Global Robot-Assisted Surgical Medical Device Market Research Report: Forecast (2022-2027)

By Application (Gynecological Surgery, Cardiovascular Surgery, Neurosurgery, Orthopedic Surgery, Urology Surgery, Other (Colorectal, Ear Nose Throat(ENT), etc.)), By End User (Hosp...itals, Ambulatory Surgery Centers), By Region (North America, South America, Europe, Asia-Pacific, the Middle East & Africa), By Company (Medtronics PLC, CRM Surgical, Stryker Corporation, Johnson & Johnson (Auris Health), Intuitive Surgical Inc. Titan medical, THINK Surgical Inc., Asensus Surgery (Formerly: TransEnterix Surgical), SRI International Inc., Renishaw PLC, Smith & Nephew PLC, Brainlab, NuVasive Inc., Synaptive Medical, Others) Read more

- Healthcare

- Jun 2022

- Pages 187

- Report Format: PDF, Excel, PPT

Market Definition

Robotically-assisted surgical (RAS) devices are computer-assisted software-controlled surgical systems that are also called Robotic Surgery. These devices enable the surgeons to use highly advanced software technologies to control & move surgical instruments for a wide array of minimally invasive surgical procedures. Therefore, with the increasing integration of technologically advanced devices in the healthcare industry, the demand for robotic-assisted surgical devices would experience noteworthy growth in the upcoming years.

Market Insights

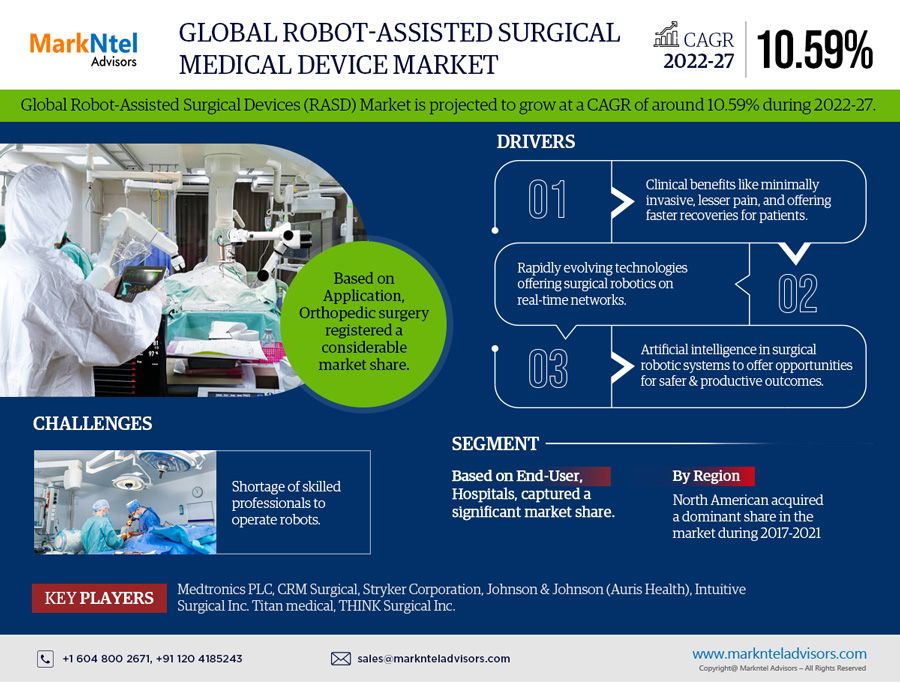

The Global Robot-assisted Surgical Devices (RASD) Market is projected to grow at a CAGR of around 10.59% during the forecast period, i.e., 2022-27. During the historical years, robotic surgery has grown exponentially, owing to clinical benefits such as being minimally invasive, causing lesser pain as compared to conventional surgery, and offering faster recoveries for patients. Simultaneously, surgeons using robotic technologies have benefited from being able to perform surgeries in a more comfortable position with greater visualization & precision. However, in the near future, newly developed robotic systems may be able to conquer even the most difficult fields, such as neurosurgery, cardiovascular surgery, and microsurgical procedures. The evolution of robot-assisted surgical procedures has witnessed significant technological advancements since its adoption in minimally invasive surgeries & other complex procedures. The overall landscape of the healthcare sector is changing tremendously to improve or maintain a high quality of treatment while lowering the cost.

