Global Bioproduction Bottles Market Research Report Forecast (2022-27)

By Material Type (Plastic Polycarbonate Polyethylene terephthalate glycol (PETG) High-density polyethylene (HDPE) Others (Fluorinated ethylene propylene (FEP), Perfluoroalkoxy alk...anes (PFA)), Glass) By Capacity Type (Upto 30 ml 30 to 60 ml 60 to 100 ml 100-250 ml 250 to 500 ml 500 to 1000 ml 1000 to 2000 ml Above 2000 ml) By Application (Sampling System, Media Preparation, Mixinga, Storage, Others), By Development Phase (Clinical, Commercial), By Component (Drug Substance, Drug Product), By Molecule Type (Protein, Gene Therapy, Cell Therapy, Conventional Vaccines), By Region (North America South America Europe Asia Pacific Middle East & Africa), By Company (Thermo Fisher Scientific, Gerresheimer Glas GmbH, Essco Glass, Spectrum Chemical Manufacturing Corporation, Corning, SGD Pharma, Duran Group, Beatson Clark, Foxx Life Sciences, Others) Read more

- Healthcare

- Feb 2022

- Pages 232

- Report Format: PDF, Excel, PPT

Market Definition

Bioproduction bottles are single-use flexible containers used for critical liquid-handling applications in the biopharmaceutical industry. These bottles are alternatives to traditional stainless steel systems. Their demand has soared in research & development activities to prevent cross-contamination of materials. Moreover, the evolution of tissue engineering or cell & gene therapy in recent years has also surged their usage in clinical testing laboratories worldwide.

Market Insights

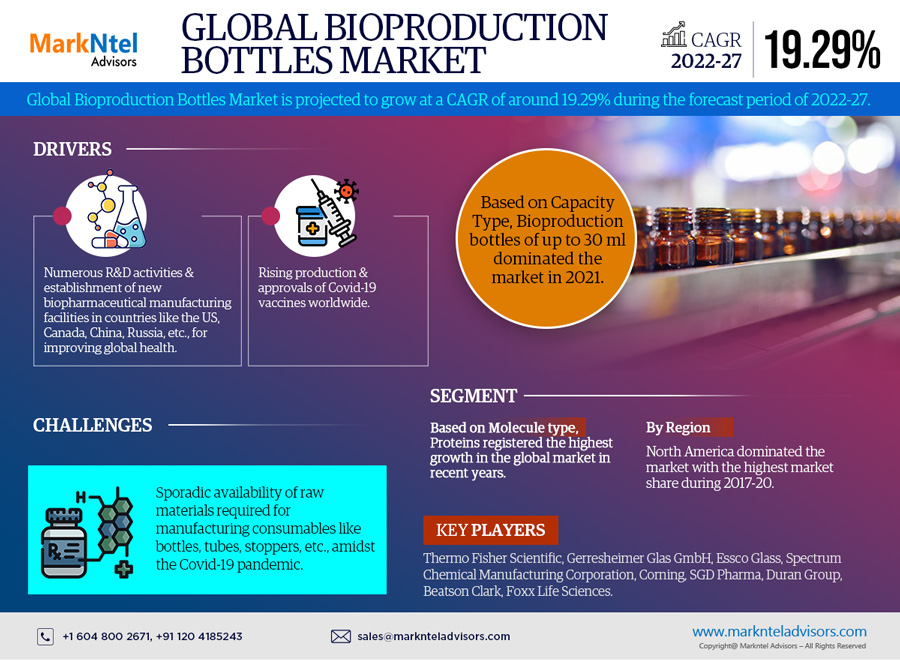

The Global Bioproduction Bottles Market is projected to grow at a CAGR of around 19.29% during the forecast period, i.e., 2022-27. The global biopharmaceutical industry continues to grow at a steady pace on account of rising investments in research & development for improving global health. In order to treat diseases, the research-based biopharmaceutical sector has played a vital role in the development of new medicines and vaccines. As a result, numerous R&D activities and the establishment of new biopharmaceutical manufacturing facilities in countries like the US, Canada, China, Russia, etc., have positively influenced the demand for bioproduction bottles during 2017-19.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2017-20 |

