India Residential Water Purifier Market Research Report: Forecast (2024-2030)

India Residential Water Purifier Market Report - By Technology (Reverse Osmosis (RO), Ultraviolet (UV), Gravity Based, Others (Ultrafiltration (UF), RO+UV+UF, etc.)), By Portabilit...y (Non-Portable, Portable), By Capacity (Up to 6L, Above 6L), By Sales Channel (Direct Sales, Retail, Online), By Region (North, South, East, West, Central, and Others Read more

- Environment

- Feb 2024

- Pages 147

- Report Format: PDF, Excel, PPT

Market Definition

Water Purifiers utilize technologies like Reverse Osmosis (RO), UV, UF, etc., for the filtration of water for drinking purposes. Among the technologies, the RO purifier system employs a semipermeable membrane to remove impurities, contaminants, and minerals from water by applying pressure, allowing only pure water molecules to pass through. Water purifiers also utilize ultraviolet (UV) light to disinfect and kill microorganisms present in water, rendering it safe for consumption.

Market Insights & Analysis: India Residential Water Purifier Market (2024-30):

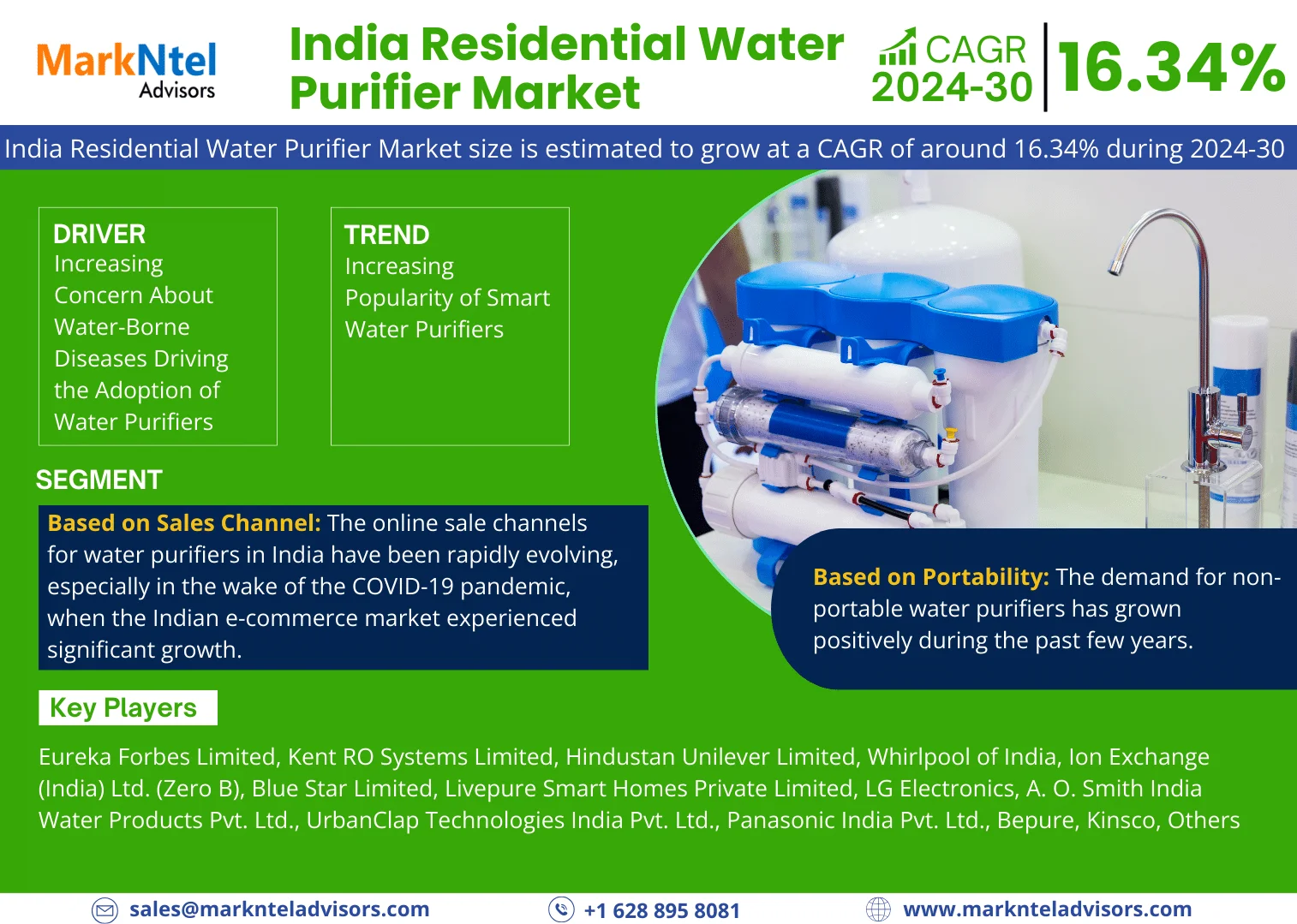

The India Residential Water Purifier Market size is estimated to grow at a CAGR of around 16.34% during the forecast period, i.e., 2024-30. In India, less than 50% of the population has access to safe drinking water, and there is a concerning prevalence of individuals falling severely ill or losing their lives due to waterborne diseases. Hence, this has led to rising health concerns and awareness amongst consumers toward the usage of purified water. Thus, customers in India are increasingly opting for water purifiers that use advanced technologies like RO, UV, and UF. These technologies offer superior purification capabilities and are effective in removing impurities like heavy metals and microbiological contaminants. Further, the Indian government has also launched an initiative, i.e., the Jal Jeevan Mission, to improve access to safe drinking water, particularly in rural areas. This initiative has led to an increase in the adoption of water purifiers, especially across the rural areas of the country, in recent years.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 16.34% |

| Region Covered | North, South, East, West, Central |

| Key Companies Profiled | Eureka Forbes Limited, Kent RO Systems Limited, Hindustan Unilever Limited, Whirlpool of India, Ion Exchange (India) Ltd. (Zero B), Blue Star Limited, Livepure Smart Homes Private Limited, LG Electronics, A. O. Smith India Water Products Pvt. Ltd., UrbanClap Technologies India Pvt. Ltd., Panasonic India Pvt. Ltd., Bepure, Kinsco, Others |

