India Cancer Treatment Drugs Market Research Report: Forecast (2025-2030)

India Cancer Treatment Drugs Market Report - By Treatment Type (Chemotherapy, Targeted Therapy, Immunotherapy, Hormonal Therapy, Other Treatment Types), By Drug Class (Cytotoxic... Drugs, [Alkylating Agents, Antimetabolites, Others], Targeted Drugs, [Monoclonal Antibodies, Others], Hormonal Drugs, Others), By Type (Blood Cancer, Breast Cancer, Colorectal Cancer, Cervical Cancer, Prostate Cancer, Gastrointestinal Cancer, Gynecologic Cancer, Non-Hodgkin’s Cancer, Respiratory/ Lung Cancer, Stomach Cancer, Other Cancers), By Dosage Form (Solid, [Tablets, Capsules], Liquid, Injectable, Prefilled Syringes, Others), By End-Users (Hospitals, Specialty Clinics, Cancer and Radiation Therapy Centers), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) and others Read more

- Healthcare

- Mar 2023

- Pages 132

- Report Format: PDF, Excel, PPT

Market Insights & Analysis: India Cancer Treatment Drugs Market (2025-30)

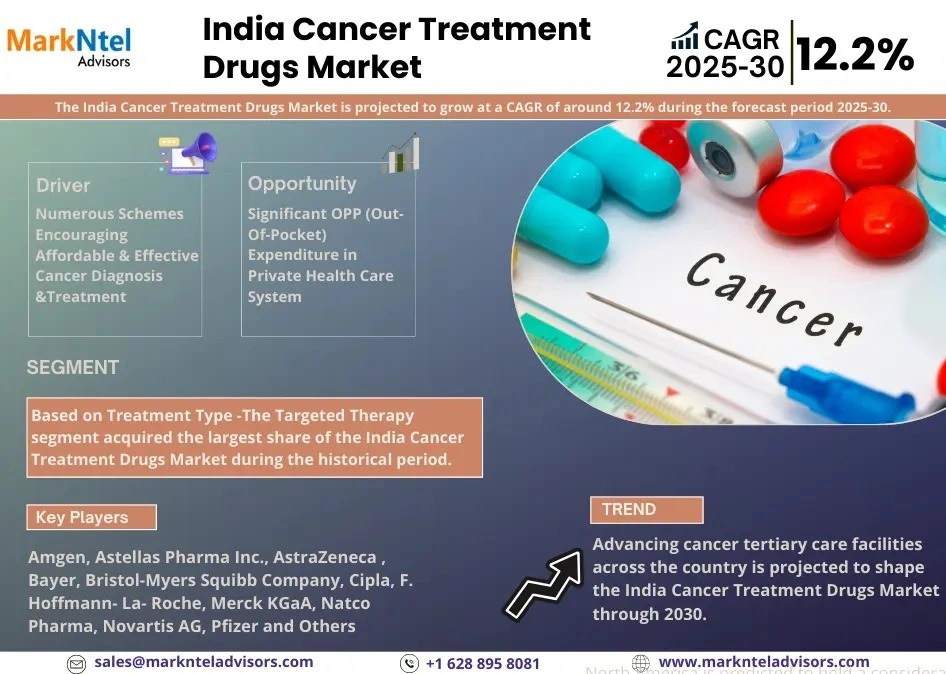

The India Cancer Treatment Drugs Market is projected to grow at a CAGR of around 12.2% during the forecast period, i.e., 2025-30. With estimated 1.39 million cancer cases in 2020, the disease has become a public health concern in India. Earlier, the total number of deaths from cancer in India was more than 0.8 million in 2019. It is estimated that one woman dies of cervical cancer every 8 minutes in India due to cancer, according to the National Institute of Cancer Prevention and Research. Of every two women newly diagnosed with breast cancer, one dies of it in India. Moreover, tobacco consumption in the country is burgeoning, thereby mounting the total number of deaths from tobacco cancer.

