Global Millimeter Wave Technology Market Research Report: Forecast (2021-2026)

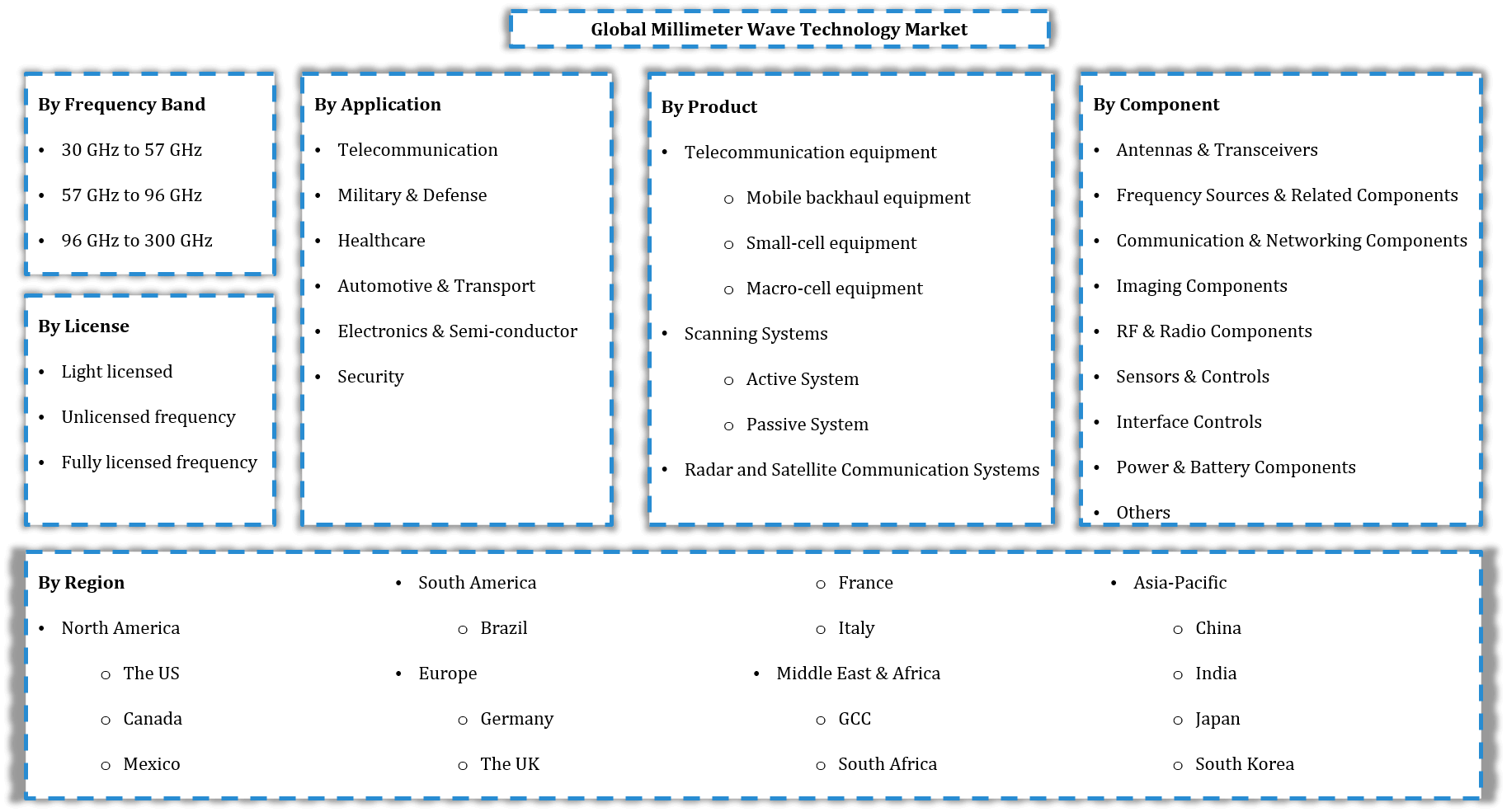

By Product (Telecommunication equipment (Mobile backhaul equipment, Small-cell equipment, Macro-cell equipment), Scanning Systems (Active System, Passive System), Radar and Satelli...te Communication Systems), By Component (Antennas & Transceivers, Frequency Sources & Related Components, Communication & Networking Components, Imaging Components, RF & Radio Components, Sensors & Controls, Interface Controls, Power & Battery Components, Others), By License Type (Light licensed, Unlicensed frequency, Fully licensed frequency), By Frequency Band (30 GHz to 57 GHz, 57 GHz to 96 GHz, 96 GHz to 300 GHz), By Application (Telecommunication, Military & Defense, Healthcare, Automotive & Transport, Electronics & Semi-conductor, Security), By Region (North America, South America, Europe, Asia-Pacific, Middle East & Africa), By Country (U.S, Canada, Mexico, Brazil, Germany, France, Italy, The U.K, India, China, South Korea, Japan, GCC, South Africa), By Competitors (Lightpointe Communications, Inc., Millitech, Inc., Bridgewave Communications, QuinStar Technology, Inc., Eravant (Sage Millimeter, Inc.), Cablefree: Wireless Excellence, E-Band Communications, Llc., Farran Technology, Aviat Networks, Inc., NEC Corporation, Siklu Communication Ltd., Trex Enterprises Corporation) Read more

- ICT & Electronics

- Jan 2022

- 201

- IT77015

Market Definition

In mobile telecommunication networks, spectrum scarcity is a longstanding problem. Sufficing the rapidly surging data rate & demand for communications in the 800 MHz- 6 GHz spectrum is becoming more challenging. Hence, communication in the millimeter-wave frequency range, i.e., 30- 300 GHz, has attracted the attention of many researchers.

