Mexico Tire Market Research Report: Forecast (2026-2032)

By Vehicle Type (Passenger Car, Light Commercial Vehicle (LCV), Medium and Heavy Commercial Vehicle (MHCV), Two-Wheeler, Three-Wheeler, Off the Road (OTR)), By Demand Type (OEMs, R...eplacement), By Price Category (Budget, Economy, Premium), By Tire Type (Radial, Bias), By Sales Channel (Direct Sales, Multi Brand Stores, Exclusive Outlets, Online), By Tire Size (Tire Size 1, Tire Size 2, Tire Size 3, Tire Size 4, Tire Size 5), and others Read more

- Tire

- Feb 2026

- Pages 131

- Report Format: PDF, Excel, PPT

Mexico Tire Market

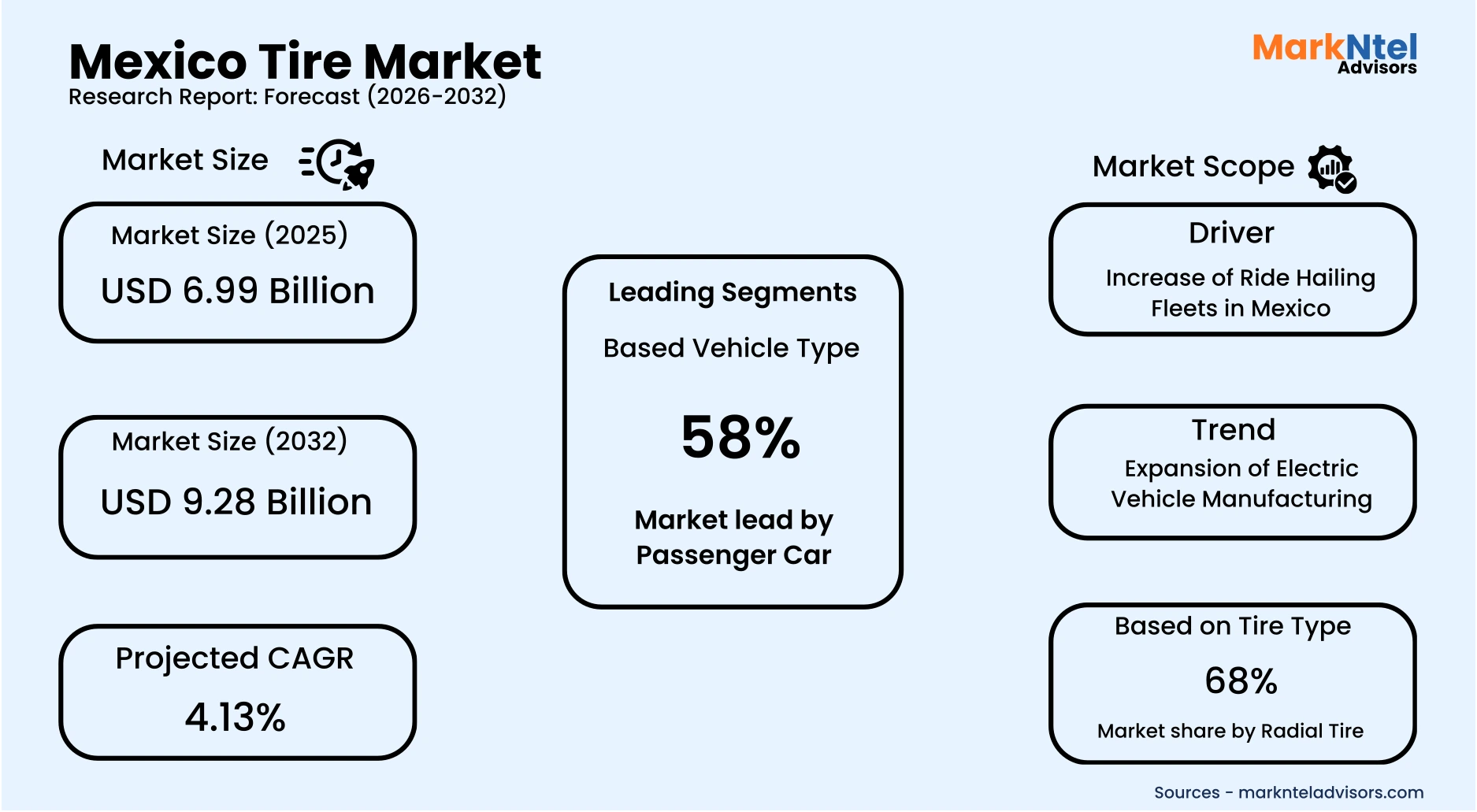

Projected 4.13% CAGR from 2026 to 2032

Study Period

2026-2032

Market Size (2025)