Continuous growth in cancer cases owing to changing eating habits, food adulteration, environmental changes, growth in chemical establishments, etc., are the major factors for escalating cancer cases in India. Other than these, the sedentary lifestyle and excessive intake of junk food have led to an increase in cancer patients over the past few years. As a result, the need for timely diagnosis and preventive care is surging at an exponential pace, leading to extensive investments in R&D, thereby setting the stage for medicine manufacturers to come up with more effective drugs to address such escalation in the country. Additionally, India has witnessed remarkable opportunities for venture capitalists and investors, as the developed markets are comparatively saturated in this industry.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020-23 |

|

Base Years

|

2024

|

|

Forecast Years

|

2025-30

|

| CAGR (2025-30) | 12.2% |

| Top Key Players | Amgen, Astellas Pharma Inc., AstraZeneca , Bayer, Bristol-Myers Squibb Company, Cipla, F. Hoffmann- La- Roche, Merck KGaA, Natco Pharma, Novartis AG, Pfizer |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

Further, expanding focus on oncology in All India Institute of Medical Sciences (AIIMS) and effective diagnosis and treatment of cancer under the Ayushman Bharat Scheme is likely to boost the sales of cancer treatment drugs. Furthermore, ever-improved cancer care infrastructure with upgraded facilities for tertiary care in recent years has positively influenced the industry with exploding need for effective medicines. Primarily in the states of Madhya Pradesh, Odisha, Assam, Uttarakhand, Himachal Pradesh, Punjab, Haryana, Delhi, Maharashtra, Karnataka, etc., where the cases are quite prominent, with the major prevalence of lip, oral, breast, and cervical cancer. Thus, requiring the drugs related to these types of cancers and accelerating their manufacturing in the forecast period, thus aiding in enhancing the India Cancer Treatment Drugs Market size.

India Cancer Treatment Drugs Market Key Driver:

Numerous Schemes Encouraging Affordable & Effective Cancer Diagnosis &Treatment - Cancer treatment has been one of the main focal areas of the Pradhan Mantri Jan Arogya Yojana in order to protect the beneficiaries from the catastrophic costs of cancer treatment. The delivery of services under the Ayushman Bharat Health and Wellness Centers (AB-HWCs) includes screening for three common malignancies, including oral, breast, and cervical cancers and other common non-communicable diseases.

Along similar lines, The National Pharmaceutical Pricing Authority (NPPA), which is part of the Ministry of Chemicals and Fertilizers, released a list of 390 non-scheduled anti-cancer medications in 2019 with MRP reductions of up to 87%. This action helped 22 lakh cancer patients in the nation and would save consumers about Rs. 800 crores annually. Following a decade of caution and organic growth, Indian pharmaceutical businesses are currently on an acquisition binge. And cancer medications seem to be their primary focus, thus driving the drug industry in the long run.

India Cancer Treatment Drugs Market Possible Restraint:

Significant OPP (Out-Of-Pocket) Expenditure in Private Health Care System - With substantially higher expenditure demonstrated by the private sector, access to drugs such as trastuzumab, rituximab, and bortezomib has been restricted by rising catastrophic spending. According to the research funded by the National Institute for Health Research (NIHR), India Institute of the University of Birmingham, and the Global Challenges program of the University of Birmingham, the government funds only encompass a quarter to a third of cancer treatment cost, compelling patients to make out-of-pocket expenditure ranging from 19,494 to 295,679 Indian Rupees (INR) based on the cancer type.

Since OPP payments include cost-sharing, self-medication, and other expenditure borne directly by a patient and are not fully covered under the insurance, the burden for health goods and services folds, which might influence the industry negatively in the coming years.

India Cancer Treatment Drugs Market Growth Opportunity:

Ayurveda-Based Cancer Medication and Therapies - The government has made numerous efforts to encourage Ayurveda research and the development of cancer therapies. The Central Council for Research in Ayurvedic Sciences (CCRAS), a government-established independent organization, has conducted research on cancer as well as work on drug development and the documentation of medical procedures, including the creation of AYUSH QOL2C to enhance the quality of life for those with the disease. Thus, Ayurveda-based medications are likely to present lucrative prospects for the industry contenders in the coming years.

India Cancer Treatment Drugs Market Key Trend:

Advancing Cancer Tertiary Care Facilities Across the Country -The Central Government is strengthening the Tertiary Care of Cancer Scheme to improve the resources available for tertiary cancer care. Under the program, 19 State Cancer Institutes (SCIs) and 20 Tertiary Care Cancer Centers (TCCCs) have so far received approval. Up until now, six institutions have been set up in Sikkim, Uttar Pradesh, Gujarat, Bihar, Tamil Nadu, and Kerala. The 33 other institutes are in various phases of development. For sounder care, therapies and medications are required, and thus advancing tertiary care is expected to shape the industry in the coming years.

