Middle East and Africa Paint Additives Market Research Report: Forecast (2021-2026)

By Formulation (Water, Solvent, Powder Based, Others), By End-User (Automobiles & Transportation, Industrial, Furniture & Woods, Building & Construction), By Product (Rheology Modi...fiers, Biocides, Anti-Foamers, Wetting & dispersing agents, Others), By Country (UAE, Saudi Arabia, Iraq, South Africa, Nigeria, Morocco, Algeria, Tunisia, Kenya, Jordon, Uganda, Ivory Coast, Cameroon, Rest of MEA), By Competitors (Akzo Nobel, Arkema S.A, Asahi Glass Co.Ltd., Ashland Inc., BASF S.E., BYK-Chamie GHBH, Cabot Corporation, Cytec Industries, Daikin Industries, Dynaa A.S) Read more

- Chemicals

- Jan 2022

- Pages 187

- Report Format: PDF, Excel, PPT

Market Definition

Additives are the most special components of paints since they can greatly enhance their performance & efficacy. Hence, choosing proper additives in the right proportion & time can improve the appearance & durability of paints.

Moreover, they also help improve paint’s production & storage properties. The various types of paint additives available in the market include deformers, wetting & dispersing agents, anti-settling agents, specialty additives, etc. These varieties of paint additives are used accordingly across several end-user industries like automotive, building & construction, furniture & woods, etc.

Market insights

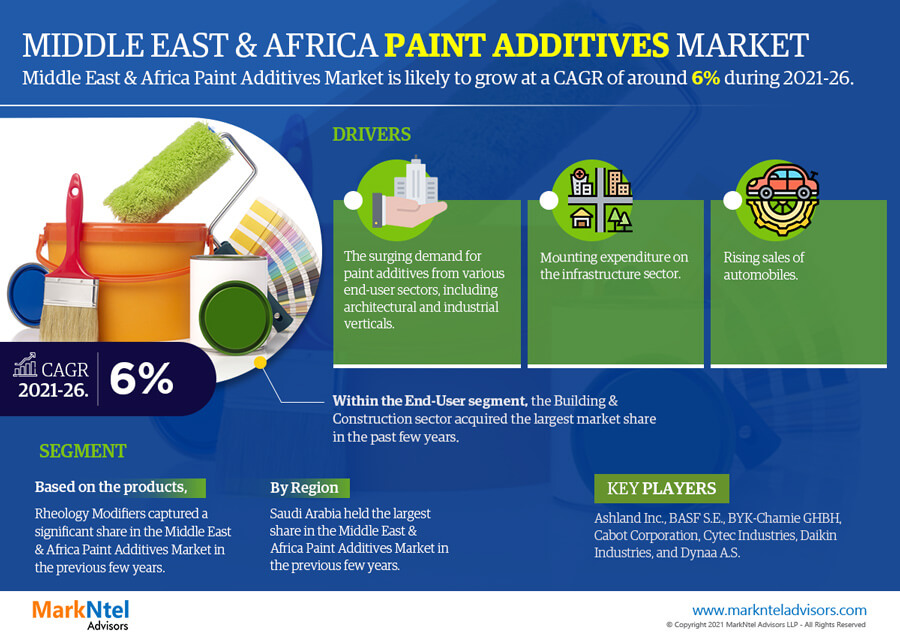

The Middle East & Africa Paint Additives Market is anticipated to grow at a CAGR of around 6% during the forecast period, i.e., 2021-26. The growth of the market attributes primarily to the increasing demand for paint additives from architectural end-use verticals. Strong economic growth in a few African countries like Nigeria is another crucial aspect providing lucrative growth opportunities for the market.

Besides, the rapid growth in the construction & automotive sector owing to its solvent properties is also contributing to the burgeoning demand for paint additives. Moreover, projects like Saudi Arabia Vision 2030 to reduce Saudi Arabia's dependence on oil, diversify its economy, & develop infrastructure, health, tourism, & educational sectors shall boost the construction industry across the region. It, in turn, shall also drive the paint additives market in the coming years.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2016-19 |

| Base Year: 2020 | |

| Forecast Period: 2021-26 | |

| CAGR (2021-2026) | 6% |

| Countries Covered | UAE, Saudi Arabia, Iraq, South Africa, Nigeria, Morocco, Algeria, Tunisia, Kenya, Jordon, Uganda, Ivory Coast, Cameroon, Rest of MEA |

| Key Companies Profiled | Akzo Nobel, Arkema S.A, Asahi Glass Co.Ltd., Ashland Inc., BASF S.E., BYK-Chamie GHBH, Cabot Corporation, Cytec Industries, Daikin Industries, Dynaa A.S |

| Unit Denominations | USD Million/Billion |

Paint additives help enhance the chemical properties of coatings, such as wettability, rheology, dispersion, chemical resistance, UV protection, and high-temperature stability. Hence, they are being used widely across different end-users across the Middle East & Africa.