| Base Year: 2021 | |

| Forecast Period: 2022-27 | |

| CAGR (2022-2027) | 19.29% |

| Regions Covered | North America: USA, Canada, Mexico |

| South America: Brazil, and Others | |

| Europe: UK, Germany, France, Spain, Italy and Others | |

| Asia-Pacific: China, India, Japan, South Korea, Australia and Others | |

| Middle East & Africa: GCC, Africa and Others | |

| Key Companies Profiled | Thermo Fisher Scientific, Gerresheimer Glas GmbH, Essco Glass, Spectrum Chemical Manufacturing Corporation, Corning, SGD Pharma, Duran Group, Beatson Clark, Foxx Life Sciences and Others |

| Unit Denominations | USD Million/Billion |

Furthermore, with the Covid-19 pandemic in 2020, biopharmaceutical companies got involved in various R&D activities for developing potential treatments, diagnostics, & vaccines for the patients. It, in turn, surged the demand for bioproduction bottles for the R&D conducted. As of February 2021, around 1,000 clinical trials were conducted just for developing Covid-19 treatment & vaccines. Nevertheless, several clinical trials & product launches got suspended other than those for Covid-19. However, faster approvals by WHO for large-scale production of several vaccines helped compensate for the overall impact on the sales of bioproduction bottles. It, in turn, catalyzed the manufacturing of vaccines globally and subsequently surpassed the overall demand for bioproduction bottles in the later part of 2020.

Notably, the rising production & approvals of Covid-19 vaccines worldwide would continue fostering the demand for bioproduction bottles in the forecast years, too. In line with the growing demand for vaccines, several bottle & glass manufacturers like DWK Life Sciences, etc., have stated that they would raise their bottle production capacity to almost double in 2022.

Impact of Covid-19 on Global Bioproduction Bottles Market

In 2020, the Covid-19 pandemic brought significant challenges to the Global Bioproduction Bottles Market, primarily by impacting the supply of drugs & APIs (Active Pharmaceutical Ingredients), along with the biopharmaceutical packaging industry. In May 2020, practitioners raised apprehension toward the availability of primary parenteral packaging consumables, including bottles, vials, containers, syringes, stoppers, etc., for the packaging of drugs & vaccines to be traded globally. Several clinical trials & processes were on hold owing to the global crisis, which, in turn, severely impacted the biologics & biosimilars development.

The number of clinical pharmaceuticals, biotech, & research organizations, viz., Eli Lilly, Pfizer, Bristol-Myers Squibb, Addex Therapeutics, Provention Bio, and contract research organizations IQVIA and Icon announced the postponement of the clinical trials carried out in their laboratories. Therefore, it became difficult for many manufacturers to provide bottles, blister packagings, pre-fillable syringes, vials, and ampoules to biopharmaceutical companies. However, the increased focus of different countries worldwide toward developing Covid-19 vaccines surged the demand for bioproduction bottles amidst the crisis.

In 2020, clinicaltrials.gov discovered that around 1,099 trials got postponed due to the pandemic. As per surveys in the US & Europe, nearly 200 oncology trials were operative from 17th March till 3rd April 2020. However, owing to the pandemic, a delay of around 6-8 months in clinical research was observed, which negatively impacted the market of bioproduction bottles since they are used for drug storage. The pandemic caused significant losses & interruption in the production facilities to various industries globally. However, it also created interest & cognizance in the biopharmaceutical sector by devising investment opportunities for developing biologics & vaccines for the Covid-19 treatment.

When WHO declared the Covid-19 outbreak a pandemic, several biopharmaceutical & biotech companies and clinical research organizations got engaged in developing Covid-19 treatments & vaccines. In addition, the growing demand for biological products and the evolving cell and gene therapies also boosted the demand for biopharma bottles. Moreover, several mergers, acquisitions, partnerships, & collaborations took place for developing the Covid-19 vaccines. For instance:

- In 2021, the Russian Direct Investment Fund (RDIF) announced their partnership with Stelis Biopharma for the production of 200 million doses of Sputnik V in India. This joint venture would aid in the increased usage of bioproduction bottles in the Indian market.