| Unit Denominations | USD Million/Billion |

In addition, in recent years, India has also witnessed a remarkable surge in quarterly residential unit launches. Across the top seven cities in India, there was an encouraging increase in new project launches during the historic period. Driven by strong sales figures and positive economic fundamentals, developers seized the opportunity to introduce residential projects in these cities. Moreover, as the massive rural population of the country has been constantly migrating to urban areas, there has been a constant need for investment in the residential sector. Also, the water scarcity issues faced in almost all the regions of the nation, especially during dry seasons, necessitate the requirements for water purifiers. Hence, with the rising development of residential units across the nation, the demand for water purifiers is anticipated to continue to rise in the upcoming years.

India Residential Water Purifier Market Driver:

Increasing Concern About Water-Borne Diseases Driving the Adoption of Water Purifiers – The rise in water-borne diseases, such as cholera, typhoid, dysentery, and gastroenteritis, has heightened health concerns among the population. Contaminated water sources are a primary vector for these diseases, prompting individuals to seek reliable methods to purify their drinking water. This contributed to the adoption of water purifiers in historical periods. Water purifiers are designed to eliminate or reduce the concentration of disease-causing microorganisms such as bacteria, viruses, and parasites. Further, increasing industrial discharge, improper sewage disposal, and agriculture runoff contribute to the growing contamination of water sources in the country. Consequently, there is a rising incidence of water-borne diseases in the country.

As per the United Nations Educational, Scientific, and Cultural Organization (UNESCO) report in 2023, approximately 37.7 million Indians are affected by water-borne diseases annually, with approximately 1.5 million children dying of diarrhea. This has heightened consumer concerns about the safety of drinking water, fostering the widespread adoption of water purifiers in households.

Furthermore, growing efforts by government agencies, non-profit organizations, and health campaigns are increasing public awareness regarding the link between contaminated water and waterborne diseases. These awareness campaigns increasingly educate individuals about the importance of purifying water before consumption, which would lead to higher adoption of water purifiers in the coming years.