India Cancer Treatment Drugs Market (2024-30): Segmentation Analysis

The India Cancer Treatment Drugs Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2024–2030 at the national level. Based on the analysis, the market has been further classified as:

Based on Treatment Type,

- Chemotherapy

- Targeted Therapy

- Immunotherapy

- Hormonal Therapy

- Other Treatment Types

The Targeted Therapy segment acquired the largest share of the India Cancer Treatment Drugs Market during the historical period. It is primarily due to the enormous potential shown by targeted therapies in killing malignant cells only, advanced efficacy, and higher survival rates associated with their use. On the other hand, the immunotherapy segment is expected to register the fastest growth during 2025-30. This massive growth is associated with the intensification of the incidences of cancer in India and the lack of related medical assistance in the country. Furthermore, India, being one of the low-resource health systems, does not include expensive cancer medicines in their public reimbursement schemes, posing catastrophic expenditure risks. Thus necessitating a careful assessment of systemic anticancer therapy before they are actually included in national formularies.

Based on Drug Class,

- Cytotoxic Drugs

- Targeted Drugs

- Hormonal Drugs

- Others

The majority of highest-priority medicines were conventional cytotoxic therapy. Well-established cytotoxic drugs, exposed to global generic competition in the past 10-20 years, include doxorubicin, cyclophosphamide, paclitaxel, carboplatin, methotrexate, cytarabine, capecitabine, fluorouracil, and gemcitabine. Likewise, Generic Chemotherapy agents are the most high-priority cancer medicines by Indian oncologists as they facilitate substantial improvements in survival and are already included in WHO EML. In May 2022, Roche Pharma launched PHESGO - the first ever fixed-dose formulation in oncology to combine two monoclonal antibodies - Perjeta (pertuzumab) and Herceptin (trastuzumab) with hyaluronidase, administered by subcutaneous injection in combination with intravenous (IV) chemotherapy, for the treatment of early and metastatic breast cancer

India Cancer Treatment Drugs Industry Recent Developments

- In August 2022, AstraZeneca India, a pharmaceutical company, announced that the Drugs Controller General of India had given the go-ahead to commercialize its medication for breast cancer treatment, Lynparza (Olaparib), as a monotherapy. Lynparza is the first and only approved medicine targeting BRCA (Breast Cancer gene) mutations in early-stage breast cancer.

- In June 2022, For the first time in history, a small clinical trial done by Memorial Sloan Kettering Cancer Center discovered that Dostarlimab, a medicine made in a lab that functions as a surrogate for antibodies in the human body, has the potential to be a 'possible' cancer cure for one of the most lethal tumors.

Gain a Competitive Edge with Our India Cancer Treatment Drugs Market Report

- India Cancer Treatment Drugs Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- India Cancer Treatment Drugs Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- India Cancer Treatment Drugs Market Policies, Regulations, and Product Standards

- India Cancer Treatment Drugs Market Trends & Developments

- India Cancer Treatment Drugs Market Dynamics

- Growth Drivers

- Challenges

- India Cancer Treatment Drugs Market Hotspot & Opportunities

- India Cancer Treatment Drugs Market Value Chain Analysis

- India Cancer Treatment Drugs Market Outlook, 2020-2030F

- Market Size & Outlook

- By Revenue (USD Million)