Furthermore, the rising trend of sustainability and mounting demand for materials that can comply with domestic & international norms is also providing a profitable opportunity to the leading market players for developing eco-friendly & no-VOC paint additives. Hence, the aspects cited above are likely to accelerate the growth of the paint additives market over the forecast years.

Impact of Covid-19 pandemic on the Middle East & Africa Paint Additives Market

The Covid-19 pandemic in 2020 catastrophically impacted many industries across the Middle East and Africa. The lockdown imposition to curb the virus spread resulted in the shutdown of manufacturing units and halt in many construction projects, which negatively impacted the production & sales of paint additives. Further, it also led to the disruption in supply chain & trade, which, in turn, affected the imports & exports of paint additives.

Moreover, the pandemic negatively affected the growth of tourism & the construction sector, which also restrained the paint additives market amidst the crisis. Further, the closure of manufacturing units of the automotive industry also resulted in the reduced demand for paint additives.

However, with the upliftment of restrictions, all the suspended projects resumed and fueled the demand for paint additives. Moreover, the reopening of manufacturing units & different end-user sectors is projected to boost the market in the coming years.

Market Segmentation

By End-User:

- Automobiles & Transportation

- Industrial

- Furniture & Woods

- Building & Construction

Based on end-users, the building & construction sector dominates the Middle East and Africa Paint Additives Market. Paint additives are widely used in the building & construction industry for specific uses like wall paints, deck finishes, or roof coatings. Additionally, they play a vital role in providing aesthetic looks to the structure, improving durability, and providing protection against damages. These additives are used in commercial applications like constructing shopping malls, office buildings, retail convenience stores, warehouses, & residential buildings.

Across the Middle East, the construction industry plays a major role in economic development. Several projects like Saudi Arabia Vision 2030, Dubai Expo, Red Sea Project, Quiddiya Entertainment City, Project NEOM and Diriyah Gate, etc., are promoting infrastructural developments in various countries across the region and, in turn, fueling the demand for paint additives.

Furthermore, the building and construction industry in the Middle East & Africa has a major concern regarding heat & UV exposure. To overcome this issue, the use of additives that could help protect the building from extreme is increasing. Hence, the paint additives market in the Middle East and Africa region is expected to grow significantly in the forecast period.

In Africa, the construction industry in Nigeria is expanding at a decent pace. Although, the demand for paints additives in construction activities across Africa declined for the short term due to the Covid-19 pandemic. However, presently, the industry is picking up its growth steadily.

By Component:

- Rheology Modifiers

- Biocides

- Anti-Foamers

- Wetting & dispersing agents

Here, Rheology modifiers are projected to attain the largest share in the Middle East and Africa Paint Additive Market. Rheology modifiers are the most important additives induced in the majority of paints to alter the rheological characteristics. Apart from achieving desired viscosity, rheological modifiers help control paint shelf stability and facilitate ease of application. It is vital to have better control over the flow of paints for their production, storage, & application. The soaring demand for rheological modifiers in the construction, automotive, & industrial sectors and wood application is expected to propel the overall market growth.

On the other hand, the demand for wetting & dispersing agents is experiencing the fastest growth. These agents help in the proper & even dispersion of paints on the surface, which helps decrease the viscosity of paints and guarantee the stabilization of dispersed particles over time.

Key Trends in the Middle East & Africa Paint Additives Market

Mounting Demand for Water-based Paints

Compared to solvent & powder-based paint additives, preferences for water-based paint additives are increasing since they are less toxic. Other types of paint additives are responsible for VOC (Volatile Organic Compounds) emissions & other hazardous air pollutants, which form smog & affect the atmosphere. Hence, many end-user industries are inclining toward water-based paint additives, which would propel the overall market growth in the coming years.