- In 2021, Merck invested around USD 28.25 million to expand a single-use assembly production unit at its Life Sciences Center in Molsheim, France. This expansion accelerated its European plan of expanding single-use or disposable technology to produce Covid-19 vaccines and other cell & gene therapies.

Key Trend in the Global Bioproduction Bottles Market

- Increasing Shift towards Manufacturing Biosimilars

Historically, Biologics became a vital medicine for the treatment of chronic diseases, such as diabetes, autoimmune disorders, and cancers. However, their high price tags encouraged the development of another low-cost option, i.e., Biosimilars, which incur low development costs & time. Moreover, the evolution of the regulatory framework in countries like the US, China, & Japan has provided significant opportunities for the adoption of Biosimilars. Several regulatory bodies that actively regulate the development & commercialization of biosimilars include European Medicines Agency (EMA), the US Food and Drug Administration (FDA), and the World Health Organization (WHO). By May 2020, Europe approved around 60 biosimilars. Some of the approved biosimilars in the EU include Adalimumab, Bevacizumab, Epoetin alfa, Etanercept, etc.

The key aim of developing biosimilars was access to the drug for a specific treatment to all. Hence, the growing worldwide inclination toward manufacturing biosimilars would drive the Bioproduction Bottles Market during 2022-27. For instance:

- In 2020, Alvotech Hf and DKSH, both European biopharma companies reported their collaboration for the initiation to sell AVT02 biosimilar drug for the treatment of autoimmune diseases such as rheumatoid arthritis, plaque psoriasis, etc. in the US, Europe, and some southeast Asian markets.

- In 2021, Cipla Ltd. and Kemwell Biopharma Pvt. Ltd. announced their partnership for the development and manufacturing of biosimilars and worldwide commercialization.

- Likewise, again in 2021, USFDA made history and approved the biosimilar of insulin i.e. Semglee by Sanofi.

Market Segmentation

By Material Type:

- Plastic

- Polycarbonate

- Polyethylene terephthalate glycol (PETG)

- High-density polyethylene (HDPE)

- Others (Fluorinated ethylene propylene (FEP), Perfluoroalkoxy alkanes (PFA), etc.)

- Glass

Of them all, plastic bioproduction bottles held a considerable share in the Global Bioproduction Bottles Market during 2017-2020, owing to their features like lightweight, robustness, resistance from inorganic chemicals, & their availability in different sizes. On the other hand, glass bioproduction bottles are fragile and can release alkalis to aqueous preparations. Plastic is preferred extensively for many solutions since it does not display a pH change over time, whereas glass containers do. However, the selection of plastic & glass bottles majorly varies on the application areas & requirements. The low cost of glass bottles enables them to be a feasible option for the R&D activities of biopharmaceutical companies.

Moreover, the usage of single-use technology in plastic bioproduction bottles is also one of the crucial factors positively impacting their demand since this technology develops the upstream & downstream processes with more safety, sterility, and reliability. The changing landscape of biopharmaceuticals has triggered many opportunities for new technological integrations. Moreover, with more biologics going off-patent and new treatments are being introduced, there has been a diversification of the drug pipeline, with companies focusing on developing drugs at lower costs. Hence, the usage of single-use technology in biopharmaceuticals is quite instrumental in positively impacting the demand for plastic bioproduction bottles.

By Capacity Type:

- Up to 30 ml

- 31 to 60 ml

- 61 to 100 ml

- 101-250 ml

- 251 to 500 ml

- 501 to 1000 ml

- 1001 to 2000 ml

- Above 2,000 ml

Here, bioproduction bottles with a capacity of up to 30 ml dominated the market in 2021 due to their extensive usage for testing & storage purposes in both clinical & commercial applications. At the clinical stage, bottles with up to 30ml capacity are the most preferred ones to undergo any test or experiment. Moreover, commercially, the packaging of single-dose vaccines deploys these bottles substantially. Further, the Covid-19 pandemic has also played a crucial role in catalyzing their demand across academia, contract research organizations, & pharmaceutical industries, and the same trend is likely to be followed during the forecast period.