- Market Share & Outlook

- By Treatment Type

- Chemotherapy- Market Size & Forecast 2020-2030, USD Million

- Targeted Therapy- Market Size & Forecast 2020-2030, USD Million

- Immunotherapy- Market Size & Forecast 2020-2030, USD Million

- Hormonal Therapy- Market Size & Forecast 2020-2030, USD Million

- Other Treatment Types- Market Size & Forecast 2020-2030, USD Million

- By Treatment Type

- By Drug Class

- Cytotoxic Drugs- Market Size & Forecast 2020-2030, USD Million

- Alkylating Agents- Market Size & Forecast 2020-2030, USD Million

- Antimetabolites- Market Size & Forecast 2020-2030, USD Million

- Others- Market Size & Forecast 2020-2030, USD Million

- Targeted Drugs- Market Size & Forecast 2020-2030, USD Million

- Monoclonal Antibodies- Market Size & Forecast 2020-2030, USD Million

- Others- Market Size & Forecast 2020-2030, USD Million

- Hormonal Drugs- Market Size & Forecast 2020-2030, USD Million

- Others- Market Size & Forecast 2020-2030, USD Million

- Cytotoxic Drugs- Market Size & Forecast 2020-2030, USD Million

- By Type

- Blood Cancer- Market Size & Forecast 2020-2030, USD Million

- Breast Cancer- Market Size & Forecast 2020-2030, USD Million

- Colorectal Cancer- Market Size & Forecast 2020-2030, USD Million

- Cervical Cancer- Market Size & Forecast 2020-2030, USD Million

- Prostate Cancer- Market Size & Forecast 2020-2030, USD Million

- Gastrointestinal Cancer- Market Size & Forecast 2020-2030, USD Million

- Gynecologic Cancer- Market Size & Forecast 2020-2030, USD Million

- Non-Hodgkin’s Cancer- Market Size & Forecast 2020-2030, USD Million

- Respiratory/ Lung Cancer- Market Size & Forecast 2020-2030, USD Million

- Stomach Cancer- Market Size & Forecast 2020-2030, USD Million

- Other Cancers- Market Size & Forecast 2020-2030, USD Million

- By Dosage Form

- Solid- Market Size & Forecast 2020-2030, USD Million

- Tablets- Market Size & Forecast 2020-2030, USD Million

- Capsules- Market Size & Forecast 2020-2030, USD Million

- Liquid- Market Size & Forecast 2020-2030, USD Million

- Injectable- Market Size & Forecast 2020-2030, USD Million

- Prefilled Syringes- Market Size & Forecast 2020-2030, USD Million

- Others- Market Size & Forecast 2020-2030, USD Million

- Solid- Market Size & Forecast 2020-2030, USD Million

- By End-Users

- Hospitals- Market Size & Forecast 2020-2030, USD Million

- Specialty Clinics- Market Size & Forecast 2020-2030, USD Million

- Cancer and Radiation Therapy Centers- Market Size & Forecast 2020-2030, USD Million

- By Distribution Channel

- Hospital Pharmacies- Market Size & Forecast 2020-2030, USD Million

- Retail Pharmacies- Market Size & Forecast 2020-2030, USD Million

- Online Pharmacies- Market Size & Forecast 2020-2030, USD Million

- By Region

- North

- South

- East

- West

- By Company

- Company Revenue Shares

- Competitor Characteristics

- Market Size & Outlook

- India Chemotherapy Cancer Treatment Drugs Market Outlook, 2020-2030F

- Market Size & Outlook

- By Revenue (USD Million)

- Market Share & Outlook

- By Drug Class- Market Size & Forecast 2020-2030, USD Million

- By Type- Market Size & Forecast 2020-2030, USD Million

- By End-Users- Market Size & Forecast 2020-2030, USD Million

- Market Size & Outlook

- India Targeted Therapy Cancer Treatment Drugs Market Outlook, 2020-2030F

- Market Size & Outlook

- By Revenue (USD Million)

- Market Share & Outlook

- By Drug Class- Market Size & Forecast 2020-2030, USD Million

- By Type- Market Size & Forecast 2020-2030, USD Million

- By End-Users- Market Size & Forecast 2020-2030, USD Million

- Market Size & Outlook

- India Immunotherapy Cancer Treatment Drugs Market Outlook, 2020-2030F

- Market Size & Outlook

- By Revenue (USD Million)

- Market Share & Outlook

- By Drug Class- Market Size & Forecast 2020-2030, USD Million

- By Type- Market Size & Forecast 2020-2030, USD Million

- By End-Users- Market Size & Forecast 2020-2030, USD Million

- Market Size & Outlook

- India Hormonal Therapy Cancer Treatment Drugs Market Outlook, 2020-2030F

- Market Size & Outlook

- By Revenue (USD Million)

- Market Share & Outlook

- By Drug Class- Market Size & Forecast 2020-2030, USD Million

- By Type- Market Size & Forecast 2020-2030, USD Million

- By End-Users- Market Size & Forecast 2020-2030, USD Million

- Market Size & Outlook

- India Cancer Treatment Drugs Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Amgen

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Astellas Pharma Inc.

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- AstraZeneca

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Bayer

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Bristol-Myers Squibb Company

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Cipla

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- F. Hoffmann- La- Roche

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Merck KGaA

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Natco Pharma

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Novartis AG

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Amgen

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making