Middle East & North Africa Timber Market Research Report: Forecast (2023-2028)

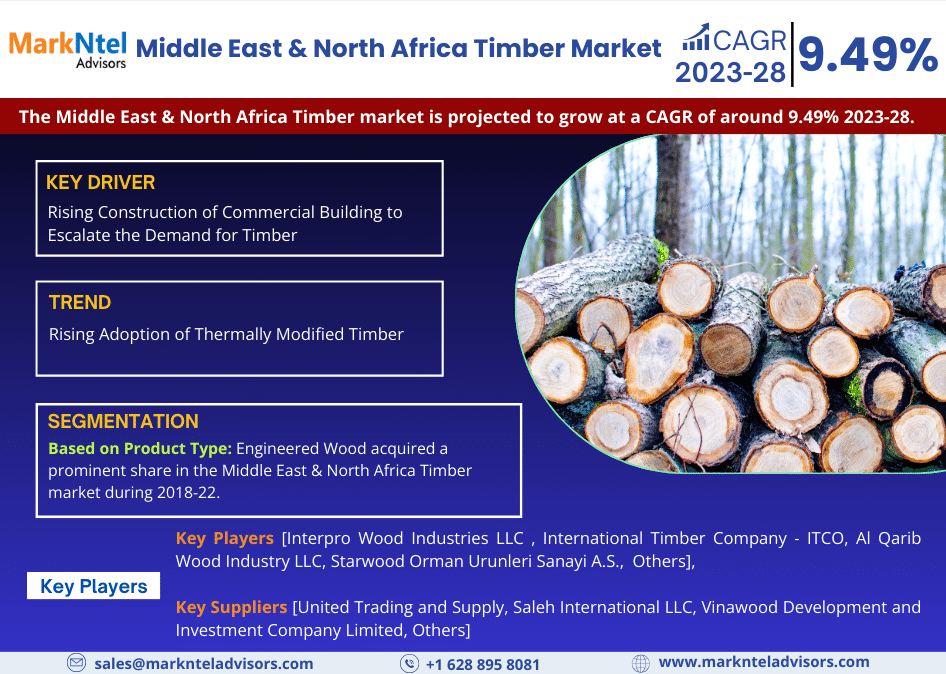

By Product Type (Softwoods [Fir, Pine, Cedar, Redwood lumber, Hemlock wood, Spruce], Hardwoods [Bamboo, Oak, Cherry, Walnut, Birch, Mahogany, Others], Engineered Wood [Chipboard, P...lywood, Laminated veneer, Cross-laminated timber, Others]), By Application (Cable Drums, Window Frames, Furniture, Pallets & Boxes, Others), By Country (The UAE, Saudi Arabia, Qatar, Oman, Kuwait, Iran, Iraq, Yemen, Jordan, Israel, Syria, Lebanon, Egypt, Rest of Middle East & Africa), By Company (Key Players [Interpro Wood Industries LLC , International Timber Company - ITCO, Al Qarib Wood Industry LLC, Starwood Orman Urunleri Sanayi A.S., ARA Timber, Danzer, Others], Key Suppliers [United Trading and Supply, Saleh International LLC, Vinawood Development and Investment Company Limited, Sunrise Plex, UNI4 Marketing AB, Others]) Read more

- FMCG

- Jun 2023

- Pages 168

- Report Format: PDF, Excel, PPT

Market Insights & Analysis: Middle East & North Africa Timber Market (2023-28)

The Middle East & North Africa Timber market size is valued at USD 2.87 billion in 2024 & is projected to grow at a CAGR of around 9.49% during the forecast period, i.e., 2023-28. Timber is a wood used in the construction of buildings in the form of beams & planks or boards. It is also known as lumber in some countries & is widely used for framing & finishing floors, window frames, home furniture, cable drums, pallets, boxes, etc., as well as can be used as raw material, finished product, insulation, etc. With several initiatives taken up by the government of countries, such as Saudi Arabia, the UAE, Kuwait, and Egypt, among others, to strengthen their residential, commercial, and infrastructural capabilities, the demand for timber modestly escalated in recent years.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 9.49% |

