Saudi Arabia Diesel Generator Market Research Report: Forecast (2025-2030)

Saudi Arabia Diesel Generator Market - By KVA Rating (Up to 75KVA, 75.1 KVA to 375 KVA, 375.1 to 750 KVA, 750.1 KVA to 1000 KVA, Above 1000 KVA), By Type (Stand By, Prime & Continu...ous Power, Peak Shaving), By End Users (Residential, Commercial, Healthcare, Government & Transport, Oil & Gas, Industrial, Equipment Rental Companies) and Others Read more

- Energy

- Jan 2024

- Pages 137

- Report Format: PDF, Excel, PPT

Market Insights & Analysis: Saudi Arabia Diesel Generator Market (2025-30)

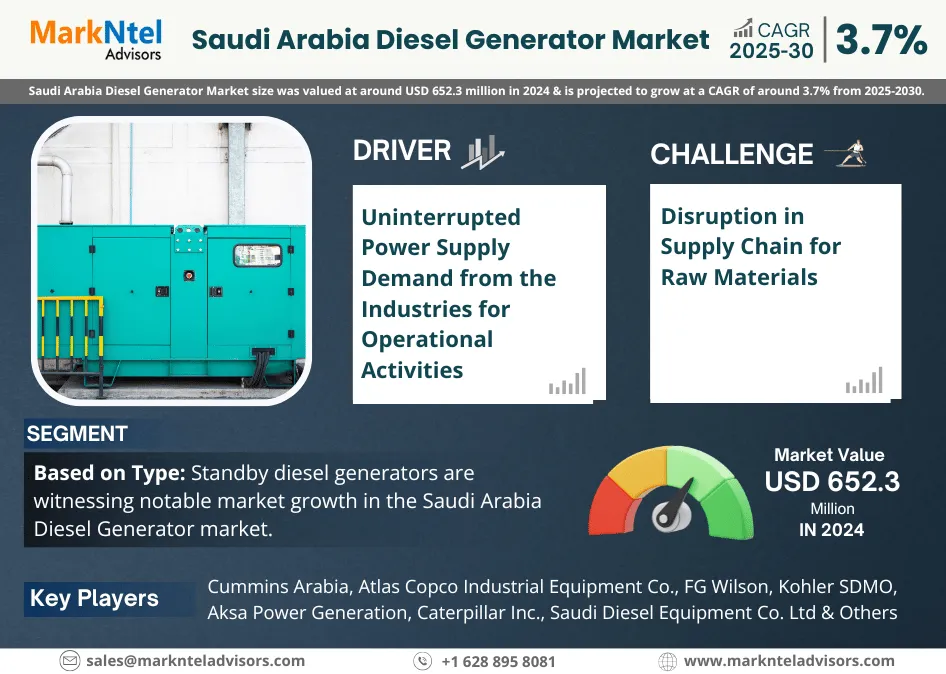

The Saudi Arabia Diesel Generator Market size was valued at around USD 652.3 million in 2024 and is projected to grow at a CAGR of around 3.7% during the forecast period, i.e., 2025-30. This is owing to the growing application of diesel generators in the oil & gas industry, manufacturing units, commercial, and other sectors. A diesel generator is the combination of a diesel engine with an electric generator to generate electrical energy. The main components of these generators include a diesel engine, an AC alternator, a fuel tank, a control panel, & radiator. These generators are used either as a power backup system or as a prime electricity source.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020-23 |

|

Base Years

|

2024

|

|

Forecast Years

|

2025-30

|

| Market Value in 2024 | USD 652.3 Million |

| CAGR (2025-30) | 3.7% |

| Top Key Players | Cummins Arabia, Atlas Copco Industrial Equipment Co., FG Wilson, Kohler SDMO, Aksa Power Generation, Caterpillar Inc., Saudi Diesel Equipment Co. Ltd., Generac Holdings Inc., Kirloskar DMCC and Others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

Extensive focus on the exploration & production of crude oil is one of the leading factors for the deployment of the generators. These generators are being utilized in the absence of a power grid at the offshore & onshore sites for drilling the oil wells, along with operating various other machinery at the rig. According to the Organization of Petroleum Countries, Saudi Arabia possess approximately 17% of the world’s proven petroleum reserves. This high presence of a huge oil reserve & the ongoing exploration process to discover new oil wells is expected to upscale the Saudi Arabia Diesel Generator market share.

