Malaysia Cybersecurity Market Research Report: Forecast (2024-2030)

Malaysia Cybersecurity Market Report - By Security Type (Network Security, Cloud Security, Endpoint & IoT Security, Application Security, Data Security, Others (Identification & Ac...cess Management, etc.)), By Solution (Identity & Access Management (IAM), Antivirus/Antimalware, Log Management & SIEM, Firewall, Encryption & Tokenization, Compliance & Policy Management, Patch Management, Others,) By Deployment mode (On-premises, Cloud, Hybrid Cloud), By Organization size (Large Enterprises, SMEs (Small & Medium Enterprises)), By End User (Banking, Financial Services and Insurance (BFSI), Government & Defense, Corporate, Healthcare & Life Sciences, Manufacturing, IT & Telecommunication, Others (Education, Media & Entertainment, etc.)), and Others Read more

- ICT & Electronics

- Jun 2024

- Pages 115

- Report Format: PDF, Excel, PPT

Market Definition

Cybersecurity can be defined as the method of protecting a complete digital network, including hardware, software, and data. It includes various strategies, such as network security, data security, cloud security, and many others, to keep the confidential information of the end users intact for the respective authorities/personnel and safeguard the information from cyber phishing attacks.

Market Insights & Analysis: Malaysia Cybersecurity Market (2024-30):

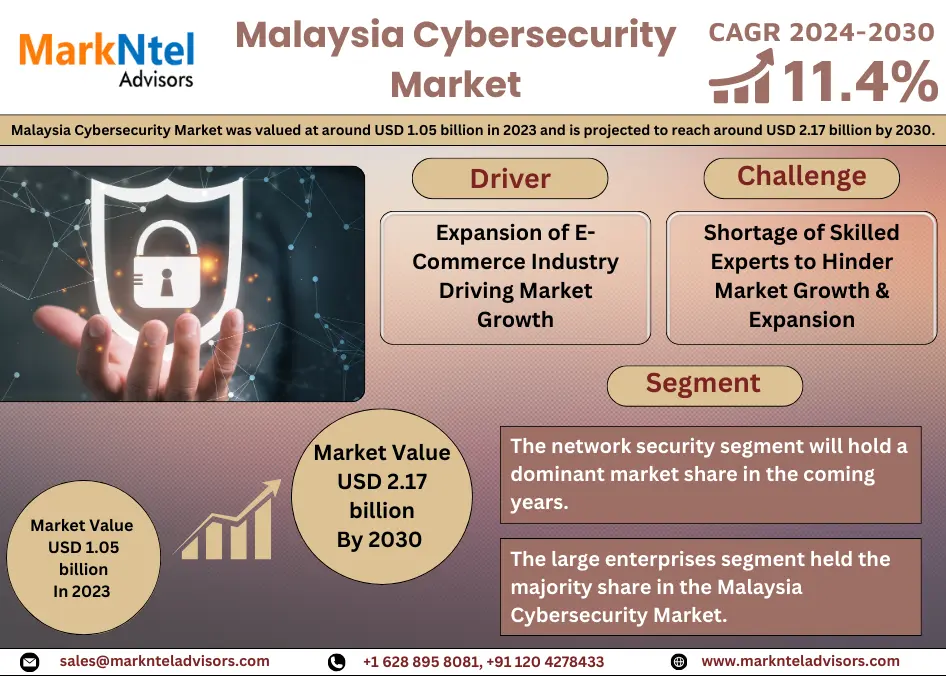

Malaysia Cybersecurity Market was valued at around USD 1.05 billion in 2023 and is projected to reach around USD 2.17 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 11.4% during the forecast period, i.e., 2024-30. The market growth is attributed to soaring foreign direct investments in the service sector due to favorable government initiatives and the absence of robust cybersecurity systems for routine work. This gap in the optimum cybersecurity infrastructure and the increasing establishment of service sector companies in the country has also resulted in rising cyber threats. According to the Malaysian Investment Development Authority, in 2023, more than 50% of the FDI received was for the service sector in the country. The growing establishment of organizations is demanding suitable cybersecurity services to shield their information, virtual structures, and ordinary operational tactics from unnecessary cyber threats and, in some instances, serious cyber assaults.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 11.4% |

