Global Female Technology (Femtech) Market Research Report: Forecast (2023-2030)

By Component (Mobile Apps, Connected Devices, Services, Others), By End User (Individuals, Hospitals, Diagnostic Centers, Fertility Clinics), By Application (Reproductive Health, P...regnancy and Nursing Care, Pelvic and Uterine Health, General Health and Wellness), By Region (North America, Europe, Asia-Pacific , Rest of the World), By Company (AlYK, Inc., Aytu BioScience, Inc., Biowink GmbH, Bloomlife, CORA, Flo Health, Inc., Glow, Inc., Inne, Kasha, NaturalCycles Nordic AB, Ovia Health, Plackal Tech, Sustain Natural, The Flex Company, Thinx, Inc., Others) Read more

- Healthcare

- May 2023

- Pages 211

- Report Format: PDF, Excel, PPT

Market Definition

Femtech (or female technology) is termed as the usage of software, diagnostics, products, and services utilizing technology to produce tools & solutions pertaining to women's health. These platforms include apps for menstrual & fertility tracking, tools for monitoring pregnancy & breastfeeding, devices for women's sexual health, and menopause management strategies, and several others.

Market Insights & Analysis: Global Female Technology (Femtech) Market (2023-28)

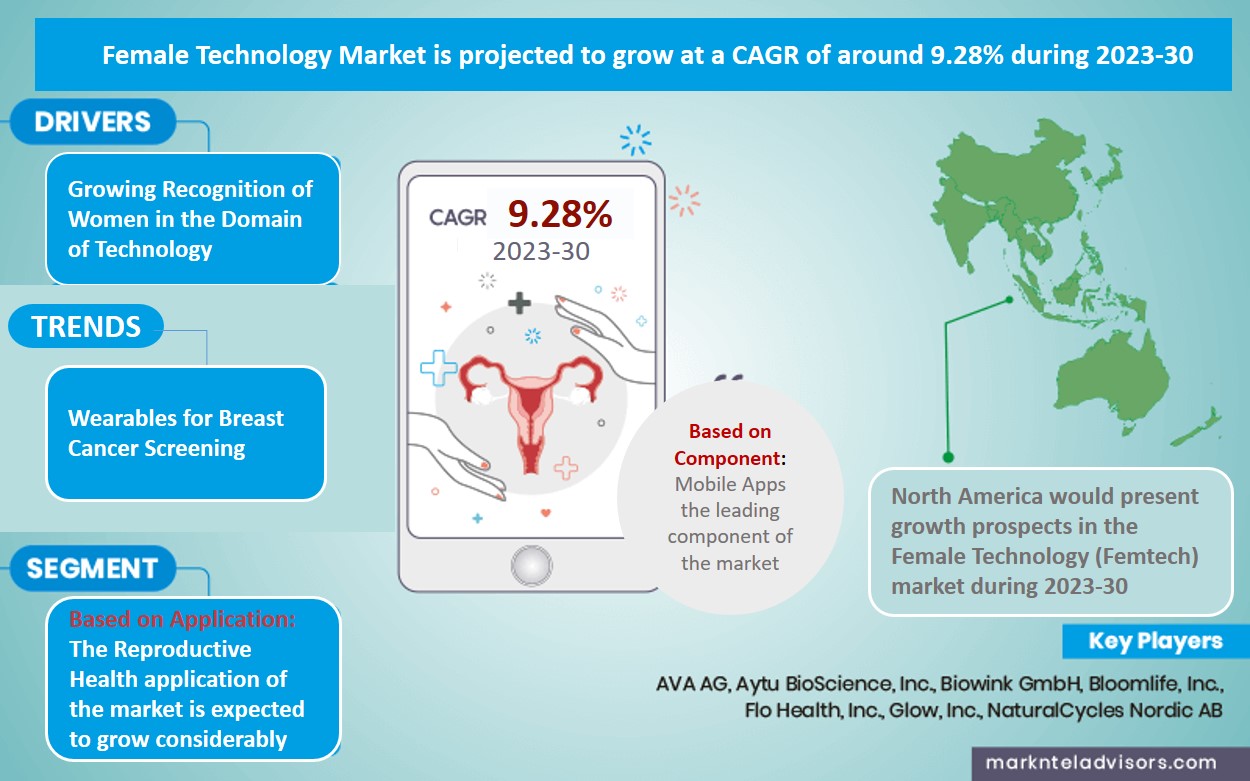

The Global Female Technology (Femtech) Market was valued at USD 57.52 billion in 2023 and further expected to grow at a CAGR of 9.28% during the forecast period 2023-2030. Women’s health technology was considered a niche market just a decade ago, and now it is a fast-growing domain, expected to show significant growth by the end of 2030. The factors attributing to the market development include technological advancements, the emergence of women-led femtech start-ups, and supporting government policies.

In the past years, there has been an upsurge in the number of educated women, which promotes the adoption of this technology-based products owing to their comfort in managing technological products. The government initiatives of numerous countries have also supported raising awareness for women’s health & wellness.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-30 | |

| CAGR (2023-2030) | 9.28% |

| Regions Covered | North America: US, Canada, Mexico |

| Europe: Germany, The UK, France, Spain, Netherlands, Sweden, Rest of Europe | |

| Asia-Pacific: China, India, Japan, South Korea, Australia, Rest of Asia-Pacific | |

| Rest of the World: Israel, Saudi Arabia, The UAE, South Africa, Brazil, Mexico, Rest of Rest of the World | |

| Key Companies Profiled | AlYK, Inc., Aytu BioScience, Inc., Biowink GmbH, Bloomlife, CORA, Flo Health, Inc., Glow, Inc., Inne, Kasha, NaturalCycles Nordic AB, Ovia Health, Plackal Tech, Sustain Natural, The Flex Company, Thinx, Inc., Others |

| Unit Denominations | USD Million/Billion |

