India Digital Out-of-Home Advertising Market Research Report: Forecast (2025-2030)

India Digital Out-of-Home Advertising Market - By Format Type (Digital Billboards, Video Advertising, Ambient Advertising, Others), By Application (Outdoor, Indoor), By End User (R...etail & Consumer Goods, Government, Recreation, Real Estate, BFSI, Transportation, Education) and Others Read more

- ICT & Electronics

- Mar 2025

- Pages 120

- Report Format: PDF, Excel, PPT

Market Insights & Analysis: India Digital Out-of-Home Advertising Market (2025-2030):

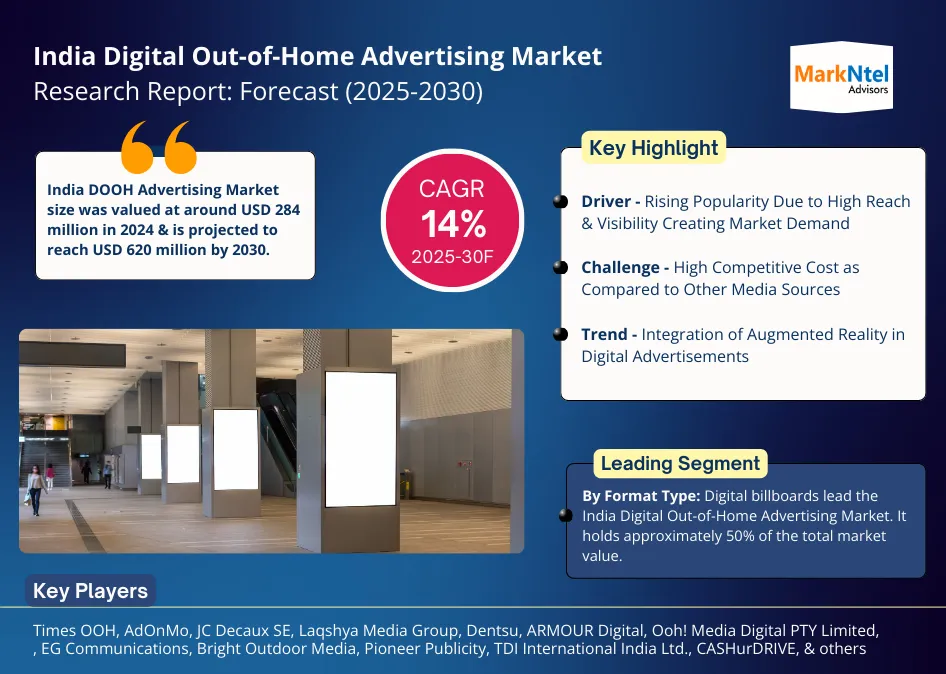

The India Digital Out-of-Home Advertising Market size was valued at around USD 284 million in 2024 and is projected to reach USD 620 million by 2030. Along with this, the market is estimated to grow at a CAGR of around 14% during the forecast period, i.e., 2025-30. Various factors are attributed to the growing market. The Digital Out-of-Home (DOOH) advertising market in India is witnessing a significant uptrend owing to programmatic advertising and real-time analytics. Programmatic advertising uses data and technology to automate the buying and selling of ad space, ensuring the right ads reach the right audience at the right time, thereby increasing reach and the return on investment.

Real-time analytics enables a form of continuous data-based planning that allows advertisers to make real-time decisions based on their data and adjust their campaigns on an ongoing basis. These both factors combined will help in leading the market rapidly in upcoming years. For instance, in 2023, Ormax OHM's partnership with Quividi, Intel India & Times OOH has enabled more targeted and cost-efficient campaigns with world-class solutions that enabled advanced audience analytics and automation. This method is gaining traction, especially in South India, with Bangalore as one of the target markets where bus shelter networks were made prime targets. Also, this is associated with the fact that the South Indian region has a high number of screens placed in traffic areas in cities like Chennai, Hyderabad, and Bangalore. These cities provide screen availability through various channels involving transit media, airports, bus terminals, malls, and metro stations.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020-23 |

|

Base Years

|

2024

|

|

Forecast Years

|

2025-30

|

| Market Value in 2024 | USD 284 Million |

| Market Value in 2030 | USD 620 Million |

| CAGR (2025-30) | 14% |

| Top Key Players | Times OOH, AdOnMo, JC Decaux SE, Laqshya Media Group, Dentsu, ARMOUR Digital, Ooh! Media Digital PTY Limited, Moving Walls India Private Limited, PlayAds Advertisement Spaces Pvt. Ltd., Bellplus Media, EG Communications, Bright Outdoor Media, Pioneer Publicity, TDI International India Ltd., CASHurDRIVE, and others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

Moreover, transit media is greatly benefitting the growth of the Digital Out-of-Home (DOOH) advertising market in India. With transit infrastructure construction on the rise, aerodromes and metros-transit media are game changers. Advertising in these highest-traffic areas provides high dwell times and quality audiences. For Instance, as per FICCI & EY 2024 reports, digital media is expected to reach 15% of the total revenue of the Indian out-of-home advertising media market, with transit media comprising 40% of it by 2026. The growth of transit media is attributed to its ability to harness data and analytics for better-targeted campaigns. For instance, Times OOH conducts passenger profile studies that reveal shopping preferences and entertainment habits, assisting advertisers in devising precise and far-reaching campaigns. These factors combined will further flourish the market growth.