| Region Covered | North, South, East, Central, Sarawak, Sabah |

| Key Companies Profiled | IBM, CISCO, Microsoft, Palo Alto Networks, Wizlynx group, AKATI Sekurity, AVG, Amazon Web Services, Inc., Qinetics MSP Sdn Bhd, Oracle, 3i Infotech Sdn Bhd, and others |

| Market Value (2023) | USD 1.05 Billion |

| Market Value (2030) | USD 2.17 Billion |

Malaysia is the most vulnerable country and has suffered the most cyberattacks in the Asia-Pacific region. Almost 26 out of 100 companies in Malaysia have reported a cyberattack in 2022, according to Kroll LLC. The motive behind the increasing threats and attacks is the surging integration of recent virtual technology, including artificial intelligence and machine learning. To prevent these cyber threats, consumers in the market have been proactively deploying cybersecurity services & solutions as per their individual needs, which has further supported market growth in the historical period.

Furthermore, the fueling development of the industrial sector in Malaysia and the government’s effort to boost revenue from it have led to a growing number of new industries in the country. The country also aims to improve its position in the global supply chain, thus promoting investments in the establishment of manufacturing facilities in-house. In industries like semiconductors, the government plans to attract around USD 107 billion from major players like Intel & Infineon and grow its contribution share in the global semiconductor industry from 13%. It has also planned to set up new domestic companies in the same industry. The rising development of the sector would generate revenue streams and increase the size of the Malaysia Cybersecurity Market in the forecast period.

Malaysia Cybersecurity Market Driver:

Expansion of E-Commerce Industry Driving Market Growth – The Malaysian population has consistently been gaining internet access across the country. According to the World Bank, internet penetration has reached around 97% in 2022, up from about 84% in 2019. Thus, with the growing adoption of the internet, smartphones, tablets, computers, etc., the residents of the country are steadily integrating e-commerce services into their routine lives due to convenience, and the variety of options available. Additionally, the Malaysian government has been supportive of the development of digitalization in the country and is implementing various initiatives to boost the e-commerce sector. Such as programs to enhance the digital infrastructure and policies to smooth the online transaction process. For instance,

-

In 2023, the Malaysian government and Google announced their partnership to strengthen home-grown companies by advancing their digital competitiveness.

According to the Department of Statistics Malaysia, the contribution of e-commerce to GDP increased 18.9% from USD 48.3 billion in 2021 to USD 57.5 billion in 2022. Hence, the escalating online shopping is resulting in more online transactions, making e-commerce companies and consumers prone to phishing, ransomware, data breaches, etc. Therefore, this increase in e-commerce platform operations has been a key factor requiring solutions for cyber threats in the country, further supporting the Malaysia Cybersecurity Market size & volume.

Malaysia Cybersecurity Market Challenge:

Shortage of Skilled Experts to Hinder Market Growth & Expansion – Cybersecurity is considered a highly technical industry that requires highly skilled professionals who can grow and apply their expertise to the ever-rising critical cyber threats and cyber-attacks. However, in Malaysia, there has been an issue with the low presence of a highly skilled workforce which limits the market growth. According to the Malaysia Communication & Digital Ministry in 2023, there are around 15,248 identified cybersecurity workers in the country, which falls short of the recommended 27,000 by 2025. The gap of nearly 12,000 experts has been a complex obstacle for the market to overcome. This gap creates hindrances in the overall cybersecurity operational process such as application of solutions and services, periodic testing and maintenance, etc. Protection from thousands of cyberattacks per day on all industries which might lead to confidential data breach or loss, ransomware, malware, and others significantly requires round-the-clock checks. Therefore, with the scarcity of workforce in the cybersecurity industry, market growth is impeded considerably.

