India Two-Wheeler Radial Tire Market Research Report: Forecast (2024-2030)

India Two-Wheeler Radial Tire Market - By Two-Wheeler Type (Moped & Scooter, Motorcycle), By Tire Size (Front Tire, [100/80 R17, 110/70 R17, 120/70 R 17, 80/100 R 18, Others (80/10...0 R 17, 90/90 R 17, etc.)], Rear Tire [190/55 R 17, 180/55 R 17, 100/90 R 17, 160/60 R 17], Others (130/70 R 17, 150/60 R 17, etc.)]), By Engine Type (Internal Combustion Engine, Electric), By Price Category (Budget, Economy, Premium), By Sales Channel (Online, Direct Sales, Multi Brand Stores, Exclusive Outlets), By Demand Type (OEMs, [Yamaha, Bajaj, Husqvarna, Royal Enfield, KTM, Hero, Suzuki, Others], Aftermarket) and others Read more

- Tire

- Jan 2024

- Pages 128

- Report Format: PDF, Excel, PPT

Market Definition

Radial tires are a category of tires that are embedded with belts made of steel that work as stabilizers and improve the overall performance of the tire. Such design elements enhance the tire's strength, durability, and grip on the road. Therefore, radial tires offer superior performance and safety features in comparison to bias tires. Furthermore, the pliable sidewalls of radial tires contribute to a smoother ride and enhanced shock absorption, resulting in a driving experience that is both comfortable and enjoyable.

Market Insights & Analysis: India Two-Wheeler Radial Tire Market (2024-30):

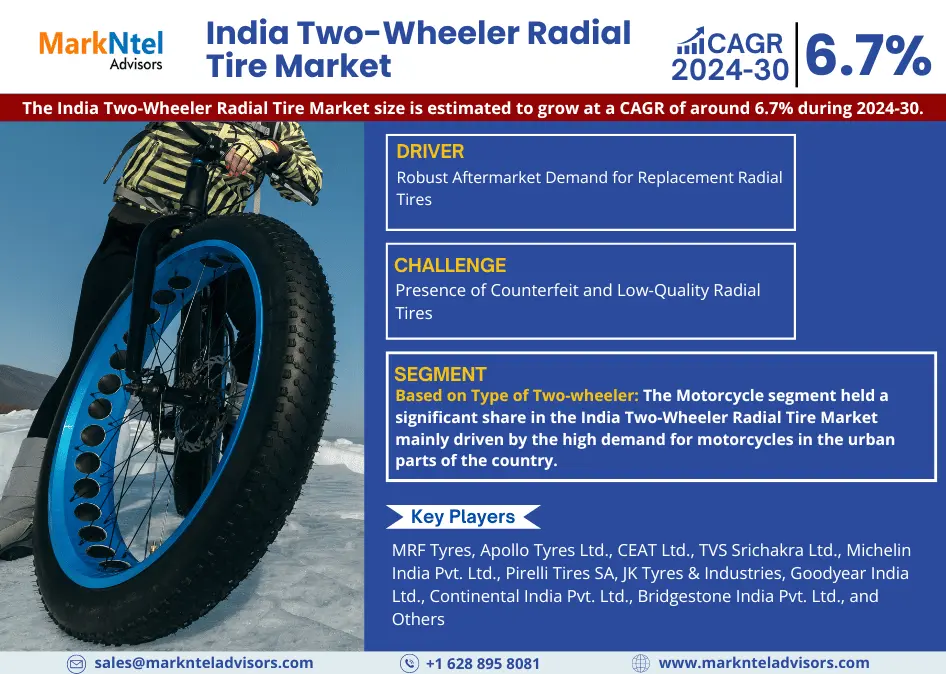

The India Two-Wheeler Radial Tire Market size is estimated to grow at a CAGR of around 6.7% during the forecast period, i.e., 2024-30. The major factor attributed to the market’s growth is the increased demand for radial tires for replacement purposes in the aftermarket.