By Development Phase:

- Clinical

- Commercial

With the rapidly growing incidences of chronic diseases like cancer, diabetes, etc., worldwide, the utilization of biologics & biosimilars for their cure is registering an uptrend. Many developed countries shifted toward biopharmaceutical manufacturing during 2017-19, which has positively influenced the demand for bioproduction bottles.

Furthermore, the commercial segment experienced robust growth after the Covid-19 pandemic in 2020 since various biopharmaceutical companies actively started focusing on developing vaccines. Most companies received vaccine approval at the end of 2020 & the beginning of 2021. The surging number of vaccine approvals led to their commercialization, which, in turn, positively impacted the demand for bioproduction bottles.

According to the International Federation of Pharmaceutical Manufacturers Association, 12 billion vaccines were expected to be produced by the end of 2021. Moreover, the rising partnerships among biopharmaceutical companies to accelerate the Covid-19 vaccine manufacturing are other crucial aspects projected to strongly contribute to the overall market growth in the forthcoming period.

By Molecule Type:

- Protein

- Gene Therapy

- Cell Therapy

- Conventional Vaccines

Of all Molecule Types, Proteins have registered the highest growing demand. It owes to Monoclonal antibodies (mAbs) utilized to provide therapeutic solutions for immune-oncology & immunotherapy. Hence, the ability of monoclonal antibodies to fight against harmful pathogens like viruses has increased their usage for the treatment of pediatric patients suffering from Covid-19. For instance:

- In 2021, U.S. Food and Drug Administration issued an emergency use authorization (EUA) of bamlanivimab and etesevimab which are monoclonal antibodies specifically designed to fight against the COVID-19 virus in adults and pediatric patients (above the age of 12 years).

The demand for bioproduction bottles for Gene therapy is expected to register an exponential growth during 2022-27 due to the development of regenerative medicine worldwide. The rapidly growing regenerative medicine industry attributes primarily to the increasing number of patients diagnosed with chronic diseases, such as diabetes, Alzheimer's, cancer, renal failure, spinal cord injury, etc. Technological advancements in stem cell therapies have led to the mounting demand for the treatment of cancer & diabetes patients globally.

By Application:

- Sampling System

- Media Preparation

- Mixing

- Storage

- Others

Regional Landscape

Geographically, the Global Bioproduction Bottles Market expands across:

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

Of all regions globally, North America captured the highest market share in the Bioproduction Bottles Market during 2017-20, owing to the extensive presence of several biopharmaceutical manufacturing facilities across the region and the significant research & development for the introduction of new treatments.

Furthermore, the Covid-19 pandemic in 2020 encouraged the governments to introduce robust plans to boost biopharmaceutical manufacturing in the countries. Hence, the launch of new manufacturing facilities provided new opportunities to the leading manufacturers of bioproduction bottles across the region, which, in turn, has strongly contributed to the regional market growth. For instance:

- The Ministry of Innovation, Science, & Industry, along with the Ministry of Health, announced an investment of USD 415 million in 2021 to support Sanofi Pasteur Limited in establishing an influenza vaccine manufacturing facility in Canada. Further, Sanofi and the government of Ontario planned to invest USD 455 million and USD 55 million, respectively.

Furthermore, across North America, the bioproduction market in the US is anticipated to touch USD 600 million by 2027. The United States, home to the largest number of biopharmaceutical manufacturing companies, such as Pfizer, Johnson & Johnson, Merck & Co., holds the highest market share in the region. Continuous developments by biopharmaceutical companies for the treatment of several chronic diseases have been a major contributor to the demand for bioproduction bottles across the country.

The burgeoning demand for better treatment among patients, the boost in the development of personalized medicines, and increasing incidences of chronic diseases have led to higher investments in cell & gene therapies.

- New Jersey is one of the major locations in the country for biopharmaceutical manufacturing. The state comprises around 139 US Food and Drug Administration-registered biopharmaceutical manufacturing facilities. Moreover, nearly 25% of the overall cell & gene therapies have been developed in New Jersey.