USD 6.99 Billion

Market Size (2032)

USD 9.28 Billion

Base Year

2025

Projected CAGR

4.13%

Leading Segments

Based Vehicle Type: Passenger Car

Mexico Tire Market Report Key Takeaways:

- Market size was valued at approximately USD 6.99 billion in 2025 and is projected to reach USD 9.28 billion by 2032. The estimated CAGR from 2026 to 2032 is around 4.13%, indicating strong growth.

- In 2025, passenger cars led the Mexico tire market with 58% shares due to the country’s large and growing vehicle parc, high reliance on private commuting, and increasing urban mobility needs.

- In 2025, radial tires captured 68% of the entire Mexico tire market owing to their better durability, fuel efficiency, and road grip compared to bias tires.

- Leading tire companies in the Mexico market are Bridgestone Corporation, Goodyear tyre and Rubber Company, Michelin, Continental Ag, Hankook Tire and Technology, Yokohama Rubber Co. Ltd, Cooper Tire Rubber Company, Pirelli Tyre S.p.A, Sumitomo Rubber Industries, Toyo tyre Corporation, Maxxis International, and others.

Market Insights & Analysis: Mexico Tire Market (2026-32):

The Mexico Tire Market size was valued at around USD 6.99 billion in 2025 and is projected to reach USD 9.28 billion by 2032. Along with this, the market is estimated to grow at a CAGR of around 4.13% during the forecast period, i.e., 2026-32.

Over the past decade, Mexico has experienced generous economic growth due to factors such as strategic trade agreements, significant foreign investment, etc. With the Mexican economy seeing potential growth, the population of the middle class with higher disposable incomes is also growing, enabling more individuals and organizations to purchase both cars and commercial vehicles. In line with this, the vehicle fleet in the country has witnessed considerable growth, which subsequently is catalyzing the demand for tires.

During the historical period, Mexico experienced a remarkable surge in the number of storehouses, due to factors such as e-commerce growth, rise in manufacturing and export hub, proximity to the US market, trade agreements, etc. The growth of e-commerce and shifting consumer preferences have created a pressing need for distribution and logistics centers to meet the demands of online shoppers.

Similarly, Mexico's strategic geographical location, adjacent to the US & near other North American nations, provides better market access to the companies. As a result, several market players are capitalizing on this opportunity and establishing their units in the country. Additionally, this is facilitating the cross-border trade. Hence, the increase in several warehouses is leading to substantial use of different types of commercial vehicles, such as small delivery vans to large trucks, forklifts, and cranes. This increased usage of commercial vehicles for logistic purposes is subsequently enhancing the demand for tires in the country.

Furthermore, the demand for industrial warehouses is surging in cities like Reynosa, Ciudad Juarez, and Tijuana, which are strategically located alongside the US-Mexico border. This is attributed to companies, that are planning to enhance their supply chains by moving manufacturing closer to their target markets. This trend is prompting higher investment in the establishment of new warehouses.

As these extensive storage spaces surge, the usage of vehicles such as forklifts, loaders, and other material handling equipment would also surge, which subsequently would enhance the demand for tires, thereby enhancing the overall market size of the Mexico Tire market.

Moreover, the government is significantly allocating funds for infrastructural development to enhance the economic growth of the country. Owing to this, the Mexican government is supporting this by allocating significant portions of the budget towards infrastructure projects. For instance:

In 2024, Mexico’s Ministry of Infrastructure, announced the delivery of more than 500 infrastructure projects. These projects, totalling an investment of over USD12 billion, is equivalent to approximately 1.3% of the national GDP.

The surge in construction activity, is driving the usage of off-the-road (OTR) vehicles and medium and heavy commercial vehicles (MHCVs) for material transport, site preparation, and the movement of heavy equipment essential for large-scale projects like roads and bridges. As number of OTR vehicles and medium & heavy commercial vehicles (MHCVs) surges the demand for tire designed for these vehicles would also increase during the forecast period.

