India Multifactor Authentication Market Research Report: Forecast (2026-2032)

India Multifactor Authentication Market - By Authentication Type (Password-Based, Password-Less), By Authentication Model (Two-Factor Authentication, Three-Factor Authentication..., Four-Factor Authentication, Five-Factor Authentication), By Application (Hardware OTP Token Authentication, Smart Card Authentication, Phone-Based Authentication), By Component Software, Hardware, Services, (Managed Services, Professional Services), By Deployment Mode (On-Premises, Cloud-Based, Hybrid), By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs), By End User (Banking, Financial Services & Insurance (BFSI), Government, Military and Defense, Healthcare & Pharmaceutical, IT & Telecommunications, Commercial Security, Energy & Utilities, Others), and others Read more

- ICT & Electronics

- Jan 2026

- Pages 135

- Report Format: PDF, Excel, PPT

India Multifactor Authentication Market

Projected 12.80% CAGR from 2026 to 2032

Study Period

2026-2032

Market Size (2023)

USD 698.53 Million

Market Size (2032)

USD 1623.52 Million

Base Year

2025

Projected CAGR

12.80%

Leading Segments

By Component: Software

India Multifactor Authentication Market Report Key Takeaways:

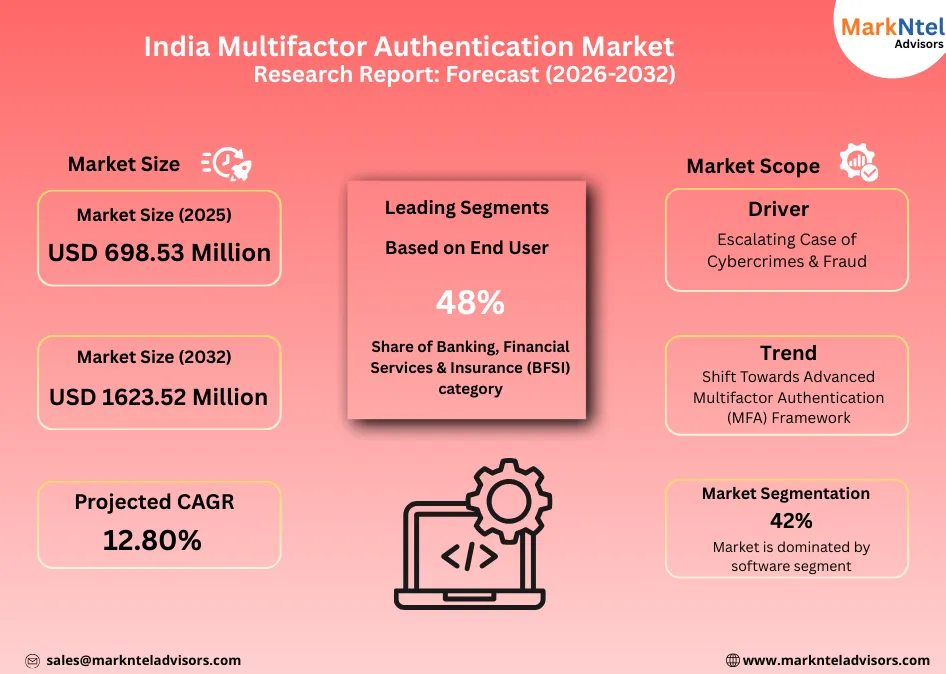

- The India Multifactor Authentication Market size was valued at around USD 698.53 million in 2025 and is projected to reach USD 1,623.52 million by 2032. The estimated CAGR from 2026 to 2032 is around 12.80%, indicating strong growth.

- By Component, the software segment represented 42% of the India Multifactor Authentication Market size in 2025.

- By End-User, the Banking, Financial Services & Insurance (BFSI) sector represented 48% of the India Multifactor Authentication Market size in 2025.

- By Authentication Model, the three-factor authentication is emerging as a high-growth segment, expanding at a steady CAGR of around 18% in the India Multifactor Authentication Market during 2026-32.

- By Deployment Mode, the cloud-based is emerging as a high-growth segment, expanding at a steady CAGR of around 16.25% during 2026-32.