Country Landscape:

- UAE

- Saudi Arabia

- Iraq

- South Africa

- Nigeria

- Morocco

- Algeria

- Tunisia

- Kenya

- Jordon

- Uganda

- Ivory Coast

- Cameroon

Of them all, Saudi Arabia holds the largest share in the Middle East and Africa Paint Additives Market, mainly due to the burgeoning construction activities, mounting government support toward infrastructural developments, and increasing tourism industry in the country. In addition, an increasing number of residential & commercial projects in Saudi Arabia is also likely to contribute to the overall market growth.

Some projects that have resulted in the rapid growth of the construction industry in Saudi Arabia include the Red Sea Project – Phase 1, which is likely to be completed by 2022, and the futuristic mega-city ‘Neom’ project. These projects will eventually boost the demand for Paint Additives. The rapid developments in the construction sector are primarily due to the country's robust economic growth.

Furthermore, the Covid-19 pandemic in 2020 led to the delay or suspension of most construction projects, which has negatively impacted the paint additives market. However, the industry is projected to pick up pace in the coming future, which, in turn, would also boost the paint additives market.

Market Dynamics:

Key Driver: Mounting Demand for Paint Additives for Industrial Uses

The demand for paint additives is increasing dramatically in the industrial sector of the Middle East & Africa, owing to the excellent properties they exhibit. It is used as thickeners, curing catalysts, leveling agents, etc., for many industrial applications since the industrial sector comprises many expensive & huge machinery that require proper maintenance. Applying paints with additives helps protect the surface from corrosion & other damage. Hence, its extensive usage in the industrial sector fuels the overall market growth.

Possible Challenge: Adverse Environmental Impact of Paint Additives

Paint additives are responsible for releasing Volatile Organic Compounds (VOCs) while applying & drying process. These VOCs result in forming ozone. On reacting with oxygen, they create toxic pollutants like smog, which can cause severe health conditions like asthmatic reactions, skin & eyes irritation, allergies, & headaches. They also impact the heart & lung tissues. As a result, keeping environmental & health issues in mind, some norms & regulations have been enforced to limit the usage of paint additives. Hence, these aspects might hamper the growth of the MEA Paint Additive Market in the coming future.

Competitive Landscape

According to MarkNtel Advisors, the major leading players in the Middle East & Africa Paint Additives market are Akzo Nobel, Arkema S.A, Asahi Glass Co.Ltd., Ashland Inc., BASF S.E., BYK-Chamie GHBH, Cabot Corporation, Cytec Industries, Daikin Industries, and Dynaa A.S.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares) of the Middle East & Africa Paint Additives Market?

- What is the country-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the Middle East & Africa Paint Additives Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the Middle East & Africa Paint Additives Market based on a competitive benchmarking matrix?

- What are the key results derived from surveys conducted during the Middle East & Africa Paint Additives Market study?

