India Battery Energy Storage System (BESS) Market Research Report: Forecast (2025-2030)

India Battery Energy Storage System (BESS) Market - By Type (Lithium-Ion Battery Lead Acid Battery Flow Battery Others) By Capacity (Small Scale (Less than 1MW) Large Scale (Greate...r than 1 MW)) By Ownership (Customer-Owned Third-Party Owned Utility Owned) By Connectivity (Off-Grid On-Grid) By Application (Residential Commercial Utility Others) and Others Read more

- Energy

- Jan 2025

- Pages 136

- Report Format: PDF, Excel, PPT

Market Insights & Analysis: India Battery Energy Storage System (BESS) Market (2025-2030):

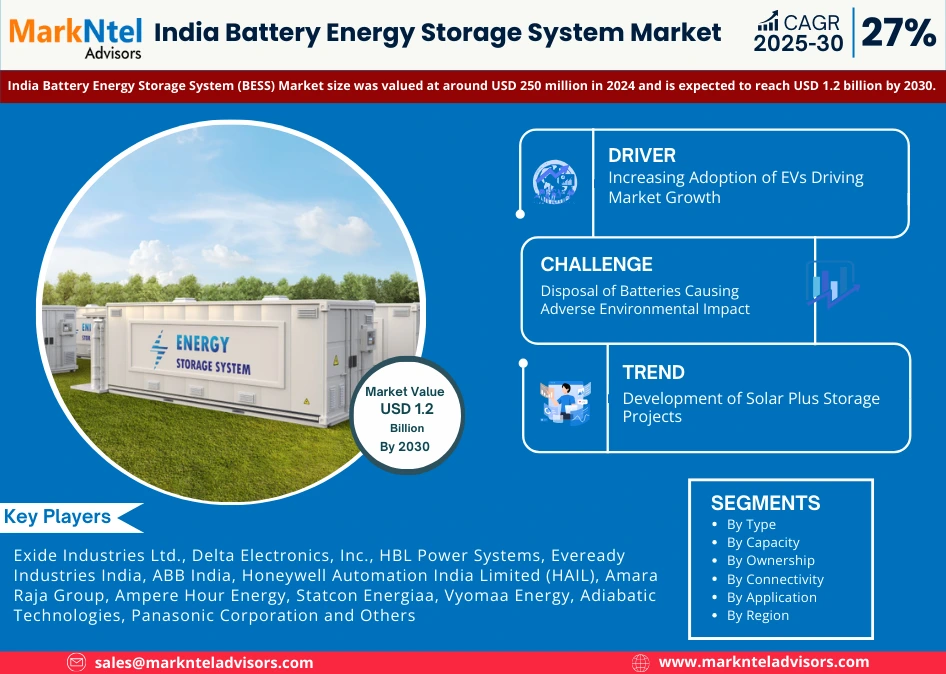

The India Battery Energy Storage System (BESS) Market size was valued at around USD 250 million in 2024 and is expected to reach USD 1.2 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 27% during the forecast period, i.e., 2025-30. Various factors are attributed to the growing market. Government initiatives and policies are crucial for the growth of the BESS market in India. Some of the interventions encouraged by the National Framework for Promoting Energy Storage Systems include the legal status for energy storage systems as well as energy storage obligations, and waiver of inter-state transmission charges.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020-23 |

|

Base Years

|

2024

|

|

Forecast Years

|

2025-30

|

| Market Value in 2024 | USD 250 Million |

| Market Value in 2030 | USD 1.2 Billion |

| CAGR (2025-30) | 27% |

| Top Key Players | Exide Industries Ltd., Delta Electronics, Inc., HBL Power Systems, Eveready Industries India, ABB India, Honeywell Automation India Limited (HAIL), Amara Raja Group, Ampere Hour Energy, Baud Resources Nunam, Luminous, AES Corporation, Toshiba Corporation, Rays Power Infra, Statcon Energiaa, Vyomaa Energy, Adiabatic Technologies, Panasonic Corporation and Others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

Viability Gap Funding would support the performance of 4,000 MWh BESS installation projects for the period 2030-31, with the support worth a maximum of 40% of the capital cost of the installation project. Each one brings along its unique and individual specifications, such as the National Solar Mission and National Mission for Enhanced Energy Efficiency, where prior are doing appreciably large work in pushing non-fossil fuel-based energy resources. One such target outlined by the government, contributing further credence to the efforts on BESS to meet the targets, is extracting resources out of non-fossil fuel energy such that, out of cumulative installed energy capacity by 2030, 50% comes from non-fossil fuel sources. These interventions, along with incentives like budgetary support and regulatory measures, shall provide an effective enabling environment for the development and deployment of BESS initiatives within India.