- By Authentication type, the password-less segment is emerging as a high-growth segment, expanding at a steady CAGR of about 19% in the India Multifactor Authentication Market during 2026-32.

- The leading Multifactor Authentication companies in India are Google LLC, IBM Corporation, Microsoft Corporation, Ping Identity Corporation, Okta, Inc., Auth0, Inc., Duo Security, Inc., OneSpan Inc., RSA Security LLC, Micro Focus International plc, and others.

Market Insights & Analysis: India Multifactor Authentication Market (2026- 2032):

The India Multifactor Authentication Market size was valued at around USD 698.53 million in 2025 and is projected to reach USD 1,623.52 million by 2032. Along with this, the market is estimated to grow at a CAGR of around 12.80% during the forecast period, i.e., 2026-32.

The India Multifactor Authentication Market is experiencing rapid growth, driven by the sharp rise in cybercrime and financial fraud, alongside a structural shift from SMS-based OTPs to advanced authentication methods such as biometrics, passkeys, and risk-based security frameworks.

This evolution is reflected in strong momentum across key technology categories, with passwordless authentication expanding at a 19% CAGR, three-factor authentication growing at 18%, and cloud-based MFA solutions advancing at 16.25%, underscoring the market’s transition toward more resilient, scalable security architectures.

Government data reveals that online payment fraud cases involving amounts above approximately USD 1,210 rose to 29,082 during 2023, generating losses of nearly USD 175 million.

More alarming is the rise of “digital arrest scams,” where fraudsters impersonate law enforcement. These incidents increased from 39,925 to 123,672 in 2024, while associated losses expanded from about USD 11 million to USD 232 million.

Cumulatively, as of February, 2025, India recorded roughly 3.8 million cyber fraud incidents, with total reported losses reaching USD 4.39 billion. Recovery remains negligible at approximately USD 7.3 million, underscoring the limited effectiveness of reactive controls and the need for preventive authentication frameworks.

Furthermore, Government-linked data already shows that cybersecurity incidents more than doubled between 2022 and 2024, with cumulative fraud losses surpassing USD 4.39 billion by early 2025.

By mid-2025, the Ministry of Home Affairs reported more than 1.2 million cybercrime cases, with Maharashtra (around 160,000 incidents), Uttar Pradesh (about 140,000), and Karnataka (nearly 100,000). States such as Telangana, Odisha, and Gujarat are witnessing some of the fastest growth, reflecting the expansion of digital services into semi-urban and rural regions where security maturity remains uneven.

Parallel to this threat landscape, the authentication ecosystem is evolving. The market is moving beyond OTP dependence toward biometrics and device-native credentials. For instance, in 2025, Samsung introduced PIN-free biometric authentication within Samsung Wallet for UPI transactions, allowing fingerprint and facial recognition to replace SMS OTPs.

Similarly, IoT startup Proxgy launched ThumbPay, a biometric payment device linking Aadhaar and UPI through thumbprint verification, eliminating the need for smartphones, cards, or OTPs for selected use cases. These deployments demonstrate how advanced MFA is transitioning from pilot initiatives to mass-market infrastructure.

India’s policy direction beyond 2025 clearly indicates that cyber risk will remain a structural challenge, reinforcing sustained demand for multifactor authentication across sectors. For example, the cybercrime control roadmap for 2026 includes training over 2,500 law enforcement officers on advanced forensic technologies, signaling recognition that cyber threats will grow in sophistication.

In parallel, India’s National Cyber Security Coordinator and CERT-In are institutionalizing national coordination platforms such as the National Cyber Coordination Centre and malware analysis networks to enable proactive threat detection and response.

India’s MFA market is being shaped by a dual force: escalating cybercrime and the systemic shift from OTPs to biometric and device-bound authentication. As digital adoption deepens and threats intensify, MFA will become foundational to India’s digital economy, driving sustained market growth through the end of the decade.