Moreover, the emergence of government initiatives for the expansion of IT, manufacturing, tourism, and service industry to attain the economic diversification target of 2030 would further assist the demand for diesel generators to be deployed in the expanding industrial units. As part of the government’s initiative to strengthen the manufacturing base in the country, various investments are underway. For instance,

- In 2022, Saudi Aramco signed 55 agreements across sustainability, digital, industrial, manufacturing, and social innovation sectors, which grew from 32 agreements made in 2021.

Additionally, the surge in investment opportunities has been a part of a major expansion of its Namaat industrial investment programs. Hence, it is anticipated that the continuous investment in manufacturing & other industry by the public & private sectors would surge the Saudi Arabia Diesel Generator Market. Further, the surging construction activities in the country are propelling the demand for diesel generator installation in construction sites that are located in remote areas with limited grid connectivity. The government of Saudi Arabia has announced various construction projects such as the Red Sea Project, AMAALA, Neom City, and others which would consist of hotels, malls, hospitals, tourist attraction places, etc. These ongoing construction activities would enhance the demand for diesel generator sets in the construction sites for powering the equipment during the forecast period, therefore enhancing the market size.

Saudi Arabia Diesel Generator Market Driver:

Uninterrupted Power Supply Demand from the Industries for Operational Activities - There are certain sectors where an uninterrupted power supply is required to ensure the smooth functioning of the industry. Hence, to suffice this need, several industries seek the sales of diesel generators as standby units. These generators are in high demand in industries like healthcare, oil refineries, and telecommunications due to unforeseeable circumstances such as power outages & blackouts. In the healthcare sector, machines such as ventilators rely on electricity to function, therefore hospitals & nursing homes keep standby diesel generators on hand to avoid disruption. Furthermore, the telecom industries have led to growth in the market for diesel generators, as telecom companies have set up new base stations to ensure better network coverage following the arrival of 5G in 2019.

Additionally, over 1000 base stations were formed to provide users with a better network coverage range & increase internet penetration in Saudi Arabia, which elevated the requirement for generators. Further, the oil & gas industries use power generators for drilling & digging since the equipment requires more power to provide the service. As a result, industries rely on these generators to supply power & provide backup to fine-tune industrial operations, as these industries typically require a consistent supply, resulting in a demand for commercial & large-power generators during 2025-30.

Saudi Arabia Diesel Generator Market Challenge:

Disruption in Supply Chain for Raw Materials - Saudi Arabia Diesel Generation industry is an import-dependent economy, owing to the fewer manufacturing facilities for generators. Further, most construction companies & rental equipment industries in the country buy these generators for short- & long-term construction projects to have an uninterrupted power supply. In recent years, the government in Saudi Arabia has highly invested & announced several mega construction projects such as NEOM, and Four Points Hotel Jeddah Corniche, among others, which led to a surge in the requirement for these generators in the construction sites.

However, due to supply chain disruption, the unavailability of components faced by the manufacturing companies resulted in hampering the market growth and increasing the cost of diesel generators. The delay in supplying generators further slowed the country's construction activities. Hence, the supply chain disruption for the raw materials after the pandemic made it difficult for the manufacturers to fulfill the growing need, thus impeding market growth.

Saudi Arabia Diesel Generator Market Opportunity:

Emergence of the Country as a Prominent Data Center Hub - In recent years, Saudi Arabia has emerged as the preferred destination for establishing data centers. This is due to the constant push by the government to establish the country as the regional digital hub for diesel generators in Saudi Arabia & boost the development of data center facilities in the country to store government-specified data effectively. Thus, this has increased the demand for diesel generators for data center facilities, owing to their requirement for 25x7 continuous power to minimize revenue loss. Furthermore, the government of the country has also planned to diversify the economy from oil-based to other avenues like technology, communication, etc. Owing to this, many strategic investments in data centers have come up in Saudi Arabia. For instance,

- In 2021, Quantum Switch & Tamasukh entered into a joint venture to establish a 300MW data center unit near Dammam. It plans to develop 60MW a year for the next 5 years. The project also includes the construction of six 50MW units in Riyadh, Jeddah, and Neom City.