Moreover, the vast scope of the market has led to a rise in the number of start-ups that have created cutting-edge health technologies with women’s health at the center & had garnered significant funding in recent years. The amount of investment received by the industry is on the rise, with a larger number of healthcare venture capitalists gradually entering the market.

For instance, the industry received more than USD500 million in funding (till 2019) & has now crossed the billion mark (nearly 2.5 billion till 2021), according to Pitchbook. Furthermore, the pandemic also pushed up the market by fueling digitalization in the healthcare industry & making customers realize the importance of digital solutions such as telemedicine, remote consultation, and remote health monitoring.

Consequently, female health technology companies accelerated their efforts to innovate in these spaces, to effectively serve the needs of women. The rising number of chronic diseases is also making women more conscious of their health & inclined towards regular health monitoring via femtech devices. Thus, the growing awareness among women & high investment combined with ascending educated women & product developments in the industry is anticipated to push the Global Female Technology (Femtech) Market share during the forecast period.

Market Dynamics

Key Driver: Growing Recognition of Women in the Domain of Technology

With the technology domain being male-dominated for years altogether, the term, femtech has been able to successfully assist the companies that dedicatedly develop mobile applications & wearables for women in gaining recognition. Other significant changes concerning the female-oriented technology that has been brought above over the years include the following:

- Emergence of femtech-dedicated VC firms

- Increase in the number of companies entering the market

- Upsurge in the amount of funding received by the companies

- Rising female angel investors

Furthermore, the presence of various companies providing solutions for period tracking, monitoring menstrual health, pregnancy health, and organic female hygiene products has assisted in the normalization of female health. This has resulted in the development of innovative products focused on various areas of women’s health, such as cervical cancer, breast cancer, menopause, and menstrual health. Moreover, many of the start-ups are led by women, thus the rising participation of women in the field of technology would support the growth of the companies.

Possible Restraint: Societal Taboos Surrounding Women’s Health Issues

There are intense societal taboos associated with women’s health issues, such as menstruation, fertility, pregnancy, and menopause. Also, there are stigmas around these terminologies that are further depicted in euphemisms worldwide. According to the study conducted by the International Women’s Health Coalition, there are around 5,000 euphemisms for the word "period & menstruation” in 10 different languages. These euphemisms are certainly indicators of the trend in attitudes regarding menstrual & reproductive health around the world.