India Multifactor Authentication Market Recent Developments:

- September 2025: The Reserve Bank of India has issued new directions mandating two-factor authentication for all digital payment transactions from April 1, 2026. The framework requires at least one transaction-specific factor. It broadens accepted methods to include biometrics, device credentials, tokens, and risk-based controls, significantly elevating security benchmarks across India’s MFA ecosystem.

- June 2025: India’s Computer Emergency Response Team (CERT-In has issued a cybersecurity alert after a reported leak of about 16 billion user credentials, including passwords and authentication tokens. To mitigate risks of account compromise and phishing, the agency strongly recommended that individuals and organizations update passwords immediately and enable multi-factor authentication (MFA) across services. This advisory highlights the growing emphasis on MFA in strengthening digital security nationwide.

India Multifactor Authentication Market Scope:

| Category | Segments |

|---|---|

| By Authentication Type | Password-Based, Password-Less |

| By Authentication Model | Two-Factor Authentication, Three-Factor Authentication, Four-Factor Authentication, Five-Factor Authentication |

| By Application | Hardware OTP Token Authentication, Smart Card Authentication, Phone-Based Authentication |

| By Component | Software, Hardware, Services, (Managed Services, Professional Services |

| By Deployment Mode | On-Premises,Cloud-Based,Hybrid |

| By Enterprise Size | Large Enterprises, Small & Medium Enterprises (SMEs) |

| By End User | Banking, Financial Services & Insurance (BFSI), Government, Military and Defense, Healthcare & Pharmaceutical, IT & Telecommunications, |

India Multifactor Authentication Market Drivers:

Escalating Case of Cybercrimes & Fraud

India’s accelerating digitalisation across banking, payments, commerce, and public services has been accompanied by a sharp rise in cybercrime, positioning security as a structural priority for the digital economy.

Government data indicates that financial fraud losses surged to USD 2.78 billion in 2024, representing a 206% year-on-year increase. More than 3.6 million financial fraud incidents were registered through the National Cyber Crime Reporting Portal and the Citizen Financial Cyber Fraud Reporting and Management System (CFCFRMS), illustrating the systemic exposure of digital platforms to malicious activity.

The threat profile is also becoming more severe. High-value cyber fraud cases, defined as incidents with an approximate USD 1,200, rose sharply from 6,699 in 2023 to 29,082 in 2024, resulting in around USD 20.3 million in financial losses. This shift toward higher-value, targeted attacks exposes the structural limitations of single-factor and OTP-based authentication, particularly against phishing, SIM-swap fraud, and identity compromise.

Cybercrime is no longer confined to isolated urban centers. In 2024, India recorded over 2.25 million cybercrime complaints, up from 450,000. For example, Maharashtra led with approximately 303,000 cases, followed by Uttar Pradesh (301,000) and Karnataka (169,000). Gujarat, Delhi, Telangana, Tamil Nadu, Rajasthan, and Haryana each exceeded 100,000 incidents, underscoring the nationwide scale of digital risk.

The magnitude, value, and geographic spread of cybercrime are fundamentally reshaping India’s security priorities. As digital transactions proliferate, the imperative to prevent identity theft and financial fraud will accelerate enterprise and consumer adoption of robust multifactor authentication, directly catalyzing market expansion.

India Multifactor Authentication Market Trends:

Shift Towards Advanced Multifactor Authentication (MFA) Framework

India’s digital ecosystem is undergoing a structural shift away from SMS-based one-time passwords (OTPs) toward advanced multifactor authentication (MFA) frameworks that incorporate biometrics, device-bound credentials, passphrases, and risk-based verification.

This transition is being driven by regulatory reform and by the operational weaknesses of OTPs, which remain highly vulnerable to phishing, malware, and SIM-swap attacks. As transaction volumes scale across UPI, wallets, and digital commerce platforms, OTP dependency increasingly creates friction, failure rates, and security gaps.

Industry leaders are already operationalizing this transition. For example, in 2024, PayU introduced Flash Pay, enabling native device biometrics, fingerprint and facial recognition for transaction approval, eliminating reliance on SMS-OTPs. The company further partnered with Mastercard to deploy passkeys, which replace passwords and OTPs with cryptographic, device-bound credentials. This model materially reduces interception risk while improving checkout speed and success rates, demonstrating real-world adoption of advanced MFA.