Also, the market is seeing considerable growth due to declining battery prices. Battery prices have declined dramatically throughout the past decade, making BESS projects feasible in economic terms. In 2023, battery prices reached their lowest point due to moderation in raw material prices and increased production. For instance, tariffs for BESS projects in the current Gujarat utilities tender amounted to USD 5,448/MW/month, down from the USD 13,164/MW/month price in the first SECI tender in 2022. The drop-off makes BESS projects more competitive, accelerating their deployment in renewable energy intermittency management and grid stability improvements. As battery prices fall further, the market growth is only expected to intensify.

Furthermore, Grid stability is also one of the key factors that is deriving the market growth, The BESS technology helps in the balancing of electricity supply and demand, ensuring a stable and reliable power grid system. For instance, India's first commercial utility-scale BESS with a capacity of 20MW/40 MWh was set up in Delhi, which provided four hours of energy support daily for enhancing grid stability. The other aspect supporting grid stability is the government support for renewable energy projects along with battery storage by introducing a policy on battery storage worth USD 451 million which would provide 40% funding to battery storage projects that have a build capacity of at least 4,000MWh. These initiatives are expected to help in managing the variability and intermittency of renewable energy sources and improve power quality as a whole.

India Battery Energy Storage System (BESS) Market Driver:

Increasing Adoption of EVs Driving Market Growth – The increasing penetration & adoption of EVs are creating a high demand for BESS in the Indian market. These systems are essential in the creation of a robust charging infrastructure that ensures stable and efficient charging during peak hours. Around 1.94 million EV units were sold in 2024 in India which reflected the year-on-year growth rate of around 27%. This high penetration of EVs in the market is increasing the need for charging infrastructures, further driving the BESS market. With the rise in the adoption of Electric Vehicles, there is a higher requirement for developing efficient energy storage solutions. This supports India's overall transition to sustainable transportation and energy systems, further boosting the market growth. BESS also helps in stabilizing the grid & preventing overloading by storing energy in non-peak hours and later optimizing the charging process when in need. This makes it essential to manage energy efficiently and ensure a reliable power supply for EVs.

India Battery Energy Storage System (BESS) Market Opportunity:

Paradigm Shift Toward Low-Carbon Energy Generation – This creates tremendous opportunities for the BESS business in India. To achieve net-zero emissions by 2070, India is ramping up its focus on renewable sources such as solar and wind. At present, low-carbon-based electricity accounts for nearly 23% of India's total power generation, with a target of non-fossil fuel power capacity by 2030, the government is indicating a strong need for better storage solutions. BESS is integral in ensuring grid stability by managing the intermittency of the supply from renewable sources. The government plans for the development of an integrated transmission system by 2030, where 51.5 GW of battery energy storage capacity is included with an estimated investment of USD 29 Billion. This transition to low-carbon energy is helpful for climate objectives in India and also presents a chance to bring about technological progress and economic growth within the energy sector.

India Battery Energy Storage System (BESS) Market Challenge:

Disposal of Batteries Causing Adverse Environmental Impact – The environmental hazards posed by the batteries could become a significant hindrance to the market growth & expansion. Lead-acid and lithium-ion batteries are toxic when certain elements spill out from them and have a predisposed contaminating effect on the soil and groundwater. Due to the improper disposal of lead-acid batteries, an estimated 275 million children in India are severely affected, representing almost 30% of the total child population. The rise of electric vehicles and renewable energy storage has increased the quantity of battery waste, resulting in the leakage of hazardous chemicals.

To reduce the extent of this pollution, battery recycling, and waste management techniques have become more important. The policies formulated by the Government of India will further help in achieving this an eliminate the challenge

India Battery Energy Storage System (BESS) Market Trend:

Development of Solar Plus Storage Projects – A rapidly growing market trend is the development of solar-plus-storage projects. These combine solar PV systems with battery storage for stable and continuous power. The solar PV with a 120 MW battery energy storage system project by Tata Power Solar in Chhattisgarh will become the largest solar-plus-storage project in India. It has an annual production capacity of 243.53 million units and can reduce carbon emissions by 4.87 million tons over 25 years. It has recently conducted reverse auctions for 2 GW in solar-plus-storage capacity, aiming to be connected to the Inter-State Transmission System, which ultimately supports energy integration from renewable sources into the grid. Such projects are a demonstration of how solar-plus-storage solutions can support grid stability, meet peak demand, and ultimately help fulfill India's renewable energy goals.

India Battery Energy Storage System (BESS) Market (2025-2030): Segmentation Analysis

The India Battery Energy Storage System (BESS) Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the national level. Based on the analysis, the market has been further classified as:

Based on Capacity:

- Small Scale (Less than 1MW)

- Large Scale (Greater than 1MW)

By capacity, Large Scale (Greater Than 1MW) Leads the India Battery Energy Storage System (BESS) Industry. It holds around 74% of the total market value. This domination is due to their extreme importance in facilitating the integration of renewable energy sources and enhancing grid stability. Their demand is intensively greater due to the potential of storing high-capacity energy in vast amounts. This helps in the efficient management of energy during peak usage hours. Also, the supportive government policies that support the development of the renewable energy market are further leading to the adoption of these large-scale battery storage systems. The market is set for prominent growth with sustainability goals and carbon emission reduction missions with the use of these large-scale battery storage systems.