Consequently, these female experiences often remain topics that people are uncomfortable talking about & are mostly discussed in closed rooms. Hence, this put obstacles in the marketing of products limiting the market growth to the educated urban areas where there is more acceptance of such debates. The sensitive nature of the topic also results in femtech companies finding it difficult to promote their devices on the internet. For instance,

- In 2022, according to the Center for Intimacy Justice, around 60 companies such as Joylux, stated that advertisements regarding women’s health products were banned by the social media platform, Facebook.

Thus, the taboos prevent the discussion about the product benefits & easy usage as well as enforces the women to keep their health issues to themselves & avoid discussion leading to restricted usage of female technology-based services. However, with the feminist movements taking place in several regions combined with the promotion of education among women, the impact of this restraint is predicted to diminish in the coming years.

Growth Opportunity: Product Development for Menopause Management

Menopause is one of the most prominent opportunities for the Global Female Technology (Femtech) market. A significant number of women reach menopause every day, which provides a huge customer base for the companies. These women often suffer from side effects (related to menopause) such as Vasomotor Symptoms (VMS), hot flashes, and night sweats that have an adverse effect on their lifestyle. Furthermore, women undergoing menopause are also susceptible to other diseases, such as hypertension, osteoporosis, and depression. Additionally, the limited number of physicians for menopause management has also boosted the need for technology integration for menstrual management.

New entrants in the market can look at the development of a wearable or mobile application for menstrual management to assist the smooth transition of women & early detection of women susceptible to developing diseases. For instance, Menopro is an application for menopause management. The application was developed by the North American Menopause Society (NAMS) with the aim of assisting women in their transition to menopause. The application connects women & clinicians to design a personalized treatment based on the medical history of females. Therefore, menstrual mobile applications for menopause management would create a lucrative market opportunity in terms of revenue as well in the forthcoming years.

Key Trend: Wearables for Breast Cancer Screening

The conventional methods of breast cancer screening requiring mammography & exposure to X-ray radiation for detection of tumor growth are often found inadequate. For instance, according to the Breast Cancer Detection Demonstration Project (BCDDP), the false-negative rate of mammography is almost 8%-10% (2019). Additionally, unnecessary radiation exposure can also cause germline mutation that can lead to debilitating effects on the patient.

Therefore, an alternative to mammography is the smart wearable, which is being introduced in the market. For instance, Higia Technologies has developed two bra cups called EVA that can detect breast cancer. The cups are fitted in the inner line of the undergarment for 15 minutes once every week. The sensors in the cups track the thermal changes in the breast that are related to tumor generation. Hence, such wearables are gaining traction in place of mammography owing to their easy & convenient usage. Also, these wearables enable women to detect breast cancer at an early age through regular testing, further becoming trending, hence enhancing the Global Female Technology (Femtech) Market size in the future years.

Market Segmentation

Based on Component:

- Mobile Apps

- Connected Devices

- Services

- Others

The rising women’s health expenditure, increasing smartphone penetration, and shift toward digital health have propelled the development of women’s health applications and, in turn, made Mobile Apps the leading component of the market. These applications are easily accessible through platforms such as Google Play Store & Apple app store. The major usage of the applications is the monitoring of reproductive health segments, such as period tracking.

For instance, according to Consumer Reports 2020, a non-profit organization for product testing & consumer advocacy, almost 50 million women used applications such as Clue, Flo, and My Period Tracker for period tracking. Moreover, the market is densely populated with applications for other reproductive health aspects, such as fertility tracking & sexual wellness.

Moreover, the rising adoption of mobile applications is their freemium business model. In the freemium model, the company offers its basic features, such as period tracking & symptom tracking for no charge. However, they charge for their premium services. Additionally, the integrations of artificial intelligence & big data have further enhanced the capabilities of the mobile, which strengthens the market growth in the forthcoming period.

Based on Application:

- Reproductive Health

- Pregnancy & Nursing Care

- Pelvic & Uterine Health

- General Health & Wellness

The Reproductive Health application of the market is expected to grow considerably due to the paradigm shift in women’s contraceptives. Women are shifting from hormone-induced contraceptives such as pills to modern-day natural contraceptives. The reproductive health trackers alert the women regarding their periods & ovulation window and act as an electronic natural contraceptive. Furthermore, for women seeking to conceive, the alert for fertility window informs them of the maximum likelihood period for the conception of pregnancy.