Malaysia Cybersecurity Market Trend:

Growing Adoption of Zero-Trust Security – There has been an increasing establishment of new organizations across banking, financial services and insurance (BFSI), manufacturing, IT & Telecom, etc., in line with government initiatives to boost the Malaysian economy. In addition, the increase in the number of new companies is also vulnerable to cyberattacks, which raises the demand for advanced cybersecurity solutions for end-point security, data protection, cloud security, etc. This led to increased adoption of zero-trust security services to implement granular access controls and authentication mechanisms, regardless of the location or device used by employees, thus mitigating the risks associated with remote work environments. Moreover, increased demand for zero-trust security solutions is resulting in the rising launch of solutions in the country by companies like Oracle, Palo Alto Networks, etc. For instance,

- In 2022, 3i Infotech reported the launch of Malaysia’s first-ever Zero Trust Sovereign Cloud integrated with Oracle’s technology, named NuRe 3i+.

Thus, the increasing demand for zero-trust security solutions and the launch of innovative offerings by leading companies are driving significant growth and advancement in the cybersecurity industry in Malaysia. These developments help organizations adopt and be prepared with effective cybersecurity measures, enhance their security posture, and address rising cyber threats more effectively.

Malaysia Cybersecurity Market (2024-30): Segmentation Analysis

The Malaysia Cybersecurity Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2024–2030 at the national level. Based on the analysis, the market has been further classified as:

Based on Security Type:

- Network Security

- Cloud Security

- Endpoint & IoT Security

- Application Security

- Data Security

- Others (Identification & Access Management, etc.)

The network security segment will hold a dominant market share in the coming years. In line with the increasing cyber threats such as malware, ransomware, phishing attacks, etc., a growing importance of securing networks has been observed. Network security shields the organization’s internal network, its network boundary, etc. The growing amalgamation of digitalization amongst all the sectors in the country has also raised the need for network security integration. Sectors such as finance, healthcare, manufacturing, education, and government services are the main sectors with increasing rates of digital transformation. Due to the adoption of digital tools in routine business operations, there has been an increasing interconnection of devices and systems. This interconnection is a soft target for cyber attackers, which further necessitates robust network security methods to alleviate potential breaches. This, in turn, contributes to the growth of the Malaysia Cybersecurity Market throughout the forecast period. For instance,

- In 2024, the Malaysian Medical Association (MMA) and the Malaysian Communications and Multimedia Commission (MCMC) commenced MMA’s Healthcare Digitalization program to boost digitalization in private general practitioner clinics.

Based on Organization Size:

- Large Enterprise

- SMEs (Small & Medium Enterprises)

Amongst them, the large enterprises segment held the majority share in the Malaysia Cybersecurity Market. This is attributed to the increased possibility of threats and attacks. The size of enterprises also presents market players with a larger landscape of services to provide. The presence of multiple departments, increased levels of critical and private data, widened operational processes, etc., all require cybersecurity services for unhindered working. With the increasingly evolving techniques of cyberattacks that are not easy to detect, large enterprises have an essential need for advanced firewalls and other cybersecurity tools for their asset protection.

Additionally, the adoption of cloud services, including infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS), is on the rise among large enterprises in Malaysia. By leveraging cloud services, large enterprises can offload the management of infrastructure, platforms, and applications to cloud providers. Such practices enable organizations to focus their resources and expertise on core business activities and strategic initiatives, rather than routine IT maintenance tasks. The increased adoption of cloud services by large enterprises further fuels their share in the market.

Malaysia Cybersecurity Industry Recent Development:

- In 2023: Cisco launched networking and security products for small and medium businesses (SMBs) in Malaysia.

- In 2023: Amazon Web Services (AWS), stated its plans to invest approximately USD 6 billion by 2037 to expand its base in the country.