Based on Type:

- Lithium-Ion Battery

- Lead Acid Battery

- Flow Battery

- Others

Lithium-Ion Battery leads the India Battery Energy Storage System (BESS) Market with a market share of around 63%. The market domination is due to their longer lifespan which helps in fewer replacements. Also, their efficiency ensures high storage & better usage of energy. Moreover, the excess production capacity has reduced the manufacturing cost, which makes them more accessible & affordable. All these benefits make them the preferred choice of both manufacturers & consumers. Furthermore, the supportive government policies and incentives to support renewable energy further lead to the extensive adoption of these batteries. This demand is also catalyzed by the craze for EVs in the Indian market. Lithium-ion batteries are playing a crucial role in aiding carbon emission reduction alongside one of the top priorities for the government, which is aiding the development of sustainable energy.

India Battery Energy Storage System (BESS) Industry Recent Development:

- January 2025: India’s first battery energy storage system headed by BSES Rajdhani, to go live in south Delhi’s Kilokri in March 2025 approved by the Delhi Electricity Regulatory Commission.

- April 2024: Exide Industries Ltd. signed a memorandum of association with Hyundai Motors India & Kia Corporation to onboard EESL (a subsidiary of Exide) as a supplier of lithium-ion cells and battery packs for use in its electric vehicles.

Gain a Competitive Edge with Our India Battery Energy Storage System (BESS) Market Report

- India Battery Energy Storage System (BESS) Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps business organizations to gain a holistic understanding of market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing business organizations to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- India Battery Energy Storage System (BESS) Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, business organizations can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- India Battery Energy Storage System (BESS) Market Trends & Deployments

- India Battery Energy Storage System (BESS) Market Dynamics

- Growth Drivers

- Challenges

- India Battery Energy Storage System (BESS) Market Opportunities & Hotspots

- India Battery Energy Storage System (BESS) Market Value Chain Analysis

- India Battery Energy Storage System (BESS) Market Regulations and Policy

- India Battery Energy Storage System (BESS) Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- Lithium-Ion Battery- Market Size & Forecast 2020-2030, USD Million

- Lead Acid Battery- Market Size & Forecast 2020-2030, USD Million

- Flow Battery- Market Size & Forecast 2020-2030, USD Million

- Others

- By Capacity

- Small Scale (Less than 1MW)- Market Size & Forecast 2020-2030, USD Million

- Large Scale (Greater than 1 MW)- Market Size & Forecast 2020-2030, USD Million

- By Ownership

- Customer-Owned- Market Size & Forecast 2020-2030, USD Million

- Third-Party Owned- Market Size & Forecast 2020-2030, USD Million

- Utility Owned- Market Size & Forecast 2020-2030, USD Million

- By Connectivity

- Off-Grid- Market Size & Forecast 2020-2030, USD Million

- On-Grid- Market Size & Forecast 2020-2030, USD Million

- By Application

- Residential- Market Size & Forecast 2020-2030, USD Million

- Commercial- Market Size & Forecast 2020-2030, USD Million

- Utility- Market Size & Forecast 2020-2030, USD Million

- Others

- By Region

- North

- South

- East

- West

- By Company

- Competition Characteristics

- Market Share and Analysis

- By Type

- Market Size & Analysis

- India Residential Battery Energy Storage System (BESS) Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, USD Million

- By Capacity-Market Size & Forecast 2020-2030, USD Million

- By Ownership- Market Size & Forecast 2020-2030, USD Million

- By Connectivity -Market Size & Forecast 2020-2030, USD Million

- By Region- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- India Commercial Battery Energy Storage System (BESS) Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, USD Million

- By Capacity-Market Size & Forecast 2020-2030, USD Million

- By Ownership- Market Size & Forecast 2020-2030, USD Million

- By Connectivity -Market Size & Forecast 2020-2030, USD Million

- By Region- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- India Utility Battery Energy Storage System (BESS) Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, USD Million

- By Capacity-Market Size & Forecast 2020-2030, USD Million

- By Ownership- Market Size & Forecast 2020-2030, USD Million

- By Connectivity -Market Size & Forecast 2020-2030, USD Million

- By Region- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- India Battery Energy Storage System (BESS) Market Strategic Imperatives for Growth & Success

- Competition Outlook

- Company Profiles

- Exide Industries Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Delta Electronics, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- HBL Power Systems

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Eveready Industries India

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- ABB India

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Honeywell Automation India Limited (HAIL)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Amara Raja Group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Ampere Hour Energy

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Baud Resources Nunam

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Luminous

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- AES Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Toshiba Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Rays Power Infra

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Statcon Energiaa

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Vyomaa Energy

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Adiabatic Technologies

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Panasonic Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Others

- Exide Industries Ltd.

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making