The popularity of period tracking applications is evident by the rising number of active users of the applications. For instance, according to a press release by Flo Health, Inc., the company had more than 7 million active users per month for its application Flo in 2018. Furthermore, other key players in the market, such as Glow, Inc. and Biowink GmbH (developer of the Clue application), have a user base of around 15 million & 10 million, respectively. Therefore, the upsurge in the period tracking application usage is primarily attributed to the rising health awareness in women, hence fueling the market growth.

Regional Projection

Geographically, the market expands across:

- North America

- Europe

- Asia-Pacific

- Rest of the World

The Female Technology market in the North American region has been growing at a notable pace owing to numerous reasons, such as high health awareness & elevated investment opportunities. The developed countries of Canada & the US provide ample opportunities for the progression of emerging start-ups associated with femtech & Health. Countries also have detailed health data availability which equips these platforms to use the latest technologies of artificial intelligence & machine learning to provide reliable products & services to women. Moreover, the government focuses on streamlining this available health data, which would further reinforce the growth of the market. For instance, in 2023, the National Institutes of Health’s Final Policy on Data Management and Sharing started to develop plans for sharing scientific data.

Furthermore, the government of these countries is launching numerous schemes & plans to further raise health awareness & promote the usage of technology in battling health risks. For instance, in 2023, the US Department of Health and Human Services (HHS) and the Department of Commerce (DOC) announced that they would work on the commercialization of their research results, thus providing more health data to the companies. Along with this, they also declared that they would take full advantage of federally-funded technologies, thus inferring more incorporation of technology in health-related products & services.

Recent Developments by the Leading Companies

- 2023: Ovia Health announced new features in their Ovia app, adding menopause symptom tracking & resources to aid women during menopause.

- 2023: Celmatix Inc., launched a new PCOS drug program targeted to treat numerous women’s health issues such as female infertility, endometriosis, and menopause.

Gain a Competitive Edge with Our Global Female Technology (Femtech) Market Report

- Global Female Technology (Femtech) Market Report by Markntel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Female Technology (Femtech) Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Female Technology (Femtech) Market Evolution, 2010-2030

- Research & Development

- Market Restructuring Events

- Technology Upgrades

- Others

- Global Female Technology (Femtech) Industry Overview, 2023

- Region wise Active Market Players

- Investors

- Region wise Associations & Community Organizations

- Region Wise R&D Hubs

- Global Health Expenditure and Financing, By Region & Country, 2018-2022

- Global Female Technology (Femtech) Industry, Startup, Investment, and Ecosystem

