North America Probiotic Supplements Market Research Report: Forecast (2023-2028)

By Form (Solid Form (Tablets, Capsules, Gummies, Powder, Chewable, Others)), By End User (Infant, Kids, Adults (16-35 Years, 36-50 Years, 51-65 Years, Above 66 Years)), By Distribu...tion Channel (Pharmacies, Health & Beauty Speciality Stores, Supermarkets & Hypermarkets, Convenience Stores, Online Stores (Via E-commerce Players, Supplier Selling Via Own Website)), By Diseases (Digestive Health (Lactose Intolerance, Constipation, Others (Ulcerative Colitis, Colic, etc.)), Irritable Bowel Syndrome (IBS), Oral Disease, Immunity-based Disease, Others (Cardiovascular Diseases, Respiratory Infections, Obesity, Memory/Mood/Relaxing)), By Country (US, Canada, Mexico), By Company (Yakult Honsha Co. Ltd, Nestle S.A, BioGaia AB, Chr. Hansen Holding A/S, Danone S.A, Kirkman Group Inc., American Biologics LLC, Biena Inc., Biotix Care, Deerland Probiotics and Enzymes Inc., and Others.) Read more

- Food & Beverages

- Mar 2023

- Pages 165

- Report Format: PDF, Excel, PPT

Market Definition

Probiotic supplements are added food products such as tablets, capsules, chewable, gummies, etc., consumed with the food to improve the nutritional intake, enhance immunity, and prevent diseases. Probiotic refers to bacteria or yeast that are conducive to human health by providing various benefits such as the prevention of multiple diseases as well as improving immunity. Furthermore, the rising awareness among consumers about the health benefits of consuming probiotic supplements ranging from digestive health, oral care, immune boosters, etc., proliferated the demand for probiotic supplements in North America.

Market Insights & Analysis: North America Probiotic Supplements Market (2023-28)

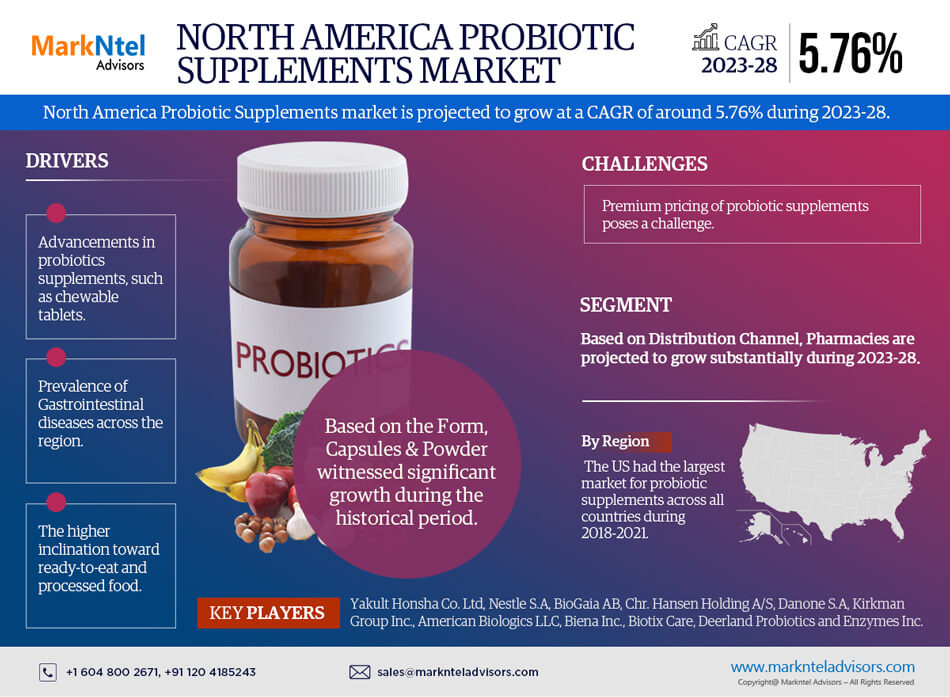

The North America Probiotic Supplements market is projected to grow at a CAGR of around 5.76% during the forecast period, i.e., 2023-28. The high consumption of processed food, the presence of high calories, saturated fat & added sugar, and the lack of proper nutrients in a typical American diet are the factors responsible for market growth. Furthermore, an upsurge in research grants for the development of new probiotic supplements & rising probiotic sports supplements in the region greatly contributed to the market growth.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 5.76% |

| Country Covered | The US, Canada, Mexico |

| Key Companies Profiled | Yakult Honsha Co. Ltd, Nestle S.A, BioGaia AB, Chr. Hansen Holding A/S, Danone S.A, Kirkman Group Inc., American Biologics LLC, Biena Inc., Biotix Care, Deerland Probiotics and Enzymes Inc., and Others. |

| Unit Denominations | USD Million/Billion |

Moreover, the US & Canada are the major contributors to the growing demand for probiotic supplements in line with the rising health awareness among individuals due to the increase in immune infection rates. As a result, the demand for probiotic supplements escalated to about 10% in the region.