Millimeter-wave technology will enable a 5G network, in which all applications could get high speed & reliability. With the growing amount of information likely to move at lightning-fast speeds along the spectrum, the adoption of Millimeter-wave technology is increasing significantly. It is in extensive demand by the users from enterprise data centers & home consumers who use smartphones & require higher bandwidth. Moreover, using millimeter-wave frequencies for connecting mobile users to nearby base stations is entirely a new approach & is likely to experience high growth in the future.

Market insights

The Global Millimeter Wave Technology Market is anticipated to grow at a CAGR of around 36% during the forecast period, i.e., 2021-26. The growth of the market attributes primarily to the mounting demand for high-speed mobile broadband owing to the increasing number of smartphone users and surging internet penetration. Additionally, the wide-range applications of mobile broadband across several verticals, including government, commercial space, telecommunication, online gaming, etc., is another crucial factor positively influencing the Millimeter Wave Technology Market.

Further, massive government investments in rolling out 5G networks and escalating adoption of millimeter wave technology in radar & security applications are other crucial aspects expected to propel the market growth in the forecast years. Moreover, rising funding by startups to boost the millimeter-wave 5G is also driving the market. For instance:

- An Irvine-based 5G telecom equipment maker, Movandi Corp raised $27 million in C series funding to accelerate & extend the range of real-world 5G mmWave deployments.

Moreover, an increasing number of internet users are also fueling the demand for millimeter-wave technology. Approximately two-thirds of the global population is projected to have Internet access by 2023, which means that there will be around 5.3 billion total Internet users by 2023, i.e., nearly 66% of the global population.