India Residential Water Purifier Market Opportunity:

Growing Innovation in Filter Technologies to Generate New Opportunities – The burgeoning innovations in filtration technology stand as a crucial opportunity to elevate the efficacy of residential water purifiers, ensuring the provision of cleaner and safer drinking water. Traditional water purification methods often encounter difficulties in effectively eliminating emerging contaminants and microorganisms. In response to this challenge, water manufacturing giants like Tata and Eureka Forbes are integrating advanced filtration technologies, such as nanotechnology and advanced membrane technologies, into their product offerings. For instance,

- In 2023, Pureit introduced a purifier series incorporating cutting-edge technologies like Reverse Osmosis (RO), Ultraviolet (UV), and Microfiltration (MF).

Consequently, the accelerating progress in filtration technologies holds the potential to significantly boost the efficiency of water purifiers, leading to a more thorough removal of contaminants. This enhanced effectiveness is anticipated to appeal to consumers who are growingly conscientious about water quality and actively seeking robust purification solutions in the foreseeable future.

India Residential Water Purifier Market Challenge:

Surging Consumption of Bottled Water in Urban Areas to Impede Market Expansion – During the historical period, increased concern regarding the quality of tap water in certain regions drove residents to choose bottled water as a reliable and safe alternative. Further, bottled water provides instant, readily available access without requiring supplementary purification measures. This convenience has garnered significant appeal, especially among residents leading busy lifestyles. According to the United Nations report in 2021, the bottled water industry in India witnessed an annual growth rate of approximately 27% from 2018 to 2021. This has negatively impacted the market growth of water purifiers, as consumers who heavily relied on bottled water perceived less urgency in investing in a home water purifier. The convenience of readily available bottled water leads them to believe that their drinking water needs are adequately met without the need for additional purification at home.

Additionally, the accessibility of packaged drinking water at a low cost makes it immediately affordable for a diverse range of consumers. This stands in contrast to the initial investment needed to acquire a water purifier, negatively influencing the market's growth in the upcoming years.

India Residential Water Purifier Market Trend:

Increasing Popularity of Smart Water Purifiers – The increasing demand for access to safe drinking water has spurred a growing need for cutting-edge solutions. Escalating pollution levels, contamination concerns, and the essential requirement for consistent water quality are propelling the advancement of innovative water purification technologies. This advancement has led to the widespread introduction of intelligent water purifiers designed for residential use by companies like Urban Company, Lustral Water, etc., with the primary goal of ensuring water safety. These purifiers play a crucial role in providing access to safe drinking water, thereby safeguarding health and well-being. Their array of benefits, including advanced filtration, real-time monitoring, and filter life tracking, has significantly contributed to their popularity among health-conscious consumers in the country, consequently fueling the market demand for smart water purifiers.

Furthermore, growing environmental awareness has prompted manufacturers like Eureka Forbes, Xiaomi, etc. to concentrate on the creation of energy-efficient smart water purifiers designed to reduce water waste. The integration of advanced technologies, including energy-saving modes, sophisticated sensors, and automation, is expected to enhance water purification processes and contribute to energy conservation. This focus on sustainability and innovation is estimated to propel the size & volume of the water purifier industry in the coming years.

India Residential Water Purifier Market (2024-30): Segmentation Analysis

The India Residential Water Purifier Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2023–2028 at the national level. According to the analysis, the market has been further classified as:

Based on Sales Channel:

- Direct Sales

- Retail

- Online

The online sale channels for water purifiers in India have been rapidly evolving, especially in the wake of the COVID-19 pandemic, when the Indian e-commerce market experienced significant growth. Many manufacturers, such as Kent RO System Limited, Eureka Forbes, etc., have adopted online distribution channels through the introduction of their e-commerce websites for a direct-to-consumer approach. These companies have been leveraging improved sales by offering different vouchers and discounts on their websites, which has led to the growth of the online segment in the India Residential Water Purifier Market.

