Global Hypersonic Technology Market Research Report: Forecast (2024-2030)

Hypersonic Technology Market - By Type (Hypersonic Glide Missile, Hypersonic Cruise Missile, Hypersonic Spaceplanes), By Launch Mode (Air, Land, Sub-Sea), By Range (Short Range, Me...dium Range, Intermediate Range, Intercontinental Range), By End Users, (Military, Space) and others Read more

- Aerospace & Defense

- Feb 2024

- Pages 211

- Report Format: PDF, Excel, PPT

Market Definition

Hypersonic refers to missiles, aircraft, rockets, and spacecraft that can achieve speeds faster than Mach 5, i.e., nearly 4,000 miles per hour. Hypersonic Technology is used in the carrier vehicle for hypersonic & long-range cruise missiles and will have several civilian applications, including the launch of small satellites at low-cost.

Market Insights & Analysis: Global Hypersonic Technology Market (2024-30):

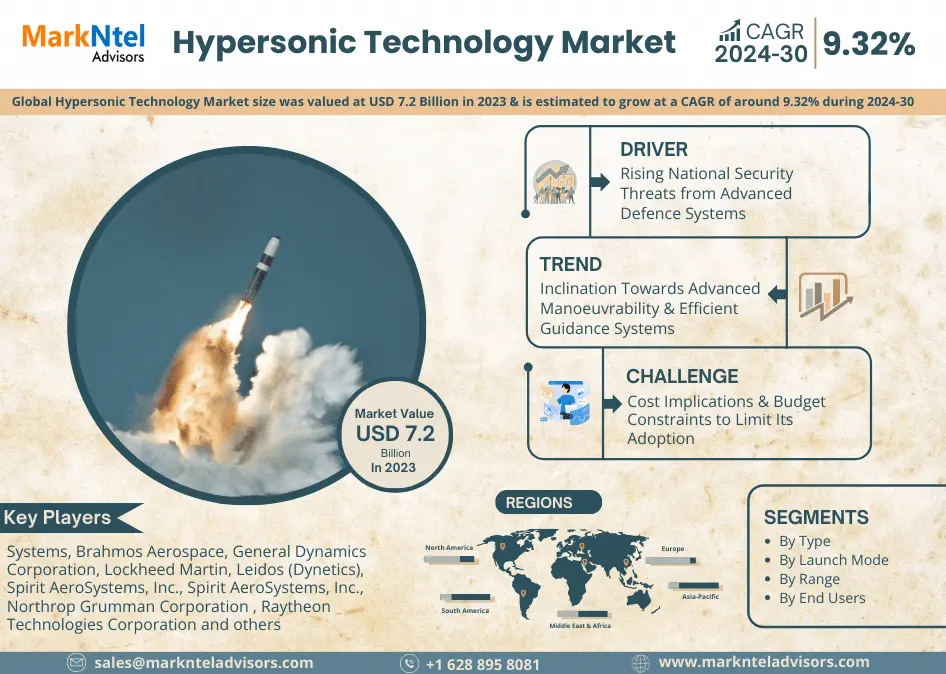

The Global Hypersonic Technology Market size was valued at USD 7.2 Billion in 2023 & is estimated to grow at a CAGR of around 9.32% during the forecast period, i.e., 2024-30. The demand for hypersonic technology in the defense industry is poised to grow globally due to several strategic & technological factors. Hypersonic missiles & vehicles offer unparalleled speed & maneuverability, making them extremely difficult to track and intercept. This capability enhances a nation's ability to respond swiftly to emerging threats, providing a crucial advantage in modern warfare.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 9.32% |

| Regions Covered | North America: US, Canada |

| Europe: Germany, The UK, France, Russia, Turkey, Italy, Rest of Europe | |

| Middle East & Africa: Israel | |

| Asia-Pacific: China, India, Japan, South Korea, Australia, Rest of Asia-Pacific | |

| Rest of the World | |

| Key Companies Profiled | BAE Systems, Brahmos Aerospace, General Dynamics Corporation, Lockheed Martin, Leidos (Dynetics), Spirit AeroSystems, Inc., Spirit AeroSystems, Inc., Northrop Grumman Corporation , Raytheon Technologies Corporation , Saab AB , SPACEX , Thales Group, Hypersonix, Hermeus Corp., Defence Research and Development Organisation (DRDO) and Others |

| Market Value (2023) | USD 7.2 Billion |

Moreover, the global security landscape is evolving, with potential adversaries investing heavily in advanced defense systems. The need for a reliable & rapid response system has become imperative, driving nations to prioritize the development & acquisition of hypersonic technology. Furthermore, the ability of hypersonic weapons to cover large distances in a short time, coupled with their capacity to penetrate sophisticated enemy defenses, positions them as a critical component in maintaining military superiority.