The rise in the usage of millimeter wave technology in small cell backhaul networks and mounting demand for millimeter wave technology across industries, such as aerospace, military, and defense, for the fast exchange of information like commands & orders from one location to another with high security & connectivity, are other crucial factors driving the Global Millimeter Wave Technology Market through 2026.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2016-19 |

| Base Year: 2020 | |

| Forecast Period: 2021-26 | |

| CAGR (2021-2026) | 36% |

| Regions Covered | North America: USA, Canada, Mexico |

| Europe: Germany, UK, France, Italy, Others | |

| Asia-Pacific: China, India, Japan, South Korea, Others | |

| South America: Brazil, Others | |

| Middle East & Africa: GCC, South Africa, Others | |

| Key Companies Profiled | Lightpointe Communications, Inc., Millitech, Inc., Bridgewave Communications, QuinStar Technology, Inc., Eravant (Sage Millimeter, Inc.), Cablefree: Wireless Excellence, E-Band Communications, Llc., Farran Technology, Aviat Networks, Inc., NEC Corporation, Siklu Communication Ltd., Trex Enterprises Corporation |

| Unit Denominations | USD Million/Billion |

Impact of Covid-19 on the Global Millimeter Wave Technology Market

The Covid-19 pandemic in 2020 crippled the entire world. Nearly all countries across the globe imposed lockdowns & social distancing measures, which adversely affected most industries, caused delays in 5G deployment, and negatively impacted the Global Millimeter Wave Technology Market.

The imposition of lockdown also led to the shutdown of Electronics manufacturing units and disrupted the supply chain of the semiconductor market by creating shortages of components & finished goods. It led to the disturbance in business continuity that further affected the millimeter wave technology market. For instance:

- Most 5G network operators are dependent on equipment from Huawei, Nokia, & Ericsson. The supply chain for 5G New Radio has been adversely affected, primarily since most 5G radio units & active antennas are manufactured in China.

However, despite the economic slowdowns, the demand for 5G is continuously increasing in the healthcare & manufacturing sectors, the millimeter wave technology market is expected to rise significantly in the years to come.

Market Segmentation

By Product:

- Telecommunication equipment

- Scanning Systems

- Radar and Satellite Communication Systems

Here, Scanning Systems acquired the largest share of the Global Millimeter Wave Technology. The rise in the demand for scanning systems is primarily due to the introduction of millimeter-wave images in the biometric field to conquer the limitation of harmful X-ray radiations. In addition, the mounting usage of millimeter wave screening scanners in security applications for identifying metallic or non-metallic concealed objects like weapons, explosives, knives, etc., is also contributing to the overall market growth.

Moreover, the surge in the implementation of scanner systems in high profile places, such as government buildings, VIP residential areas, five-star hotels, business workplaces, etc., and compulsory installation of a body scanner at airports are other crucial factors driving the millimeter wave technology market. For instance:

In April 2019, Aviation security regulator BCAS directed 84 hypersensitive & sensitive airports across India to install body scanners by March 2020 by replacing all the existing door frame metal detectors and hand-held scanners. After this, in 2020, the AAI had issued a tender to get 198 body scanners for 63 airports.

On the other hand, the demand for Telecommunication equipment is projected to experience the fastest growth over the forecast years, primarily due to the mounting adoption of millimeter wave components in indoor & outdoor telecommunication equipment.

Additionally, the burgeoning need for high-speed mobile networks has led to a surge in investments in 5G deployment projects to provide 5G services, which, in turn, positively influenced the growth of the Millimeter-Wave Technology Market.

By Component:

- Antennas & Transceivers

- Frequency Sources & Related Components

- Communication & Networking Components

- Imaging Components

- RF & Radio Components

- Sensors & Controls

- Interface Controls

- Power & Battery Components

Here, of all components, Antennas & Transceivers hold the largest share in the Global Millimeter Wave Technology Market. It is due to the increasing development of advanced millimeter wave distributed antenna radio units to provide better capacity & coverage. Besides, the rising adoption of 5G wireless networks for broadband wireless communication is another crucial aspect contributing to the surging demand for Antennas & Transceivers.

The escalating usage of antennas & transceivers in the telecommunication industry is primarily for high-speed wireless communication and the rising deployment of 5G equipment for smart devices, autonomous vehicles, etc. Moreover, the burgeoning demand for advanced antennas to facilitate the large-scale deployment of 5G mobile networks shall also augment the overall market growth in the coming years.