| Country Covered | The UAE, Saudi Arabia, Qatar, Oman, Kuwait, Iran, Iraq, Yemen, Jordan, Israel, Syria, Lebanon, Egypt, Rest of Middle East & Africa |

| Key Companies Profiled |

Key Players [Interpro Wood Industries LLC , International Timber Company - ITCO, Al Qarib Wood Industry LLC, Starwood Orman Urunleri Sanayi A.S., ARA Timber, Danzer, Others], Key Suppliers [United Trading and Supply, Saleh International LLC, Vinawood Development and Investment Company Limited, Sunrise Plex, UNI4 Marketing AB, Others] |

| Market Value (2024) | USD 2.87 Billion |

In addition, the large-scale residential projects in the region have proved to be a major demand generator for timber as it helps reduce the pressure on the housing structure considerably due to its lightweight. Consequently, the rising construction of new residential units in the region would heighten the demand for timber in the upcoming years. Furthermore, the growing inclination of the Middle East & North African economies to strengthen the domestic tourism industry by promoting the development of commercial buildings such as hotels, restaurants, and other leisure & entertainment spaces is forecasted to soar the construction activities in the region. Hence, the extensive use of timber in the construction & furnishing of the buildings is predicted to provide a lucrative growth opportunity to the MENA timber suppliers during 2023-28.

Middle East & North Africa Timber Market Key Driver:

Rising Construction of Commercial Building to Escalate the Demand for Timber - Due to rising commercial building construction activities such as 5- & 7-star hotels, resorts, etc., in the countries like the UAE, Saudi Arabia, Oman, Egypt, and others, timber has been in considerable demand since the past period. The vital usage of it in building construction, such as windows, doors, etc., has magnified its requirement in the Middle East & North Africa region. Furthermore, the accelerating tourism in the regional countries has led to the construction of commercial buildings like lavish hotels, retail malls, resorts, etc. Besides, the governments of the countries have been extensively involved in boosting tourism by establishing recreational hubs, luxurious malls, and many more, as well as also by preserving & maintaining historical monuments & cultural heritage sites by renovating them.

Thus, the growing commercial building construction activities in the region are anticipated to drive the demand for timber in the region during the forecast period. Along with this, the benefits, including enhancement in seismic building performance of timber-concrete hybrid tall buildings, would also positively impact the demand for timber in the region, thus influencing the Middle East & North Africa Timber market growth.

Middle East & North Africa Timber Market Possible Restraint:

Presence of Timber Substitutes, Making Market Competitive - Historically, the demand for timber was significant in the region due to its crucial use in building construction activities, such as the fact it is naturally anti-corrosive, unlike steel. However, the presence of other substitutes, such as wood-look tiles, luxury vinyl planks, ceramic tiles, etc., have been posing a challenge to the market. The rising inclination of customers towards aesthetically pleasing interiors is attracting them to use other types of flooring structures rather than timber flooring, such as waterproof wood effect tiles, laminated flooring, cork flooring, etc. In addition, these types of floorings have also been considered as cost-effective than timber flooring structures. Therefore, the presence of alternates would create a barrier to market growth in the forthcoming years, or rather, it would make the market more competitive.

Middle East & North Africa Timber Market Key Trend:

Rising Adoption of Thermally Modified Timber - The use of thermally modified timber, ThermoWood, has increased considerably across the Middle East & North Africa during the historical years. Lower thermal conductivity, better biological durability, enhanced dimensional stability, and reduced shrinkage due to moisture are some factors contributing to the rising adoption of thermally modified timber. Furthermore, the process of thermal modification is suitable for both hardwood & softwoods & is optimized for the wood species that are majorly used as the raw materials. Various construction projects in the Middle East & North African countries are incorporating these thermally modified woods for better consumer experience & durability, thus making it a trend in the Middle East & North Africa Timber market.

Middle East & North Africa Timber Market (2023-28): Segmentation Analysis

The Middle East & North Africa Timber Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2023–2028 at the , regional, and national levels. Based on the Product Type, and Application the market has been further classified as:

Based on Product Type:

- Softwoods

- Fir

- Pine

- Cedar

- Redwood lumber

- Hemlock wood

- Spruce

- Hardwoods

- Bamboo

- Oak

- Cherry

- Walnut

- Birch

- Mahogany

- Others (Ashwood, Balsa Wood, etc.)