The factors such as the increasing geriatric population on a global level as well as different healthcare standards between developed & developing economies are posing a challenge to reconciling these issues. Additionally, minimally invasive surgery within the healthcare sector holds enormous potential as it is considered the most effective treatment option for surgeries. Further, with the rapidly evolving technologies, surgical robotics would be delivered on real-time networks in the near future, bringing single specialized expertise into a single community setting.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2017-20 |

| Base Year: 2021 | |

| Forecast Period: 2022-27 | |

| CAGR (2022-2027) | 10.59% |

| Regions Covered | North America: The US, Canada, Mexico |

| South America: Brazil, Rest of South America | |

| Europe: Germany, France, Italy, The UK, Spain, Rest of Europe | |

| Asia-Pacific: China, Japan, India, South Korea, Rest of Asia Pacific | |

| Middle East & Africa: The UAE, Saudi Arabia, South Africa, Rest of Middle East and Africa | |

| Key Companies Profiled | Medtronics PLC, CRM Surgical, Stryker Corporation, Johnson & Johnson (Auris Health), Intuitive Surgical Inc. Titan medical, THINK Surgical Inc, Other |

| Unit Denominations | USD Million/Billion |

Also, if properly implemented, it can become the most-effective healthcare service, further lowering the operating & overhead costs. Moreover, the US Food and Drug Administration (FDA) is working with professional societies to encourage education & training associated with the utilization of Robotically-assisted surgical devices so that the technology could be adopted by more healthcare professionals & surgical centers.

Key Trend in the Market

- Operating Lease Programs Implemented by the Surgical Robotic Manufacturers

The market for surgical robotics is continuously emerging as more than 70 companies are trying to tap the hidden potential by developing novel technologies & targeting different surgical applications. Intuitive Surgical, Inc. is a pioneer in this field & has established multiple sales channels to maintain market dominance to reduce the risk of indulging in the business as usual. The company has strategically adopted an operating leasing program to enter the next level of revenue-generating growth strategy.

Further, the overall impact of this growth strategy has fueled its revenue by leasing its system. Hence, in order to tap into emerging & low-income markets, system leasing could facilitate the market penetration & would be a key trend for the Global Robot-assisted Surgical Device market.

Impact of COVID-19 on the Global Robot-assisted Surgical Devices Market

Robot-assisted Surgical Device market experienced a steep decline due to the outbreak of the COVID-19 pandemic. The tremendously increasing COVID-19 affected patients were the prime concern of all the healthcare workers across the world. In both developed & developing countries, there was a shortage of medical consumables, hospital beds, and available doctors due to the substantial increase in patients.

Therefore, the cardiovascular, cancer-related & other minimally invasive surgeries were halted, which negatively impacted the robotics-assisted market globally. Additionally, the government & private hospitals heavily invested in providing basic amenities to their patients, which, in turn, affected the sales of RASD across various regions.

Market Segmentation

By Application:

- Gynecology Surgery

- Cardiovascular Surgery

- Neurosurgery

- Orthopedic Surgery

- Urology Surgery

- Other (Colorectal, Ear Nose Throat (ENT), etc.))

Here, the orthopedic surgery application held a considerable market share in the Global Surgical Robotics market due to the robust research & development (R&D) investments for enhancing the surgery procedures. Robotics-assisted surgical systems for Orthopedic Surgery offer accuracy & precision in bone resection procedures. Through accurate bone resection, surgical robotic systems can improve the alignment of bones & can increase the contact area between bones & implants, which may further improve the functional outcomes & longevity of the implants. For instance:

- In November 2020, Johnson & Johnson revealed its new robotic surgical system, Ottava, for orthopedic surgical applications. The company planned to begin verification & validation processes for the Ottava system in 2021, followed by enrollment in clinical trials in 2022.

- In July 2020, Smith & Nephew plc launched its Real Intelligence brand of enabling technology solutions, as well as its new-generation handheld robotics platform 'CORI Surgical System' for both unicompartmental knee arthroplasty & total knee arthroplasty.

Furthermore, the increasing prevalence & incidence of chronic disorders, elevating global population coupled with the geriatric population, favorable reimbursement policies in developed economies, and public initiatives & funding to develop advanced robotic technologies would help in the adoption of robot-assisted surgical devices in other categories during the forecast period.

By End User:

- Hospitals

- Ambulatory Surgery Centers

Among them all, Hospitals, being the primary buyers of robot-assisted surgical devices, captured a significant share in the Global Robot-assisted Surgical Devices (RASD) market during 2017-2022. Further, due to the increasing geriatric population, rising prevalence of chronic disorders, and continuous technological advancements in surgical robotics, there is a growing demand for these advanced technologies both from the healthcare providers & the patients to meet the increasing volume of the patients. Moreover, the surgical robotic manufacturers have been developing strategic alliances with hospitals & ambulatory surgical centers. As a result of such alliances, manufacturers have incorporated sales, marketing, and product development strategies into their sales, marketing, and product development plans.

Besides, the Ambulatory surgical centers is the second-most dominating end-user in the Global Surgical Robotics market. This segment has become a fast-evolving segment in the Global Surgical Robotics market. Furthermore, the increasing number of ambulatory surgical centers on the global level coupled with the growing adoption of technologically advanced products are driving the market growth.