Market Outlook, Segmentation, and Statistics

- Impact of COVID-19 on the Middle East & Africa Paint Additives Market

- Market Size & Analysis

- By Value

- By Volume

- Market Share & Analysis

- By Formulation

- Water

- Solvent

- Powder Based

- Others

- By End-User

- Automobiles & Transportation

- Industrial

- Furniture & Woods

- Building & Construction

- Others

- By Products

- Rheology Modifiers

- Biocides

- Anti-Foamers

- Wetting & dispersing agents

- Others

- By Region

- UAE

- Saudi Arabia

- Iraq

- South Africa

- Nigeria

- Morocco

- Algeria

- Tunisia

- Kenya

- Jordon

- Uganda

- Ivory Coast

- Cameroon

- Rest of MEA

- By Competitors

- Competition Characteristics

- Market Share & Analysis

- Competitive Matrix

- By Formulation

- Middle East & Africa Paint Additives Market Hotspots & Opportunities

- Middle East & Africa Paint Additives Market Regulations & Policy

- Key Strategic Imperatives for Success and Growth

- Global Competition Outlook

- Competition Matrix

- Company Profile

Frequently Asked Questions

- Research Methodology

- Product Definition

- Research Process

- Assumptions

- Market Definition

- Executive Summary

- Middle East & Africa Paint Additives Market Outlook 2016-2026F

- Market Size & Analysis

- By Volume

- By Value

- Market Share & Analysis

- By Formulation

- Water

- Solvent

- Powder Based

- Others

- By End-User

- Automobiles & Transportation

- Industrial

- Furniture & Woods

- Building & Construction

- Others

- By Products

- Rheology Modifiers

- Biocides

- Anti-Foamers

- Wetting & dispersing agents

- Others

- By Region

- UAE

- Saudi Arabia

- Iraq

- South Africa

- Nigeria

- Morocco

- Algeria

- Tunisia

- Kenya

- Jordon

- Uganda

- Ivory Coast

- Cameroon

- Rest of MEA

- By Company

- Revenue Shares

- Strategic Factorial Indexing

- Competitor Placement in MarkNtel Quadrant

- By Formulation

- Market Size & Analysis

- UAE Paint Additives Market Outlook 2016-2026F

- Market Size & Analysis

- By Volume

- By Volume

- Market Share & Analysis

- By Formulation

- By Products

- By End-User

- Market Size & Analysis

- Saudi Arabia Paint Additives Market Outlook 2016-2026F

- Market Size & Analysis

- By Volume

- By Volume

- Market Share & Analysis

- By Formulation

- By Products

- By End-User

- Market Size & Analysis

- Iraq Paint Additives Market Outlook 2016-2026F

- Market Size & Analysis

- By Volume

- By Volume

- Market Share & Analysis

- By Formulation

- By Products

- By End-User

- Market Size & Analysis

- South Africa Paint Additives Market Outlook 2016-2026F

- Market Size & Analysis

- By Volume

- By Volume

- Market Share & Analysis

- By Formulation

- By Products

- By End-User

- Market Size & Analysis

- Nigeria Paint Additives Market Outlook 2016-2026F

- Market Size & Analysis

- By Volume

- By Volume

- Market Share & Analysis

- By Formulation

- By Products

- By End-User

- Market Size & Analysis

- Morocco Paint Additives Market Outlook 2016-2026F

- Market Size & Analysis

- By Volume

- By Volume

- Market Share & Analysis

- By Formulation

- By Products

- By End-User

- Market Size & Analysis

- Algeria Paint Additives Market Outlook 2016-2026F

- Market Size & Analysis

- By Volume

- By Volume

- Market Share & Analysis

- By Formulation

- By Products

- By End-User

- Market Size & Analysis

- Tunisia Paint Additives Market Outlook 2016-2026F

- Market Size & Analysis

- By Volume

- By Volume

- Market Share & Analysis

- By Formulation

- By Products

- By End-User

- Market Size & Analysis

- Kenya Paint Additives Market Outlook 2016-2026F

- Market Size & Analysis

- By Volume

- By Volume

- Market Share & Analysis

- By Formulation

- By Products

- By End-User

- Market Size & Analysis

- Jordan Paint Additives Market Outlook 2016-2026F

- Market Size & Analysis

- By Volume

- By Volume

- Market Share & Analysis

- By Formulation

- By Products

- By End-User

- Market Size & Analysis

- Uganda Paint Additives Market Outlook 2016-2026F

- Market Size & Analysis

- By Volume

- By Volume

- Market Share & Analysis

- By Formulation

- By Products

- By End-User

- Market Size & Analysis

- Ivory Coast Paint Additives Market Outlook 2016-2026F

- Market Size & Analysis

- By Volume

- By Volume

- Market Share & Analysis

- By Formulation

- By Products

- By End-User

- Market Size & Analysis

- Cameroon Paint Additives Market Outlook 2016-2026F

- Market Size & Analysis

- By Volume

- By Volume

- Market Share & Analysis

- By Formulation

- By Products

- By End-User

- Market Size & Analysis

- Middle East & Africa Paint Additives Market Regulations

- Middle East & Africa Paint Additives Market Trends & Insights

- Middle East & Africa Paint Additives Market Dynamics

- Growth Drivers

- Challenges

- Impact Analysis

- Middle East & Africa Paint Additives Market Hotspot and Opportunities

- Middle East & Africa Paint Additives Market Key Strategic Imperatives for Success and Growth

- Competition Outlook

- Competition Matrix

- Fuel Portfolio

- Brand Specialization

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles (Business Description, Fuel Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Akzo Nobel

- Arkema S.A

- Asahi Glass Co.Ltd.

- Ashland Inc.

- BASF S.E.

- BYK-Chamie GHBH

- Cabot Corporation

- Cytec Industries

- Daikin Industries

- Dynaa A.S

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making