Global Next Generation Immunotherapy Market Research Report: Forecast (2024-2029)

By Type (Vaccines, Immune Checkpoint Modulators, CAR-T Cell Therapy, Tumor-Infiltrating Lymphocytes [TILs] Therapy, Bispecific Antibodies, Oncolytic Virus Therapy, Others), By Rout...e of Administration (Intravenous, Intratumoral, Subcutaneous, Oral), By Therapeutic Area (Oncology, Autoimmune Diseases, Infectious Diseases, Inflammatory Diseases, Others), By End User (Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Cancer Research Centers), By Region (North America,, South America,, Europe,, Middle East & Africa,, Asia-Pacific), By Company (Bristol Myers Squibb, Regeneron Pharmaceuticals, MacroGenics, AbbVie Inc., Pfizer Inc., Novartis, Merck & Co., Inc., AstraZeneca, Incyte Corporation, Eli Lilly and Company, Johnson and Johnson, Others,) Read more

- Healthcare

- Oct 2023

- Pages 198

- Report Format: PDF, Excel, PPT

Market Definition

The Next Generation Immunotherapy encompasses innovative therapies that harness the immune system to target and eradicate diseases like cancer, autoimmune disorders, infectious diseases, and others. It involves advanced technologies like genetically engineered cells, immune checkpoint inhibitors, and monoclonal antibodies. These therapies aim to improve treatment efficacy, minimize side effects, and enhance patient outcomes.

Market Insights & Analysis: Global Next Generation Immunotherapy Market (2024-29):

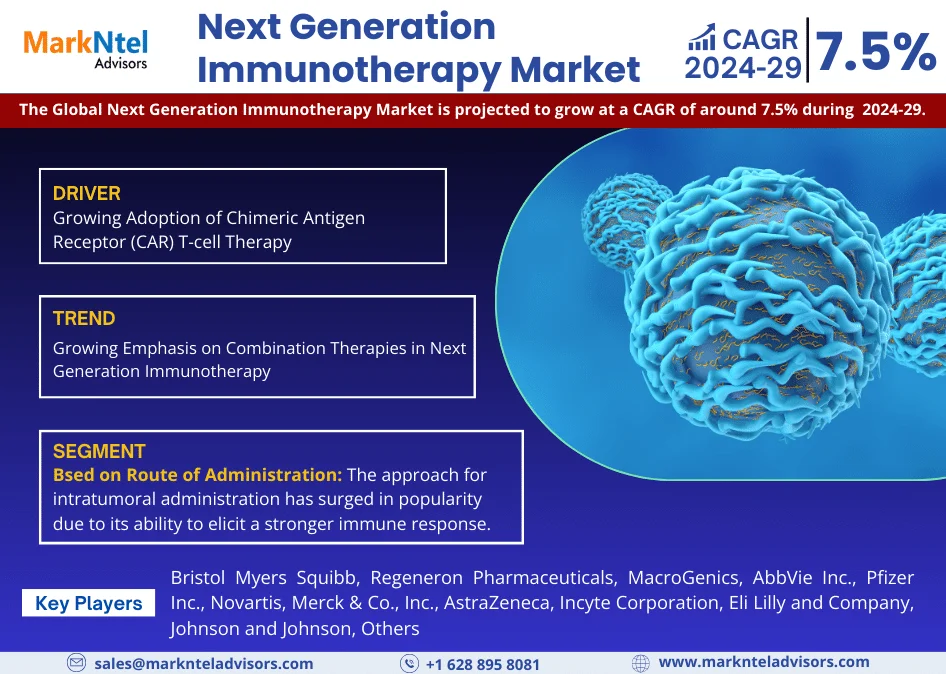

Global Next Generation Immunotherapy Market is projected to grow at a CAGR of around 7.5% during the forecast period, i.e., 2024-29. Some of the key factors propelling the market growth included the rising burden of chronic diseases, increasing research in the area of next-generation drugs, and an increased focus on targeted therapies for certain diseases. Also, the factor majorly affecting the Global Next Generation Immunotherapy Market was the rising prevalence of chronic diseases like asthma, allergic conditions, cancer, and multiple sclerosis.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-29 | |

| CAGR (2024-2029) | 7.5% |

| Regions Covered | North America: US, Canada, Mexico |

| Europe: Germany, The UK, France, Spain, Italy, Rest of Europe | |

| Asia-Pacific: China, India, Japan, South Korea, Singapore, Australia, Rest of Asia-Pacific | |