In the past years, the sales of two-wheelers have been constantly rising due to expansion in economic sectors like e-commerce, logistics, etc. In these sectors, tires witnessed wear & tear due to extensive usage, which further led to the demand for the replacement of tires. Users have been observed to prefer radial tires over conventional ones as they offer several benefits, such as higher fuel efficiency, better grip & traction, longer tread life, noise reduction, and many others. This resulted in a higher demand for radial tires and led to the growth of the market in the historical years.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 6.7% |

| Region Covered | North, East, West, South |

| Key Companies Profiled | MRF Tyres, Apollo Tyres Ltd., CEAT Ltd., TVS Srichakra Ltd., Michelin India Pvt. Ltd., Pirelli Tires SA, JK Tyres & Industries, Goodyear India Ltd., Continental India Pvt. Ltd., Bridgestone India Pvt. Ltd., and Others |

| Unit Denominations | USD Million/Billion |

Further, post-2021, it was observed that the Indian economy growth was enhanced and economic activities such as home delivery, Two-wheeler ride-hailing services, and others gained momentum. This has led to an increase in the overall sales and production of two-wheelers as well. This further generated the demand for radial tires by OEMs like Bajaj, TVS, Honda, etc. because the radial tires offer higher fuel efficiency, improved stability, and longer tread life. Therefore, to improve the overall functionality of the Two-wheeler, OEMs switched to radial-based tires. For instance,

- In 2021, Honda launched a CB300R sports motorbike with radial-mount for front & rear tires. The bike comes with upside-down front forks that offer the highest precision in city traffic conditions.

Moreover, in the coming years, the sales of radial tires are further projected to grow, as they are comparatively more cost-effective than bias tires in the long run because they require less maintenance. Due to this, highly price-sensitive customers in India are projected to switch to radial tires in the aftermarket as awareness regarding their cost-effectiveness is rising gradually.

Along with this, the penetration of electric scooters and motorbikes is also projected to grow in the coming years. In 2022, according to NITI Aayog, the penetration of electric two-wheelers is expected to reach 100% by the year 2026-2027, if current incentives and subsidy support as provided by the government are not abolished. Hence, with the optimistic scenario of electric Two-wheelers, automotive manufacturers across the country are also focusing on upscaling their production capacity in the coming years. This would generate demand for radial tires by the OEMs, as these tires are technologically more advanced than bias ply and offer better vehicle performance and safety to the rider. Thus, the constantly growing demand for electric Two-wheelers would emerge as an opportunity area for the growth of the India Two-Wheeler Radial Tire Market during 2024-2030.

India Two-Wheeler Radial Tire Market Driver:

Robust Aftermarket Demand for Replacement Radial Tires – There has been a notable surge in the number of Two-wheelers on Indian roads, which has led to a substantial demand for radial tire replacements due to the effects of wear and tear. This demand has been largely driven by factors such as poor road conditions and excessive path holes, which resulted in extensive wear & tear. In addition, the mileage covered by two-wheelers on Indian roads has been higher as compared to other vehicles, given the extensive use of motorcycles and scooters for daily commuting.

As a result, the need for tire replacement became more frequent in the past, contributing to the improved demand for Two-wheeler radial tires in the aftermarket. Also, as radial tires offer a better riding experience in terms of safety & security, consumers prefer radial tires for replacement purposes over Bias tires.

This changing landscape of consumer preference has promoted vehicle manufacturers like TVS Eurogrip, MRF Tyres, and others to prioritize advanced technologies to cater to the growing audience base. For instance:

- In 2020, TVS Eurogrip’s Two-wheeler tires, with its R&D capabilities and patented innovations launched world-class tires that offered exceptional performance, control, stability, and durability through advanced technologies like Zero-degree steel-belted radials and tri-polymer technology.

Therefore, the launch of world-class two-wheeler tires and the rising demand for two-wheeler tires in the aftermarket enhanced market growth in the historical years. Further, as riders are seeking improved performance and fuel efficiency, they are projected to shift toward the installation of radial tires in their two-wheelers, which would drive the demand for tire replacement in the coming years as well.

India Two-Wheeler Radial Tire Market Opportunity:

Growing Adoption of Premium and High-Performance Motorcycles – With the rise in disposable income and a growing emphasis on brand value, Indian consumers are increasingly gravitating towards premium motorcycles and sports bikes, indicating a noticeable shift in their preferences. Observing this shift in consumer preferences, companies like KTM, Duke, Keeway, etc., have been introducing their new range of premium bikes in recent years. For instance,

- In 2022, Keeway introduced the K300 N and K300 R bikes, and through the launch of these models, the company aims to attract customers seeking premium and performance-oriented motorcycles.