Also, many of these manufacturers sell their products through popular e-commerce platforms in India, such as Amazon, Flipkart, etc. As the market continues to grow, online sales channels are likely to diversify further, with more specialized retailers catering to specific customer segments and preferences. Thus, consumers are likely to prefer online platforms for researching, comparing, and purchasing products. On the other hand, direct sales held a nominal share in the India Residential Water Purifier Market.

Based on Portability:

- Non-Portable

- Portable

The demand for non-portable water purifiers has grown positively during the past few years. Non-portable water purifiers have been primarily designed for home use and are available in various types, such as RO, UV, and gravity-based purifiers. These purifiers use advanced technologies to remove impurities and contaminants from water and ensure safe and clean drinking water. Hence, with increasing awareness about water pollution, health concerns, and the need for safe and clean drinking water in urban and rural areas, the demand for non-portable water purifiers across residential setups has been increasing significantly.

The increasing number of new residential unit sales in India has driven the demand for non-portable water purifiers due to the specific needs of larger and permanent households and customization options for local water quality challenges to ensure access to clean and safe drinking water for residents in new homes across the country.

India Residential Water Purifier Industry Recent Development:

- 2023: Urbanclap Technologies India Pvt. Ltd. launched a new range of smart water purifiers under the sub-brand ‘Native”. Native M1 and M2 models are equipped with cutting-edge technology and superior-quality filters to deliver clean and safe drinking water to households.

- 2023: Eureka Forbes introduced the Aquaguard Slim Glass UV Bar Inline water purifier in India.

Gain a Competitive Edge with Our India Residential Water Purifier Market Report

- India Residential Water Purifier Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- India Residential Water Purifier Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- India Residential Water Purifier Market Evolution Timeline, 2019-2023

- Introduction of New Technologies

- Expansion of New Players

- Acquisition/Mergers

- India Water Industry Outlook, 2023

- Current Scenario

- Government Initiatives

- Others (Sustainable Developments, etc.)

- India Water Properties Facts, 2024

- State-wise PH level or Water properties

- Suitability of Water Purifier type for States as per the Water Properties

- India State Wise Drinking Water Purification Methods- By Number of Households

- India State Wise Water Purifier Penetration, 2024

- National Average Vs States

- India Residential Water Purifier Market Pricing Analysis Per Product

- India Residential Water Purifier Market Trends & Insights

- India Residential Water Purifier Market Dynamics

- Growth Drivers

- Challenges

- India Residential Water Purifier Market Hotspots & Opportunities

- India Residential Water Purifier Market Value Chain & Margin Analysis

- India Residential Water Purifier Market Regulations & Policy Standards

- India Residential Water Purifier Market Import-Export Analysis

- India Residential Water Purifier Market Best-Selling Products

- India Residential Water Purifier Market Customer Analysis, 2023

- Key Factors Impacting the Purchase Decision

- Brand Awareness and Benefits associated with Water Purification Systems

- Challenges Faced/Need-Gap Analysis

- Source of Awareness

- Amount in Consideration to be Spent for Purchasing

- Perception of Purchasing Water Purification Systems Online

- Brands in Consideration

- India Residential Water Purifier Key Market Risk Analysis

- Diversifiable Risk

- Non Diversifiable Risk

- India Residential Water Purifier Market Product Purchasing Power Matrix

- India Residential Water Purifier Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Share & Analysis

- By Technology

- Reverse Osmosis (RO)- Market Size & Forecast 2019-2030, USD Million & Thousand Units

- Ultraviolet (UV)- Market Size & Forecast 2019-2030, USD Million & Thousand Units

- Gravity Based- Market Size & Forecast 2019-2030, USD Million & Thousand Units

- Others (Ultrafiltration (UF), RO+UV+UF, etc.)- Market Size & Forecast 2019-2030, USD Million & Thousand Units