Mexico Tire Industry Recent Development:

- June 2025: Aztema, a joint venture owned 51% by China’s Sailun and 49% by Mexico’s Tire Direct, commenced operations at its new tire manufacturing facility in Irapuato, Guanajuato. Backed by a USD 400 million investment, the plant is designed to produce 6 million tires annually, serving both the domestic market and export markets in the Americas, as reported by the National Chamber of the Rubber Industry (CNIH).

- August 2024: ZC Rubber officially commenced construction on its third overseas manufacturing facility in Saltillo, Mexico. This development reflects the company’s strategic push to expand its global footprint and better meet the rising tire demand in North America and Latin America.

- April 2024: Yokohama Rubber held a groundbreaking ceremony for its new tire manufacturing plant in Saltillo, Mexico, with a planned investment of USD 380 million. The plant is set to produce 5 million passenger car and light truck tires annually, with production targeted to start in early 2027, catering to the growing North American market.

Mexico Tire Market Driver:

Increase of Ride Hailing Fleets in Mexico

During the past few decades, Mexico has experienced substantial population growth in urban areas, which has intensified daily mobility requirements across major cities. In fact, over 81.8% of Mexico’s population lived in urban areas in 2024, reflecting the country’s rising urban concentration. This rapid urban growth has placed strong pressure on Mexico’s public transportation systems, which have struggled to expand at the same pace. As a result, a large share of urban residents has increasingly shifted toward ride-hailing services, since they offer flexible, on-demand, and time-efficient mobility solutions.

Furthermore, the increasing adoption of ride-hailing is strongly supported by Mexico’s improving digital ecosystem. For example, mobile connections in Mexico reached 97.3% of the total population in January 2024, enabling easier app downloads, digital payments, and seamless ride-booking. With improved accessibility, more individuals are utilizing ride-hailing applications for both intracity and intercity travel, boosting overall vehicle utilization and travel frequency. This rising dependency on taxi and ride-hailing services is compelling major mobility platforms and fleet operators to expand their ride-hailing vehicle fleets, which is directly uplifting tire demand due to higher mileage, faster tread wear, and shorter replacement cycles.

Moreover, Mexico’s government has been strengthening its focus on the tourism sector, resulting in rising investments in tourism infrastructure that support stronger visitor movement and travel convenience. Consequently, tourist inflows continue to climb, Mexico welcomed approximately 45.0 million international tourists in 2024, up from 41.9 million in 2023, indicating sustained growth in inbound tourism. This expanding tourism base increases demand for local transportation, particularly ride-hailing services in key tourist hubs and cities. Therefore, as ride-hailing usage and fleets expand in response to both urban mobility gaps and growing tourism activity, the demand for tires is expected to rise notably during the forecast period.

Mexico Tire Market Opportunity:

Plan to Enhance Industrialization in Southern Mexico to Provide New Opportunities for OTR Tire Companies

Southern Mexico has historically remained less industrialized than the northern regions, leading to lower infrastructure density and weaker manufacturing penetration. However, this gap is now being addressed through large-scale government-led regional development initiatives aimed at strengthening industrial activity, trade movement, and employment generation in the South, creating a strong opportunity for Off-the-Road (OTR) and commercial tire manufacturers.

A key pillar of this transformation is Mexico’s Interoceanic Corridor of the Isthmus of Tehuantepec (CIIT), which gained significant momentum after 2024. The corridor is designed to connect the Pacific port of Salina Cruz (Oaxaca) with the Gulf hub of Coatzacoalcos (Veracruz) through modern rail and logistics infrastructure, positioning the region as a strategic trade & industrial belt.

Under this initiative, the government plans the development of around 10 industrial parks/development hubs (PODEBIS) along the corridor. These parks are being promoted as manufacturing and logistics nodes capable of attracting domestic and international companies due to their location between two coasts and improved multimodal connectivity.

To accelerate adoption, Mexico is offering business-friendly incentives such as VAT relief/credits and other tax benefits for firms operating inside these development hubs, improving the feasibility of setting up production units and warehouses in the region. Additionally, recent tenders and industrial park development activity indicate ongoing implementation, rather than only policy-level planning.