Additionally, the geopolitical competition among major powers is intensifying, prompting nations to invest in cutting-edge technologies to bolster their defense capabilities. Also, the global arms race is fostering collaboration & competition in the defense sector among governments and hypersonic technology providers to strengthen their military capabilities. As a result, the demand for hypersonic technology is likely to grow as countries seek to maintain or gain a competitive edge to ensure their national security in the coming years, thus enhancing the market size.

Global Hypersonic Technology Market Driver:

Rising National Security Threats from Advanced Defence Systems – The proliferation of advanced defense systems, particularly anti-access and area denial (A2/AD) capabilities, has prompted an increased demand for hypersonic technology globally. Nations are grappling with the challenge of overcoming the sophisticated anti-missile & anti-aircraft systems developed by potential adversaries. Countries like Russia & China have made substantial strides in A2/AD technologies, investing in advanced radar systems, surface-to-air missiles, and integrated air defense networks.

Russia's deployment of the S-400 Triumf anti-aircraft system and China's development of the DF-21D anti-ship ballistic missile illustrate the growing threat to traditional military strategies. These advanced systems pose a significant threat to traditional missile delivery systems, necessitating the development of hypersonic weapons that can effectively evade or counteract these defenses. As a result, the US, India, and other NATO members are accelerating their efforts to deploy hypersonic capabilities to maintain a credible offensive deterrent, driving the demand for hypersonic technology among the end-users.

Global Hypersonic Technology Market Opportunity:

Growing Focus on Naval Superiority & Anti-Ship Capabilities – The quest for naval superiority in the face of geopolitical tensions and maritime rivalries offers a compelling opportunity for the demand for hypersonic technology in the defense sector. In recent years, there has been a notable shift in global strategic focus toward maritime domains, with nations recognizing the significance of controlling sea lanes and projecting power across vast oceans. Hypersonic missiles, characterized by their extraordinary speed & range, become essential tools in securing maritime dominance.

Moreover, as naval forces become increasingly crucial elements of a nation's military strategy, the demand for hypersonic technology grows. Government programs, such as the United States Navy's Conventional Prompt Strike (CPS), are indicative of the emphasis placed on hypersonic capabilities to reinforce anti-ship capabilities. Hence, this aligns with the broader trend of nations investing in hypersonic technology to bolster their maritime capabilities and address the evolving challenges in naval warfare, thereby opening new avenues for the Hypersonic Technology Market in the coming years.

Global Hypersonic Technology Market Challenge:

Cost Implications & Budget Constraints to Limit Its Adoption – The exorbitant costs associated with research, development, and deployment of hypersonic technology constitute a significant barrier to its widespread adoption. The intricate engineering demands & the necessity for cutting-edge materials contribute to elevated production costs. Furthermore, governments across middle- & low-income economies are often constrained by budget considerations & competing priorities, thus finding it challenging to allocate substantial resources to hypersonic programs. Therefore, this restricts the willingness of nations to invest heavily in this advanced technology, which, in turn, is restraining the revenue growth of the Hypersonic Technology Market.

Global Hypersonic Technology Market Trend:

Inclination Towards Advanced Manoeuvrability & Efficient Guidance Systems – With the transition of hypersonic vehicles from simple ballistic trajectories to more dynamic flight paths, the need to improve precision strike capabilities & countermeasures against advanced defense is rising notably. Thus, manufacturers such as Raytheon Technologies and MBDA are actively developing advanced guidance systems & maneuvering capabilities for hypersonic missiles.

Additionally, government-based programs are also playing a significant role in supporting the advancements in maneuverability and guidance systems in hypersonic technology. Besides, as hypersonic weapons equipped with advanced maneuverability & guidance systems become increasingly integral to military strategies, the market for hypersonic technology is poised to experience significant growth, driven by the demand for highly capable & precise weapons systems, hence instigating the Hypersonic Technology Market share.