Recent Trends in the Global Millimeter Wave Technology Market

- In 2020, Keysight Technologies, Inc. collaborated with VIOMI to expand its automotive portfolio with New Radar Multi-Target Simulator and Advanced Automotive Ethernet Solutions. Keysight Technologies is a leading technology company that assists services providers, governments, and enterprises in fueling innovation to connect & secure the world. Further, VIOMI is a pioneer of IoT@Home. It has selected Keysight to validate the radio frequency (RF) performance of the company's IoT devices for home applications.

- In January 2020, NEC Corporation, a leader in the integration of IT and network technologies, announced the development of millimeter-wave distributed antennas for the effective usage of 5G millimeter-wave spectrum.

Regional Landscape:

- North America

- South America

- Europe

- Asia-Pacific

- Middle East & Africa

Amongst all regions, North America dominates the Millimeter Wave Technology Market, mainly due to the increasing deployment of millimeter wave technology in verticals, including telecom, aerospace, healthcare, etc. In addition, rising customer preference for autonomous vehicles and connected devices, such as tablets & smartphones, are other crucial aspects contributing to the regional market growth.

Further, snowballing government investments to facilitate the development of 5G networks and mounting web traffic is also expected to propel the Millimeter Meter Wave Technology Market across North America in the coming years. In addition, the launch of public millimeter wave services by the market players shall also drive the North America Millimeter Wave Technology Market during 2021-26.

Market Dynamics:

Key Driver: Rise in Mobile & Broadband Data Speeds

Broadband speed is the most critical factor that has accelerated IP traffic & consumption of high-bandwidth content. It is expected that between 2020 & 2025, the global average broadband speed is likely to grow two folds, from 62.5 Mbps to > 130 Mbps, due to the mounting adoption of Fiber-to-the-Home (FTTH), cable broadband, & high-speed DSL.

Furthermore, the increasing deployment of 5G technology using millimeter wave spectrum for low-latency, high-capacity fixed wireless broadband networks is also fueling the overall market growth. Millimeter-wave frequencies allow the usage of narrow beamwidth antennas that enables power to be directed to where it is required with a high-speed capacity.

Possible Challenge: Adverse Environmental Impact of Millimeter Waves

The power density of waves above 5–10 mW/cm2 leads to thermal effects. The high-intensity millimeter waves affect human skin & cornea, causing pain and physical damage at higher exposures. Furthermore, the deployment of 5G networks can surge energy usage and result in rapid climate changes. Besides, the manufacturing of new technologies associated with 5G produces waste and uses crucial resources that lead to environmental consequences. Moreover, millimeter waves can be harmful to birds, which, in turn, has cascading effects through entire ecosystems.

Competitive Landscape

According to MarkNtel Advisors, the giant leading players in the global Millimeter Wave Technology market are Bridgewave Communications, Ablefree: Wireless Excellence, E-Band Communications, Llc., Farran Technology, Aviat Networks, Inc., Lightpointe Communications, Inc., Millitech, Inc., NEC Corporation, QuinStar Technology, Inc., Eravant (Sage Millimeter, Inc.), Siklu Communication Ltd., Trex Enterprises Corporation, etc.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares) of the Global Millimeter Wave Technology Market?

- What is the region-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the Global Millimeter Wave Technology Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the Global Millimeter Wave Technology Market based on a competitive benchmarking matrix?

- What are the key results derived from surveys conducted during the Global Millimeter Wave Technology Market study?