Furthermore, companies such as Aramco, Cognite, STC, Huawei, and others made significant investments to establish data centers in 2022. As a result, the demand for diesel generators is predicted to rise in the near future as more data center units are to be built, therefore supporting the market growth.

Saudi Arabia Diesel Generator Market Trend:

Increasing Popularity of Common Rail Technology & Electronic Fuel Injection in DG - The burgeoning vogue of advanced technology has affected the market of diesel generators in Saudi Arabia, where consumer preference has enhanced with technologically advanced features. The demand for high fuel efficiency, high reliability, and low emission has generated a supplemented demand for mechanically advanced generators, due to which technologies like Common Rail Technology & Electronic Fuel Injections are witnessing rapid adoption in diesel sets. The trend of continuous mechanical & technical upgradation of generator sets has been brought about by growing government initiatives & consumer awareness about carbon emissions & energy efficiency.

Diesel generator sets have higher carbon footprints than their counterparts, so continuous improvement has been a long-term trend. Although companies like MTU Solutions introduced their diesel generators with common rail technology in 2014, the requirement for advanced engine modifications has occurred only in recent years. Hence, this has further brought a new trend where continuous research & development activities are being carried on by the manufacturers, to deal with the consumer demands of mechanical & technological advancements.

Saudi Arabia Diesel Generator Market (2025-30): Segmentation Analysis

The Saudi Arabia Diesel Generator Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the level. According to the analysis, the market has been further classified as:

Based on Type:

- Standby

- Prime & Continuous Power

- Peak Shaving

Among these, Standby diesel generators are witnessing notable market growth in the Saudi Arabia Diesel Generator market due to their surging application in the residential, commercial, and healthcare sectors for providing an uninterrupted supply of electricity. End-user industries are actively utilizing standby generators to meet short-term power requirements in the event of a power outage to reduce the possibility of operational inefficiency. Due to the surging construction of residential, commercial, and healthcare buildings in the country, the deployment of these generators is also rapidly expanding. Additionally, the launch of various housing projects like the Sakani housing program, Nasaj Town, and others to cater to the growing housing needs of the residents would drive the installation of these generators in the coming years. For instance,

- In 2022, Saudi Arabia launched Nasaj Town Alnarjis to construct 455 villas. It is one of the 28 housing projects located in the Riyadh region of the country.

Hence, with the upscaling investments in the commercial, residential, and healthcare sectors of the country as a part of the Saudi Vision 2030 to strengthen the non-oil economic sectors, the demand for standby generators is anticipated to rise in the upcoming years.

Based on End Users:

- Residential

- Commercial

- Healthcare

- Government & Transport

- Oil & Gas

- Industrial

- Equipment Rental Companies

Of them, the Healthcare segment is becoming a major source of demand for diesel generators in Saudi Arabia owing to the surging construction of hospitals & clinics due to the growing prevalence of various non-communicable diseases. The continuous requirement for power supply for operating medical devices like ECG monitors, ventilators, oxygen concentrators, etc., for treating these diseases has augmented the demand for DG sets in healthcare units. In addition, the launch of government initiatives like 'The Health Sector Transformation' to restructure the health sector by implementing an integrated health system like e-health services & digital solutions. This has augmented the adoption of modern technologies & integrated care models in hospitals, thereby requiring these generators for continuous operations.

Additionally, the country is undergoing several public-private partnerships to construct healthcare facilities, including King Abdullah Bin Abdulaziz Medical Complexes – Riyadh & Jeddah, King Khalid Medical City, King Faisal Medical City, etc. Further, the investment plans of the Saudi Government for the expansion of the healthcare industry by 2030 would significantly contribute to the healthcare-based construction activities & deployment of modern electrical equipment. Hence, the upcoming construction of the healthcare sector supported by public-private & government investment would further push the market in the coming years.