Global Hypersonic Technology Market (2024-30): Segmentation Analysis

The Global Hypersonic Technology Market study by MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment & includes predictions for the period 2024–2030 at the global level. In accordance to the analysis, the market has been further classified as:

Based on Type:

- Hypersonic Glide Missiles

- Hypersonic Cruise Missiles

- Hypersonic Spaceplanes

Hypersonic Glide Missiles are anticipated to be in high demand across global militaries, holding the potential share of the Hypersonic Technology Market due to their versatility & unique operational advantages. These missiles, propelled to high speeds by ballistic missiles before gliding at hypersonic velocities, offer a combination of long-range precision & unpredictable flight paths. The ability to glide and maneuver during the descent phase enhances their evasive capabilities, making interception challenging for existing air defense systems. This characteristic is particularly appealing for strategic strike missions and has the potential to penetrate sophisticated enemy defenses.

Also, governments and defense forces are recognizing the strategic importance of Hypersonic Glide Missiles in delivering prompt & precise strikes against time-sensitive targets. Nations such as the United States, China, and Russia are actively investing in the development & deployment of hypersonic glide vehicles, exemplifying market demand.

Based on End User:

- Military

- Aerial

- Naval

- Land-based

- Space

The Military sector is expected to be the biggest end-user of hypersonic technology across the Hypersonic Technology Market globally. This is owing to its immediate applicability in strategic defense and precision strike capabilities. Hypersonic weapons, such as glide missiles, offer unparalleled speed & maneuverability, making them invaluable for military operations. Thus, nations are investing significantly in hypersonic technology to maintain a competitive edge in modern warfare, where the ability to deliver rapid & precise strikes is paramount. Notable contracts underscore the military's emphasis on hypersonic technology.

Additionally, Russia's deployment of hypersonic systems, exemplified by the Avangard missile, emphasizes the military's focus on hypersonic capabilities for strategic deterrence. Moreover, as countries expand their military reach to safeguard strategic interests & respond to emerging geopolitical challenges, hypersonic technology is becoming crucial to maintain technological competition, strategic deterrence, and rapid response capabilities.

Global Hypersonic Technology Market (2024-30): Regional Projection

Geographically, the Global Hypersonic Technology Market expands across:

- North America

- Europe

- The Middle East & Africa

- Asia-Pacific

North America is predicted to grasp a promising share in the Hypersonic Technology Market during 2024-30. Among all the regional countries, particularly the US is emerging as a dominant end user of hypersonic technology globally. The country has demonstrated a longstanding commitment to technological leadership in defense, with a focus on maintaining a strategic advantage. Ongoing government initiatives, such as the Hypersonic Conventional Strike Weapon (HCSW) and the Air-launched Rapid Response Weapon (ARRW) programs, underscore the nation's dedication to advancing hypersonic capabilities.

Besides, the region benefits from substantial defense budgets and robust R&D initiatives, which allow significant investment in hypersonic technology. The unique speed and maneuverability of hypersonic weapons align closely with the evolving nature of modern warfare, prompting increased emphasis on their development & deployment in North America. In addition to the US, Canada is also contributing to the prominence of the North America Hypersonic Technology Market.

Global Hypersonic Technology Industry Recent Development:

- 2023: Raytheon Technologies announced that it received a contract worth around USD 985 million from the US Air Force to develop & demonstrate scramjet-powered hypersonic cruise missiles.

- 2022: Thales declared to develop & demonstrate scramjet-powered hypersonic cruise missiles.

Gain a Competitive Edge with Our Global Hypersonic Technology Market Report

- Global Hypersonic Technology Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Hypersonic Technology Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Hypersonic Technology Evolution and Development Timeline

- Global Hypersonic Technology Market Ongoing Programs Developments, By Country

- Global Hypersonic Technology Market Hotspots & Growth Opportunities

- Global Hypersonic Technology Market Dynamics

- Drivers

- Challenges

- Global Hypersonic Technology Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Type

- Hypersonic Glide Missile- Market Size & Forecast 2019-2030F, (USD Million)

- Hypersonic Cruise Missile- Market Size & Forecast 2019-2030F, (USD Million)

- Hypersonic Spaceplanes- Market Size & Forecast 2019-2030F, (USD Million)