- By Portability

- Non-Portable- Market Size & Forecast 2019-2030, USD Million & Thousand Units

- Portable- Market Size & Forecast 2019-2030, USD Million & Thousand Units

- By Capacity

- Up to 6L- Market Size & Forecast 2019-2030, USD Million & Thousand Units

- Above 6L- Market Size & Forecast 2019-2030, USD Million & Thousand Units

- By Sales Channel

- Direct Sales- Market Size & Forecast 2019-2030, USD Million & Thousand Units

- Retail- Market Size & Forecast 2019-2030, USD Million & Thousand Units

- Online- Market Size & Forecast 2019-2030, USD Million & Thousand Units

- By Region

- North

- South

- East

- West

- Central

- By Company

- Competition Characteristics

- Market Revenues and Units Sold By Leading Companies

- Eureka Forbes Limited

- Units Sold Vs Revenues

- Kent RO Systems Limited

- Units Sold Vs Revenues

- Hindustan Unilever

- Units Sold Vs Revenues

- Livpure

- Units Sold Vs Revenues

- LG Electronics

- Units Sold Vs Revenues

- Eureka Forbes Limited

- Best Selling Models- By Brands

- Eureka Forbes Limited

- Units Sold Vs Revenues

- Kent RO Systems Limited

- Units Sold Vs Revenues

- Hindustan Unilever

- Units Sold Vs Revenues

- Livpure

- Units Sold Vs Revenues

- LG Electronics

- Units Sold Vs Revenues

- Eureka Forbes Limited

- By Technology

- Market Size & Analysis

- India Reverse Osmosis (RO) Residential Water Purifier Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenue (USD Million)

- By Units Sold (Thousands)

- Market Share & Analysis

- By Capacity- Market Size & Forecast 2019-2030, USD Million & Thousand Units

- By Sales Channel- Market Size & Forecast 2019-2030, USD Million & Thousand Units

- By Region- Market Size & Forecast 2019-2030, USD Million & Thousand Units

- By Company Market Size & Forecast 2019-2030, USD Million & Thousand Units

- Market Size & Analysis

- India Ultraviolet (UV) Residential Water Purifier Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenue (USD Million)

- By Units Sold (Thousands)

- Market Share & Analysis

- By Capacity- Market Size & Forecast 2019-2030, USD Million & Thousand Units

- By Sales Channel- Market Size & Forecast 2019-2030, USD Million & Thousand Units

- By Region- Market Size & Forecast 2019-2030, USD Million & Thousand Units

- By Company- Market Size & Forecast 2019-2030, USD Million & Thousand Units

- Market Size & Analysis

- India Gravity-Based Residential Water Purifier Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenue (USD Million)

- By Units Sold (Thousands)

- Market Share & Analysis

- By Capacity- Market Size & Forecast 2019-2030, USD Million & Thousand Units

- By Sales Channel- Market Size & Forecast 2019-2030, USD Million & Thousand Units

- By Region- Market Size & Forecast 2019-2030, USD Million & Thousand Units

- By Company Market Size & Forecast 2019-2030, USD Million & Thousand Units

- Market Size & Analysis

- India Residential Water Purifier Market Key Strategic Imperatives for Growth & Success

- Competition Outlook

- Company Profiles

- Eureka Forbes Limited

- Business Description

- Dealers and Distributors

- Product Portfolio & Features

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kent RO Systems Limited

- Business Description

- Dealers and Distributors

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Hindustan Unilever Limited

- Business Description

- Dealers and Distributors

- Product Portfolio & Features

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Whirlpool of India

- Business Description

- Dealers and Distributors

- Product Portfolio & Features

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Ion Exchange (India) Ltd. (Zero B)

- Business Description

- Dealers and Distributors

- Product Portfolio & Features

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Blue Star Limited

- Business Description

- Dealers and Distributors

- Product Portfolio & Features

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Livepure Smart Homes Private Limited

- Business Description

- Product Portfolio & Features

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- LG Electronics

- Business Description

- Dealers and Distributors

- Product Portfolio & Features

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- A. O. Smith India Water Products Pvt. Ltd.

- Business Description

- Dealers and Distributors

- Product Portfolio & Features

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- UrbanClap Technologies India Pvt. Ltd.

- Business Description

- Dealers and Distributors

- Product Portfolio & Features

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Panasonic India Pvt. Ltd.

- Business Description

- Dealers and Distributors

- Product Portfolio & Features

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Bepure

- Business Description

- Dealers and Distributors

- Product Portfolio & Features

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kinsco

- Business Description

- Dealers and Distributors

- Product Portfolio & Features

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Eureka Forbes Limited

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making