Market Outlook, Segmentation, and Statistics

- Impact of COVID-19 on Global Millimeter Wave Technology Market

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Product

- Telecommunication equipment

- Mobile backhaul equipment

- Small-cell equipment

- Macro-cell equipment

- Scanning Systems

- Active System

- Passive System

- Radar and Satellite Communication Systems

- Radar and Satellite Communication Systems

- Application-specific radar system

- Telecommunication equipment

- By Component

- Antennas & Transceivers

- Frequency Sources & Related Components

- Communication & Networking Components

- Imaging Components

- RF & Radio Components

- Sensors & Controls

- Interface Controls

- Power & Battery Components

- Others

- By License Type

- Light licensed

- Unlicensed frequency

- Fully licensed frequency

- By Frequency Band

- 30 GHz to 57 GHz

- 57 GHz to 96 GHz

- 96 GHz to 300 GHz

- By Application

- Telecommunication

- Military & Defense

- Healthcare

- Automotive & Transport

- Electronics & Semi-conductor

- Security

- By Region

- North America Millimeter Wave Technology Market Outlook, 2016-2026F (USD Million)

- The US Millimeter Wave Technology Market Outlook, 2016-2026F (USD Million)

- Canada Millimeter Wave Technology Market Outlook, 2016-2026F (USD Million)

- Mexico Millimeter Wave Technology Market Outlook, 2016-2026F (USD Million)

- South America Millimeter Wave Technology Market Outlook, 2016-2026F (USD Million)

- Brazil Millimeter Wave Technology Market Outlook, 2016-2026F (USD Million)

- Europe Millimeter Wave Technology Market Outlook, 2016-2026F (USD Million)

- The UK Millimeter Wave Technology Market Outlook, 2016-2026F (USD Million)

- Germany Millimeter Wave Technology Market Outlook, 2016-2026F (USD Million)

- France Millimeter Wave Technology Market Outlook, 2016-2026F (USD Million)

- Italy Millimeter Wave Technology Market Outlook, 2016-2026F (USD Million)

- Asia-Pacific Millimeter Wave Technology Market Outlook, 2016-2026F (USD Million)

- China Millimeter Wave Technology Market Outlook, 2016-2026F (USD Million)

- South Korea Millimeter Wave Technology Market Outlook, 2016-2026F (USD Million)

- Japan Millimeter Wave Technology Market Outlook, 2016-2026F (USD Million)

- India Millimeter Wave Technology Market Outlook, 2016-2026F (USD Million)

- Middle East & Africa Millimeter Wave Technology Market Outlook, 2016-2026F (USD Million)

- GCC Millimeter Wave Technology Market Outlook, 2016-2026F (USD Million)

- South Africa Millimeter Wave Technology Market Outlook, 2016-2026F (USD Million)

- North America Millimeter Wave Technology Market Outlook, 2016-2026F (USD Million)

- By Competitors

- Competition Characteristics

- Market Share & Analysis

- Competitive Metrix

- By Product

- Global Millimeter Wave Technology Market Hotspots & Opportunities

- Global Millimeter Wave Technology Market Regulations & Policy

- Key Strategic Imperatives for Success and Growth

- Global Competition Outlook

- Competition Matrix

- Company Profile

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Assumptions

- Market Segmentation

- Preface

- Executive Summary

- Impact of COVID-19 on Global Millimeter Wave Technology Market

- Global Millimeter Wave Technology Market Trends & Insights

- Global Millimeter Wave Technology Market Dynamics

- Drivers

- Challenges

- Impact Analysis

- Global Millimeter Wave Technology Market Hotspots & Opportunities

- Global Millimeter Wave Technology Market Value Chain Analysis

- Global Millimeter Wave Technology Market Regulations & Policy

- Global Millimeter Wave Technology Market Outlook, 2016- 2026F

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Product

- Telecommunication equipment

- Mobile backhaul equipment

- Small-cell equipment

- Macro-cell equipment

- Scanning Systems

- Active System

- Passive System

- Radar and Satellite Communication Systems

- Telecommunication equipment

- By Component

- Antennas & Transceivers

- Frequency Sources & Related Components

- Communication & Networking Components

- Imaging Components

- RF & Radio Components

- Sensors & Controls

- Interface Controls

- Power & Battery Components

- Others

- By License Type

- Light licensed

- Unlicensed frequency

- Fully licensed frequency

- By Frequency Band

- 30 GHz to 57 GHz

- 57 GHz to 96 GHz

- 96 GHz to 300 GHz

- By Application

- Telecommunication

- Military & Defense

- Healthcare

- Automotive & Transport

- Electronics & Semi-conductor

- Security

- By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

- By Competitors

- Competition Characteristics

- Market Share & Analysis

- Competitive Metrix

- By Product

- Market Size & Analysis

- North America Millimeter Wave Technology Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Product

