Price Category– Market Size & Forecast, 2019-2030 (Thousands)

- By Tire Size– Market Size & Forecast, 2019-2030 (Thousands)

- By Sales Channel– Market Size & Forecast, 2019-2030 (Thousands)

- Market Size & Analysis

- Singapore Passenger Car Tire Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Share & Analysis

- By Vehicle Type– Market Size & Forecast, 2019-2030 (Thousands)

- By Type of Tire– Market Size & Forecast, 2019-2030 (Thousands)

- By Demand Type– Market Size & Forecast, 2019-2030 (Thousands)

- By Price Category– Market Size & Forecast, 2019-2030 (Thousands)

- By Tire Size– Market Size & Forecast, 2019-2030 (Thousands)

- By Sales Channel– Market Size & Forecast, 2019-2030 (Thousands)

- Market Size & Analysis

- Cambodia Passenger Car Tire Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Share & Analysis

- By Vehicle Type– Market Size & Forecast, 2019-2030 (Thousands)

- By Type of Tire– Market Size & Forecast, 2019-2030 (Thousands)

- By Demand Type– Market Size & Forecast, 2019-2030 (Thousands)

- By Price Category– Market Size & Forecast, 2019-2030 (Thousands)

- By Tire Size– Market Size & Forecast, 2019-2030 (Thousands)

- By Sales Channel– Market Size & Forecast, 2019-2030 (Thousands)

- Market Size & Analysis

- Vietnam Passenger Car Tire Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Share & Analysis

- By Vehicle Type– Market Size & Forecast, 2019-2030 (Thousands)

- By Type of Tire– Market Size & Forecast, 2019-2030 (Thousands)

- By Demand Type– Market Size & Forecast, 2019-2030 (Thousands)

- By Price Category– Market Size & Forecast, 2019-2030 (Thousands)

- By Tire Size– Market Size & Forecast, 2019-2030 (Thousands)

- By Sales Channel– Market Size & Forecast, 2019-2030 (Thousands)

- Market Size & Analysis

- Thailand Passenger Car Tire Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Share & Analysis

- By Vehicle Type– Market Size & Forecast, 2019-2030 (Thousands)

- By Type of Tire– Market Size & Forecast, 2019-2030 (Thousands)

- By Demand Type– Market Size & Forecast, 2019-2030 (Thousands)

- By Price Category– Market Size & Forecast, 2019-2030 (Thousands)

- By Tire Size– Market Size & Forecast, 2019-2030 (Thousands)

- By Sales Channel– Market Size & Forecast, 2019-2030 (Thousands)

- Market Size & Analysis

- Philippines Passenger Car Tire Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Share & Analysis

- By Vehicle Type– Market Size & Forecast, 2019-2030 (Thousands)

- By Type of Tire– Market Size & Forecast, 2019-2030 (Thousands)

- By Demand Type– Market Size & Forecast, 2019-2030 (Thousands)

- By Price Category– Market Size & Forecast, 2019-2030 (Thousands)

- By Tire Size– Market Size & Forecast, 2019-2030 (Thousands)

- By Sales Channel– Market Size & Forecast, 2019-2030 (Thousands)

- Market Size & Analysis

- Competition Outlook

- Company Profiles

- Pirelli Tyre S.p.A.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Goodyear Southeast Asia Pvt Ltd

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Bridgestone Tire Co., Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Continental AG

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- MRF Tires

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- The Yokohama Rubber Co., Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Triangle Group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Michelin Tyres

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Apollo Tires Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Stamford Tyres Thailand

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Pirelli Tyre S.p.A.

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making