| South America: Brazil, Rest of South America | |

| Middle East & Africa: GCC, South Africa, Rest of MEA | |

| Key Companies Profiled | Bristol Myers Squibb, Regeneron Pharmaceuticals, MacroGenics, AbbVie Inc., Pfizer Inc., Novartis, Merck & Co., Inc., AstraZeneca, Incyte Corporation, Eli Lilly and Company, Johnson and Johnson, Others |

| Unit Denominations | USD Million/Billion |

For instance, in 2020, as per the World Health Organization, cancer accounted for around 9.9 million deaths and remains the second leading cause of death worldwide. The burden is projected to increase in the future because risk factors including smoking, unhealthy eating habits, and not exercising are becoming more prevalent in economically developing countries. With a growing number of chronic diseases, demand for novel drugs would improve, further contributing to market growth.

Furthermore, the key activities undertaken by the various companies have also been supporting the market growth. Companies involved in offering next-generation immunotherapy have been investing heavily in clinical trials and research to develop and validate innovative immunotherapies. These trials have been crucial for demonstrating the safety and efficacy of new treatments, gaining regulatory approvals, and expanding the range of conditions and patient populations that can be catered to with advanced immunotherapy approaches.

- For instance, in 2022, Human Immunology Biosciences Inc. announced that it had raised USD120 million to develop targeted treatments for autoimmune and allergic diseases. The company developed two drug candidates, called felzartamab and HIB210, that were licensed by the German biotechnology company MorphoSys. Both are in clinical trials, with the former in Phase 2 testing for two rare kidney diseases and the latter in Phase 1.

Hence, owing to the increasing focus of companies such as Human Immunology Biosciences Inc, Merck & Co., Inc., Bristol Myers Squibb (BMS), etc. on developing such novel drugs, it is expected that the market is likely to witness strong growth. It would be attributed to the increased efficacy of the novel drugs and increased patient pool which would be prescribed with next-generation immunotherapies in the coming years.

Global Next Generation Immunotherapy Market Driver:

Growing Adoption of Chimeric Antigen Receptor (CAR) T-cell Therapy – In recent years, there has been a high demand for chimeric antigen receptor (CAR) T-cell therapy, which has been majorly driven by the rising prevalence of relapsed B-cell acute lymphoblastic leukemia (ALL) and specific non-Hodgkin lymphomas. For instance,

- In 2020, according to the GLOBOCON, non-Hodgkin lymphomas (NHL) have been ranked as one of the most common cancers and had an estimated 544,000 new cancer cases and 260,000 cancer deaths in 2020.

The rising demand for CAR-T cell therapy among NHL patients has been majorly attributed to the superior clinical outcomes of chimeric antigen receptor (CAR) T-cell therapy arising from its proven success in treating challenging conditions. In addition, to cater to this rising demand for CAR-T cell therapy, companies have heightened funding into CAR-T cell therapy research & development, which led to the launch of new drugs. For instance,

- In 2020, Tecartus, by Kite Pharma Inc., a CAR-T cell therapy was approved by the US FDA, which provided a significant treatment option for relapsed or refractory mantle cell lymphoma, expanding the application of CAR-T cell therapies of non-Hodgkin lymphoma.

Hence, with the availability of better next-generation immunotherapies, the market has experienced considerable growth. Moreover, the regulatory approvals and accelerated pathways granted by regulatory agencies such as the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have played a crucial role in driving the adoption of CAR-T cell therapy. Hence, the established regulatory framework and clear pathways for approval would further facilitate the development and commercialization of CAR-T cell therapies, which would help in the market growth in the coming years as well.

Global Next Generation Immunotherapy Market Opportunity:

Development and Commercialization of Personalized Cancer Vaccines – The progress and commercialization of personalized cancer vaccines represent a significant opportunity driven by advances in genomics and molecular biology. Leading companies such as BioNTech, Moderna, and AstraZeneca are pioneering these innovative therapies, harnessing mRNA technology and other cutting-edge approaches.

Moreover, there is a growing awareness among consumers, particularly in countries like the US, India, and the UK, about the superior efficacy of personalized cancer vaccines compared to traditional ones. In addition to increasing awareness, the rising incidence of cancers like breast cancer and ovarian cancer in countries such as China, Canada, and Australia due to various factors, including lifestyle, environmental conditions, and genetic mutations, will drive the demand for personalized medicines in the coming years.

Furthermore, the global personalized cancer vaccines market is poised for significant growth, with pharmaceutical companies worldwide heavily investing in research and development. For Instance,

- In 2023, BioNTech and Roche's personalized cancer vaccine Phase I trial data was published in Nature offering promising potential for improving outcomes in lethal pancreatic ductal adenocarcinoma.