As this industrialization strengthens, new employment opportunities and urban settlement growth will emerge in corridor-linked states, increasing the requirement for personal vehicles for local commuting. In parallel, the corridor will drive demand for commercial vehicles used in freight movement, construction, and industrial supply chains. This will expand the in-use fleet and increase vehicle operating intensity, directly pushing up demand for replacement tires, especially across OTR tires (construction & industrial projects) and truck/bus tires (logistics operations), thereby creating a high-potential growth opportunity for tire manufacturers during the forecast period.

Mexico Tire Market Challenge:

Growing Penetration of Tire Retreading Plants

The rising penetration of tire retreading plants is emerging as a key challenge for the Mexico tire market, particularly in the OTR and heavy commercial vehicle (truck & bus) categories. Over the past few years, fleet operators across Mexico, especially in mining, construction, logistics, and last-mile delivery, have increasingly adopted retreaded tires as a cost-effective alternative to new tires. Retreading involves refurbishing used casings by replacing worn-out tread with a new one, enabling buyers to access tires at significantly lower costs while maintaining acceptable performance levels for heavy-duty operations.

This preference has continued to strengthen after 2024, supported by expanding commercial fleet activity and the growing focus of global tire brands on retreading solutions. For instance, Bridgestone (Bandag) has been actively promoting advanced retread offerings such as its BDR-AS3 retread, designed for high-mileage package and delivery fleets, reflecting strong industry innovation and push toward retreads in commercial mobility.

In addition, Mexico’s trade activity also signals increasing circulation of retread-related products, Mexico’s total trade exchange for retread/used rubber pneumatic tires & related products reached around USD 161 million in 2024, indicating sustained supply and growing market relevance.

As companies in mining and construction are highly cost-sensitive with strict operational cost controls, they tend to prefer retreaded options, reducing replacement demand for brand-new tires. Therefore, the expanding adoption of retreaded tires is expected to limit fresh tire sales, creating pricing pressure and slowing down the overall growth potential of the Mexico tire market during the forecast period.

Mexico Tire Market Trend:

Expansion of Electric Vehicle Manufacturing

In Mexico, the government has been showcasing its increased inclination towards a green economy, and in line with this, the government is providing tax reductions and other financial benefits for electric vehicle manufacturers. Moreover, there is growing demand for electric vehicles in the North American region, due to supportive regulatory measures and environmental concerns. Owing to this, many EV manufacturers are establishing production facilities in Mexico to serve both local and international markets. For instance:

In 2024, Chinese electric vehicle manufacturer, BYD Co Ltd announced to set up a new electric vehicle (EV) factory in Mexico.

As EV manufacturers are growing in the country, the demand for tires optimized for specific EV models, that ensure performance and efficiency is growing. Hence, the growth of electric vehicle (EV) manufacturing plants is setting a new trend in the demand for tires.

Mexico Tire Market (2026-32): Segmentation Analysis

The Mexico Tire Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2026–2032 at the global, regional, and national levels. Based on the analysis, the market has been further classified as:

Based Vehicle Type:

- Passenger Car

- Light Commercial vehicle

- Medium & Heavy Commercial Vehicle

- Two-Wheeler

- Three-Wheeler

- Off the Road (OTR)

In the Mexico tire market, passenger cars dominated in 2025 with nearly 58% share, mainly owing to the country’s large and continuously growing vehicle parc and the strong reliance on private commuting across urban areas. With rapid urban expansion and rising daily mobility needs, passenger vehicles remain the most preferred mode of travel, especially in major cities where public transportation is often unable to fully meet demand. In addition, increasing vehicle usage for routine commuting, leisure trips, and intercity travel has resulted in higher tire wear-and-tear, accelerating replacement frequency. The widespread penetration of radial tires, improving road connectivity, and growing consumer preference for comfort and performance-oriented driving further supported passenger car tire sales. As a result, the segment continues to remain the key revenue contributor to the Mexico tire market.