- Engineered Wood

- Chipboard

- Plywood

- Laminated Veneer

- Cross-laminated Timber

- Others (Medium-density Fiberboard, Oriented strand board, etc.)

Here, Engineered Wood acquired a prominent share in the Middle East & North Africa Timber market during 2018-22. Of all the engineered woods, plywood & oriented strand board (OSD) gained higher popularity in the market owing to the number of benefits, including greater strength, durability, flexibility, and cost-effectiveness. The weather conditions in the Middle East are generally hot & humid throughout the year, so raw hardwood & softwood cannot be used as interior & exterior furnishing materials in houses & commercial spaces since these woods react with moisture, causing them to swell & shrink. Besides, the demand for plywood has significantly increased in Middle Eastern countries, especially in the UAE, Egypt, Saudi Arabia, and Qatar, among others, owing to its effective resistance to moisture, hence supporting the Middle East & North Africa Timber market growth.

Based on Application:

- Cable Drums

- Window Frames

- Furniture

- Pallets & Boxes

- Others (Skids, Crane Mats, etc.)

Furniture & Window Frames acquired a significant share in the Middle East & North Africa Timber market during the historical period. The presence of prominent furniture manufacturing firms in the region and the growing wood carving industry contributed to the revenue growth of MENA timber suppliers. Further, the rise in purchasing power of the residents & the increasingly wide range of affordable furniture products made of hardwood, softwoods, and engineered woods catering to the customized demand of residents opened up enormous growth opportunities for the timber suppliers in MENA. Moreover, the increase in the expatriate population & boost in the construction of houses to provide affordable housing & utility needs to the residents across the UAE, Saudi Arabia, Jordan, etc., have substantially elevated the demand for timber for scaffolding, furnishing, etc.

Middle East & North Africa Timber Market Regional Projection

Geographically, the Middle East & North Africa Timber market expands across:

- The UAE

- Saudi Arabia

- Qatar

- Oman

- Kuwait

- Iran

- Iraq

- Yemen

- Jordan

- Israel

- Syria

- Lebanon

- Egypt

- Rest of the Middle East & Africa

Of all the countries across the region, the UAE experienced significant growth in the Middle East & North Africa timber market during historical years, owing to rapid urbanization and infrastructural development in the country. According to the Global Media Insights (Dubai-based digital interactive agency) & the United Nations, about 87.50% of the country’s population was urban, and is anticipated to surge by over 90% by 2050. This eventually impacted the growing number of residential & industrial projects in the country. Thus, with the growing construction activities, there was a rising market demand for timber- & wood-based furniture in public, private, single-story, and multi-story buildings to meet various needs. In addition, the rapid development in the hospitality sector also fueled the demand for timber & related materials to serve the construction & furniture purposes of hotels & resorts.

Gain a Competitive Edge with Our Middle East & North Africa Timber Market Report

- Middle East & North Africa Timber Market report provides a detailed and thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics and make informed decisions.

- This report also highlights current market trends and future projections, allowing businesses to identify emerging opportunities and potential challenges. By understanding market forecasts, companies can align their strategies and stay ahead of the competition.

- Middle East & North Africa Timber Market report aids in assessing and mitigating risks associated with entering or operating in the market.

- The report would help in understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks and optimize their operations.

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Assumptions

- Market Segmentation

- Executive Summary

- Impact of COVID-19 on Middle East & North Africa Timber Market

- The Middle East & North Africa Timber Market Trends & Insights

- The Middle East & North Africa Timber Market Dynamics

- Growth Drivers

- Challenges

- The Middle East & North Africa Timber Market Policies, Regulations, Product Standards, Custom Duty

- The Middle East & North Africa Timber Key Raw Materials Supply and Demand Analysis

- The Middle East & North Africa Timber Key Raw Materials Pricing Analysis

- The Middle East & North Africa Timber Market Consumer Behavior Analysis

- The Middle East & North Africa Timber Market Hotspot & Opportunities

- The Middle East & North Africa Timber Market Manufacturing Cost Structure Analysis