These motorcycles often come equipped with larger engines, advanced suspension systems, and higher top speeds, which require tires that can withstand the increased power and deliver optimal performance. Radial tires offer distinct advantages over conventional bias-ply tires in terms of grip, stability, and cornering capabilities. Therefore, the introduction of high-performance bikes aimed at attracting customers seeking premium and performance-oriented motorcycles is likely to increase the demand for radial tires in the coming years.

India Two-Wheeler Radial Tire Market Challenge:

Presence of Counterfeit and Low-Quality Radial Tires – The India Two-Wheeler Radial Tire Market has been facing a significant challenge due to the presence of counterfeit and low-quality radial tires. These substandard alternatives have been available at a lower price, making them attractive to price-sensitive consumers. The price differential has led consumers to adopt counterfeit radial tires, which has impacted the sales of radial tires in the market.

In addition, the Indian government has been constantly observed to discover unorganized players producing counterfeit tires of popular brands like CEAT, MRF, etc. Hence, as the number of counterfeit tires has been constantly rising across the nation, the sales of original tires have been negatively affected.

India Two-Wheeler Radial Tire Market Trend:

Tubeless Radial Tires Gaining Traction – Tubeless radial tires have gained popularity in the Indian Two-wheeler Market due to their improved safety, convenience, and performance benefits. They were particularly preferred by urban riders and enthusiasts who prioritized safety and a hassle-free riding experience. Their better stability and handling characteristics contributed to enhanced ride comfort and improved fuel efficiency. Additionally, the absence of an inner tube eliminated the need for frequent tube maintenance and repairs, making tubeless radial tires more convenient and cost-effective in the long run, which has enhanced their demand in the Indian market in recent years.

Further, to cater to the growing demand, manufacturers such as TVS, MRF Tyres, CEAT, and others have introduced new variants of tubeless radial tires with advanced features and technologies in recent years. For instance:

- In 2023, TVS Eurogrip entered the enthusiast segment by unveiling adventure touring and superbike tires, including the Roadhound zero-degree steel belted radial tire, which was available in tubeless variants.

Therefore, the introduction of tubeless radial tires in the enthusiast segment by companies showcases their commitment to catering to the needs of motorcyclists in the Indian market. Hence, with the enhancement in the number of options available in the tubeless radial tire segment and the growth in awareness of the benefits of tubeless tires, their adoption is anticipated to expand further in the coming years.

India Two-Wheeler Radial Tire Market (2024-30): Segmentation Analysis

The India Two-Wheeler Radial Tire Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment. It includes predictions for the period 2024–2030 at the national level. According to the analysis, the market has been further classified as:

Based on the Type of Two-wheeler:

-

Moped & Scooter

-

Motorcycle

The motorcycle segment held a significant share in the India Two-Wheeler Radial Tire Market mainly driven by the high demand for motorcycles in the urban parts of the country. This demand has been majorly arising among the working population of the country due to easy maneuverability, as motorcycles are more suited for negotiating through congested streets and high traffic. These factors resulted in higher sales of motorcycles in the cities, which generated an increased demand for radial tires by the OEMs to increase their production to cater to incoming demand.

Further, in the coming year, premium & sports bikes are expected to drive the demand for radial tires. The younger population in the cities is largely inclined toward premium-category bikes such as KTM, Kawasaki Ninja, BMW Motorrad, etc., For instance,

- In 2022, nearly 7282 units of BMW Motorrad were sold in India in comparison to 5191 units in 2021.

Also, in the coming year, the same trend is expected to persist primarily due to rising disposable income and inclination toward luxury among individuals. Therefore, the higher sales of premium & sports category bikes would further boost the demand for radial two-wheeler tires, both among OEMs and in the aftermarket, in the coming years. Thus, it would lead to the growth of the motorcycle segment in the India Two-Wheeler Radial Tire Market during 2024-2030.

Based on the Engine Type:

- Internal Combustion Engine

- Electric

In India, Internal Combustion Engine (ICE)-based two-wheelers have held a substantial share in the India Two-Wheeler Radial Tire Market because the availability of petrol fuel is widespread and there is a well-integrated network of petrol pumps across the country. Along with it, they can offer greater mileage and cover larger distances in comparison to electric Two-wheelers due to which the inclination of consumers has been more towards Internal Combustion Engine-based Two-wheelers. Therefore, considering these demand patterns, automobile manufacturers like Keeway, Bajaj, etc. have introduced high-performance ICE-based Two-wheelers to cater to this rising demand among consumers. For instance,

- In 2022, Keeway entered the Indian market with the launch of 3 new petrol-run scooters.