Based on Tire Type:

- Radial Tire

- Bias Tire

Based on tire type, radial tires dominated the Mexico tire market in 2025 with nearly 68% share, primarily due to their superior durability, fuel efficiency, and improved road grip compared to bias tires. Radial tires offer a stronger tread structure and better heat dissipation, making them more suitable for Mexico’s varied driving conditions, including high-temperature regions and long-distance highway travel. In addition, their longer tread life and enhanced riding comfort make them cost-effective in the long run, encouraging higher adoption among both individual consumers and fleet operators. The expanding passenger car fleet and rising preference for performance-oriented tires have further boosted radial tire demand. Consequently, radial tires continue to remain the most preferred tire type in Mexico, supported by both OEM fitment trends and the strong replacement market.

Gain a Competitive Edge with Our Mexico Tire Market Report

- Mexico Tire Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Mexico Tire Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Mexico Tire Import-Export Analysis, 2022-2025

- Mexico Tire Supply Chain Analysis

- Mexico Tire Market Trends & Developments

- Mexico Tire Market Dynamics

- Drivers

- Challenges

- Mexico Tire Market Hotspot & Opportunities

- Mexico Tire Market Regulations & Policy

- Mexico Tire Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Size & Analysis

- By Vehicle Type

- Passenger Car

- Light Commercial Vehicle (LCV)

- Medium and Heavy Commercial Vehicle (MHCV)

- Two-Wheeler

- Three-Wheeler

- Off the Road (OTR)

- By Demand Type

- OEMs- Market Size & Forecast 2022-2032F, Thousand Units

- Replacement- Market Size & Forecast 2022-2032F, Thousand Units

- By Price Category

- Budget- Market Size & Forecast 2022-2032F, Thousand Units

- Economy- Market Size & Forecast 2022-2032F, Thousand Units

- Premium- Market Size & Forecast 2022-2032F, Thousand Units

- By Tire Type

- Radial- Market Size & Forecast 2022-2032F, Thousand Units

- Bias- Market Size & Forecast 2019-2030, Thousand Units

- By Sales Channel

- Direct Sales- Market Size & Forecast 2022-2032F, Thousand Units

- Multi Brand Stores - Market Size & Forecast 2022-2032F, Thousand Units

- Exclusive Outlets - Market Size & Forecast 2022-2032F, Thousand Units

- Online- Market Size & Forecast 2022-2032F, Thousand Units

- By Tire Size

- Tire Size 1 - Market Size & Forecast 2022-2032F, Thousand Units

- Tire Size 2 - Market Size & Forecast 2022-2032F, Thousand Units

- Tire Size 3 - Market Size & Forecast 2022-2032F, Thousand Units

- Tire Size 4 - Market Size & Forecast 2022-2032F, Thousand Units

- Tire Size 5 - Market Size & Forecast 2022-2032F, Thousand Units

- By Region

- North

- South

- East

- West

- Central

- By Competition

- Competition Characteristics

- Market Share Analysis

- By Vehicle Type

- Market Size & Analysis

- Mexico Passenger Car Tire Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Segmentation & Analysis

- By Type of Car- Market Size & Forecast 2022-2032F, Thousand Units

- Sedan- Market Size & Forecast 2022-2032F, Thousand Units

- SUV- Market Size & Forecast 2022-2032F, Thousand Units

- Hatchback- Market Size & Forecast 2022-2032F, Thousand Units

- By Type of Car- Market Size & Forecast 2022-2032F, Thousand Units

- By Demand Type- Market Size & Forecast 2022-2032F, Thousand Units

- By Price Category- Market Size & Forecast 2022-2032F, Thousand Units

- By Tire Type- Market Size & Forecast 2022-2032F, Thousand Units

- By Sales Channel- Market Size & Forecast 2022-2032F, Thousand Units

- By Tire Size- Market Size & Forecast 2022-2032F, Thousand Units

- Market Size & Analysis

- Mexico Light Commercial Vehicle Tire Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Segmentation & Analysis

- By Type of Vehicle- Market Size & Forecast 2022-2032F, Thousand Units

- Light Trucks- Market Size & Forecast 2022-2032F, Thousand Units

- Light Buses- Market Size & Forecast 2022-2032F, Thousand Units

- Pick-up Trucks and Vans- Market Size & Forecast 2022-2032F, Thousand Units

- By Type of Vehicle- Market Size & Forecast 2022-2032F, Thousand Units

- By Demand Type- Market Size & Forecast 2022-2032F, Thousand Units

- By Price Category- Market Size & Forecast 2022-2032F, Thousand Units

- By Tire Type- Market Size & Forecast 2022-2032F, Thousand Units

- By Sales Channel- Market Size & Forecast 2022-2032F, Thousand Units

- By Tire Size- Market Size & Forecast 2022-2032F, Thousand Units

- Market Size & Analysis

- Mexico Medium Heavy Commercial Vehicle Tire Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Segmentation & Analysis