- Key Raw Materials Cost Analysis

- Labor Cost Analysis

- Energy Costs Analysis

- R&D Analysis

- The Middle East & North Africa Timber Market Import, Export & Internal Production

- The Middle East & North Africa Timber Consumption Statistics, By Country

- Consumption in Thousand Cubic Meter

- The UAE

- Saudi Arabia

- Qatar

- Oman

- Kuwait

- Iran

- Iraq

- Yemen

- Jordan

- Israel

- Syria

- Lebanon

- Egypt

- Consumption in Thousand Cubic Meter

- The Middle East & North Africa Timber Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Cubic Meter)

- Market Share & Analysis

- By Product Type

- Softwoods

- Fir

- Pine

- Cedar

- Redwood lumber

- Hemlock wood

- Spruce

- Hardwoods

- Bamboo

- Oak

- Cherry

- Walnut

- Birch

- Mahogany

- Others (Ashwood, Balsa Wood, etc.)

- Engineered Wood

- Chipboard

- Plywood

- Laminated veneer

- Cross-laminated timber

- Others (Medium-density fibreboard, Oriented strand board, etc.)

- Softwoods

- By Application Type

- Cable Drums

- Window Frames

- Furniture

- Pallets & Boxes

- Others (Skids, Crane Mats, etc.)

- By Country

- The UAE

- Saudi Arabia

- Qatar

- Oman

- Kuwait

- Iran

- Iraq

- Yemen

- Jordan

- Israel

- Syria

- Lebanon

- Egypt

- Rest of Middle East & Africa

- By Company

- Competitor Characteristics

- Revenue Shares

- By Product Type

- The UAE Timber Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Cubic Meter)

- Market Share & Analysis

- By Product Type

- By Application Type

- Market Size & Analysis

- Saudi Arabia Timber Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Cubic Meter)

- Market Share & Analysis

- By Product Type

- By Application Type

- Market Size & Analysis

- Qatar Timber Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Cubic Meter)

- Market Share & Analysis

- By Product Type

- By Application Type

- Market Size & Analysis

- Oman Timber Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Cubic Meter)

- Market Share & Analysis

- By Product Type

- By Application Type

- Market Size & Analysis

- Kuwait Timber Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Cubic Meter)

- Market Share & Analysis

- By Product Type

- By Application Type

- Market Size & Analysis

- Iran Timber Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Cubic Meter)

- Market Share & Analysis

- By Product Type

- By Application Type

- Market Size & Analysis

- Iraq Timber Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Cubic Meter)

- Market Share & Analysis

- By Product Type

- By Application Type

- Market Size & Analysis

- Yemen Timber Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Cubic Meter)

- Market Share & Analysis

- By Product Type

- By Application Type

- Market Size & Analysis

- Jordan Timber Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Quantity Sold (Thousand Cubic Meter)

- Market Share & Analysis

- By Product Type

- By Application Type

- Market Size & Analysis

- Israel Timber Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Quantity Sold (Thousand Cubic Meter)

- Market Share & Analysis

- By Product Type

- By Application Type

- Market Size & Analysis

- Syria Timber Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Quantity Sold (Thousand Cubic Meter)

- Market Share & Analysis

- By Product Type

- By Application Type

- Market Size & Analysis

- Lebanon Timber Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Quantity Sold (Thousand Cubic Meter)

- Market Share & Analysis

- By Product Type

- By Application Type

- Market Size & Analysis

- Egypt Timber Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Quantity Sold (Thousand Cubic Meter)

- Market Share & Analysis

- By Product Type

- By Application Type

- Market Size & Analysis

- Market Size & Analysis

- Competition Outlook

- Competition Matrix

- Product Portfolio

- Target Markets

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles of top companies (Business Description, Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Key Players

- Interpro Wood Industries LLC

- International Timber Company - ITCO

- Al Qarib Wood Industry LLC

- Starwood Orman Urunleri Sanayi A.S.

- ARA Timber

- Danzer

- Others

- Key Suppliers

- United Trading and Supply

- Saleh International LLC

- Vinawood Development and Investment Company Limited

- Sunrise Plex

- UNI4 Marketing AB

- Others

- Key Players

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making