- By Launch Mode

- Air- Market Size & Forecast 2019-2030F, (USD Million)

- Land- Market Size & Forecast 2019-2030F, (USD Million)

- Sub-Sea- Market Size & Forecast 2019-2030F, (USD Million)

- By Range

- Short Range- Market Size & Forecast 2019-2030F, (USD Million)

- Medium Range- Market Size & Forecast 2019-2030F, (USD Million)

- Intermediate Range- Market Size & Forecast 2019-2030F, (USD Million)

- Intercontinental Range- Market Size & Forecast 2019-2030F, (USD Million)

- By End Users

- Military- Market Size & Forecast 2019-2030F, (USD Million)

- Aerial- Market Size & Forecast 2019-2030F, (USD Million)

- Naval- Market Size & Forecast 2019-2030F, (USD Million)

- Land Based- Market Size & Forecast 2019-2030F, (USD Million)

- Space- Market Size & Forecast 2019-2030F, (USD Million)

- Military- Market Size & Forecast 2019-2030F, (USD Million)

- By Region

- North America

- Europe

- The Middle East & Africa

- Asia Pacific

- Rest of the World

- By Company

- Market Share & Analysis

- Competition Characteristics

- By Type

- Market Size & Analysis

- North America Hypersonic Technology Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2030F, (USD Million)

- By End Users- Market Size & Forecast 2019-2030F, (USD Million)

- By Country

- The US

- Canada

- The US Hypersonic Technology Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By End Users- Market Size & Forecast 2019-2030F, (USD Million)

- Market Size & Analysis

- Canada Hypersonic Technology Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By End Users- Market Size & Forecast 2019-2030F, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- Europe Hypersonic Technology Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2030F, (USD Million)

- By End Users- Market Size & Forecast 2019-2030F, (USD Million)

- By Country

- France

- Germany

- The UK

- Russia

- Italy

- Turkey

- Rest of Europe

- France Hypersonic Technology Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By End Users- Market Size & Forecast 2019-2030F, (USD Million)

- Market Size & Analysis

- Germany Hypersonic Technology Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By End Users- Market Size & Forecast 2019-2030F, (USD Million)

- Market Size & Analysis

- The UK Hypersonic Technology Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By End Users- Market Size & Forecast 2019-2030F, (USD Million)

- Market Size & Analysis

- Russia Hypersonic Technology Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By End Users- Market Size & Forecast 2019-2030F, (USD Million)

- Market Size & Analysis

- Italy Hypersonic Technology Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By End Users- Market Size & Forecast 2019-2030F, (USD Million)

- Market Size & Analysis

- Turkey Hypersonic Technology Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By End Users- Market Size & Forecast 2019-2030F, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Hypersonic Technology Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2030F, (USD Million)

- By End Users- Market Size & Forecast 2019-2030F, (USD Million)

- By Country

- Israel

- Rest of the Middle East & Africa

- Israel Hypersonic Technology Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By End Users- Market Size & Forecast 2019-2030F, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- Asia Pacific Hypersonic Technology Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2030F, (USD Million)

- By End Users- Market Size & Forecast 2019-2030F, (USD Million)

- By Country

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- China Hypersonic Technology Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By End Users- Market Size & Forecast 2019-2030F, (USD Million)

- Market Size & Analysis

- India Hypersonic Technology Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By End Users- Market Size & Forecast 2019-2030F, (USD Million)

- Market Size & Analysis

- Japan Hypersonic Technology Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By End Users- Market Size & Forecast 2019-2030F, (USD Million)

- Market Size & Analysis

- South Korea Hypersonic Technology Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By End Users- Market Size & Forecast 2019-2030F, (USD Million)

- Market Size & Analysis

- Australia Hypersonic Technology Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By End Users- Market Size & Forecast 2019-2030F, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- Global Hypersonic Technology Key Strategic Imperatives for Market Success and Growth

- Competition Outlook

- Company profiles

- BAE Systems

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Brahmos Aerospace

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- General Dynamics Corporation

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Lockheed Martin

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Leidos (Dynetics)

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Spirit AeroSystems, Inc.

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- L3 Harris Technologies Inc.

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Northrop Grumman Corporation

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Raytheon Technologies Corporation

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Saab AB

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- SPACEX

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Thales Group

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Hypersonix

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Hermeus Corp.

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Defence Research and Development Organisation (DRDO)

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making