Saudi Arabia Diesel Generator Industry Recent Developments

- 2023, Volvo Penta launched the D8 Stage II engine, featuring a power output of 200 kVA, enhancing its lineup of industrial genset engines. This model boasts an up to 8% reduction in fuel consumption per kWh compared to the D7, with power options of 200, 253, 303, and 326 kVA at 1,500 rpm, catering to diverse applications.

- 2022: Atlas Copco launched its new range of energy storage systems, which operate by working in hybrid mode with diesel-driven generators. This was done to provide sustainable power solutions for companies operating in demanding & noise-sensitive applications like metropolitan construction & events.

Gain a Competitive Edge with Our Saudi Arabia Diesel Generator Market Report

- Saudi Arabia Diesel Generator Market Report by Markntel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps business organizations to gain a holistic understanding of market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing business organizations to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Saudi Arabia Diesel Generator Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, business organizations can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Macroeconomic Outlook

- Saudi Arabia Diesel Generator Market Porters Five Forces Analysis

- Saudi Arabia Diesel Generator Market Supply Chain Analysis

- Saudi Arabia Diesel Generator Market Trends & Insights

- Saudi Arabia Diesel Generator Market Dynamics

- Drivers

- Challenges

- Saudi Arabia Diesel Generator Market Growth Opportunities & Hotspots

- Saudi Arabia Diesel Generator Market Policy & Regulations

- Saudi Arabia Diesel Generator Market Pricing Analysis

- Saudi Arabia Diesel Generator Market Outlook, 2020-2030F

- Market Size & Outlook

- Revenues (USD Million)

- Units Sold (Thousands)

- Market Share & Outlook

- By KVA Rating

- Up to 75KVA

- 75.1 KVA to 375 KVA

- 375.1 to 750 KVA

- 750.1 KVA to 1000 KVA

- Above 1000 KVA

- By Type

- Stand By

- Prime & Continuous Power

- Peak Shaving

- By End Users

- Residential

- Commercial (Hospitality, Retail, Educational Institutions, etc.)

- Healthcare

- Government & Transport (Airports, Metro Stations, Govt. Buildings, Religious Centres, etc.)

- Oil & Gas

- Industrial (Manufacturing Facilities, Assembly Units, etc.)

- Equipment Rental Companies

- By Company

- Market Share

- Competition Characteristics

- By KVA Rating

- Market Size & Outlook

- Saudi Arabia Up to 75KVA Diesel Generator Market Outlook, 2020-2030F

- Market Size & Outlook

- Revenues

- Units Sold

- Market Share & Outlook

- By Type

- By End Users

- By Company

- Market Size & Outlook

- Saudi Arabia 75.1 KVA to 375KVA Diesel Generator Market Outlook, 2020-2030F

- Market Size & Outlook

- Revenues

- Units Sold

- Market Share & Outlook

- By Type

- By End Users

- By Company

- Market Size & Outlook

- Saudi Arabia 375.1 KVA to 750KVA Diesel Generator Market Outlook, 2020-2030F

- Market Size & Outlook

- Revenues

- Units Sold

- Market Share & Outlook

- By Type

- By End Users

- By Company

- Market Size & Outlook

- Saudi Arabia 750.1 KVA to 1,000 KVA Diesel Generator Market Outlook, 2020-2030F

- Market Size & Outlook

- Revenues

- Units Sold

- Market Share & Outlook

- By Type

- By End Users

- By Company

- Market Size & Outlook

- Saudi Arabia Above 1000 KVA Diesel Generator Market Outlook, 2020-2030F

- Market Size & Outlook

- Revenues

- Units Sold

- Market Share & Outlook

- By Type

- By End Users

- By Company

- Market Size & Outlook

- Saudi Arabia Diesel Generator Market Key Strategic Imperatives for Growth & Success

- Competitive Benchmarking

- Competition Matrix

- Product Portfolio

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Company Profiles (Business Description, Product Offering, Strategic Alliances or Partnerships, etc.)

- Cummins Arabia

- Atlas Copco Industrial Equipment Co.

- FG Wilson

- Kohler SDMO

- Aksa Power Generation

- Caterpillar Inc.

- Saudi Diesel Equipment Co. Ltd.

- Generac Holdings Inc.

- Kirloskar DMCC

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making