India Digital Out-of-Home Advertising Market Driver:

Rising Popularity Due to High Reach & Visibility Creating Market Demand – The increasing popularity of digital Out-of-Home advertising in India owing to greater reach and visibility is fueling the growth of the market. Set up in bustling urban centers like major intersections, DOOH screens target a diverse and larger audience. Its share of the total OOH market is expected to grow from 20% in 2024 to 30% by the end of 2025, indicating its high reach & popularity. For instance, the digital billboards on the Western Express Highway in Mumbai are viewed by hundreds of thousands of commuters daily, providing extensive exposure to brands and creating market demand in these areas. In addition, the vibrant & high-resolution nature of digital billboards allows for compelling advertisements that can easily be revised to reflect current promotions or events. For instance, continuous marquee events set to hit the country for the DOOH industry in 2025 will open new avenues like the Delhi elections, Maha Kumbh, and Asia Cup, among others. This creates a high market demand for digital advertisements of these events. This high reach and visibility of DOOH advertising make it a very attractive area for advertisers, since it allows them to maximize impact, which again boosts demand.

India Digital Out-of-Home Advertising Market Opportunity:

Expansion in Tier 2 & Tier 3 Cities – This offers an opportunity for the India Digital Out-of-Home Advertising Market. These towns are growing rapidly in urbanization and budding digital adoption, thereby proving to be viable options for advertisers. Cities like Jaipur, Indore, and Surat have shown fantastic growth regarding digital engagement in recent years, considering which companies have already started to capitalize on the opportunity. For instance, the Media Ant Company in Jaipur is providing DOOH services in Sangenar near the Airport. By grabbing on these upcoming markets, advertisers have the opportunity to nail into more relevant and growing customer bases. Tier 2 and Tier 3 cities with lower real estate rates and a skilled employee base, prove more cost-effective than metropolitan areas in terms of business. The growing end-users like real estate in these cities are creating more opportunities for the market players to advertise their properties through this medium. This expansion could ease the pressure on congested metro markets while opening up new vistas for growth in the DOOH advertising sector.

India Digital Out-of-Home Advertising Market Challenge:

High Competitive Cost as Compared to Other Media Sources Impeding Market Growth – High competitive costs as compared to other media sources are dragging the market down. DOOH is pricier due to the costs associated with digital screens, installation, and maintenance of its structure as compared to conventional media such as banners, online ads, television, and print. For Instance, the cost of a month-long advertisement on a digital billboard widely varies from approx. USD 36 (Rs.3K) to USD 24K (Rs.20 Lakhs), depending on the location and size of the display. For advertisers with budget constraints, the high costs might prevent them from using this, owing to the limitation of their competitive capabilities against the big, established competition. Adding up to this is the cutthroat competition among prime advertising space in prime-potential traffic areas where astronomical costs are paid by advertisers for occupying a coveted location. This high cost of advertisement posed challenges to the growth and accessibility of DOOH advertising in India.

India Digital Out-of-Home Advertising Market Trend:

Integration of Augmented Reality in Digital Advertisements – Integrating augmented reality in digital Out-of-Home advertising is a trend gaining traction in India. This technology combines digital and physical worlds to provide a unique immersive interactive experience to end consumers. This phenomenon is changing the way brands connect with their audience, making their adverts more interactive and memorable. For instance, Pepsi is using augmented reality in the bus stop campaign, featuring digital screens that present surprises animatedly, which captivates passersby. Also, One Plus incorporated AR technology at the launch of the Nord phone through a virtual event, including display advertisements broadcasted in India as well as globally. It provided a completely different and immersive customer experience by allowing users to scan & view the product in 3D on their cell phones. Brands using AR may make advertising alive, multi-sensory, and personalized, bridging the digital and physical divide. This emergent tendency is gaining relevance as it provides brands with an opportunity to connect to consumers in a unique bond and impact them for a longer span, making it a significant market trend.

India Digital Out-of-Home Advertising Market (2025-2030): Segmentation Analysis

The India Digital Out-of-Home Advertising Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the national level. Based on the analysis, the market has been further classified as:

By Format Type:

- Digital Billboards

- Video Advertising

- Ambient Advertising

- Others

By format type, digital billboards lead the India Digital Out-of-Home Advertising Market. It holds approximately 50% of the total market value. This leadership is attributed to significant investments that are made by various market players in the country. Also, they are strategically positioned in high-traffic urban areas, including highly populated streets, highways, shopping malls, and transit stations, ensuring maximum visibility and audience reach. The high-resolution screens allow multiple ads to be displayed at the same time for enhanced efficiency, giving them an advantage over other format types. The reprogrammable nature of the boards lets advertisers remotely change content quickly and deliver messages for time-sensitive campaigns, making them an effective choice in India.