Therefore, as companies have been launching new ICE-based Two-wheelers, it has generated the demand for radial tires among these OEMs in the past few years.

Besides, in the coming years, the electric Two-wheeler segment is projected to generate a higher demand for radial tires. The ownership of electric Two-wheelers is anticipated to rise because the government has been encouraging the adoption of electric Two-wheelers by providing monetary incentives.

- For instance, in 2023, the government sanctioned an investment package of nearly USD96.9 million to develop nearly 7,432 public charging stations in the country by the year 2024.

Therefore, such developments are projected to boost the production of electric two-wheelers in the country. Hence, as the manufacturing of electric two-wheelers would amplify, it would generate an opportunity for the growth in demand for radial tires among manufacturers during 2024-2030.

India Two-Wheeler Radial Tire Industry Recent Development:

- In 2022, Apollo Tyres introduced a Tramplr range of motorcycle tires for 150CC to 500CC range of motorcycles. These tires are equipped with bigger tread blocks and steel radial technology.

Gain a Competitive Edge with Our India Two-Wheeler Radial Tire Market Report

-

India Two-Wheeler Radial Tire Market Report by Markntel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps business organizations gain a holistic understanding of market dynamics & make informed decisions.

-

This report also highlights current market trends & future projections, allowing business organizations to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- India Two-Wheeler Radial Tire Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, business organizations can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Research Process

- Assumptions

- Market Definition

- Executive Summary

- India Two-Wheeler Radial Tire Market Trends & Development

- India Two-Wheeler Radial Tire Market Dynamics

- Drivers

- Challenges

- India Two-wheeler Tire Manufacturing Outlook, 2024

- Top Brands & Their Manufacturing Units

- Production Volumes

- Future Plans

- Top Brands & Their Manufacturing Units

- India Two-Wheeler Radial Tire Market Supply Chain Analysis

- India Two-Wheeler Radial Tire Market Regulations, Policies, Regulation

- India Two-Wheeler Radial Tire Market Hotspot & Opportunities

- India Two-Wheeler Radial Tire Market Analysis, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand)

- Market Share & Analysis

- By Two-Wheeler Type

- Moped & Scooter -Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- Motorcycle -Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- By Tire Size

- Front Tire-Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- 100/80 R17-Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- 110/70 R17 -Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- 120/70 R 17-Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- 80/100 R 18- Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- Others (80/100 R 17, 90/90 R 17, etc.) -Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- Rear Tire-Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- 190/55 R 17-Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- 180/55 R 17-Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- 100/90 R 17-Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- 160/60 R 17-Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- Others (130/70 R 17, 150/60 R 17, etc.) -Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- Front Tire-Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- By Engine Type

- Internal Combustion Engine-Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- Electric -Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- By Price Category

- Budget- Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- Economy- Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- Premium- Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- By Sales Channel

- Online- Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- Direct Sales- Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- Multi Brand Stores- Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- Exclusive Outlets- Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- By Demand Type

- OEMs- Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- Yamaha

- Bajaj

- Husqvarna

- Royal Enfield

- KTM

- Hero

- Suzuki

- Others

- OEMs- Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- Aftermarket- Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- By Two-Wheeler Type

- By Region

- North

- East

- West

- South

- By Company

- Competition Characteristics

- Market Share & Analysis

- Market Size & Analysis

- India Scooter & Moped Radial Tire Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand)

- Market Share & Analysis

- By Tire Size- Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- By Engine Type- Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- By Price Category- Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- By Sales Channel- Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- By Demand Type- Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- By Region- Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- Market Size & Analysis

- India Motorcycle Radial Tire Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand)

- Market Share & Analysis

- By Tire Size- Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- By Engine Type- Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- By Price Category- Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- By Sales Channel- Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- By Demand Type- Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- By Region- Market Size & Forecast 2019-2030F, Unit Sold (Thousand)

- Market Size & Analysis

- India Two-Wheeler Radial Tire Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- MRF Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Apollo Tyres Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- CEAT Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- TVS Srichakra Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Michelin India Pvt. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Pirelli Tyres SA

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- JK Tyres & Industries

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Goodyear India Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Continental India Pvt. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Bridgestone India Pvt. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- MRF Ltd.

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making