This represents a noteworthy advancement in personalized cancer vaccine development and holds the potential to revolutionize cancer treatment and create significant opportunities for market growth.

Global Next Generation Immunotherapy Market Challenge:

Reimbursement Challenges in the Global Next Generation Immunotherapy Market– The high costs associated with innovative therapies have been raising concerns regarding their affordability and reimbursement. The personalized and complex nature of next-generation immunotherapies has contributed to their high price tags, which were creating challenges for healthcare systems, payers, and patients in securing reimbursement and access. Reimbursement policies and mechanisms were not fully developed or adapted to account for the unique characteristics of these therapies, considering factors such as long-term patient outcomes, cost-effectiveness, and the potential for cure or prolonged remission. For instance,

- In 2021, as per the Centres for Medicare & Medicaid Services (CMS), in the inpatient setting, the current reimbursement model for CAR-T therapy falls short of covering the high costs, leading to potential financial losses for hospitals treating Medicare patients.

One of the key issues with the current reimbursement model in the inpatient setting has been that it fails to account for the full cost spectrum of next-generation immunotherapies like CAR-T therapy, including the complex and resource-intensive care required for patient management. Hence, this financial strain has not only been impacting patient’s access to CAR-T therapy but has also been affecting the sales of next-generation immunotherapies across the globe.

Global Next Generation Immunotherapy Market Trend:

Growing Emphasis on Combination Therapies in Next Generation Immunotherapy – Researchers and pharmaceutical companies have been increasingly exploring the potential benefits of combining different immunotherapies, as well as combining immunotherapies with other treatment modalities such as targeted therapies, chemotherapy, and radiation therapy. Combination therapies have been showing promising results in enhancing treatment efficacy, overcoming resistance mechanisms, and expanding the applicability of immunotherapy.

It has also been observed in recent years, that combining immune checkpoint inhibitors (ICIs) like pembrolizumab and nivolumab with other therapies, such as targeted treatments or adoptive cell therapies, has demonstrated enhanced efficacy in various cancers, including advanced non-small cell lung cancer. These innovations have recently improved the preference for next-generation immunotherapies as combination therapies among healthcare professionals. To cater to this rising interest of consumers, notable pharmaceutical companies like Bristol Myers Squibb and Merck & Co. among others have been actively involved in developing these combination therapies to improve cancer treatment outcomes and address resistance mechanisms. For instance:

- In 2022, the US FDA approved AstraZeneca’s tremelimumab (Imjudo) in combination with durvalumab for adult patients with unresectable hepatocellular carcinoma (uHCC).

Hence, pharmaceutical companies have been at the forefront of this trend of developing combination therapies that target multiple pathways to improve patient outcomes. The companies are also investing in ongoing clinical trials to assess the safety and effectiveness of these regimens. Hence, once proven successful, these combination therapies would further support the growth of the Global Next Generation Immunotherapy Market in the coming years as well.

Global Next Generation Immunotherapy Market (2024-29): Segmentation Analysis

Global Next Generation Immunotherapy Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment. It includes predictions for the period 2024-29 at the global level. According to the analysis, the market has been further classified as:

Based on Route of Administration:

- Intravenous

- Intratumoral

- Subcutaneous

- Oral

Among them, in recent years, the approach for intratumoral administration has surged in popularity due to its ability to elicit a stronger immune response, backed by promising clinical findings. Hence, consumers and healthcare professionals have recently started showing interest in the intratumoral mode of administration of next-generation immunotherapies. Also, in recent years, companies have started investing in R&D to improve advancements in intratumoral therapy. For instance,

- In 2020, Idera Pharmaceuticals started trials of the ILLUMINATE-204, which is an intratumoral tilsotolimod, an investigational Toll-like receptor 9 (TLR9) agonist, which was in phase 1/2 trial.

These developments demonstrate the growing recognition of intratumoral therapy's potential, and thus, the launch of new therapies in the segment would further support its growth in the coming years.

Based on Therapeutic Area:

- Cancer

- Autoimmune Diseases

- Infectious Diseases

- Inflammatory Diseases

- Others (Non-Hodgkin lymphoma, B-cell Malignancies, etc.)

Out of these, the oncology (cancer) segment has dominated the Global Next Generation Immunotherapy Market in recent years, owing to the rising prevalence of cancer across the globe. For instance, in 2020, the American Cancer Society reported that there were around 1.8 million new cancer cases diagnosed in the United States alone. Hence, the rising demand for next-generation immunotherapies with a growing cancer burden has improved the overall growth of the market.