Furthermore, additional funding provided by various investors to probiotic supplement startups, as well as the formation of distribution agreements with existing retailer chains & distributors to add new probiotic flavors & skincare products to the North American market, are expected to drive revenue growth of probiotic supplements in the coming year.

Key Trends in the Market

Advancements in Probiotics Supplements Such as Chewable Tablets

The growing advancement in probiotic supplements, such as the introduction of chewable tablets by different manufacturing companies such as BioGaia, and Nestle S.A., has resulted in the increased demand for chewable probiotic supplements in the historical years. These are easily available in pharmacies & chemist stores, online platforms, etc. Additionally, with the growing number of customers in the countries such as the US, Italy, and China, the demand for chewable tablets has seen an increasing trend across the globe. For instance:

- In 2022, BioGaia launched first probiotic product in the US Market to support the immune system and strengthen children health.

Furthermore, the demand for chewable tablets is anticipated to grow due to their benefits, which include ease of consumption when compared to other tablets & capsules, as well as making it easier for children to consume. As a result, the market for probiotic supplements in the form of chewable tablets is expected to grow significantly in the coming years.

Market Segmentation

Based on the Form:

- Tablets

- Capsules

- Gummies

- Powder

- Chewable

- Others

Here, Capsules & Powder acquired significant growth during the historical period. Capsules have a high comparative advantage over tablets and are chewable for senior citizens. They also help in reducing the formation of acids in the gastrointestinal tract. Additionally, the presence of added sugars in chewable & gummies has decreased their usage among adults & infants.

Moreover, the growing dietary & immune-related diseases such as obesity, eating disorders, cancer, type 2 diabetes, etc., coupled with the rising awareness among consumers for the use of probiotic-based health supplements to promote healthy living & reduce disease burden are expected to elevate the growth of probiotic supplements in the forthcoming years.

Based on Distribution Channel:

- Pharmacies

- Health & Specialty Stores

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Stores

Among all, Pharmacies witnessed a considerable growth rate during the historical period, owing to the increasing penetration of probiotic supplements in the market with a diversified product portfolio. In response, pharmacies increased their prescription probiotic sales due to allergic risks associated with the product. The probiotic supplements may contain sugar, lactose, etc., which may severely affect the person with lactose intolerance and diabetes. These reasons have resulted in an increased demand for probiotic supplements from pharmacies during 2018-2021.

Additionally, the rise in communicable & non-communicable diseases in North America, such as dysentery and streptococcus, has led to an increase in the production of probiotic supplements. Moreover, pharmacies promoted the use of probiotic supplements by recommending a probiotic for disease control. As a result, this trend is expected to dominate the North America Probiotic Supplements market in the forthcoming years.

Based on Disease

- Digestive Health

- Irritable Bowel Syndrome

- Oral Diseases

- Immunity Based Diseases

- Others (Cardiovascular diseases, Obesity, etc.)

Of them, Digestive Health & Irritable Bowel Syndrome witnessed a considerable growth rate during the historical period. As the digestive system plays a key role in maintaining the overall health of the body, it is imperative that the stomach is fed healthy foods containing vitamins, minerals, starch, proteins, and beneficial bacteria. However, the increasing adoption of western lifestyles & the rising promotion of unhealthy food through advertisements has facilitated several digestive issues, such as indigestion, abdominal pain, bloating, etc., among adults, infants, and kids across the North American region.

These issues have led to an increase in the demand for probiotic supplements backed by their natural healing properties during 2018-2021. As a consequence, the rising awareness among residents regarding the side effects of traditional medicine intake and the advantages associated with the consumption of probiotic supplements is expected to proliferate the demand for probiotic supplements during 2023-2028.

Country Landscape

Geographically, North America Probiotics Supplements Market expands across:

- The US

- Canada

- Mexico

In the North American region, the US had the largest market for probiotic supplements across all countries due to a growing awareness among US residents about the importance of functional foods & drinks to treat immune system disorders naturally and the presence of health-conscious consumers. In addition, the increased spread of the COVID-19 virus in the US during Q1 of 2020 resulted in the growing demand for probiotic supplements in the US market to boost the immune systems, especially in infants & elderly people. For instance:

- Microbiome Labs, a US-based Danish firm, reported a double-digit sales growth of probiotic supplements in 2020, resulting in revenue growth of around USD4 million.

Furthermore, the International Probiotic Association suggests the development of next-generation personalized probiotics to complement microbiome deficiency or disturbances that could help address probiotic supplements in the US. Hence, this might create an opportunity for the growth of probiotic supplements in the US during 2023-28.