At the infrastructure level, the National Payments Corporation of India (NPCI) has launched biometric authentication for UPI, integrating facial recognition through UIDAI’s FaceRD app and on-device fingerprint or face verification. These mechanisms allow users to authenticate payments without PINs or OTPs for defined thresholds, enhancing both security and user experience across mass-market digital payments.

The convergence of regulatory intent and enterprise innovation is accelerating India’s migration beyond OTPs. As biometrics and device-native credentials become embedded across payment ecosystems, advanced MFA will emerge as the default authentication layer, expanding adoption and structurally driving market growth.

India Multifactor Authentication Market Challenges:

Data Privacy & Compliance Concerns Hindering Market Growth

Data privacy and regulatory compliance present a significant challenge for the India Multifactor Authentication (MFA) market, particularly as digital identity and authentication systems scale across sectors. The Digital Personal Data Protection (DPDP) Act, 2023, enforced through rules in 2025, mandates strict consent, data retention limits, privacy impact assessments, and timely breach reporting. Large data fiduciaries face heightened due diligence obligations, increasing operational complexity and compliance costs for organizations deploying MFA across sectors.

Non-compliance with the DPDP Act can attract substantial penalties, with fines of up to USD 30 million, creating a heavy compliance burden for enterprises deploying MFA solutions across digital payments, healthcare, e-commerce, and government services. Adhering to expanded consent management, retention limits, and breach notification requirements adds operational complexity to MFA adoption, particularly for organizations integrating cross-platform authentication infrastructure.

The evolving regulatory environment demands significant investment in legal, technical, and compliance resources. As privacy standards tighten and enforcement mechanisms mature, MFA providers and adopters must align with nuanced requirements while balancing user experience and security.

Without clear, streamlined compliance guidance and support mechanisms, data privacy and regulatory burdens may slow MFA deployment, constrain innovation, and moderate overall market growth.

India Multifactor Authentication Market (2026-32) Segmentation Analysis:

The India Multifactor Authentication Market Report and Forecast 2026-2032 offers a detailed analysis of the market based on the following segments:

Based on Component:

- Software

- Hardware

- Services

- Managed Services

- Professional Services

The software segment holds the top spot in the India Multifactor Authentication Market, with a market share of around 42%. This segment is maintaining its leadership as enterprises’ growing reliance on scalable, cloud-native, and application-integrated security architectures.

Software-based MFA solutions encompassing biometric engines, mobile authenticators, adaptive risk scoring, and identity orchestration platforms enable rapid deployment across high-volume digital environments without the capital intensity associated with physical hardware.

India’s accelerated digitization across banking, payments, e-commerce, healthcare, and e-governance has created millions of daily authentication events, best addressed through flexible software layers embedded directly into mobile apps, web portals, and APIs. These platforms support frictionless user journeys while meeting regulatory-grade security standards, a critical requirement in consumer-facing ecosystems.

The segment’s dominance is further reinforced by SaaS delivery models, which minimize upfront investment, enable continuous security updates, and allow organizations to respond dynamically to emerging fraud vectors. As regulatory scrutiny intensifies and transaction volumes expand, enterprises increasingly prioritize software-led MFA for its agility, scalability, and cost-efficient ability to protect large, distributed user bases in real time.

Based on End User:

- Banking, Financial Services & Insurance (BFSI)

- Government

- Military and Defense

- Healthcare & Pharmaceutical

- IT & Telecommunications

- Commercial Security

- Energy & Utilities

- Others

The Banking, Financial Services & Insurance (BFSI) category leads the India Multifactor Authentication Industry, accounting for 48% of market share, and continues to lead due to the sector’s structural exposure to digital fraud and regulatory scrutiny.

India’s rapid shift toward real-time payments, mobile banking, and digital lending has expanded the attack surface for cybercriminals, making strong identity verification mission-critical. Banks, fintech firms, and insurers handle high-value, high-frequency transactions, where even minor breaches translate into significant financial and reputational losses.