Gain a Competitive Edge with Our Malaysia Cybersecurity Market Report

- Malaysia Cybersecurity Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Malaysia Cybersecurity Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Market Definition

- Research Process

- Assumption

- Executive Summary

- Malaysia Cybersecurity Market Start-Up Ecosystem

- Entrepreneurial Activity

- Funding Received by Top Companies

- Key Investors Active in The Market

- Series Wise Funding Received

- Seed Funding

- Angel Investing

- Venture Capitalists (VC) Funding

- Others

- Malaysia Cybersecurity Market Trends & Insights

- Malaysia Cybersecurity Market Dynamics

- Growth Drivers

- Challenges

- Malaysia Cybersecurity Market Hotspot & Opportunities

- Malaysia Cybersecurity Market Regulation & Policy

- Malaysia Cybersecurity Market Outlook, 2019- 2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Security Type

- Network Security- Market Size & Forecast 2019-2030, (USD Million)

- Cloud Security- Market Size & Forecast 2019-2030, (USD Million)

- Endpoint & IoT Security- Market Size & Forecast 2019-2030, (USD Million)

- Application Security- Market Size & Forecast 2019-2030, (USD Million)

- Data Security- Market Size & Forecast 2019-2030, (USD Million)

- Others (Identification & Access Management, etc.)- Market Size & Forecast 2019-2030, (USD Million)

- By Solution

- Identity & Access Management (IAM)- Market Size & Forecast 2019-2030, (USD Million)

- Antivirus/Antimalware- Market Size & Forecast 2019-2030, (USD Million)

- Log Management & SIEM- Market Size & Forecast 2019-2030, (USD Million)

- Firewall- Market Size & Forecast 2019-2030, (USD Million)

- Encryption & Tokenization- Market Size & Forecast 2019-2030, (USD Million)

- Compliance & Policy Management- Market Size & Forecast 2019-2030, (USD Million)

- Patch Management- Market Size & Forecast 2019-2030, (USD Million)

- Others- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment mode

- On-premises- Market Size & Forecast 2019-2030, (USD Million)

- Cloud- Market Size & Forecast 2019-2030, (USD Million)

- Hybrid Cloud- Market Size & Forecast 2019-2030, (USD Million)

- By Organization size

- Large Enterprises- Market Size & Forecast 2019-2030, (USD Million)

- SMEs (Small & Medium Enterprises)- Market Size & Forecast 2019-2030, (USD Million)

- By End User

- Banking, Financial Services and Insurance (BFSI)- Market Size & Forecast 2019-2030, (USD Million)

- Government & Defense- Market Size & Forecast 2019-2030, (USD Million)

- Corporate- Market Size & Forecast 2019-2030, (USD Million)

- Healthcare & Life Sciences- Market Size & Forecast 2019-2030, (USD Million)

- Manufacturing- Market Size & Forecast 2019-2030, (USD Million)

- IT & Telecommunication- Market Size & Forecast 2019-2030, (USD Million)

- Others (Education, Media & Entertainment, etc.)- Market Size & Forecast 2019-2030, (USD Million)

- By Region

- North

- South

- East

- Central

- Sarawak

- Sabah

- By Company

- Competition Characteristics

- Revenue Shares

- By Security Type

- Market Size & Analysis

- Malaysia Network Security Market Outlook, 2019- 2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment Mode- Market Size & Forecast 2019-2030, (USD Million)

- By Organization Size- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Malaysia Cloud Security Market Outlook, 2019- 2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment Mode- Market Size & Forecast 2019-2030, (USD Million)

- By Organization Size- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Malaysia Endpoint & IoT Security Market Outlook, 2019- 2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment Mode- Market Size & Forecast 2019-2030, (USD Million)

- By Organization Size- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Malaysia Application Security Market Outlook, 2019- 2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment Mode- Market Size & Forecast 2019-2030, (USD Million)

- By Organization Size- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Malaysia Data Security Market Outlook, 2019- 2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment Mode- Market Size & Forecast 2019-2030, (USD Million)

- By Organization Size- Market Size & Forecast 2019-2030, (USD Million)

- By End User- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Malaysia Cybersecurity Market Key Strategic Imperatives for Success & Growth

- Competitive Outlook

- Company Profiles

- IBM

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- CISCO

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Microsoft

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Palo Alto Networks

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Wizlynx group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- AKATI Sekurity

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- AVG

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Amazon Web Services, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Qinetics MSP Sdn Bhd

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Oracle

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- 3i Infotech Sdn Bhd

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- IBM

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making