Market Dynamics

Key Driver: Rapid Development of Vaccines to Induce Demand for Bioproduction Bottles

The growth of the Global Bioproduction Bottles Market attributes primarily to the growing research & development on vaccines worldwide & their commercialization, coupled with biopharmaceutical companies worldwide planning to expand their production capacities.

- In 2018, Sanofi announced its plans to double its vaccine output by 2023 in Canada by establishing a vaccine production plant worth USD 431 million to manufacture five-component Acellular Pertussis (5-aP) Antigen & new pertussis (whooping cough) vaccine.

- In 2019, IDT Biologika launched its new vaccine production plant in the BioPharmaPark area in DessauRosslau, Germany.

Furthermore, the Covid-19 pandemic in 2020 increased the focus of various governments worldwide to develop local biopharmaceutical sectors across different countries. Besides, the biopharmaceutical companies initiated the development & manufacturing of Covid-19 vaccines around the US, the UK, Canada, etc. Hence, this has further positively impacted the growth of the Global Bioproduction Bottles Market.

Growth Challenge: Supply Chain Disruptions Associated with Bioproduction Bottles

The most prominent factor w.r.t to the Covid-19 vaccine manufacturing has been the availability of consumables. However, the sporadic availability of raw materials required for manufacturing consumables like bottles, single-use bags, tubing, sterile filters, tubes, stoppers, etc., significantly hampered the sales of bioproduction bottles in the first half of 2020. For instance:

- In 2020, due to the Covid-19, companies involved in biopharmaceuticals and biotech & life sciences faced problems while manufacturing bottles due to the shortage of consumables, which, in turn, resulted in a lot of pressure on the supplier side while meeting the consumer demand.

Moreover, since organizations planned to change their product & service portfolio, there were shortages of biopharmaceutical equipment & supplies, viz., single-use bioprocessing technologies, bioreactors, analytical support, etc., even before the pandemic. It also hampered the Global Bioproduction Bottles Market to some extent.

Hence, the reduced production of Bioproduction bottles due to the global supply chain disruptions provided severe challenges to the market in the historical period, where the market would have performed well & experienced considerable growth.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares) of the Global Bioproduction Bottles Market?

- What are the region-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the Global Bioproduction Bottles Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the Global Bioproduction Bottles Market based on the competitive benchmarking matrix?

- What are the key results derived from surveys conducted during the Global Bioproduction Bottles Market study?

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Assumptions

- Market Segmentation

- Executive Summary

- Impact of COVID-19 on Global Bioproduction Bottles Market

- Global Bioproduction Bottles Market Trends & Insights

- Global Bioproduction Bottles Market Dynamics

- Drivers

- Challenges

- Impact Analysis

- Global Bioproduction Bottles Market Regulations & Policy

- Global Bioproduction Bottles Market Hotspots & Opportunities

- Global Bioproduction Bottles Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Kilo Tons)

- Market Share & Analysis (Revenue Vs Quantity Sold)

- By Material Type

- Plastic

- Polycarbonate

- Polyethylene terephthalate glycol (PETG)

- High-density polyethylene (HDPE)

- Others (Fluorinated ethylene propylene (FEP), Perfluoroalkoxy alkanes (PFA))

- Glass

- Plastic

- By Capacity Type

- Upto 30 ml

- 30 to 60 ml

- 60 to 100 ml

- 100-250 ml

- 250 to 500 ml

- 500 to 1000 ml

- 1000 to 2000 ml

- Above 2000 ml

- By Application

- Sampling System

- Media Preparation

- Mixing

- Storage

- Others

- By Development Phase

- Clinical

- Commercial

- By Component

- Drug Substance

- Drug Product

- By Molecule Type

- Protein

- Gene Therapy

- Cell Therapy

- Conventional Vaccines

- By Region

- North America

- South America

- Europe

- Asia Pacific

- Middle East & Africa

- By Company

- Competition Characteristics

- Revenue Shares

- Competitor Placement in MarkNtel Quadrant

- By Material Type

- Market Size & Analysis

- North America Bioproduction Bottles Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis (Revenue Vs Quantity Sold)