Further, to cater to this demand in the oncology segment, companies like Bristol Myers Squibb, Merck, etc., have been introducing new drugs in the segment. For instance, in 2021, Bristol Myers Squibb received FDA approval for Opdivo (nivolumab) for adjuvant treatment of esophageal or gastroesophageal junction cancer. Hence, the presence of better immunotherapies in the oncology segment further strengthened the segment’s growth, which is projected to dominate in the coming years as well as escalating investments in R&D.

Global Next Generation Immunotherapy Market: Regional Projections

Geographically, the Global Next Generation Immunotherapy Market expands across:

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

North America has witnessed significant growth in the Next Generation Immunotherapy Market due to several key reasons. In recent years, North America, particularly the United States, has played a pivotal role in advancing immunotherapy. Additionally, North America had a high prevalence of cancer and autoimmune diseases, creating significant demand for next-generation immunotherapy treatments. The region had a large patient population actively seeking effective and personalized therapies, which led to increased adoption and market growth.

Also, the factors influencing this trajectory including evolving treatment landscapes, regulatory approvals for new therapies, ongoing research and development efforts, and healthcare policies. In addition, companies like Pfizer, BioNtech, etc., have recently announced their efforts to introduce novel therapies across the region. These efforts are expected to further shape the future of immunotherapy adoption and market expansion in North America.

Global Next Generation Immunotherapy Industry Recent Development:

- 2023: Boehringer Ingelheim and 3T Biosciences have formed a strategic collaboration to leverage 3T Biosciences' 3T-TRACE discovery platform and Boehringer Ingelheim's research expertise to develop next-generation cancer therapies. Boehringer Ingelheim will supply patient-derived TCR data to support 3T's antigen discovery using the TRACE platform, with 3T receiving initial payment and research backing.

- 2022: Regeneron Pharmaceuticals and CytomX Therapeutics have formed a collaboration to develop conditionally-activated bispecific cancer therapies by combining CytomX's Probody platform and Regeneron's Veloci-Bi bispecific antibody development platform, with a focus on improving the therapeutic window and reducing off-target effects in immunotherapies.

Gain a Competitive Edge with Our Global Next Generation Immunotherapy Market Report

- Global Next Generation Immunotherapy Market Report by Markntel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps business organizations to gain a holistic understanding of the market dynamics & to make informed decisions.

- This report also highlights current market trends & future projections, allowing business organizations to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Next Generation Immunotherapy Market Report aids in assessing & mitigating risks associated with entering or operating level in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, business organizations can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

Global Next Generation Immunotherapy Market Research Report (2024-2029) - Table of Contents

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Next Generation Immunotherapy Market Patent Analysis, 2019-2023

- Global Next Generation Immunotherapy Market Recent Approvals, 2019-2023

- Global Next Generation Immunotherapy Market Clinical Trial Analysis, 2019-2023

- Global Immunotherapy Market Evolution, 2000-2023

- Global Next Generation Immunotherapy Market Trends & Insights

- Global Next Generation Immunotherapy Market Dynamics

- Drivers

- Challenges

- Global Next Generation Immunotherapy Market Hotspot & Opportunities

- Global Next Generation Immunotherapy Market Policies, Regulations, Product Standards

- Global Next Generation Immunotherapy Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- Vaccines- Market Size & Forecast 2019-2029F, USD Million

- mRNA Vaccines- Market Size & Forecast 2019-2029F, USD Million

- DNA Vaccines- Market Size & Forecast 2019-2029F, USD Million

- Protein Vaccines- Market Size & Forecast 2019-2029, USD Million

- Others (Viral Vector Vaccines, Nanoparticle Vaccines, etc.)- Market Size & Forecast 2019-2029, USD Million

- Immune Checkpoint Modulators- Market Size & Forecast 2019-2029F, USD Million

- CAR-T Cell Therapy- Market Size & Forecast 2019-2029F, USD Million

- Tumor-Infiltrating Lymphocytes (TILs) Therapy- Market Size & Forecast 2019-2029F, USD Million

- Bispecific Antibodies- Market Size & Forecast 2019-2029F, USD Million

- Oncolytic Virus Therapy- Market Size & Forecast 2019-2029F, USD Million

- Others (Antibody-drug Conjugates, ACE Inhibitors, etc.)- Market Size & Forecast 2019-2029F, USD Million