Regional Landscape

Geographically, the Global Robot-assisted Medical Device Market expands across:

- North America

- South America

- Europe

- Asia-Pacific

- The Middle East & Africa

Of all the regions, the North American region accounted for a significant share of the Global Robot-assisted Medical Device market during 2017-2021 due to the presence of companies such as Zimmer Biomet, Medtronic, and Globus Medical, among others, which manufacture & market robot-assisted medical devices. North America is the early adopter of the latest technologies & the region now serves as a technological hub for the companies offering advanced solutions to the healthcare market.

Furthermore, the region offers potential growth opportunities to the companies, owing to the increased adoption of technologies such as surgical robotics across various branches, including orthopedics, cardiovascular, etc., of the healthcare industry. Hence, North America would be one of the most productive regions in the forecast years.

Recent Developments by Leading Companies

- In 2021, Stryker announced the acquisition of privately-held OrthoSensor & its Verasense intraoperative sensor tech, which would further boost the Mako surgical robotics systems.

- In 2021, TransEnterix, Inc. received the CE mark approval for the Intelligent Surgical Unit that enables the machine vision capabilities in the Robotic surgical systems.

- In 2019, Titan Medical Inc. announced a collaboration with Teleflex Incorporated to develop a robotic litigation technology. The collaboration permitted the expansion of the robotic instruments portfolio to offer proven technologies in a variety of surgical disciplines.

Market Dynamics:

Key Driver: Rising Demand for Minimally Invasive Surgical Procedures to Escalate the Market Growth

From complex vascular procedures to gynecological procedures, surgical robotics has found its application in various surgical procedures. The rising inclination of the patients toward minimally invasive surgeries on account of the reduced hospital stay, patient recovery time, lesser patient trauma, and post-operative pain has positively contributed to the growth of the Robot-assisted Surgical Devices market. Therefore, the surgical robotics market is anticipated to witness considerable growth in the upcoming years as the demand for minimally invasive surgical procedures propels.

Possible Restraint: Shortage of Skilled Professionals to Hinder the Market

The shortage of skilled professionals is one of the common factors that is hampering the growth of the Surgical Robotics market. This market has witnessed an increase in the number of patients worldwide. This can currently be observed in a healthcare landscape, where the volume of surgical procedures is increasing faster than the rate at which new surgeons are entering the field. However, several players, such as Mimic Technologies, Inc. & 3D Systems Corporation, offer a simulation-based training curriculum that can be customized based on simulation & surgical review to minimize the training hours required to maximize performance. Moreover, every surgical robotic system manufacturer provides dedicated training sessions & modules to the surgeons regarding the use of the system in an efficient manner.

Growth Opportunity Development of Low-cost Surgical Robotic Systems to Create a Great Opportunity for the Market

Artificial intelligence in surgical robotic systems will give companies new opportunities to make work safer, increase productivity, and save the valuable time of the end-users. Artificial intelligence is an attempt to eliminate or even minimize the risk of human error. Robot-assisted surgical devices that are enabled with artificial intelligence offer high accuracy in assisting microsurgical procedures in reducing the variations that could affect the health of the patients. In addition, several surgical robotic manufacturers are heavily investing in integrating the benefits of artificial intelligence in their surgical robotic systems.

In 2018, Asensus Surgical, Inc. acquired all the assets of MST Medical Surgery Technologies Ltd. (Israel), a developer of a software-based image analytics platform, by utilizing scene recognition, advanced visualization, machine learning, data analytics, and artificial intelligence. Through this acquisition, Asensus Surgical, Inc. Inc. would implement the technologies of MST Medical Surgery Technologies Ltd. in its Senhance Surgical Platform to accelerate & advance the benefits of digital laparoscopy to patients.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares) of the Global Robot-assisted Surgical Devices (RASD) Market?

- What are the region-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the Global Robot-assisted Surgical Devices (RASD) Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the Global Robot-assisted Surgical Devices (RASD) Market based on the competitive landscape?

- What are the key results derived from surveys conducted during the Global Robot-assisted Surgical Devices (RASD) Market study?

Frequently Asked Questions

- Introduction

- Research Process

- Assumption

- Market Segmentation

- Market Definition

- Executive Summary

- Impact of COVID-19 on Global Robot-assisted Surgical Devices (RASD) Market

- Global Robot-assisted Surgical Devices (RASD) Market Trends & Insights

- Global Robot-assisted Surgical Devices (RASD) Market Dynamics

- Growth Drivers

- Challenges

- Global Robot-assisted Surgical Devices (RASD) Market Hotspot and Opportunities

- Global Robot-assisted Surgical Devices (RASD) Market Value Chain Analysis

- Global Robot-assisted Surgical Devices (RASD) Market FDA Approvals, 2017-2022

- Global Robot-assisted Surgical Devices (RASD) Market Patent Landscape

- Global Robot-assisted Surgical Devices (RASD) Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues (USD Million)

- Market Share and Analysis

- By Application

- Gynaecological Surgery

- Cardiovascular Surgery

- Neurosurgery

- Orthopaedic Surgery

- Urology Surgery

- Other (Colorectal, Ear Nose Throat(ENT), etc.)