Also, they can display interactive and engaging content to maximize advertising impact providing more opportunities for the advertisers. Further driving this maturation are new advances in technology and a growing desire for inventive advertising solutions. It is set to continue to dominate the DOOH market of India during the forecast period.

By End User:

- Retail & Consumer Goods

- Government

- Recreation

- Real Estate

- BFSI

- Transportation

- Education

- Others

Based on end users, Retail & Consumer Goods lead the India Digital Out-of-Home Advertising Market. It holds around 40% of the total market. DOOH advertising draws considerable attention from retail advertisers because of its visibility and impact. The retail environments found in shopping malls, supermarkets, and storefronts provide a good platform for DOOH advertising to a wide variety of audiences across the country. Dynamic and interactive by nature, DOOH advertising can facilitate real-time engagement of brands & consumers, thus creating an experience that leads to increased purchase conversion. In addition, it is easily modifiable and adaptable to target groups, which helps in supporting retail delivery in a store environment. This further helps in appealing to them regarding present customer shopping tendencies. Thus, in consonance with consumer trends of digital and omnichannel shopping experiences, the Retail & Consumer goods industry continues investing in DOOH advertising to ensure they remain competitive and relevant in the market. The segment will continue to bolster during the forecast period.

India Digital Out-of-Home Advertising Industry Recent Development:

- September 2024: AdOnMo raised USD 25 Million in a funding round led by Rigel Capital and Srinath Mars. This round of funding will help in expanding its presence in India and increase the number of its digital screens.

- July 2024: Times OOH secures Exclusive Advertising Rights for Mumbai Metro Line 3, reinforcing its leadership in urban transit advertising. Awarded by Mumbai Metro Rail Corporation Limited (MMRCL), the mandate includes exclusive advertising rights across 27 stations and 31 trains, approximately 20,000 sqm of advertising space, and station semi-naming rights from Cuffe Parade to Aarey.

Gain a Competitive Edge with Our India Digital Out-of-Home Advertising Market Report

- India Digital Out-of-Home Advertising Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps business organizations to gain a holistic understanding of market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing business organizations to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- India Digital Out-of-Home Advertising Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, business organizations can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- India Digital Out-of-Home Advertising Market Trends & Deployments

- India Digital Out-of-Home Advertising Market Dynamics

- Growth Drivers

- Challenges

- India Digital Out-of-Home Advertising Market Opportunities & Hotspots

- India Digital Out-of-Home Advertising Market Value Chain Analysis

- India Digital Out-of-Home Advertising Market Regulations and Policy

- India Digital Out-of-Home Advertising Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Format Type

- Digital Billboards- Market Size & Forecast 2020-2030, USD Million

- Video Advertising- Market Size & Forecast 2020-2030, USD Million

- Ambient Advertising- Market Size & Forecast 2020-2030, USD Million

- Others- Market Size & Forecast 2020-2030, USD Million

- By Application

- Outdoor- Market Size & Forecast 2020-2030, USD Million

- Indoor- Market Size & Forecast 2020-2030, USD Million

- By End User

- Retail & Consumer Goods- Market Size & Forecast 2020-2030, USD Million

- Government- Market Size & Forecast 2020-2030, USD Million

- Recreation- Market Size & Forecast 2020-2030, USD Million

- Real Estate- Market Size & Forecast 2020-2030, USD Million

- BFSI- Market Size & Forecast 2020-2030, USD Million

- Transportation- Market Size & Forecast 2020-2030, USD Million

- Education- Market Size & Forecast 2020-2030, USD Million

- Others- Market Size & Forecast 2020-2030, USD Million

- By Region

- North

- South

- East

- West

- By Format Type

- By Company

- Competition Characteristics

- Market Share and Analysis

- Market Size & Analysis

- India Outdoor Digital Out-of-Home Advertising Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Format Type- Market Size & Forecast 2020-2030, USD Million

- By End User -Market Size & Forecast 2020-2030, USD Million

- By Region- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- India Indoor Digital Out-of-Home Advertising Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Format Type- Market Size & Forecast 2020-2030, USD Million

- By End User -Market Size & Forecast 2020-2030, USD Million

- By Region- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- India Digital Out-of-Home Advertising Market Strategic Imperatives for Growth & Success

- Competition Outlook

- Company Profiles

- Times OOH

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- AdOnMo

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- JC Decaux SE

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Laqshya Media Group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Dentsu

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- ARMOUR Digital

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Ooh! Media Digital PTY Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Moving Walls India Private Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- PlayAds Advertisement Spaces Pvt. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Bellplus Media

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- EG Communications

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Bright Outdoor Media

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Pioneer Publicity

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- TDI International India Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- CASHurDRIVE

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Others

- Times OOH

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making