- By Type of Vehicle- Market Size & Forecast 2022-2032F, Thousand Units

- Trucks- Market Size & Forecast 2022-2032F, Thousand Units

- Buses- Market Size & Forecast 2022-2032F, Thousand Units

- By Type of Vehicle- Market Size & Forecast 2022-2032F, Thousand Units

- By Demand Type- Market Size & Forecast 2022-2032F, Thousand Units

- By Price Category- Market Size & Forecast 2022-2032F, Thousand Units

- By Tire Type- Market Size & Forecast 2022-2032F, Thousand Units

- By Sales Channel- Market Size & Forecast 2022-2032F, Thousand Units

- By Tire Size- Market Size & Forecast 2022-2032F, Thousand Units

- Market Size & Analysis

- Mexico Two-Wheeler Tire Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Segmentation & Analysis

- By Type of Vehicle- Market Size & Forecast 2022-2032F, Thousand Units

- Scooters & Moped- Market Size & Forecast 2022-2032F, Thousand Units

- Motorcycles- Market Size & Forecast 2022-2032F, Thousand Units

- By Type of Vehicle- Market Size & Forecast 2022-2032F, Thousand Units

- By Demand Type- Market Size & Forecast 2022-2032F, Thousand Units

- By Price Category- Market Size & Forecast 2022-2032F, Thousand Units

- By Tire Type- Market Size & Forecast 2022-2032F, Thousand Units

- By Sales Channel- Market Size & Forecast 2022-2032F, Thousand Units

- By Tire Size- Market Size & Forecast 2022-2032F, Thousand Units

- Market Size & Analysis

- Mexico Three Wheeler Tire Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Segmentation & Analysis

- By Type of Vehicle- Market Size & Forecast 2022-2032F, Thousand Units

- Load Carrier- Market Size & Forecast 2022-2032F, Thousand Units

- Passenger Carrier- Market Size & Forecast 2022-2032F, Thousand Units

- By Type of Vehicle- Market Size & Forecast 2022-2032F, Thousand Units

- By Demand Type- Market Size & Forecast 2022-2032F, Thousand Units

- By Price Category- Market Size & Forecast 2022-2032F, Thousand Units

- By Tire Type- Market Size & Forecast 2022-2032F, Thousand Units

- By Sales Channel- Market Size & Forecast 2022-2032F, Thousand Units

- By Tire Size- Market Size & Forecast 2022-2032F, Thousand Units

- Market Size & Analysis

- Mexico Off the Road (OTR) Tire Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Segmentation & Analysis

- By Type of Vehicle- Market Size & Forecast 2022-2032F, Thousand Units

- Earthmoving Equipment- Market Size & Forecast 2022-2032F, Thousand Units

- Agricultural Equipment- Market Size & Forecast 2022-2032F, Thousand Units

- Material Handling Equipment-- Market Size & Forecast 2022-2032F, Thousand Units

- By Type of Vehicle- Market Size & Forecast 2022-2032F, Thousand Units

- By Demand Type- Market Size & Forecast 2022-2032F, Thousand Units

- By Price Category- Market Size & Forecast 2022-2032F, Thousand Units

- By Tire Type- Market Size & Forecast 2022-2032F, Thousand Units

- By Sales Channel- Market Size & Forecast 2022-2032F, Thousand Units

- By Tire Size- Market Size & Forecast 2022-2032F, Thousand Units

- Market Size & Analysis

- Mexico Tire Industry Key Strategic Imperatives for Growth & Success

- Competition Outlook

- Company Profiles

- Bridgestone Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Goodyear Tire and Rubber Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Michelin

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Continental AG

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Hankook Tire and Technology

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Yokohama Rubber Co. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Cooper Tire Rubber Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Pirelli Tyre S.p.A

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Sumitomo Rubber Industries

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Toyo Tire Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Maxxis International

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Bridgestone Corporation

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making