- By End User

- Hospitals

- Ambulatory Surgery Centres

- By Region

- North America

- South America

- Europe

- The Middle East and Africa

- Asia-Pacific

- By Company

- Competition Characteristics

- Revenue Shares

- By Application

- Market Size and Analysis

- North America Robot-assisted Surgical Devices (RASD) Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues

- Market Share and Analysis

- By Application

- By End User

- By Country

- The US

- Canada

- Mexico

- The US Robot-assisted Surgical Devices (RASD) Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues

- Market Share and Analysis

- By Application

- By End User

- Market Size and Analysis

- Canada Robot-assisted Surgical Devices (RASD) Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues

- Market Share and Analysis

- By Application

- By End User

- Market Size and Analysis

- Mexico Robot-assisted Surgical Devices (RASD) Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues

- Market Share and Analysis

- By Application

- By End User

- Market Size and Analysis

- Market Size and Analysis

- South America Robot-assisted Surgical Devices (RASD) Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues

- Market Share and Analysis

- By Application

- By End User

- By Country

- Brazil

- Rest of South America

- Brazil Robot-assisted Surgical Devices (RASD) Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues

- Market Share and Analysis

- By Application

- By End User

- Market Size and Analysis

- Market Size and Analysis

- Europe Robot-assisted Surgical Devices (RASD) Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues

- Market Share and Analysis

- By Application

- By End User

- By Country

- Germany

- The UK

- France

- Italy

- Spain

- Rest of Europe

- Germany Robot-assisted Surgical Devices (RASD) Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues

- Market Share and Analysis

- By Application

- By End User

- Market Size and Analysis

- The UK Robot-assisted Surgical Devices (RASD) Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues

- Market Share and Analysis

- By Application

- By End User

- Market Size and Analysis

- France Robot-assisted Surgical Devices (RASD) Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues

- Market Share and Analysis

- By Application

- By End User

- Market Size and Analysis

- Italy Robot-assisted Surgical Devices (RASD) Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues

- Market Share and Analysis

- By Application

- By End User

- Market Size and Analysis

- Spain Robot-assisted Surgical Devices (RASD) Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues

- Market Share and Analysis

- By Application

- By End User

- Market Size and Analysis

- Market Size and Analysis

- The Middle East and Africa Robot-assisted Surgical Devices (RASD) Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues

- Market Share and Analysis

- By Application

- By End User

- By Country

- The UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- The UAE Robot-assisted Surgical Devices (RASD) Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues

- Market Share and Analysis

- By Application

- By End User

- Market Size and Analysis

- Saudi Arabia Robot-assisted Surgical Devices (RASD) Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues

- Market Share and Analysis

- By Application

- By End User

- Market Size and Analysis

- South Africa Robot-assisted Surgical Devices (RASD) Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues

- Market Share and Analysis

- By Application

- By End User

- Market Size and Analysis

- Market Size and Analysis

- Asia-Pacific Robot-assisted Surgical Devices (RASD) Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues

- Market Share and Analysis

- By Application

- By End User

- By Country

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- China Robot-assisted Surgical Devices (RASD) Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues

- Market Share and Analysis

- By Application

- By End User

- Market Size and Analysis

- Japan Robot-assisted Surgical Devices (RASD) Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues

- Market Share and Analysis

- By Application

- By End User

- Market Size and Analysis

- India Robot-assisted Surgical Devices (RASD) Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues

- Market Share and Analysis

- By Application

- By End User

- Market Size and Analysis

- South Korea Robot-assisted Surgical Devices (RASD) Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues

- Market Share and Analysis

- By Application

- By End User

- Market Size and Analysis

- Market Size and Analysis

- Global Robot-assisted Surgical Devices (RASD) Market Key Strategic Imperatives for Success and Growth

- Competitive Outlook

- Competition Matrix

- Application Portfolio

- Brand Specialization

- Target Markets

- Target Applications

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles (Business Description, Application Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Medtronics PLC

- CRM Surgical

- Stryker Corporation

- Johnson & Johnson (Auris Health)

- Intuitive Surgical Inc.

- Titan medical

- THINK Surgical Inc.

- Asensus Surgery (Formerly: TransEnterix Surgical)

- SRI International Inc.

- Renishaw PLC

- Smith & Nephew PLC

- Brainlab

- NuVasive Inc.

- Synaptive Medical

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making