- Vaccines- Market Size & Forecast 2019-2029F, USD Million

- By Route of Administration

- Intravenous- Market Size & Forecast 2019-2029F, USD Million

- Intratumoral- Market Size & Forecast 2019-2029F, USD Million

- Subcutaneous- Market Size & Forecast 2019-2029F, USD Million

- Oral- Market Size & Forecast 2019-2029F, USD Million

- By Therapeutic Area

- Oncology- Market Size & Forecast 2019-2029F, USD Million

- Autoimmune Diseases- Market Size & Forecast 2019-2029F, USD Million

- Infectious Diseases- Market Size & Forecast 2019-2029F, USD Million

- Inflammatory Diseases- Market Size & Forecast 2019-2029F, USD Million

- Others (Neurological Disorders, B-cell Malignancies, etc.) - Market Size & Forecast 2019-2029F, USD Million

- By End User

- Hospitals- Market Size & Forecast 2019-2029F, USD Million

- Specialty Clinics- Market Size & Forecast 2019-2029F, USD Million

- Ambulatory Surgical Centres- Market Size & Forecast 2019-2029F, USD Million

- Cancer Research Centres- Market Size & Forecast 2019-2029F, USD Million

- By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

- By Competition

- Market Share of Top Companies

- Competition Characteristics

- By Type

- Market Size & Analysis

- North America Next Generation Immunotherapy Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Route of Administration- Market Size & Forecast 2019-2029F, USD Million

- By Therapeutic Area- Market Size & Forecast 2019-2029F, USD Million

- By End User- Market Size & Forecast 2019-2029F, USD Million

- By Country

- The US

- Canada

- Mexico

- The US Next Generation Immunotherapy Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Therapeutic Area- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- Canada Next Generation Immunotherapy Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Therapeutic Area- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- Mexico Next Generation Immunotherapy Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Therapeutic Area- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- Market Size & Analysis

- South America Next Generation Immunotherapy Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Route of Administration- Market Size & Forecast 2019-2029F, USD Million

- By Therapeutic Area- Market Size & Forecast 2019-2029F, USD Million

- By End User- Market Size & Forecast 2019-2029F, USD Million

- By Country

- Brazil

- Rest of South America

- Brazil Next Generation Immunotherapy Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Therapeutic Area- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Europe Next Generation Immunotherapy Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Route of Administration- Market Size & Forecast 2019-2029F, USD Million

- By Therapeutic Area- Market Size & Forecast 2019-2029F, USD Million

- By End User- Market Size & Forecast 2019-2029F, USD Million

- By Country

- Germany

- The UK

- France

- Italy

- Spain

- Rest of Europe

- Germany Next Generation Immunotherapy Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Therapeutic Area- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- The UK Next Generation Immunotherapy Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Therapeutic Area- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- France Next Generation Immunotherapy Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Therapeutic Area- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- Italy Next Generation Immunotherapy Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Therapeutic Area- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- Spain Next Generation Immunotherapy Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Therapeutic Area- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Middle East & Africa Next Generation Immunotherapy Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Route of Administration- Market Size & Forecast 2019-2029F, USD Million

- By Therapeutic Area- Market Size & Forecast 2019-2029F, USD Million

- By End User- Market Size & Forecast 2019-2029F, USD Million

- By Country

- GCC

- South Africa

- Rest of Middle East & Africa

- GCC Next Generation Immunotherapy Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Therapeutic Area- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- South Africa Next Generation Immunotherapy Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Therapeutic Area- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Next Generation Immunotherapy Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Route of Administration- Market Size & Forecast 2019-2029F, USD Million

- By Therapeutic Area- Market Size & Forecast 2019-2029F, USD Million

- By End User- Market Size & Forecast 2019-2029F, USD Million

- By Country

- China

- India

- Japan

- South Korea

- Singapore

- Australia

- Rest of Asia-Pacific

- China Next Generation Immunotherapy Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Therapeutic Area- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- India Next Generation Immunotherapy Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Therapeutic Area- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- Japan Next Generation Immunotherapy Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Therapeutic Area- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- South Korea Next Generation Immunotherapy Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Therapeutic Area- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- Singapore Next Generation Immunotherapy Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Therapeutic Area- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- Australia Next Generation Immunotherapy Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Therapeutic Area- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Global Next Generation Immunotherapy Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Bristol Myers Squibb

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Regeneron Pharmaceuticals

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- MacroGenics

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- AbbVie Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Pfizer Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Novartis

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Merck & Co., Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- AstraZeneca

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Incyte Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Eli Lilly and Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Johnson and Johnson

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Bristol Myers Squibb

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making