- By Material Type

- By Capacity Type

- By Application

- By Development Phase

- By Molecule Type

- By Country

- The US

- Canada

- Mexico

- The US Bioproduction Bottles Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis (Revenue Vs Quantity Sold)

- By Material Type

- By Application

- Market Size & Analysis

- Canada Bioproduction Bottles Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis (Revenue Vs Quantity Sold)

- By Material Type

- By Application

- Market Size & Analysis

- Mexico Bioproduction Bottles Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis (Revenue Vs Quantity Sold)

- By Material Type

- By Application

- Market Size & Analysis

- Market Size & Analysis

- South America Bioproduction Bottles Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis (Revenue Vs Quantity Sold)

- By Material Type

- By Capacity Type

- By Application

- By Development Phase

- By Molecule Type

- By Country

- Brazil

- Others

- Brazil Bioproduction Bottles Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis (Revenue Vs Quantity Sold)

- By Material Type

- By Application

- Market Size & Analysis

- Market Size & Analysis

- Europe Bioproduction Bottles Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis (Revenue Vs Quantity Sold)

- By Material Type

- By Capacity Type

- By Application

- By Development Phase

- By Molecule Type

- By Country

- The UK

- Germany

- France

- Spain

- Italy

- Others

- The UK Bioproduction Bottles Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis (Revenue Vs Quantity Sold)

- By Material Type

- By Application

- Market Size & Analysis

- Germany Bioproduction Bottles Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis (Revenue Vs Quantity Sold)

- By Material Type

- By Application

- Market Size & Analysis

- France Bioproduction Bottles Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis (Revenue Vs Quantity Sold)

- By Material Type

- By Application

- Market Size & Analysis

- Spain Bioproduction Bottles Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis (Revenue Vs Quantity Sold)

- By Material Type

- By Application

- Market Size & Analysis

- Italy Bioproduction Bottles Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis (Revenue Vs Quantity Sold)

- By Material Type

- By Application

- Market Size & Analysis

- Market Size & Analysis

- Middle East & Africa Bioproduction Bottles Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis (Revenue Vs Quantity Sold)

- By Material Type

- By Capacity Type

- By Application

- By Development Phase

- By Molecule Type

- By Country

- GCC

- Africa

- Others

- GCC Bioproduction Bottles Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis (Revenue Vs Quantity Sold)

- By Material Type

- By Application

- Market Size & Analysis

- Africa Bioproduction Bottles Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis (Revenue Vs Quantity Sold)

- By Material Type

- By Application

- Market Size & Analysis

- Market Size & Analysis

- Asia Pacific Bioproduction Bottles Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis (Revenue Vs Quantity Sold)

- By Material Type

- By Capacity Type

- By Application

- By Development Phase

- By Molecule Type

- By Country

- China

- India

- Japan

- South Korea

- Australia

- Others

- China Bioproduction Bottles Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis (Revenue Vs Quantity Sold)

- By Material Type

- By Application

- Market Size & Analysis

- India Bioproduction Bottles Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis (Revenue Vs Quantity Sold)

- By Material Type

- By Application

- Market Size & Analysis

- Japan Bioproduction Bottles Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis (Revenue Vs Quantity Sold)

- By Material Type

- By Application

- Market Size & Analysis

- South Korea Bioproduction Bottles Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis (Revenue Vs Quantity Sold)

- By Material Type

- By Application

- Market Size & Analysis

- Australia Bioproduction Bottles Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue

- By Quantity Sold

- Market Share & Analysis (Revenue Vs Quantity Sold)

- By Material Type

- By Application

- Market Size & Analysis

- Market Size & Analysis

- Global Bioproduction Bottles Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Competition Matrix

- Brand Specialization

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profile (Business Description, Product Segment, Business Segment, Financials, Strategic Alliances or Partnerships, Future Plans

- Thermo Fisher Scientific

- Gerresheimer Glas GmbH

- Essco Glass

- Spectrum Chemical Manufacturing Corporation

- Corning

- SGD Pharma

- Duran Group

- Beatson Clark

- Foxx Life Sciences

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making