Recent Developments by the Leading Companies

- 2021: Probi AB announced a strategic partnership with Blis Technologies to develop and deliver clinically proven probiotic supplements.

- 2020: BioGaia launched 5 products in new variants without palm oil for children such as protectis drops, protectis drops with vitamin D, protectis drops with strawberry flavor, and protectis tablets with orange flavor.

Market Dynamics:

Key Drivers: Prevalence of Gastrointestinal Diseases Across the Region

With the increasing number of gastrointestinal diseases across the region, the demand for probiotic supplements has been boosted. Countries with sizeable populations, such as the US, Canada, etc., have reported an increase in the number of gastrointestinal diseases. In addition, the growing cases of irritable bowel syndrome, Crohn's, and liver diseases have been some of the major factors attributing to the growth in the cases of gastrointestinal disease. Degrading eating habits & genetic disorders are chiefly responsible for the growing number of liver disease cases among the population.

Furthermore, the rise in research & development activities by the companies and their addition of new probiotic supplements have assisted in providing different supplements for patients suffering from gastrointestinal diseases such as hemorrhoids, constipation, etc. Hence, this is expected to encourage consumers to use probiotic supplements, resulting in increased market growth in the coming years.

Possible Restraint: Premium Pricing of the Probiotic Supplements

Probiotic supplements have gained popularity as health-improving bacteria, which provide a preventive mechanism to avoid general disorders such as oral care, gastrointestinal diseases, etc. However, the prices of probiotic supplements have been on the higher side, which has restricted a wide variety of audiences in the middle and lower-income groups. Furthermore, probiotics supplements have a lower shelf life, therefore the manufacturers need cold storage to increase their shelf life, which requires a very high amount of cost & might hinder market growth.

Gain a Competitive Edge with our North America Probiotics Supplements Market Report

- North America Probiotics Supplements Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size, share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- North America Probiotics Supplements Market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Impact of COVID-19 on North America Probiotic Supplements Market

- North America Probiotic Supplements Market Trends & Insights

- North America Probiotic Supplements Market Dynamics

- Drivers

- Challenges

- North America Probiotic Supplements Market Regulations & Policies

- North America Probiotic Supplements Market Supply Chain Analysis

- North America Probiotic Supplements Market Hotspots & Opportunities

- North America Probiotic Supplements Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Form

- Solid Form

- Tablets

- By End User

- Kids (3.1 to 15 years)

- Adults (Above 15 years)

- By End User

- Capsules

- By End User

- Kids (3.1 to 15 years)

- Adults (Above 15 years)

- By End User

- Gummies

- By End User

- Kids (3.1 to 15 years)

- Adults (Above 15 years)

- By End User

- Powder

- By End User

- Infants (Upto 3 Years)

- Kids (3.1 to 15 years)

- Adults (Above 15 years)

- By End User

- Chewable

- By End User

- Kids (3.1 to 15 years)

- Adults (Above 15 years)

- By End User

- Others

- Tablets

- Solid Form

- By End User

- Infant

- Kids

- Adults

- 16-35 Years

- 36-50 Years

- 51-65 Years

- Above 66 Years

- By Distribution Channel

- Pharmacies

- Health & Beauty Speciality Stores

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Stores

- Via E-commerce Players

- Supplier Selling Via Own Website

- By Diseases

- Digestive Health

- Lactose Intolerance

- Constipation

- Others (Ulcerative Colitis, Colic, etc.)

- Irritable Bowel Syndrome (IBS)

- Oral Disease

- Immunity-based Disease

- Others

- Cardiovascular Diseases

- Respiratory Infections

- Obesity

- Memory/Mood/Relaxing

- Digestive Health

- By Country

- The US

- Canada

- Mexico

- By Company

- Competition Characteristics

- Market Share of Leading Companies

- By Form

- The US Probiotic Supplements Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Form

- By End User

- By Distribution Channel

- By Disease

- Market Size & Analysis

- Canada Probiotic Supplements Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Form

- By End User

- By Distribution Channel

- By Disease

- Market Size & Analysis

- Mexico Probiotic Supplements Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Form

- By End User

- By Distribution Channel

- By Disease

- Market Size & Analysis

- Market Size & Analysis

- North America Probiotic Supplements Market Key Strategic Imperatives for Growth & Success

- Competition Outlook

- Competition Matrix

- Brand Specialization

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles

- Yakult Honsha Co. Ltd

- Nestle S.A

- BioGaia AB

- Chr. Hansen Holding A/S

- Danone S.A

- Kirkman Group Inc.,

- American Biologics LLC

- Biena Inc.

- Biotix Care

- Deerland Probiotics and Enzymes Inc.

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making