- By Component

- By License Type

- By Frequency Band

- By Application

- By Country

- The US

- Canada

- Mexico

- The US Millimeter Wave Technology Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Product

- By Component

- By License Type

- By Frequency Band

- By Application

- Market Size & Analysis

- Canada Millimeter Wave Technology Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Product

- By Component

- By License Type

- By Frequency Band

- By Application

- Market Size & Analysis

- Mexico Millimeter Wave Technology Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Product

- By Component

- By License Type

- By Frequency Band

- By Application

- Market Size & Analysis

- Market Size & Analysis

- South America Millimeter Wave Technology Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Product

- By Component

- By License Type

- By Frequency Band

- By Application

- By Country

- Brazil

- Others

- Brazil Millimeter Wave Technology Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Product

- By Component

- By License Type

- By Frequency Band

- By Application

- Market Size & Analysis

- Market Size & Analysis

- Europe Millimeter Wave Technology Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Product

- By Component

- By License Type

- By Frequency Band

- By Application

- By Country

- Germany

- The UK

- France

- Italy

- Others

- Germany Millimeter Wave Technology Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Product

- By Component

- By License Type

- By Frequency Band

- By Application

- Market Size & Analysis

- The UK Millimeter Wave Technology Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Product

- By Component

- By License Type

- By Frequency Band

- By Application

- Market Size & Analysis

- France Millimeter Wave Technology Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Product

- By Component

- By License Type

- By Frequency Band

- By Application

- Market Size & Analysis

- Italy Millimeter Wave Technology Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Product

- By Component

- By License Type

- By Frequency Band

- By Application

- Market Size & Analysis

- Market Size & Analysis

- Middle East & Africa Millimeter Wave Technology Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Product

- By Component

- By License Type

- By Frequency Band

- By Application

- By Country

- GCC

- South Africa

- Others

- GCC Millimeter Wave Technology Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Product

- By Component

- By License Type

- By Frequency Band

- By Application

- Market Size & Analysis

- South Africa Millimeter Wave Technology Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Product

- By Component

- By License Type

- By Frequency Band

- By Application

- Market Size & Analysis

- Market Size & Analysis

- Asia Pacific Millimeter Wave Technology Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Product

- By Component

- By License Type

- By Frequency Band

- By Application

- By Country

- China

- India

- Japan

- South Korea

- Others

- China Millimeter Wave Technology Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Product

- By Component

- By License Type

- By Frequency Band

- By Application

- Market Size & Analysis

- India Millimeter Wave Technology Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Product

- By Component

- By License Type

- By Frequency Band

- By Application

- Market Size & Analysis

- Japan Millimeter Wave Technology Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Product

- By Component

- By License Type

- By Frequency Band

- By Application

- Market Size & Analysis

- South Korea Millimeter Wave Technology Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Product

- By Component

- By License Type

- By Frequency Band

- By Application

- Market Size & Analysis

- Market Size & Analysis

- Key Strategic Imperatives for Success and Growth

- Competition Outlook

- Competition Matrix

- Product Portfolio

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles

- Bridgewave Communications

- Cablefree: Wireless Excellence

- E-Band Communications, Llc

- Farran Technology

- Aviat Networks, Inc.

- Lightpointe Communications, Inc.

- Millitech, Inc.

- NEC Corporation

- QuinStar Technology, Inc.

- Eravant (Sage Millimeter, Inc.)

- Siklu Communication Ltd.

- Trex Enterprises Corporation

- Competition Matrix

- Disclaimer