- Venture Capital Funding, 2010-2022

- Total Funding, By Subsectors

- Menstrual Health

- Sexual Health

- Pelvic & Uterine Health

- Reproductive Health & Contraception

- General Health

- Mental Health

- Others

- List of top 10 Most Funded Startups

- Year of Fund Raise

- Amount Raised Under Various Rounds

- Purpose of Fund Raise

- Future Plans

- Geography Wise Investors Vs Amount Invested

- The US

- China

- India

- Germany

- France

- Canada

- Israel

- Switzerland

- Others

- Global Female Technology (Femtech) Market Mergers & Acquisitions, 2018-2022

- Global Female Technology (Femtech) Market Regulations and Policy

- Global Female Technology (Femtech) Market Business Model Analysis, 2023

- One-for-One Give Back Model

- Direct-to-Consumer

- Subscription

- Prescription Telemedicine Model

- Global Female Technology (Femtech) Market Product Mapping Analysis

- Overview

- Top Products, By Category

- Reproductive Health

- Pregnancy and Nursing Care

- Pelvic and Uterine Care

- General Wellness

- Global Female Technology (Femtech) Market Trends & Developments

- Global Female Technology (Femtech) Innovation Tracker, 2018-2023

- Fertility & Fertility Cycle Monitoring

- Genomics

- Cancer Screening

- Hormone Testing and Tracking

- Global Female Technology (Femtech) Market Dynamics

- Drivers

- Challenges

- Global Female Technology (Femtech) Market Hotspot & Opportunities, By Country

- The United States

- Canada

- India

- Israel

- The UAE

- Australia

- Austria

- The UK

- Switzerland

- Sweden

- Hungary

- Poland

- Global Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Component

- Mobile Apps- Market Size & Forecast 2019-2030, USD Million

- Connected Devices- Market Size & Forecast 2019-2030, USD Million

- Wearable Connected Device-- Market Size & Forecast 2019-2030, USD Million

- Non-Wearable Connected Device- Market Size & Forecast 2019-2030, USD Million

- Services- Market Size & Forecast 2019-2030, USD Million

- Others- Market Size & Forecast 2019-2030, USD Million

- By Application

- Reproductive Health- Market Size & Forecast 2019-2030, USD Million

- Period Tracking- Market Size & Forecast 2019-2030, USD Million

- At-Home Fertility Tracking and Monitoring- Market Size & Forecast 2019-2030, USD Million

- Pregnancy and Nursing Care

- Pregnancy Care- Market Size & Forecast 2019-2030, USD Million

- Post Pregnancy Care- Market Size & Forecast 2019-2030, USD Million

- Breastfeeding- Market Size & Forecast 2019-2030, USD Million

- Others- Market Size & Forecast 2019-2030, USD Million

- Pelvic and Uterine Health

- Pelvic Wellness- Market Size & Forecast 2019-2030, USD Million

- Menstrual Health- Market Size & Forecast 2019-2030, USD Million

- General Health and Wellness

- Reproductive Health- Market Size & Forecast 2019-2030, USD Million

- By End User

- Individuals- Market Size & Forecast 2019-2030, USD Million

- Hospitals- Market Size & Forecast 2019-2030, USD Million

- Diagnostic Centers- Market Size & Forecast 2019-2030, USD Million

- Fertility Clinics- Market Size & Forecast 2019-2030, USD Million

- By Competition

- Market Share of Top Companies

- Application Wise Concentration of Competitors or Total Number of Competitors

- Reproductive Health

- Pregnancy and Nursing Care

- Pelvic and Uterine Health

- General Health and Wellness

- Competitor Concentration, By Product Types or Total Number of Competitors by Product Category

- Wearables

- Digital Platforms

- Diagnostics

- Drugs, vitamins & supplements

- Consumer products

- Services

- Competitor Concentration, By Annual Revenue Range

- Upto USD 1 Million

- USD1.1 Million to USD10 Million

- USD 11 Million to USD 100 Million

- USD101 Million to USD 500 Million

- USD501 Million to USD 1,000 Million

- Above USD1,000 Million

- Pricing & Branding Strategies

- By Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

- By Component

- Market Size & Analysis

- North America Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- By Country

- The US

- Canada

- Mexico

- The US Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Canada Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Mexico Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Europe Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- By Country

- Germany

- The UK

- France

- Spain

- Netherlands

- Sweden

- Rest of Europe

- Germany Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- The UK Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Sweden Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Spain Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- France Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- The Netherlands Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Rest of Europe Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- By Country

- China

- Japan

- South Korea

- Australia

- India

- Rest of Asia Pacific

- China Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Japan Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- South Korea Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Australia Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- India Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Rest of Asia Pacific Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Rest of the World Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- By Country

- Israel

- Saudi Arabia

- The UAE

- South Africa

- Brazil

- Mexico

- Rest of Rest of the World

- Israel Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Saudi Arabia Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- The UAE Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- South Africa Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Brazil Female Technology (Femtech) Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Competitive Outlook

- Company Profiles

- AlYK, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Aytu BioScience, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Biowink GmbH

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Bloomlife

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- CORA

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Flo Health, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Glow, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Inne

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kasha

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- NaturalCycles Nordic AB

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Ovia Health

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Plackal Tech

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Sustain Natural

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- The Flex Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Thinx, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Celmatix Inc.

- Conceivable Inc.

- Lia Diagnostics Inc.

- Lucina Analytics

- Progyny, Inc.

- Univfy Inc.

- AlYK, Inc.

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making