Regulatory frameworks from the Reserve Bank of India mandate robust customer authentication for digital payments, remote account access, and onboarding processes, compelling institutions to deploy layered security models. Beyond OTPs, BFSI players are increasingly integrating biometrics, device binding, behavioral analytics, and risk-based authentication to reduce fraud and transaction failures.

Moreover, financial institutions serve as early adopters of security innovation, supported by larger IT budgets and in-house cybersecurity teams. Continuous innovation in digital wallets, UPI, neo-banking, and embedded finance further entrenches MFA as a core infrastructure layer. This convergence of regulatory pressure, fraud intensity, and digital scale cements BFSI’s leadership in MFA adoption.

Gain a Competitive Edge with Our India Multifactor Authentication Market Report

- India Multifactor Authentication Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- India Multifactor Authentication Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- India Multifactor Authentication Market Policies, Regulations, and Product Standards

- India Multifactor Authentication Market Trends & Developments

- India Multifactor Authentication Market Dynamics

- Growth Drivers

- Challenges

- India Multifactor Authentication Market Hotspot & Opportunities

- India Multifactor Authentication Market Outlook, 2022-2032

- Market Size & Outlook

- By Revenues (USD Million)

- Market Share & Outlook

- By Authentication Type – Market Size & Forecast 2022-2032, USD Million

- Password-Based

- Password-Less

- By Authentication Model – Market Size & Forecast 2022-2032, USD Million

- Two-Factor Authentication

- Three-Factor Authentication

- Four-Factor Authentication

- Five-Factor Authentication

- By Application– Market Size & Forecast 2022-2032, USD Million

- Hardware OTP Token Authentication

- Smart Card Authentication

- Phone-Based Authentication

- By Component – Market Size & Forecast 2022-2032, USD Million

- Software

- Hardware

- Services

- Managed Services

- Professional Services

- By Deployment Mode – Market Size & Forecast 2022-2032, USD Million

- On-Premises

- Cloud-Based

- Hybrid

- By Enterprise Size – Market Size & Forecast 2022-2032, USD Million

- Large Enterprises

- Small & Medium Enterprises (SMEs)

- By End User – Market Size & Forecast 2022-2032, USD Million

- Banking, Financial Services & Insurance (BFSI)

- Government

- Military and Defense

- Healthcare & Pharmaceutical

- IT & Telecommunications

- Commercial Security

- Energy & Utilities

- Others

- By Region

- North India

- South India

- West India

- East India

- By Company

- Company Revenue Shares

- Competitor Characteristics

- By Authentication Type – Market Size & Forecast 2022-2032, USD Million

- Market Size & Outlook

- India Password-Based Multifactor Authentication Market Outlook, 2022-2032

- Market Size & Outlook

- By Revenues (USD Million)

- Market Share & Outlook

- By Authentication Model – Market Size & Forecast 2022-2032, USD Million

- By Application– Market Size & Forecast 2022-2032, USD Million

- By Component – Market Size & Forecast 2022-2032, USD Million

- By Deployment Mode – Market Size & Forecast 2022-2032, USD Million

- By Enterprise Size – Market Size & Forecast 2022-2032, USD Million

- By End User – Market Size & Forecast 2022-2032, USD Million

- By Region

- Market Size & Outlook

- India Password- Less Multifactor Authentication Market Outlook, 2022-2032

- Market Size & Outlook

- By Revenues (USD Million)

- Market Share & Outlook

- By Authentication Model – Market Size & Forecast 2022-2032, USD Million

- By Application– Market Size & Forecast 2022-2032, USD Million

- By Component – Market Size & Forecast 2022-2032, USD Million

- By Deployment Mode – Market Size & Forecast 2022-2032, USD Million

- By Enterprise Size – Market Size & Forecast 2022-2032, USD Million

- By End User – Market Size & Forecast 2022-2032, USD Million

- By Region

- Market Size & Outlook

- India Multifactor Authentication Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Google LLC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- IBM Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Microsoft Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Ping Identity Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Okta, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Auth0, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Duo Security, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- OneSpan Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- RSA Security LLC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Micro Focus International plc

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Google LLC

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making